Global Aircraft Engine Mro Market

Market Size in USD Billion

CAGR :

%

USD

22.32 Billion

USD

33.80 Billion

2024

2032

USD

22.32 Billion

USD

33.80 Billion

2024

2032

| 2025 –2032 | |

| USD 22.32 Billion | |

| USD 33.80 Billion | |

|

|

|

|

Aircraft Engine MRO Market Size

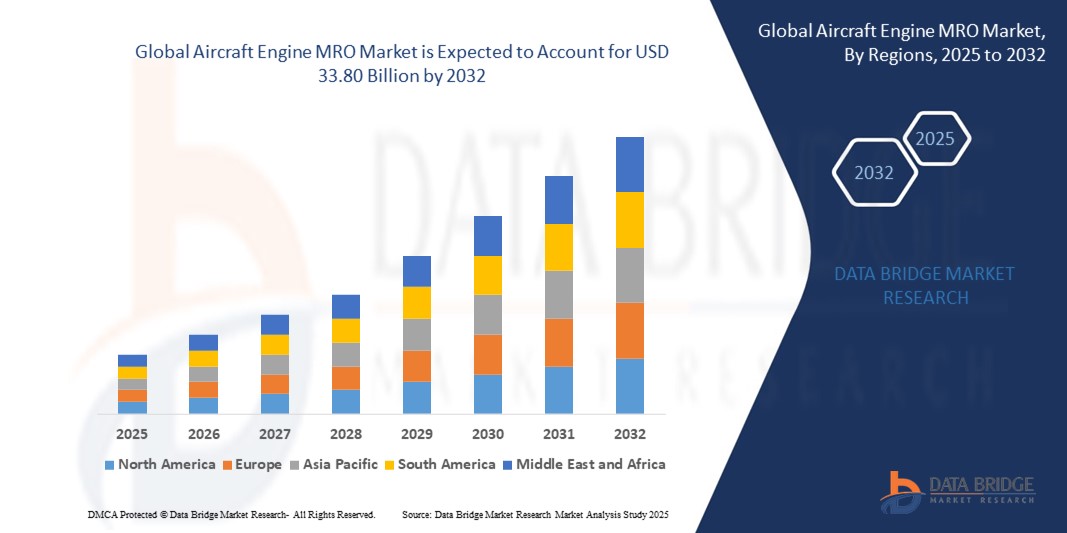

- The global aircraft engine MRO market size was valued at USD 22.32 billion in 2024 and is expected to reach USD 33.80 billion by 2032, at a CAGR of 5.32% during the forecast period

- The market growth is largely fueled by the increasing global fleet of commercial and military aircraft, driving the demand for regular maintenance, repair, and overhaul (MRO) services. The rising focus on fleet reliability, safety compliance, and operational efficiency is prompting airlines and defense operators to invest heavily in engine MRO solutions

- Furthermore, technological advancements in predictive maintenance, engine health monitoring, and digital MRO platforms are enabling service providers to reduce downtime, optimize resource utilization, and enhance the lifespan of aircraft engines. These converging factors are accelerating the adoption of advanced MRO services, thereby significantly boosting the market’s growth

Aircraft Engine MRO Market Analysis

- Aircraft Engine MRO involves comprehensive maintenance, repair, and overhaul of aircraft engines to ensure safety, reliability, and optimal performance. Services include inspections, component repairs, part replacements, engine testing, and performance upgrades for both civil and military aircraft

- The escalating demand for Aircraft Engine MRO services is primarily fueled by the growth of commercial aviation, rising defense budgets, fleet modernization programs, and increasing adoption of predictive and data-driven maintenance solutions across the global aviation sector

- North America dominated the aircraft engine MRO market with a share of 33.41% in 2024, due to the presence of major commercial airlines, strong defense budgets, and advanced aviation infrastructure

- Asia-Pacific is expected to be the fastest growing region in the aircraft engine MRO market during the forecast period due to increasing air traffic, stringent aviation safety regulations, and modernization of commercial and military fleets

- Civil aviation segment dominated the market with a market share of 70.5% in 2024, due to the rapid expansion of passenger air travel, rising airline fleets, and increased emphasis on operational efficiency. Airlines prioritize routine engine maintenance, timely overhauls, and component upgrades to minimize downtime and comply with stringent regulatory standards. The segment also benefits from partnerships between airlines and OEMs, along with the adoption of predictive maintenance and digital MRO platforms that streamline service schedules and reduce costs

Report Scope and Aircraft Engine MRO Market Segmentation

|

Attributes |

Aircraft Engine MRO Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Engine MRO Market Trends

Increasing Adoption of Predictive Maintenance and Digital MRO Solutions

- Growing integration of advanced analytics, artificial intelligence, and IoT sensors into aircraft engine maintenance, repair, and overhaul (MRO) processes is transforming efficiency by enabling proactive condition monitoring, real-time diagnostics, and data-driven lifecycle management, which reduce unplanned downtime and improve overall safety

- For instance, leading MRO providers such as Lufthansa Technik, Rolls-Royce, and GE Aviation are investing in digital platforms, cloud-based engine monitoring systems, and AI-powered predictive maintenance tools that optimize maintenance schedules, manage parts inventories, and deliver tailored engine health reports to airlines and fleet operators

- Expansion of digital twins and advanced simulation technologies enables more precise fault detection, virtual troubleshooting, and predictive prognostics, enhancing reliability and minimizing operational costs for aircraft owners and operators

- Growth of mobile MRO services and remote technical support offers faster turnaround times for engine inspections, minor repairs, and performance assessments, allowing aviation companies to maintain fleet readiness and comply with regulatory standards

- Wider adoption of blockchain and secure digital recordkeeping supports transparent tracking of maintenance history, parts authenticity, and regulatory compliance across multi-operator networks

- Implementation of advanced 3D printing for spare parts manufacturing accelerates repair cycles and reduces dependency on traditional supply chains, particularly for aging aircraft engine platforms

Aircraft Engine MRO Market Dynamics

Driver

Rising Air Passenger Traffic

- Global increases in air passenger traffic, driven by economic growth, tourism, and expansion of airline networks, are stimulating demand for dependable and cost-effective engine MRO services to keep growing fleets operational, safe, and compliant with performance standards

- For instance, major airlines in North America, Europe, and Asia-Pacific are entering long-term support agreements with MRO providers such as Safran Aircraft Engines and Pratt & Whitney to manage engine reliability, extend service intervals, and minimize operational disruptions as passenger volumes surge

- Rising aircraft deliveries and fleet renewal strategies require robust MRO capacity and skilled workforce to support high utilization rates and diverse engine platforms. Expansion of low-cost carriers and regional airlines intensifies demand for flexible, scalable MRO offerings catering to cost-sensitive fleet operators

- Regulatory requirements on aircraft asset management, safety, and emissions underscore the need for prompt, thorough engine maintenance, fueling ongoing investments in MRO infrastructure

- Increased focus on sustainability and fuel efficiency motivates airlines and OEMs to regularly upgrade and maintain engines, further strengthening the MRO sector

Restraint/Challenge

Supply Chain Disruptions

- Ongoing supply chain challenges—including parts shortages, logistics bottlenecks, and geopolitical tensions—create obstacles in sourcing engine components and spare parts, leading to delays, increased costs, and extended aircraft groundings

- For instance, engine manufacturers and MRO facilities such as MTU Aero Engines and StandardAero have reported longer lead times and inventory constraints resulting from raw material price volatility, pandemic aftereffects, and imbalanced supplier networks

- Increased demand for specialized materials and advanced components, coupled with capacity limitations at key suppliers, puts pressure on MRO planning and fleet availability

- Rigid certification and regulatory approval processes for new suppliers and alternative part sources complicate supply chain flexibility, hindering rapid adaptation to disruptions. Dependence on globalized logistics and just-in-time inventory models heightens vulnerability to transport delays and regional emergencies

- Workforce shortages, especially skilled technicians and engineers, exacerbate supply chain related delays, impacting turnaround times and overall operational resilience

Aircraft Engine MRO Market Scope

The market is segmented on the basis of engine type, aircraft type, and application.

- By Engine Type

On the basis of engine type, the Aircraft Engine MRO market is segmented into turbine engines and piston engines. The turbine engine segment dominated the largest market revenue share in 2024, driven by the extensive use of turbine engines in commercial airlines, regional jets, and large military aircraft. Turbine engines require regular maintenance, repair, and overhaul due to their high operational hours and complexity, which ensures consistent demand for MRO services. The segment benefits from technological advancements in predictive maintenance, engine health monitoring systems, and OEM support services, which enhance reliability and reduce downtime. Moreover, airline operators prioritize turbine engine MRO to maintain fleet efficiency and safety compliance, making it the dominant contributor to market revenue.

The piston engine segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing use in general aviation, small aircraft, and emerging markets. Piston engines are simpler in design, allowing cost-effective MRO services and quicker turnaround times. The growing demand for private aviation and pilot training schools also drives the need for piston engine maintenance, repairs, and upgrades. In addition, rising adoption of piston engines in UAVs and small rotary-wing aircraft presents new avenues for aftermarket services.

- By Aircraft Type

On the basis of aircraft type, the market is segmented into fixed-wing aircraft and rotary-wing aircraft. The fixed-wing aircraft segment held the largest market revenue share in 2024, owing to the dominance of commercial airlines and regional carriers that operate fixed-wing fleets. These aircraft require frequent engine inspections, component replacements, and performance upgrades to meet safety regulations and operational efficiency standards. MRO service providers invest heavily in fixed-wing engine maintenance infrastructure and skilled technicians, ensuring high service reliability and customer trust. The need for scheduled overhauls and modernization of engines in aging fleets also supports the continued dominance of this segment.

The rotary-wing aircraft segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising military, emergency response, and offshore transport operations. Rotary-wing aircraft engines are increasingly adopted in urban air mobility and private helicopter services, necessitating specialized MRO services. The compact design and operational flexibility of rotary-wing aircraft engines create opportunities for innovative maintenance solutions, predictive diagnostics, and modular repair services. Growing investments in rotary-wing fleets across emerging markets further accelerate demand for dedicated MRO solutions.

- By Application

On the basis of application, the Aircraft Engine MRO market is segmented into civil aviation and military aviation. The civil aviation segment dominated the largest market revenue share of 70.5% in 2024, fueled by the rapid expansion of passenger air travel, rising airline fleets, and increased emphasis on operational efficiency. Airlines prioritize routine engine maintenance, timely overhauls, and component upgrades to minimize downtime and comply with stringent regulatory standards. The segment also benefits from partnerships between airlines and OEMs, along with the adoption of predictive maintenance and digital MRO platforms that streamline service schedules and reduce costs.

The military aviation segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising defense budgets, modernization of air forces, and expansion of unmanned aerial systems. Military engines require specialized MRO services for high-performance operations, including combat readiness, endurance testing, and rapid deployment. Advanced diagnostic tools, component life-cycle management, and strategic overhaul programs contribute to the increasing adoption of military MRO services. Moreover, geopolitical tensions and increasing defense procurement create sustained demand for military engine maintenance solutions.

Aircraft Engine MRO Market Regional Analysis

- North America dominated the aircraft engine MRO market with the largest revenue share of 33.41% in 2024, driven by the presence of major commercial airlines, strong defense budgets, and advanced aviation infrastructure

- Operators in the region emphasize the importance of regular engine maintenance, overhauls, and predictive diagnostics to ensure operational efficiency and fleet reliability. The market is supported by established MRO service providers, advanced training facilities for technicians, and high adoption of digital maintenance management systems

- The U.S., in particular, leads the regional market, with a large commercial fleet requiring continuous maintenance and growing investments in next-generation engine technologies further bolstering MRO demand

U.S. Aircraft Engine MRO Market Insight

The U.S. Aircraft Engine MRO market captured the largest revenue share in North America in 2024, driven by a combination of expansive commercial airline operations and rising military aviation programs. The country’s emphasis on safety, adherence to stringent FAA regulations, and adoption of predictive maintenance solutions ensures consistent demand for engine MRO services. Furthermore, collaborations between airlines, OEMs, and MRO providers are enhancing service efficiency and reducing aircraft downtime. The growing focus on fleet modernization, along with the integration of advanced diagnostic technologies, continues to drive the U.S. market forward.

Asia-Pacific Aircraft Engine MRO Market Insight

The Asia-Pacific Aircraft Engine MRO market is poised for substantial growth during the forecast period, supported by the rapid expansion of commercial aviation in countries such as China, Japan, and India. Increasing passenger traffic, fleet expansion, and government initiatives to enhance aviation infrastructure are driving engine maintenance and overhaul demand. The presence of cost-effective MRO service providers and growing investments in digital maintenance platforms contribute to the region’s expanding market.

Japan Aircraft Engine MRO Market Insight

The Japan Aircraft Engine MRO market is growing steadily, fueled by the modernization of commercial and defense fleets and a strong focus on operational safety. The integration of advanced diagnostic tools and predictive maintenance systems enhances efficiency and reduces aircraft downtime.

China Aircraft Engine MRO Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2024, supported by a rapidly expanding airline fleet, growing defense programs, and rising adoption of predictive engine maintenance solutions. The country’s emphasis on building domestic MRO capabilities and partnerships with global OEMs further strengthens the market.

Europe Aircraft Engine MRO Market Insight

The Europe Aircraft Engine MRO market is projected to grow at the fastest CAGR during the forecast period, fueled by increasing air traffic, stringent aviation safety regulations, and modernization of commercial and military fleets. The expansion of low-cost carriers, alongside investments in regional airports, is boosting demand for engine maintenance and repair services. European airlines and defense operators are increasingly adopting predictive maintenance, digital monitoring tools, and engine health management systems to reduce operational disruptions. The region is also witnessing significant growth in engine MRO partnerships with OEMs and independent providers, driving efficiency and reliability across both civil and military aviation sectors.

U.K. Aircraft Engine MRO Market Insight

The U.K. Aircraft Engine MRO market is expected to grow at a considerable CAGR during the forecast period, supported by the modernization of commercial and defense aircraft fleets. Investments in MRO infrastructure, skilled workforce development, and adoption of advanced predictive maintenance technologies are key growth drivers. The region’s focus on fleet efficiency, reduced downtime, and regulatory compliance further strengthens demand for engine overhaul and repair services.

Germany Aircraft Engine MRO Market Insight

The Germany Aircraft Engine MRO market is witnessing steady growth, driven by a strong presence of commercial airlines, defense aviation programs, and OEM partnerships. Emphasis on technological advancements in engine diagnostics, efficiency improvements, and eco-friendly operations promotes MRO service adoption. Germany’s focus on innovation and regulatory compliance ensures high-quality maintenance services across commercial and military fleets.

Aircraft Engine MRO Market Share

The aircraft engine MRO industry is primarily led by well-established companies, including:

- GE Aerospace (U.S.)

- Rolls-Royce (U.K.)

- Pratt & Whitney (U.S.)

- Lufthansa Technik (Germany)

- Safran Aircraft Engines (Paris)

- SIA Engineering Company (Singapore)

- Air France Industries KLM Engineering & Maintenance (France)

- MTU Aero Engines (Germany)

- ST Aerospace (Singapore)

- Delta TechOps (U.S.)

Latest Developments in Global Aircraft Engine MRO Market

- In November 2023, GE Aerospace secured a USD 48 million contract with the U.S. Navy through its subsidiary CFM International to modify and rebuild aircraft engines. This deal strengthens GE Aerospace’s leadership in the military engine MRO segment and also underscores the growing need for specialized, high-precision maintenance services in defense aviation. By leveraging its global expertise, GE is positioned to enhance fleet readiness and reliability for naval operations, reflecting the increasing investment of defense organizations in OEM-backed maintenance solutions to ensure operational efficiency and long-term cost savings

- In November 2023, SriLankan Airlines entered a five-year agreement with MTU Maintenance to manage the maintenance of LEAP-1A engines. This long-term partnership highlights a trend toward strategic outsourcing of engine MRO services in the South Asian civil aviation market. It allows SriLankan Airlines to ensure continuous engine performance, minimize unscheduled downtimes, and extend the service life of its fleet. For MTU Maintenance, this engagement strengthens its presence in emerging markets, showcasing its capability to deliver tailored, reliable, and high-value MRO services to regional carriers

- In October 2023, Cebu Pacific, a Philippine-based low-cost carrier, partnered with Lufthansa Technik AG for engine maintenance of three CFM56-5B engines, as well as Cyclean Engine Wash and Aircraft Transition Services (ATS) for two A320ceo aircraft. This collaboration reflects the increasing importance of integrated MRO services that go beyond basic engine repairs to include efficiency-enhancing solutions and comprehensive lifecycle support. The agreement positions Lufthansa Technik as a preferred MRO partner in the Asia-Pacific low-cost carrier segment, highlighting the growing reliance of regional airlines on specialized third-party providers to optimize fleet performance and reduce operational costs

- In September 2022, Rolls-Royce Holdings Plc and Air China announced the establishment of a new repair and overhaul facility in Beijing, China, operated by BAESL (Beijing Aero Engine Services Company Limited), to service Trent 700, Trent XWB-84, and Trent 1000 engines. This facility significantly expands Rolls-Royce’s direct MRO footprint in China, a key aviation growth market. It enables faster turnaround times, localized support, and compliance with regional regulatory standards, while also addressing the rising demand for high-quality engine maintenance in China’s growing civil aviation and cargo sectors. The collaboration represents a strategic move to strengthen OEM-controlled MRO services and meet the increasing fleet modernization requirements

- In July 2022, Delta TechOps, the maintenance division of Delta Airlines, signed a CFM Branded Service Agreement (CBSA) with CFM International to provide MRO services for LEAP-1B engines. This partnership allows Delta to expand its in-house maintenance capabilities under a certified OEM framework, ensuring high-quality, reliable, and standardized engine servicing. It demonstrates the growing trend of airlines investing in integrated MRO solutions to enhance fleet availability and reduce operational disruptions, while also benefiting from OEM expertise, advanced tools, and global best practices in engine maintenance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.