Global Agroscience Market

Market Size in USD Billion

CAGR :

%

USD

62.80 Billion

USD

148.95 Billion

2024

2032

USD

62.80 Billion

USD

148.95 Billion

2024

2032

| 2025 –2032 | |

| USD 62.80 Billion | |

| USD 148.95 Billion | |

|

|

|

|

Agroscience Market Size

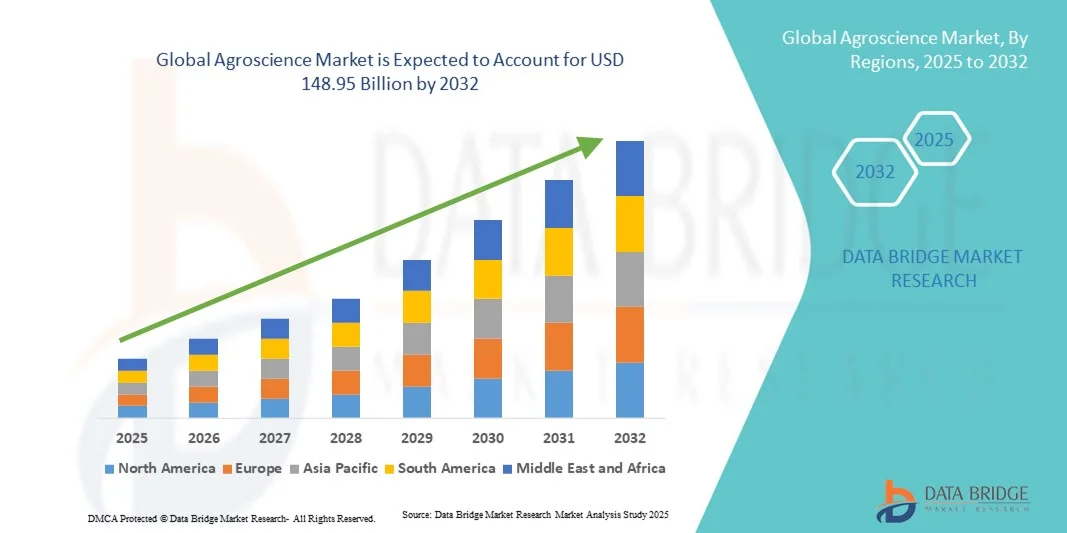

- The global agroscience market size was valued at USD 62.80 billion in 2024 and is expected to reach USD 148.95 billion by 2032, at a CAGR of 11.40% during the forecast period

- The market growth is largely fuelled by the rising global demand for sustainable agricultural solutions, improved crop productivity, and the adoption of advanced biotechnology in farming practices

- Increasing investments in research and development for crop protection and genetically modified seeds are further propelling market expansion

Agroscience Market Analysis

- The agroscience market is witnessing significant transformation due to advancements in genetic engineering, precision farming, and digital agriculture technologies

- Increasing awareness about sustainable farming and government support for eco-friendly crop protection measures are fostering innovation across the industry

- North America dominated the agroscience market with the largest revenue share of 39.84% in 2024, driven by advanced agricultural technologies, strong R&D investment, and early adoption of biotechnology-based solutions. The region benefits from the widespread use of genetically modified seeds, precision farming tools, and sustainable crop protection products aimed at maximizing yield efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global agroscience market, driven by expanding agricultural activities, rising food demand, and increasing adoption of innovative crop protection and enhancement technologies

- The Genetically Modified (GM) Seeds segment held the largest market revenue share in 2024, driven by their high yield potential, pest resistance, and ability to withstand adverse environmental conditions. GM seeds are widely adopted in large-scale farming due to their role in reducing crop loss and improving productivity, making them a crucial component in addressing global food security challenges

Report Scope and Agroscience Market Segmentation

|

Attributes |

Agroscience Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agroscience Market Trends

Integration of Digital and Precision Technologies in Agroscience

- The growing adoption of precision farming technologies is transforming the agroscience landscape by enabling data-driven decision-making and optimized resource utilization. Tools such as drones, IoT sensors, and satellite imaging are enhancing crop monitoring and improving yield prediction accuracy. This integration supports sustainable farming practices and reduces input wastage while increasing overall operational efficiency for both large and small-scale farms

- The increasing affordability and accessibility of digital platforms are promoting widespread adoption among medium and small-scale farmers. These tools provide real-time data on soil health, moisture levels, and pest activity, allowing timely interventions and more efficient resource allocation. Governments and private players are also encouraging the use of precision solutions through subsidies, farmer training programs, and technology demonstration projects

- The trend is further supported by advancements in artificial intelligence and machine learning, which enable predictive analytics for crop performance and pest management. These technologies help farmers make proactive decisions to prevent yield losses and minimize chemical overuse. AI-based forecasting models are improving planning accuracy and helping reduce environmental impact across agricultural systems

- For instance, in 2023, several agritech firms across Europe introduced AI-driven crop monitoring tools that helped farmers identify nutrient deficiencies early, reducing fertilizer usage and boosting overall productivity. These tools are now being adapted for various climatic conditions and soil types to ensure wider adoption globally. Such innovations are making precision agriculture more inclusive and regionally relevant

- While precision agriculture technologies are revolutionizing the agroscience market, their effectiveness depends on digital literacy, infrastructure availability, and data management practices. Limited internet access in rural regions and high setup costs can hinder adoption rates. Continuous innovation, farmer education, and government-backed digital inclusion policies are essential to fully realize their potential and ensure scalability

Agroscience Market Dynamics

Driver

Rising Demand for Sustainable Agriculture and Food Security

- The growing global population and shrinking arable land are driving the need for sustainable farming solutions that maximize productivity with minimal environmental impact. Agroscience innovations, such as biofertilizers, biopesticides, and genetically enhanced seeds, are becoming crucial for ensuring food security and long-term agricultural sustainability. These technologies help mitigate the effects of climate change, improve soil fertility, and reduce dependency on synthetic inputs

- Farmers and agribusinesses are increasingly aware of the importance of soil health, crop diversity, and eco-friendly pest management. This awareness is boosting the adoption of biological and organic inputs that reduce chemical dependency and improve yield resilience against climate fluctuations. Such transitions are also enhancing market opportunities for sustainable agri-products in both domestic and international trade

- Governments and international organizations are implementing policies to promote sustainable practices through research grants, certification programs, and education initiatives. These efforts are accelerating the integration of advanced agroscience solutions into mainstream farming and encouraging the use of environmentally responsible technologies. Public-private partnerships are also being leveraged to expand access to sustainable inputs across developing regions

- For instance, in 2023, the U.S. Department of Agriculture launched new funding programs to support biotechnological research aimed at improving crop resistance to pests and drought, stimulating market growth across North America. This initiative also provided incentives for startups focusing on bio-based agricultural solutions. Such programs are fostering innovation and boosting global competitiveness in sustainable farming

- While sustainability goals are driving market expansion, ongoing challenges such as regulatory hurdles, high development costs, and limited farmer awareness in developing economies remain critical issues that need to be addressed. Bridging the gap between innovation and accessibility is key to long-term success. Continuous policy support, education, and localized innovation will play a crucial role in ensuring broad adoption of sustainable practices

Restraint/Challenge

High R&D Costs and Regulatory Complexities in Product Development

- Developing advanced agroscience solutions, including biotechnological seeds, biopesticides, and precision tools, involves substantial research and regulatory expenditure. The long approval timelines and complex compliance standards in multiple regions significantly increase product development costs. This discourages smaller companies from entering the market and can slow the pace of innovation across the sector

- Many small and medium-sized agroscience firms struggle to compete with large corporations due to limited access to funding and testing infrastructure. As a result, innovative ideas often fail to reach commercialization or are acquired by larger entities before scaling. This imbalance limits competition and reduces the availability of diverse and cost-effective products in the global market

- Regulatory inconsistencies across countries further complicate market entry, especially for genetically modified crops and biological inputs. Differences in biosafety regulations, labeling laws, and field trial requirements can delay approvals and create uncertainty for investors. This lack of harmonization also discourages cross-border collaboration and slows international technology transfer

- For instance, in 2023, several European biotechnology companies reported delayed launches due to extended safety evaluations and multi-layered approval processes under the EU’s stringent agricultural regulations. These delays increased operational costs and slowed product adoption across major farming economies. The resulting uncertainty hindered investor confidence and affected overall market momentum

- While regulatory frameworks are essential for ensuring environmental and food safety, streamlining approval processes and encouraging public-private partnerships are crucial to enhance innovation and global market competitiveness. Policymakers must balance safety with agility to support rapid innovation. Simplified approval pathways and transparent review systems can attract investment and stimulate technological advancement in agroscience

Agroscience Market Scope

The market is segmented on the basis of product type and end users.

- By Product Type

On the basis of product type, the agroscience market is segmented into Genetically Modified (GM) Seeds, Biopesticides, and Biostimulants. The Genetically Modified (GM) Seeds segment held the largest market revenue share in 2024, driven by their high yield potential, pest resistance, and ability to withstand adverse environmental conditions. GM seeds are widely adopted in large-scale farming due to their role in reducing crop loss and improving productivity, making them a crucial component in addressing global food security challenges.

The Biostimulants segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for organic and sustainable agricultural inputs that enhance soil fertility and plant health. Biostimulants promote nutrient uptake, improve crop resilience, and reduce dependency on chemical fertilizers, aligning with the global shift toward eco-friendly and climate-resilient farming practices.

- By End Users

On the basis of end users, the agroscience market is segmented into Crops and Fruits & Vegetables. The Crops segment accounted for the largest market share in 2024, attributed to the extensive cultivation of cereals, grains, and oilseeds, which form the backbone of global food production. The rising need for high-yield, disease-resistant varieties is further driving the demand for advanced agroscience solutions within this segment.

The Fruits & Vegetables segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer preference for healthy, fresh produce and the rising adoption of sustainable cultivation techniques. Enhanced focus on nutrient enrichment, shelf-life extension, and biological crop protection is promoting the use of biopesticides and biostimulants in this segment, contributing to overall market expansion.

Agroscience Market Regional Analysis

- North America dominated the agroscience market with the largest revenue share of 39.84% in 2024, driven by advanced agricultural technologies, strong R&D investment, and early adoption of biotechnology-based solutions. The region benefits from the widespread use of genetically modified seeds, precision farming tools, and sustainable crop protection products aimed at maximizing yield efficiency

- Farmers in North America prioritize productivity, climate resilience, and soil health management, supported by favorable government policies and corporate initiatives promoting sustainable agriculture

- The region’s emphasis on innovation, combined with a robust agri-biotech infrastructure and large-scale adoption of digital farming, continues to strengthen its dominance in the global agroscience market

U.S. Agroscience Market Insight

The U.S. agroscience market captured the largest revenue share in 2024 within North America, driven by the integration of biotechnology and precision agriculture. Farmers are rapidly adopting genetically modified seeds, biostimulants, and crop protection products that enhance productivity and soil health. The presence of leading agribusiness corporations and strong federal support for sustainable farming research further bolster market growth. In addition, the expansion of digital farming platforms and AI-based crop management tools continues to propel the adoption of advanced agroscience solutions.

Europe Agroscience Market Insight

The Europe agroscience market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict environmental regulations and the increasing demand for sustainable and organic farming solutions. European countries are actively shifting toward bio-based crop protection products and reducing chemical input usage. The rise in awareness of food safety and soil conservation practices is also supporting market development. Moreover, the European Green Deal and CAP reforms are accelerating the adoption of biopesticides and other eco-friendly agricultural technologies.

U.K. Agroscience Market Insight

The U.K. agroscience market is expected to witness strong growth from 2025 to 2032, fuelled by the rapid shift toward sustainable agriculture and innovation in biotechnology. Rising concerns about soil degradation and climate change are prompting farmers to adopt eco-friendly crop management practices. Government support for agri-tech innovation, including biostimulant and biofertilizer development, is strengthening the country’s agricultural competitiveness. The growing emphasis on food security and post-Brexit agricultural reform is also enhancing domestic production efficiency.

Germany Agroscience Market Insight

The Germany agroscience market is projected to witness significant growth from 2025 to 2032, driven by the country’s focus on sustainability, innovation, and environmental protection. Germany’s strong industrial base and R&D capabilities are fostering advancements in bio-based agricultural inputs and precision farming tools. The adoption of digital monitoring systems and smart farming techniques is gaining momentum, supported by government initiatives promoting green technology integration in agriculture. The market’s emphasis on quality, safety, and resource optimization continues to boost adoption rates.

Asia-Pacific Agroscience Market Insight

The Asia-Pacific agroscience market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing food demand, rapid population growth, and modernization of farming practices in countries such as China, India, and Japan. Government initiatives promoting sustainable agriculture and the adoption of biotechnology are transforming traditional farming systems. The region’s growing manufacturing capabilities and expanding agricultural R&D investments are also improving accessibility to cost-effective agroscience products.

Japan Agroscience Market Insight

The Japan agroscience market is expected to witness robust growth from 2025 to 2032, owing to the country’s technological innovation and strong focus on sustainable crop production. Japan’s aging farming population is driving automation and digitalization in agriculture, including the use of biostimulants and precision farming tools. The government’s push toward eco-friendly crop inputs and reduced chemical dependency is promoting new product adoption. Moreover, the integration of robotics and AI-driven analytics in farm management is further enhancing efficiency and output quality.

China Agroscience Market Insight

The China agroscience market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by large-scale agricultural modernization and strong government backing for biotechnology and sustainable farming. The country’s expanding middle class and rising demand for food security are accelerating the adoption of GM seeds and biopesticides. China is also a key producer of agroscience products, benefiting from a strong domestic manufacturing base and increasing exports. The growing emphasis on productivity, digital farming, and eco-friendly agricultural inputs continues to drive market expansion across the region.

Agroscience Market Share

The Agroscience industry is primarily led by well-established companies, including:

• Corteva (U.S.)

• Novozymes A/S (Denmark)

• Sumitomo Chemical Co., Ltd. (Japan)

• Eurofins Scientific (Luxembourg)

• Syngenta (Switzerland)

• Agrinos (Norway)

• Nutrien Ltd. (Canada)

• UPL (India)

• BASF SE (Germany)

• Bayer AG (Germany)

• SRT Agro Science Pvt. Ltd. (India)

• GNP Agrosciences Pvt. Ltd. (India)

• BioWorks Inc. (U.S.)

• Himalaya Agro Science (India)

• Green Earth Agro Science (India)

• Sigma Agriscience, LLC (U.S.)

• TeselaGen (U.S.)

• Dow (U.S.)

Latest Developments in Global Agroscience Market

- In April 2021, Corteva Agriscience announced a strategic collaboration with Ginkgo Bioworks to accelerate innovation in sustainable agriculture. The partnership focuses on combining Ginkgo’s advanced cell engineering platform and DNA codebase with Corteva’s agricultural expertise to develop next-generation, bio-based crop solutions. This collaboration aims to create environmentally friendly alternatives to traditional agrochemicals, enhancing crop productivity while reducing ecological impact. The initiative is expected to strengthen Corteva’s leadership in agri-biotechnology and drive the global agroscience market toward more sustainable and technology-driven practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.