Global Aircraft Elevator Market

Market Size in USD Billion

CAGR :

%

USD

2.58 Billion

USD

4.14 Billion

2022

2030

USD

2.58 Billion

USD

4.14 Billion

2022

2030

| 2023 –2030 | |

| USD 2.58 Billion | |

| USD 4.14 Billion | |

|

|

|

|

Aircraft Elevators Market Analysis and Size

Airlines are measured to be a significant to numerous aspects of the global economy aiding domestic and international business to day-to-day transportation of goods and citizens. According to the report published by the International Air Transport Association (IATA) in 2015, the number of passengers travelling by air in 2015 augmented to 3.4 billion passengers from 3.3 billion passengers in 2014 and registered a growth of 3 percent. Furthermore, as per the report of IATA, the number of passengers travelling by air are anticipated to touch 7.3 billion by 2034. Thus, increasing consumer preference for air travel is expected to enhance the market growth rate.

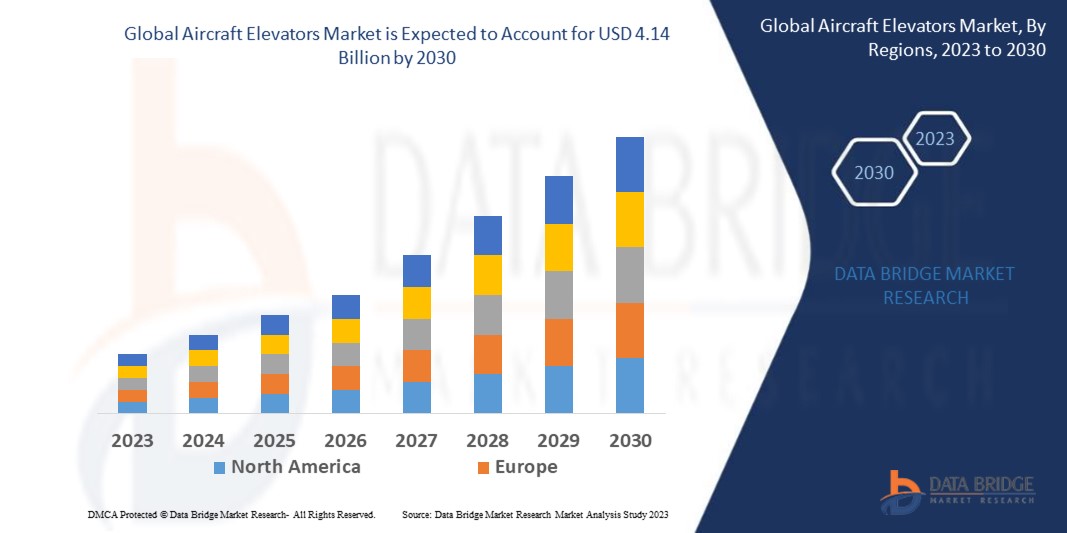

Data Bridge Market Research analyses that the aircraft elevators market is expected to reach USD 4.14 billion by 2030, which is USD 2.58 billion in 2022, at a CAGR of 6.10% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Aircraft Elevators Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Horizontal Stabilator Aircraft Elevator, Elevons Aircraft Elevator, Levcons Aircraft Elevator), Aircraft Type (Narrow Body Aircraft, Wide Body Aircraft, Regional Jet, and Others), Wing Type (Fixed-Wing Aircraft and Rotary Wing Aircraft), Application (Commercial Air Transport, Business and General Aviation, and Military Aviation) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Airbus S.A.S (France), Hitachi, Ltd. (Japan), Honeywell International Inc. (U.S.), BAE Systems (U.S.), Raytheon Technologies Corporation (U.S.), Textron Aviation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Moog Inc. (U.S.), Nabtesco Corporation (Japan), Liebherr (Switzerland), PAR Systems (U.S.), FUJITEC CO., LTD (Hikone), HYUNDAIELEVATOR CO., LTD., (South Korea), Toshiba Elevator and Building Systems Corporation (Malaysia), Otis Elevator Company (I). Ltd. (U.S.), KONE Corporation (Finland) |

|

Market Opportunities |

|

Market Definition

An aircraft elevator is a propulsion system that offers an aircraft lift. It comprises of two main component such as the tail fin and the propellers. These components provide thrust to make it fly downward or upward; the landing gear, elevators and air brakes on wings with attached flaps control its direction. The principle of different types of elevators in aircraft depends upon their function concerning aerodynamic forces.

Aircraft Elevators Market Dynamics

Drivers

- Growing demand for commercial aircraft

The demand for the commercial aircraft is highest owing to the augmented freight and passenger traffic. With enhanced trade relations, there is an augmented demand for the cargo services worldwide, which is expected to drive the growth rate of the aircraft elevators market. The product demand for commercial aircraft is projected to increase owing to low prices and a growth in aircraft size. Commercial aircraft are expected to increase due to their productivity because air travel requires minimum time as compared to other modes of travel. This is projected to drive the demand for the commercial aircraft and benefitting aircraft elevators market growth during the forecast period.

- Rising number of aircrafts

Aircraft elevator plays a significant role in producing drag force and higher lift on the wings of the aircraft. Rising aerospace industry with growing aircraft in numerous countries worldwide is estimated to propel the demand for the aircraft elevator in the forecast period. This in turn is projected to contribute to the growth of the global aircraft elevator market.

Opportunities

- Increasing number of air passenger

Growing number of air passenger mainly in the developing regions is estimated to increase the demand for more commercial aircrafts consequently influencing the demand for aircraft elevator and generating lucrative opportunities for market growth. Middle East region has become a hot spot of the airline industry due to sturdy growth of some of its internationally renowned carriers such as Qatar Airways, Emirates, Etihad Airways and Saudi Arabian Airlines ordering a bulk of very large body and narrow body airlines for the upcoming period. Emirates, the flag carrier airline of Dubai, has ordered around 142 Airbus A380 large body aircraft in which 81 have already delivered, and the remaining 61 are anticipated to be delivered in the upcoming period. This in turn is anticipated to considerably contribute to the market growth in the coming years.

Restraints

- Drawbacks associated with aircraft elevators

Increasing sales of electric and battery-powered vehicles in upcoming years is expected to hamper the market growth during the forecast period. Battery-powered or electric vehicles are zero emission vehicles that do not need an active purge pump. Therefore, all these factors are likely to hamper the demand for the aircraft elevators during the forecast period.

This aircraft elevators market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aircraft elevators market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Aircraft Elevators Market Scope

The aircraft elevators market is segmented based on the product type, aircraft type, wing type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Horizontal Stabilator Aircraft Elevator

- Elevons Aircraft Elevator

- Levcons Aircraft Elevator

Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Regional Jet

- Others

Wing Type

- Fixed-Wing Aircraft

- Rotary Wing Aircraft

Application

- Commercial Air Transport

- Business and General Aviation

- Military Aviation

Aircraft Elevators Market Regional Analysis/Insights

The aircraft elevators market is analyzed and market size insights and trends are provided by country, product type, aircraft type, wing type and application as referenced above.

The countries covered in the aircraft elevators market report are report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the aircraft elevators market in terms of revenue growth owing to increasing air traffic and investments by the OEMs. Furthermore, increasing dependence on the small and medium wide-body aircraft and growing air passenger traffic will further boost the market growth.

Europe is projected to be the fastest developing region during the forecast period of 2023-2030. This is mainly increasing investments in this region's numerous commercial and military aviation programs.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Aircraft Elevators Market Share Analysis

The aircraft elevators market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to aircraft elevators market.

Some of the major players operating in the aircraft elevators market are:

- Airbus S.A.S (France)

- Hitachi, Ltd. (Japan)

- Honeywell International Inc. (U.S.)

- BAE Systems (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Textron Aviation Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Moog Inc. (U.S.)

- Nabtesco Corporation (Japan)

- Liebherr (Switzerland)

- PAR Systems (U.S.)

- FUJITEC CO., LTD (Hikone)

- HYUNDAIELEVATOR CO., LTD., (South Korea)

- Toshiba Elevator and Building Systems Corporation (Malaysia)

- Otis Elevator Company (I). Ltd. (U.S.)

- KONE Corporation (Finland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AIRCRAFT ELEVATORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AIRCRAFT ELEVATORS MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TOP TO BOTTOM ANALYSIS

2.1 STANDARDS OF MEASUREMENT

2.11 VENDOR SHARE ANALYSIS

2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.14 GLOBAL AIRCRAFT ELEVATORS MARKET: RESEARCH SNAPSHOT

2.15 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

6 GLOBAL AIRCRAFT ELEVATORS MARKET, BY OPERATION

6.1 OVERVIEW

6.2 TRIM TAB ELEVATOR

6.3 BALANCED ELEVATOR

6.4 OTHERS

7 GLOBAL AIRCRAFT ELEVATORS MARKET, BY TAIL DESIGN

7.1 OVERVIEW

7.2 CONVENTIONAL

7.3 T-TAIL

7.4 V-TAIL

7.5 DUAL TAIL

7.6 TRIPLE TAIL

7.7 OTHERS

8 GLOBAL AIRCRAFT ELEVATORS MARKET, BY CONSTRUCTION

8.1 OVERVIEW

8.2 HORIZONTAL STABILIZER

8.3 ELEVONS

8.4 CANARDS

8.5 LEVCONS

9 GLOBAL AIRCRAFT ELEVATORS MARKET, BY WING TYPE

9.1 OVERVIEW

9.2 FIXED-WING AIRCRAFT

9.2.1 FIXED-WING AIRCRAFT

9.2.2 GLIDERS

9.2.3 ULTRALIGHTS

9.2.4 OTHERS

9.3 ROTARY WING AIRCRAFT

9.3.1 TILTROTOR AIRCRAFT

9.3.2 AUTOGYROS

9.3.3 OTHERS

10 GLOBAL AIRCRAFT ELEVATORS MARKET, BY COMPONENTS

10.1 OVERVIEW

10.2 CONTROL SURFACE

10.3 CONTROL YOKE OR STICK

10.4 CABLES OR PUSHRODS

10.5 SERVO OR ACTUATOR

10.6 CONTROL SURFACE HORN

10.7 TRIM SYSTEM

10.8 CONTROL ELECTRONICS

10.9 OTHERS

11 GLOBAL AIRCRAFT ELEVATORS MARKET, BY AIRCRAFT TYPE

11.1 OVERVIEW

11.2 NARROW BODY AIRCRAFT

11.3 WIDE BODY AIRCRAFT

11.4 REGIONAL JET

11.5 UNMANNED AERIAL VEHICLES (UAVS)

11.6 OTHERS

12 GLOBAL AIRCRAFT ELEVATORS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 COMMERCIAL AIR TRANSPORT

12.2.1 BY OPERATION

12.2.1.1. TRIM TAB ELEVATOR

12.2.1.2. BALANCED ELEVATOR

12.2.1.3. OTHERS

12.3 BUSINESS AND GENERAL AVIATION

12.3.1 BY OPERATION

12.3.1.1. TRIM TAB ELEVATOR

12.3.1.2. BALANCED ELEVATOR

12.3.1.3. OTHERS

12.4 MILITARY AVIATION

12.4.1 BY OPERATION

12.4.1.1. TRIM TAB ELEVATOR

12.4.1.2. BALANCED ELEVATOR

12.4.1.3. OTHERS

13 GLOBAL AIRCRAFT ELEVATORS MARKET, BY GEOGRAPHY

13.1 GLOBAL AIRCRAFT ELEVATORS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. SWITZERLAND

13.1.2.11. DENMARK

13.1.2.12. POLAND

13.1.2.13. SWEDEN

13.1.2.14. NORWAY

13.1.2.15. FINLAND

13.1.2.16. REST OF EUROPE

13.1.3 ASIA PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. SINGAPORE

13.1.3.7. THAILAND

13.1.3.8. MALAYSIA

13.1.3.9. INDONESIA

13.1.3.10. PHILIPPINES

13.1.3.11. NEW ZEALAND

13.1.3.12. VIETNAM

13.1.3.13. TAIWAN

13.1.3.14. REST OF ASIA PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. EGYPT

13.1.5.3. SAUDI ARABIA

13.1.5.4. U.A.E

13.1.5.5. ISRAEL

13.1.5.6. KUWAIT

13.1.5.7. OMAN

13.1.5.8. QATAR

13.1.5.9. BAHRAIN

13.1.5.10. REST OF MIDDLE EAST AND AFRICA

13.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL AIRCRAFT ELEVATORS MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL AIRCRAFT ELEVATORS MARKET , SWOT & DBMR ANALYSIS

16 GLOBAL AIRCRAFT ELEVATORS MARKET, COMPANY PROFILE

16.1 ADVENT INTERNATIONAL CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CINVEN

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 TRIUMPH GROUP

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 TRANSDIGM GROUP, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 MOOG INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 FLSMIDTH

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 PARKER HANNIFIN CORP

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENTS

16.8 HONEYWELL INTERNATIONAL INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENTS

16.9 COLLINS AEROSPACE

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENTS

16.1 BAE SYSTEMS

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENTS

16.11 LOCKHEED MARTIN CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 GENERAL ELECTRIC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENTS

16.13 THE BOEING COMPANY

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 GARMIN LTD

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 THALES GROUP

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENTS

16.16 L3HARRIS TECHNOLOGIES, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENTS

16.17 NORTHROP GRUMMAN

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENTS

16.18 SAFRAN ELECTRONICS & DEFENSE

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENTS

16.19 RAYTHEON TECHNOLOGIES CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 WOODWARD, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

16.21 EATON

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

16.21.5 RECENT DEVELOPMENTS

16.22 CURTISS-WRIGHT CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 GEOGRAPHIC PRESENCE

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 SARGENT AEROSPACE & DEFENSE

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 GEOGRAPHIC PRESENCE

16.23.4 PRODUCT PORTFOLIO

16.23.5 RECENT DEVELOPMENTS

16.24 ELBIT SYSTEMS LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 GEOGRAPHIC PRESENCE

16.24.4 PRODUCT PORTFOLIO

16.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.