Global Aircraft Brackets Market

Market Size in USD Billion

CAGR :

%

USD

1.13 Billion

USD

2.22 Billion

2024

2032

USD

1.13 Billion

USD

2.22 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 2.22 Billion | |

|

|

|

|

Aircraft Brackets Market Size

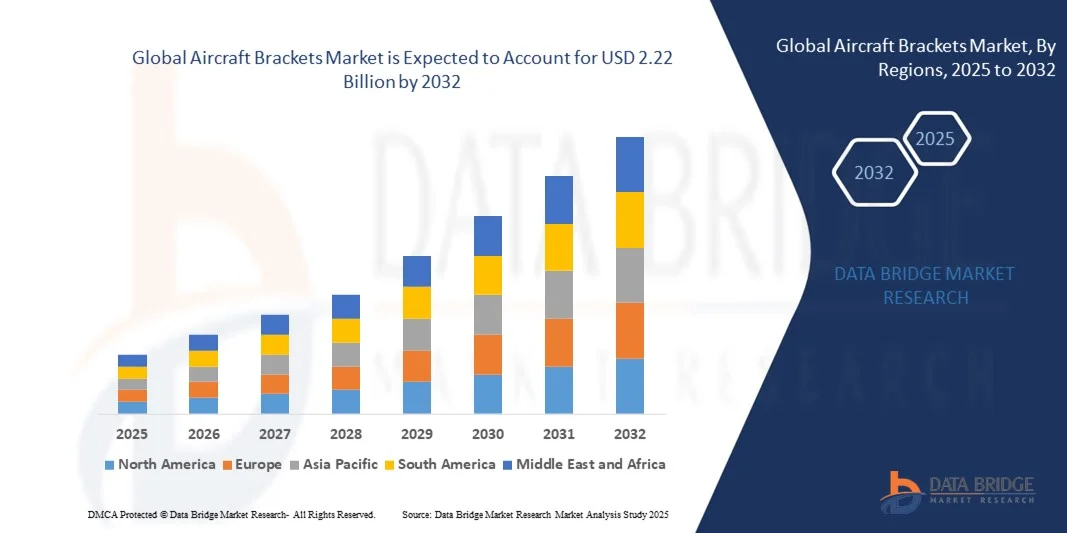

- The global aircraft brackets market size was valued at USD 1.13 billion in 2024 and is expected to reach USD 2.22 billion by 2032, at a CAGR of 8.81% during the forecast period

- The market growth is largely fueled by the increasing production and modernization of commercial and military aircraft, coupled with the rising demand for lightweight, high-strength components that enhance fuel efficiency and performance. Continuous advancements in materials such as aluminum alloys, composites, and titanium are enabling the development of brackets that meet stringent safety and structural requirements while reducing overall aircraft weight

- Furthermore, growing investments in aerospace manufacturing, the adoption of advanced fabrication technologies such as additive manufacturing, and the expansion of aircraft fleets by airlines are significantly contributing to market expansion. These developments are driving demand for durable and precision-engineered aircraft brackets, reinforcing their importance in maintaining the structural integrity and operational efficiency of modern aircraft

Aircraft Brackets Market Analysis

- Aircraft brackets are critical structural components used to support, connect, and secure various systems and assemblies in an aircraft, including wings, fuselage, engines, and landing gear. Their performance directly influences aircraft safety, stability, and efficiency, making them indispensable to aerospace design and engineering. The market is evolving rapidly due to the ongoing shift toward lightweight materials and the integration of digital manufacturing processes that enhance precision and reduce production costs

- The demand for aircraft brackets is primarily driven by the increasing global aircraft production, fleet expansion, and the aerospace industry’s emphasis on weight reduction to improve fuel economy. With OEMs and suppliers adopting advanced composites and additive manufacturing techniques, the market is poised for sustained growth, supported by both commercial and defense aviation sectors worldwide

- North America dominated the aircraft brackets market with a share of over 40% in 2024, due to the high production rate of commercial and military aircraft and the strong presence of key aerospace manufacturers such as Boeing and Lockheed Martin

- Asia-Pacific is expected to be the fastest growing region in the aircraft brackets market during the forecast period due to the rapid expansion of the aviation industry in countries such as China, India, and Japan

- Commercial aircraft segment dominated the market with a market share of 47% in 2024, due to the rising production of commercial airplanes by manufacturers such as Boeing and Airbus to meet growing global air passenger traffic. Increased focus on fuel efficiency and weight reduction has boosted the demand for lightweight yet durable brackets used in structural assemblies, engine mounts, and cabin interiors. The expansion of international fleets and the replacement of aging aircraft further support segment growth

Report Scope and Aircraft Brackets Market Segmentation

|

Attributes |

Aircraft Brackets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Brackets Market Trends

Adoption of Lightweight Composite and Additive Manufacturing Technologies

- The aircraft brackets market is experiencing a major evolution driven by the increasing adoption of lightweight composite materials and additive manufacturing technologies aimed at improving structural efficiency and reducing overall aircraft weight. These advancements are supporting manufacturers in achieving better fuel economy, sustainability goals, and cost efficiency across the aerospace supply chain

- For instance, Boeing and Airbus are increasingly incorporating composite-based brackets manufactured through additive processes in aircraft assemblies to reduce both weight and part complexity. Boeing’s use of 3D-printed thermoplastic composite brackets in the 787 Dreamliner exemplifies how the industry is leveraging advanced production methods to enhance performance efficiency and reduce assembly labor time

- The integration of composite materials such as carbon fiber-reinforced polymers and titanium alloys in aircraft brackets provides superior strength-to-weight ratios, corrosion resistance, and longer operational durability. Such properties are essential for meeting stringent performance standards, particularly in fuselage and engine mounting structures

- Additive manufacturing, or 3D printing, allows for the production of brackets with intricate geometries that were previously unachievable through conventional machining. This approach enables reduced material waste and faster prototyping, accelerating design cycles and improving production agility for both commercial and defense aircraft programs

- Aircraft component suppliers are increasingly collaborating with technology partners to develop bracket systems tailored for next-generation aircraft configurations. For instance, Spirit AeroSystems and GE Aerospace have advanced their additive manufacturing divisions to produce customized, lightweight structural brackets that enhance overall aircraft performance and maintenance efficiency

- The adoption of lightweight composites combined with additive manufacturing is redefining the aerospace manufacturing landscape, promoting sustainability and cost-effectiveness. As the industry continues to prioritize efficiency, these technologies will remain crucial for enabling structural integrity, weight optimization, and reduced lifecycle costs across advanced aircraft platforms

Aircraft Brackets Market Dynamics

Driver

Rising Aircraft Production and Fleet Expansion

- The increasing production of aircraft and rapid fleet expansion driven by surging air travel demand are major factors propelling the growth of the aircraft brackets market. Global passenger traffic recovery and the rise of low-cost carriers are compelling manufacturers to ramp up commercial and regional aircraft production to fulfill delivery backlogs and new orders

- For instance, Airbus SE reported record aircraft deliveries in 2024, with over 770 units delivered worldwide, supported by robust demand for A320neo and A350 models. This surge in production directly increases the demand for various structural and support components, including advanced brackets used across the fuselage, landing gear, and engine systems

- The resurgence in air cargo operations and defense aviation modernization programs further supports bracket demand across diverse aircraft categories. With airlines upgrading their fleets to fuel-efficient and lightweight models, component suppliers are witnessing higher procurement for precision-engineered brackets compatible with new airframe technologies

- Manufacturers are focusing on expanding their production capacities and adopting automated manufacturing processes to meet bulk order requirements from OEMs. The need for precision, reliability, and weight reduction in aircraft structures is driving continuous innovation in the design and production of brackets for both commercial and military segments

- As aviation expansion continues globally, the increasing output of aircraft production lines and fleet modernization initiatives will remain key growth drivers for the aircraft brackets market. The growing emphasis on performance optimization and fuel efficiency further strengthens bracket demand as an integral element in the evolving aerospace supply network

Restraint/Challenge

High Manufacturing Costs

- High production and tooling costs remain a key challenge in the aircraft brackets market, primarily due to the sophisticated materials and precision processes involved in aerospace manufacturing. The use of advanced alloys, composites, and additive manufacturing technologies increases both material and equipment expenses for suppliers

- For instance, smaller aerospace component manufacturers face high entry barriers into additive manufacturing due to the cost of proprietary technology, specialized printers, and certification processes required by major OEMs such as Boeing and Airbus. These initial setup and validation costs can be substantial, restricting participation of smaller firms in the global supply chain

- Complex machining tolerances, multi-step finishing requirements, and stringent certification standards contribute further to overall production costs. The need to ensure mechanical integrity and resistance against extreme environmental conditions raises the costs associated with testing and quality assurance procedures

- Fluctuating raw material prices, particularly for titanium and carbon composites, create uncertainty for manufacturers managing long-term projects. In addition, maintaining advanced production infrastructure capable of meeting aircraft-grade specifications demands significant capital investment and skilled labor availability

- To address these cost challenges, industry participants are leveraging automation, multi-material printing, and centralized supply chain integration to achieve cost efficiency while maintaining high precision. Controlling production expenses and achieving economies of scale through technology optimization and material innovation will be critical for sustainable growth in the aircraft brackets market

Aircraft Brackets Market Scope

The market is segmented on the basis of type, material type, brackets, application, and end user.

- By Type

On the basis of type, the aircraft brackets market is segmented into commercial aircraft, regional aircraft, general aviation, military aircraft, and helicopter. The commercial aircraft segment dominated the market with the largest market revenue share of 47% in 2024, attributed to the rising production of commercial airplanes by manufacturers such as Boeing and Airbus to meet growing global air passenger traffic. Increased focus on fuel efficiency and weight reduction has boosted the demand for lightweight yet durable brackets used in structural assemblies, engine mounts, and cabin interiors. The expansion of international fleets and the replacement of aging aircraft further support segment growth.

The military aircraft segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising defense modernization programs and the procurement of advanced fighter jets and UAVs. Countries across North America, Europe, and Asia are investing heavily in next-generation aircraft requiring high-performance and corrosion-resistant brackets. The integration of advanced materials and precision engineering technologies in military aircraft production also supports this segment’s accelerated growth.

- By Material Type

On the basis of material type, the aircraft brackets market is segmented into steel, aluminum, composites, and others. The aluminum segment dominated the market with the largest market share in 2024 due to its lightweight properties, corrosion resistance, and excellent strength-to-weight ratio, making it the preferred material for most aircraft structural components. The use of aluminum brackets contributes to overall aircraft fuel efficiency and structural durability, aligning with the aviation industry’s sustainability objectives.

The composites segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the increasing shift toward advanced lightweight materials for modern aircraft designs. Composites offer superior fatigue resistance, reduced maintenance needs, and improved aerodynamic performance, making them ideal for critical applications in fuselage and wings. Rising adoption of carbon fiber-reinforced materials in both commercial and defense aircraft is expected to accelerate this growth further.

- By Brackets

On the basis of brackets, the aircraft brackets market is categorized into Class-A, Class-B, and Class-C. The Class-A segment accounted for the largest market share in 2024, primarily due to its extensive use in primary aircraft structures that require high strength and precision. These brackets play a vital role in connecting major assemblies such as fuselage and wings, where load-bearing and safety standards are paramount. The demand for Class-A brackets continues to rise with the growth of new aircraft programs and stringent airworthiness regulations.

The Class-C segment is forecasted to register the fastest growth rate from 2025 to 2032, driven by increasing usage in secondary structures and systems where flexibility, cost-effectiveness, and customization are critical. The growing adoption of 3D printing and advanced manufacturing methods for low-weight, high-performance Class-C brackets further enhances segment expansion.

- By Application

On the basis of application, the aircraft brackets market is divided into aircraft fuselage, aircraft wings, engine mount, landing gear, aircraft control surfaces, and others. The aircraft fuselage segment dominated the market in 2024, supported by the high installation volume of brackets required for assembling fuselage sections. These brackets ensure stability and alignment in the aircraft structure, directly impacting overall safety and performance. The continuous introduction of new lightweight fuselage materials further boosts demand for advanced brackets designed to maintain compatibility and durability.

The engine mount segment is expected to record the fastest growth from 2025 to 2032, owing to the rising production of fuel-efficient engines and the demand for vibration-resistant bracket systems. The precision and thermal resistance required in engine installations make specialized brackets critical components in modern aircraft design. Increasing investments in next-generation propulsion systems will further fuel this segment’s growth.

- By End User

On the basis of end user, the aircraft brackets market is bifurcated into original equipment manufacturer (OEM) and aftermarket. The OEM segment held the largest market share in 2024 due to the high number of new aircraft deliveries and increasing aircraft production rates by major manufacturers. OEMs continue to integrate advanced bracket designs that align with performance, efficiency, and safety standards, contributing to steady market demand.

The aftermarket segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for maintenance, repair, and replacement of brackets in aging aircraft fleets. The rise in global air travel and extended aircraft lifespans necessitate continuous aftermarket support. Expansion of MRO (maintenance, repair, and overhaul) facilities worldwide also enhances the demand for reliable and compatible replacement brackets.

Aircraft Brackets Market Regional Analysis

- North America dominated the aircraft brackets market with the largest revenue share of over 40% in 2024, driven by the high production rate of commercial and military aircraft and the strong presence of key aerospace manufacturers such as Boeing and Lockheed Martin

- The region’s advanced aviation infrastructure, continuous technological innovations, and focus on lightweight materials for improved fuel efficiency have strengthened its market leadership

- The growing demand for aircraft modernization, repair, and maintenance further contributes to the expanding use of high-performance brackets across various aircraft platforms

U.S. Aircraft Brackets Market Insight

The U.S. aircraft brackets market captured the largest revenue share in 2024 within North America, fueled by robust investments in aerospace manufacturing and defense modernization programs. The country’s leading role in producing commercial and military aircraft supports the demand for precision-engineered brackets designed for reliability and durability. In addition, the U.S. aerospace industry’s shift toward composite materials and additive manufacturing has accelerated the adoption of advanced bracket designs that enhance structural integrity and reduce overall weight.

Europe Aircraft Brackets Market Insight

The Europe aircraft brackets market is projected to expand at a notable CAGR during the forecast period, primarily driven by rising aircraft deliveries from Airbus and increasing demand for fuel-efficient aircraft. The region’s focus on sustainability and weight reduction initiatives promotes the adoption of lightweight brackets made from aluminum and composite materials. Europe’s well-established aviation ecosystem and growing investments in electric and hybrid aircraft programs further stimulate market growth across both civil and defense applications.

U.K. Aircraft Brackets Market Insight

The U.K. aircraft brackets market is expected to grow steadily during the forecast period, supported by the nation’s strong aerospace manufacturing base and participation in global aircraft programs such as Airbus and BAE Systems. The U.K.’s commitment to advancing lightweight engineering and improving aircraft efficiency has accelerated the adoption of high-performance brackets in both commercial and military sectors. Moreover, government support for innovation and R&D in aerospace materials continues to strengthen the market outlook.

Germany Aircraft Brackets Market Insight

The Germany aircraft brackets market is anticipated to expand at a considerable CAGR from 2025 to 2032, driven by the country’s engineering excellence and focus on sustainable aviation manufacturing. Germany’s extensive supplier network, coupled with its emphasis on precision and automation in production processes, promotes the integration of advanced bracket systems. The increasing collaboration between OEMs and local suppliers for next-generation aircraft development enhances the demand for lightweight, corrosion-resistant bracket solutions.

Asia-Pacific Aircraft Brackets Market Insight

The Asia-Pacific aircraft brackets market is poised to grow at the fastest CAGR from 2025 to 2032, propelled by the rapid expansion of the aviation industry in countries such as China, India, and Japan. Increasing air travel demand, rising disposable incomes, and major investments in domestic aircraft manufacturing programs are driving regional growth. The emergence of APAC as a key hub for aerospace component production, combined with government initiatives supporting aviation infrastructure, is further boosting the demand for advanced bracket technologies.

China Aircraft Brackets Market Insight

The China aircraft brackets market held the largest revenue share in the Asia-Pacific region in 2024, driven by strong government support for indigenized aircraft production and rising investment in commercial aviation. The development of aircraft programs such as COMAC C919 and ARJ21 has significantly increased the local demand for high-quality brackets. China’s growing aerospace supply chain and emphasis on adopting advanced materials to improve aircraft efficiency are further fueling market growth.

Japan Aircraft Brackets Market Insight

The Japan aircraft brackets market is witnessing rapid growth due to its focus on precision engineering, advanced material technologies, and participation in global aerospace supply chains. Japan’s strong presence in producing key aircraft components, coupled with the adoption of lightweight composites, enhances the market’s competitiveness. Moreover, increasing collaborations with international manufacturers and the development of indigenous aircraft models are boosting the domestic demand for high-performance brackets used in critical applications.

Aircraft Brackets Market Share

The aircraft brackets industry is primarily led by well-established companies, including:

- Triumph Group (U.S.)

- Arconic (U.S.)

- Premium AEROTEC (Germany)

- Precision Castparts Corp. (U.S.)

- AmeriStar MFG (U.S.)

- Tri-Mack Plastics Manufacturing Corporation (U.S.)

- Woodward Industries, Inc. (U.S.)

- SEKISUI Aerospace (U.S.)

- Kampi Components Co., Inc. (U.S.)

- Daher (France)

- Zauba Technologies Pvt Ltd (India)

- WestStar Precision (U.S.)

- FedTech Inc. (U.S.)

- Denroy (U.K.)

- Spirit Aerosystems Inc. (U.S.)

- Augen Technologies Software Solutions Pvt Ltd (India)

- Serra Manufacturing Corporation (U.S.)

- Hexagon AB (Sweden)

- Quality Sheet Metal Inc. (U.S.)

- STROCO Manufacturing Inc. (U.S.)

Latest Developments in Global Aircraft Brackets Market

- In April 2025, Spirit AeroSystems entered into a definitive agreement with Airbus SE to transfer ownership of select aerostructure production assets and facilities, including those involved in aircraft brackets and structural components. This strategic divestiture aims to streamline Spirit’s manufacturing portfolio and enhance operational focus, while strengthening Airbus’s control over key supply chain elements. The move is expected to improve efficiency and coordination in bracket production for next-generation aircraft platforms, reinforcing Europe’s aerospace manufacturing base

- In June 2024, Diehl Aviation and 9T Labs jointly launched the “ECO Bracket,” an innovative aircraft bracket made using 3D-printed carbon fiber-reinforced thermoplastic composites. This lightweight solution delivers approximately 50% weight reduction compared to aluminum brackets, contributing to significant fuel savings and sustainability in aviation. The introduction of the ECO Bracket represents a major step toward integrating additive manufacturing and recycled materials into mainstream aircraft component production

- In March 2024, Victrex plc partnered with Safran Cabin to develop a hybrid thermoplastic composite platform for aircraft bracket applications using PEEK polymers. This collaboration enhances manufacturing flexibility and reduces cycle times, allowing the production of lighter, stronger brackets with improved performance. The advancement is set to accelerate the adoption of polymer-based composite brackets in both commercial and regional aircraft, strengthening the market’s focus on material innovation

- In November 2023, Spirit AeroSystems expanded its partnership with Norsk Titanium to qualify 3D-printed titanium components for use in structural aircraft applications, including brackets. This advancement in additive manufacturing supports higher precision, material efficiency, and reduced production lead times. The collaboration marks a major leap toward large-scale use of titanium-based, 3D-printed brackets, positioning Spirit AeroSystems as a leader in next-generation aerospace component manufacturing

- In August 2023, The Insight Partners highlighted growing strategic collaborations and technological innovations among leading manufacturers to develop lightweight and durable aircraft brackets. The report emphasized the rising demand for composite and hybrid-material brackets from OEMs focused on fuel efficiency and performance optimization. This trend underlines the market’s shift toward sustainable production methods and advanced engineering solutions to meet the evolving needs of the global aviation sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.