Global Ai Video Analytics Market

Market Size in USD Billion

CAGR :

%

USD

9.40 Billion

USD

11.99 Billion

2024

2032

USD

9.40 Billion

USD

11.99 Billion

2024

2032

| 2025 –2032 | |

| USD 9.40 Billion | |

| USD 11.99 Billion | |

|

|

|

|

AI Video Analytics Market Size

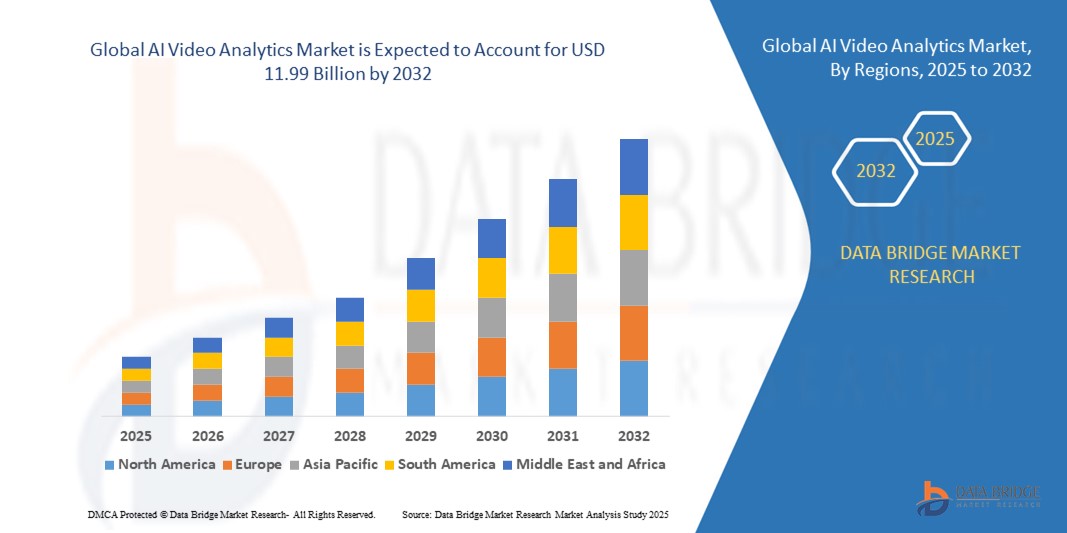

- The global AI video analytics market size was valued at USD 9.40 billion in 2024 and is expected to reach USD 11.99 billion by 2032, at a CAGR of 3.09% during the forecast period

- The market growth is largely fuelled by the increasing adoption of AI-powered surveillance systems, rising demand for real-time video monitoring, and growing deployment of smart city and industrial automation projects

- Technological advancements in computer vision, deep learning, and edge AI are enabling more accurate and faster video analytics, enhancing security and operational efficiency across sectors

AI Video Analytics Market Analysis

- The market is witnessing growth as enterprises and governments increasingly adopt AI-powered surveillance solutions for enhanced security, operational efficiency, and real-time monitoring

- Advances in computer vision, deep learning, and edge computing are enabling more accurate object detection, facial recognition, and behavior analysis, driving adoption across industries

- North America dominated the AI video analytics market with the largest revenue share in 2024, driven by increasing concerns over public safety, industrial security, and critical infrastructure protection. The region’s early adoption of advanced technologies and robust IT infrastructure is fostering widespread deployment across government, BFSI, retail, and transportation sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global AI video analytics market, driven by rapid technological advancements, increasing investments in smart cities, and growing demand for automated security and operational intelligence solutions across emerging economies such as China, Japan, and South Korea

- The software segment held the largest market revenue share in 2024, driven by growing demand for advanced analytics features such as real-time object detection, behavior analysis, and predictive alerts. AI video analytics software enables organizations to monitor multiple locations simultaneously, improving security and operational efficiency

Report Scope and AI Video Analytics Market Segmentation

|

Attributes |

AI Video Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

AI Video Analytics Market Trends

Rise of AI-Powered Real-Time Video Analytics

- The growing adoption of AI-powered video analytics is transforming surveillance and monitoring systems by enabling real-time detection of objects, behaviors, and anomalies. AI algorithms allow immediate alerts and automated responses, enhancing security and operational efficiency across commercial, industrial, and public sectors

- The demand for intelligent video analytics in remote locations and large-scale facilities is driving the deployment of cloud-based and edge AI solutions. These systems reduce dependency on manual monitoring, minimize response times, and provide actionable insights even where on-site personnel are limited

- The affordability and scalability of modern AI video analytics platforms are making them accessible for small- and mid-sized businesses, enabling continuous monitoring and predictive insights without excessive infrastructure costs

- For instance, in 2023, several transportation hubs in Europe implemented AI-driven video analytics to detect unusual crowd behavior and security threats, reducing response times and improving overall operational safety

- While AI video analytics is accelerating automated surveillance and operational efficiency, its effectiveness depends on algorithm accuracy, data privacy compliance, and integration with existing security infrastructure. Vendors must focus on R&D, edge computing solutions, and cost-effective deployments to fully capitalize on growing demand

AI Video Analytics Market Dynamics

Driver

Increasing Demand for Enhanced Security and Operational Efficiency

- Rising concerns over public safety, industrial security, and critical infrastructure protection are driving organizations to adopt AI video analytics as a frontline monitoring solution. Intelligent video systems provide real-time alerts, helping prevent security breaches, vandalism, and operational disruptions. The adoption is particularly strong in high-risk sectors such as transportation, manufacturing, and utilities

- Businesses and government agencies are recognizing the cost savings and productivity benefits associated with automated video monitoring compared to traditional manual surveillance. AI solutions reduce human error, enable proactive interventions, and allow security personnel to focus on critical tasks, increasing overall operational efficiency

- Integration with smart city initiatives, industrial automation, and retail analytics is further boosting demand, as AI video analytics provides actionable insights for both security and operational decision-making. Predictive analytics, anomaly detection, and crowd behavior monitoring are increasingly being leveraged for smarter, data-driven operations

- For instance, in 2022, several European airports implemented AI video analytics to improve crowd management, detect unattended objects, and monitor restricted areas, significantly enhancing security operations while reducing response times and manpower requirements

- While rising security concerns and operational optimization are driving market growth, continuous improvements in AI model accuracy, edge computing adoption, integration with IoT devices, and regulatory compliance are crucial for sustained expansion

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- Advanced AI video analytics solutions, including edge AI devices and cloud-based platforms, involve high upfront costs for installation, integration, and licensing, limiting adoption among small- and mid-sized organizations. The cost of high-resolution cameras, servers, and software licenses can further add to the financial burden

- Ensuring compliance with data protection regulations and addressing privacy concerns pose significant challenges, particularly in regions with strict surveillance laws. Organizations must invest in secure data handling, encryption, anonymization, and cybersecurity measures to gain user trust and avoid legal repercussions

- Technical complexities, including integration with legacy systems, continuous algorithm updates, maintenance of high-resolution camera networks, and scaling across multiple locations, can hinder seamless deployment and operational efficiency

- For instance, in 2023, several municipalities in North America delayed AI surveillance adoption due to budget constraints, data privacy concerns, and public skepticism regarding misuse of personal information, affecting project timelines and planned security upgrades

- While AI video analytics continues to advance, addressing cost, privacy, and technical barriers remains essential. Market players must focus on modular solutions, local processing, subscription-based pricing models, and user-friendly deployment strategies to accelerate adoption and unlock long-term potential

AI Video Analytics Market Scope

The market is segmented on the basis of component, development model, enterprise size, integration, and end-user.

- By Component

On the basis of component, the AI video analytics market is segmented into software and services. The software segment held the largest market revenue share in 2024, driven by growing demand for advanced analytics features such as real-time object detection, behavior analysis, and predictive alerts. AI video analytics software enables organizations to monitor multiple locations simultaneously, improving security and operational efficiency.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of consulting, integration, and managed services that facilitate seamless deployment and maintenance of AI video analytics solutions. Services help organizations optimize system performance, ensure regulatory compliance, and reduce the burden on internal IT teams.

- By Development Model

On the basis of development model, the market is segmented into on-premises and cloud. The on-premises segment dominated in 2024 due to concerns over data privacy and security, particularly for sensitive operations in sectors such as BFSI, government, and healthcare.

The cloud segment is expected to witness the fastest growth rate from 2025 to 2032, driven by scalability, remote accessibility, and lower upfront investment requirements. Cloud-based AI video analytics supports centralized monitoring, real-time updates, and integration with IoT and edge devices.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into large enterprises and small & medium-sized enterprises (SMEs). Large enterprises held the largest market share in 2024, fueled by their higher security budgets, need for large-scale surveillance, and ability to integrate AI analytics into complex operational workflows.

SMEs is expected to witness the fastest growth rate from 2025 to 2032, as affordable AI video analytics solutions, cloud-based platforms, and subscription models make adoption feasible for smaller organizations.

- By Integration

On the basis of integration, the market is segmented into edge-based solutions, server-based solutions, and hybrid solutions. Edge-based solutions dominated in 2024, supported by the need for real-time analytics, low latency, and reduced bandwidth usage, particularly in large facilities and transportation hubs.

Hybrid solutions is expected to witness the fastest growth rate from 2025 to 2032, offering the flexibility to combine edge processing with cloud analytics, enabling enhanced scalability, redundancy, and advanced insights across multiple locations.

- By End-User

On the basis of end-user, the market is segmented into BFSI, retail, government & public sector, healthcare, transportation & logistics, manufacturing, and others. The government & public sector segment held the largest share in 2024 due to investments in public safety, smart city initiatives, and critical infrastructure monitoring.

The transportation & logistics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for automated monitoring of ports, airports, railways, and logistics hubs to ensure safety, operational efficiency, and regulatory compliance.

AI Video Analytics Market Regional Analysis

- North America dominated the AI video analytics market with the largest revenue share in 2024, driven by increasing concerns over public safety, industrial security, and critical infrastructure protection. The region’s early adoption of advanced technologies and robust IT infrastructure is fostering widespread deployment across government, BFSI, retail, and transportation sectors

- Organizations in the region highly value the ability of AI video analytics to provide real-time monitoring, automated alerts, and predictive insights that enhance both security and operational efficiency. These systems help reduce human error, improve incident response, and enable proactive decision-making

- The adoption is further supported by strong investments in smart city initiatives, government-funded security programs, and integration with IoT devices, establishing AI video analytics as a critical solution for both public and private sector operations

U.S. AI Video Analytics Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by significant investments in AI-based surveillance, transportation monitoring, and industrial security solutions. Enterprises and government agencies are increasingly deploying cloud-based and edge AI analytics to monitor multiple locations in real-time. Rising demand for automated threat detection, facial recognition, and crowd management solutions further drives market expansion. The country’s strong technology ecosystem and adoption of smart city projects are key factors supporting growth.

Europe AI Video Analytics Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent public safety regulations, rising investments in airport, railway, and urban surveillance, and the growing need for operational efficiency. The adoption of AI video analytics across retail, BFSI, and government sectors is accelerating due to increasing urbanization and integration with IoT and industrial automation systems. European enterprises are also leveraging analytics for loss prevention, operational monitoring, and regulatory compliance.

U.K. AI Video Analytics Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by public safety initiatives, smart city development, and growing adoption of AI-driven video surveillance solutions in transportation and retail sectors. Rising awareness of cyber-physical security and the need for proactive threat monitoring are encouraging government agencies and private organizations to adopt intelligent analytics systems.

Germany AI Video Analytics Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s focus on industrial automation, smart infrastructure, and technological innovation. AI video analytics is being widely implemented in manufacturing plants, transportation hubs, and public safety projects. The integration of analytics with IoT devices and edge computing solutions is also increasing, providing low-latency insights and improving operational monitoring.

Asia-Pacific AI Video Analytics Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising security concerns, and increased adoption of AI and IoT technologies in countries such as China, Japan, and India. Government initiatives promoting smart cities, industrial automation, and public safety are boosting market demand. In addition, the region’s growing manufacturing base for AI cameras and analytics solutions is making adoption more affordable and accessible to enterprises.

Japan AI Video Analytics Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s technological advancement, urban growth, and emphasis on public safety and industrial security. The adoption of AI video analytics is increasing across smart buildings, transportation hubs, and industrial facilities. Integration with IoT devices and automation systems enhances operational efficiency while providing real-time threat monitoring and predictive insights.

China AI Video Analytics Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, growing government initiatives for smart cities, and the country’s strong adoption of AI and cloud technologies. AI video analytics is increasingly used in public safety, transportation, retail, and industrial sectors. The combination of domestic AI technology providers, affordable solutions, and a large-scale implementation of smart infrastructure projects is driving market growth across the region.

AI Video Analytics Market Share

The AI Video Analytics industry is primarily led by well-established companies, including:

- IBM (U.S.)

- Intel Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Hikvision (China)

- Dahua Technology (China)

- Avigilon (Canada)

- Axis Communications (Sweden)

- Hanwha Techwin (South Korea)

- BriefCam (Israel)

- VIVOTEK (Taiwan)

- Hanwha Techwin (South Korea)

- IntelliVision Technologies (U.S.)

- Verint Systems (U.S.)

- Verkada (U.S.)

- i2v System (India)

- Bosch Security Systems (Germany)

- NICE Systems (Israel)

- Honeywell International (U.S.)

- ObjectVideo Labs, LLC (U.S.)

- Viseum International Limited (U.K.)

- Pro-Vigil, Inc. (U.S.)

Latest Developments in Global AI Video Analytics Market

- In June 2023, IBM, in collaboration with The All England Lawn Tennis Club, introduced AI-driven enhancements to the Wimbledon digital fan experience. Utilizing IBM watsonx's generative AI technology, the platform now delivers automated tennis commentary for all video highlights, improving viewer engagement and personalization while showcasing the potential of AI in sports broadcasting

- In March 2023, Irisity AB (publ) launched Irisity Edge for Axis, an advanced video analytics solution integrating AI perimeter security algorithms directly into Axis cameras. This system eliminates the need for additional hardware, enabling intelligent, real-time surveillance and enhancing operational efficiency for security providers and end-users

- In September 2022, Honeywell International Inc. released the Pro-Watch Integrated Security Suite, including Pro-Watch 6.0, the VMS R750, and the 35 Series cameras. The updated suite emphasizes cybersecurity and regulatory compliance, providing enterprises with a robust, scalable security infrastructure that strengthens monitoring capabilities and operational reliability

- In February 2020, Avigilon Corporation, a subsidiary of Motorola Solutions, unveiled the Avigilon H5M camera, a compact and cost-effective solution for outdoor video security projects. The addition expanded accessibility for budget-conscious organizations, improving coverage and enabling high-quality monitoring in diverse environments

- In August 2022, Derq, a spin-off from MIT, partnered with Paradigm Traffic Systems to deploy AI video analytics and connected infrastructure solutions in Texas. The collaboration aimed to enhance road safety and develop smart traffic systems, combining Derq’s real-time AI analytics with Paradigm’s established market presence, driving adoption of intelligent transportation solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.