Global Ai Radiology Tool Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

3.99 Billion

2024

2032

USD

1.35 Billion

USD

3.99 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 3.99 Billion | |

|

|

|

|

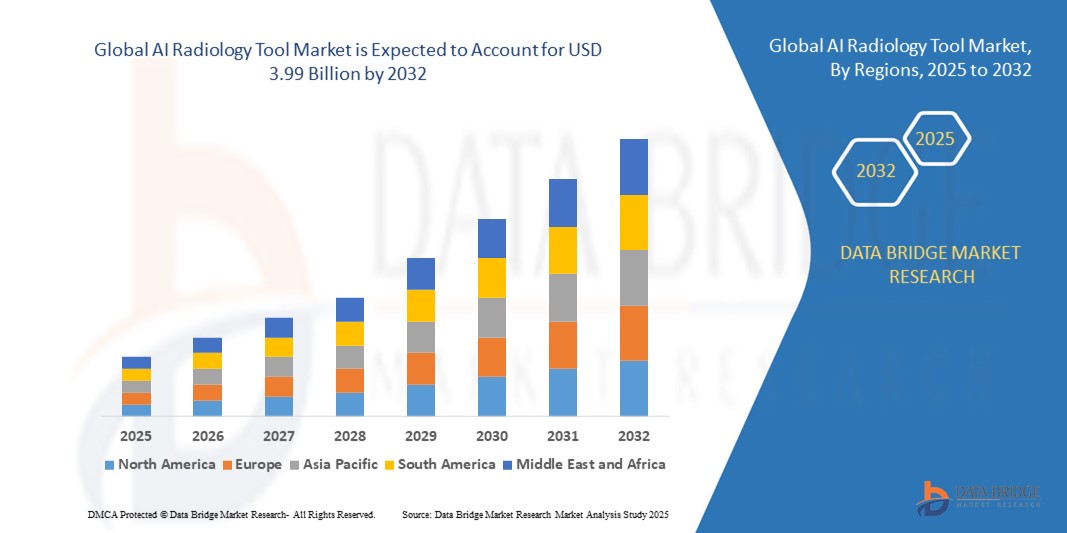

What is the Global AI Radiology Tool Market Size and Growth Rate?

- The global AI radiology tool market size was valued at USD 1.35 billion in 2024 and is expected to reach USD 3.99 billion by 2032, at a CAGR of 14.50% during the forecast period

- Increasingly adopts artificial intelligence to enhance diagnostic accuracy and efficiency. AI-powered radiology tools utilize machine learning algorithms to analyze medical images such as X-rays, MRIs, and CT scans, aiding radiologists in detecting abnormalities and making diagnoses. Key trends in this market include the integration of AI into existing radiology workflows, the development of advanced image analysis techniques, and the rise of collaborations between technology firms and healthcare providers to optimize patient care. This burgeoning market promises to revolutionize medical imaging, offering improved diagnostic capabilities and potentially reducing healthcare costs.

What are the Major Takeaways of AI Radiology Tool Market?

- The growing demand for accurate and timely diagnostic imaging solutions is a significant driver for the Global AI radiology tool market. AI-powered tools offer radiologists enhanced capabilities to interpret medical images swiftly and accurately, thereby improving patient outcomes and reducing diagnosis time

- North America dominated the AI radiology tool market with a revenue share of 35.01% in 2024, driven by the rising adoption of AI-assisted imaging, early disease detection, and digital healthcare infrastructure

- Asia-Pacific (APAC) region is projected to grow at the fastest CAGR of 4.68% from 2025 to 2032, driven by rapid urbanization, expanding healthcare infrastructure, and increasing investment in AI-enabled medical imaging

- The Diagnostic Radiology segment dominated the market with a revenue share of 57.4% in 2024, driven by the widespread use of AI tools in routine imaging workflows such as X-rays, CT scans, and MRI

Report Scope and AI Radiology Tool Market Segmentation

|

Attributes |

AI Radiology Tool Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the AI Radiology Tool Market?

Advanced Diagnostic Accuracy Through AI-Powered Imaging

- A major and accelerating trend in the global AI Radiology Tool market is the integration of advanced artificial intelligence (AI) algorithms with imaging technologies to improve diagnostic accuracy, speed, and workflow efficiency. AI-powered tools assist radiologists in detecting anomalies such as tumors, fractures, and vascular diseases with higher precision.

- For instance, Zebra Medical Vision’s AI platform analyzes imaging data to flag potential abnormalities in real time, while Arterys’ AI-enabled radiology solutions support cardiovascular and oncology imaging with automated measurements and lesion tracking.

- AI integration enables predictive analytics, pattern recognition, and automated reporting, reducing manual workload and minimizing human error. Some IBM Watson Health solutions can prioritize critical cases based on AI assessment, helping radiologists focus on urgent diagnoses

- The seamless incorporation of AI radiology tools into hospital information systems (HIS) and picture archiving and communication systems (PACS) facilitates centralized management of patient imaging data, improving collaboration and efficiency across medical teams

- This trend towards AI-driven diagnostic support is reshaping expectations in clinical care, prompting companies such as Siemens Healthineers and Philips to develop AI-enhanced radiology tools capable of faster, more accurate analyses, and integration with electronic health records (EHRs)

- The demand for AI radiology tools that provide automated, precise, and workflow-optimized imaging solutions is rapidly growing, driven by hospitals and diagnostic centers seeking to enhance patient care and operational efficiency

What are the Key Drivers of AI Radiology Tool Market?

- The rising incidence of chronic diseases, cancer, and cardiovascular conditions is driving the demand for accurate and early diagnosis, which AI radiology tools enable through automated detection and analysis

- For instance, in March 2024, Siemens Healthineers launched AI-Rad Companion Chest CT, an AI-powered solution designed to assist radiologists in identifying lung nodules and abnormalities, enhancing diagnostic confidence

- The shortage of trained radiologists globally and the need for faster turnaround times in imaging departments further fuels adoption, as AI tools can augment human expertise and reduce diagnostic delays

- Growing adoption of hospital digitalization and integration of AI solutions into PACS and EHR systems supports efficient workflow management and remote diagnostic capabilities, promoting market growth

- Advancements in machine learning, deep learning algorithms, and cloud computing enable scalable, accurate, and cost-effective radiology solutions, making AI tools increasingly accessible to diagnostic centers, hospitals, and imaging clinics

Which Factor is Challenging the Growth of the AI Radiology Tool Market?

- Data privacy and regulatory compliance issues pose significant challenges, as AI radiology tools require access to sensitive patient imaging data, which must adhere to HIPAA, GDPR, and other local regulations

- For instance, concerns about algorithm transparency and potential biases in AI models have raised questions about liability in misdiagnosis, slowing adoption in certain regions

- Integration complexities with legacy hospital IT infrastructure and the need for specialized training for radiologists can hinder seamless deployment of AI radiology tools. Companies such as IBM Watson Health and Arterys emphasize user training and support to mitigate these challenges

- High development and implementation costs of AI-powered solutions, particularly those with advanced analytics and multi-modal imaging capabilities, can be prohibitive for smaller healthcare facilities

- Overcoming these challenges through robust data security measures, compliance with regulatory standards, and cost-optimized solutions will be essential for sustained market growth

How is the AI Radiology Tool Market Segmented?

The market is segmented on the basis of type and end user.

- By Type

On the basis of type, the AI radiology tool market is segmented into Diagnostic Radiology and Interventional Radiology. The Diagnostic Radiology segment dominated the market with a revenue share of 57.4% in 2024, driven by the widespread use of AI tools in routine imaging workflows such as X-rays, CT scans, and MRI. Diagnostic applications benefit from AI-powered detection of anomalies, automated reporting, and prioritization of urgent cases, making it indispensable in hospitals and diagnostic centers. The growing prevalence of chronic diseases and cancer has also fueled adoption in this segment, as radiologists increasingly rely on AI to enhance accuracy and reduce human error.

The Interventional Radiology segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, supported by increasing minimally invasive procedures and AI integration in real-time imaging guidance, robotic assistance, and precision-targeted interventions that improve patient outcomes and procedural efficiency.

- By End User

On the basis of end user, the AI radiology tool market is segmented into Clinics, Hospitals, Diagnostic Centres, and Others. The Hospitals segment held the largest market revenue share of 52.8% in 2024, due to their high patient volumes, extensive imaging departments, and investments in advanced AI technologies for both diagnostic and interventional workflows. Hospitals benefit from AI radiology tools through faster turnaround times, workflow automation, and improved diagnostic accuracy across multiple imaging modalities.

The Diagnostic Centres segment is expected to witness the fastest CAGR of 25.2% from 2025 to 2032, driven by the proliferation of standalone imaging facilities and the growing demand for cost-effective, AI-assisted imaging services. The increasing focus on outpatient care and specialized diagnostic services further accelerates the adoption of AI radiology tools in these centers, enabling enhanced patient care and operational efficiency.

Which Region Holds the Largest Share of the AI Radiology Tool Market?

- North America dominated the AI radiology tool market with a revenue share of 35.01% in 2024, driven by the rising adoption of AI-assisted imaging, early disease detection, and digital healthcare infrastructure

- Healthcare providers in the region prioritize advanced diagnostic accuracy, workflow efficiency, and reduced human error, which AI radiology tools provide across hospitals, diagnostic centers, and outpatient facilities

- High healthcare expenditure, robust infrastructure, and a strong focus on technological innovation contribute to widespread adoption of AI radiology solutions, establishing the region as a global leader in this market

U.S. AI Radiology Tool Market Insight

U.S. captured the largest share within North America in 2024, fueled by widespread implementation of AI in hospital systems, diagnostic imaging centers, and specialty clinics. Hospitals increasingly rely on AI for automated image analysis, lesion detection, and reporting to improve efficiency and diagnostic accuracy. Growing investment in AI research, integration with hospital PACS systems, and supportive regulatory frameworks accelerate adoption. In addition, the U.S. market benefits from a strong presence of leading AI radiology solution providers such as IBM Watson Health, Siemens Healthineers, and Arterys.

Europe AI Radiology Tool Market Insight

Europe is projected to grow steadily during the forecast period, driven by stringent healthcare regulations, rising demand for precision diagnostics, and the adoption of AI-powered imaging solutions in hospitals and diagnostic centers. Countries such as Germany, France, and the U.K. are increasingly integrating AI radiology tools for oncology, cardiovascular, and neurological applications. The region emphasizes workflow optimization, interoperability with existing systems, and patient safety, encouraging hospitals and diagnostic centers to adopt AI solutions.

U.K. AI Radiology Tool Market Insight

U.K. market is expected to grow at a significant CAGR, supported by government initiatives promoting AI in healthcare, advanced hospital infrastructure, and rising awareness of early disease detection. Hospitals and private diagnostic centers are adopting AI radiology tools to streamline workflows and improve diagnostic confidence. The increasing use of AI for automated reporting, imaging analytics, and predictive modeling is accelerating adoption across the region.

Germany AI Radiology Tool Market Insight

Germany is experiencing substantial growth due to technological advancements in healthcare, high investment in hospital digitalization, and the integration of AI radiology tools into clinical workflows. The country emphasizes precision diagnostics and early disease detection, driving adoption in both public and private healthcare facilities. AI solutions for radiology are increasingly combined with electronic health records (EHR) and PACS, offering improved efficiency and patient outcomes.

Fastest Growing Region in the AI Radiology Tool Market

Asia-Pacific (APAC) region is projected to grow at the fastest CAGR of 4.68% from 2025 to 2032, driven by rapid urbanization, expanding healthcare infrastructure, and increasing investment in AI-enabled medical imaging. Rising awareness of early diagnosis and improved access to healthcare facilities are fueling adoption in countries such as China, Japan, and India.

Japan AI Radiology Tool Market Insight

Japan’s high-tech healthcare ecosystem, focus on elderly care, and demand for accurate imaging diagnostics are driving adoption of AI radiology tools. Integration with hospital systems and remote diagnostic solutions enhances patient care, while the growing number of smart hospitals accelerates AI deployment.

China AI Radiology Tool Market Insight

China accounted for the largest market share in APAC in 2024, propelled by government support for digital healthcare, rapid hospital modernization, and increasing patient demand for AI-assisted imaging. Domestic AI solution providers, affordability, and integration with hospital PACS systems further strengthen market growth.

Which are the Top Companies in AI Radiology Tool Market?

The AI radiology tool industry is primarily led by well-established companies, including:

- IBM (U.S.)

- Bay Labs (U.S.)

- Resonance Health (Australia)

- Zebra Medical Vision (Israel)

- Samsung Electronics (South Korea)

- Arterys (U.S.)

- Koninklijke Philips (Netherlands)

- Nuance Communications (U.S.)

- Siemens Healthineers AG (Germany)

- OrCam (Israel)

What are the Recent Developments in Global AI Radiology Tool Market?

- In April 2025, Spark Radiology launched a cloud-based workflow platform for radiologists in India, designed to streamline imaging operations and reporting, integrating AI-powered tools for automated case triage, structured reporting, and collaboration, significantly enhancing diagnostic accuracy and operational efficiency, which is expected to transform imaging practices across healthcare facilities

- In February 2025, the Madras Medical Mission (MMM) in Chennai inaugurated an AI-powered cardiac care center, equipped with advanced imaging technologies including a state-of-the-art cath lab offering AI-driven diagnostics for angioplasty and stenting, improving the identification of blockages and treatment planning, thereby elevating patient care standards and clinical outcomes

- In February 2025, Coreline Soft, a South Korean medical imaging AI company, expanded into Australia through a partnership with ParagonCare to support major hospitals participating in the National Lung Cancer Screening Program, enhancing early detection capabilities and strengthening collaborative cancer care initiatives across the country

- In January 2024, GE HealthCare announced an acquisition agreement with MIM Software from Cleveland, a global provider of medical imaging analysis and AI solutions in molecular radiotherapy, radiation oncology, urology, and diagnostic imaging, aiming to integrate MIM Software's imaging analytics and digital workflow solutions across diverse care areas, thereby accelerating innovation and improving patient outcomes globally

- In November 2023, GE HealthCare introduced its AI suite, MyBreastAI, at the RSNA 2023 conference, offering advanced tools to help radiologists identify and diagnose breast cancer at earlier stages, streamline workflows, and enhance decision-making, ultimately contributing to better patient outcomes and efficiency in clinical practice

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.