Global Aircraft Electricals Systems Market

Market Size in USD Billion

CAGR :

%

USD

23.55 Billion

USD

37.82 Billion

2024

2032

USD

23.55 Billion

USD

37.82 Billion

2024

2032

| 2025 –2032 | |

| USD 23.55 Billion | |

| USD 37.82 Billion | |

|

|

|

|

Aircraft Electrical Systems Market Size

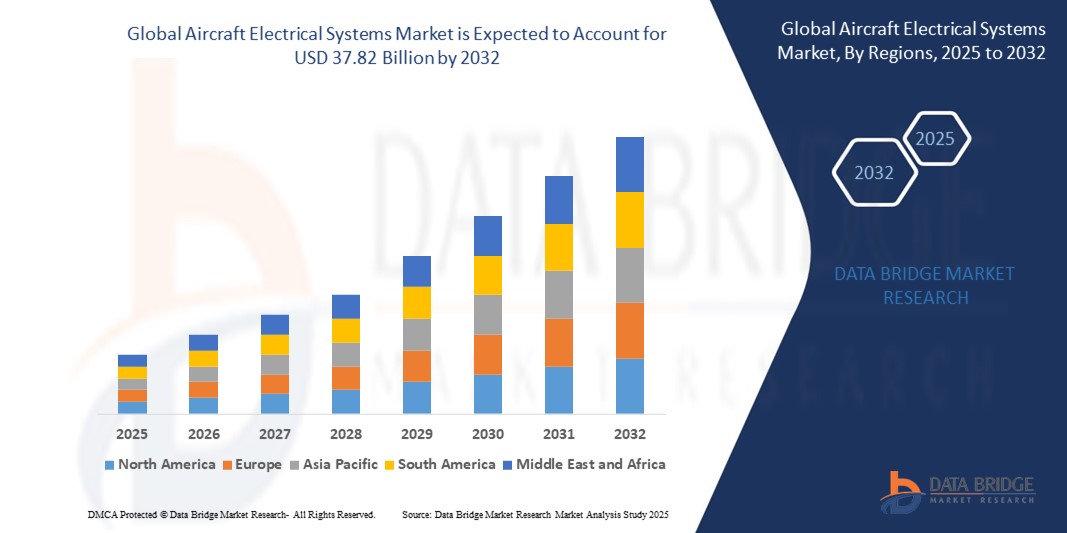

- The global aircraft electrical systems market size was valued at USD 23.55 billion in 2024 and is expected to reach USD 37.82 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of more-electric and all-electric aircraft concepts, increasing demand for lightweight and fuel-efficient aircraft systems, and the ongoing replacement of mechanical and pneumatic systems with advanced electrical solutions

- Rapid urbanization and the projected expansion of commercial aviation fleets, especially in emerging economies such as India and China, are contributing significantly to the increased demand for advanced electrical systems in modern aircraft

Aircraft Electrical Systems Market Analysis

- The growing electrification trend in modern aircraft is transforming the aviation industry by enhancing performance, improving energy efficiency, and reducing operational costs

- Commercial and military aviation segments are significantly investing in next-generation electrical systems to support expanding air travel demand and future urban air mobility (UAM) concepts

- North America dominated the aircraft electrical systems market with the largest revenue share in 2024, driven by the presence of major aircraft manufacturers, growing demand for next-generation aircraft, and increasing investments in electrification technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global aircraft electrical systems market, driven by rapid urbanization, increasing air travel demand, and significant investments in domestic aircraft production and aviation infrastructure development

- The power generation segment dominated the market with the largest revenue share in 2024, driven by the increasing integration of high-voltage electrical architecture in next-generation aircraft. Aircraft manufacturers are investing in robust onboard generation systems to meet the growing electrical loads for avionics, propulsion, and cabin functions. The emphasis on fuel savings and reduced emissions further boosts demand for advanced electrical power generation modules.

Report Scope and Aircraft Electrical Systems Market Segmentation

|

Attributes |

Aircraft Electrical Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for More-Electric Aircraft Solutions in Emerging Aviation Markets • Increasing Integration of Advanced Power Management Systems in Next-Generation Aircraft |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Electrical Systems Market Trends

“Increased Adoption of More-Electric Aircraft (MEA) Architectures”

- Aircraft manufacturers are increasingly replacing hydraulic and pneumatic systems with electric systems to reduce weight and fuel consumption. This shift enhances aircraft performance while simplifying system architecture for better maintenance and reliability. The trend is accelerating as sustainability becomes a top priority in aviation design

- The MEA approach significantly improves operational efficiency by centralizing power management and reducing reliance on mechanical subsystems. These systems also offer enhanced diagnostics and control capabilities, allowing for smarter energy distribution and failure prediction. As a result, airlines can improve uptime and reduce lifecycle costs

- Advancements in high-voltage power distribution, electric actuators, and energy storage systems are enabling the adoption of electric-based aircraft systems. These technologies not only enhance onboard energy usage but also support partial electrification of propulsion. Such innovation makes the MEA framework more viable for commercial and defense aircraft programs

- For instance, the Boeing 787 Dreamliner incorporates MEA features by using electrical power for de-icing, engine start, and environmental control systems. This change reduces the aircraft's dependence on bleed air systems, improving energy efficiency and reducing maintenance. It exemplifies how MEA applications can be practically integrated into commercial aviation

- The shift toward More-Electric Aircraft represents a strategic evolution in the aerospace industry, aiming for greener, lighter, and more efficient air travel. With growing investments and proven benefits, MEA technologies are expected to dominate future aircraft platforms. This trend is pivotal in shaping the next generation of sustainable aviation

Aircraft Electrical Systems Market Dynamics

Driver

“Growing Emphasis on Fuel Efficiency and Emission Reduction in Aviation”

• The aviation sector is under immense pressure to reduce its carbon footprint, driving demand for lightweight and energy-efficient aircraft electrical systems. These systems replace heavier hydraulic components, directly contributing to improved fuel economy. Aircraft OEMs are increasingly investing in electric system innovations to meet environmental regulations

• Electric power systems help reduce fuel consumption by optimizing energy distribution and minimizing unnecessary mechanical loads. By reducing aircraft weight and improving power conversion efficiency, airlines can achieve significant operational savings. This makes electric systems an attractive option for both commercial and military aircraft

• Government regulations such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) are reinforcing the push toward greener technologies. Electrical systems support compliance by offering cleaner alternatives to traditional energy systems. Their growing integration marks a vital step toward achieving global decarbonization goals

• For instance, Airbus has made substantial investments in hybrid-electric propulsion and more-electric aircraft systems for its future aircraft lineups. These initiatives aim to cut down fuel usage and prepare the company for upcoming zero-emission aircraft. Such industry actions are accelerating the adoption of electric systems on a global scale

• Rising fuel costs and environmental concerns are key market drivers, prompting faster adoption of aircraft electrical systems. These systems align with sustainability goals while improving operational performance. As airlines and OEMs prioritize long-term efficiency, the shift toward electric integration will continue to gain momentum

Restraint/Challenge

“High Complexity and Cost of Integration in Legacy Aircraft”

• Retrofitting modern electrical systems into older aircraft fleets is highly complex and expensive, limiting widespread adoption. Legacy aircraft require extensive design alterations and electrical architecture reconfiguration to support new systems. This creates operational downtime and increased labor costs during upgrades

• Many existing aircraft were not originally designed to support high-voltage electrical components or distributed power networks. Integrating such systems requires not only structural changes but also re-certification, making it a slow and costly process. Operators may delay upgrades due to uncertain return on investment

• In addition, the shortage of skilled engineers and technicians who can work on advanced electrical systems creates another bottleneck. Specialized training and safety measures are mandatory for installation and maintenance, which adds to the overall integration cost. This skill gap is more pronounced in developing aviation markets

• For instance, several regional airline operators in Asia have delayed transitioning to electrical systems due to high initial investment and lack of compatible infrastructure. In many cases, older aircraft remain in service longer than expected, thereby slowing modernization efforts. This hesitancy affects global market growth

• While the benefits of electric systems are clear, the integration into legacy fleets presents notable challenges. High cost, technical complexity, and regulatory hurdles continue to restrain adoption, especially among smaller carriers. Overcoming these barriers requires scalable solutions, government incentives, and industry-wide collaboration

Aircraft Electrical Systems Market Scope

The market is segmented on the basis of system, component, application, technology, platform, and distribution channel.

- By System

On the basis of system, the aircraft electrical systems market is segmented into power generation, power distribution, power conversion, and energy storage. The power generation segment dominated the market with the largest revenue share in 2024, driven by the increasing integration of high-voltage electrical architecture in next-generation aircraft. Aircraft manufacturers are investing in robust onboard generation systems to meet the growing electrical loads for avionics, propulsion, and cabin functions. The emphasis on fuel savings and reduced emissions further boosts demand for advanced electrical power generation modules.

The energy storage segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising adoption of hybrid and fully electric aircraft. Battery systems are gaining prominence as they provide auxiliary power, reduce engine dependency, and support electrification of subsystems. Continuous improvements in battery capacity and safety are making them a critical component in electric aviation transitions.

- By Component

Based on component, the market is divided into generators, conversion devices, distribution devices, and battery management systems. The generators segment held the largest revenue share in 2024 owing to its essential role in powering a wide range of aircraft operations. Modern generators are being designed for higher efficiency, lightweight construction, and reliability across both commercial and defense applications. The aviation sector’s shift toward all-electric capabilities further strengthens demand for compact and powerful onboard generators.

The battery management systems segment is expected to witness the fastest growth rate from 2025 to 2032as efficient monitoring and regulation of energy storage systems becomes crucial. The growth of electric propulsion and distributed electrical systems has increased the need for intelligent power control and safety features, driving innovation in this segment.

- By Application

On the basis of application, the market is segmented into power generation management, flight control and operation, cabin system, configuration management, and air pressurization and conditioning. The flight control and operation segment accounted for the largest revenue share in 2024, owing to the growing reliance on electric actuators and fly-by-wire systems in modern aircraft. Replacing traditional mechanical controls with electrical systems improves responsiveness, reduces weight, and enhances safety.

The cabin system segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising passenger expectations for comfort and connectivity. Electrical systems power advanced lighting, in-flight entertainment, and air circulation systems, playing a key role in enhancing the onboard experience across all aircraft classes.

- By Technology

By technology, the aircraft electrical systems market is categorized into conventional, more electric, and electric. The more electric segment dominated the market in 2024, supported by increased adoption across commercial aviation for its ability to replace pneumatic and hydraulic systems. These systems reduce aircraft weight, enhance energy efficiency, and simplify maintenance.

The electric segment is expected to witness the fastest growth rate from 2025 to 2032, as the industry moves closer to zero-emission aviation. Electrically propelled aircraft and fully electric subsystems are attracting major investments and regulatory support, signaling a transformative shift in aircraft design philosophy.

- By Platform

On the basis of platform, the market is divided into commercial aviation, military aviation, and business and general aviation. Commercial aviation held the largest share in 2024 due to the rising production of narrow-body and wide-body aircraft equipped with advanced electrical infrastructure. Airlines are actively upgrading fleets to incorporate energy-efficient systems that lower fuel costs and reduce maintenance requirements.

The military aviation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by modernization programs and the demand for highly electrified systems in advanced fighter jets and surveillance aircraft. Electrical systems offer stealth, improved weapon control, and enhanced battlefield readiness.

- By Distribution Channel

Based on distribution channel, the market is segmented into OEM and aftermarket. The OEM segment accounted for the dominant market share in 2024, supported by the rising number of new aircraft deliveries and increased installation of electric systems during the production stage. Aircraft manufacturers are working closely with system suppliers to integrate more electric components from the design phase.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032, as airlines and operators upgrade legacy systems to improve efficiency and comply with evolving safety standards. The demand for maintenance, repair, and overhaul (MRO) services for electrical systems continues to rise across both civil and defense sectors.

Aircraft Electrical Systems Market Regional Analysis

• North America dominated the aircraft electrical systems market with the largest revenue share in 2024, driven by the presence of major aircraft manufacturers, growing demand for next-generation aircraft, and increasing investments in electrification technologies

• The region benefits from a strong aerospace infrastructure, significant defense spending, and rising adoption of more electric aircraft, especially for commercial and military aviation

• The push for fuel efficiency and environmental compliance further encourages the adoption of advanced electrical systems in both new aircraft and retrofitting programs

U.S. Aircraft Electrical Systems Market Insight

The U.S. aircraft electrical systems market accounted for the largest revenue share in North America in 2024, supported by its strong military aviation sector and leading commercial aircraft production. Ongoing modernization of aircraft fleets, increasing use of electric components in unmanned aerial vehicles (UAVs), and substantial government defense budgets are propelling growth. In addition, the U.S. is a major hub for research and development in electric aviation technologies, contributing significantly to innovation in aircraft power systems.

Europe Aircraft Electrical Systems Market Insight

The Europe aircraft electrical systems market is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s focus on sustainability and the electrification of aviation. Regulatory support for carbon reduction in air transport, as well as the presence of key aircraft manufacturers in countries such as France and Germany, fosters demand. The region also sees increasing adoption of more electric and hybrid-electric systems in both commercial and defense aircraft segments.

Germany Aircraft Electrical Systems Market Insight

The Germany aircraft electrical systems market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country's advanced aerospace sector and technological emphasis on cleaner propulsion systems. Germany plays a key role in collaborative European aircraft projects and is investing heavily in electric and hybrid aviation technologies. Strong research institutions and public-private partnerships further support the development of energy-efficient power generation and distribution systems for aircraft.

U.K. Aircraft Electrical Systems Market Insight

The U.K. aircraft electrical systems market is expected to witness the fastest growth rate from 2025 to 2032, driven by its established aerospace sector and growing focus on green aviation. Government-backed initiatives such as FlyZero and investments in electrification research are accelerating the development of more electric aircraft technologies. The U.K.'s strong engineering capabilities and participation in multinational aircraft programs further support the integration of advanced electrical systems across commercial, defense, and urban air mobility platforms.

Asia-Pacific Aircraft Electrical Systems Market Insight

The Asia-Pacific aircraft electrical systems market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising air travel, fleet expansion, and government investments in regional aviation infrastructure. Countries such as China, India, and Japan are increasing their aircraft production capabilities, contributing to higher demand for advanced electrical systems. Moreover, the region’s shift towards sustainable aviation and growing commercial aviation sector are expected to drive long-term growth.

China Aircraft Electrical Systems Market Insight

China accounted for the largest revenue share in the Asia-Pacific aircraft electrical systems market in 2024, propelled by its fast-growing aviation industry and increasing domestic aircraft manufacturing. Government support for the development of indigenous aircraft and efforts to modernize military fleets are key contributors. China’s push towards electrification and investment in new energy aviation platforms further stimulates the integration of innovative electrical systems across commercial and defense applications.

Japan Aircraft Electrical Systems Market Insight

The Japan aircraft electrical systems market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s emphasis on aerospace innovation and energy-efficient technologies. Japan’s aerospace suppliers are increasingly involved in global aircraft programs, contributing high-precision electrical components and systems. Moreover, the rising interest in electric vertical takeoff and landing (eVTOL) aircraft, combined with smart city initiatives, is boosting the demand for reliable, lightweight electrical systems in the aviation sector.

Aircraft Electrical Systems Market Share

The Aircraft Electrical Systems industry is primarily led by well-established companies, including:

- AMETEK, Inc. (U.S.)

- Thales Group (France)

- Astronics Corporation (U.S.)

- Acme Aerospace Inc. & Avionic Instruments, LLC (U.S.)

- EaglePicher Technologies (U.S.)

- Honeywell International, Inc. (U.S.)

- Allied Motion, Inc. (U.S.)

- Altra Industrial Motion Corp. (U.S.)

- ARC Systems Inc. (U.S.)

- Electromech Technologies (India)

- FAULHABER MICROMO, LLC (U.S.)

- H3X Technologies Inc. (U.S.)

- magniX (U.S.)

- maxon (Switzerland)

- Meggitt PLC (U.K.)

- Moog Inc. (U.S.)

- Rolls-Royce plc (U.K.)

- Safran (France)

Latest Developments in Global Aircraft Electrical Systems Market

- In August 2024, Lilium completed the first phase of integration testing for its Jet's electrical power system at a custom-built lab near Munich. It marked a key milestone towards flight conditions approval and type-certification under EASA's SC-VTOL regulations. Engineers tested core powertrain functionalities, using bespoke software to simulate flight profiles and collect real-time data for airworthiness certification. The lab was developed in collaboration with Italian supplier EN4 and employed advanced software and hardware from NI

- In September 2023, VoltAero's Cassio S aircraft completed the world's first electric-hybrid flight using 100% sustainable fuel provided by TotalEnergies at its Royan, France facility. The flight utilized Excellium Racing 100, a bioethanol fuel derived from winemaking waste, achieving an 80% CO2 reduction. This milestone supported the validation of VoltAero's electric-hybrid powertrain and contributed to decarbonization efforts in aviation. The Cassio 330 will be the first production model in VoltAero's upcoming aircraft lineup

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.