Global Ai Enabled Life Sciences Procurement Platforms Market

Market Size in USD Million

CAGR :

%

USD

274.42 Million

USD

642.06 Million

2025

2033

USD

274.42 Million

USD

642.06 Million

2025

2033

| 2026 –2033 | |

| USD 274.42 Million | |

| USD 642.06 Million | |

|

|

|

|

AI-Enabled Life Sciences Procurement Platforms Market Size

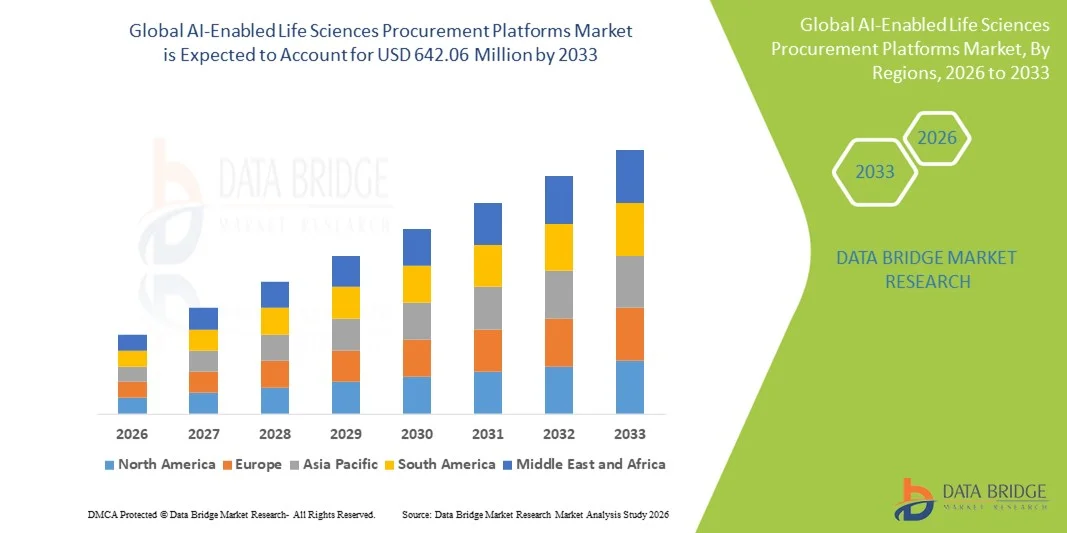

- The global AI-enabled life sciences procurement platforms market size was valued at USD 274.42 million in 2025 and is expected to reach USD 642.06 million by 2033, at a CAGR of 11.21% during the forecast period

- The market growth is largely driven by the increasing adoption of artificial intelligence, machine learning, and automation across life sciences procurement workflows, enabling organizations to optimize sourcing, spend management, supplier selection, and compliance through data-driven decision-making

- Furthermore, rising pressure on pharmaceutical, biotechnology, and research organizations to improve operational efficiency, ensure regulatory compliance, and manage complex global supply chains is positioning AI-enabled procurement platforms as a critical digital infrastructure, thereby significantly accelerating overall market growth

AI-Enabled Life Sciences Procurement Platforms Market Analysis

- AI-enabled life sciences procurement platforms, which apply artificial intelligence, machine learning, and advanced analytics to streamline sourcing, supplier management, and procurement operations, are increasingly essential digital tools for pharmaceutical, biotechnology, and research organizations due to their ability to enhance efficiency, visibility, and compliance across complex procurement environment

- The growing adoption of these platforms is primarily driven by the rising need to optimize procurement costs, manage large and diverse supplier ecosystems, and improve decision-making accuracy across R&D, clinical trial, and manufacturing procurement activities within the life sciences sector

- North America dominated the AI-enabled life sciences procurement platforms market with the largest revenue share of 41.0% in 2025, supported by strong adoption of cloud-based enterprise solutions, advanced AI capabilities, and a high concentration of pharmaceutical and biotechnology companies, with the U.S. leading platform deployments across large-scale life sciences enterprises

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid expansion of pharmaceutical and biotechnology industries, increasing digitalization of procurement processes, and rising adoption of cloud-based AI procurement platforms across emerging economies

- The solutions segment dominated the market with a revenue share of 64.5% in 2025, driven by strong demand for AI-powered procurement software incorporating machine learning, natural language processing, and predictive analytics to automate procurement workflows and deliver actionable insights for life sciences organizations

Report Scope and AI-Enabled Life Sciences Procurement Platforms Market Segmentation

|

Attributes |

AI-Enabled Life Sciences Procurement Platforms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

AI-Enabled Life Sciences Procurement Platforms Market Trends

Accelerated Adoption of AI-Driven Procurement Intelligence and Automation

- A significant and accelerating trend in the global AI-enabled life sciences procurement platforms market is the increasing integration of advanced artificial intelligence technologies such as machine learning, natural language processing, and predictive analytics to enhance procurement intelligence, automation, and decision-making across life sciences organizations

- These platforms are increasingly being embedded within broader digital ecosystems, enabling seamless integration with enterprise resource planning (ERP), laboratory information management systems (LIMS), and supply chain platforms to create unified and data-driven procurement environments

- For instance, AI-enabled procurement platforms are being deployed to automatically analyze large volumes of spend and supplier data, identify cost-saving opportunities, predict demand fluctuations, and flag potential supplier risks, allowing procurement teams to act proactively rather than reactively

- The adoption of natural language processing capabilities is enabling automated contract review, extraction of key terms, and compliance checks, significantly reducing manual workload and improving contract accuracy in highly regulated life sciences procurement workflows

- Additionally, cloud-based AI procurement platforms are facilitating real-time collaboration across global procurement teams, contract research organizations, and contract manufacturing partners, supporting centralized visibility and control over complex, multi-region supplier networks

- This trend toward more intelligent, automated, and integrated procurement platforms is reshaping procurement strategies within life sciences organizations, as companies increasingly prioritize AI-enabled solutions to improve efficiency, ensure regulatory compliance, and strengthen supply chain resilience

AI-Enabled Life Sciences Procurement Platforms Market Dynamics

Driver

Rising Need for Cost Optimization, Compliance, and Supply Chain Visibility

- The increasing pressure on pharmaceutical, biotechnology, and research organizations to optimize procurement costs while maintaining strict regulatory compliance is a major driver accelerating the adoption of AI-enabled life sciences procurement platforms

- For instance, life sciences companies are increasingly leveraging AI-powered procurement solutions to gain real-time visibility into supplier performance, spend patterns, and procurement risks, enabling faster and more informed decision-making across R&D, clinical trials, and manufacturing operations

- The growing complexity of global supply chains, coupled with frequent disruptions and regulatory scrutiny, is driving demand for platforms that can use predictive analytics to forecast supply risks and ensure uninterrupted access to critical materials and services

- Furthermore, the ongoing digital transformation of life sciences enterprises and the shift toward cloud-based enterprise solutions are making AI-enabled procurement platforms a strategic investment for organizations seeking scalable and future-ready procurement infrastructures

- The ability of AI-enabled platforms to automate repetitive procurement tasks, reduce manual errors, and improve operational efficiency is further propelling their adoption across large pharmaceutical companies as well as mid-sized biotechnology firms and CROs

- Increasing pressure to improve sustainability and supplier transparency within life sciences supply chains is also driving demand for AI-enabled procurement platforms that can track supplier compliance, ethical sourcing, and environmental metrics

- The growing adoption of outsourcing models, including CROs and CMOs, is further accelerating demand for centralized AI-enabled procurement platforms that can manage multi-partner procurement workflows efficiently

Restraint/Challenge

Data Integration Complexity and Regulatory Validation Requirements

- The complexity of integrating AI-enabled procurement platforms with existing legacy systems, disparate data sources, and enterprise applications poses a significant challenge for many life sciences organizations, particularly those with highly customized IT environments

- For instance, procurement data across R&D, clinical trials, and manufacturing is often fragmented, requiring extensive data cleansing and standardization before AI models can deliver accurate and reliable insights

- Additionally, the need to validate AI-enabled systems in accordance with stringent regulatory standards and internal quality requirements can lengthen implementation timelines and increase deployment costs for life sciences organizations

- Concerns related to data security, intellectual property protection, and confidentiality of supplier and pricing data can further slow adoption, especially when deploying cloud-based AI procurement platforms

- Limited availability of skilled professionals capable of managing AI models and interpreting advanced procurement analytics can act as a barrier, particularly for smaller biotechnology firms and research organizations

- Overcoming these challenges through improved data governance frameworks, pre-validated AI models, enhanced cybersecurity measures, and modular platform architectures will be critical for enabling wider adoption and sustained growth of AI-enabled life sciences procurement platforms

AI-Enabled Life Sciences Procurement Platforms Market Scope

The market is segmented on the basis of component, deployment model, technology, and end user.

- By Component

On the basis of component, the global AI-enabled life sciences procurement platforms market is segmented into solutions and services. The solutions segment dominated the market in 2025 with a market share of 64.5%, driven by the growing adoption of AI-powered procurement software across pharmaceutical, biotechnology, and research organizations. These solutions offer integrated capabilities such as spend analytics, supplier management, contract lifecycle management, and compliance monitoring within a single platform. Life sciences organizations increasingly prefer comprehensive software solutions that can automate complex procurement workflows while ensuring regulatory adherence. The availability of cloud-based AI solutions further supports scalability and real-time decision-making. Additionally, solutions enable organizations to leverage machine learning and predictive analytics for cost optimization and supplier risk mitigation. This strong functional value has positioned solutions as the primary revenue contributor in the market.

The services segment is expected to witness the fastest growth during the forecast period, supported by rising demand for implementation, integration, customization, and managed services. Life sciences organizations often operate in highly regulated environments, requiring specialized consulting and validation services during platform deployment. Increasing complexity of data migration from legacy systems is also driving demand for professional services. Furthermore, ongoing needs for AI model tuning, training, and regulatory compliance support are accelerating service adoption. As mid-sized biotech firms and CROs adopt AI procurement platforms, reliance on third-party service providers is expected to increase. This trend makes services a rapidly expanding segment.

- By Deployment Model

On the basis of deployment model, the market is segmented into cloud, on-premises, and hybrid. The cloud deployment model dominated the market in 2025, owing to its scalability, cost efficiency, and ease of integration with enterprise systems. Cloud-based platforms enable real-time access to procurement data across geographically distributed teams and partners. Life sciences companies increasingly favor cloud solutions due to faster deployment timelines and continuous software updates. These platforms also support advanced AI processing capabilities without requiring heavy on-site infrastructure. Enhanced data security measures and compliance certifications offered by cloud providers have further strengthened trust. As a result, cloud deployment has emerged as the preferred choice for most organizations.

The hybrid deployment model is projected to be the fastest-growing segment during forecast period, driven by the need to balance data control with scalability. Hybrid models allow organizations to retain sensitive procurement and compliance data on-premises while leveraging cloud-based AI analytics. This approach is particularly attractive to large pharmaceutical companies with strict internal data governance policies. Hybrid deployment supports gradual digital transformation without complete system overhauls. Additionally, it enables organizations to comply with regional data residency regulations while benefiting from cloud innovation. These advantages are accelerating adoption of hybrid procurement platforms.

- By Technology

On the basis of technology, the market is segmented into machine learning, natural language processing, robotic process automation, generative AI, and predictive analytics. The machine learning segment held the largest market share in 2025, driven by its widespread use in spend analysis, supplier scoring, and demand forecasting. Machine learning algorithms enable procurement platforms to identify hidden patterns in large datasets and improve decision accuracy over time. Life sciences organizations rely heavily on ML for cost optimization and supplier performance evaluation. These capabilities are critical in managing complex procurement ecosystems involving thousands of suppliers. Continuous learning from historical procurement data further enhances operational efficiency. This broad applicability has made machine learning the dominant technology segment.

The generative AI segment is expected to grow at the fastest rate during the forecast period, supported by rising interest in intelligent automation and decision support. Generative AI enables automated drafting of contracts, supplier communications, and procurement reports. It also supports conversational interfaces that allow procurement teams to interact with systems using natural language queries. Life sciences organizations are increasingly exploring generative AI to reduce manual workload and improve productivity. Integration of generative AI with procurement analytics enhances strategic planning and scenario modeling. These innovations are driving rapid adoption of generative AI technologies.

- By End User

On the basis of end user, the market is segmented into pharmaceutical companies, biotechnology companies, contract research organizations, contract manufacturing organizations, medical device & diagnostics companies, and research institutes & academic laboratories. The pharmaceutical companies segment dominated the market in 2025, due to high procurement complexity and large-scale operations. Pharmaceutical companies manage extensive supplier networks across R&D, clinical trials, and manufacturing. AI-enabled procurement platforms help these organizations optimize costs, manage compliance, and ensure supply continuity. The need for real-time procurement intelligence and risk mitigation further drives adoption. Large IT budgets and early adoption of digital technologies also support market dominance. As a result, pharmaceutical companies remain the largest end-user segment.

The contract research organizations (CROs) segment is anticipated to register the fastest growth during the forecast period, driven by increasing outsourcing of clinical research activities. CROs manage procurement across multiple sponsors, trials, and geographies, creating high demand for centralized AI-enabled platforms. These platforms help CROs streamline supplier coordination and improve transparency. Growing clinical trial volumes and global trial expansion are further fueling adoption. Additionally, CROs increasingly rely on cloud-based procurement solutions for scalability and collaboration. This makes CROs a key high-growth end-user segment.

AI-Enabled Life Sciences Procurement Platforms Market Regional Analysis

- North America dominated the AI-enabled life sciences procurement platforms market with the largest revenue share of 41.0% in 2025, supported by strong adoption of cloud-based enterprise solutions, advanced AI capabilities, and a high concentration of pharmaceutical and biotechnology companies, with the U.S. leading platform deployments across large-scale life sciences enterprises

- Organizations in the region place high value on AI-driven spend analytics, supplier risk management, and regulatory compliance capabilities, along with seamless integration of procurement platforms with enterprise systems such as ERP and supply chain management solutions

- This strong adoption is further supported by significant R&D investments, a mature life sciences ecosystem, and the increasing focus on improving supply chain resilience and operational efficiency, positioning AI-enabled procurement platforms as a critical digital solution across both large enterprises and growing biotech firms

U.S. AI-Enabled Life Sciences Procurement Platforms Market Insight

The U.S. AI-enabled life sciences procurement platforms market captured the largest revenue share within North America in 2025, driven by early adoption of artificial intelligence, a highly mature life sciences ecosystem, and strong investment in digital transformation. U.S.-based pharmaceutical and biotechnology companies are increasingly prioritizing AI-driven procurement solutions to enhance spend visibility, supplier risk management, and regulatory compliance. The presence of leading life sciences enterprises, advanced IT infrastructure, and a strong focus on supply chain resilience further accelerates market growth. Moreover, growing adoption of cloud-based enterprise platforms and integration with ERP and analytics systems is significantly contributing to the expansion of the market in the U.S.

Europe AI-Enabled Life Sciences Procurement Platforms Market Insight

The Europe AI-enabled life sciences procurement platforms market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulatory requirements and increasing emphasis on procurement transparency and compliance. The region’s strong pharmaceutical manufacturing base and rising adoption of digital procurement tools are supporting market growth. European organizations are increasingly leveraging AI-enabled platforms to manage complex supplier networks and ensure compliance with evolving regulations. Growing investments in digital transformation across healthcare and life sciences sectors are further fostering adoption. The market is witnessing strong traction across pharmaceutical, biotechnology, and medical device companies.

U.K. AI-Enabled Life Sciences Procurement Platforms Market Insight

The U.K. AI-enabled life sciences procurement platforms market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing digitalization of procurement processes and strong life sciences R&D activities. Organizations in the U.K. are adopting AI-enabled platforms to optimize procurement costs and improve supplier collaboration. The presence of established pharmaceutical companies and contract research organizations is driving demand for centralized procurement solutions. Additionally, supportive government initiatives promoting digital innovation in healthcare and life sciences are contributing to market growth. The increasing use of cloud-based platforms is further strengthening adoption.

Germany AI-Enabled Life Sciences Procurement Platforms Market Insight

The Germany AI-enabled life sciences procurement platforms market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong pharmaceutical manufacturing base and emphasis on process efficiency and compliance. German organizations are increasingly adopting AI-driven procurement platforms to improve operational transparency and supplier management. The focus on data security and regulatory adherence aligns well with advanced AI-enabled solutions. Integration of procurement platforms with enterprise systems is becoming more prevalent across large manufacturers. These factors collectively support steady market growth in Germany.

Asia-Pacific AI-Enabled Life Sciences Procurement Platforms Market Insight

The Asia-Pacific AI-enabled life sciences procurement platforms market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid expansion of pharmaceutical and biotechnology industries across the region. Increasing digital transformation initiatives, rising R&D investments, and growing adoption of cloud-based enterprise platforms are accelerating market growth. Countries such as China, India, and Japan are witnessing increased demand for AI-enabled procurement solutions to manage complex supplier ecosystems. Additionally, the growing presence of contract manufacturing and research organizations is boosting platform adoption. These factors position Asia-Pacific as the fastest-growing regional market.

Japan AI-Enabled Life Sciences Procurement Platforms Market Insight

The Japan AI-enabled life sciences procurement platforms market is gaining momentum due to the country’s advanced technological landscape and strong focus on automation and efficiency. Japanese pharmaceutical and biotechnology companies are increasingly adopting AI-enabled platforms to optimize procurement workflows and ensure supply continuity. The integration of AI solutions with existing enterprise systems is supporting data-driven decision-making. Japan’s emphasis on precision, compliance, and operational excellence further drives adoption. Additionally, increasing investments in digital healthcare infrastructure are contributing to market growth.

India AI-Enabled Life Sciences Procurement Platforms Market Insight

The India AI-enabled life sciences procurement platforms market accounted for the largest market revenue share within Asia-Pacific in 2025, driven by rapid growth of the pharmaceutical and biotechnology sectors. Indian organizations are increasingly adopting AI-enabled procurement platforms to manage large supplier bases and improve cost efficiency. The country’s expanding contract manufacturing and research ecosystem is generating strong demand for centralized procurement solutions. Government initiatives supporting digital transformation and healthcare modernization are further propelling market growth. The availability of cost-effective cloud-based platforms is also accelerating adoption across mid-sized and large enterprises.

AI-Enabled Life Sciences Procurement Platforms Market Share

The AI-Enabled Life Sciences Procurement Platforms industry is primarily led by well-established companies, including:

- Labviva (U.S.)

- Quartzy (U.S.)

- Coupa Software Inc. (U.S.)

- GEP (U.S.)

- SAP SE (Germany)

- Ivalua Inc. (U.S.)

- JAGGAER (U.S.)

- Basware Corporation (Finland)

- Procurify (Canada)

- Tradeshift (U.S.)

- Determine, Inc. (U.S.)

- Vroozi, Inc. (U.S.)

- Xeeva, Inc. (U.S.)

- Kissflow Inc. (India)

- Precoro (U.S.)

- ProcurementExpress.com (Canada)

- Levelpath (U.S.)

- Globality, Inc. (U.S.)

- Tamr, Inc. (U.S.)

- akiroLabs GmbH (Germany)

What are the Recent Developments in Global AI-Enabled Life Sciences Procurement Platforms Market?

- In June 2025, Bayer Innovation Procurement expanded its use of Scientist.com’s AI-powered platform for global R&D procurement orchestration, enabling Bayer teams across pharmaceutical and crop science to leverage AI tools for supplier discovery, competitive bidding, compliance checks, and spend analytics in one secure environment to accelerate research and improve efficiency

- In June 2025, Labviva showcased advanced AI procurement tools, including automated purchasing and inventory management innovations, at the R&D Procurement & Sourcing in Pharma Summit, demonstrating how life sciences organizations can use AI to drive cost efficiencies and accelerate scientific innovation

- In June 2025, Labviva launched the HarperChem AI-powered chemical supply chain automation suite within its cloud-based platform, designed to automate sourcing, storage, and replenishment of raw materials for laboratories, helping address supply chain bottlenecks in pharmaceutical and biotech research

- In September 2024, Labviva introduced its real-time Inventory Management System (IMS) for life sciences purchasing, which provides AI-driven automation for inventory workflows, forecasting, and replenishment across millions of SKUs, helping researchers and procurement teams optimize stock and reduce waste

- In July 2024, Scientist.com launched the Clinical Labs Navigator™ to expand clinical sourcing capabilities, enhancing its AI-enabled R&D procurement platform with real-time clinical-trial intelligence and a broader set of sourcing and

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.