Global Aircraft Soft Goods Market

Market Size in USD Million

CAGR :

%

USD

597.17 Million

USD

792.45 Million

2025

2033

USD

597.17 Million

USD

792.45 Million

2025

2033

| 2026 –2033 | |

| USD 597.17 Million | |

| USD 792.45 Million | |

|

|

|

|

Aircraft Soft Goods Market Size

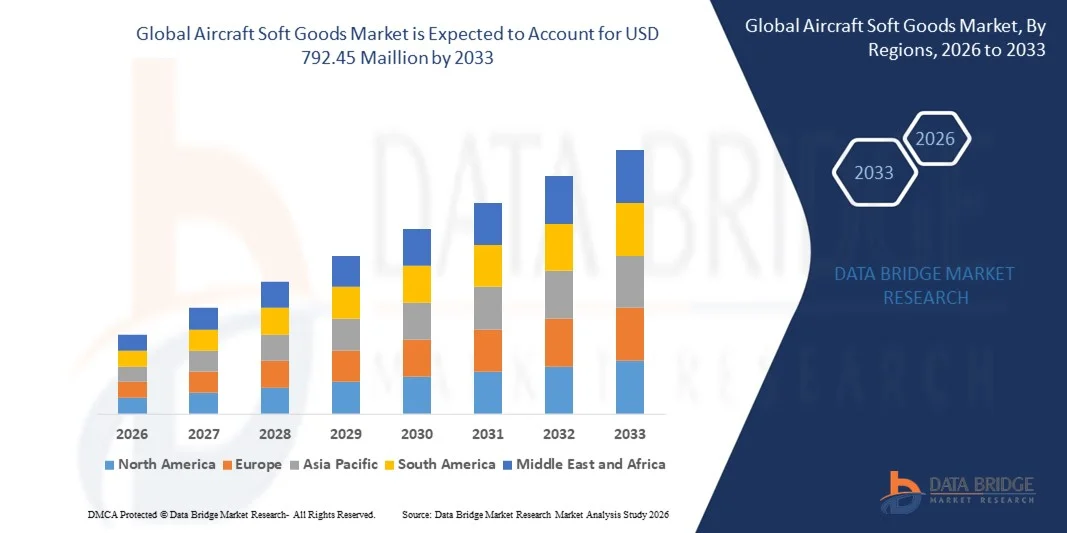

- The global aircraft soft goods market size was valued at USD 597.17 million in 2025 and is expected to reach USD 792.45 million by 2033, at a CAGR of 3.60% during the forecast period

- The market growth is largely driven by the expanding global aircraft fleet and the increasing focus of airlines and operators on cabin modernization, passenger comfort, and interior aesthetics across commercial, regional, and business aircraft

- Furthermore, rising demand for lightweight, durable, and regulation-compliant interior materials to improve fuel efficiency and reduce maintenance costs is strengthening the adoption of advanced aircraft soft goods, thereby accelerating overall market growth

Aircraft Soft Goods Market Analysis

- Aircraft soft goods, including carpets, seat covers, and curtains, play a critical role in enhancing cabin comfort, safety compliance, and brand differentiation for airlines and aircraft operators across both new aircraft deliveries and retrofit programs

- The growing emphasis on cabin refurbishment, sustainability-oriented materials, and frequent replacement cycles driven by high aircraft utilization is significantly fueling demand for aircraft soft goods in both OEM and aftermarket segments

- North America dominated the aircraft soft goods market with a share of 38.60% in 2025, due to the presence of a large commercial and business aircraft fleet and continuous investments in cabin refurbishment

- Asia-Pacific is expected to be the fastest growing region in the aircraft soft goods market during the forecast period due to rapid expansion of commercial aircraft fleets and increasing air passenger traffic

- Commercial segment dominated the market with a market share of 47% in 2025, due to the high global fleet size and continuous demand for cabin refurbishment and replacement of interior components. Airlines operating commercial aircraft focus heavily on passenger comfort, durability, and compliance with aviation safety standards, which drives consistent demand for carpets, seat covers, and curtains

Report Scope and Aircraft Soft Goods Market Segmentation

|

Attributes |

Aircraft Soft Goods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Soft Goods Market Trends

Growing Adoption of Lightweight and Sustainable Cabin Textile Materials

- A key trend in the aircraft soft goods market is the increasing adoption of lightweight and sustainable cabin textile materials as airlines and aircraft manufacturers focus on improving fuel efficiency and reducing environmental impact. Lightweight carpets, seat fabrics, and curtains directly contribute to lower aircraft weight, enabling operators to reduce fuel consumption while maintaining passenger comfort and interior durability

- For instance, Lantal supplies lightweight and flame-retardant cabin textiles to multiple global airlines, supporting weight reduction initiatives while meeting stringent aviation safety standards. These materials help airlines balance operational efficiency with regulatory compliance and aesthetic requirements

- Sustainability is becoming a central consideration as airlines increasingly seek materials with recycled content and lower lifecycle emissions. This shift is influencing supplier innovation toward eco-friendly fabrics and leather alternatives that align with airline sustainability targets and environmental reporting frameworks

- Aircraft manufacturers are also supporting this trend by integrating advanced soft goods into new aircraft programs to enhance overall efficiency. The preference for lightweight and sustainable materials is strengthening collaboration between OEMs and interior suppliers during the aircraft design and production phases

- Cabin modernization programs across aging fleets are further accelerating adoption as airlines replace heavier legacy materials with modern textile solutions. This trend is reshaping procurement strategies and reinforcing the importance of innovation in aircraft soft goods

- Overall, the growing focus on sustainability and weight optimization is positioning lightweight cabin textile materials as a defining trend that supports efficiency, compliance, and long-term cost reduction in the aircraft soft goods market

Aircraft Soft Goods Market Dynamics

Driver

Growing Aircraft Fleet and Cabin Refurbishment

- The expanding global aircraft fleet and the rising emphasis on cabin refurbishment are major drivers supporting growth in the aircraft soft goods market. Airlines are continuously investing in interior upgrades to enhance passenger experience, extend aircraft service life, and maintain competitive brand positioning across commercial and business aviation

- For instance, Airbus and Boeing both support extensive retrofit and cabin upgrade programs, which create sustained demand for carpets, seat covers, and curtains across in-service fleets. These programs generate recurring replacement cycles for soft goods throughout an aircraft’s operational lifespan

- High aircraft utilization rates accelerate wear and tear of interior materials, making refurbishment essential to maintain cabin quality and safety compliance. Airlines increasingly prioritize cabin refresh cycles to meet passenger expectations and improve overall travel experience

- Business aviation and charter operators are also investing heavily in cabin refurbishment to deliver premium and customized interiors. This broad-based refurbishment activity across aircraft categories is reinforcing the driver’s long-term impact on market growth

- As global air traffic continues to recover and expand, the combination of fleet growth and refurbishment programs remains a critical factor sustaining demand for aircraft soft goods

Restraint/Challenge

Stringent Certification and Regulatory Requirements

- The aircraft soft goods market faces significant challenges due to stringent certification and regulatory requirements governing interior materials used in aircraft cabins. Soft goods must comply with strict flammability, smoke, and toxicity standards imposed by aviation authorities, which increases development time and cost

- For instance, suppliers must meet certification standards set by organizations such as Federal Aviation Administration and European Union Aviation Safety Agency, requiring extensive testing and documentation before materials can be approved for aircraft use. These processes create high entry barriers for new products and suppliers

- The complexity of certification limits rapid innovation, as even minor material modifications often require requalification. This slows time-to-market and increases financial risk for manufacturers developing advanced or sustainable soft goods

- Smaller suppliers face additional pressure due to the high cost of compliance testing and ongoing regulatory audits. Maintaining consistent quality while meeting evolving safety standards adds operational complexity across the supply chain

- The need to balance regulatory compliance with cost efficiency remains a persistent challenge for the market. These stringent requirements continue to restrain flexibility while shaping product development strategies within the aircraft soft goods industry

Aircraft Soft Goods Market Scope

The market is segmented on the basis of aircraft type, product type, material type, and distribution channel.

- By Aircraft

On the basis of aircraft type, the aircraft soft goods market is segmented into commercial, regional, business, and helicopters. The commercial aircraft segment dominated the market in 2025, accounting for the largest revenue share of 47%, driven by the high global fleet size and continuous demand for cabin refurbishment and replacement of interior components. Airlines operating commercial aircraft focus heavily on passenger comfort, durability, and compliance with aviation safety standards, which drives consistent demand for carpets, seat covers, and curtains. The frequent utilization cycles of commercial aircraft further accelerate wear and replacement needs, strengthening this segment’s dominance.

The business aircraft segment is expected to witness the fastest growth from 2026 to 2033, supported by rising demand for private and charter aviation. Operators in this segment prioritize premium aesthetics, customized interiors, and high-quality materials to enhance passenger experience. Increasing high-net-worth individuals and corporate travel requirements are further accelerating investments in upgraded soft goods for business jets.

- By Product

On the basis of product, the aircraft soft goods market is segmented into carpets, seat covers, and curtains. The seat covers segment dominated the market in 2025 due to their critical role in passenger comfort, cabin appearance, and brand differentiation for airlines. Seat covers experience high wear and tear because of constant passenger usage, leading to frequent replacement cycles. Airlines and aircraft operators also invest in seat cover upgrades to align interiors with branding and comfort standards, reinforcing this segment’s strong revenue contribution.

The carpets segment is anticipated to register the fastest growth during the forecast period, driven by increasing emphasis on lightweight materials and improved cabin aesthetics. Aircraft operators are adopting advanced carpet designs that offer durability, noise reduction, and weight efficiency. The growing focus on cabin modernization programs across both commercial and business aircraft further supports the rapid growth of this segment.

- By Material

On the basis of material, the aircraft soft goods market is segmented into wool/nylon blend fabric, natural leather, synthetic leather, and polyester fabric. The wool/nylon blend fabric segment dominated the market in 2025, driven by its superior durability, fire resistance, and compliance with stringent aviation safety regulations. This material is widely used for carpets and seat upholstery due to its ability to withstand heavy foot traffic and long service life. Airlines prefer wool/nylon blends as they balance performance, comfort, and maintenance efficiency.

The synthetic leather segment is projected to witness the fastest growth from 2026 to 2033, supported by rising demand for cost-effective and lightweight alternatives to natural leather. Synthetic leather offers ease of cleaning, consistent quality, and improved sustainability attributes, which are increasingly valued by aircraft operators. Its growing acceptance in both commercial and business aircraft interiors is accelerating adoption.

- By Distribution Channel

On the basis of distribution channel, the aircraft soft goods market is segmented into OEM and aftermarket. The OEM segment dominated the market in 2025, driven by steady aircraft production rates and direct installation of soft goods during new aircraft manufacturing. Aircraft manufacturers collaborate closely with soft goods suppliers to ensure compliance with design, safety, and performance requirements. The integration of customized interiors at the production stage further strengthens the OEM segment’s leading position.

The aftermarket segment is expected to grow at the fastest rate during the forecast period, fueled by increasing aircraft fleet aging and rising demand for refurbishment and replacement. Airlines and operators regularly upgrade soft goods to improve passenger experience and maintain brand standards. The growing focus on cabin retrofitting and life-cycle cost optimization is significantly boosting aftermarket demand.

Aircraft Soft Goods Market Regional Analysis

- North America dominated the aircraft soft goods market with the largest revenue share of 38.60% in 2025, driven by the presence of a large commercial and business aircraft fleet and continuous investments in cabin refurbishment

- Aircraft operators in the region place strong emphasis on passenger comfort, regulatory compliance, and interior aesthetics, supporting steady demand for carpets, seat covers, and curtains

- The region benefits from high air travel frequency, strong MRO infrastructure, and early adoption of premium and lightweight interior materials, reinforcing its leading market position

U.S. Aircraft Soft Goods Market Insight

The U.S. aircraft soft goods market captured the largest revenue share within North America in 2025, supported by the world’s largest commercial aviation fleet and strong presence of business jets. Airlines and operators in the country consistently invest in cabin upgrades to enhance passenger experience and brand differentiation. The growing focus on aircraft retrofitting, combined with stringent FAA interior safety standards, continues to drive demand for high-quality soft goods.

Europe Aircraft Soft Goods Market Insight

The Europe aircraft soft goods market is expected to grow at a steady CAGR over the forecast period, driven by increasing aircraft modernization programs and emphasis on sustainable, lightweight interior materials. Airlines across the region are focusing on improving cabin efficiency and aesthetics to remain competitive. Strong regulatory standards and frequent refurbishment cycles across commercial and regional aircraft further support market growth.

U.K. Aircraft Soft Goods Market Insight

The U.K. aircraft soft goods market is projected to witness notable growth during the forecast period, driven by active MRO activities and rising demand for business and charter aviation. Aircraft operators increasingly focus on premium interiors and customized cabin solutions. The country’s strong aerospace supply chain and refurbishment expertise continue to support consistent market expansion.

Germany Aircraft Soft Goods Market Insight

The Germany aircraft soft goods market is anticipated to expand at a considerable CAGR, supported by its strong aerospace manufacturing base and focus on high-quality engineering standards. Airlines and operators prioritize durable, fire-resistant, and lightweight interior materials to meet strict safety norms. The country’s emphasis on sustainability is also encouraging the adoption of advanced fabric and synthetic leather solutions.

Asia-Pacific Aircraft Soft Goods Market Insight

The Asia-Pacific aircraft soft goods market is expected to register the fastest CAGR during the forecast period, driven by rapid expansion of commercial aircraft fleets and increasing air passenger traffic. Rising investments in new aircraft deliveries and cabin upgrades across emerging economies are accelerating demand. The region’s growing role as a manufacturing and MRO hub further enhances market growth prospects.

Japan Aircraft Soft Goods Market Insight

The Japan aircraft soft goods market is witnessing steady growth, supported by a strong focus on quality, safety, and passenger comfort. Airlines in the country invest heavily in cabin refurbishment and premium interior materials to maintain service excellence. The demand for lightweight and durable soft goods is further supported by Japan’s technologically advanced aviation sector.

China Aircraft Soft Goods Market Insight

The China aircraft soft goods market accounted for the largest revenue share in Asia Pacific in 2025, driven by rapid fleet expansion and rising domestic air travel demand. Airlines are increasingly upgrading cabin interiors to cater to a growing middle-class passenger base. Strong government support for aviation infrastructure and expanding MRO capabilities continue to propel market growth in the country.

Aircraft Soft Goods Market Share

The aircraft soft goods industry is primarily led by well-established companies, including:

- Anker Technology (UK) Ltd (U.K.)

- Tapis Corp (U.S.)

- Spectra Interior Products (U.S.)

- RAMM Aerospace (U.S.)

- Mohawk Carpet, LLC (U.S.)

- Intech Aerospace (U.S.)

- Hong Kong Aircraft Engineering Company Limited (Hong Kong)

- Lantal (Switzerland)

- FELLFAB (U.S.)

- ELeather (U.S.)

- Tarkett (France)

- Botany Weaving (U.S.)

- Aereos, Inc. (U.S.)

- Aircraft Interior Products (U.S.)

- Hira Technologies Pvt Ltd (India)

- Aerofloor Ltd (U.S.)

Latest Developments in Global Aircraft Soft Goods Market

- In September 2025, Collins Aerospace introduced a digital customization platform enabling airlines to configure aircraft soft goods in real time, significantly transforming customer engagement in cabin interiors. This development allows operators to align soft goods selections with passenger preferences and branding strategies more efficiently, strengthening Collins Aerospace’s competitive positioning. The platform is expected to accelerate decision-making cycles and drive higher adoption of customized interior solutions across global fleets

- In August 2025, Boeing announced a strategic partnership with a leading textile manufacturer to develop lightweight, high-performance fabrics for aircraft interiors, directly impacting fuel efficiency objectives. By integrating advanced textiles into cabin soft goods, Boeing aims to achieve measurable weight reductions that enhance aircraft performance and lower operating costs. This initiative reinforces Boeing’s value proposition for airlines seeking efficiency-driven interior upgrades

- In July 2025, Airbus unveiled a new range of sustainable aircraft soft goods produced from recycled materials, signaling a strong shift toward environmentally responsible cabin solutions. This move supports airlines’ sustainability goals and positions Airbus as a frontrunner in eco-conscious interior innovation. The introduction of recycled soft goods is likely to influence airline procurement strategies as sustainability becomes a key differentiator in fleet modernization

- In June 2025, Safran expanded its aircraft interiors portfolio with next-generation seat fabrics designed for enhanced durability and reduced maintenance requirements. This development addresses airline demand for longer lifecycle soft goods that lower total cost of ownership. The introduction of these materials is expected to strengthen Safran’s presence in both OEM and aftermarket segments

- In May 2025, Lufthansa Technik launched an upgraded cabin refurbishment program focusing on premium and lightweight soft goods for wide-body aircraft. This initiative enhances airlines’ ability to modernize cabins without full aircraft replacement, supporting fleet life extension strategies. The program is anticipated to boost aftermarket demand for aircraft soft goods as operators prioritize cost-efficient interior upgrades

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.