Global Aircraft Wheels Market

Market Size in USD Million

CAGR :

%

USD

70.66 Million

USD

91.61 Million

2025

2033

USD

70.66 Million

USD

91.61 Million

2025

2033

| 2026 –2033 | |

| USD 70.66 Million | |

| USD 91.61 Million | |

|

|

|

|

Aircraft Wheels Market Size

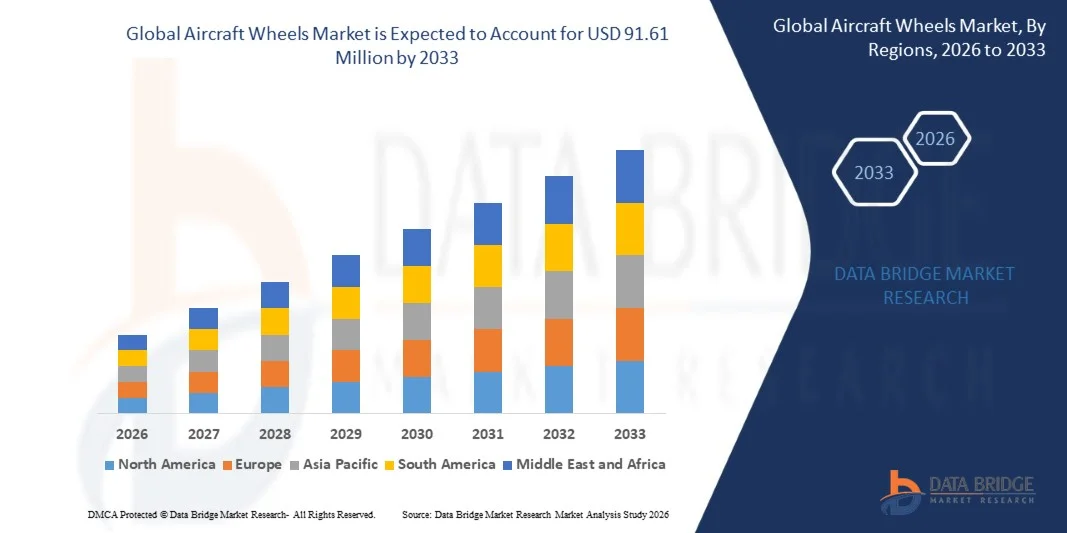

- The Aircraft Wheels Market size was valued at USD 70.66 million in 2025 and is expected to reach USD 91.61 million by 2033, at a CAGR of 3.30% during the forecast period.

- The market growth is largely driven by the rising demand for fuel-efficient and lightweight aircraft, along with increased air travel and expansion of commercial aviation fleets globally.

- Furthermore, advancements in wheel materials, design innovations, and stringent safety regulations are prompting airlines and manufacturers to adopt high-performance aircraft wheels. These factors are collectively propelling market adoption, thereby significantly contributing to the industry's growth.

Aircraft Wheels Market Analysis

- Aircraft wheels, essential components for landing gear systems, are increasingly critical in both commercial and military aviation due to their role in ensuring safe take-offs, landings, and taxiing, as well as their ability to withstand high loads and extreme operational conditions.

- The growing demand for aircraft wheels is primarily driven by the expansion of global air travel, fleet modernization programs, and the need for lightweight, durable, and low-maintenance wheel solutions to enhance aircraft performance and safety.

- North America dominated the Aircraft Wheels Market with the largest revenue share of 33.5% in 2025, attributed to the presence of major aircraft manufacturers, high air traffic volumes, and substantial investments in fleet upgrades, with the U.S. leading in the adoption of advanced wheel technologies and maintenance solutions for both commercial and defense aircraft.

- Asia-Pacific is expected to be the fastest-growing region in the Aircraft Wheels Market during the forecast period due to rapid urbanization, increasing air passenger traffic, and expanding aerospace manufacturing hubs in countries such as China and India.

- The main landing gear wheels segment dominated the market with the largest revenue share of 61.4% in 2025, driven by their critical role in supporting the aircraft’s full weight during take-off, landing, and taxiing operations.

Report Scope and Aircraft Wheels Market Segmentation

|

Attributes |

Aircraft Wheels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Wheels Market Trends

“Enhanced Performance Through AI-Enabled Monitoring and Predictive Maintenance”

- A significant and accelerating trend in the Aircraft Wheels Market is the growing integration of artificial intelligence (AI) and advanced sensor technologies into landing gear and wheel systems. This convergence is significantly enhancing operational safety, performance monitoring, and maintenance efficiency.

- For instance, AI-enabled wheel systems can monitor tire pressure, temperature, and wear in real-time, allowing airlines to predict maintenance needs before critical failures occur. Similarly, predictive analytics platforms can assess data from multiple aircraft fleets to optimize maintenance schedules and reduce operational downtime.

- AI integration in aircraft wheels enables features such as learning wear patterns, detecting anomalies, and providing intelligent alerts for abnormal conditions. Some modern wheels from Collins Aerospace and Safran Landing Systems use AI algorithms to detect irregularities in tire or brake performance, improving safety and reliability over time. Furthermore, predictive maintenance reduces unexpected delays and enhances fleet utilization.

- The seamless integration of AI and sensor data with aircraft diagnostic and maintenance systems facilitates centralized monitoring and proactive fleet management. Through a single interface, airlines can track wheel health, landing gear performance, and maintenance requirements across multiple aircraft, improving operational efficiency.

- This trend towards smarter, data-driven, and interconnected wheel systems is fundamentally reshaping airline and aircraft manufacturer expectations for landing gear performance. Consequently, companies such as Liebherr-Aerospace and Meggitt PLC are developing AI-enabled wheels with predictive maintenance capabilities and real-time monitoring features.

- The demand for aircraft wheels with AI-driven monitoring and predictive maintenance is growing rapidly across commercial and defense aviation sectors, as operators increasingly prioritize safety, reliability, and cost-efficient fleet operations.

Aircraft Wheels Market Dynamics

Driver

“Growing Demand Driven by Fleet Expansion and Safety Regulations”

- The increasing growth of commercial and defense aviation fleets, coupled with stringent safety and regulatory requirements, is a significant driver for the heightened demand for advanced aircraft wheels.

- For instance, in 2025, Safran Landing Systems announced the development of next-generation sensor-integrated wheels for narrowbody and widebody aircraft, aiming to enhance operational safety and predictive maintenance. Strategies like these by key manufacturers are expected to drive market growth during the forecast period.

- As airlines and aircraft operators seek to reduce operational risks and improve turnaround efficiency, aircraft wheels with features such as lightweight alloys, advanced braking systems, and real-time condition monitoring provide a compelling upgrade over conventional wheels.

- Furthermore, the modernization of aging fleets and the growing popularity of regional and low-cost carriers are making advanced aircraft wheels an integral component of operational efficiency, offering seamless integration with predictive maintenance systems and aircraft monitoring platforms.

- The need for durable, lightweight, and low-maintenance wheels, coupled with the ability to monitor performance remotely and optimize maintenance schedules, is propelling adoption across both commercial and defense aviation sectors. Investments in fleet modernization and increasing awareness of operational safety further contribute to market growth.

Restraint/Challenge

“High Costs and Maintenance Complexity”

- The high initial cost of advanced aircraft wheels, particularly those made from specialized alloys or integrated with sensor and AI technologies, poses a significant challenge to broader market penetration.

- For instance, airlines operating in developing regions or budget-conscious operators may find the upfront investment in advanced wheel systems prohibitive, delaying widespread adoption despite the long-term benefits.

- Additionally, maintenance complexity and the need for specialized training or equipment to service advanced wheels can act as barriers, particularly for smaller airlines or operators with limited technical resources. Companies such as Liebherr-Aerospace and Meggitt PLC provide extensive training and support programs to mitigate these challenges.

- While long-term cost savings through reduced maintenance and improved safety can offset the initial investment, the perceived premium and technical complexity can hinder immediate adoption.

- Overcoming these challenges through cost optimization, enhanced maintenance support, and operator training programs will be crucial for sustaining market growth and ensuring widespread adoption of next-generation aircraft wheels.

Aircraft Wheels Market Scope

Aircraft wheels market is segmented on the basis of type, application and distribution channel.

• By Type

On the basis of type, the Aircraft Wheels Market is segmented into nose wheels and main landing gear wheels. The main landing gear wheels segment dominated the market with the largest revenue share of 61.4% in 2025, driven by their critical role in supporting the aircraft’s full weight during take-off, landing, and taxiing operations. Main landing gear wheels are designed to withstand extreme loads, high-speed landings, and repeated stress cycles, making them indispensable for commercial and defense aircraft. Airlines and aircraft manufacturers prioritize advanced materials, durability, and maintenance-friendly designs in main landing gear wheels, leading to steady demand across regions.

The nose wheels segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by technological innovations in steering systems, lightweight materials, and enhanced braking integration. Increasing focus on aircraft maneuverability and precision ground handling is driving investments in upgraded nose wheel designs.

• By Application

On the basis of application, the Aircraft Wheels Market is segmented into narrow-body aircraft, wide-body aircraft, very large-body aircraft, and regional aircraft. The narrow-body aircraft segment dominated the market with a revenue share of 52.6% in 2025, driven by the widespread use of single-aisle aircraft in domestic and short-haul operations, and fleet expansions by low-cost carriers. Narrow-body aircraft wheels are often subject to frequent cycles of take-off and landing, necessitating high durability and low-maintenance designs, which has bolstered demand.

The very large-body aircraft segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, owing to increasing long-haul air travel, rising global cargo demand, and the introduction of next-generation widebody aircraft. The need for high-capacity wheels that can withstand greater loads and provide enhanced braking performance is driving growth in this segment.

• By Distribution Channel

On the basis of distribution channel, the Aircraft Wheels Market is segmented into Original Equipment Manufacturer (OEM) and aftermarket. The OEM segment dominated the market with the largest revenue share of 64.2% in 2025, driven by the strong integration of advanced wheels into new aircraft production and fleet modernization programs. OEM wheels are preferred for their compliance with manufacturer specifications, reliability, and warranty coverage, making them the primary choice for airline operators and aircraft manufacturers.

The aftermarket segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by the growing need for replacement wheels, retrofitting of older aircraft, and maintenance, repair, and overhaul (MRO) services. Rising aircraft operational hours and increased focus on predictive maintenance are driving aftermarket demand globally, especially in regions with aging fleets and expanding defense aviation programs.

Aircraft Wheels Market Regional Analysis

- North America dominated the Aircraft Wheels Market with the largest revenue share of 33.5% in 2025, driven by the presence of major aircraft manufacturers, extensive commercial and defense aviation fleets, and increasing investments in fleet modernization.

- Airlines and aircraft operators in the region prioritize high-performance, durable, and low-maintenance aircraft wheels to enhance operational safety and efficiency, particularly for frequent domestic and international flights.

- This strong demand is further supported by stringent safety regulations, high air traffic volumes, and advanced maintenance, repair, and overhaul (MRO) infrastructure, establishing North America as a key market for both OEM and aftermarket aircraft wheels.

U.S. Aircraft Wheels Market Insight

The U.S. aircraft wheels market captured the largest revenue share of 81% in 2025 within North America, driven by the extensive presence of commercial and defense aviation fleets and high air traffic volumes. Airlines and aircraft manufacturers are increasingly prioritizing advanced, durable, and low-maintenance wheels to enhance safety and operational efficiency. The growing trend of fleet modernization, coupled with the adoption of sensor-enabled wheels for predictive maintenance, is further propelling market growth. Moreover, strong OEM and aftermarket networks, alongside advanced MRO infrastructure, are supporting the rapid deployment of next-generation aircraft wheels across both commercial and military applications.

Europe Aircraft Wheels Market Insight

The Europe aircraft wheels market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent aviation safety regulations and rising investments in fleet modernization. Growing air passenger traffic, increasing adoption of regional and narrow-body aircraft, and the need for efficient landing gear systems are fostering demand. European airlines are also emphasizing low-maintenance, high-performance wheels to reduce operational downtime, particularly in commercial and cargo applications.

U.K. Aircraft Wheels Market Insight

The U.K. aircraft wheels market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing domestic and regional air travel, as well as fleet expansion initiatives. The country’s focus on aircraft safety, adherence to strict regulatory standards, and the modernization of older aircraft are driving demand for advanced OEM and aftermarket wheel solutions. Additionally, the U.K.’s robust aerospace manufacturing and MRO infrastructure supports widespread adoption of technologically advanced wheels.

Germany Aircraft Wheels Market Insight

The Germany aircraft wheels market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong aerospace industry, high standards for aviation safety, and growing emphasis on technological innovation. Airlines and defense operators are increasingly adopting sensor-enabled and lightweight wheels for improved fuel efficiency and predictive maintenance. The integration of advanced materials and real-time monitoring systems is further boosting demand in both commercial and military aviation sectors.

Asia-Pacific Aircraft Wheels Market Insight

The Asia-Pacific aircraft wheels market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, fueled by increasing air travel, urbanization, and rising aircraft fleet expansions in countries such as China, India, and Japan. Growing low-cost carrier operations, investments in new airports, and rising regional aviation infrastructure are driving demand. Furthermore, the presence of key OEMs and MRO facilities in the region, combined with technological adoption in aircraft wheels, is enhancing accessibility and deployment across commercial and defense fleets.

Japan Aircraft Wheels Market Insight

The Japan aircraft wheels market is gaining momentum due to the country’s high technological standards, growing domestic air traffic, and fleet modernization initiatives. Japanese operators prioritize lightweight, durable, and sensor-integrated wheels to enhance safety, reduce maintenance costs, and improve operational efficiency. Integration with predictive maintenance systems and advanced monitoring capabilities is fueling adoption across commercial and defense aircraft fleets.

China Aircraft Wheels Market Insight

The China aircraft wheels market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid fleet expansion, increasing domestic and regional air traffic, and government investment in aviation infrastructure. China is emerging as a hub for aircraft manufacturing and MRO services, supporting widespread adoption of advanced wheels. Rising demand for commercial and regional aircraft, coupled with the availability of cost-effective and technologically advanced wheel solutions, is propelling market growth in both OEM and aftermarket segments.

Aircraft Wheels Market Share

The Aircraft Wheels industry is primarily led by well-established companies, including:

- Safran Landing Systems (France)

- Collins Aerospace (U.S.)

- Liebherr-Aerospace (Germany)

- Meggitt PLC (U.K.)

- UTC Aerospace Systems (U.S.)

- Parker Hannifin Corporation (U.S.)

- Zodiac Aerospace (France)

- Héroux-Devtek (Canada)

- Figeac Aero (France)

- Goodrich Corporation (U.S.)

- Precision Castparts Corp. (U.S.)

- Nexcelle (U.S.)

- Woodward, Inc. (U.S.)

- AVIC Aircraft Landing Gear Co., Ltd. (China)

- Zhejiang Shaoxing Landing Gear Co., Ltd. (China)

- Bharat Forge Ltd. (India)

- Taikong Wheel Co., Ltd. (China)

- Beijing Aircraft Equipment Co., Ltd. (China)

- Hensoldt Aerospace (Germany)

- FACC AG (Austria)

What are the Recent Developments in Aircraft Wheels Market?

- In April 2024, Safran Landing Systems, a global leader in landing gear solutions, launched a strategic initiative in South Africa aimed at upgrading aircraft fleet safety through its advanced main and nose wheel technologies. This initiative underscores the company’s commitment to delivering high-performance, durable, and maintenance-efficient wheel systems tailored to the operational needs of regional airlines and defense operators. By leveraging its global expertise and innovative solutions, Safran is strengthening its position in the rapidly growing Aircraft Wheels Market.

- In March 2024, Collins Aerospace, a U.S.-based aerospace technology provider, introduced a next-generation sensor-integrated wheel system for commercial and regional aircraft. The system is designed to enhance predictive maintenance capabilities and optimize fleet operations, offering improved reliability and safety for operators. This advancement highlights Collins Aerospace’s focus on integrating cutting-edge technologies to support safer, more efficient air travel.

- In March 2024, Honeywell Aerospace successfully deployed its advanced landing gear monitoring solutions as part of the Bengaluru Safe Aviation Project. This initiative uses real-time wheel and brake data to improve aircraft turnaround efficiency and operational safety, demonstrating Honeywell’s commitment to leveraging innovative technologies to enhance urban and regional aviation infrastructure.

- In February 2024, Meggitt PLC, a leading provider of aerospace braking and wheel systems, announced a strategic partnership with several Asian MRO providers to expand aftermarket wheel and landing gear services. This collaboration aims to streamline maintenance, improve fleet availability, and enhance safety for commercial and defense aircraft, emphasizing Meggitt’s dedication to innovation and operational excellence.

- In January 2024, Liebherr-Aerospace unveiled its new lightweight, high-durability main landing gear wheels at the Aircraft Interiors Expo 2024. The wheels feature advanced materials and integrated monitoring sensors, enabling operators to track performance and maintenance needs in real-time. This launch highlights Liebherr’s commitment to combining cutting-edge materials and technology to improve aircraft safety, operational efficiency, and lifecycle management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.