Global Aircraft Fairings Market

Market Size in USD Billion

CAGR :

%

USD

2.93 Billion

USD

4.66 Billion

2025

2033

USD

2.93 Billion

USD

4.66 Billion

2025

2033

| 2026 –2033 | |

| USD 2.93 Billion | |

| USD 4.66 Billion | |

|

|

|

|

Aircraft Fairings Market Size

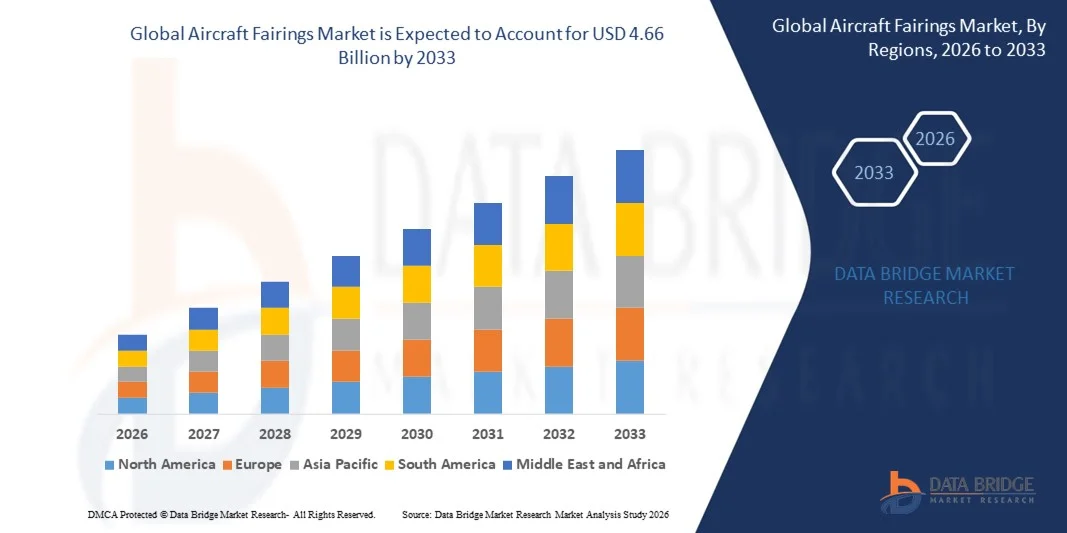

- The global aircraft fairings market size was valued at USD 2.93 billion in 2025 and is expected to reach USD 4.66 billion by 2033, at a CAGR of 6.00% during the forecast period

- The market growth is largely driven by increasing aircraft production rates and continuous fleet modernization programs aimed at improving aerodynamic efficiency and fuel performance across commercial, military, and business aviation

- Furthermore, the rising emphasis on lightweight structures, emissions reduction, and noise control is accelerating the adoption of advanced composite fairings, significantly supporting overall market expansion

Aircraft Fairings Market Analysis

- Aircraft fairings, which streamline airflow and protect critical aircraft components, are essential in enhancing fuel efficiency, reducing drag, and improving overall aircraft performance across new-build and retrofit applications

- The growing demand for aircraft fairings is primarily supported by rising air passenger traffic, expansion of global airline fleets, and increasing maintenance and replacement activities for in-service aircraft

- North America dominated the aircraft fairings market with a share of 36.74% in 2025, due to strong aircraft production activity, continuous fleet modernization, and high defense spending

- Asia-Pacific is expected to be the fastest growing region in the aircraft fairings market during the forecast period due to rapid expansion of commercial aviation, rising air passenger traffic, and increasing defense procurement

- Commercial segment dominated the market with a market share of 58.19% in 2025, due to high global fleet volumes and continuous production of narrow-body and wide-body aircraft to meet rising passenger traffic. Aircraft fairings are critical in commercial aviation for reducing aerodynamic drag, improving fuel efficiency, and lowering noise emissions

Report Scope and Aircraft Fairings Market Segmentation

|

Attributes |

Aircraft Fairings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Fairings Market Trends

Increasing Adoption of Lightweight Composite Fairings

- A key trend in the aircraft fairings market is the increasing adoption of lightweight composite materials to reduce overall aircraft weight and improve aerodynamic efficiency, driven by the aviation industry’s focus on fuel optimization and emission reduction. Composite fairings offer superior strength-to-weight ratios and corrosion resistance, making them suitable for both commercial and military aircraft programs

- For instance, Spirit AeroSystems manufactures advanced composite fairings supplied to major aircraft platforms, supporting improved fuel efficiency and reduced maintenance requirements. These solutions help aircraft manufacturers achieve performance targets while complying with stringent environmental regulations

- Aircraft OEMs are increasingly integrating composite fairings into new-generation narrow-body and wide-body aircraft to enhance airflow management and reduce drag during flight operations. This trend is strengthening demand for precision-engineered fairings across fuselage, wing, and engine nacelle applications

- The growing use of composite fairings is also driven by their ability to support complex aerodynamic designs that are difficult to achieve with traditional metallic materials. This design flexibility is enabling manufacturers to optimize aircraft performance without compromising structural integrity

- Maintenance advantages associated with composite fairings, including improved fatigue resistance and longer service life, are further supporting their adoption across global fleets. Airlines are favoring components that contribute to lower lifecycle costs and higher operational reliability

- Overall, the shift toward lightweight composite fairings is reinforcing the market’s alignment with next-generation aircraft design priorities focused on efficiency, sustainability, and long-term performance improvements

Aircraft Fairings Market Dynamics

Driver

Rising Demand for Fuel-Efficient and Low-Emission Aircraft

- The rising demand for fuel-efficient and low-emission aircraft is a major driver for the aircraft fairings market, as fairings play a critical role in reducing aerodynamic drag and improving overall fuel performance. Airlines and operators are prioritizing aircraft configurations that support lower operating costs and compliance with environmental standards

- For instance, Airbus incorporates advanced fairing designs across its aircraft families to enhance aerodynamic efficiency and reduce fuel burn. These design improvements contribute directly to meeting airline sustainability goals and regulatory emission targets

- Increasing pressure from international aviation bodies to reduce carbon emissions is pushing manufacturers to optimize every external aircraft component, including fairings. This regulatory environment is accelerating investments in innovative fairing technologies

- The expansion of global air travel is also amplifying demand for new aircraft with improved fuel efficiency, indirectly strengthening the requirement for high-performance fairings. Fleet modernization programs are emphasizing aerodynamic enhancements to maximize operational efficiency

- As fuel costs remain a significant expense for airlines, components that support fuel savings are gaining strategic importance. This sustained focus on efficiency continues to drive steady growth in the aircraft fairings market

Restraint/Challenge

High Manufacturing and Certification Complexity

- The aircraft fairings market faces challenges related to high manufacturing and certification complexity, as fairings must meet strict aerospace quality, safety, and performance standards. Compliance with these requirements increases development time and production costs for manufacturers

- For instance, GKN Aerospace follows rigorous certification and testing procedures for composite fairings to meet global aviation authority requirements. These processes demand extensive validation, adding complexity and cost to product development

- Manufacturing composite fairings involves advanced tooling, precise layup techniques, and controlled production environments to ensure dimensional accuracy and structural integrity. These requirements limit production flexibility and increase capital investment

- Certification procedures for aircraft fairings require detailed documentation, material qualification, and performance testing under various operating conditions. This extends time-to-market and can delay program timelines for both OEMs and suppliers

- The challenge of balancing regulatory compliance, production efficiency, and cost control continues to constrain market participants. Addressing these complexities is essential for manufacturers seeking to scale operations while maintaining quality and certification standards

Aircraft Fairings Market Scope

The market is segmented on the basis of aircraft type, system, component, and end-user.

- By Aircraft Type

On the basis of aircraft type, the aircraft fairings market is segmented into commercial, regional, business, military, and helicopters. The commercial aircraft segment dominated the market with the largest share of 58.19% in 2025, supported by high global fleet volumes and continuous production of narrow-body and wide-body aircraft to meet rising passenger traffic. Aircraft fairings are critical in commercial aviation for reducing aerodynamic drag, improving fuel efficiency, and lowering noise emissions. Airlines prioritize advanced composite fairings to optimize operating costs and comply with stringent environmental regulations. The large number of in-service commercial aircraft further supports sustained demand for replacement and retrofit fairings.

The business aircraft segment is expected to register the fastest growth from 2026 to 2033, driven by increasing demand for private and charter aviation. Business jets require lightweight and high-performance fairings to enhance speed, range, and fuel efficiency. Rising adoption of advanced materials and customized aerodynamic designs in business aviation is accelerating fairings demand. Growth in high-net-worth individuals and corporate travel is reinforcing this trend.

- By System

On the basis of system, the aircraft fairings market is segmented into engine exhaust system and APU exhaust system. The engine exhaust system segment held the largest market share in 2025 due to its essential role in managing exhaust flow, reducing thermal impact, and improving overall propulsion efficiency. Engine exhaust fairings are exposed to high temperatures and aerodynamic stress, driving demand for durable and heat-resistant materials. Increasing aircraft engine upgrades and new engine programs are sustaining strong demand for this segment.

The APU exhaust system segment is projected to grow at the fastest rate during the forecast period, supported by rising focus on auxiliary power efficiency and emissions control. Modern aircraft increasingly rely on APUs for ground operations, creating demand for advanced exhaust fairings that reduce noise and heat dispersion. Technological improvements in APU design are further supporting segment growth.

- By Component

On the basis of component, the market is segmented into exhaust cone, exhaust pipe, exhaust nozzle, and APU exhaust liner. The exhaust nozzle segment dominated the market in 2025, as it plays a critical role in controlling exhaust flow and optimizing engine thrust performance. Exhaust nozzles require precision engineering and high-performance materials, leading to higher value contribution per unit. Continuous advancements in engine efficiency and noise reduction technologies are supporting steady demand for this component.

The APU exhaust liner segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing emphasis on thermal insulation and noise attenuation. Aircraft manufacturers are adopting advanced liner materials to improve APU performance and reduce maintenance requirements. Rising APU utilization across commercial and business aircraft is accelerating demand for this component.

- By End-User

On the basis of end-user, the aircraft fairings market is segmented into original equipment manufacturer (OER) and maintenance, repair and operations (MRO). The OER segment accounted for the largest market share in 2025, supported by steady aircraft production rates and integration of fairings during initial assembly. Aircraft manufacturers increasingly incorporate lightweight composite fairings to improve fuel efficiency and meet regulatory standards. Long-term supply agreements between fairing suppliers and OEMs further strengthen this segment.

The MRO segment is anticipated to grow at the fastest rate over the forecast period, driven by the expanding global aircraft fleet and rising need for repair and replacement of worn fairings. Fairings are subject to environmental exposure and mechanical stress, resulting in periodic maintenance requirements. Growth in aircraft utilization and aging fleets is significantly boosting MRO-driven demand.

Aircraft Fairings Market Regional Analysis

- North America dominated the aircraft fairings market with the largest revenue share of 36.74% in 2025, driven by strong aircraft production activity, continuous fleet modernization, and high defense spending

- The region benefits from the presence of major aircraft manufacturers and tier-1 suppliers that consistently invest in aerodynamic efficiency and lightweight structural components

- Rising demand for fuel-efficient aircraft, coupled with stringent emission and noise regulations, is reinforcing the adoption of advanced composite fairings across commercial, military, and business aviation platforms

U.S. Aircraft Fairings Market Insight

The U.S. aircraft fairings market accounted for the largest share within North America in 2025, supported by robust commercial aircraft deliveries and sustained defense aircraft programs. Strong investments in next-generation aircraft, engine upgrades, and aftermarket services are driving continuous demand for exhaust and aerodynamic fairings. The presence of a large in-service fleet further supports recurring replacement and maintenance demand through MRO activities.

Europe Aircraft Fairings Market Insight

The Europe aircraft fairings market is projected to grow at a notable CAGR during the forecast period, driven by increasing aircraft manufacturing activities and a strong focus on sustainability. European aviation regulations emphasize fuel efficiency and emissions reduction, encouraging the adoption of lightweight fairings. Growth is supported by rising demand from both commercial aviation and military modernization programs across the region.

U.K. Aircraft Fairings Market Insight

The U.K. aircraft fairings market is expected to expand steadily over the forecast period, supported by its strong aerospace manufacturing base and active participation in global aircraft programs. Demand is driven by ongoing investments in engine technologies and aerodynamic enhancements. The country’s focus on advanced materials and precision engineering further supports fairings innovation and adoption.

Germany Aircraft Fairings Market Insight

The Germany aircraft fairings market is anticipated to grow at a considerable CAGR, fueled by technological innovation and strong emphasis on fuel-efficient aircraft structures. Germany’s advanced aerospace supply chain supports high demand for precision-engineered fairings. Increasing involvement in commercial aircraft programs and defense upgrades is further strengthening market growth.

Asia-Pacific Aircraft Fairings Market Insight

The Asia-Pacific aircraft fairings market is expected to register the fastest CAGR during 2026 to 2033, driven by rapid expansion of commercial aviation, rising air passenger traffic, and increasing defense procurement. Growing aircraft manufacturing capabilities and airline fleet expansion across the region are accelerating fairings demand. Cost-effective production and rising MRO activities are further supporting market growth.

Japan Aircraft Fairings Market Insight

The Japan aircraft fairings market is witnessing steady growth due to strong investments in aerospace technology and fleet modernization. Demand is supported by the country’s focus on lightweight materials and high-precision components. Increasing maintenance activities for both commercial and defense aircraft are reinforcing fairings demand.

China Aircraft Fairings Market Insight

The China aircraft fairings market held the largest revenue share in Asia-Pacific in 2025, driven by rapid growth in domestic aircraft manufacturing and expanding airline fleets. Government support for indigenous aircraft programs and rising defense aviation investments are key growth drivers. The increasing number of aircraft in service is also boosting demand for fairings in the aftermarket segment.

Aircraft Fairings Market Share

The aircraft fairings industry is primarily led by well-established companies, including:

- Magellan Aerospace (Canada)

- Triumph Group (U.S.)

- Ducommun Incorporated (U.S.)

- Nexcelle (U.S.)

- The NORDAM Group LLC (U.S.)

- Franke Industries (U.S.)

- Senior plc (U.K.)

- CKT Engineering (Canada)

- Melrose Industries PLC (U.K.)

- Power Flow Systems, Inc. (U.S.)

- Collins Aerospace (U.S.)

- Sky Dynamics Corporation (U.S.)

- Knisley Welding, Inc. (U.S.)

- Aerospace Manufacturing Inc. (U.S.)

- Acorn Welding (U.S.)

- Safran (France)

- Sejong Industrial Co., Ltd (South Korea)

- D’Shannon Aviation (U.S.)

Latest Developments in Global Aircraft Fairings Market

- In March 2025, RTX Corporation entered into an agreement with JetZero to supply engine-integration and nacelle structures for a blended-wing-body demonstrator, including advanced fairings planned for 2027 test flights. This development strengthens the aircraft fairings market by accelerating the adoption of next-generation aerodynamic designs and validating demand for highly integrated, lightweight fairing solutions in future aircraft architectures. It also signals growing investment in unconventional airframe concepts that require advanced fairing technologies

- In August 2024, Daher enhanced its aircraft fairing manufacturing processes through the integration of digital inspection systems to enable real-time production monitoring. This move positively impacts the market by improving quality assurance, reducing defect rates, and increasing production efficiency. The adoption of digitalized manufacturing practices supports higher reliability and scalability in fairing supply for both OEM and MRO demand

- In April 2024, GKN Aerospace introduced an advanced composite radome fairing solution designed to improve signal transparency using optimized material layup and precision fabrication technologies. This innovation drives market growth by addressing the increasing need for fairings that balance aerodynamic performance with advanced communication and radar requirements. It also reinforces the shift toward high-performance composite materials in critical aircraft structures

- In January 2024, Spirit AeroSystems expanded its composite fairing production capacity to support rising narrowbody aircraft output, supported by automated composite manufacturing capabilities. This expansion strengthens the aircraft fairings market by improving supply reliability and meeting growing demand from high-volume commercial aircraft programs. It also highlights the role of automation in reducing production bottlenecks and supporting long-term market scalability

- In June 2023, Strata Manufacturing PJSC and SABCA signed a contract to manufacture and assemble A350-1000 flap support fairings, building on their existing collaboration for the A350-900 program. This agreement reinforces the aircraft fairings market by ensuring continuity of supply for widebody aircraft programs and strengthening global supplier partnerships. It also reflects sustained demand for high-precision fairings in advanced commercial aircraft platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.