Global Aircraft Seals Market

Market Size in USD Billion

CAGR :

%

USD

3.05 Billion

USD

4.72 Billion

2024

2032

USD

3.05 Billion

USD

4.72 Billion

2024

2032

| 2025 –2032 | |

| USD 3.05 Billion | |

| USD 4.72 Billion | |

|

|

|

|

Aircraft Seals Market Size

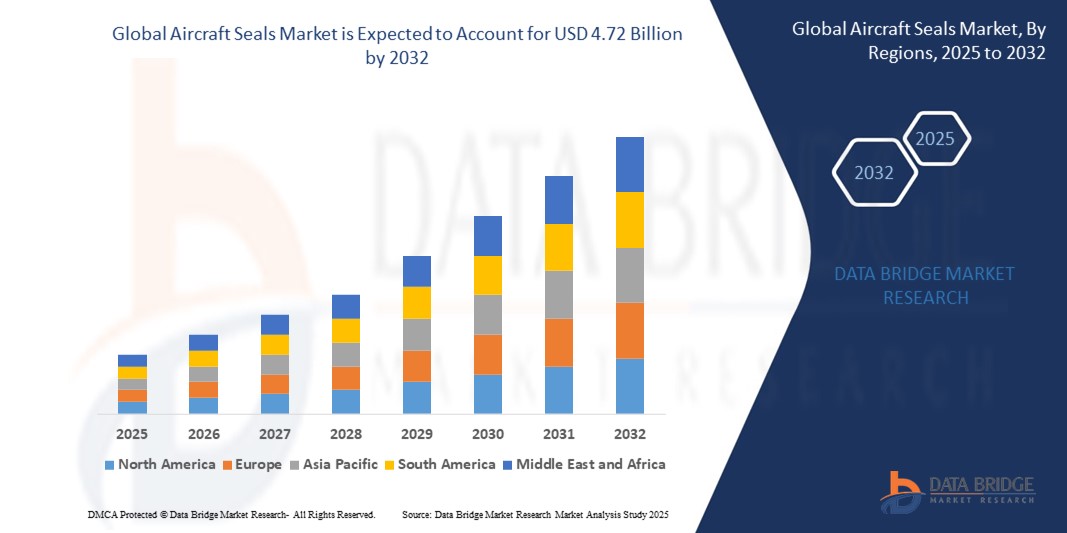

- The global aircraft seals market size was valued at USD 3.05 billion in 2024 and is expected to reach USD 4.72 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is primarily driven by increasing demand for fuel-efficient aircraft, advancements in aerospace materials, and the rising production of commercial and military aircraft globally

- In addition, the growing adoption of unmanned aerial vehicles (UAVs) and the need for high-performance sealing solutions in extreme aerospace environments are significantly boosting the industry's expansion

Aircraft Seals Market Analysis

- Aircraft seals, critical for maintaining pressure, preventing fluid leaks, and ensuring operational efficiency in aircraft systems, are integral to the safety and performance of modern aircraft across commercial, military, and unmanned platforms

- The surge in demand for aircraft seals is fueled by the expansion of the global aviation industry, increasing air passenger traffic, and the need for lightweight, durable sealing solutions to enhance fuel efficiency and reduce maintenance costs

- North America dominated the aircraft seals market with the largest revenue share of 42.5% in 2024, driven by a robust aerospace industry, significant investments in defense and commercial aviation, and the presence of major manufacturers in the U.S. Innovations in advanced materials and sealing technologies further support market growth in this region

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing air travel demand, and growing aerospace manufacturing in countries such as China and India

- The dynamic seals segment dominated the largest market revenue share of 45% in 2024, driven by their extensive use in applications involving moving components, such as engine systems and flight control and hydraulics systems

Report Scope and Aircraft Seals Market Segmentation

|

Attributes |

Aircraft Seals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Seals Market Trends

Increasing Adoption of Advanced Materials and Smart Sealing Technologies

- The global aircraft seals market is experiencing a significant trend toward the integration of advanced materials, such as high-performance elastomers, composites, and lightweight polymers, to enhance seal durability and performance

- These materials are designed to withstand extreme temperatures, pressure fluctuations, and chemical exposure, improving fuel efficiency and reducing maintenance costs

- Smart sealing technologies, such as self-healing seals and sensor-integrated seals, are gaining traction, enabling real-time monitoring of seal health and predictive maintenance to prevent failures

- For instance, companies are developing seals with embedded sensors that detect wear or damage, allowing for proactive replacements and minimizing aircraft downtime

- This trend is increasing the reliability and efficiency of seals, making them more appealing to aircraft manufacturers and operators across commercial, military, and unmanned aerial vehicle (UAV) segments

- Advanced materials such as fluorosilicone and carbon composites are being utilized to optimize sealing performance in critical applications, such as engine systems and flight control hydraulics, supporting lightweight aircraft designs and compliance with environmental regulations

Aircraft Seals Market Dynamics

Driver

Rising Demand for Fuel-Efficient Aircraft and Stringent Safety Regulations

- The growing demand for fuel-efficient and environmentally sustainable aircraft is a key driver for the global aircraft seals market, as advanced seals contribute to aerodynamic performance and weight reduction

- Seals play a critical role in enhancing aircraft safety by preventing fluid leakage, maintaining pressure, and protecting against environmental factors in systems such as engines, airframes, and landing gear

- Government regulations, particularly in regions such as Europe and North America, mandating stringent safety and emissions standards are driving the adoption of high-performance sealing solutions

- The proliferation of unmanned aerial vehicles (UAVs) and the development of next-generation aircraft, such as hybrid and electric models, are further expanding the need for specialized seals tailored to new propulsion systems

- Aircraft manufacturers are increasingly incorporating factory-fitted seals as standard features to meet regulatory requirements and enhance aircraft reliability and value

Restraint/Challenge

High Production Costs and Stringent Regulatory Compliance

- The high cost of developing and manufacturing advanced seals, particularly those using specialized composites and polymers, poses a significant barrier to market growth, especially for smaller manufacturers or in cost-sensitive markets

- Integrating seals into complex aircraft systems, such as engines and flight control hydraulics, requires precise engineering and compliance with rigorous aerospace standards, increasing production complexity and cost

- Data security and intellectual property concerns related to smart sealing technologies, such as sensor-integrated seals, present challenges, as these systems may collect and transmit sensitive operational data, raising risks of breaches or misuse

- The fragmented regulatory landscape across regions, with varying certification and testing requirements for aircraft seals, complicates operations for global manufacturers and service providers

- These factors can deter adoption in emerging markets and limit market expansion, particularly in regions with high cost sensitivity or strict regulatory oversight

Aircraft Seals market Scope

The market is segmented on the basis of type, application, material, platform, and end use.

- By Type

On the basis of type, the global aircraft seals market is segmented into dynamic seals and static seals. The dynamic seals segment dominated the largest market revenue share of 45% in 2024, driven by their extensive use in applications involving moving components, such as engine systems and flight control and hydraulics systems. These seals ensure reliable performance under high-pressure and high-temperature conditions, critical for aircraft safety and efficiency.

The static seals segment is anticipated to witness significant growth from 2025 to 2032, fueled by their critical role in sealing stationary components such as airframes and access panels, where preventing air, fluid, or dust leakage is essential for aerodynamic integrity and environmental protection. Advancements in lightweight and durable materials further enhance their adoption.

- By Application

On the basis of application, the global aircraft seals market is segmented into engine system, airframe, avionics and electrical system, flight control and hydraulics system, and landing gear system. The engine system segment is expected to hold the largest market revenue share of 38% in 2024, driven by the critical need for seals to maintain engine efficiency, prevent fluid and gas leaks, and withstand extreme temperatures and pressures in combustors, turbines, and compressors.

The airframe segment is anticipated to experience robust growth from 2025 to 2032. The increasing focus on fuel efficiency and aerodynamic performance drives demand for high-performance seals in fuselage, wings, and flight control surfaces, which ensure structural integrity and reduce maintenance needs.

- By Material

On the basis of material, the global aircraft seals market is segmented into composites, polymers, and metals. The polymers segment is expected to hold the largest market revenue share of 50% in 2024, owing to the versatility of elastomers and fluoropolymers, which offer lightweight properties, flexibility, and resistance to extreme temperatures, chemicals, and pressure. These characteristics make them ideal for dynamic sealing applications in engines and hydraulic systems.

The composites segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by their high strength, heat resistance, and low weight, which align with the aviation industry’s demand for fuel-efficient and corrosion-resistant seals. Innovations in composite materials further enhance their adoption in high-performance applications.

- By Platform

On the basis of platform, the global aircraft seals market is segmented into fixed wing, rotary wing, and unmanned aerial vehicles (UAVs). The fixed wing segment is expected to hold the largest market revenue share of 60% in 2024, driven by the high volume of commercial, business, and military aviation aircraft, which require extensive sealing solutions for engines, airframes, and hydraulic systems to ensure safety and efficiency.

The unmanned aerial vehicles segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of UAVs in military, commercial, and surveillance applications. The demand for lightweight, durable seals to support UAVs in diverse operating conditions drives this segment’s growth.

- By End Use

On the basis of end use, the global aircraft seals market is segmented into OEM and aftermarket. The OEM segment is expected to hold the largest market revenue share of 55% in 2024, driven by the increasing production of commercial and military aircraft by major manufacturers such as Boeing and Airbus, which integrate seals during the assembly process to meet stringent safety and performance standards.

The aftermarket segment is anticipated to experience rapid growth from 2025 to 2032, fueled by the frequent replacement cycle of seals due to wear and tear, coupled with the expansion of Maintenance, Repair, and Overhaul (MRO) facilities to support aging aircraft fleets and ensure operational reliability.

Aircraft Seals Market Regional Analysis

- North America dominated the aircraft seals market with the largest revenue share of 42.5% in 2024, driven by a robust aerospace industry, significant investments in defense and commercial aviation, and the presence of major manufacturers in the U.S. Innovations in advanced materials and sealing technologies further support market growth in this region

- Consumers and manufacturers prioritize seals for preventing fluid leakage, maintaining pressure, and ensuring reliability in extreme conditions, particularly in engine systems, airframes, and flight control systems

- Growth is supported by technological advancements in seal materials, such as elastomers, composites, and polymers, alongside rising adoption in both OEM and aftermarket segments

U.S. Aircraft Seals Market Insight

The U.S. smart lock market captured the largest revenue share of 85.7% in 2024 within North America, fueled by strong demand from both OEMs and aftermarket services, as well as growing consumer awareness of the importance of high-performance seals for safety and fuel efficiency. The trend towards lightweight and durable materials, such as advanced composites and elastomers, further boosts market expansion. The presence of major aerospace manufacturers and extensive MRO (Maintenance, Repair, and Overhaul) facilities supports a diverse product ecosystem.

Europe Aircraft Seals Market Insight

The Europe aircraft seals market is expected to witness significant growth, supported by stringent regulatory standards emphasizing aircraft safety and performance. Consumers and manufacturers seek seals that enhance system reliability while offering resistance to extreme temperatures and pressures. Growth is prominent in both new aircraft production and retrofit projects, with countries such as Germany and France showing significant uptake due to advanced aerospace industries and environmental concerns.

U.K. Aircraft Seals Market Insight

The U.K. market for aircraft seals is expected to witness rapid growth, driven by demand for high-performance seals that improve system efficiency and safety in commercial and military aircraft. Increased focus on aircraft aesthetics, fuel efficiency, and compliance with evolving safety regulations encourages adoption. The integration of advanced materials such as polymers and composites in both OEM and aftermarket applications further supports market growth.

Germany Aircraft Seals Market Insight

Germany is expected to witness a high growth rate in the aircraft seals market, attributed to its advanced aerospace manufacturing sector and strong consumer focus on aircraft performance and energy efficiency. German manufacturers prefer technologically advanced seals that reduce maintenance costs and enhance durability in engine systems and airframes. The integration of these seals in premium aircraft and aftermarket services supports sustained market growth.

Asia-Pacific Aircraft Seals Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global aircraft seals market, driven by expanding aerospace production and rising investments in countries such as China, India, and Japan. Increasing awareness of fuel efficiency, safety, and environmental benefits is boosting demand for advanced seals. Government initiatives promoting aerospace innovation and safety standards further encourage the adoption of high-performance sealing solutions.

Japan Aircraft Seals Market Insight

Japan’s aircraft seals market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced seals that enhance aircraft safety and performance. The presence of major aerospace manufacturers and the integration of seals in OEM aircraft accelerate market penetration. Rising interest in aftermarket maintenance and customization also contributes to growth.

China Aircraft Seals Market Insight

China holds the largest share of the Asia-Pacific aircraft seals market, propelled by rapid growth in aerospace production, increasing aircraft ownership, and rising demand for advanced sealing solutions for safety and efficiency. The country’s expanding aerospace industry and focus on technological innovation support the adoption of advanced seals made from composites and polymers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Aircraft Seals Market Share

The aircraft seals industry is primarily led by well-established companies, including:

- SKF (Sweden)

- Saint-Gobain Group (France)

- Trelleborg AB (Sweden)

- Meggitt PLC (U.K.)

- Parker Hannifin Corp. (U.S.)

- METAX GmbH (Germany)

- PAULSTRA SNC (France)

- Harwal Ltd (U.A.E)

- Dichtomatik (Germany)

- Temel Gaskets (Turkey)

- W. L. Gore & Associates, Inc. (U.S.)

- Repack-S (Italy)

- Eaton (U.S.)

- Dp Seals Ltd. (U.K.)

- Rexnord Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- STACEM (France)

What are the Recent Developments in Global Aircraft Seals Market?

- In May 2025, Trelleborg Sealing Solutions, part of the Trelleborg Group, acquired Aero-Plastics, Inc., a U.S.-based specialist in high-performance polymer components for aircraft interiors. This strategic move strengthens Trelleborg’s aerospace portfolio by adding expertise in precision injection molding, thermoforming, and machining of advanced polymer materials. Aero-Plastics also brings value-added capabilities such as assembly, engraving, and specialized coatings. The acquisition supports Trelleborg’s expansion in the growing aerospace sector, particularly in seals and structural interior components, and aligns with its commitment to long-term customer relationships and innovation

- In July 2024, Marsh Brothers Aviation Inc. received Transport Canada approval for its innovative King Air Flap Roller bearing—the company’s first polymer bearing solution for commercial aircraft. This grease-free, self-lubricating bearing addresses a long-standing maintenance issue in Beechcraft King Air aircraft, offering improved safety, reduced operating costs, and enhanced reliability. The new design eliminates the need for supplemental lubrication, minimizing wear and tear on flap tracks and simplifying installation. This milestone marks a significant advancement in polymer-based aviation components and reflects Marsh Brothers’ commitment to modernizing aircraft systems

- In May 2024, Michelin Aviation joined forces with CDI Products and Fenner Precision Polymers to unveil a comprehensive solution strategy designed to simplify aircraft maintenance and elevate quality standards across aerospace operations. This collaboration leverages the strengths of all three companies—Michelin’s legacy in aviation tires, CDI’s expertise in high-performance polymer components, and Fenner’s advanced elastomeric technologies—to deliver more efficient and reliable sealing and maintenance solutions. By consolidating supplier networks and streamlining processes, the partnership aims to reduce operational risks and improve overall aircraft performance

- In February 2024, Saint-Gobain announced a definitive agreement to acquire CSR Limited, a leading Australian building products company.This strategic move expands Saint-Gobain’s footprint in the Asia-Pacific region and strengthens its position in light and sustainable construction. While CSR’s core focus is not on sealing technologies, its diverse portfolio—including insulation, plasterboard, and other building materials—could complement Saint-Gobain’s offerings in advanced materials and sealing solutions, potentially impacting sectors such as aerospace, automotive, and industrial manufacturing

- In June 2023, Parker Aerospace significantly broadened its aircraft systems portfolio following the merger of Parker-Hannifin and Meggitt. This strategic combination united Parker-Hannifin’s strengths in wing sealing, shielding, hydraulics, and flight control actuation with Meggitt’s advanced technologies in engine sensors, composites, braking systems, and thermal management. The merger enabled Parker Aerospace to offer more integrated and efficient sealing solutions, particularly in aircraft fabrication, while also supporting industry trends such as electrification and sustainability. The expanded portfolio positions the company as a more versatile and competitive player in the global aerospace market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.