Global Ai Powered Dental Workflow Platforms Market

Market Size in USD Million

CAGR :

%

USD

415.80 Million

USD

967.93 Million

2024

2032

USD

415.80 Million

USD

967.93 Million

2024

2032

| 2025 –2032 | |

| USD 415.80 Million | |

| USD 967.93 Million | |

|

|

|

|

AI-Powered Dental Workflow Platforms Market Size

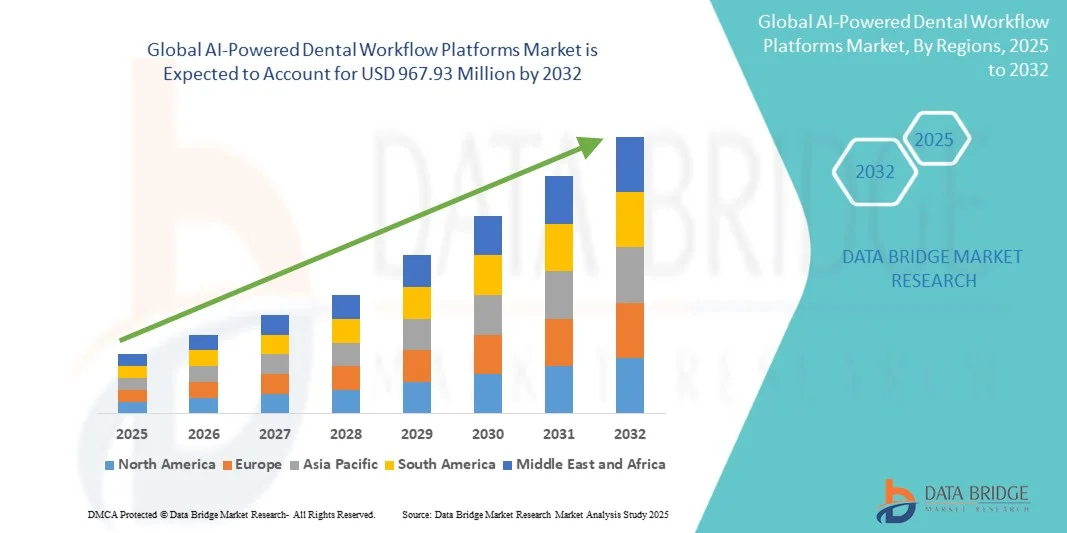

- The global AI-powered dental workflow platforms market size was valued at USD 415.80 million in 2024 and is expected to reach USD 967.93 million by 2032, at a CAGR of 11.14% during the forecast period

- The market growth is largely fueled by the increasing integration of artificial intelligence across dental imaging, diagnostics, and treatment planning, enhancing accuracy, efficiency, and patient outcomes in modern dental practices

- Furthermore, the rising demand for automated, data-driven, and interoperable solutions among dental clinics, hospitals, and laboratories is positioning AI-powered platforms as the cornerstone of next-generation dental care. These converging factors are accelerating adoption globally, thereby significantly boosting the industry's growth

AI-Powered Dental Workflow Platforms Market Analysis

- AI-powered dental workflow platforms, integrating advanced artificial intelligence for imaging, diagnostics, and treatment planning, are becoming essential tools in modern dental practices, enabling greater precision, efficiency, and automation across clinical and administrative workflows in both hospitals and private clinics

- The accelerating adoption of these platforms is primarily driven by the growing demand for digital dentistry, the need for faster and more accurate diagnosis, and the increasing emphasis on patient-centered, data-driven care supported by interoperable systems

- North America dominated the AI-powered dental workflow platforms market with the largest revenue share of 39.6% in 2024, supported by early technological adoption, strong digital infrastructure, and the presence of leading dental software providers, with the U.S. experiencing rapid integration of AI tools in imaging, orthodontic planning, and patient management systems

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by expanding dental care infrastructure, growing awareness of AI-driven dental technologies, and increasing investments in healthcare digitalization

- The AI Imaging & Radiograph Analysis segment dominated the market with a share of 41.8% in 2024, driven by its proven ability to enhance diagnostic accuracy, streamline workflow efficiency, and reduce chair time, making it a critical component of the evolving digital dental ecosystem

Report Scope and AI-Powered Dental Workflow Platforms Market Segmentation

|

Attributes |

AI-Powered Dental Workflow Platforms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

AI-Powered Dental Workflow Platforms Market Trends

“Integration of AI with Cloud and Imaging Technologies Enhancing Dental Precision”

- A significant and accelerating trend in the global AI-powered dental workflow platforms market is the growing integration of artificial intelligence with cloud-based infrastructure and advanced imaging systems, enabling seamless, data-driven decision-making across dental practices

- For instance, Dentsply Sirona’s DS Core platform integrates AI-driven imaging analysis and cloud connectivity, allowing practitioners to visualize, plan, and share treatment data in real time for enhanced collaboration

- AI integration within dental workflows enables functions such as automated image segmentation, real-time diagnostics, and predictive treatment planning to optimize clinical precision and efficiency. For instance, Pearl’s Second Opinion® uses AI algorithms to detect caries and other pathologies on radiographs, assisting clinicians in improving diagnostic confidence and patient communication

- The adoption of AI-driven automation also extends to appointment scheduling, billing, and patient record management, reducing administrative workload and improving operational productivity. Through unified cloud platforms, users can access AI-based tools from any location, enhancing workflow continuity across dental networks

- This trend toward cloud-integrated, AI-enhanced dental ecosystems is transforming both clinical and business processes within dentistry. Consequently, companies such as Overjet are expanding AI-based diagnostic and analytics solutions to integrate seamlessly with existing practice management systems, improving overall care delivery

- The demand for AI-powered platforms capable of advanced image analysis, cloud integration, and interoperability is rapidly increasing as dental professionals seek intelligent, scalable solutions to enhance diagnostic accuracy and workflow efficiency across clinical settings

AI-Powered Dental Workflow Platforms Market Dynamics

Driver

“Rising Demand for Digital Dentistry and AI-Enabled Diagnostic Precision”

- The growing shift toward digital dentistry, coupled with the rising need for faster and more accurate diagnostics, is a major driver fueling the adoption of AI-powered dental workflow platforms

- For instance, in February 2024, 3Shape launched AI-driven TRIOS software updates that enhance intraoral scan accuracy and automate case documentation, demonstrating strong momentum in clinical AI adoption

- As dental practitioners increasingly recognize the value of AI in enhancing image interpretation, treatment planning, and patient management, these solutions are becoming essential tools for modern practices

- Furthermore, the surge in dental imaging volume and the need to streamline repetitive diagnostic tasks are reinforcing the demand for automation within clinical workflows, improving efficiency and reducing human error

- The integration of AI with dental imaging, CAD/CAM, and practice management systems provides comprehensive support from diagnosis to patient communication, enhancing overall treatment quality and operational effectiveness. The expansion of cloud-based AI solutions and remote collaboration capabilities further strengthens this trend

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance Barriers”

- Concerns related to patient data privacy and strict healthcare data regulations pose significant challenges to the widespread adoption of AI-powered dental workflow platforms

- For instance, reports of data breaches in healthcare IT systems have raised concerns about patient confidentiality, making compliance with regulations such as HIPAA and GDPR a top priority for dental software providers

- Addressing these challenges requires strong encryption standards, secure cloud hosting, and transparent AI algorithm governance to ensure compliance and maintain clinician and patient trust

- In addition, the regulatory complexity surrounding AI-driven diagnostics, including validation and clinical trial requirements for medical-grade approval, can slow market entry for new products and innovations

- The relatively high cost of implementing AI-driven platforms, including integration with existing dental systems, can be a financial barrier for smaller clinics or independent practitioners. While adoption costs are expected to decline with technological maturity, affordability remains a concern in price-sensitive regions

- Overcoming these challenges through enhanced cybersecurity, standardized compliance frameworks, and cost-effective subscription models will be essential to ensure sustainable market growth and broader AI integration in dental workflows

AI-Powered Dental Workflow Platforms Market Scope

The market is segmented on the basis of component, solution, technology, application, and end user.

- By Component

On the basis of component, the AI-powered dental workflow platforms market is segmented into solutions and services. The Solutions segment dominated the market with the largest revenue share of 63.4% in 2024, driven by the rising deployment of AI-powered software across dental imaging, diagnostics, and patient management. Clinics and DSOs are increasingly adopting integrated AI platforms to automate diagnostic interpretation, treatment planning, and workflow optimization. The growing emphasis on digital transformation and the integration of cloud-based software has strengthened this segment’s dominance. Furthermore, key players are investing in developing scalable, interoperable AI modules that enhance precision, reduce manual workload, and improve patient engagement. The demand for AI-driven solutions that provide real-time insights, clinical accuracy, and data security continues to propel growth within this segment.

The Services segment is anticipated to witness the fastest CAGR of 21.1% from 2025 to 2032, fueled by the rising demand for implementation support, technical assistance, and ongoing maintenance of AI platforms. With the increasing complexity of AI systems, service providers are essential for data migration, compliance with healthcare regulations, and customized training for clinical teams. The segment benefits from the transition toward cloud deployment and software-as-a-service (SaaS) models that require regular updates and managed services. In addition, as more dental organizations seek personalized AI integrations, service contracts and consulting engagements are expanding rapidly. This strong demand for post-deployment support and optimization positions services as a key growth driver in the forecast period.

- By Solution

On the basis of solution, the market is segmented into AI imaging & radiograph analysis, treatment planning & surgical guides, workflow automation & scheduling, patient engagement & virtual assistant, practice analytics & revenue cycle management, and EHR integration & interoperability. The AI Imaging & Radiograph Analysis segment dominated the market with a share of 41.8% in 2024, owing to its extensive use in early disease detection and diagnostic accuracy improvement. AI-based imaging platforms are increasingly being used to detect caries, bone loss, and lesions with high precision, enhancing clinical confidence and reducing diagnostic errors. The segment’s growth is supported by regulatory clearances and the rapid adoption of deep learning technologies in radiology and intraoral scanning. Moreover, the integration of AI with existing dental imaging systems allows practitioners to automate repetitive tasks and improve patient communication. The continuous innovation from leading vendors such as Pearl and Overjet further consolidates this segment’s market leadership.

The Workflow Automation & Scheduling segment is expected to record the fastest CAGR of 22.6% from 2025 to 2032, driven by the increasing demand for efficiency in clinical and administrative operations. AI-powered scheduling tools automate patient bookings, optimize chair time, and reduce no-shows through predictive analytics and automated reminders. Dental groups and DSOs are investing in workflow automation to standardize operations across multi-site practices. Furthermore, these solutions integrate with patient management systems, enhancing coordination and operational productivity. As the dental sector embraces digital efficiency, workflow automation continues to gain traction as an essential element of AI-driven transformation.

- By Technology

On the basis of technology, the market is segmented into deep learning, machine learning, natural language processing (NLP), and robotics & automation. The Deep Learning segment dominated the market with the largest revenue share of 46.9% in 2024, as it underpins the majority of AI-based diagnostic and imaging applications. Deep learning algorithms process complex radiographic data to identify subtle anomalies with exceptional accuracy, enhancing clinician confidence and improving treatment outcomes. The segment benefits from the increasing volume of annotated dental image datasets, which enhance algorithm training and precision. Moreover, continuous R&D investments by companies in convolutional neural networks (CNNs) have made deep learning integral to dental image processing. The scalability and versatility of deep learning also enable predictive modeling for caries risk and implant success rates. Its widespread adoption across diagnostic and decision-support platforms ensures this segment’s sustained dominance.

The Natural Language Processing (NLP) segment is projected to witness the fastest CAGR of 24.4% from 2025 to 2032, driven by the increasing adoption of AI-powered speech recognition and automated documentation tools. NLP technology allows clinicians to convert voice notes into structured records, streamlining data entry and clinical reporting. Dental practices are adopting NLP-based assistants for patient interaction, treatment summaries, and billing management. Furthermore, the integration of NLP within electronic health records enhances communication between practitioners and patients. Vendors are developing multilingual NLP solutions to support global adoption, improving accessibility and usability. This growing reliance on AI-driven language tools positions NLP as a key innovation frontier in digital dentistry.

- By Application

On the basis of application, the market is categorized into general dentistry, endodontics, orthodontics, oral surgery & implantology, and prosthodontics. The General Dentistry segment dominated the market with a share of 39.8% in 2024, owing to the extensive application of AI in preventive diagnostics and routine care. General practitioners utilize AI-powered tools for caries detection, periodontal assessment, and digital imaging, enhancing diagnostic precision and efficiency. The segment benefits from the wide availability of affordable, user-friendly AI solutions compatible with existing dental practice systems. Increasing focus on early disease detection and patient retention strategies is driving adoption among small and mid-sized practices. Moreover, AI platforms designed for general dentistry offer scalable solutions that integrate seamlessly with daily operations, reducing human error and improving patient satisfaction. Continuous advancements in chairside diagnostics and automation further reinforce this segment’s dominance.

The Orthodontics segment is anticipated to grow at the fastest CAGR of 23.7% from 2025 to 2032, fueled by the growing adoption of AI in digital aligner planning and 3D imaging analysis. AI algorithms are increasingly used to simulate tooth movement, enhance treatment design, and predict outcomes, leading to greater precision and shorter treatment times. Orthodontic clinics are leveraging AI to automate case assessment and improve patient experience through visual treatment simulations. Furthermore, integration with CAD/CAM systems allows for faster, more accurate aligner fabrication. The surge in personalized orthodontic solutions, combined with rising aesthetic dentistry demand, continues to accelerate this segment’s expansion.

- By End User

On the basis of end user, the market is divided into dental clinics & private practices, dental support organizations (DSOs), hospitals & dental departments, dental laboratories, imaging centers, and academic & research institutions. The Dental Clinics & Private Practices segment dominated the market with a revenue share of 44.6% in 2024, driven by increasing adoption of AI-powered solutions among independent and small-scale practices. Clinics are using AI to automate diagnostic workflows, enhance patient experience, and streamline billing and scheduling processes. The affordability and scalability of cloud-based AI platforms have made them accessible to solo practitioners and mid-sized practices. Furthermore, the growing trend toward digital transformation in private clinics supports sustained demand for intelligent workflow automation. AI’s ability to integrate seamlessly with imaging and patient management systems makes it indispensable in everyday practice. Continuous product innovations tailored to smaller practices further solidify this segment’s dominance.

The Dental Support Organizations (DSOs) segment is expected to register the fastest CAGR of 25.2% from 2025 to 2032, driven by large-scale implementation of AI for centralized diagnostics, performance analytics, and patient data management. DSOs are leveraging AI platforms to unify workflows across multiple clinic networks, ensuring consistent quality of care and operational efficiency. The use of AI for performance tracking, predictive analytics, and revenue optimization has become a strategic focus for large dental networks. In addition, cloud-based AI systems facilitate centralized data access and collaboration between clinics and laboratories. The increasing focus on enterprise-scale AI adoption positions DSOs as major contributors to market expansion in the coming years.

AI-Powered Dental Workflow Platforms Market Regional Analysis

- North America dominated the AI-powered dental workflow platforms market with the largest revenue share of 39.6% in 2024, supported by early technological adoption, strong digital infrastructure, and the presence of leading dental software providers

- Dental professionals across the U.S. and Canada are increasingly integrating AI-driven diagnostic and workflow solutions to enhance treatment accuracy, patient experience, and operational efficiency

- This dominance is further supported by favorable regulatory frameworks encouraging AI in healthcare, widespread availability of digital imaging equipment, and a robust network of dental service organizations adopting AI for automation and clinical decision support

U.S. AI-Powered Dental Workflow Platforms Market Insight

The U.S. AI-powered dental workflow platforms market captured the largest revenue share of 82% in 2024 within North America, driven by the rapid digitalization of dental practices and the integration of AI across diagnostics, imaging, and patient management systems. The growing need for precision-based treatment planning and efficient workflow automation is fueling adoption among both private practices and dental service organizations (DSOs). Moreover, the presence of leading AI developers, strong regulatory support for digital health solutions, and a well-established dental technology ecosystem continue to strengthen the U.S. market. The increasing use of AI-enabled analytics for patient outcomes and practice optimization is further propelling market expansion.

Europe AI-Powered Dental Workflow Platforms Market Insight

The Europe AI-powered dental workflow platforms market is projected to expand at a substantial CAGR throughout the forecast period, propelled by rising investments in healthcare digitalization and stringent standards for data-driven dental care. The adoption of AI for imaging diagnostics, treatment planning, and patient engagement is growing rapidly across dental hospitals and clinics. European countries are emphasizing interoperability between AI systems and electronic health records, improving efficiency in dental workflows. In addition, the region’s strong focus on patient data security and ethical AI use is fostering innovation in transparent and compliant platforms.

U.K. AI-Powered Dental Workflow Platforms Market Insight

The U.K. AI-powered dental workflow platforms market is anticipated to grow at a notable CAGR during the forecast period, driven by strong government initiatives supporting healthcare AI adoption and digital transformation within dental care services. Dental professionals are increasingly leveraging AI tools for radiograph analysis, clinical decision support, and administrative automation. The country’s advanced IT infrastructure and growing number of AI-driven dental startups are accelerating innovation in personalized and preventive dental solutions. Moreover, the U.K.’s emphasis on integrating AI with the National Health Service (NHS) digital systems is expected to further boost market growth.

Germany AI-Powered Dental Workflow Platforms Market Insight

The Germany AI-powered dental workflow platforms market is expected to expand at a considerable CAGR, driven by the nation’s focus on precision healthcare and advanced dental technology adoption. German dental clinics are increasingly integrating AI for automated diagnostics, 3D treatment planning, and workflow optimization. The country’s strong manufacturing base in dental equipment and commitment to research in machine learning and imaging technologies are fueling the development of AI-enhanced systems. In addition, the growing demand for secure, GDPR-compliant AI platforms that enhance clinical outcomes aligns with the German market’s high standards for data protection and innovation.

Asia-Pacific AI-Powered Dental Workflow Platforms Market Insight

The Asia-Pacific AI-powered dental workflow platforms market is poised to grow at the fastest CAGR of 25.4% during the forecast period (2025–2032), driven by rapid urbanization, expanding dental infrastructure, and increasing adoption of digital imaging systems. Countries such as China, Japan, South Korea, and India are witnessing surging demand for AI-enabled solutions that improve diagnostic precision and streamline dental workflows. Government initiatives promoting healthcare digitalization and the emergence of regional AI innovators are supporting this expansion. Moreover, the growing dental tourism industry and focus on affordable AI solutions are broadening accessibility across the region.

Japan AI-Powered Dental Workflow Platforms Market Insight

The Japan AI-powered dental workflow platforms market is gaining strong traction due to the country’s advanced technological ecosystem, early adoption of robotics, and commitment to precision healthcare. Japanese dental practices are utilizing AI for diagnostic imaging, patient scheduling, and virtual treatment simulations. The nation’s aging population and rising demand for minimally invasive dental care are further fueling the need for efficient, AI-driven workflows. Moreover, the integration of AI platforms with 3D printing and robotic-assisted dental systems is positioning Japan as a key innovator in this space.

India AI-Powered Dental Workflow Platforms Market Insight

The India AI-powered dental workflow platforms market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s growing dental care industry, increasing adoption of cloud-based healthcare solutions, and strong focus on affordable digital innovation. Dental clinics and laboratories are increasingly leveraging AI to improve imaging accuracy, streamline patient management, and enhance treatment efficiency. The government’s “Digital India” initiative and the rise of domestic AI developers are further driving accessibility to intelligent dental platforms. In addition, rising awareness of preventive dental care and expanding tele-dentistry adoption are contributing to robust market growth.

AI-Powered Dental Workflow Platforms Market Share

The AI-Powered Dental Workflow Platforms industry is primarily led by well-established companies, including:

- OVERJET (U.S.)

- Videa Health (U.S.)

- Denti.AI Technology Inc. (U.S.)

- Diagnocat (U.S.)

- PEARL, INC. (U.S.)

- DentalMonitoring (France)

- 3Shape A/S (Denmark)

- Align Technology, Inc. (U.S.)

- Planmeca Oy (Finland)

- ORCA Dental AI (Israel)

- CD Newco, LLC (Canada)

- Adit (U.S.)

- Good Methods Global Inc. (U.S.)

- SmileSecure, Inc. (U.S.)

- OraQ AI (U.S.)

- DentalRobot.ai LLC (U.S.)

- Thoughtful Automation Inc. (U.S.)

- Zentist (U.S.)

- Apteryx (U.S.)

- Neocis, Inc. (U.S.)

What are the Recent Developments in Global AI-Powered Dental Workflow Platforms Market?

- In June 2025, Denti.AI announced a partnership with Synergy Dental Partners to deploy its Voice Perio and Scribe AI-powered solutions across Synergy’s dental practices. The collaboration emphasizes the growing trend of AI for clinical documentation and periodontology, where Denti.AI’s Voice-activated charting and automated scribe functionalities streamline clinical workflows and reduce administrative load

- In November 2024, Overjet introduced its new product IRIS, billed as “the first smart imaging software for dentistry.” IRIS combines cloud-based imaging with advanced AI: it enhances low-quality X-rays into high-clarity, full-colour images and overlays AI annotations to highlight conditions such as caries, periapical radiolucencies and calculus. It supports offline mode, integrates with any sensor, provides unlimited storage, and is FDA-cleared for image enhancement with clinical precision

- In March 2024, Overjet announced a USD 53.2 million Series C funding round, the largest investment in dental AI to date. This funding is aimed at expanding Overjet’s AI platform for both dental providers and payers, enhancing diagnostics, patient education, and claims automation across the dental ecosystem. The company’s valuation rose to approximately USD 550 million, underscoring investor confidence in AI-driven dental workflow technologies

- In February 2024, 3Shape announced the launch of new AI-driven workflows within its lab software suite (3Shape LMS) for dental laboratories, enabling labs to automate model generation and design proposals. By generating a model proposal that technicians merely check or adjust, the workflow reduces repetitive tasks and accelerates throughput. The move underscores how AI is not only used in clinics but also in lab & production workflows in dentistry

- In August 2022, NovoDynamics, Inc. and Vyne Dental announced a partnership to integrate NovoDynamics’ “NovoHealth Dental” AI platform into Vyne Dental’s payer-services portfolio. This integration enables over 800 dental insurance plans served by Vyne to use real-time AI assessment of claims and attachments, thereby improving claim accuracy, reducing administrative burden, and enhancing communication between providers and payers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.