Global Ai Powered Diagnostic Imaging Market

Market Size in USD Billion

CAGR :

%

USD

3.46 Billion

USD

22.58 Billion

2024

2032

USD

3.46 Billion

USD

22.58 Billion

2024

2032

| 2025 –2032 | |

| USD 3.46 Billion | |

| USD 22.58 Billion | |

|

|

|

|

AI-Powered Diagnostic Imaging Market Size

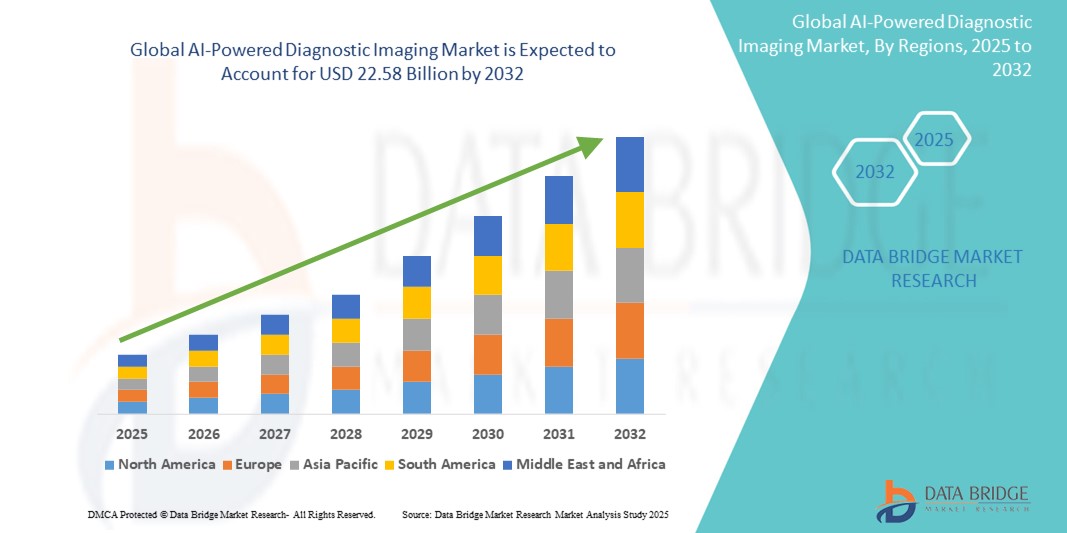

- The global AI-Powered Diagnostic Imaging market size was valued at USD 3.46 billion in 2024 and is expected to reach USD 22.58 billion by 2032, at a CAGR of 26.40% during the forecast period

- This growth is driven by factors such as the increasing demand for early and accurate disease detection, and advancements in AI algorithms that enhance image analysis efficiency and diagnostic precision

AI-Powered Diagnostic Imaging Market Analysis

- AI-powered diagnostic imaging systems leverage advanced machine learning algorithms to enhance image interpretation, improve diagnostic accuracy, and streamline workflow in radiology and related medical fields

- The demand for these systems is significantly driven by the rising prevalence of chronic diseases, growing aging population, and increasing need for early and precise diagnosis

- North America is expected to dominate the AI-powered diagnostic imaging market with a market share of 38.79%, due to robust healthcare infrastructure, early adoption of advanced imaging technologies, and the strong presence of key AI solution providers

- Asia-Pacific is expected to be the fastest growing region in the AI-powered diagnostic imaging market with a market share of 23.3%, during the forecast period due to growing healthcare digitization, rising disease burden, and increasing government support for AI in healthcare

- Software tools/ platform segment is expected to dominate the market with a market share of 58.70% due to its ability to integrate seamlessly with existing imaging systems, offering advanced analytics, automated image interpretation, and workflow optimization

Report Scope and AI-Powered Diagnostic Imaging Market Segmentation

|

Attributes |

AI-Powered Diagnostic Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

AI-Powered Diagnostic Imaging Market Trends

“Integration of Deep Learning & Cloud-Based Imaging Solutions”

- One prominent trend in the AI-powered diagnostic imaging market is the increasing adoption of deep learning algorithms and cloud-based platforms to enhance image processing and diagnostics

- These technologies enable automated detection of abnormalities, real-time analysis, and remote access to imaging data, significantly improving diagnostic speed and accuracy

- For instance, cloud-integrated AI solutions allow radiologists to collaborate across locations, access large datasets for training models, and perform diagnostics without heavy on-premise infrastructure—enhancing scalability and efficiency in clinical settings

- These innovations are revolutionizing diagnostic workflows, enabling early disease detection, reducing interpretation errors, and driving the adoption of intelligent imaging platforms globally

AI-Powered Diagnostic Imaging Market Dynamics

Driver

“Rising Demand for Early and Accurate Diagnosis of Chronic Diseases”

- The growing global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is significantly driving the demand for AI-powered diagnostic imaging solutions

- As early and accurate diagnosis becomes essential for effective treatment and improved patient outcomes, healthcare providers are increasingly adopting AI-driven tools to enhance image analysis and interpretation

- AI algorithms enable the detection of subtle patterns and abnormalities in imaging data, reducing diagnostic errors and accelerating clinical decision-making

For instance,

- According to the World Health Organization, non-communicable diseases account for approximately 74% of all global deaths as of 2022, underscoring the urgent need for advanced diagnostic technologies to detect these conditions early

- As the incidence of chronic diseases continues to rise, AI-powered imaging solutions play a vital role in improving diagnostic efficiency and supporting personalized treatment strategies

Opportunity

“Revolutionizing Diagnostics Through AI Integration and Workflow Automation”

- The integration of artificial intelligence in diagnostic imaging presents a major opportunity to enhance workflow efficiency, reduce diagnostic errors, and enable personalized care by automating image interpretation and clinical decision support

- AI can assist radiologists by rapidly analyzing vast amounts of imaging data, identifying anomalies, and prioritizing critical cases, leading to faster and more accurate diagnoses

- Advanced AI tools also offer predictive analytics capabilities, helping clinicians monitor disease progression and tailor treatment plans based on individual patient profiles

For instance,

- In October 2024, according to a study published in The Lancet Digital Health, AI algorithms demonstrated comparable or superior diagnostic accuracy to radiologists in interpreting mammograms and CT scans, particularly for breast cancer and lung nodules, highlighting AI’s potential in augmenting diagnostic capabilities and addressing radiologist shortages

- As AI continues to evolve, its integration into diagnostic imaging systems is expected to revolutionize patient care, improve early detection rates, and streamline healthcare delivery across diverse medical settings

Restraint/Challenge

“High Implementation Costs and Infrastructure Barriers”

- The high cost associated with deploying AI-powered diagnostic imaging systems remains a major challenge, particularly for smaller healthcare facilities and institutions in low- and middle-income regions

- These systems often require significant investments in advanced imaging equipment, software licenses, IT infrastructure, and staff training, making adoption financially burdensome for resource-constrained facilities

- Moreover, integration with existing hospital information systems and ensuring compliance with data privacy regulations add further complexity and costs to implementation

For instance,

- In September 2024, a report by the National Institute for Health and Care Excellence (NICE) highlighted that while AI tools improve diagnostic accuracy and efficiency, their initial setup and maintenance costs, including cybersecurity and data storage requirements, are a significant concern for many healthcare providers

- Consequently, despite the promising benefits of AI in diagnostics, financial and infrastructural challenges can slow market adoption, particularly in underserved areas, limiting access to advanced diagnostic solutions

AI-Powered Diagnostic Imaging Market Scope

The market is segmented on the basis of solution, image acquisition technology, application, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Image Acquisition Technology |

|

|

By Application |

|

|

By End Use |

|

In 2025, the software tools/ platform is projected to dominate the market with a largest share in application segment

The software tools/ platform segment is expected to dominate the AI-powered diagnostic imaging market with the largest share of 58.70% in 2025 due to its ability to integrate seamlessly with existing imaging systems, offering advanced analytics, automated image interpretation, and workflow optimization. These platforms enhance diagnostic accuracy and speed, reduce human error, and support clinical decision-making, making them indispensable in modern radiology practices

The computed tomography is expected to account for the largest share during the forecast period in image acquisition technology market

In 2025, the computed tomography segment is expected to dominate the market with the largest market share of 30.14% due to its widespread use in diagnosing a broad range of conditions, including cancer, cardiovascular, and neurological diseases. The integration of AI enhances image reconstruction, reduces scan times, and improves diagnostic precision. Its ability to provide detailed cross-sectional imaging makes it a critical tool in both emergency and routine diagnostics

AI-Powered Diagnostic Imaging Market Regional Analysis

“North America Holds the Largest Share in the AI-Powered Diagnostic Imaging Market”

- North America dominates the AI-powered diagnostic imaging market with a market share of estimated 38.79%, driven, by robust healthcare infrastructure, early adoption of advanced imaging technologies, and the strong presence of key AI solution providers

- U.S. holds a market share of 60.5%, due to the high burden of chronic diseases, increasing investments in AI healthcare startups, and favorable regulatory support for AI integration in clinical settings

- The well-established reimbursement policies and collaborative initiatives between tech companies and healthcare providers further accelerate AI deployment across hospitals and imaging centers

- The region also benefits from a high level of radiologist training and continuous innovation in machine learning models, supporting faster diagnosis and better patient outcomes

“Asia-Pacific is Projected to Register the Highest CAGR in the AI-Powered Diagnostic Imaging Market”

- Asia-Pacific is expected to witness the highest growth rate in the AI-powered diagnostic imaging market with a market share of 23.3%, driven by growing healthcare digitization, rising disease burden, and increasing government support for AI in healthcare

- Countries such as China, India, and Japan are becoming key contributors to market growth due to expanding healthcare access, rising medical imaging volumes, and the growing need for efficient diagnostic tools

- Japan, with its aging population and focus on medical innovation, continues to adopt AI-driven imaging systems to support early detection and precision diagnostics

- India is projected to register the highest CAGR in the AI-powered diagnostic imaging market, driven by government-led digital health initiatives, increasing AI investments, and the demand for scalable diagnostic solutions to serve its large population

AI-Powered Diagnostic Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Merative (U.S.)

- Aidoc (Israel)

- Tempus AI, Inc. (U.S.)

- HeartFlow, Inc. (U.S.)

- Butterfly Network, inc. (U.S.)

- EchoNous, Inc. (U.S.)

- Lunit Inc. (South Korea)

- Infervision (China)

- CureMetrix Inc. (U.S.)

- Qure.ai (India)

- RadNet, Inc. (U.S.)

- DeepHealth (U.S.)

- Riverain Technologies (U.S.)

- Viz.ai, Inc. (U.S.)

- Imbio (U.S.)

Latest Developments in Global AI-Powered Diagnostic Imaging Market

- In January 2025, GE HealthCare launched its AI-Powered Imaging Suite, which incorporates deep learning algorithms to enhance imaging accuracy in CT, MRI, and X-ray scans. The suite is designed to reduce diagnostic errors, optimize scan protocols, and shorten patient wait times

- In February 2025, IBM Watson Health (now part of Merative) introduced a new AI-driven platform aimed at improving imaging diagnostics for oncology. This platform leverages deep learning to detect and classify various types of cancer in radiology images, offering a 20% improvement in accuracy compared to previous versions. This system is designed to help radiologists identify early-stage cancers that might otherwise be missed, thereby improving patient outcomes

- In December 2024, Philips Healthcare unveiled a new version of its AI-based Radiology Platform, featuring AI-driven tools that aid in early detection of conditions such as heart disease, stroke, and cancers. The platform is being integrated into hospital systems globally to improve diagnostic speed and accuracy

- In November 2024, Siemens Healthineers introduced an upgraded version of its AI-Rad Companion, which automatically analyzes CT scans, X-rays, and mammograms to detect abnormalities such as lung cancer and fractures. The platform significantly speeds up the workflow for radiologists and improves diagnostic accuracy

- In October 2024, Aidoc announced a partnership with Canon Medical Systems to integrate AI solutions into Canon’s imaging systems. This collaboration aims to enhance stroke and trauma diagnostics by using AI to identify critical conditions such as brain hemorrhages and aneurysms in real-time

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.