Global Aircraft Evacuation Market

Market Size in USD Billion

CAGR :

%

USD

1.45 Billion

USD

2.09 Billion

2024

2032

USD

1.45 Billion

USD

2.09 Billion

2024

2032

| 2025 –2032 | |

| USD 1.45 Billion | |

| USD 2.09 Billion | |

|

|

|

|

Aircraft Evacuation Market Size

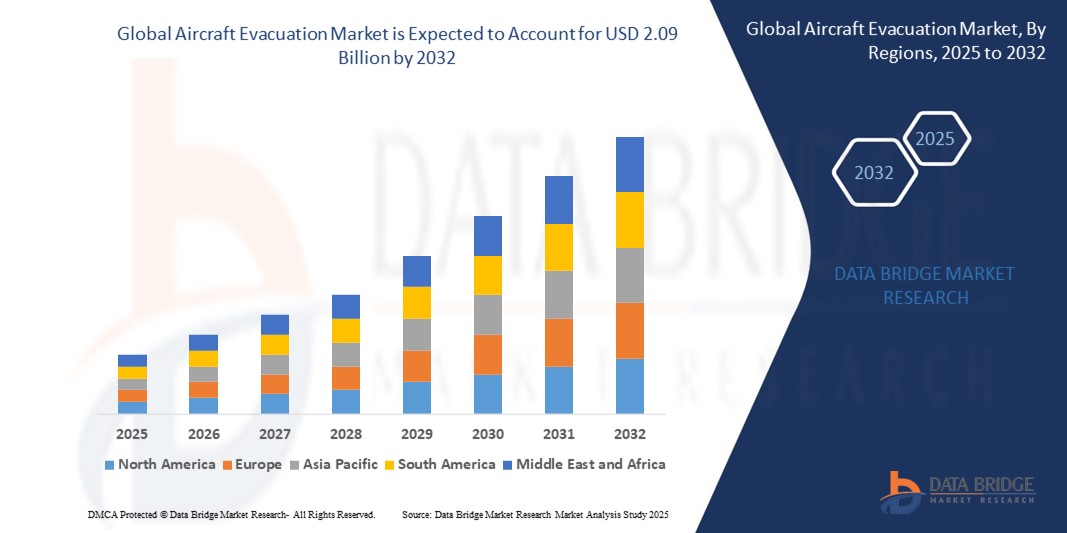

- The global aircraft evacuation market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 2.09 billion by 2032, at a CAGR of 4.68% during the forecast period

- The market growth is largely fuelled by increasing air passenger traffic, stringent safety regulations enforced by aviation authorities, and rising aircraft deliveries across both commercial and military sectors

- Advancements in evacuation technologies, such as lightweight materials and automatic deployment systems, are further enhancing passenger safety, boosting product adoption across new-generation aircraft

Aircraft Evacuation Market Analysis

- Increasing emphasis on reducing aircraft turnaround times and ensuring quick, safe passenger evacuation is driving innovation in evacuation systems such as slides, life rafts, and ejection systems

- The growing demand for wide-body and long-haul aircraft, especially in Asia-Pacific and Middle East regions, is expanding the need for reliable, scalable evacuation solutions that comply with international safety standards

- North America dominated the aircraft evacuation market with the largest revenue share of 36.4% in 2024, primarily driven by strong investments in aviation safety technologies and the presence of major aircraft manufacturers and defense contractors

- The Asia-Pacific region is expected to witness the highest growth rate in the global aircraft evacuation market, driven by rapid fleet expansion, increasing air travel demand, and growing investments in aviation infrastructure across emerging economies such as China and India

- The evacuation slide segment held the largest market revenue share in 2024, driven by its mandatory installation across all commercial aircraft and its critical role in rapid passenger egress during emergencies. Airlines prioritize evacuation slides due to regulatory compliance, high reliability, and improvements in inflation systems that ensure deployment within seconds. The segment continues to gain traction with advancements in lightweight materials and compact storage designs enhancing both performance and fuel efficiency

Report Scope and Aircraft Evacuation Market Segmentation

|

Attributes |

Aircraft Evacuation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Lightweight and Automated Evacuation Systems • Increasing Aircraft Deliveries in Emerging Economies |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Evacuation Market Trends

“Growing Integration of Smart Evacuation Technologies”

- Increasing adoption of smart evacuation technologies such as sensor-based evacuation slides, dynamic emergency lighting, and automated deployment mechanisms is reshaping the aircraft evacuation market, as airlines aim to enhance safety compliance and minimize human error during high-stress emergency situations

- Integration of real-time monitoring and diagnostics systems is becoming more common, allowing crew members and maintenance teams to detect malfunctions in evacuation equipment before takeoff, thereby improving system reliability and response efficiency

- Growing demand for lightweight and space-efficient evacuation systems is influencing design innovation, with manufacturers developing compact, high-speed inflation systems that reduce aircraft weight and enable quicker deployment

- For instance, Zodiac Aerospace and Collins Aerospace have introduced smart evacuation slides equipped with self-check capabilities and faster inflation systems to reduce evacuation time while meeting stringent aviation regulations

- These advancements are accelerating the shift toward intelligent evacuation ecosystems, especially in new-generation aircraft, encouraging broader airline investments in passenger safety and evacuation readiness

Aircraft Evacuation Market Dynamics

Driver

“Stringent Aviation Safety Regulations Driving Innovation in Evacuation Systems”

• Stringent global safety regulations by agencies such as the Federal Aviation Administration and the European Union Aviation Safety Agency are mandating that all commercial aircraft support complete evacuation within 90 seconds, even under partial system failure, prompting airlines to adopt advanced evacuation systems to remain compliant and avoid penalties

• Increased focus on passenger safety and operational preparedness is pushing original equipment manufacturers to redesign aircraft interiors for more accessible exits, improve cabin layout optimization, and deploy faster-deploying evacuation slides capable of functioning under variable weather and terrain conditions

• Rapid expansion in aircraft deliveries and fleet modernization programs across emerging markets is fuelling demand for enhanced evacuation systems that not only meet compliance but also reduce system weight and cost over lifecycle

• For instance, Airbus and Boeing have collaborated with evacuation system suppliers to embed smart technologies directly into aircraft design blueprints to ensure streamlined integration and safety compliance from manufacturing stage

• These regulatory and operational factors are playing a pivotal role in driving innovation, standardization, and increased procurement of aircraft evacuation systems across both commercial and defense aviation sectors

Restraint/Challenge

“High Development and Retrofit Costs Limiting Adoption in Older Fleets”

• High development and retrofitting costs associated with integrating advanced aircraft evacuation systems are limiting adoption, particularly among low-cost carriers and operators managing older fleets where return on investment is uncertain and upgrade feasibility remains limited

• The complex process of retrofitting existing aircraft requires structural modifications, system recalibration, and extensive regulatory approvals, all of which contribute to prolonged aircraft downtime and higher operational disruption

• Limited technical interoperability between legacy aircraft components and modern smart evacuation systems adds to cost inefficiencies, making upgrades resource-intensive and operationally risky for budget-conscious airlines

• For instance, smaller airlines in Southeast Asia and Latin America have deferred fleet upgrades due to the financial burden of retrofitting advanced evacuation systems, choosing to maintain manual or outdated systems despite growing passenger volumes

• These financial and logistical hurdles are creating disparities in global safety standards, hampering uniform technology adoption and slowing down modernization efforts in several regional aviation markets

Aircraft Evacuation Market Scope

The market is segmented on the basis of equipment type, fit, and aircraft type.

- By Equipment Type

On the basis of equipment type, the aircraft evacuation market is segmented into life vest, evacuation slide, ejection seat, evacuation raft, and emergency flotation. The evacuation slide segment held the largest market revenue share in 2024, driven by its mandatory installation across all commercial aircraft and its critical role in rapid passenger egress during emergencies. Airlines prioritize evacuation slides due to regulatory compliance, high reliability, and improvements in inflation systems that ensure deployment within seconds. The segment continues to gain traction with advancements in lightweight materials and compact storage designs enhancing both performance and fuel efficiency.

The ejection seat segment is expected to witness the fastest growth rate from 2025 to 2032, largely propelled by rising defense procurement and modernization of fighter jet fleets globally. These systems are essential for pilot survival in high-risk scenarios and benefit from ongoing innovations in propulsion and shock absorption technologies. For instance, modern ejection seats equipped with automated flight path detection and adaptive thrust capabilities are being adopted by next-generation military aircraft.

- By Fit

On the basis of fit, the market is segmented into linefit and retrofit. The linefit segment accounted for the largest market share in 2024, supported by the rising production of new-generation aircraft with integrated safety systems designed to meet evolving safety standards. Aircraft manufacturers increasingly prefer linefit evacuation solutions for their seamless integration, enhanced reliability, and reduced certification burden during final assembly stages.

The retrofit segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need to upgrade existing fleets with modern evacuation technologies. Airlines and defense operators are investing in retrofitting to extend aircraft service life and comply with updated safety mandates. The growing availability of modular retrofit kits and government-backed safety grants is further encouraging adoption across aging commercial and military aircraft.

- By Aircraft Type

On the basis of aircraft type, the market is segmented into narrow body aircraft, wide body aircraft, very large aircraft, regional transport aircraft, business jet, helicopter, and fighter jet. The narrow body aircraft segment dominated the market in 2024 due to high global demand for single-aisle jets in both commercial and low-cost carriers, where efficient evacuation systems are essential for safety certification and passenger throughput. Operators in high-density routes rely on robust slide and vest systems to maintain operational compliance and passenger confidence.

The fighter jet segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased military spending and procurement programs in Asia-Pacific, the Middle East, and Europe. Advanced ejection seats and flotation systems are becoming standard in modern fighter aircraft to ensure pilot survivability during critical missions. For instance, several defense ministries have partnered with leading manufacturers to incorporate next-gen ejection technologies into their active and upcoming fighter fleets.

Aircraft Evacuation Market Regional Analysis

• North America dominated the aircraft evacuation market with the largest revenue share of 36.4% in 2024, primarily driven by strong investments in aviation safety technologies and the presence of major aircraft manufacturers and defense contractors

• The region’s focus on regulatory compliance, continuous upgrades to safety mechanisms, and high demand for commercial and military aircraft contribute significantly to market expansion

• Government-led initiatives to modernize aging fleets and increase defense budgets, especially in the U.S., further accelerate the deployment of advanced evacuation systems across various aircraft types

U.S. Aircraft Evacuation Market Insight

The U.S. aircraft evacuation market captured the largest revenue share in 2024 within North America, fuelled by a growing emphasis on passenger and pilot safety in both commercial and military aviation sectors. The Federal Aviation Administration’s stringent evacuation regulations and mandatory safety testing drive continuous innovation and integration of advanced systems. Moreover, the presence of key players such as Collins Aerospace and Safran, along with the increasing procurement of fighter jets and helicopters by the U.S. Department of Defense, boosts demand for reliable evacuation equipment.

Europe Aircraft Evacuation Market Insight

The Europe aircraft evacuation market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in aerospace research and development and stringent passenger safety mandates imposed by the European Union Aviation Safety Agency. The market benefits from the presence of major aircraft manufacturers such as Airbus and a rising demand for commercial aircraft in both Western and Eastern Europe. In addition, initiatives promoting greener and safer aviation practices are encouraging the development of lightweight and efficient evacuation systems.

U.K. Aircraft Evacuation Market Insight

The U.K. aircraft evacuation market is expected to witness the fastest growth rate from 2025 to 2032, supported by advancements in aerospace engineering, a strong defense sector, and a growing emphasis on flight safety and survivability. The nation’s participation in multinational military programs, such as the Tempest Future Combat Air System, and increased procurement of modern transport aircraft are key factors driving demand. Furthermore, investments in aerospace innovation hubs and strong collaboration with academic and defense institutions foster ongoing development in evacuation technologies.

Germany Aircraft Evacuation Market Insight

The Germany aircraft evacuation market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for commercial aircraft, a strong presence of tier-1 aerospace suppliers, and government-backed defense modernization programs. The country’s focus on aviation safety standards and its robust engineering capabilities support the adoption of sophisticated evacuation solutions. Germany also plays a vital role in European defense partnerships, including helicopter and jet fighter programs, where safety systems such as ejection seats and flotation devices are integral components.

Asia-Pacific Aircraft Evacuation Market Insight

The Asia-Pacific aircraft evacuation market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid fleet expansion, increasing air passenger traffic, and growing defense expenditures in countries such as China, India, and Japan. Rising demand for new aircraft deliveries and heightened awareness of aviation safety contribute to increased adoption of advanced evacuation equipment. In addition, local manufacturing and government support for aerospace development are boosting market penetration across the region.

Japan Aircraft Evacuation Market Insight

The Japan aircraft evacuation market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong emphasis on aviation safety and advanced technology. As Japan increases its defense spending and continues to upgrade its commercial and military fleets, demand for evacuation equipment such as ejection seats and emergency rafts is rising. Japan’s well-established aerospace industry, combined with technological collaborations with international manufacturers, positions the country as a key contributor to innovation in this sector.

China Aircraft Evacuation Market Insight

The China aircraft evacuation market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to strong domestic aircraft production, expanding commercial aviation networks, and a growing defense aviation segment. The government’s push for self-reliance in aerospace manufacturing and aggressive investments in civil aviation safety programs are major drivers. Chinese manufacturers are increasingly integrating evacuation slides, flotation devices, and ejection systems into new aircraft models to meet both domestic and international safety standards.

Aircraft Evacuation Market Share

The Aircraft Evacuation industry is primarily led by well-established companies, including:

- Collins Aerospace (U.S.)

- Zodiac Aerospace (France)

- EAM Worldwide (U.S.)

- Martin-Baker Aircraft Co. Ltd (U.K.)

- NPP Zvezda PAO (Russia)

- Trelleborg AB (Sweden)

- GKN AEROSPACE (U.K.)

- Cobham Limited (U.K.)

- DART AEROSPACE (Canada)

- Survival Equipment Services Ltd (U.K.)

- Switlik Parachute Co. (U.S.)

- Mustang Survival Corp. (Canada)

- Safran (France)

- The MEL Group (U.K.)

- Tulmar Safety Systems (Canada)

Latest Developments in Global Aircraft Evacuation Market

- In September 2023, Safran Electrical and Power entered into a cooperation agreement with Cuberg, a subsidiary of Northvolt, to jointly develop aviation energy storage systems. This strategic collaboration aims to advance battery technologies for future electric and hybrid aircraft. By combining Safran’s aerospace expertise with Cuberg’s battery innovation, the partnership is expected to accelerate the adoption of sustainable aviation solutions, positively impacting the market for electric aircraft systems

- In June 2023, Martin-Baker extended its existing agreement with Lockheed Martin's Sikorsky to supply troop seats for Black Hawk helicopters. This development reinforces Martin-Baker’s position as a key provider of military safety systems. The extension ensures continuity in the production of critical safety components, strengthening the market presence of both companies in the defense aviation sector

- In March 2022, KaraMD launched Pure Health Apple Cider Vinegar Gummies, a vegan dietary supplement designed to support ketosis, enhance digestion, manage weight, and improve energy. This product introduction marks KaraMD’s expansion into holistic wellness solutions, contributing to the growing consumer demand for functional, plant-based health products in the dietary supplement market

- In January 2022, Solace Nutrition acquired the assets of R-Kane Nutritionals, a U.S.-based company specializing in high-protein meal replacements for weight loss. This acquisition allows Solace Nutrition to broaden its medical nutrition portfolio and strengthen brand synergies. It is expected to accelerate company growth and enhance its competitive positioning in the specialized nutrition market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.