Global Aircraft Galley Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.64 Billion

USD

5.17 Billion

2024

2032

USD

3.64 Billion

USD

5.17 Billion

2024

2032

| 2025 –2032 | |

| USD 3.64 Billion | |

| USD 5.17 Billion | |

|

|

|

|

Aircraft Galley Equipment Market Size

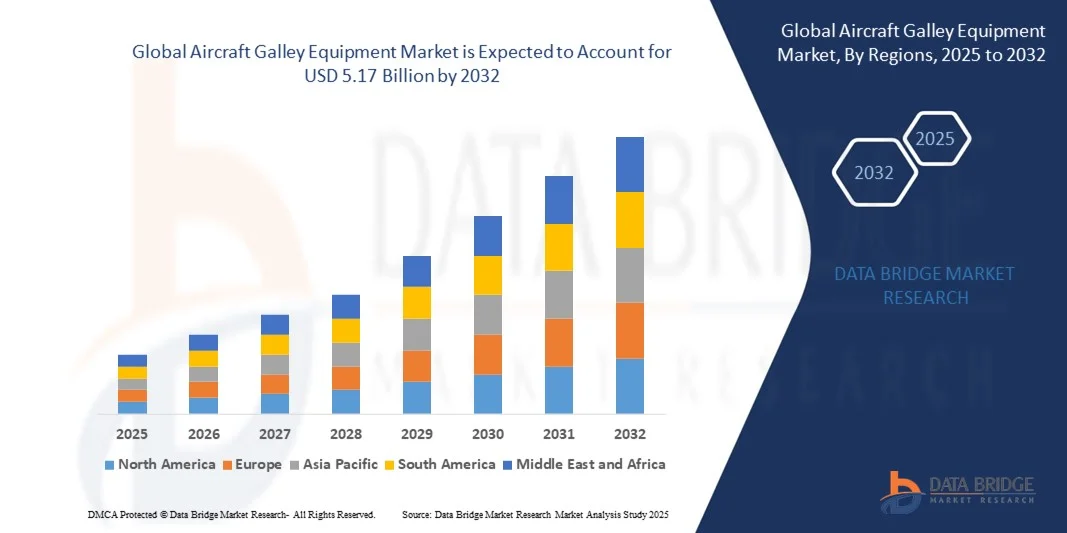

- The global aircraft galley equipment market size was valued at USD 3.64 billion in 2024 and is expected to reach USD 5.17 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing production and deliveries of commercial aircraft, coupled with rising passenger traffic that drives demand for modernized cabin interiors and efficient catering systems

- Furthermore, airlines’ growing focus on lightweight, modular, and energy-efficient galley solutions to enhance fuel efficiency and reduce operational costs is accelerating adoption. These converging factors are strengthening the uptake of advanced galley equipment, thereby significantly boosting the industry’s growth

Aircraft Galley Equipment Market Analysis

- Aircraft galley equipment refers to the specialized systems and inserts installed onboard to support in-flight catering, storage, and service operations. These include ovens, coffee makers, trolleys, refrigeration units, and modular galley designs, all tailored to improve operational efficiency and passenger experience

- The escalating demand for aircraft galley equipment is primarily fueled by rapid fleet expansion, rising investments in cabin modernization, and the growing preference for customized and premium in-flight services. Airlines are increasingly adopting advanced galley systems to optimize space utilization, improve service quality, and align with sustainability objectives

- North America dominated the aircraft galley equipment market with a share of 40.5% in 2024, due to strong aircraft production and deliveries from OEMs such as Boeing

- Asia-Pacific is expected to be the fastest growing region in the aircraft galley equipment market during the forecast period due to increasing air passenger traffic, rapid fleet expansion, and rising aircraft deliveries in countries such as China, Japan, and India

- Line fit segment dominated the market with a market share of 61.8% in 2024, due to its integration into new aircraft deliveries by major OEMs such as Airbus and Boeing. Airlines typically prefer line-fit galleys as they come factory-installed, ensuring standardization, quality assurance, and compliance with aircraft certification requirements. Increasing global air passenger traffic and new aircraft orders are sustaining the growth of this segment

Report Scope and Aircraft Galley Equipment Market Segmentation

|

Attributes |

Aircraft Galley Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Galley Equipment Market Trends

Rising Adoption of Modular and Lightweight Galley Systems

- The rising preference for modular and lightweight galley systems is shaping the aircraft galley equipment market as airlines focus on enhancing efficiency, fuel savings, and cabin space optimization. Manufacturers are developing advanced galley systems that use composite materials and modular designs to reduce weight without compromising functionality and passenger service quality

- For instance, Bucher Group has introduced modular galley solutions designed for long-haul aircraft, allowing airlines to customize layouts and integrate lighter materials. This highlights how market leaders are responding to airline demands for reduced operational costs and improved design flexibility in galley systems

- Weight reduction remains a primary driver since every kilogram saved translates to significant fuel efficiency improvements and cost savings over time. Lightweight galleys improve operational economics and also boost sustainability in line with airlines’ carbon-reduction commitments

- The modular approach allows airlines to adapt galley layouts according to specific service requirements, thereby improving space utilization in both narrowbody and widebody aircraft. This provides airlines with the ability to optimize cabin design while maintaining passenger comfort and service standards

- Technological advancements have further enhanced galley systems with features such as energy-efficient ovens, smart beverage dispensers, and compact refrigeration units. These innovations allow for multifunctional use within reduced spaces while ensuring better energy management on flights

- In conclusion, the trend toward modular and lightweight galley systems is transforming cabin interior strategies. As fuel efficiency, customization, and environmental goals become more critical, this shift is expected to redefine the competitive standards of galley equipment globally

Aircraft Galley Equipment Market Dynamics

Driver

Increasing Aircraft Deliveries and Fleet Modernization Programs

- The steady increase in global aircraft deliveries and fleet modernization initiatives is a major driver of growth in the galley equipment market. Airlines are expanding fleets to meet rising passenger traffic demand, making high-quality galley installations essential for enhancing in-flight services and operational efficiency

- For instance, Safran Cabin has partnered with Airbus to supply advanced galley equipment for newer A320 and A350 aircraft deliveries. This collaboration showcases how major equipment providers are directly benefiting from rising aircraft production and deliveries worldwide

- Modernization programs aimed at upgrading cabins are further influencing demand for advanced galley systems. Airlines are replacing old galley structures with lighter and more efficient equipment to improve fuel economy while offering better service capabilities to passengers

- As the number of international travelers increases, particularly in fast-growing markets such as Asia-Pacific and the Middle East, the demand for new aircraft accompanies the requirement for innovative galley solutions. This ensures galley equipment continues to grow in tandem with fleet expansions and upgrades

- In summary, the combination of increased aircraft deliveries and extensive fleet modernization strategies is fueling consistent growth in galley equipment adoption. This driver reflects the strong link between aviation expansion and in-flight service infrastructure advancements

Restraint/Challenge

High Initial Investment

- The high initial investment required for advanced galley equipment poses a key challenge for airlines and operators. Lightweight and modular systems, although offering long-term operational savings, often involve significant upfront costs due to advanced technology integration and specialized materials

- For instance, airlines upgrading fleets with premium galley solutions from firms such as JAMCO Corporation face high procurement expenses. These costs can be a major barrier for budget carriers or smaller operators looking to balance service quality with financial constraints

- The integration of energy-efficient ovens, smart beverage dispensers, and compact refrigeration systems further increases the capital required. While these innovations enhance passenger service, the immediate investment demand often slows adoption among cost-conscious airlines

- In addition, retrofitting existing aircraft with new galley systems involves not just procurement but also labor, installation, and downtime expenses. These factors make the overall process resource-intensive, creating hesitancy in large-scale implementation

- Ultimately, the high upfront investment continues to limit faster market penetration of advanced galley equipment. Overcoming this restraint will require more cost-effective solutions, flexible financing options, and long-term ROI demonstration to encourage broader airline adoption across regions

Aircraft Galley Equipment Market Scope

The market is segmented on the basis of galley type, fit, inserts, and application.

- By Galley Type

On the basis of galley type, the aircraft galley equipment market is segmented into standard galley, modular galley, and customized galley. The standard galley segment accounted for the largest market revenue share in 2024, driven by its widespread adoption across both narrow-body and wide-body aircraft due to its cost-effectiveness and straightforward design. Airlines prefer standard galleys as they streamline catering operations, ensure reliability, and are easy to maintain, which lowers operational costs. Their compatibility with conventional insert systems and the ability to accommodate a wide range of catering equipment further strengthen their dominance.

The modular galley segment is projected to witness the fastest growth rate from 2025 to 2032, propelled by rising demand for lightweight, flexible solutions that enhance space utilization inside aircraft. Modular designs enable airlines to optimize layouts according to route requirements and passenger demands, improving operational efficiency and fuel savings. The growing trend toward cabin modernization and the push for innovative interior solutions in both premium and economy class sections are also accelerating modular galley adoption.

- By Fit

On the basis of fit, the aircraft galley equipment market is segmented into line fit and retro fit. The line fit segment dominated the market with a share of 61.8% in 2024, driven by its integration into new aircraft deliveries by major OEMs such as Airbus and Boeing. Airlines typically prefer line-fit galleys as they come factory-installed, ensuring standardization, quality assurance, and compliance with aircraft certification requirements. Increasing global air passenger traffic and new aircraft orders are sustaining the growth of this segment.

The retro fit segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the rising need for cabin refurbishment and modernization of aging fleets. Airlines are increasingly investing in retrofitting galley systems to improve passenger service quality, introduce energy-efficient equipment, and extend the lifespan of aircraft interiors. The demand is further supported by low-cost carriers seeking affordable upgrades and premium airlines enhancing their onboard service differentiation.

- By Inserts

On the basis of inserts, the market is segmented into electric inserts and non-electric inserts. The electric insert segment held the largest market revenue share in 2024, primarily due to the growing use of powered equipment such as ovens, coffee makers, and refrigeration units to improve onboard catering services. Airlines favor electric inserts for their ability to provide passengers with a wider variety of fresh and hot meals, directly impacting customer satisfaction. Their role in supporting premium cabin services and aligning with modern galley systems reinforces their market dominance.

The non-electric insert segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its energy efficiency, lightweight structure, and low maintenance needs. Non-electric inserts such as trolleys, drawers, and racks are essential for efficient storage and food handling operations, especially in narrow-body aircraft where weight reduction is a critical factor. The segment’s growth is also supported by budget carriers focusing on cost-effective catering solutions without compromising operational efficiency.

- By Application

On the basis of application, the aircraft galley equipment market is divided into narrow-body and wide-body. The narrow-body segment accounted for the largest market revenue share in 2024, driven by the high production volumes and rising demand for single-aisle aircraft globally. Airlines operating short- and medium-haul routes prefer narrow-body planes due to lower operating costs, and these aircraft require galley systems designed for quick turnaround times and efficient meal service. The expansion of low-cost carriers in Asia-Pacific and other emerging markets strongly supports this segment’s leadership.

The wide-body segment is projected to grow at the fastest pace from 2025 to 2032, fueled by rising demand for long-haul international travel and premium in-flight services. Wide-body aircraft require larger, more sophisticated galleys with advanced insert systems to cater to higher passenger capacity and premium service standards. Airlines are increasingly investing in upgraded wide-body galley equipment to differentiate service offerings, enhance passenger comfort, and align with sustainability goals through energy-efficient galley systems.

Aircraft Galley Equipment Market Regional Analysis

- North America dominated the aircraft galley equipment market with the largest revenue share of 40.5% in 2024, driven by strong aircraft production and deliveries from OEMs such as Boeing

- The demand for advanced galley systems is supported by the region’s well-established airline industry, which places high emphasis on passenger comfort and efficient onboard catering

- Airlines are continuously upgrading their cabin interiors, focusing on modern galley layouts that improve space utilization and reduce weight for better fuel efficiency. The region’s dominance is further fueled by technological innovations, strong investments in aviation infrastructure, and rising demand for premium in-flight services

U.S. Aircraft Galley Equipment Market Insight

The U.S. aircraft galley equipment market captured the largest revenue share in 2024 within North America, owing to its position as a global hub for both commercial aviation and aerospace manufacturing. The growing need for fleet modernization, alongside high domestic air traffic, drives demand for innovative galley systems. Airlines in the U.S. are investing in lightweight modular galleys, energy-efficient inserts, and smart storage solutions to optimize operational efficiency and improve passenger experience. Moreover, the presence of key manufacturers and a robust supply chain enhances the country’s leadership in the market.

Europe Aircraft Galley Equipment Market Insight

The Europe aircraft galley equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising aircraft deliveries from Airbus and the increasing adoption of sustainable aviation solutions. European airlines are focusing on lightweight galley systems that reduce carbon emissions while improving cabin space efficiency. The market is further propelled by the region’s emphasis on premium travel experiences and innovation in cabin interiors, with galleys playing a critical role in service differentiation. Both wide-body and narrow-body aircraft in Europe are being fitted with upgraded galley systems during new deliveries and retrofit programs.

U.K. Aircraft Galley Equipment Market Insight

The U.K. aircraft galley equipment market is anticipated to grow at a noteworthy CAGR, supported by its strong aviation ecosystem and high passenger demand for long-haul travel. Airlines are increasingly investing in modern galley systems to enhance in-flight catering capabilities, particularly for international routes. The U.K.’s focus on sustainability and the adoption of lightweight cabin equipment are driving upgrades in galley systems. In addiiton, the presence of major aerospace component suppliers and refurbishment programs contributes significantly to market growth.

Germany Aircraft Galley Equipment Market Insight

The Germany aircraft galley equipment market is expected to expand at a considerable CAGR, underpinned by its role as a key European aviation hub and center for aircraft component manufacturing. German carriers are emphasizing advanced galley solutions that align with energy efficiency, innovation, and passenger comfort standards. Airlines are integrating electric inserts, modular galleys, and eco-friendly materials to align with the country’s sustainability goals. The adoption of galley upgrades in both commercial fleets and corporate jets is further accelerating growth in the German market.

Asia-Pacific Aircraft Galley Equipment Market Insight

The Asia-Pacific aircraft galley equipment market is poised to grow at the fastest CAGR during 2025 to 2032, fueled by increasing air passenger traffic, rapid fleet expansion, and rising aircraft deliveries in countries such as China, Japan, and India. Airlines in the region are actively modernizing cabin interiors to meet growing demand for in-flight services while improving operational efficiency with lightweight galley systems. The affordability of aircraft components due to local manufacturing, coupled with government-backed aviation growth initiatives, makes APAC the most dynamic region for galley equipment adoption.

Japan Aircraft Galley Equipment Market Insight

The Japan aircraft galley equipment market is gaining momentum, supported by the country’s strong aviation sector, rapid urbanization, and passenger demand for premium services. Japanese carriers are emphasizing the integration of modern galley systems that support advanced electric inserts and modular layouts, aligning with the nation’s focus on high-quality, efficient service. The market is also benefiting from ongoing aircraft procurement and refurbishment programs, alongside Japan’s reputation for adopting technologically advanced, compact, and energy-efficient solutions.

China Aircraft Galley Equipment Market Insight

The China aircraft galley equipment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by its expanding middle-class population, rapid urbanization, and surge in domestic air travel. China stands as one of the world’s largest markets for aircraft production and fleet expansion, fueling strong demand for advanced galley equipment. Airlines are investing in wide-body and narrow-body aircraft with upgraded galley systems to cater to both domestic and international routes. The presence of domestic manufacturers, government aviation expansion programs, and a push toward modernized cabin interiors are major factors accelerating the market in China.

Aircraft Galley Equipment Market Share

The aircraft galley equipment industry is primarily led by well-established companies, including:

- Parker Hannifin Corp (U.S.)

- Trelleborg AB (Sweden)

- GMT Rubber-Metal-Technic Ltd (U.K.)

- Cadence Aerospace (U.S.)

- Mayday Manufacturing (U.S.)

- Socitec (France)

- AirLoc Ltd. (Switzerland)

- Angerole Mounts, LLC (U.S.)

- National Products Inc. (U.S.)

- Meeker Aviation (U.S.)

- Vibrasystems Inc. (Canada)

- Hutchinson (France)

- Butser Rubber (U.K.)

- Collins Aerospace (U.S.)

- Arkon Resources, Inc. (U.S.)

- Anti Vibration Methods (Rubber) Co. Ltd (U.K.)

- TCI Cabin Interiors (Turkey)

- Bucher Group (Switzerland)

- Avionics Support Group, Inc. (U.S.)

- MyGoFlight (U.S.)

Latest Developments in Global Aircraft Galley Equipment Market

- In November 2023, Jamco Corporation unveiled its next-generation lightweight aircraft galley systems designed to reduce fuel consumption and improve operational efficiency. This launch highlights the industry’s growing focus on weight reduction and sustainability, supporting airlines in meeting strict environmental targets. The introduction of lighter galley solutions is expected to accelerate adoption among global carriers, boosting the market’s shift toward eco-conscious and cost-efficient designs

- In May 2023, Safran Cabin announced the expansion of its manufacturing facility in Thailand to scale up production of aircraft cabin interiors, including advanced galley systems. This move strengthens Safran’s supply chain presence in Asia-Pacific, enabling it to meet the surging demand from airlines in the region. By enhancing production capacity close to one of the fastest-growing aviation markets, Safran is positioning itself to capitalize on the rising aircraft deliveries and retrofitting programs, thereby fueling regional market growth

- In November 2022, Crown Airline and J&C Aero entered into an agreement to design and produce cabin interior elements such as carpets, seat belts, and galley modifications tailored to the needs of the new operator of two aircraft. This collaboration demonstrates the increasing importance of customization in cabin interiors, with galley upgrades playing a key role in aligning with operator-specific requirements. Such projects strengthen aftermarket demand and reinforce the trend toward flexible galley configurations

- In March 2022, Lynx Air, one of Canada’s newest airlines, selected Turkish Cabin Interior (TCI) for cabin design and interior manufacturing, with the agreement covering galleys for its fleet of 40 Boeing 737 MAX 8 aircraft. This partnership underscores the rising reliance on global suppliers for high-quality galley systems in new aircraft deliveries. The deal also highlights how emerging carriers prioritize efficient and modern galley solutions to enhance passenger services and operational performance

- In July 2021, Diehl Aviation and Haeco Cabin Solutions from Haeco Group signed a preferred strategic commercial agreement to jointly deliver comprehensive cabin interiors, including galleys, lavatories, seating, and lighting. This collaboration represents a consolidation trend within the industry, where partnerships enable suppliers to offer integrated cabin solutions. By combining expertise, both companies aim to deliver more competitive and innovative galley systems, strengthening their positions in a market that increasingly values holistic cabin interior solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.