Global Ai Agents Market

Market Size in USD Billion

CAGR :

%

USD

5.38 Billion

USD

111.38 Billion

2024

2032

USD

5.38 Billion

USD

111.38 Billion

2024

2032

| 2025 –2032 | |

| USD 5.38 Billion | |

| USD 111.38 Billion | |

|

|

|

|

AI Agents Market Size

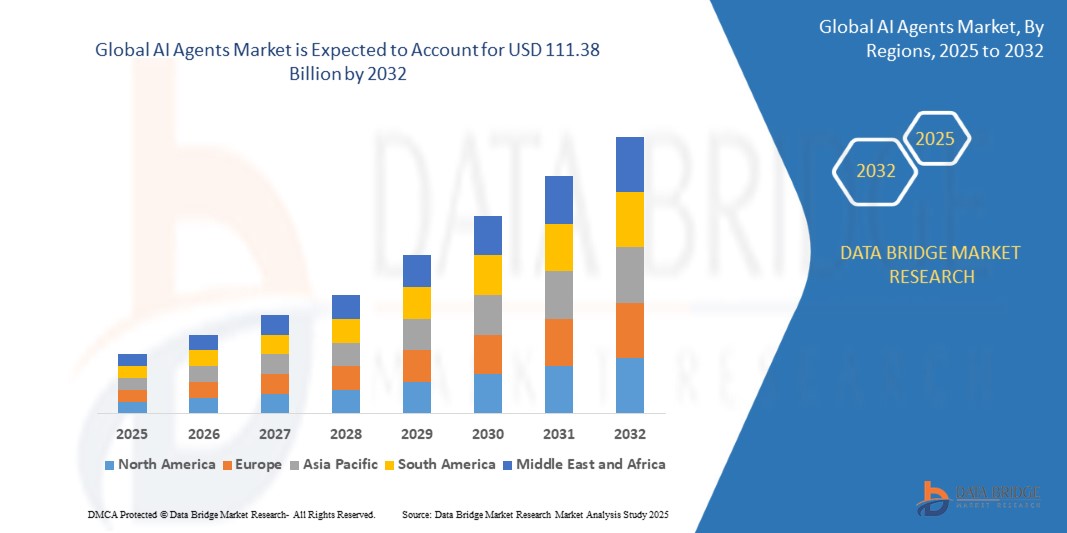

- The global AI agents market size was valued at USD 5.38 billion in 2024 and is expected to reach USD 111.38 billion by 2032, at a CAGR of 46.05% during the forecast period

- The market growth is largely fuelled by increasing adoption of AI-powered automation across industries, rising demand for virtual assistants, and advancements in machine learning, NLP, and computer vision technologies

- Growing need for enhanced customer experience, cost optimization, and real-time decision-making is accelerating the deployment of AI agents in enterprise, consumer, and industrial applications

AI Agents Market Analysis

- AI agents are increasingly being deployed in customer service, virtual assistants, industrial automation, healthcare, and financial sectors, driving efficiency, accuracy, and operational scalability

- The rising need for intelligent, automated, and adaptive systems is prompting enterprises to adopt AI agents for decision support, monitoring, and predictive analytic

- North America dominated the global AI agents market with the largest revenue share of 40.5% in 2024, driven by widespread adoption of AI technologies across enterprises and a high level of digital transformation initiatives. Organizations are increasingly deploying AI agents to automate workflows, enhance customer experiences, and improve operational efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global AI agents market, driven by rapid industrialization, increasing IT and telecom infrastructure, and rising awareness of AI benefits among enterprises. Countries such as China, Japan, and Australia are leading investments in AI research, automation, and smart technologies, boosting demand for AI agents in diverse sectors

- The Machine Learning segment held the largest market revenue share in 2024, driven by its ability to analyze large datasets, learn from patterns, and provide actionable insights across various industries. Machine learning-powered AI agents are extensively adopted for predictive analytics, process automation, and decision-making support, making them highly valuable for enterprises and service providers

Report Scope and AI Agents Market Segmentation

|

Attributes |

AI Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

AI Agents Market Trends

Increasing Adoption of Intelligent AI Agents Across Industries

- The growing deployment of AI agents is transforming business operations by enabling real-time decision-making, automation, and predictive insights. Intelligent agents assist enterprises in monitoring processes, managing tasks, and analyzing data efficiently, leading to improved productivity and optimized workflows

- The rising demand for AI-driven virtual assistants, customer service bots, and autonomous systems is accelerating the adoption of both ready-to-deploy and build-your-own AI agents. These solutions are particularly beneficial for enterprises looking to enhance operational efficiency and reduce human error

- The scalability and versatility of AI agents make them suitable for multiple applications, from robotics and automation to healthcare, finance, and marketing. Organizations benefit from cost savings, faster response times, and enhanced decision-making capabilities

- For instance, in 2023, several global enterprises implemented AI-powered virtual assistants for customer support, resulting in reduced response times, improved customer satisfaction, and operational cost reductions. These deployments also enhanced analytics and service personalization

- While AI agents are driving operational efficiency and supporting digital transformation, their effectiveness depends on robust infrastructure, data quality, and continuous learning. Developers must focus on security, customization, and integration strategies to fully leverage the market potential

AI Agents Market Dynamics

Driver

Rising Demand for Automation and Intelligent Decision-Making Solutions

- Enterprises are increasingly adopting AI agents to automate repetitive tasks, improve customer interactions, and gain predictive insights. These agents help in streamlining workflows, reducing manual errors, and accelerating business processes, leading to significant cost and time savings. In addition, AI agents enable real-time monitoring and reporting, allowing managers to make data-driven decisions faster and more accurately, which strengthens organizational efficiency

- Organizations across sectors such as healthcare, finance, and retail are leveraging AI agents to improve operational efficiency, personalize customer experiences, and enhance compliance with regulations. The growing focus on digital transformation further supports market growth. AI agents also facilitate predictive analytics, enabling companies to anticipate customer needs, optimize inventory management, and reduce operational bottlenecks, thereby enhancing competitiveness

- Advancements in machine learning, natural language processing, and computer vision are enabling the development of sophisticated AI agents capable of complex problem-solving and multi-tasking. These innovations expand their applicability and adoption. Moreover, AI agents are increasingly integrated with IoT devices and enterprise platforms, enabling seamless cross-system automation and better end-to-end business intelligence

- For instance, in 2022, multiple financial institutions deployed AI agents for fraud detection and risk management, boosting real-time decision-making capabilities and improving security measures. The implementation also helped in reducing false positives, streamlining compliance reporting, and providing actionable insights for strategic planning, thereby optimizing operational resilience

- While automation and intelligent decision-making are driving market adoption, challenges such as data privacy, system integration, and high implementation costs need to be addressed to ensure sustainable growth. Stakeholders must also consider employee training, change management, and robust cybersecurity frameworks to ensure successful deployment and maximize ROI

Restraint/Challenge

Data Privacy Concerns and High Implementation Costs

- The high cost of implementing AI agent solutions, including infrastructure, software licensing, and workforce training, limits adoption among small and medium-sized enterprises. Large-scale deployments are often required to realize substantial ROI, creating financial barriers. In addition, ongoing maintenance, cloud subscription fees, and hardware upgrades add to total cost of ownership, which can further delay adoption

- Data privacy, cybersecurity, and regulatory compliance concerns remain critical challenges for enterprises deploying AI agents. Organizations must ensure secure data handling and adherence to legal frameworks, especially in sensitive sectors such as healthcare and finance. Non-compliance can result in heavy penalties, reputational damage, and operational interruptions, emphasizing the need for robust governance frameworks

- Integration with existing enterprise systems and legacy IT infrastructure can be complex and time-consuming, hindering seamless deployment and limiting operational efficiency. Organizations often face challenges in standardizing data formats, ensuring API compatibility, and maintaining system uptime, which can slow project timelines and impact productivity

- For instance, in 2023, several global enterprises delayed AI agent adoption due to concerns around data protection compliance and integration complexity, slowing down initial deployment timelines. These delays not only affected technology rollout schedules but also limited the immediate benefits of process automation, predictive analytics, and operational optimization

- While AI agents offer significant operational and strategic benefits, addressing cost, privacy, and integration challenges through scalable, secure, and flexible solutions is essential for broader market acceptance and long-term growth. Companies also need to adopt hybrid deployment models, continuous monitoring, and AI governance strategies to fully capitalize on the technology while mitigating associated risks

AI Agents Market Scope

The market is segmented on the basis of technology, agent system, type, application, and end use.

• By Technology

On the basis of technology, the global AI agents market is segmented into Machine Learning, Natural Language Processing (NLP), Deep Learning, Computer Vision, and Others. The Machine Learning segment held the largest market revenue share in 2024, driven by its ability to analyze large datasets, learn from patterns, and provide actionable insights across various industries. Machine learning-powered AI agents are extensively adopted for predictive analytics, process automation, and decision-making support, making them highly valuable for enterprises and service providers.

The Natural Language Processing (NLP) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for conversational AI, virtual assistants, and customer service automation. NLP-enabled AI agents are increasingly used for real-time communication, sentiment analysis, and automated query resolution, offering enhanced user experiences and operational efficiency.

• By Agent System

On the basis of agent system, the global AI agents market is segmented into Single Agent Systems and Multi Agent Systems. Single Agent Systems held the largest market share in 2024 due to their simplicity, ease of deployment, and suitability for task-specific automation. These systems are widely used in customer support, process monitoring, and simple data analytics tasks.

Multi Agent Systems is expected to witness the fastest growth rate from 2025 to 2032, driven by their capability to perform complex, collaborative tasks across multiple domains. These systems enable decentralized problem-solving, coordination, and dynamic decision-making, making them ideal for large-scale enterprise applications and industrial automation.

• By Type

On the basis of type, the global AI agents market is segmented into Ready-to-Deploy Agents and Build-Your-Own Agents. Ready-to-Deploy Agents held the largest revenue share in 2024, fueled by their ease of implementation and immediate functionality across business processes. These solutions reduce deployment time, require minimal technical expertise, and allow organizations to quickly leverage AI-driven benefits.

Build-Your-Own Agents is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for customized AI solutions tailored to specific enterprise requirements. Organizations prefer these agents for niche applications, complex workflows, and industry-specific use cases where flexibility and adaptability are critical.

• By Application

On the basis of application, the global AI agents market is segmented into Customer Service and Virtual Assistants, Robotics and Automation, Healthcare, Financial Services, Security and Surveillance, Gaming and Entertainment, Marketing and Sales, Human Resources, Legal and Compliance, and Others. The Customer Service and Virtual Assistants segment held the largest market share in 2024, supported by the rising demand for automated support, chatbot integration, and seamless customer interactions.

The Healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of AI agents for remote patient monitoring, diagnostics, personalized treatment recommendations, and operational automation within hospitals and clinics.

• By End Use

On the basis of end use, the global AI agents market is segmented into Consumer, Enterprise, and Industrial. The Enterprise segment held the largest revenue share in 2024, fueled by large-scale adoption across IT, BFSI, retail, and telecom sectors to enhance efficiency, reduce operational costs, and improve customer experiences.

The Industrial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of AI agents for industrial automation, robotics coordination, predictive maintenance, and quality control in manufacturing and logistics operations.

AI Agents Market Regional Analysis

- North America dominated the global AI agents market with the largest revenue share of 40.5% in 2024, driven by widespread adoption of AI technologies across enterprises and a high level of digital transformation initiatives. Organizations are increasingly deploying AI agents to automate workflows, enhance customer experiences, and improve operational efficiency

- Businesses in the region highly value the predictive analytics, real-time decision-making, and multi-tasking capabilities offered by AI agents, enabling faster problem-solving and cost optimization. This adoption is supported by strong technological infrastructure, robust R&D investments, and a skilled workforce, establishing AI agents as critical solutions for both enterprise and industrial applications

U.S. AI Agents Market Insight

The U.S. AI agents market captured the largest revenue share in 2024 within North America, fueled by extensive adoption across sectors such as finance, healthcare, and retail. Enterprises are leveraging AI agents for customer support, fraud detection, robotic process automation, and predictive analytics. The growing focus on digital transformation, combined with the availability of advanced cloud platforms and AI frameworks, is significantly driving market expansion.

Europe AI Agents Market Insight

The Europe AI agents market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing investments in intelligent automation and government initiatives promoting AI adoption. Enterprises are focused on improving operational efficiency, regulatory compliance, and customer service through AI agent deployment. European organizations are also leveraging AI agents to enhance decision-making and streamline enterprise operations across industrial, commercial, and public sector applications.

U.K. AI Agents Market Insight

The U.K. AI agents market is expected to witness the fastest growth rate from 2025 to 2032, driven by widespread adoption in finance, healthcare, and enterprise sectors. Rising demand for automated customer service solutions, virtual assistants, and intelligent analytics tools is further fueling market growth. In addition, the U.K.’s strong technology ecosystem and regulatory support for AI initiatives contribute to the increased deployment of AI agent systems.

Germany AI Agents Market Insight

The Germany AI agents market is expected to witness the fastest growth rate from 2025 to 2032, owing to growing digital transformation initiatives, advanced IT infrastructure, and a focus on Industry 4.0. German enterprises are increasingly adopting AI agents for process automation, analytics, and predictive insights, particularly in manufacturing, healthcare, and logistics sectors. The emphasis on secure, privacy-compliant solutions also aligns with local regulatory expectations and corporate strategies.

Asia-Pacific AI Agents Market Insight

The Asia-Pacific AI agents market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising AI adoption in industries such as IT, manufacturing, healthcare, and finance. Countries such as China, Japan, and India are witnessing rapid digitalization and enterprise automation initiatives, creating strong demand for AI agents. Government programs supporting smart technologies, coupled with the availability of cost-effective AI solutions, are further expanding market adoption across the region.

Japan AI Agents Market Insight

The Japan AI agents market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced technology infrastructure, high-tech enterprise culture, and focus on automation in manufacturing and service sectors. Adoption is driven by demand for virtual assistants, robotics automation, and intelligent decision-making systems. Integration with IoT and cloud platforms, along with government initiatives for AI-driven smart industries, is fueling growth.

China AI Agents Market Insight

The China AI agents market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrial automation, smart city initiatives, and strong technology adoption across enterprises. Chinese companies are increasingly using AI agents for customer service, predictive analytics, and intelligent automation in industrial, financial, and commercial applications. The presence of leading AI technology providers and supportive government policies are key factors boosting market growth in China.

AI Agents Market Share

The AI Agents industry is primarily led by well-established companies, including:

- Alibaba Group Holding Limited (China)

- Amazon Web Services, Inc. (U.S.)

- Apple Inc. (U.S.)

- Baidu, Inc. (China)

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Meta Platforms, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Salesforce, Inc. (U.S.)

Latest Developments in Global AI Agents Market

- In February 2025, GitHub introduced Agent Mode for GitHub Copilot, enhancing the AI coding assistant to independently iterate on code, detect errors, and implement fixes. This development enables Copilot to interpret high-level requests, generate multi-file code, and debug outputs with minimal human intervention, improving developer efficiency and accelerating software development workflows

- In September 2024, Microsoft launched innovations in Microsoft 365 Copilot, introducing new AI agents that automate and streamline processes within Microsoft and third-party software. These agents help users create customized AI assistants to perform repetitive and complex tasks, boosting productivity and enhancing enterprise adoption of AI-driven workflows

- In September 2024, IBM Corporation partnered with Salesforce, Inc. to integrate AI agents through the Agentforce platform combined with WatsonX. This initiative allows organizations to deploy AI agents on their own IT infrastructure while leveraging proprietary data securely, empowering businesses to automate tasks, improve operational efficiency, and strengthen data-driven decision-making

- In July 2024, BRYTER launched a new AI Agents suite and updates to its no-code platform, targeting law firms and corporate legal departments. The AI Agents automate repetitive tasks such as contract reviews and drafting routine emails, significantly reducing manual workload, increasing accuracy, and enabling faster turnaround in legal and commercial operation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.