Global Air Runner Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

3.14 Billion

2024

2032

USD

1.26 Billion

USD

3.14 Billion

2024

2032

| 2025 –2032 | |

| USD 1.26 Billion | |

| USD 3.14 Billion | |

|

|

|

|

Air Runner Market Size

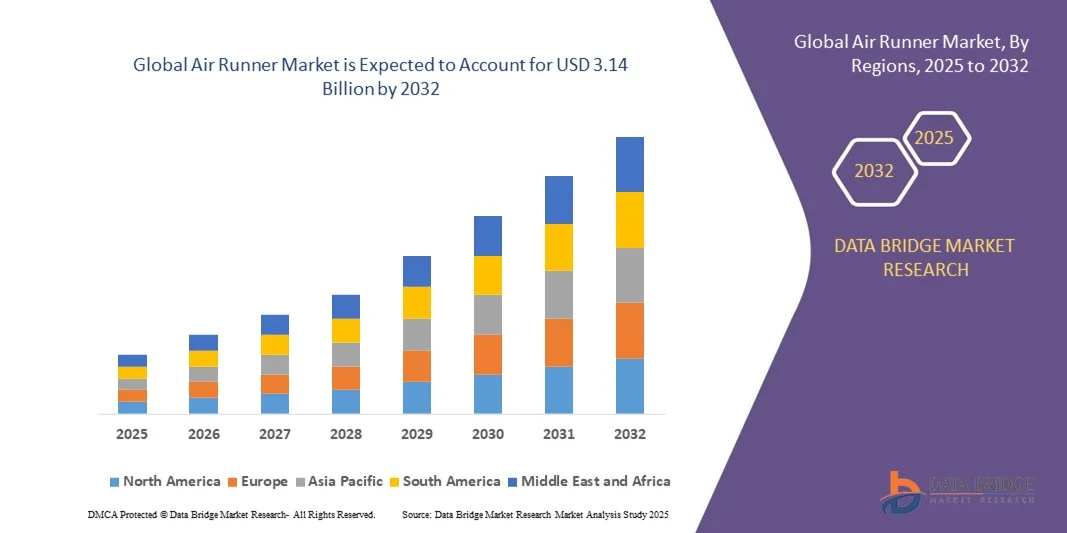

- The global air runner market size was valued at USD 1.26 billion in 2024 and is expected to reach USD 3.14 billion by 2032, at a CAGR of 12.1% during the forecast period

- The market growth is largely fueled by the rise in awareness about the advantages of exercising and physical fitness, as well as the increasing prevalence of obesity

Air Runner Market Analysis

- The market growth is driven by increasing awareness of physical fitness, rising prevalence of obesity, and growing disposable income

- Challenges such as higher energy consumption compared to traditional treadmills may limit market expansion

- North America dominated the air runner market with the largest revenue share of 38.5% in 2024, driven by increasing health awareness, adoption of home fitness equipment, and a strong presence of commercial gyms and boutique fitness studios

- Asia-Pacific region is expected to witness the highest growth rate in the global air runner market, driven by rising health consciousness, government initiatives promoting fitness, and rapid adoption of modern gym and home fitness equipment

- The Commercial segment held the largest market revenue share in 2024, driven by the increasing adoption of air runners in gyms, boutique fitness studios, and corporate wellness centers. Commercial facilities prefer high-performance air runners for continuous use, enhanced durability, and advanced monitoring features, making them a preferred choice for professional fitness environments

Report Scope and Air Runner Market Segmentation

|

Attributes |

Air Runner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Air Runner Market Trends

Rise of Home Fitness and Commercial Gym Adoption

- The growing shift toward home fitness and commercial gym adoption is transforming the air runner market by increasing demand for versatile and easy-to-use treadmill solutions. Compact, energy-efficient designs allow users to exercise conveniently at home or in fitness centers, improving overall health and engagement. The integration of smart tracking features and connectivity with fitness apps is further enhancing user experience and motivation. Increasing awareness about personalized workout regimes is encouraging consistent adoption across different age groups and fitness levels

- High demand for low-impact cardio equipment in both urban and semi-urban regions is accelerating the adoption of air runners. These devices are particularly effective for rehabilitation, elderly fitness programs, and high-intensity interval training (HIIT), where traditional treadmills may cause strain or injury. Enhanced cushioning systems reduce joint stress, making air runners suitable for long-duration workouts. Fitness enthusiasts are increasingly preferring these devices for multi-purpose training and recovery exercises, promoting sustained market growth

- The affordability and durability of modern air runners are making them attractive for personal and commercial use, enabling more frequent workouts without excessive maintenance costs. Consumers benefit from customizable speed and incline options, supporting varied fitness goals. Manufacturers are introducing modular and lightweight designs that simplify storage and portability. Additionally, competitive pricing and financing options are encouraging adoption among first-time buyers and small gyms

- For instance, in 2023, several boutique fitness studios in North America and Europe reported increased member retention after integrating air runners into their group training programs. The combination of safety features and performance monitoring led to higher customer satisfaction and reduced injury rates. Studios observed improved workout efficiency and engagement during cardio-focused sessions. The success stories are motivating other fitness centers to invest in air runners to enhance service offerings and differentiate themselves in the market

- While air runners are driving increased fitness adoption, their long-term impact depends on continued product innovation, energy efficiency, and user education. Manufacturers must focus on ergonomic designs, smart monitoring features, and competitive pricing to fully capitalize on this growing trend. Partnerships with fitness influencers and online platforms are also playing a role in educating consumers about the benefits. Continuous R&D in cushioning, energy efficiency, and compact design will sustain market expansion

Air Runner Market Dynamics

Driver

Increasing Health Awareness and Rising Adoption of Home Fitness Equipment

- Growing awareness about the importance of physical fitness is pushing consumers and gyms to invest in air runners as a safe and effective cardio solution. Rising concerns over sedentary lifestyles, obesity, and lifestyle diseases are boosting market demand. Consumers are actively looking for equipment that supports cardiovascular health while minimizing injury risks. Online fitness challenges and home workout trends are amplifying interest in air runners globally

- Consumers are increasingly seeking convenient, low-impact, and space-efficient exercise equipment, enabling frequent workouts at home or in commercial fitness centers. This trend is supported by the proliferation of virtual fitness programs and mobile applications. The ability to track performance metrics and integrate with wearables is enhancing user engagement. Fitness-conscious households and gyms are prioritizing equipment that delivers versatility, safety, and connectivity

- Government initiatives and corporate wellness programs promoting physical activity have further fueled the adoption of air runners. Subsidies for fitness equipment in some regions have encouraged consumers to integrate air runners into routine exercise regimens. Public campaigns emphasizing obesity prevention and workplace health are raising awareness. Corporate gyms and wellness programs are increasingly recommending air runners for employee health improvement initiatives

- For instance, in 2022, several corporate wellness programs in the U.S. and Europe incorporated air runners into office gyms, leading to improved employee engagement and health outcomes. The integration of ergonomic features and performance tracking encouraged consistent participation. Companies reported a reduction in absenteeism and improved morale among employees using air runners regularly. The positive outcomes highlighted the value of investing in advanced cardio equipment for workplace wellness

- While health awareness and institutional support are driving growth, accessibility, affordability, and product customization remain key focus areas for sustained market expansion. Manufacturers must continuously innovate to provide value for money and maintain competitive differentiation. Expansion into emerging markets with localized products and services is critical for future growth. User education, especially regarding safety and performance benefits, is vital for continued adoption

Restraint/Challenge

High Equipment Cost and Energy Consumption Compared to Traditional Treadmills

- The high price point of advanced air runners limits accessibility for individual consumers and small fitness centers. Premium features such as adjustable cushioning, incline, and smart monitoring are often reserved for high-end models, restricting widespread adoption. The upfront investment may deter potential buyers despite long-term health benefits. Smaller gyms often face budget constraints, limiting procurement of advanced models

- In many regions, lack of awareness about the benefits of air runners over traditional treadmills limits market penetration. Consumers often prioritize price over ergonomic or performance advantages, reducing demand in cost-sensitive segments. Marketing and educational initiatives are required to highlight unique benefits such as joint protection and multi-functional use. Without proper awareness, adoption rates may remain concentrated in urban and affluent markets

- Energy consumption and maintenance requirements of high-performance air runners may deter potential buyers. The need for specialized parts or service can increase total cost of ownership and reduce appeal among casual users. High energy usage also raises environmental concerns in regions with elevated electricity costs. Manufacturers are challenged to innovate energy-efficient designs to improve affordability and sustainability

- For instance, in 2023, market surveys in Asia-Pacific revealed that over 60% of home fitness buyers preferred conventional treadmills due to lower upfront and maintenance costs, despite acknowledging the superior cushioning and performance of air runners. Buyers often weigh cost versus long-term health and convenience benefits. High maintenance requirements for air runners, such as motor servicing and belt replacement, were cited as deterrents. Retailers and manufacturers are exploring service plans to mitigate these concerns

- While air runner technology continues to advance, addressing cost, energy efficiency, and consumer education challenges is crucial. Market stakeholders must focus on affordable models, localized service networks, and user-friendly designs to unlock long-term growth potential. Collaborative initiatives with gyms, fitness centers, and online platforms can further boost awareness and adoption. Ongoing R&D in energy efficiency, durability, and smart features will sustain market competitiveness

Air Runner Market Scope

The market is segmented on the basis of type, end-user, application, and usage.

- By Application

On the basis of application, the air runner market is segmented into Residential and Commercial. The Commercial segment held the largest market revenue share in 2024, driven by the increasing adoption of air runners in gyms, boutique fitness studios, and corporate wellness centers. Commercial facilities prefer high-performance air runners for continuous use, enhanced durability, and advanced monitoring features, making them a preferred choice for professional fitness environments.

The Residential segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising awareness of home fitness and the convenience of exercising at home. Compact and energy-efficient designs allow residential users to engage in low-impact cardio workouts, high-intensity interval training (HIIT), and rehabilitation exercises without requiring extensive space or professional supervision. Home adoption is further boosted by integration with fitness apps and smart tracking devices, supporting personalized workout routines.

- By End-User

On the basis of end-user, the air runner market is segmented into Gym, School, Community, Sports Center, and Other. The Gym segment accounted for the largest market share in 2024, owing to the increasing demand for cardio and HIIT equipment in fitness centers. Gyms prioritize air runners for their low-impact running surfaces, safety features, and durability under high usage, which enhances member experience and retention.

The Community and Sports Center segments are projected to witness significant growth during 2025–2032. These facilities are increasingly incorporating air runners to support wellness programs, rehabilitation, and athletic training. Schools are also adopting air runners for physical education programs, promoting early fitness awareness among children and adolescents. The Other segment includes home gyms and boutique studios, which are expected to expand rapidly due to growing interest in personalized fitness solutions.

Air Runner Market Regional Analysis

- North America dominated the air runner market with the largest revenue share of 38.5% in 2024, driven by increasing health awareness, adoption of home fitness equipment, and a strong presence of commercial gyms and boutique fitness studios

- Consumers in the region highly value the convenience, low-impact cardio options, and smart monitoring features offered by modern air runners, enabling personalized workouts and performance tracking

- This widespread adoption is further supported by high disposable incomes, growing interest in home fitness, and the increasing preference for connected fitness equipment, establishing air runners as a favored solution for both residential and commercial applications

U.S. Air Runner Market Insight

The U.S. air runner market captured the largest revenue share in 2024 within North America, fueled by rising home fitness trends and the expansion of commercial gyms. Consumers are increasingly prioritizing low-impact cardio solutions and multifunctional workout equipment for both health maintenance and rehabilitation purposes. The growing popularity of smart fitness devices with app integration, performance tracking, and virtual training programs is further propelling the air runner market. Additionally, corporate wellness programs and boutique fitness studios are adopting air runners to enhance member engagement and reduce injury risks.

Europe Air Runner Market Insight

The Europe air runner market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising health consciousness, urbanization, and the increasing number of fitness centers. Consumers are adopting air runners for residential and commercial use, appreciating their ergonomic designs and low-impact running surfaces. The market is also benefiting from government initiatives promoting active lifestyles and wellness programs. Air runners are increasingly incorporated into gyms, sports facilities, and rehabilitation centers, supporting both preventive health and fitness training across age groups.

U.K. Air Runner Market Insight

The U.K. air runner market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing trend of home fitness, desire for low-impact cardio workouts, and focus on overall wellness. Increasing awareness of exercise benefits, alongside concerns regarding joint injuries from traditional treadmills, is encouraging adoption. The UK’s established fitness infrastructure, online fitness platforms, and e-commerce penetration are further contributing to market expansion. Residential adoption of air runners for home workouts is complemented by growing usage in commercial gyms and rehabilitation centers.

Germany Air Runner Market Insight

The Germany air runner market is expected to witness the fastest growth rate from 2025 to 2032, fueled by a strong focus on health, fitness, and technological innovation. Consumers are seeking advanced cardio solutions with enhanced safety, energy efficiency, and performance monitoring. Germany’s well-developed fitness industry and emphasis on sustainable products promote adoption across both residential and commercial segments. Integration with virtual training programs and smart fitness apps is becoming increasingly prevalent, reflecting the country’s preference for connected and performance-driven fitness solutions.

Asia-Pacific Air Runner Market Insight

The Asia-Pacific air runner market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing awareness of health and fitness. Countries such as China, Japan, and India are experiencing heightened interest in home fitness and commercial gym equipment. Government initiatives promoting wellness, coupled with the region’s emergence as a manufacturing hub for fitness equipment, are increasing the accessibility and affordability of air runners. The adoption of connected fitness technologies and online workout programs is further accelerating market growth.

Japan Air Runner Market Insight

The Japan air runner market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high health awareness, technologically advanced population, and strong home fitness culture. Consumers are prioritizing low-impact cardio solutions that support joint health, rehabilitation, and personalized workouts. Integration with fitness apps, virtual coaching programs, and connected smart devices is driving demand. Additionally, Japan’s aging population is likely to boost adoption of easy-to-use, safe, and compact air runners for both residential and commercial use.

China Air Runner Market Insight

The China air runner market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing middle-class population, and increasing fitness consciousness. Air runners are becoming popular in residential homes, gyms, and wellness centers. The push for smart and connected home fitness solutions, along with strong domestic manufacturing capabilities, is driving market growth. Affordability, easy availability, and government initiatives supporting healthy lifestyles are key factors propelling the adoption of air runners across China.

Air Runner Market Share

The Air Runner industry is primarily led by well-established companies, including:

- Assault Fitness (U.S.)

- ACC USA (U.S.)

- Fitcare India (India)

- Cosco (India) Limited (India)

- Woodway U.S.A., Inc. (U.S.)

- SD Fitness Equipment (U.S.)

- Zhejiang Lianmei Industrial Co., Ltd (China)

- Tabono Fitness (U.K.)

- TrueForm Runner (U.S.)

- Land Fitness Tech Co., Ltd (China)

- Being Strong Fitness Equipment (U.S.)

- DRAX Inc. (U.S.)

- China Guangzhou B.F.T. Fitness Equipment Co., Ltd (China)

- Technogym (Italy)

- NOHrD (Germany)

- JERAI FITNESS PVT. LTD. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.