Global Air Seeders Market

Market Size in USD Billion

CAGR :

%

USD

10.41 Billion

USD

16.22 Billion

2025

2033

USD

10.41 Billion

USD

16.22 Billion

2025

2033

| 2026 –2033 | |

| USD 10.41 Billion | |

| USD 16.22 Billion | |

|

|

|

|

What is the Global Air Seeders Market Size and Growth Rate?

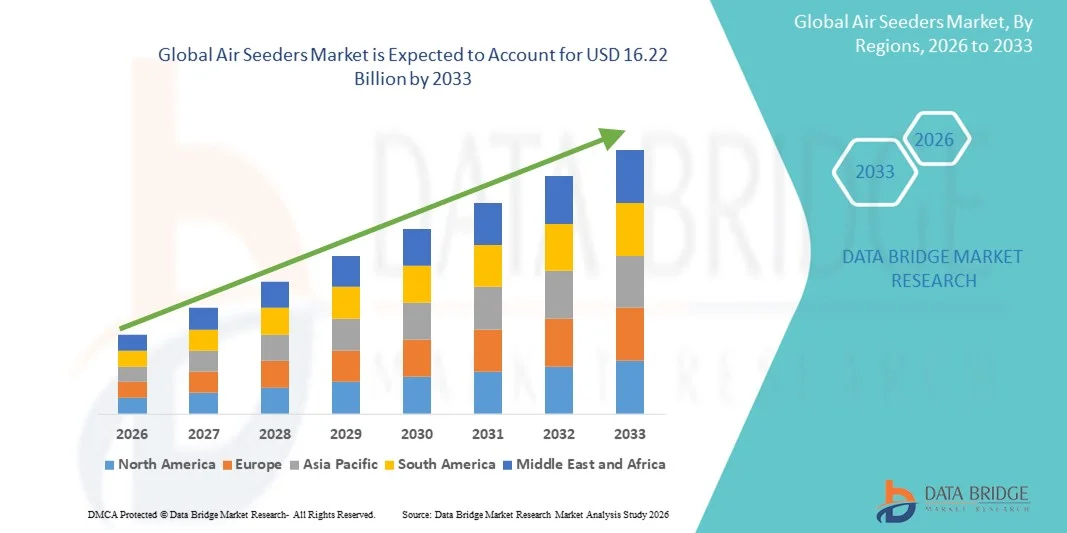

- The global air seeders market size was valued at USD 10.41 billion in 2025 and is expected to reach USD 16.22 billion by 2033, at a CAGR of5.70% during the forecast period

- The development of highly advanced and technically superior agriculture equipment acts as one of the major factors driving the growth of air seeders market. The rise in the emphasis on developing technically advanced seeding equipment that require less maintenance and have high efficiency and expansion of agriculture sector across the globe accelerate the air seeders market growth

- The increase in demand for air seeders because of its advantages over other types of seeder such as it makes easy transportation, less maintenance and fertilizes while seeding and growing acceptance of advanced farming techniques among farmers further influence the air seeders market

What are the Major Takeaways of Air Seeders Market?

- Increase in investment, favorable regulations, growing food requirement across the globe and research and developments positively affect the air seeders market. Furthermore, technological advancements extend profitable opportunities to the air seeders market players

- High capital investment is expected to obstruct the air seeders market growth. Lack of awareness is projected to challenge the air seeders market

- North America dominated the air seeders market with a 36.75% revenue share in 2025, driven by strong adoption of high-capacity, precision-controlled, and electronically monitored air seeders across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.69% from 2026 to 2033, driven by rising mechanization in India, China, South Korea, Japan, and Southeast Asia, and increasing adoption of precision agriculture technologies

- The Rear Tow Seeder Bins segment dominated the market with a 62.7% share in 2025, supported by their high-capacity design, ability to cover large acreages, and compatibility with broadacre farming operations

Report Scope and Air Seeders Market Segmentation

|

Attributes |

Air Seeders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Air Seeders Market?

Increasing Shift Toward High-Capacity, Smart, and Precision-Controlled Air Seeders

- The air seeders market is experiencing rapid adoption of high-efficiency, GPS-enabled, and electronically controlled seeding equipment designed to enhance accuracy, reduce input wastage, and support large-scale farming operations

- Manufacturers are launching multi-tank, variable-rate, and ISOBUS-compatible air seeding systems that offer better seed distribution, enhanced depth control, and seamless integration with precision agriculture platforms

- Rising demand for compact, fuel-efficient, and productivity-boosting seeding machinery is driving usage across mid- to large-acre farms, row-crop applications, and conservation agriculture systems

- For instance, companies such as John Deere, CNH Industrial, Bourgault, and Morris Industries have upgraded their air seeders with smart meters, real-time blockage monitoring, sectional control, and upgraded digital displays

- Increasing emphasis on achieving uniform seed placement, optimizing field efficiency, and minimizing operational downtime is accelerating the shift toward automation-equipped air seeders

- As agriculture becomes more data-driven and performance-centric, advanced air seeders will continue to play a crucial role in boosting yields, lowering costs, and supporting sustainable farm management

What are the Key Drivers of Air Seeders Market?

- Rising demand for precision planting equipment that supports uniform seed distribution, improved depth accuracy, and optimized fertilizer placement in large-scale crop production

- For instance, in 2025, leading manufacturers such as Deere & Company, AGCO, and Bourgault Industries expanded their product lines with higher-capacity seed tanks, improved hydraulic systems, and more efficient metering technologies

- Growing adoption of precision agriculture, autonomous tractors, controlled traffic farming, and variable-rate technology is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in telematics, cloud-connected monitoring systems, real-time soil mapping, and automated calibration mechanisms have improved productivity, operational flexibility, and ease of use

- Increasing global focus on maximizing yields, conserving resources, and reducing manual labor is driving demand for high-performance, multi-tank, multi-section air seeding system

- Supported by rising investments in agricultural mechanization, smart farming initiatives, and digital agriculture platforms, the Air Seeders market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Air Seeders Market?

- High initial purchase costs associated with advanced, high-capacity, and precision-enabled air seeders limit adoption among small and mid-sized farmers

- For instance, during 2024–2025, fluctuations in steel prices, rising input costs, and global supply chain disruptions increased manufacturing expenses for major equipment producers

- Skill requirements for operating GPS-integrated systems, managing variable-rate seeding, and maintaining complex electronic controls restrict adoption in regions with limited technical support

- Limited awareness in emerging markets regarding precision seeding benefits, machine calibration practices, and maintenance requirements slows technology penetration

- Competition from low-cost conventional seed drills, mechanical planters, and localized seeding machinery creates price pressure and reduces differentiation for premium air seeder brands

- To address these challenges, companies are focusing on cost-optimized designs, operator training programs, simplified electronics, and improved connectivity solutions to increase global adoption of air seeders

How is the Air Seeders Market Segmented?

The market is segmented on the basis of product type, application, and sales channel.

- By Product Type

The Air Seeders market is segmented into Rear Tow Seeder Bins and Front Mounted Bins. The Rear Tow Seeder Bins segment dominated the market with a 62.7% share in 2025, supported by their high-capacity design, ability to cover large acreages, and compatibility with broadacre farming operations. These systems offer superior efficiency in seed and fertilizer placement, allow easy towing with high-horsepower tractors, and provide optimized airflow systems for uniform distribution. Their durability, multi-tank configurations, and suitability for diverse crops make them the preferred option among large commercial farms in North America, Australia, and Europe.

The Front Mounted Bins segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increased demand for improved weight distribution, enhanced maneuverability, and better tractor visibility. Adoption is rising among farmers seeking compact, fuel-efficient setups and improved seed-fertilizer balance, making front-mounted systems more attractive for precision agriculture and small-to-medium fields.

- By Application

The market is segmented into Wheat, Corn, Soybeans, Rice, and Canola applications. The Wheat Application segment dominated the market with a 41.3% share in 2025, owing to large-scale wheat cultivation across Australia, Canada, Europe, and the U.S. Air Seeders are widely preferred for wheat due to the need for uniform seed depth, consistent germination, and efficient coverage of vast farmlands. Their multi-tank capacity, precise metering, and compatibility with conservation tillage further support strong adoption.

The Soybeans Application segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising global soybean production, expansion of oilseed farming, and increasing adoption of variable-rate seeding. Farmers increasingly prefer Air Seeders for soybeans due to benefits such as minimal soil disturbance, enhanced input efficiency, and improved plant spacing. Growth in protein demand, biofuel production, and crop rotation strategies further accelerates uptake across North America, Brazil, and Asia-Pacific.

- By Sales Channel

The Air Seeders market is segmented into OEMs and Aftermarket. The OEMs segment dominated the market with a 68.5% share in 2025, driven by strong sales of new machinery, integration of advanced technologies, and long-term partnerships between farmers and established manufacturers. OEMs provide factory-fitted precision components, enhanced warranty support, and advanced compatibility with tractors, GPS systems, and ISOBUS platforms. Increasing investments in high-capacity air carts, smart metering systems, and digital monitoring tools further strengthen OEM demand across major agricultural regions.

The Aftermarket segment is expected to witness the fastest CAGR from 2026 to 2033, as farmers increasingly upgrade existing equipment with variable-rate meters, blockage sensors, hydraulic upgrades, and connectivity modules. Cost-conscious buyers are turning to aftermarket solutions to extend machine lifespan and enhance performance without purchasing new units. Growing dealer networks, availability of retrofit kits, and rising demand for replacement parts contribute significantly to segment expansion.

Which Region Holds the Largest Share of the Air Seeders Market?

- North America dominated the air seeders market with a 36.75% revenue share in 2025, driven by strong adoption of high-capacity, precision-controlled, and electronically monitored air seeders across the U.S. and Canada. Rapid mechanization, precision agriculture adoption, and increasing use of smart farming solutions continue to fuel demand for Air Seeders across large-scale wheat, corn, and soybean farms

- Leading companies in North America are introducing multi-tank, ISOBUS-compatible air seeders, GPS-guided variable-rate systems, and real-time monitoring solutions, enhancing operational efficiency, reducing input wastage, and reinforcing the region’s technological edge. Investment in autonomous tractors, digital farm management tools, and precision planting equipment is driving long-term market expansion

- High concentration of skilled operators, well-established agricultural equipment distribution networks, and strong adoption of digital agriculture solutions further reinforce regional market leadership

U.S. Air Seeders Market Insight

The U.S. is the largest contributor in North America, supported by advanced farm mechanization, strong adoption of precision agriculture technologies, and widespread use of high-capacity seeders in large-acre crop farms. Increasing demand for GPS-guided planting, variable-rate seeding, and sectional control systems intensifies market growth. Presence of leading OEMs, extensive dealer networks, and a technology-savvy farming community further drives adoption of Air Seeders across the country.

Canada Air Seeders Market Insight

Canada contributes significantly to regional growth, driven by rising adoption of precision planting, large-scale wheat and canola cultivation, and integration of smart farming tools. Farmers increasingly rely on Air Seeders for uniform seed placement, fertilizer optimization, and reduced soil compaction. Government-backed farm modernization programs, robust agricultural R&D, and strong dealer support continue to strengthen market penetration.

Asia-Pacific Air Seeders Market

Asia-Pacific is projected to register the fastest CAGR of 9.69% from 2026 to 2033, driven by rising mechanization in India, China, South Korea, Japan, and Southeast Asia, and increasing adoption of precision agriculture technologies. Expansion of large-scale crop farms, government-supported farm modernization, and rising demand for yield optimization accelerate the need for high-capacity, GPS-enabled air seeders. Growing production of wheat, rice, and soybeans, coupled with adoption of autonomous tractors and digital farm management systems, further propels market growth. Rising awareness of sustainable farming practices, smart irrigation integration, and multi-section seeding solutions is boosting the adoption of advanced Air Seeders across engineering and agricultural applications.

China Air Seeders Market Insight

China is the largest contributor in Asia-Pacific due to rapid farm mechanization, strong government support for digital agriculture, and increasing demand for large-capacity, precision-controlled seeders. Rising adoption of GPS guidance, variable-rate seeding, and smart farm monitoring drives demand for technologically advanced Air Seeders. Local manufacturing capacity and competitive pricing further expand domestic and export adoption.

Japan Air Seeders Market Insight

Japan shows steady growth supported by precision farming initiatives, advanced agricultural machinery manufacturing, and modernization of crop planting operations. High emphasis on compact, fuel-efficient, and reliable Air Seeders drives adoption, particularly for specialty crops and high-value farm applications.

India Air Seeders Market Insight

India is emerging as a key growth hub, driven by government-backed farm mechanization programs, large-scale wheat and rice cultivation, and rising adoption of precision planting solutions. Increased demand for multi-tank, high-capacity seeders with sectional control supports market expansion. Growing awareness of efficiency optimization, digital farm management, and sustainable agriculture further accelerates adoption.

South Korea Air Seeders Market Insight

South Korea contributes significantly due to rising mechanization, adoption of smart farming solutions, and increasing demand for precision seed placement. Growth in high-value crops, integration of GPS-guided systems, and adoption of autonomous tractors drives the need for high-capacity, multi-section Air Seeders. Technological innovation, efficient manufacturing, and strong farm equipment networks support sustained market growth.

Which are the Top Companies in Air Seeders Market?

The Air Seeders industry is primarily led by well-established companies, including:

- AGCO Corporation (U.S.)

- CNH Industrial (U.K.)

- Deere & Company (U.S.)

- Bourgault Industries Ltd. (Canada)

- Morris Industries Ltd. (Canada)

- SEED HAWK (Canada)

- Amity Technology (Canada)

- Clean Seed Capital (Canada)

- Gandy Company (U.S.)

- Great Plains Manufacturing (U.S.)

- CNH Industrial Australia (Australia)

- Grogans Machinery (Australia)

- Taege Engineering (Australia)

- Ausplow (Australia)

- Redhead Equipment (Australia)

- Sandhills Global, Inc. (U.S.)

- Theebo Tech (Australia)

- Doolan's Precision Seeding (Australia)

- HFL Fabricating (Australia)

- Forward Farming Australia Pty Ltd. (Australia)

- Tractor & Equipment Co (U.S.)

What are the Recent Developments in Global Air Seeders Market?

- In January 2023, Lemken acquired Equaliser, a renowned seed drill manufacturer headquartered in Cape Town, to expand its operations in the southern hemisphere. This strategic acquisition strengthens Lemken’s market presence and accelerates growth in precision seeding solutions across emerging agricultural markets. This move is expected to enhance Lemken’s competitive advantage and global footprint in seed drill technology

- In July 2022, John Deere launched the P600 series, an updated range of precision air hole drills specifically designed for small grain growers. The new series incorporates advanced planting technologies and precision features to optimize seeding efficiency and yield performance. This release reinforces John Deere’s leadership in precision agricultural equipment for small-scale farming operations

- In July 2022, Morris introduced the next-generation Quantum Air Drill, an innovative pneumatic seed drill packed with advanced technology and design improvements. Unsuch as incremental updates such as the C3 Contour, the Quantum Air Drill represents a significant evolution in Morris’s product lineup. This launch sets a new benchmark for future innovations in pneumatic seeding equipment

- In March 2022, AGCO, Your Agriculture Company, announced that it signed a memorandum of intent with Amity Technology, LLC to form a joint venture for the development and distribution of Pneumatic Seeding Equipment and tillage solutions. This collaboration aims to leverage combined expertise in machinery design, manufacturing, and distribution networks. The partnership is expected to accelerate product innovation and expand market reach for pneumatic seeding technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.