Global Aircraft Ejection Seat Market

Market Size in USD Billion

CAGR :

%

USD

2.41 Billion

USD

3.54 Billion

2024

2032

USD

2.41 Billion

USD

3.54 Billion

2024

2032

| 2025 –2032 | |

| USD 2.41 Billion | |

| USD 3.54 Billion | |

|

|

|

|

What is the Global Aircraft Ejection Seat Market Size and Growth Rate?

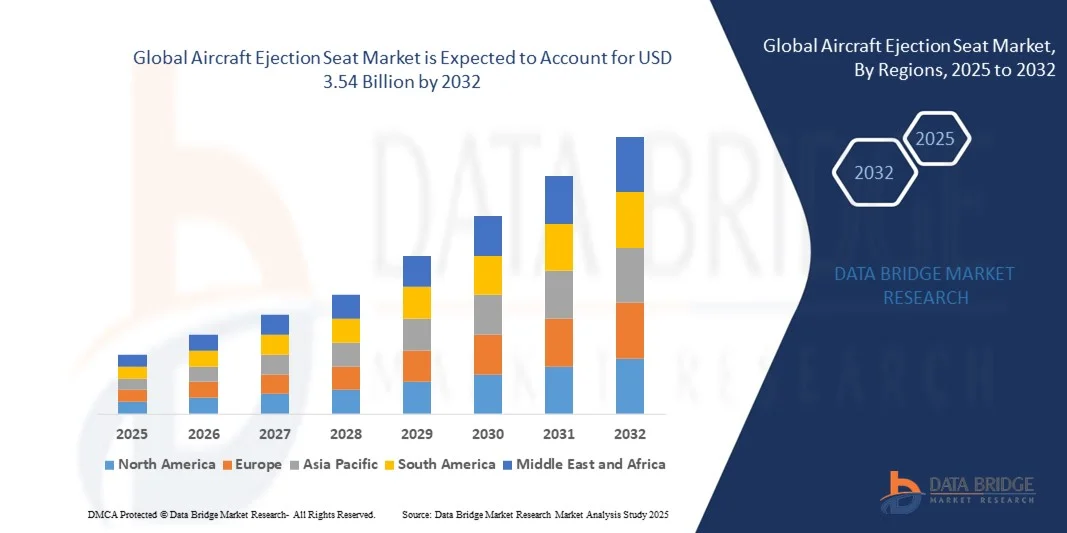

- The global aircraft ejection seat market size was valued at USD 2.41 billion in 2024 and is expected to reach USD 3.54 billion by 2032, at a CAGR of 2.41% during the forecast period

- Major factors that are expected to boost the growth of the aircraft ejection seat market in the forecast period are the increase in the need from the military sector on account of rise in combat operations. Furthermore, growing defense budget fuels the application of developed aircraft models in military operations is further anticipated to propel the growth aircraft ejection seat market

- Moreover, the rise in the arms race between superpowers is further estimated to cushion the growth of the aircraft ejection seat market. On the other hand, the injuries that are sustained during ejection is further projected to impede the growth of the aircraft ejection seat market in the timeline period

What are the Major Takeaways of Aircraft Ejection Seat Market?

- The application of ejection seats in combat helicopters and light commercial aircraft will further provide potential opportunities for the growth of the aircraft ejection seat market in the coming years. However, the possibilities of the seat ejection malfunctions might further challenge the growth of the aircraft ejection seat market in the near future

- North America dominated the aircraft ejection seat market with the largest revenue share of 36.12% in 2024, driven by strong defense budgets, continuous fleet modernization programs, and the procurement of advanced combat and trainer aircraft

- The Asia-Pacific Aircraft Ejection Seat market is poised to grow at the fastest CAGR of 10.8% during 2025–2032, driven by rising defense spending in China, India, Japan, and South Korea

- The combat aircraft segment dominated the market with the largest revenue share of 41.67% in 2024, driven by continuous fleet modernization programs and rising procurement of advanced 4th and 5th generation fighters such as the F-35, Rafale, and Gripen

Report Scope and Aircraft Ejection Seat Market Segmentation

|

Attributes |

Aircraft Ejection Seat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aircraft Ejection Seat Market?

Integration of Advanced Safety and Life-Support Technologies

- A major and accelerating trend in the global aircraft ejection seat market is the integration of advanced safety systems, lightweight materials, and life-support features to enhance pilot survivability across varying altitudes and speeds

- For instance, modern ejection seats are increasingly being equipped with automatic seat-parachute separation, limb-restraint systems, and oxygen supply modules to safeguard pilots during high-G ejections. Martin-Baker and Collins Aerospace are continuously innovating with modular designs tailored for 4th, 5th, and 6th generation fighter aircraft

- The adoption of smart sensors and automatic adjustment features enables real-time responses to flight conditions, such as seat trajectory correction and stabilization for safe pilot recovery. These innovations are reshaping industry standards by prioritizing safety, adaptability, and reduced pilot injury risks

- The growing integration of advanced survival kits, lightweight composites, and ergonomic designs also supports compatibility with modern aircraft cockpits

- This trend reflects a broader industry push toward next-gen combat readiness and enhanced pilot survivability, positioning technologically advanced ejection seats as a critical requirement for modern air forces globally

What are the Key Drivers of Aircraft Ejection Seat Market?

- Increasing global defense spending and modernization programs for fighter jets and military aircraft are significantly boosting demand for advanced ejection seats

- For instance, in July 2024, Martin-Baker Aircraft Co. Ltd secured contracts to supply next-gen ejection seats for the U.S. Air Force T-7A Red Hawk trainer jets, emphasizing safety and modularity

- Rising procurement of 4th and 5th generation combat aircraft, such as the F-35, Rafale, and Gripen, requires ejection seats with improved safety mechanisms, modularity, and life-support integration

- The focus on pilot safety and survivability during combat and training missions is pushing air forces worldwide to upgrade legacy systems

- In addition, the growing demand for lightweight, ergonomic, and maintenance-friendly ejection seats is driving innovation across the sector

Which Factor is Challenging the Growth of the Aircraft Ejection Seat Market?

- High costs associated with research, development, and integration of advanced ejection seat technologies remain a major barrier for widespread adoption, particularly in developing regions

- For instance, procurement delays in budget-constrained air forces often limit fleet modernization programs, directly impacting ejection seat upgrades

- Technical challenges such as ensuring pilot safety across wide anthropometric ranges (short, tall, heavy pilots) also create design complexity and increase production costs

- Furthermore, supply chain disruptions in critical materials such as lightweight composites and advanced pyrotechnics can hinder timely manufacturing

- While the need for advanced safety remains unquestioned, balancing affordability with state-of-the-art functionality will be crucial

- Overcoming these challenges through modular seat designs, cost-efficient production, and government-industry collaborations will be vital for sustained growth of the Aircraft Ejection Seat market

How is the Aircraft Ejection Seat Market Segmented?

The market is segmented on the basis of aircraft type, component, seat type, fit, and application.

- By Aircraft Type

On the basis of aircraft type, the aircraft ejection seat market is segmented into combat aircraft and trainer aircraft. The combat aircraft segment dominated the market with the largest revenue share of 41.67% in 2024, driven by continuous fleet modernization programs and rising procurement of advanced 4th and 5th generation fighters such as the F-35, Rafale, and Gripen. These aircraft require sophisticated ejection systems that ensure pilot safety at high speeds and altitudes.

The trainer aircraft segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the growing demand for pilot training programs globally. Nations are investing heavily in trainer fleets, such as the U.S. T-7A Red Hawk, which require reliable ejection seats to safeguard trainee pilots during emergencies.

- By Component

On the basis of component, the market is segmented into belts, foams and fitting, life support, parachutes, seat actuator, and other components. The parachute segment held the largest revenue share in 2024 due to its indispensable role in ensuring safe descent and survival post-ejection. Advanced parachute systems with rapid deployment and stabilization features are in high demand.

The seat actuator segment is projected to record the fastest CAGR through 2032, driven by advancements in explosive charges and rocket motor technologies that enhance ejection performance, minimize injury risk, and improve pilot survival rates across different flight scenarios.

- By Seat Type

On the basis of seat type, the aircraft ejection seat market is segmented into single seat and twin seat. The single seat segment dominated in 2024, largely due to its prevalence in fighter aircraft and lightweight combat jets that typically operate with a single pilot.

The twin seat segment is expected to expand at the fastest CAGR, supported by its growing installation in trainer aircraft and certain combat jets that require pilot and co-pilot configurations. Increased demand for pilot training globally is a key growth driver for this segment.

- By Fit

On the basis of fit, the market is segmented into line-fit and retro-fit. The line-fit segment accounted for the largest share in 2024, owing to defense procurement programs that install advanced ejection seats directly into newly manufactured combat and trainer aircraft.

The retro-fit segment is projected to witness the fastest growth during the forecast period, as many air forces are upgrading legacy fleets with modern ejection seats that comply with evolving safety standards and pilot protection requirements.

- By Application

On the basis of application, the aircraft ejection seat market is segmented into military and civil & commercial. The military segment dominated the market in 2024, driven by significant global defense budgets, modernization of combat aircraft, and the critical importance of pilot safety in high-risk missions.

The civil & commercial segment, though relatively smaller, is anticipated to grow at a steady pace, particularly with the adoption of specialized ejection systems in experimental aircraft, defense training organizations, and niche aviation platforms prioritizing pilot survivability.

Which Region Holds the Largest Share of the Aircraft Ejection Seat Market?

- North America dominated the aircraft ejection seat market with the largest revenue share of 36.12% in 2024, driven by strong defense budgets, continuous fleet modernization programs, and the procurement of advanced combat and trainer aircraft

- The region benefits from the presence of major aircraft and ejection seat manufacturers, along with extensive R&D investments in pilot safety and next-generation technologies

- Furthermore, U.S. and Canadian air forces are focusing on upgrading legacy aircraft fleets with modern ejection seat systems, reinforcing North America’s leading position in the global market

U.S. Aircraft Ejection Seat Market Insight

The U.S. aircraft ejection seat market captured the largest revenue share in 2024 within North America, fueled by large-scale defense contracts and modernization of fighter jets such as the F-35 Lightning II, F-16, and trainer fleets. The U.S. Air Force and Navy continue to invest in advanced ejection seats that enhance survivability under extreme flight conditions. Moreover, domestic suppliers and partnerships with global defense OEMs ensure a steady demand pipeline.

Europe Aircraft Ejection Seat Market Insight

The Europe aircraft ejection seat market is projected to expand at a substantial CAGR throughout the forecast period, supported by defense modernization programs across the U.K., France, Germany, and other nations. NATO-driven requirements for improved pilot safety, combined with strong aerospace infrastructure, are accelerating adoption. The region also houses leading ejection seat manufacturers such as Martin-Baker (U.K.), further strengthening Europe’s role in the market.

U.K. Aircraft Ejection Seat Market Insight

The U.K. aircraft ejection seat market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its domestic champion Martin-Baker, which supplies ejection seats for over 90 air forces worldwide. Continuous upgrades in Royal Air Force fleets and export demand for advanced safety solutions further solidify the U.K.’s strong position in the global market.

Germany Aircraft Ejection Seat Market Insight

The Germany aircraft ejection seat market is expected to expand at a considerable CAGR, supported by its role in the Eurofighter Typhoon program and ongoing investments in defense modernization. Germany’s focus on innovation, safety, and sustainability in aerospace platforms contributes to the demand for advanced ejection systems, particularly in multirole combat and training aircraft.

Which Region is the Fastest Growing Region in the Aircraft Ejection Seat Market?

The Asia-Pacific aircraft ejection seat market is poised to grow at the fastest CAGR of 10.8% during 2025–2032, driven by rising defense spending in China, India, Japan, and South Korea. Increasing procurement of combat aircraft, trainer fleets, and indigenous aerospace programs are boosting demand for advanced ejection seat systems. The region’s emergence as a defense manufacturing hub and government-backed modernization initiatives further accelerate market growth.

Japan Aircraft Ejection Seat Market Insight

The Japan aircraft ejection seat market is gaining momentum due to the nation’s advanced aerospace industry, procurement of F-35 fighters, and investments in pilot training programs. The emphasis on safety, coupled with Japan’s high-tech manufacturing capabilities, is encouraging the adoption of state-of-the-art ejection systems across both combat and trainer aircraft fleets.

China Aircraft Ejection Seat Market Insight

The China aircraft ejection seat market accounted for the largest share in Asia-Pacific in 2024, supported by the country’s rapid defense expansion, rising procurement of indigenous aircraft such as the J-20 and JL-10, and significant investments in aerospace innovation. The government’s push for military modernization and strong domestic manufacturing capabilities position China as a key growth driver in the regional market.

Which are the Top Companies in Aircraft Ejection Seat Market?

The aircraft ejection seat industry is primarily led by well-established companies, including:

- NPP Zvezda (Russia)

- Collins Aerospace (U.S.)

- Clarks Precision Machine (U.S.)

- Airborne Systems Inc (U.S.)

- Survival Equipment Services (U.K.)

- United Technologies Corporation (U.S.)

- RUAG Holding (Switzerland)

- Martin-Baker Aircraft Co. Ltd (U.K.)

- EDM Ltd (U.K.)

- RLC Group (U.K.)

- ALSO Holding AG (Switzerland)

- NeOmega Resin (U.K.)

What are the Recent Developments in Global Aircraft Ejection Seat Market?

- In September 2024, Martin-Baker developed the advanced US18E ejection seat designed specifically for the F-16 aircraft’s narrower cockpit, building on the proven success of the US16E seat used in the F-35, and incorporating new safety features such as airbag-such as cushions for head and neck protection along with active arm restraints, ensuring enhanced pilot safety in emergency situations. This innovation is expected to significantly improve survivability for pilots operating in high-risk missions

- In June 2024, Martin-Baker Aircraft Co. Ltd. signed a strategic technology transfer agreement with India to supply advanced ejection seats for the indigenous TEJAS MK-2 fighter jet, supporting India’s “Make in India” initiative by boosting domestic aerospace manufacturing and reducing reliance on imports. This collaboration is set to strengthen India’s self-reliance in defense aviation technology

- In March 2023, Collins Aerospace introduced the state-of-the-art ACES 5 ejection seat, incorporating advancements such as passive head and neck protection, enhanced spinal injury mitigation, and a modular design that simplifies maintenance. This development marks a breakthrough in safety and serviceability for modern combat aircraft

- In November 2022, Hindustan Aeronautics Limited (HAL) announced plans to establish a joint venture for domestically manufacturing ejection seats, aiming to reduce dependency on foreign players and lower the cost of indigenous fighter jets such as the LCA Tejas. This move is expected to enhance India’s competitiveness in the global defense market

- In January 2022, the Taiwanese Air Force showcased an upgraded F-5 fighter jet equipped with the Mk 16 ejection seat, which features advanced systems such as the Personal Survival Pack (PSP) and compatibility with modern canopy jettison mechanisms. This upgrade underscores Taiwan’s efforts to modernize its fleet and improve pilot safety standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.