Global Agrochemical Intermediates Market

Market Size in USD Billion

CAGR :

%

USD

7.75 Billion

USD

13.93 Billion

2024

2032

USD

7.75 Billion

USD

13.93 Billion

2024

2032

| 2025 –2032 | |

| USD 7.75 Billion | |

| USD 13.93 Billion | |

|

|

|

|

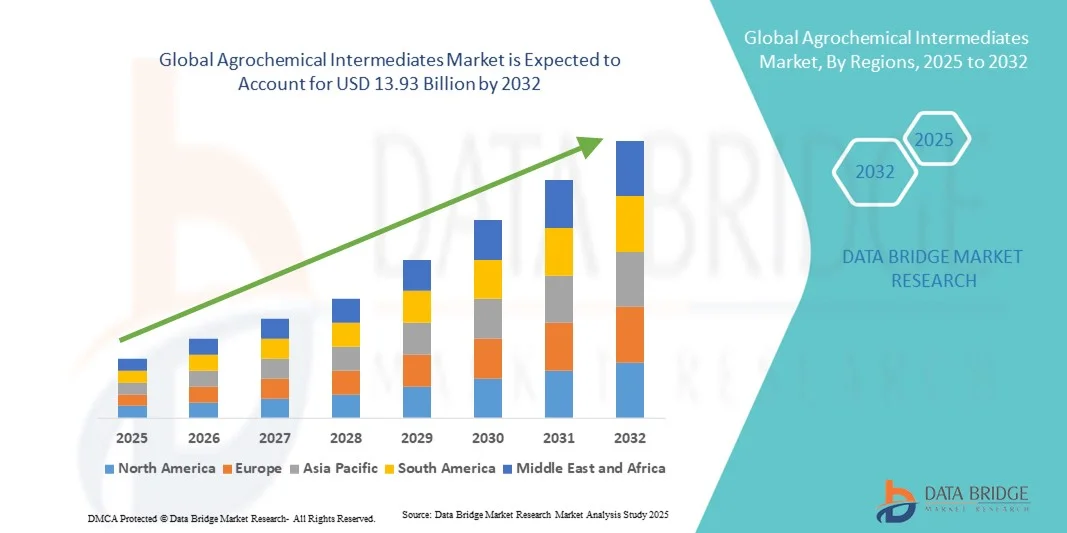

What is the Global Agrochemical Intermediates Market Size and Growth Rate?

- The global agrochemical intermediates market size was valued at USD 7.75 billion in 2024 and is expected to reach USD 13.93 billion by 2032, at a CAGR of 7.60% during the forecast period

- Emerging environmental concerns is the vital factor escalating the market growth, also increase in commercial value of agrochemical intermediates, rising demand for innovative but organic compost, rising favorable government policies, rising technological advancements, rising agriculture activities all over the globe due to rise in the demand for food, increasing population all over the globe directly impacts the rising need for agriculture which acts as the major factors among others driving the growth of agrochemical intermediates

What are the Major Takeaways of Agrochemical Intermediates Market?

- Rising modernization and technological advancements in the farming techniques and increasing research and development activities will further create new opportunities for agrochemical intermediates market

- However, rising lack of consumer awareness and ecological concerns and rising prices of the agrochemicals are the major factors among others acting as restraints, and will further challenge the growth of agrochemical intermediates market

- North America dominated the agrochemical intermediates market with the largest revenue share of 39.7% in 2024, driven by the strong presence of major agrochemical producers, technological innovation in crop protection, and rising adoption of high-performance intermediates in sustainable farming

- The Asia-Pacific agrochemical intermediates market is poised to grow at the fastest CAGR of 9.6% from 2025 to 2032, driven by expanding agricultural production, rapid industrialization, and increasing adoption of advanced crop protection technologies

- The alkylamines segment dominated the market with the largest revenue share of 41.8% in 2024, owing to their extensive application in manufacturing herbicides, fungicides, and plant growth regulators

Report Scope and Agrochemical Intermediates Market Segmentation

|

Attributes |

Agrochemical Intermediates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agrochemical Intermediates Market?

Shift Toward Sustainable and Bio-Based Production

- A major trend shaping the global Agrochemical Intermediates market is the rising focus on eco-friendly and bio-based intermediates derived from renewable sources such as plant oils, sugars, and biomass. This transformation aligns with global sustainability goals and regulatory efforts to reduce carbon footprints and chemical pollution

- For instance, BASF SE and Croda International Plc are investing heavily in green chemistry solutions to develop intermediates that minimize environmental harm and enhance biodegradability

- These sustainable intermediates are being increasingly adopted in the formulation of herbicides, insecticides, and fungicides to meet stringent government regulations and consumer demand for safer agro-products

- The transition toward renewable-based intermediates is fostering innovation in the market, leading to the introduction of novel products with improved efficiency and reduced toxicity levels

- Moreover, collaborations between chemical manufacturers and agricultural technology firms are accelerating research into biological synthesis pathways, enhancing the scalability of bio-based agrochemical intermediates

- This trend marks a fundamental shift from conventional petrochemical-based production to sustainable manufacturing practices, reshaping the competitive landscape of the Agrochemical Intermediates industry

What are the Key Drivers of Agrochemical Intermediates Market?

- The rising global demand for food security, driven by a rapidly growing population, is significantly propelling the Agrochemical Intermediates market. Increased agricultural output requires advanced crop protection chemicals, boosting the consumption of intermediates used in pesticide and fertilizer production

- For instance, in March 2024, Dow announced the expansion of its high-performance intermediate production facilities to meet increasing demand for efficient and sustainable crop protection solutions

- In addition, supportive government policies promoting modern agricultural practices and the use of advanced agrochemicals are driving market growth in emerging economies such as India, China, and Brazil

- The development of high-performance intermediates that enhance pesticide stability and improve crop yield efficiency is attracting large-scale investments from major chemical companies

- Rising awareness about integrated pest management and the importance of reducing post-harvest losses further strengthen market expansion

- Moreover, strategic partnerships among agrochemical producers and research institutes are accelerating innovation, enabling the production of more selective and environmentally benign intermediates tailored for diverse climatic conditions

Which Factor is Challenging the Growth of the Agrochemical Intermediates Market?

- One of the key challenges hindering market growth is the stringent environmental regulations imposed on chemical manufacturing, particularly regarding emissions and waste management. These regulations increase operational costs for producers of synthetic intermediates

- For instance, following tighter EU REACH regulations, several mid-sized chemical firms faced reduced profit margins due to mandatory compliance investments in waste treatment and safety protocols

- In addition, the volatility of raw material prices, especially petrochemical derivatives, impacts production costs and profitability for many agrochemical intermediate manufacturers

- Another significant challenge lies in the public perception of chemical toxicity associated with agrochemicals, leading to growing resistance toward conventional crop protection products. Companies such as Evonik Industries AG and Akzo Nobel N.V. are tackling this through green chemistry and safer formulation processes

- Developing regions also face constraints such as limited infrastructure, inadequate farmer awareness, and dependency on imports, which restrict market penetration

- To overcome these challenges, companies must prioritize innovation in sustainable production, strengthen supply chain resilience, and educate farmers on the responsible use of agrochemical intermediates to ensure long-term growth and environmental balance

How is the Agrochemical Intermediates Market Segmented?

The market is segmented on the basis of product and end-user.

- By Product

On the basis of product, the agrochemical intermediates market is segmented into alkylamines, amines, aldehydes, and acids. The alkylamines segment dominated the market with the largest revenue share of 41.8% in 2024, owing to their extensive application in manufacturing herbicides, fungicides, and plant growth regulators. Their high reactivity and versatility make them vital for synthesizing multiple agrochemical compounds that enhance crop yield and protect against pests. In addition, their cost-effectiveness and wide availability contribute to their dominance across developing agricultural economies.

The acids segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, driven by their increasing use in the synthesis of modern, eco-friendly formulations with higher efficiency and lower toxicity. Growing demand for biodegradable agrochemicals and advancements in organic acid-based intermediates further propel this segment’s expansion, aligning with global sustainability and regulatory standards.

- By End-User

Based on end-user, the agrochemical intermediates market is segmented into insecticides, herbicides, and fungicides. The herbicides segment dominated the market with the largest revenue share of 46.3% in 2024, primarily due to the global rise in weed infestation and the increasing need for high-yield crop production. Herbicide intermediates are in strong demand for their role in formulating selective and non-selective weed control agents that improve crop quality and minimize manual labor. Growing mechanization and adoption of chemical-based weed management in large-scale farming also support segment growth.

The fungicides segment is projected to witness the fastest CAGR of 19.4% from 2025 to 2032, fueled by rising incidences of fungal infections caused by changing climatic conditions and the emergence of resistant strains. Continuous R&D in developing advanced fungicidal formulations and expanding applications across fruits and vegetables are key factors driving this segment’s accelerated growth.

Which Region Holds the Largest Share of the Agrochemical Intermediates Market?

- North America dominated the agrochemical intermediates market with the largest revenue share of 39.7% in 2024, driven by the strong presence of major agrochemical producers, technological innovation in crop protection, and rising adoption of high-performance intermediates in sustainable farming. The region’s emphasis on improving agricultural yield and reducing environmental impact has boosted the use of advanced chemical intermediates in the production of herbicides, insecticides, and fungicides

- Moreover, favorable government policies supporting eco-friendly formulations and increasing R&D investments by key market players continue to fuel regional dominance.

- The demand for agrochemical intermediates in North America is also supported by large-scale cultivation of corn, soybeans, and wheat, alongside the presence of robust distribution networks and established agri-tech infrastructure

U.S. Agrochemical Intermediates Market Insight

The U.S. agrochemical intermediates market captured the largest revenue share of 82% in 2024 within North America, driven by extensive use of intermediates in high-value crop protection formulations and strong technological innovation from major chemical companies. The country's focus on sustainable agriculture, precision farming, and bio-based intermediates is fostering industry growth. Furthermore, increasing collaborations between chemical manufacturers and agri-tech firms are leading to the development of next-generation intermediates with improved efficiency and reduced toxicity. The growing awareness of crop productivity enhancement and the integration of R&D-driven formulations continue to expand the U.S. market outlook.

Europe Agrochemical Intermediates Market Insight

The Europe agrochemical intermediates market is projected to expand at a substantial CAGR during the forecast period, supported by strict regulatory frameworks promoting the use of low-emission and biodegradable agrochemicals. European nations are witnessing a shift toward sustainable crop protection products, resulting in high demand for innovative intermediates that align with green chemistry principles. Furthermore, the region’s strong focus on organic farming, coupled with government-funded agricultural sustainability programs, is driving the uptake of bio-based intermediates. Key markets such as Germany, France, and the U.K. are investing heavily in R&D to create next-generation formulations that meet environmental standards while maintaining crop productivity.

U.K. Agrochemical Intermediates Market Insight

The U.K. agrochemical intermediates market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the nation’s shift toward sustainable agricultural practices and growing awareness about soil health and pest management. The increasing adoption of precision farming technologies and the push for reduced pesticide residues are driving the demand for high-purity intermediates in the manufacturing of eco-friendly herbicides and insecticides. Moreover, favorable trade relations with major chemical exporters and strong R&D capabilities in agricultural biotechnology are further strengthening market growth across the U.K.

Germany Agrochemical Intermediates Market Insight

The Germany agrochemical intermediates market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s robust chemical industry and commitment to developing sustainable agricultural inputs. With a strong focus on innovation, German companies are pioneering bio-based intermediates and green chemistry solutions to comply with EU environmental regulations. In addition, the growing adoption of digital agriculture tools and demand for efficient crop protection agents are accelerating the integration of advanced intermediates in agrochemical manufacturing. Germany’s emphasis on environmental stewardship continues to drive its leadership in sustainable agrochemical production.

Which Region is the Fastest Growing Region in the Agrochemical Intermediates Market?

The Asia-Pacific agrochemical intermediates market is poised to grow at the fastest CAGR of 9.6% from 2025 to 2032, driven by expanding agricultural production, rapid industrialization, and increasing adoption of advanced crop protection technologies. Rising food demand, coupled with shrinking arable land, is pushing farmers to use more efficient agrochemicals derived from high-quality intermediates. Furthermore, government initiatives in countries such as China, India, and Japan promoting self-sufficiency in agrochemical manufacturing are bolstering regional growth. The establishment of local production units and availability of cost-effective intermediates are also making Asia-Pacific a global manufacturing hub for agrochemicals.

Japan Agrochemical Intermediates Market Insight

The Japan agrochemical intermediates market is gaining momentum due to the nation’s technological advancements in chemical synthesis and its commitment to precision agriculture. Japanese manufacturers are focusing on developing high-purity intermediates for use in environmentally safe formulations. Increasing adoption of smart farming techniques and government emphasis on food security are boosting the demand for efficient crop protection products. In addition, collaborations between academic research institutions and private companies are fostering innovation in sustainable agrochemical development.

China Agrochemical Intermediates Market Insight

The China agrochemical intermediates market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by a thriving chemical manufacturing ecosystem and rising demand for high-quality intermediates for domestic agrochemical production. China’s strong export capacity, coupled with government-backed agricultural modernization initiatives, has positioned it as a major producer and consumer of agrochemical intermediates. The expansion of smart agriculture projects and continuous investment in R&D for green intermediates are expected to further accelerate market growth. In addition, increasing focus on sustainable formulations and reduced reliance on imported raw materials continues to shape China’s leadership in the Asia-Pacific region.

Which are the Top Companies in Agrochemical Intermediates Market?

The agrochemical intermediates industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Solvay (Belgium)

- Evonik Industries AG (Germany)

- Nufarm Limited (Australia)

- Croda International Plc (U.K.)

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- Huntsman International LLC (U.S.)

- Helena Agri-Enterprises LLC (U.S.)

- Wilbur-Ellis Holdings Inc. (U.S.)

- Stepan Company (U.S.)

- Clariant (Switzerland)

- Lamberti S.p.A. (Italy)

- WinField Solutions LLC (U.S.)

- Tanatex Chemicals B.V. (Netherlands)

- Momentive (U.S.)

- Interagro Ltd. (U.K.)

- Monsanto Company (U.S.)

- ORO AGRI (U.S.)

- Syngenta (Switzerland)

- Elkem ASA (Norway)

- Brandt Consolidated Inc. (U.S.)

- Monument Chemical (U.S.)

- Loveland Products Inc. (U.S.)

- Global Nutrition International (U.S.)

- QualiTech (U.S.)

What are the Recent Developments in Global Agrochemical Intermediates Market?

- In February 2025, Bain Capital completed the acquisition of the pharmaceutical division of Mitsubishi Chemical, allowing Mitsubishi to concentrate on its core chemical operations and sustainability-oriented sectors. This strategic divestiture strengthens Mitsubishi’s focus on innovation, environmental responsibility, and long-term competitiveness within the global chemical industry

- In April 2024, Atul Ltd, a diversified chemical company, introduced Sindica, a post-emergence herbicide designed to target and control major weeds affecting sugarcane crops. This product launch underscores Atul’s commitment to enhancing agricultural productivity through innovative and effective crop protection solutions tailored for high-value crops

- In February 2024, Corteva, a leading multinational in agricultural science, unveiled two new crop protection products at Show Rural 2024 in Brazil, as reported by AgroPages. The company introduced Gapper (Florpirauxifen-benzil), a herbicide for managing weeds in maize and soybean fields, and Elevore (Halauxifen-methyl), aimed at desiccating soybean plants during sowing. This dual launch reinforces Corteva’s dedication to innovation and its role in advancing sustainable agricultural practices

- In September 2023, LyondellBasell launched a new range of low-carbon chemical intermediates, developed to address the growing global demand for eco-friendly and sustainable industrial products. This initiative aligns with the company’s long-term commitment to supporting the transition toward greener chemical solutions and reducing the carbon footprint of industrial manufacturing

- In July 2023, Phillips Carbon Black Limited (PCBL) commenced operations at the first phase of its new specialty chemicals plant in Gujarat, India, aimed at expanding its production capacity. This expansion enhances PCBL’s ability to meet the increasing global demand for high-performance chemical intermediates and strengthens its footprint in the specialty chemicals market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.