Global Aircraft Transparencies Market

Market Size in USD Billion

CAGR :

%

USD

1.15 Billion

USD

2.02 Billion

2024

2032

USD

1.15 Billion

USD

2.02 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 2.02 Billion | |

|

|

|

Aircraft Transparencies Market Analysis

The aircraft transparencies market involves the production and supply of critical transparent components such as windows, windshields, canopies, and cabin separators used in various aircraft types, including commercial, military, and business aviation. These components are essential for providing safety, visibility, and comfort during flight. The market is driven by the increasing demand for air travel, the need for improved cabin aesthetics, and advancements in transparency materials such as glass, acrylic, and polycarbonate. In addition, the rise of aircraft refurbishing activities and the growing trend of luxury aircraft upgrades further contribute to market growth. Recent developments include innovations in lightweight, durable materials and the integration of advanced in-flight technologies, such as energy-efficient windows. Companies are increasingly focusing on improving the durability, scratch resistance, and anti-UV properties of aircraft transparencies to meet the evolving needs of the aviation industry. With the expansion of air fleets and the rise in air traffic, the aircraft transparencies market is poised for steady growth.

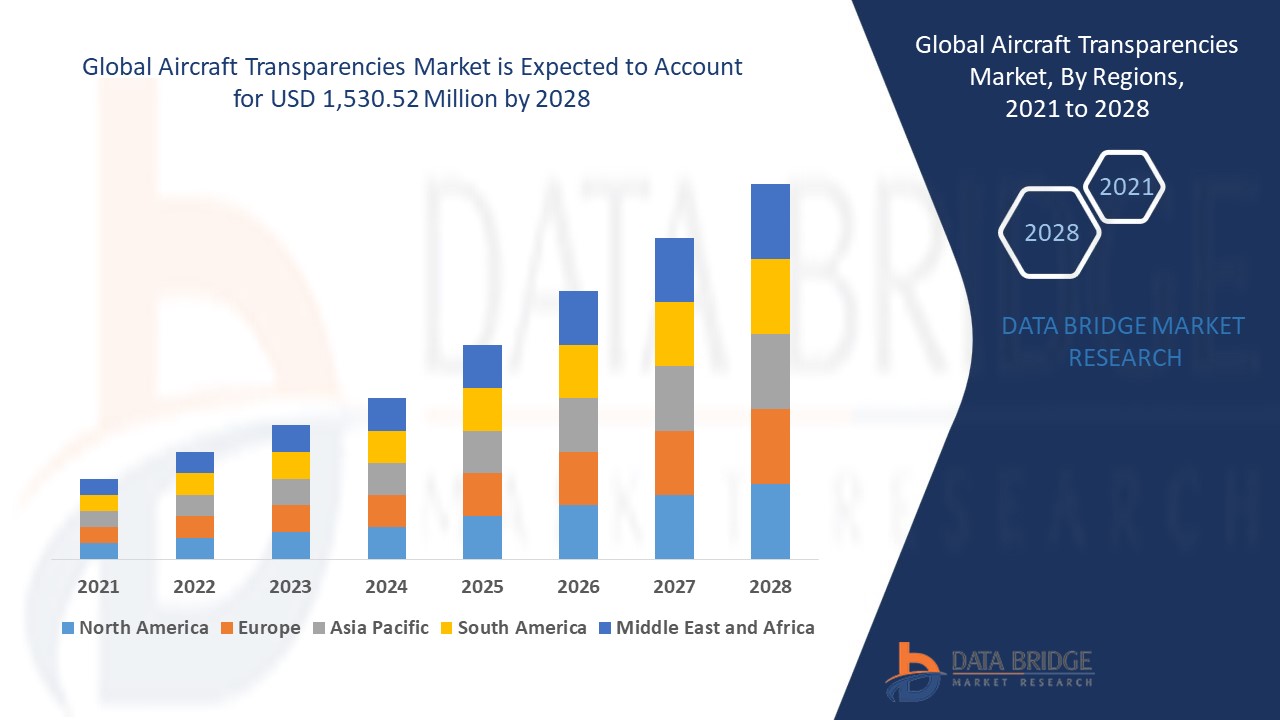

Aircraft Transparencies Market Size

The global aircraft transparencies market size was valued at USD 1.15 billion in 2024 and is projected to reach USD 2.02 billion by 2032, with a CAGR of 7.30% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Aircraft Transparencies Market Trends

“Lightweight and Durable Materials”

A significant trend in the aircraft transparencies market is the increasing preference for lightweight and durable materials such as polycarbonate and acrylic. These materials are gaining popularity due to their ability to reduce the overall weight of the aircraft, which directly contributes to improved fuel efficiency and operational cost savings. In addition to being lightweight, polycarbonate and acrylic offer superior impact resistance, enhancing safety by providing greater protection in the event of bird strikes or other external forces. The use of these advanced materials also allows for greater design flexibility and durability, ensuring longer service life and reduced maintenance needs. As the aviation industry focuses on performance and sustainability, the adoption of these materials is expected to continue growing, offering significant advantages in terms of safety, efficiency, and cost-effectiveness.

Report Scope and Aircraft Transparencies Market Segmentation

|

Attributes |

Aircraft Transparencies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

GENERAL ELECTRIC COMPANY (U.S.), PPG Industries, Inc. (U.S.), GKN Aerospace (U.K.), Saint-Gobain (France), GENTEX CORPORATION (U.S.), Textron Specialized Vehicles (U.S.), Lee Aerospace (U.S.), THE NORDAM GROUP LLC (U.S.), Fallz Media LLC (U.S.), Spartech LLC (U.S.), MECAPLEX Ltd. (U.K.), Control Logistics Inc. (U.S.), Aeropair Ltd (U.S.), Tech-Tool Plastics (U.S.), ceebaileys (U.S.), LP Aero Plastics Inc. (U.S.), New Season (U.S.), Micro-Surface Finishing Products Inc. (U.S.), Dart Aerospace (Canada), Wencor Group, LLC. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Transparencies Market Definition

Aircraft transparencies refer to transparent components used in aircraft, such as windows, windshields, canopies, cockpit glazing, cabin dividers, and other transparent panels. These components are essential for providing clear visibility for pilots and passengers while ensuring safety, protection, and comfort during flight. Aircraft transparencies are made from materials such as glass, acrylic, and polycarbonate, chosen for their durability, impact resistance, and optical clarity. They also undergo specialized treatments and coatings to enhance performance, including UV protection, scratch resistance, and anti-reflective properties. These transparent elements are crucial for maintaining aircraft integrity, improving aerodynamics, and contributing to overall passenger experience.

Aircraft Transparencies Market Dynamics

Drivers

- Rising Air Traffic

The growth in global air travel, fueled by rising disposable incomes, urbanization, and a growing demand for efficient transportation, is a key driver for the aircraft transparencies market. As more passengers opt for air travel, airlines are increasing their fleets and investing in new aircraft to meet this demand. In addition, the trend of refurbishing older aircraft to extend their lifespan and improve passenger experience further boosts the need for high-quality transparent components such as windows, windshields, and canopies. This expanding market for both new and refurbished aircraft continues to drive the demand for advanced, durable, and efficient transparencies.

- Aircraft Refurbishment and Upgrades

Airlines and private operators are placing greater emphasis on refurbishing older aircraft to align with rising passenger expectations and enhance fuel efficiency. This trend has led to an increased demand for modern, high-performance aircraft transparencies, including windows, windshields, and cabin dividers. Refurbishing older fleets helps operators comply with regulatory standards, improve the passenger experience, and reduce operational costs. The need for advanced materials, such as lightweight, durable polycarbonate and acrylic, is also growing as they contribute to better fuel economy and increased safety. As airlines and operators continue to upgrade their fleets, the demand for top-quality transparencies continues to rise, driving market growth.

Opportunities

- Growing Demand for Luxury Aircraft

The rising demand for luxury aircraft, particularly within the private jet and VIP segments, is driving a notable market opportunity for customized aircraft transparencies. Operators and owners of high-end aircraft are increasingly seeking unique and personalized features, such as panoramic windows and bespoke canopies, to enhance the luxury experience. These customized transparencies offer superior aesthetics and contribute to greater comfort and an elevated sense of space. As this demand grows, manufacturers are capitalizing on the opportunity to provide tailored, high-quality transparent components that meet the specific needs of luxury aircraft, expanding their market share in this lucrative sector.

- Sustainability and Fuel Efficiency

As the aviation industry places increasing emphasis on sustainability and reducing carbon footprints, lightweight and energy-efficient aircraft transparencies have emerged as a key opportunity for market growth. These advanced materials, such as polycarbonate and acrylic, contribute to overall fuel efficiency by reducing the weight of the aircraft, which in turn leads to lower fuel consumption and fewer emissions. With airlines and aircraft operators focusing on eco-friendly solutions and compliance with stricter environmental regulations, the demand for energy-efficient transparencies is growing. This trend presents manufacturers with a significant opportunity to innovate and supply materials that support sustainability goals, further driving the market for high-performance aircraft transparencies.

Restraints/Challenges

- Maintenance and Replacement Costs

While aircraft transparencies are engineered for durability, the associated costs of maintenance, repair, and replacement can be significant, creating a major challenge for the market. Airlines and operators are faced with higher operational costs, particularly when refurbishing older aircraft fleets. These costs, which include labor, materials, and replacement components, can deter operators from investing in new transparency technologies or upgrading to more advanced, energy-efficient options. As a result, the financial burden of ongoing maintenance and repairs may impact operators' willingness to adopt the latest innovations in aircraft transparencies, limiting market growth and adoption of newer solutions.

- High Manufacturing Costs

The production of high-quality aircraft transparencies, particularly those crafted from advanced materials such as polycarbonate and acrylic, involves costly manufacturing processes. Ensuring the strength, durability, and impact resistance required for aerospace components adds to production expenses, making it difficult for smaller manufacturers to compete in the market. These high costs can act as a barrier for new entrants or less-established companies, limiting their ability to offer competitive pricing. As a result, the market may become dominated by a few large players with significant resources, reducing price competition and hindering the growth of smaller manufacturers in the aircraft transparencies sector.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Aircraft Transparencies Market Scope

The market is segmented on the basis of material, aircraft type, application and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Glass

- Acrylic

- Polycarbonate

Aircraft Type

- Commercial Aviation

- Military Aviation

- Business and General Aviation

Application

- Windows

- Windshields

- Canopies

- Landing Lights and Wingtip Lenses

- Chin Bubbles

- Cabin Interiors (Separators)

- Skylights

End Use

- OEM (Original Equipment Manufacturer)

- Aftermarket

Aircraft Transparencies Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, material, aircraft type, application and end use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the aircraft transparencies market from 2025 to 2032, driven by the rapid advancement of transparency technologies and a growing demand for commercial aircraft. The region’s dominance is further supported by increased aircraft orders, a robust supply chain, and the presence of key industry players. These factors collectively contribute to North America's strong position in the market during the forecast period.

Asia Pacific region is to be the fastest-growing segment in the aircraft transparencies market during the forecast period. The region's rapid economic development, rising air travel, and expansion of the aviation industry are fueling the demand for new aircraft and fleet retrofitting. These factors make Asia Pacific a key driver of growth in the global aircraft transparencies market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aircraft Transparencies Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Aircraft Transparencies Market Leaders Operating in the Market Are:

- GENERAL ELECTRIC COMPANY (U.S.)

- PPG Industries, Inc. (U.S.)

- GKN Aerospace (U.K.)

- Saint-Gobain (France)

- GENTEX CORPORATION (U.S.)

- Textron Specialized Vehicles (U.S.)

- Lee Aerospace (U.S.)

- THE NORDAM GROUP LLC (U.S.)

- Fallz Media LLC (U.S.)

- Spartech LLC (U.S.)

- MECAPLEX Ltd. (U.K.)

- Control Logistics Inc. (U.S.)

- Aeropair Ltd (U.S.)

- Tech-Tool Plastics (U.S.)

- ceebaileys (U.S.)

- LP Aero Plastics Inc. (U.S.)

- New Season (U.S.)

- Micro-Surface Finishing Products Inc. (U.S.)

- Dart Aerospace (Canada)

- Wencor Group, LLC. (U.S.)

Latest Developments in Aircraft Transparencies Market

- In January 2024, GKN Aerospace announced plans to double its F-35 canopy production at its Garden Grove, California facility. This expansion will be supported by a customer investment of up to USD 150 million to acquire advanced tools and equipment for the new production line. This capacity increase aims to meet the growing demand for F-35 Lightning II aircraft, ensuring the company's ability to deliver high-performance cockpit canopies to meet military needs for the next decade. GKN Aerospace has been a key supplier of F-35 canopy systems since the program’s inception

- In February 2023, GKN Aerospace launched an expansion of its Chihuahua, Mexico facility, adding 80,000 square feet of space to meet the increasing demand for complex composite manufacturing and assembly services within the business jet sector. The expansion, which was expected to be completed by December 2023, reflects GKN Aerospace's commitment to bolstering its production capabilities to support the growing business jet market with advanced, sustainable manufacturing solutions

- In October 2020, PPG Industries was chosen by Dassault Aviation, the French aircraft manufacturer, to supply coatings for the Falcon 6X business jet. PPG will provide both exterior paint coatings and interior coatings for the aircraft, leveraging its expertise in the coatings industry to enhance the durability and aesthetic appeal of the new business jet. This collaboration highlights PPG’s role in providing high-quality solutions for the commercial aerospace sector

- In October 2020, GKN Aerospace acquired Permanova Lasersystem AB, a Swedish company specializing in advanced laser technology and additive manufacturing systems. This acquisition is part of GKN Aerospace's ongoing efforts to transform its supply chain and offer more sustainable, advanced material solutions to its customers. Permanova's expertise in laser welding and laser metal deposition systems will enhance GKN's capabilities in additive manufacturing, supporting the company's commitment to innovation and sustainability in aerospace

- In January 2020, Gentex Corporation announced its selection by Boeing to supply dimmable windows for the 777X wide-body jet. Gentex’s electronically dimmable windows allow passengers to control the level of light entering the cabin, improving comfort and reducing the need for traditional window shades. This innovative technology is set to enhance the passenger experience on the new 777X, providing a more customizable and convenient in-flight environment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.