Global Aircraft Refuelling Hose Market

Market Size in USD Billion

CAGR :

%

USD

2.41 Billion

USD

3.56 Billion

2024

2032

USD

2.41 Billion

USD

3.56 Billion

2024

2032

| 2025 –2032 | |

| USD 2.41 Billion | |

| USD 3.56 Billion | |

|

|

|

|

Aircraft Refuelling Hose Market Size

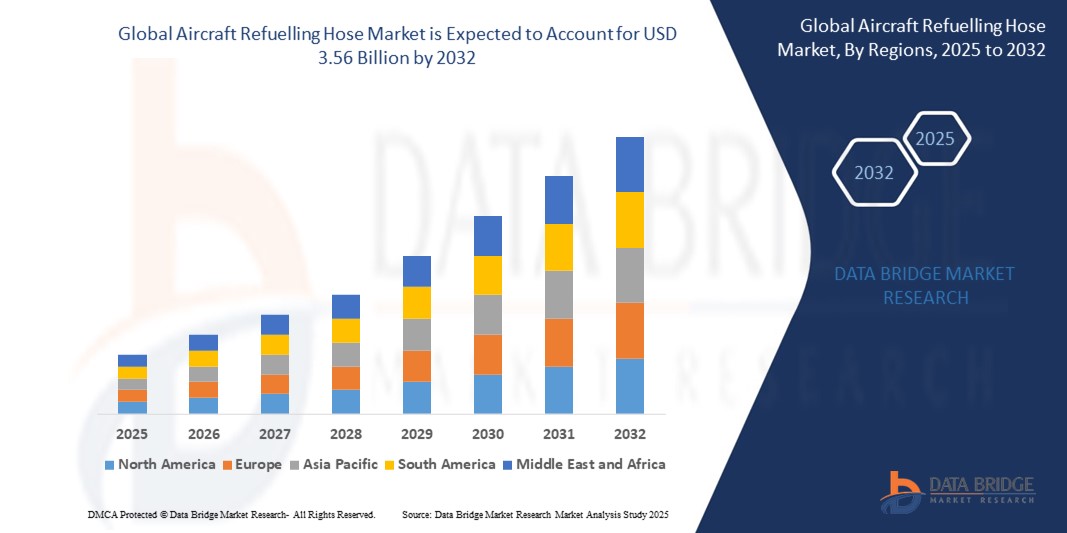

- The global aircraft refuelling hose market size was valued at USD 2.41 billion in 2024 and is expected to reach USD 3.56 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for air travel, expanding global aircraft fleet, and rising military and commercial aviation activities across developing regions

Aircraft Refuelling Hose Market Analysis

- The aircraft refuelling hose market is experiencing steady growth due to rising air traffic and a surge in commercial airline operations, particularly in Asia-Pacific and the Middle East

- Increasing investments in airport infrastructure, modernization of air force fleets, and the growing preference for aerial refuelling in defense operations are contributing significantly to market expansion

- North America dominated the aircraft refuelling hose market with the largest revenue share of 39.8% in 2024, driven by the presence of a large military fleet, advanced aviation infrastructure, and increasing investments in commercial air travel

- Asia-Pacific region is expected to witness the highest growth rate in the global aircraft refuelling hose market, driven by rapid expansion of commercial aviation, increasing defense budgets, and large-scale airport infrastructure projects in countries such as China, India, and Japan

- The composite hose segment held the largest market revenue share in 2024, driven by its lightweight construction, high flexibility, and superior resistance to fuel degradation and extreme weather. Composite hoses are widely used in military and commercial aircraft due to their safety features, durability, and ability to handle high-pressure refuelling operations. Their compatibility with a range of aviation fuels also contributes to their widespread adoption across global refuelling systems

Report Scope and Aircraft Refuelling Hose Market Segmentation

|

Attributes |

Aircraft Refuelling Hose Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Military Aerial Refuelling Operations • Increasing Adoption of Sustainable Aviation Fuel Systems |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Refuelling Hose Market Trends

“Integration of Lightweight and Durable Composite Materials in Hose Design”

- Increasing integration of thermoplastic composites and aramid fibers is enhancing hose durability, flexibility, and pressure tolerance, especially under harsh operational conditions

- These materials reduce overall system weight, contributing to improved aircraft fuel efficiency and easier handling during ground operations

- Composite hoses demonstrate higher resistance to UV exposure, static build-up, and fuel degradation, making them ideal for frequent use in commercial and military aviation

- Growing demand for hoses that can support biofuel and alternative fuel compatibility is pushing manufacturers to innovate in material science

- Several aviation equipment suppliers are focusing on producing hoses that meet new environmental and mechanical benchmarks without compromising performance

- For instance, GKN Aerospace introduced high-performance lightweight hoses using reinforced polymer layers, which are now used in advanced military refuelling systems for improved fuel handling under extreme pressures

Aircraft Refuelling Hose Market Dynamics

Driver

“Growing Demand for Commercial Air Travel and Global Fleet Expansion”

- Rising middle-class population, increased tourism, and improved air connectivity have led to a notable surge in global air passenger traffic

- Airlines are expanding their fleets with newer fuel-efficient aircraft, requiring compatible, high-specification refuelling hoses for both hydrant and overwing operations

- Airport modernization projects across emerging economies are driving investments in upgraded refuelling infrastructure, including hose reels and couplings

- Aircraft turnaround time is becoming a critical factor, leading ground support operators to adopt more efficient and fast-refuelling hose systems

- Regulatory support for expanding regional connectivity and fleet renewal programs is further boosting demand for certified hose assemblies

- For instance, India’s UDAN (Ude Desh ka Aam Nagrik) scheme has triggered a sharp increase in regional air services, prompting new airport developments that include advanced refuelling systems supported by premium-grade hoses

Restraint/Challenge

“Stringent Safety Regulations and Certification Standards”

- Refuelling hoses are required to pass rigorous safety, pressure, conductivity, and flammability tests under international aviation regulations, including EN, SAE, and FAA standards

- Achieving these certifications demands significant investment in R&D, laboratory infrastructure, and compliance documentation, increasing time-to-market

- Small and mid-sized players often face competitive disadvantages due to the financial burden and technical expertise required for certification

- Constant revisions in safety protocols—especially with the growing use of alternative fuels—can render existing hose products non-compliant, leading to recalls or redevelopment

- Delays in certification approvals can stall production schedules, disrupt supplier contracts, and limit product availability in fast-growing aviation markets

- For instance, a European aerospace supplier experienced an 8-month delay in deploying new biofuel-compatible hoses due to updated EN 1361 aviation standards, resulting in lost contracts with two regional airports

Aircraft Refuelling Hose Market Scope

The market is segmented on the basis of type, application, and sales channel.

• By Type

On the basis of type, the aircraft refuelling hose market is segmented into composite hose, stainless steel hose, and rubber hose. The composite hose segment held the largest market revenue share in 2024, driven by its lightweight construction, high flexibility, and superior resistance to fuel degradation and extreme weather. Composite hoses are widely used in military and commercial aircraft due to their safety features, durability, and ability to handle high-pressure refuelling operations. Their compatibility with a range of aviation fuels also contributes to their widespread adoption across global refuelling systems.

The rubber hose segment is expected to witness a fastest growth rate from 2025 to 2032, owing to its cost-effectiveness, flexibility, and ease of handling during ground operations. These hoses are particularly favored for commercial ground support at smaller airports and helipads where lower pressure tolerance is sufficient. In addition, advancements in synthetic rubber formulations have enhanced the hose’s lifespan and resistance to abrasion and chemical exposure.

• By Application

On the basis of application, the market is segmented into helicopters, military aircraft, unmanned aerial vehicle (UAV), and commercial aircraft. The military aircraft segment led the market with the largest revenue share in 2024, driven by the growing emphasis on aerial refuelling capabilities and increased global defense spending. High-performance hose systems are critical in mid-air refuelling missions, requiring exceptional pressure durability and anti-static features.

The UAV segment is to expected witness a fastest growth rate from 2025 to 2032, due to rising defense and surveillance applications. As UAVs become more sophisticated and long-range capable, the need for compact, lightweight, and efficient refuelling hoses has risen, prompting manufacturers to develop customized solutions for unmanned systems.

• By Sales Channel

On the basis of sales channel, the market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment accounted for the largest market share in 2024, supported by ongoing aircraft production and increasing orders for next-generation military and commercial aircraft. OEMs prioritize durable, certified hose systems that can be integrated into new aircraft during assembly.

The aftermarket segment is expected to witness a fastest growth rate from 2025 to 2032 due to the frequent need for hose replacement, maintenance, and retrofitting in existing aircraft fleets. Airlines and defense forces regularly procure high-performance hoses through aftermarket suppliers to ensure fuel system integrity and compliance with updated safety standards.

Aircraft Refuelling Hose Market Regional Analysis

• North America dominated the aircraft refuelling hose market with the largest revenue share of 39.8% in 2024, driven by the presence of a large military fleet, advanced aviation infrastructure, and increasing investments in commercial air travel

• The region benefits from a robust aerospace manufacturing ecosystem, frequent technological upgrades, and widespread adoption of aerial refuelling systems across defense and civil aviation sectors

• High demand for durable and certified refuelling hoses, particularly in military air-to-air refuelling and commercial ground support operations, continues to fuel market expansion in both the U.S. and Canada

U.S. Aircraft Refuelling Hose Market Insight

The U.S. aircraft refuelling hose market accounted for the largest revenue share of 82% in North America in 2024, supported by extensive defense spending and the presence of key aerospace OEMs. The country’s growing focus on upgrading air force refuelling fleets, combined with a high frequency of domestic and international flights, is driving the demand for high-performance hoses. In addition, the use of composite hoses in advanced tanker aircraft such as the KC-46 Pegasus is contributing to market growth.

Europe Aircraft Refuelling Hose Market Insight

The Europe aircraft refuelling hose market is expected to witness a fastest growth rate from 2025 to 2032, driven by stringent aviation fuel safety regulations and rising investment in green aviation infrastructure. The region is also witnessing increased aerial refuelling demand due to NATO-led defense initiatives and multinational military exercises. Furthermore, European commercial airports are focusing on efficient ground support systems, including the replacement of aging refuelling hose assemblies to meet environmental and operational standards.

U.K. Aircraft Refuelling Hose Market Insight

The U.K. aircraft refuelling hose market is expected to witness a fastest growth rate from 2025 to 2032, driven by modernization in its Royal Air Force operations and ongoing investments in sustainable aviation technologies. The integration of high-performance hoses into ground fuelling vehicles and air-to-air refuelling systems is gaining traction, especially as the country enhances its defense mobility and airport service capabilities in response to global geopolitical developments.

Germany Aircraft Refuelling Hose Market Insight

The Germany aircraft refuelling hose market is expected to witness a fastest growth rate from 2025 to 2032 due to the nation’s focus on upgrading both civil and military aviation infrastructure. Germany’s commitment to EU climate targets has led to the adoption of biofuel-compatible hose systems at major airports. Moreover, the country’s leadership in engineering and aerospace innovation supports the development and deployment of advanced hose materials designed for operational longevity and fuel efficiency.

Asia-Pacific Aircraft Refuelling Hose Market Insight

The Asia-Pacific aircraft refuelling hose market is expected to witness a fastest growth rate from 2025 to 2032, supported by rapid fleet expansion, increasing defense budgets, and rising air travel demand in countries such as China, India, and Japan. Government-led initiatives to modernize airports and military refuelling capabilities are accelerating the deployment of advanced hose systems. In addition, the growing manufacturing base for aviation components is improving regional accessibility and affordability.

Japan Aircraft Refuelling Hose Market Insight

The Japan aircraft refuelling hose market is expected to witness a fastest growth rate from 2025 to 2032 due to the country's strategic defense upgrades and growing demand for resilient ground support systems. Japan’s adoption of advanced military aircraft and increasing involvement in international defense cooperation are boosting the need for high-spec refuelling hoses. Moreover, investments in smart airport infrastructure are contributing to wider adoption of durable and environmentally compliant hose technologies.

China Aircraft Refuelling Hose Market Insight

The China aircraft refuelling hose market held the largest revenue share in Asia Pacific in 2024, driven by the country’s rapidly expanding commercial aviation sector and substantial investment in military modernization. China’s development of indigenous refuelling aircraft and expanding fleet of civilian airliners is fueling the need for both OEM and aftermarket hose solutions. The government's strong focus on infrastructure, including airport expansions and smart city projects, further supports continued growth in this market.

Aircraft Refuelling Hose Market Share

The Aircraft Refuelling Hose industry is primarily led by well-established companies, including:

- Eaton (Ireland)

- PARKER HANNIFIN CORP (U.S.)

- RYCO Hydraulics (Australia)

- Kurt Manufacturing (U.S.)

- NORRES Schlauchtechnik GmbH (Germany)

- Transfer Oil S.p.A (Italy)

- ContiTech AG (Germany)

- Kanaflex Corporation Co.,ltd. (Japan)

- Pacific Echo (U.S.)

- Colex International Limited (U.K.)

- Gates Corporation (U.S.)

- Semperit AG Holding (Austria)

- KURIYAMA OF AMERICA, INC. (U.S.)

- Titeflex (U.S.)

- Trelleborg Group (Sweden)

- Flexaust Inc. (U.S.)

- Salem-Republic Rubber Company (U.S.)

- PIRTEK (Australia)

- Dixon Valve & Coupling Company, LLC (U.S.)

- Titan Fittings (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AIRCRAFT REFUELLING HOSE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIO

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AIRCRAFT REFUELLING HOSE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AIRCRAFT REFUELLING HOSE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

5.6 COMPANY COMPARITIVE ANALYSIS

5.7 PRICING ANALYSIS

6 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY TYPE

6.1 OVERVIEW

6.2 COMPOSITE HOSE

6.3 STAINLESS STEEL HOSE

6.4 RUBBER HOSE

6.5 OTHERS

7 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY WORKING PRESSURE

7.1 OVERVIEW

7.2 LESS THAN 200 PSI

7.3 MORE THAN 200 PSI

8 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY SIZE

8.1 OVERVIEW

8.2 LESS 2 INCH

8.3 ABOVE 2 INCH

9 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY AIRCRAFT TYPE

9.1 OVERVIEW

9.2 NARROW BODY

9.3 WIDE BODY

9.4 ROTOCRAFT

10 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 REEL HOSES

10.3 PLATFORM (DECK) HOSES

10.4 HYDRANT DISPENSER INLET HOSES

10.5 FUELLER LOADING HOSES

11 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY FUEL TYPE

11.1 OVERVIEW

11.2 AVIATION GASOLINE

11.3 JET FUELS

11.4 OTHERS (ANTI-ICINGS FLUIDS AND MOTOR OILS)

12 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY END USER

12.1 OVERVIEW

12.2 COMMERCIAL AVIATION

12.2.1 BY TYPE

12.2.1.1.1. COMPOSITE HOSE

12.2.1.1.2. STAINLESS STEEL HOSE

12.2.1.1.3. RUBBER HOSE

12.2.1.1.4. OTHERS

12.3 MILITARY AVIATION

12.3.1 MILITARY AVIATION, BY TYPE

12.3.1.1.1. TRAINING AIRCRAFT

12.3.1.1.2. COMBAT AIRCRAFT

12.3.1.1.3. HELICOPTERS

12.3.1.1.4. TRANSPORT AIRCRAFT

12.3.2 BY TYPE

12.3.2.1.1. COMPOSITE HOSE

12.3.2.1.2. STAINLESS STEEL HOSE

12.3.2.1.3. RUBBER HOSE

12.3.2.1.4. OTHERS

12.4 OTHERS

13 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY REGION

14.1 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 NORTH AMERICA

14.1.1.1.1. U.S.

14.1.1.1.2. CANADA

14.1.1.1.3. MEXICO

14.1.2 EUROPE

14.1.2.1.1. GERMANY

14.1.2.1.2. FRANCE

14.1.2.1.3. U.K.

14.1.2.1.4. ITALY

14.1.2.1.5. SPAIN

14.1.2.1.6. RUSSIA

14.1.2.1.7. TURKEY

14.1.2.1.8. BELGIUM

14.1.2.1.9. NETHERLANDS

14.1.2.1.10. SWITZERLAND

14.1.2.1.11. SWEDEN

14.1.2.1.12. DENMARK

14.1.2.1.13. NORWAY

14.1.2.1.14. POLAND

14.1.2.1.15. CZECH REPUBLIC

14.1.2.1.16. REST OF EUROPE

14.1.3 ASIA PACIFIC

14.1.3.1.1. JAPAN

14.1.3.1.2. CHINA

14.1.3.1.3. SOUTH KOREA

14.1.3.1.4. INDIA

14.1.3.1.5. AUSTRALIA

14.1.3.1.6. SINGAPORE

14.1.3.1.7. THAILAND

14.1.3.1.8. MALAYSIA

14.1.3.1.9. INDONESIA

14.1.3.1.10. PHILIPPINES

14.1.3.1.11. VIETNAM

14.1.3.1.12. TAIWAN

14.1.3.1.13. REST OF ASIA PACIFIC

14.1.4 SOUTH AMERICA

14.1.4.1.1. BRAZIL

14.1.4.1.2. ARGENTINA

14.1.4.1.3. COLOMBIA

14.1.4.1.4. PERU

14.1.4.1.5. CHILE

14.1.4.1.6. ECUADOR

14.1.4.1.7. REST OF SOUTH AMERICA

14.1.5 MIDDLE EAST AND AFRICA

14.1.5.1.1. SOUTH AFRICA

14.1.5.1.2. EGYPT

14.1.5.1.3. SAUDI ARABIA

14.1.5.1.4. U.A.E

14.1.5.1.5. ISRAEL

14.1.5.1.6. KUWAIT

14.1.5.1.7. QATAR

14.1.5.1.8. OMAN

14.1.5.1.9. REST OF MIDDLE EAST AND AFRICA

14.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL AIRCRAFT REFUELLING HOSE MARKET , COMPANY PROFILE

17.1 CONTITECH

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 PARKER HANNIFI N CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 POLYHOSE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 EATON

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 APACHE MOTION IND.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 DELAFIELD CORPORATION

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AERO-HOSE, CORP.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SEMPERIT AG HOLDING

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 TITEFLEX.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 TRELLEBORG GROUP

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 FLEXAUST INC

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 SALEM-REPUBLIC RUBBER COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 PIRTEK

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 DIXON VALVE & COUPLING COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 AIRBUS S.A.S

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 LOCKHEED MARTIN

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 TITAN ASIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 BOEING.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 SAFRAN

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 IAI

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 HUSKY CORPORATION

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 AERO-HOSE, CORP.

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.