Global Airborne Wind Energy Market

Market Size in USD Billion

CAGR :

%

USD

1.25 Billion

USD

2.39 Billion

2024

2032

USD

1.25 Billion

USD

2.39 Billion

2024

2032

| 2025 –2032 | |

| USD 1.25 Billion | |

| USD 2.39 Billion | |

|

|

|

|

Airborne Wind Energy Market Size

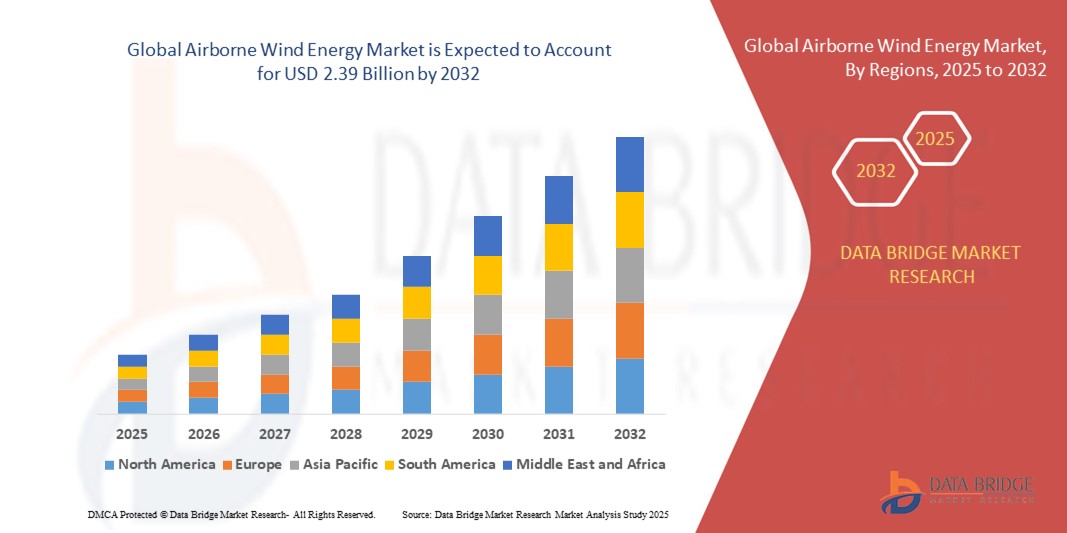

- The global airborne wind energy market size was valued at USD 1.25 billion in 2024 and is expected to reach USD 2.39 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by increasing demand for clean, space-efficient, and infrastructure-light renewable energy sources that can operate in remote and off-grid areas, making airborne wind energy a compelling alternative to conventional wind turbines

- Furthermore, advancements in autonomous flight control systems, lightweight materials, and real-time data analytics are improving the reliability and efficiency of airborne wind devices, accelerating commercialization and investment interest across global markets

Airborne Wind Energy Market Analysis

- Airborne wind energy systems generate electricity by harnessing high-altitude winds through tethered flying devices such as kites or drones, which are connected to ground-based generators. These systems operate at altitudes where winds are stronger and more consistent, offering improved energy yield compared to traditional wind turbines

- The escalating interest in airborne wind energy is driven by its potential for lower installation costs, minimal land use, and high scalability for diverse geographies, including offshore and rural environments. Increasing R&D activity, pilot deployments, and government support for next-gen renewables are further contributing to market growth

- sAsia-Pacific dominated the airborne wind energy market with a share of 45% in 2024, due to increasing renewable energy targets, supportive government policies, and growing investments in clean energy technologies across emerging economies

- North America is expected to be the fastest growing region in the airborne wind energy market during the forecast period due to

- Onshore segment dominated the market with a market share of 67.9% in 2024, due to its easier infrastructure access, reduced logistical costs, and faster regulatory approvals. Most airborne wind energy systems in operation or under testing are land-based, as they leverage existing terrestrial support systems and transportation networks. Onshore sites also provide greater flexibility for iterative testing, maintenance, and adaptation of control systems. Favorable land-based wind conditions in high-altitude regions enhance energy capture while minimizing visual and environmental footprints compared to traditional wind turbines

Report Scope and Airborne Wind Energy Market Segmentation

|

Attributes |

Airborne Wind Energy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Airborne Wind Energy Market Trends

Rising Technological Advancements

- The airborne wind energy market is rapidly advancing through the integration of autonomous flight control, advanced composite materials, and real-time data analytics, allowing systems to efficiently harness stronger, high-altitude winds and deliver consistent renewable energy

- For instance, Norwegian firm Kitemill and Germany’s SkySails Power GmbH are pioneering utility-scale airborne wind installations, with Kitemill’s KM2 system achieving multi-hour continuous flight and SkySails’ technology being deployed in joint ventures with ENGIE Group to power gas storage facilities in Europe

- Increased application of artificial intelligence and machine learning is enhancing system stability, performance optimization, and predictive maintenance, resulting in greater reliability for commercial operations

- The adoption of modular AWE systems is facilitating scalable deployment in a variety of environments, from remote islands and off-grid communities to co-located projects alongside solar or ground-based wind farms

- Ongoing cost reductions in installation, maintenance, and materials, along with technology demonstrations and pilot projects, are improving the economic viability and bankability of airborne wind projects, encouraging industry and investor interest

- Companies are focusing on improving system scalability and making strides toward grid integration, with utility partnerships and hybrid energy parks paving the way for larger, more impactful AWE installations in Europe, Asia-Pacific, and North America

Airborne Wind Energy Market Dynamics

Driver

Renewable Energy Transition

- The global transition toward clean energy and decarbonization is a primary driver for airborne wind energy, with countries and companies seeking innovative solutions that can harness consistent high-altitude winds to meet ambitious climate and sustainability targets

- For instance, the European Commission’s Horizon 2020 program and U.S. Department of Energy support airborne wind innovation through pilot projects, grants, and updated regulatory frameworks, enabling industry growth and public-private partnerships

- Airborne wind energy systems offer installation flexibility and reduced land requirements, addressing limitations of traditional wind turbines, especially in offshore or remote locations

- The growing need to diversify energy portfolios amid rising global energy demand and supply chain pressures further accelerates the adoption of scalable, off-grid-capable renewable technologies

- Integration of airborne wind with hybrid and microgrid solutions expands its applicability to rural electrification, emergency response, and distributed infrastructure in hard-to-reach markets

Restraint/Challenge

Regulatory Hurdles and Safety Concerns

- The lack of standardized regulations and clear airspace governance for airborne wind systems introduces operational uncertainty for developers, particularly when addressing grid connection, aviation safety, and environmental compliance

- For instance, project deployments by SkySails Power GmbH and other innovators have faced scrutiny from civil aviation authorities and required the establishment of restricted flight zones to mitigate risk and address local concerns

- Public acceptance challenges arise from unfamiliarity with airborne wind technology and apprehension around safety, such as the potential for system failure, tether detachment, or wildlife impacts

- The complex technical requirements for system reliability and safety compliance demand rigorous certification processes, increasing time-to-market and investment burden for emerging AWE companies

- Investment risks remain elevated due to limited field data from operational systems, high pilot project costs, and the need for harmonized industry standards to accelerate commercialization and eliminate insurance and financing barriers

Airborne Wind Energy Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the airborne wind energy market is segmented into Less Than 1 MW, 1 MW–3 MW, and More Than 3 MW. The Less Than 1 MW segment held the largest revenue share in 2024 due to its applicability in pilot projects, microgrids, and rural electrification initiatives. These smaller systems are easier to deploy, require lower initial capital investment, and are often used to demonstrate technology viability before scaling. They are ideal for testing aerodynamic performance, control systems, and energy output in varied terrains. In addition, governments and startups prefer this segment for early-stage innovations, R&D programs, and regulatory sandbox environments. The segment’s compatibility with both tethered drones and kites further reinforces its adoption across diverse geographies and use cases. It continues to serve as the foundation for technological refinement and commercial proof-of-concept projects.

The 1 MW–3 MW segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing interest from utility providers and energy developers looking for scalable and cost-efficient renewable solutions. These systems strike a balance between energy output and operational complexity, making them suitable for semi-commercial installations and distributed generation projects. Their size allows them to harness stronger high-altitude winds while still maintaining logistical feasibility. Several prototypes in this range are advancing toward commercialization, aided by improved material science and real-time flight control algorithms. Their potential to offer stable energy output in remote or grid-challenged regions enhances their appeal. This segment is also benefiting from rising venture capital investments and policy support aimed at mid-scale renewable deployment.

- By Application

On the basis of application, the airborne wind energy market is segmented into Offshore and Onshore. The Onshore segment accounted for the largest revenue share of 67.9% in 2024, largely due to its easier infrastructure access, reduced logistical costs, and faster regulatory approvals. Most airborne wind energy systems in operation or under testing are land-based, as they leverage existing terrestrial support systems and transportation networks. Onshore sites also provide greater flexibility for iterative testing, maintenance, and adaptation of control systems. Favorable land-based wind conditions in high-altitude regions enhance energy capture while minimizing visual and environmental footprints compared to traditional wind turbines. Furthermore, lower deployment and anchoring costs make onshore systems an attractive starting point for startups and research institutions. As a result, the onshore segment continues to dominate early adoption and market readiness.

The Offshore segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing need to tap into stronger and more consistent offshore wind resources without the constraints of fixed tower installations. Airborne wind systems are uniquely suited for offshore use because they eliminate the need for massive underwater foundations and complex anchoring structures. Their lightweight and modular design allows for easier transportation and deployment from floating platforms or vessels. As floating wind farms gain traction, airborne solutions offer a complementary path to increase efficiency and reduce levelized cost of energy (LCOE). Regulatory frameworks and maritime energy policies in Europe and parts of Asia are increasingly supporting offshore innovation, creating fertile ground for rapid advancement. Improved tethering systems and autonomous flight controls are also reducing the operational risks associated with offshore deployment.

Airborne Wind Energy Market Regional Analysis

- Asia-Pacific dominated the airborne wind energy market with the largest revenue share of 45% in 2024, driven by increasing renewable energy targets, supportive government policies, and growing investments in clean energy technologies across emerging economies

- Countries across the region are prioritizing energy diversification and carbon neutrality, creating fertile ground for airborne wind pilot projects and technology trials

- A strong industrial base, growing focus on energy innovation, and cost-effective labor and production infrastructure are accelerating adoption of airborne wind energy systems

China Airborne Wind Energy Market Insight

China held the largest share in the Asia-Pacific airborne wind energy market in 2024, supported by its aggressive renewable energy policies, dominance in global manufacturing, and commitment to reducing carbon emissions. The country’s strong state-led initiatives are fostering R&D and commercial testing of airborne wind technologies, particularly in remote, mountainous, and inland regions. Academic institutions and cleantech firms are actively collaborating to refine autonomous flight systems and tether technologies suitable for large-scale deployment. With its vertically integrated industrial base, China is well-positioned to scale production while maintaining cost efficiency. The government's dual focus on domestic innovation and export-oriented technology is also enabling Chinese firms to lead in both regional and international airborne wind markets.

India Airborne Wind Energy Market Insight

India is witnessing the fastest growth in the Asia-Pacific airborne wind energy market, fueled by its rising need for clean energy access in rural and underserved areas. Government programs such as “Startup India” and “National Renewable Energy Mission” are supporting the development of new technologies, including airborne wind systems. Startups, universities, and public institutions are jointly exploring cost-effective, mid-scale solutions that can be deployed without extensive grid infrastructure. India's emphasis on sustainability, combined with high solar-wind hybrid potential in certain regions, is driving interest in airborne wind for both backup and primary power. Expanding innovation hubs, improved ease of doing business, and increasing foreign investment in cleantech are accelerating the pace of market growth.

Europe Airborne Wind Energy Market Insight

Europe remains a key contributor to the airborne wind energy market, underpinned by robust climate legislation, strong public-private R&D partnerships, and early adoption of advanced renewable technologies. The region is home to several pioneering airborne wind energy companies that are actively testing and refining autonomous flight systems, durable composite materials, and tether control mechanisms. With the European Union pushing aggressive carbon neutrality goals, airborne wind is being explored as a complementary source to conventional renewables, particularly in areas with limited land availability. The presence of regulatory support, innovation funding, and a collaborative research environment is propelling the commercial readiness of airborne wind systems across Europe.

Germany Airborne Wind Energy Market Insight

Germany’s airborne wind energy market is bolstered by its leadership in engineering, renewable energy R&D, and a strong commitment to transitioning away from fossil fuels. The country’s advanced scientific infrastructure supports the development of control systems, flight dynamics optimization, and high-efficiency turbine kites. Strong coordination between universities, federal agencies, and cleantech firms is facilitating rapid testing and iteration of airborne prototypes. Germany also benefits from a favorable regulatory environment and public funding, making it one of the most active testing grounds for airborne wind energy in Europe. As land constraints and community opposition to large onshore turbines grow, airborne wind is increasingly seen as a viable solution for space-efficient energy generation.

U.K. Airborne Wind Energy Market Insight

The U.K. airborne wind energy market is expanding steadily, supported by a mature renewable energy policy framework, growing interest in offshore applications, and a proactive innovation ecosystem. Government-backed grants and carbon reduction targets are encouraging startups and researchers to develop systems optimized for coastal and island installations. The U.K.’s marine engineering expertise, particularly in floating platforms, is being leveraged to trial offshore airborne wind solutions with minimal seabed impact. A network of test centers and collaboration with universities is strengthening product development. With energy security becoming a top national priority, airborne wind energy is being viewed as a future-forward technology capable of delivering flexible and clean power.

North America Airborne Wind Energy Market Insight

North America is projected to experience the fastest CAGR in the airborne wind energy market from 2025 to 2032, driven by increasing demand for resilient, off-grid, and climate-friendly power generation. The region’s focus on energy innovation, particularly through federal clean energy funding and private sector investment, is catalyzing the development of airborne wind prototypes. Both public utilities and defense agencies are exploring the potential of airborne systems to provide portable and infrastructure-light solutions in remote or emergency-prone areas. A mature technological landscape, combined with favorable state-level policies and pilot testing sites, is positioning North America as a key player in the future of airborne wind energy.

U.S. Airborne Wind Energy Market Insight

The U.S. held the largest share of the North American airborne wind energy market in 2024, supported by a robust cleantech sector, highly developed aerospace expertise, and substantial public and private investment in renewable innovation. Federal agencies such as the Department of Energy are actively funding airborne wind research, with applications ranging from rural electrification to disaster response. Startups are advancing both tethered drone and kite-based systems, focusing on reliability, autonomous control, and scalable deployment. The presence of a strong entrepreneurial ecosystem, combined with increasing energy diversification goals, is helping the U.S. emerge as a leading testbed for airborne wind commercialization. Offshore wind expansion strategies are also incorporating airborne concepts, particularly along the Pacific and Atlantic coasts.

Airborne Wind Energy Market Share

The airborne wind energy industry is primarily led by well-established companies, including:

- ENERCON Global GmbH (Germany)

- Vestas (Denmark)

- General Electric (U.S.)

- NORDEX SE (Germany)

- Siemens (Germany)

- Senvion (Germany)

- goldwind.com (China)

- United Power (China)

- Envision Group (China)

- Suzlon Energy Limited (India)

Latest Developments in Global Airborne Wind Energy Market

- In February 2024, ENGIE Group and SkySails Power GmbH made notable progress in their joint initiative to harness high-altitude winds for renewable energy, marking a pivotal advancement in the airborne wind energy (AWE) market. Their pilot project, aimed at powering the Peckenser gas storage facility with sustainable energy from AWE and solar photovoltaics, has received favorable feedback from local authorities. This development strengthens commercial confidence in airborne wind solutions and also sets a precedent for hybrid renewable integration, accelerating the market’s transition from pilot to early-stage adoption

- In July 2023, Norwegian firm Kitemill launches the KM2 system, its utility-scale airborne wind energy technology, with a 16m wingspan and vertical take-off and landing capabilities. The system, aiming to generate 100kW on average, follows the successful testing of the KM1 prototype, which covered over 500km in continuous operation

- In May 2023, Norwegian renewable energy firm Kitemill achieved a major operational milestone with its KM1 pilot system, which covered over 500 kilometers during five hours of uninterrupted flight. This record-setting achievement underscores the technical viability and endurance of AWE systems, reinforcing their competitiveness against traditional renewables. The demonstration of long-duration, high-range operation strengthens investor and stakeholder confidence, positioning Kitemill and similar players for further commercial scaling within Europe and beyond

- In January 2021, SkySails Power entered a collaboration with REW Renewables to jointly develop a Kite Power Generator, signaling continued innovation in airborne wind technologies. The proposed 120-square-meter kite is designed to fly at 400 meters altitude, generating electricity via an onboard generator driven by rotational energy. This partnership reflects growing private-sector investment in scalable AWE systems and highlights efforts to diversify deployment formats, thereby expanding the addressable market for airborne wind solutions

- In February 2020, Kitemill acquired the property assets of Kite Power Systems (KPS), a move that consolidated critical intellectual and physical resources for airborne wind development in Norway. This strategic acquisition reinforced Kitemill’s R&D capabilities and marked a significant step toward establishing Norway as a hub for AWE innovation. The deal enabled the continuation of KPS’s technological progress under Kitemill’s leadership, enhancing Norway’s positioning in the global AWE landscape and fostering long-term regional competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Airborne Wind Energy Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Airborne Wind Energy Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Airborne Wind Energy Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.