Global Air Handling Units Market

Market Size in USD Billion

CAGR :

%

USD

11.72 Billion

USD

19.26 Billion

2024

2032

USD

11.72 Billion

USD

19.26 Billion

2024

2032

| 2025 –2032 | |

| USD 11.72 Billion | |

| USD 19.26 Billion | |

|

|

|

|

Air Handling Units Market Size

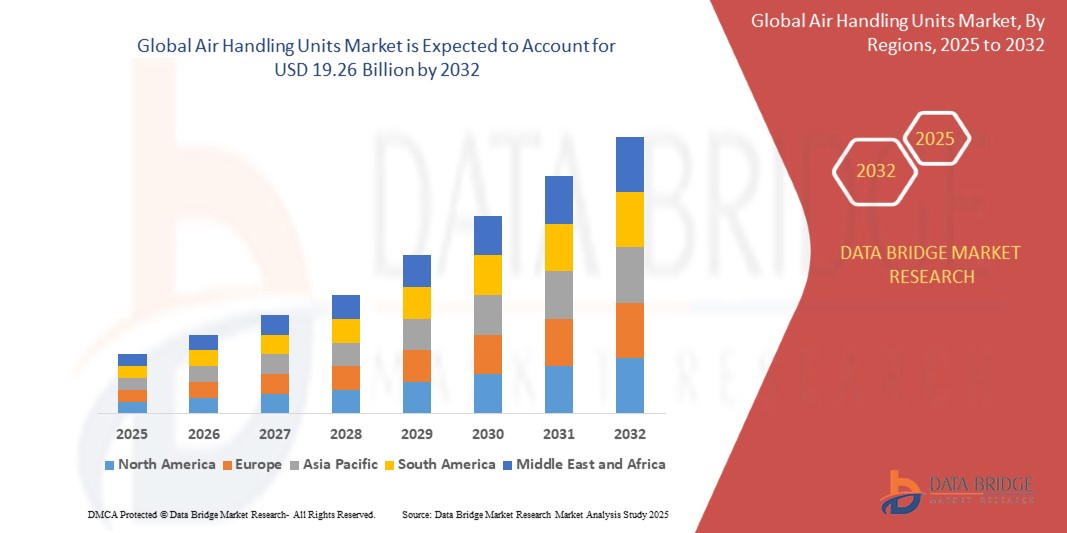

- The global Air Handling Units market was valued at USD 11.72 billion in 2024 and is expected to reach USD 19.26 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.42%, primarily driven by rising HVAC demand, energy efficiency regulations, urbanization, and increasing commercial construction projects

- This growth is driven by factors such as energy-efficient solutions, smart building integration, urbanization, air quality concerns, and infrastructure development

Air Handling Units Market Analysis

- Air Handling Units are utilized in advanced applications across commercial buildings, industrial facilities, hospitals, data centers, and cleanrooms to improve indoor air quality, regulate temperature, enhance energy efficiency, and ensure occupant comfort. These systems enable optimal ventilation, filtration, and humidity control, reducing operational costs and complying with stringent indoor environmental standards. Air Handling Units foster collaborations among HVAC manufacturers, component suppliers, and building contractors to drive innovation, meet evolving energy regulations, and support green building certifications

- The demand for Air Handling Units is significantly driven by increasing construction of energy-efficient buildings, stringent indoor air quality regulations, and growing awareness of ventilation’s role in health and safety. Rising demand from healthcare, hospitality, and industrial sectors, alongside rapid urbanization, boosts adoption. Advancements in heat recovery systems, variable-speed fans, smart controls, and eco-friendly refrigerants improve energy savings, reduce carbon footprints, and lower lifecycle costs. Government initiatives promoting green infrastructure, net-zero targets, and energy conservation further propel market growth, along with retrofitting trends in aging buildings

- North America stands out as one of the dominant regions for Air Handling Units, driven by expanding commercial construction, strict energy efficiency codes, and increasing demand for high-performance HVAC systems in healthcare, data centers, and educational institutions. The region benefits from technological advancements, regulatory mandates, and incentives for sustainable building practices

- For instance, U.S. leads in Air Handling Units adoption, with major projects in hospitals, airports, and high-rise buildings utilizing advanced heat recovery, demand-controlled ventilation, and energy-efficient motors, supported by LEED certifications, government incentives, and building modernization initiatives aimed at improving indoor air quality, reducing energy consumption, and meeting sustainability goals

Globally, the Air Handling Units market ranks as a critical segment within the HVAC and building services industry, playing a pivotal role in ensuring healthy indoor environments, reducing energy usage, and supporting sustainable building practices across sectors such as healthcare, education, hospitality, and manufacturing. The market continues to evolve with innovations in modular design, integrated controls, energy recovery technologies, and low-global-warming-potential refrigerants, positioning it as a key enabler of resilient, efficient, and sustainable building infrastructure

Report Scope and Air Handling Units Market Segmentation

|

Attributes |

Air Handling Units Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Air Handling Units Market Trends

“Rapid Growth of Commercial and Industrial Construction”

- One prominent trend in the advancement of Air Handling Units is the rapid growth of commercial and industrial construction, which is significantly boosting demand for high-performance HVAC solutions tailored for large-scale buildings such as offices, hospitals, malls, data centers, and industrial facilities

- Air Handling Units provide essential benefits such as superior indoor air quality, enhanced energy efficiency, and flexible integration with building management systems, making them critical for ensuring occupant comfort, operational efficiency, and regulatory compliance in modern commercial and industrial

- For instance, Daikin Industries launched its Rebel Applied rooftop system and SmartSource Dedicated Outdoor Air System (DOAS), specifically engineered for high-efficiency air handling in commercial buildings, offering up to 66% energy savings compared to conventional systems. These units leverage variable-speed compressors, energy recovery wheels, and advanced controls to optimize ventilation and dehumidification while meeting stringent ASHRAE 90.1 and LEED standards

The widespread integration of advanced Air Handling Units in commercial and industrial facilities contributes to reduced operational costs, improved building sustainability scores, and extended equipment lifespans, reinforcing the value proposition of energy-efficient, and low-emission HVAC solutions in urban development projects

These developments are transforming building design and operations, driving innovation in air handling technologies, digital controls, and decarbonization strategies, and aligning with global goals for net-zero energy buildings and environmentally responsible construction practices

Air Handling Units Market Dynamics

Driver

“Technological Advancements in HVAC Systems”

- The rising demand for energy-efficient, sustainable buildings is significantly driving the growth of the Air Handling Units market within the commercial and industrial HVAC sector

- As building owners and operators push for improved energy efficiency, indoor air quality, and reduced operational costs, they increasingly adopt technologically advanced AHUs featuring innovations such as heat recovery wheels, variable-speed fans, and intelligent controls

- Air Handling Units equipped with these technologies are extensively used in offices, hospitals, malls, data centers, and educational institutions due to their ability to optimize energy consumption, improve ventilation effectiveness, and integrate seamlessly with smart building management systems

- These innovations not only lower energy bills and carbon footprints but also contribute to better humidity control, noise reduction, and occupant health, aligning with stringent building codes and green certification standards like LEED and WELL

- As global construction activities and retrofitting projects accelerate alongside sustainability initiatives, the adoption of advanced Air Handling Units is poised to expand, supporting the evolution of smart, high-performance, and low-carbon buildings

For instance,

- Lennox launched its Model L rooftop units with integrated smart sensors and variable-speed compressors, designed for enhanced ventilation and humidity control in commercial spaces. This innovation provides building owners with real-time performance insights and up to 50% higher part-load efficiency compared to traditional systems

Opportunity

“Integration with Smart Building Systems”

- The growing demand for advanced Air Handling Units in the smart building sector is driven by their ability to provide intelligent, sensor-integrated, and connected solutions that enhance operational efficiency, indoor air quality, and occupant comfort

- These smart Air Handling Units enable real-time monitoring, predictive maintenance, and adaptive airflow control by leveraging IoT, AI, and automation technologies, supporting proactive management of HVAC performance and reducing unplanned downtime

- Additionally, the integration of Air Handling Units with building management systems aligns with the global shift toward smart, sustainable, and energy-efficient infrastructure, enabling data-driven insights, remote diagnostics, and seamless interoperability with other building systems

For instance,

- Johnson Controls launched its YORK Smart Air Handling Units featuring factory-mounted sensors, BACnet connectivity, and AI-powered predictive analytics. This system enables facility managers to remotely monitor and adjust ventilation parameters, detect anomalies, and schedule maintenance proactively, reducing energy consumption by up to 30% while improving occupant health and productivity

Restraint/Challenge

“High Initial Investment and Installation Costs”

- While Air Handling Units remain critical in ensuring optimal indoor air quality and energy efficiency, the high initial investment and installation costs associated with advanced, energy-efficient models can pose a barrier to wider adoption—especially in cost-sensitive construction and retrofitting projects

- Customization requirements, including tailored airflow capacities, integrated heat recovery systems, and specialized filtration units, further elevate upfront costs by requiring bespoke engineering, longer lead times, and complex installation logistics

- The availability of lower-cost, less technologically advanced HVAC alternatives can discourage the adoption of premium Air Handling Units—particularly in budget-constrained sectors such as public schools, small businesses, and low-income housing—potentially slowing market expansion in these segments during the forecast period

Air Handling Units Market Scope

The market is segmented on the basis of application, capacity, type, and effect.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Capacity |

|

|

By Type |

|

|

By Effect |

|

Air Handling Units Market Regional Analysis

“North America is the Dominant Region in the Air Handling Units Market”

- The North American region is a key growth driver in the Air Handling Units market, driven by robust commercial construction, industrial facilities, and a growing emphasis on energy-efficient HVAC systems across sectors like healthcare, education, and data centers

- The United States holds a leading position in the market due to its extensive infrastructure projects, including hospitals, educational institutions, and high-rise buildings, all requiring advanced AHUs for energy efficiency, indoor air quality, and compliance with stringent building codes. Additionally, the country’s push for net-zero carbon buildings supports AHU adoption

- Canada’s booming commercial real estate, healthcare facilities, and government infrastructure projects, along with a high demand for energy-efficient and sustainable building solutions, further contribute to the growth of the AHU market. The country’s focus on LEED-certified buildings and government incentives for green infrastructure fosters AHU adoption

- Furthermore, stringent energy regulations such as ASHRAE standards, along with increasing investments in retrofitting and sustainable construction practices, continue to drive the demand for energy-efficient and environmentally friendly AHUs across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is poised for significant growth in the Air Handling Units market, driven by rapid urbanization, increased infrastructure development, and rising demand for energy-efficient HVAC solutions in commercial, industrial, and residential buildings

- China leads the regional market, benefiting from its vast construction projects, including smart cities, commercial complexes, and green building initiatives. The government’s push for sustainable building practices and energy conservation boosts demand for advanced AHUs, which offer optimal indoor air quality and reduced energy consumption

- India, with its expanding industrial and commercial sectors, increasingly adopts AHUs in modern infrastructure projects, particularly in healthcare, education, and IT sectors. Rising awareness of indoor air quality and regulatory push for energy-efficient buildings further drive the AHU market in India

- Japan and South Korea have robust construction sectors, high-tech industries, and a growing emphasis on energy-efficient solutions. Both countries are witnessing increasing demand for AHUs with integrated smart control systems, heat recovery, and eco-friendly refrigerants to comply with environmental regulations and enhance building energy performance

- Furthermore, government policies promoting green construction, renewable energy, and energy efficiency, along with rising investments in urbanization, eco-friendly technologies, and sustainable building practices, are fueling the demand for high-performance, energy-saving AHUs across the Asia-Pacific region, accelerating market growth

Air Handling Units Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Daikin Industries Ltd. (Japan)

- Carrier (U.S.)

- Trane Technologies plc (Ireland)

- Johnson Controls (Ireland)

- Systemair AB (Sweden)

- Flaktwoods India Pvt. Ltd. (India)

- CIAT Group (France)

- TROX GmbH (Germany)

- Lennox International(U.S.)

- Airedale Air Conditioning (U.K)

- Sabiana SpA (Italy)

- WOLF GmbH (Germany)

- Novenco (Denmark)

- Euroclima SpA (Italy)

Latest Developments in Global Air Handling Units Market

- In February 2024, Modine announced that it had reached a definitive agreement to acquire Scott Springfield Manufacturing, a producer of AHUs. This acquisition provided Modine with immediate access to a complementary product portfolio and a diverse customer base across various industries, including telecommunications, hyperscale and colocation data centers, healthcare, and aerospace

- In January 2024, Carrier expanded its HVAC product offerings manufactured in India by introducing air handling units (AHUs) and fan coil units (FCUs) designed to cater to the varied needs of India’s commercial buildings. These new products, engineered to deliver tailored solutions for healthy indoor environments with high-efficiency air filtration, highlight Carrier’s over five-decade presence in India and reinforce the company’s commitment to supporting the country's growth under the 'Make in India' initiative

- In May 2021, Trane Technologies plc opened a new operations hub in Las Vegas, Nevada. The company plans to collaborate with local engineers, contractors, commercial building owners, and facility managers to offer energy management solutions, HVAC systems, services, and aftermarket parts

- In April 2020, Daikin Industries, Ltd. announced an investment of approximately 2 million USD in a capital increase through a third-party allocation to Locix, Inc., a Silicon Valley-based startup. Daikin Industries aimed to reduce labor hours at installation sites by leveraging Locix’s advanced local positioning technology, Locix LPS

- In August 2019, Systemair AB acquired a distributor in Morocco. The company, which had 27 employees and a sales volume of around SEK 70 million in 2018, operated under a license agreement with Systemair and had an office and warehouse located in Casablanca

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Air Handling Units Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Air Handling Units Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Air Handling Units Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.