Global Airport Interactive Kiosk Market

Market Size in USD Billion

CAGR :

%

USD

38.53 Billion

USD

83.19 Billion

2024

2032

USD

38.53 Billion

USD

83.19 Billion

2024

2032

| 2025 –2032 | |

| USD 38.53 Billion | |

| USD 83.19 Billion | |

|

|

|

|

Airport Interactive Kiosk Market Size

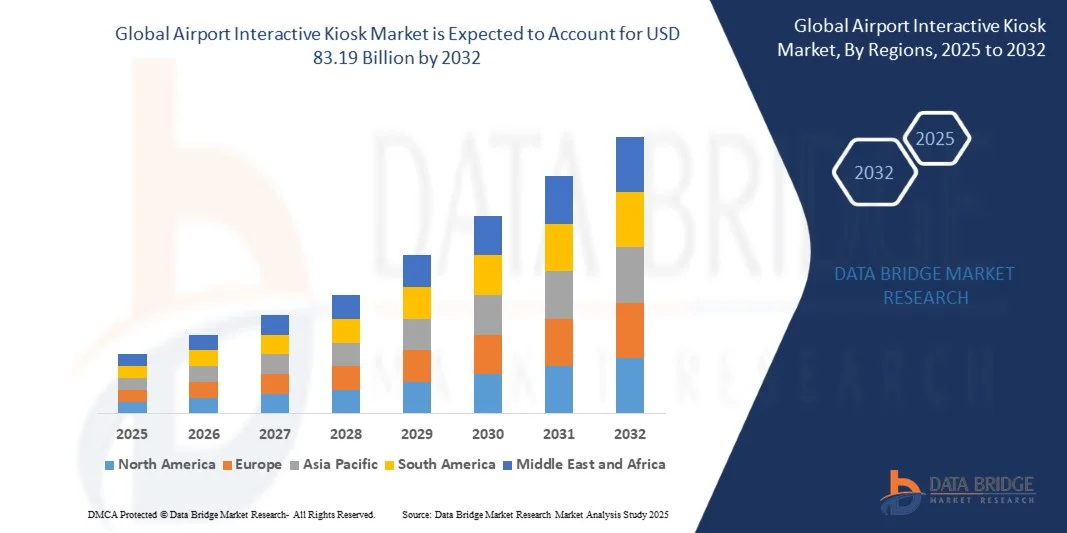

- The global airport interactive kiosk market size was valued at USD 38.53 billion in 2024 and is expected to reach USD 83.19 billion by 2032, at a CAGR of 10.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of self-service solutions and digital technologies in airports, leading to enhanced operational efficiency, reduced passenger wait times, and improved overall traveler experience

- Furthermore, rising demand for automated, user-friendly, and secure check-in, baggage handling, and information services is establishing airport interactive kiosks as essential solutions in modern airport operations. These converging factors are accelerating the deployment of kiosks, thereby significantly driving market expansion

Airport Interactive Kiosk Market Analysis

- Airport interactive kiosks are self-service systems that allow passengers to complete check-in, baggage drop, passport control, and access information using touchscreens, biometric authentication, and integrated software platforms. These kiosks streamline airport operations, enhance passenger convenience, and support contactless and automated processing

- The escalating demand for airport interactive kiosks is primarily fueled by increasing air passenger traffic, modernization of airport infrastructure, the need for faster processing times, and growing adoption of AI- and cloud-enabled technologies that enhance efficiency and personalization in airport services

- North America dominated the airport interactive kiosk market with a share of 42.5% in 2024, due to increasing passenger traffic, airport modernization initiatives, and the adoption of self-service technologies to enhance operational efficiency

- Asia-Pacific is expected to be the fastest growing region in the airport interactive kiosk market during the forecast period due to rising air travel, airport expansions, and government initiatives promoting smart infrastructure

- Hardware segment dominated the market with a market share of 53.1% in 2024, due to the increasing deployment of durable and multifunctional kiosks across airports globally. Hardware components, including touchscreens, printers, scanners, and biometric modules, are critical for seamless operation, making this segment essential for the adoption of interactive kiosks. Airports prioritize advanced hardware to ensure durability under heavy passenger traffic and to support integration with other airport systems. The demand is further strengthened by rising investments in modernizing airport infrastructure and enhancing passenger experience

Report Scope and Airport Interactive Kiosk Market Segmentation

|

Attributes |

Airport Interactive Kiosk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Airport Interactive Kiosk Market Trends

Adoption of AI- and Cloud-Enabled Kiosks

- The airport interactive kiosk market is experiencing significant growth fueled by the increasing adoption of AI-enabled and cloud-integrated kiosks. These advanced kiosks enhance passenger experience through improved usability, faster processing, and personalized services, while allowing airports to manage operations more efficiently through centralized cloud platforms

- For instance, Phoenix Kiosk has developed AI-powered interactive kiosks capable of facial recognition and seamless biometric authentication, reducing passenger wait times drastically. Similarly, Siemens has deployed cloud-connected kiosks that integrate with airport management systems to provide real-time updates and remote troubleshooting capabilities

- AI integration enables features such as predictive maintenance, dynamic content updates tailored to passenger profiles, and voice-activated interfaces that improve accessibility. Cloud support allows scalability and data analytics, offering insights into passenger behavior and operational bottlenecks that can be addressed proactively

- Interactive kiosks are also evolving with multi-language support, touchless interaction capabilities, and mobile integration, reflecting growing demand for contactless and efficient airport services post-pandemic. This trend aligns with airports’ digital transformation initiatives aimed at enhancing passenger satisfaction and reducing operational costs

- Collaborations between kiosk manufacturers and technology providers are driving innovation, with investments in cybersecurity and data privacy becoming critical as more sensitive passenger data is processed digitally. The convergence of AI, cloud, and IoT technologies is establishing interactive kiosks as a vital element in modern airport ecosystems

- The ongoing adoption of intelligent, cloud-enabled kiosks is poised to revolutionize airport operations, offering scalable solutions that address rising passenger traffic and operational complexity risks. This trend is expected to dominate market developments and investment priorities through 2030

Airport Interactive Kiosk Market Dynamics

Driver

Rising Air Passenger Traffic and Demand for Contactless Services

- Growing global air passenger volumes are driving airports to deploy interactive kiosks that streamline passenger flow and reduce check-in and baggage drop times. The increase in travel demand places pressure on airport infrastructure, necessitating automation solutions that improve throughput without sacrificing passenger satisfaction

- For instance, Dubai International Airport recorded a 40% reduction in passenger wait times after expanding its use of common-use self-service kiosks for multi-airline check-ins during peak travel seasons. Singapore Changi Airport’s rollout of biometric-enabled kiosks has also enhanced contactless service options, improving processing speeds and safety perceptions

- The COVID-19 pandemic accelerated the demand for touchless and contactless self-service technologies at airports, as travelers prioritize hygiene and minimal physical interactions. Airports have responded by investing in kiosks with biometric authentication, voice control, and mobile integration to facilitate seamless traveler journeys

- Airlines and airport authorities seek cost-efficient ways to manage increasing passenger numbers and reduce dependence on counter staff, making kiosks an essential element of modern airport workflows. The use of interactive kiosks supports these objectives by enabling faster check-in, flight information access, and baggage handling

- This rising traffic combined with evolving passenger preferences towards contactless services ensures sustained demand for interactive kiosks. Automation and digitization initiatives remain core strategies for airports aiming to boost operational efficiency and enhance the travel experience

Restraint/Challenge

High Installation Costs and System Integration

- The deployment of interactive kiosk systems in airports involves substantial upfront installation expenses, which include hardware procurement, software development, and customization to integrate with existing airport IT infrastructure. These high costs can be prohibitive, especially for smaller airports or those in regions with budgetary constraints

- For instance, airports upgrading legacy check-in counters to AI-enabled kiosks have faced multi-million dollar investments in equipment and back-end system integration, with extended timelines for full deployment. Integration complexity arises due to the need for compatibility with multiple airline systems, security protocols, and data privacy requirements

- The integration process often requires significant coordination among stakeholders, including airlines, airport authorities, and technology vendors, which can delay project completion and increase costs. Ongoing maintenance and software updates add recurring expenses that need to be managed carefully to maintain system performance and security

- In addition, ensuring cybersecurity and compliance with data protection laws demands continuous investments, as kiosks process sensitive traveler information. Any failure in these systems can disrupt airport operations and undermine passenger trust, heightening the challenge of reliable system implementation

- In conclusion, while interactive kiosks significantly enhance airport efficiency and passenger experience, the high installation costs and complex integration requirements remain significant barriers. Overcoming these challenges through modular solutions, cloud-based deployment models, and collaborative implementation frameworks will be critical to market expansion and technological adoption

Airport Interactive Kiosk Market Scope

The market is segmented on the basis of components and applications.

• By Components

On the basis of components, the airport interactive kiosk market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share of 53.1% in 2024, driven by the increasing deployment of durable and multifunctional kiosks across airports globally. Hardware components, including touchscreens, printers, scanners, and biometric modules, are critical for seamless operation, making this segment essential for the adoption of interactive kiosks. Airports prioritize advanced hardware to ensure durability under heavy passenger traffic and to support integration with other airport systems. The demand is further strengthened by rising investments in modernizing airport infrastructure and enhancing passenger experience.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the need for customized applications that enhance operational efficiency and passenger convenience. Software solutions enable functionalities such as self-check-in, real-time flight information, and integration with mobile applications and airport management systems. The increasing adoption of AI-driven and cloud-based software enhances personalization, predictive analytics, and automation, driving its rapid growth in the airport interactive kiosk market.

• By Application

On the basis of application, the airport interactive kiosk market is segmented into common-use self-service, automated passport control, baggage check-in, information kiosk, and others. The common-use self-service (CUSS) segment dominated the largest market revenue share in 2024, owing to its ability to streamline check-in processes and reduce passenger wait times. Airports are increasingly investing in CUSS kiosks to improve operational efficiency, minimize human errors, and provide a consistent self-service experience for travelers. The segment’s dominance is also reinforced by rising passenger traffic and the adoption of contactless solutions for enhanced safety and convenience.

The automated passport control (APC) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by stringent security regulations and growing demand for expedited immigration procedures. APC kiosks utilize biometrics and advanced scanning technologies to facilitate faster passenger processing, particularly in international airports. The integration of AI and machine learning in APC software enables accurate identity verification and reduced processing times, making it a preferred solution for airports aiming to enhance passenger throughput while maintaining high security standards.

Airport Interactive Kiosk Market Regional Analysis

- North America dominated the airport interactive kiosk market with the largest revenue share of 42.5% in 2024, driven by increasing passenger traffic, airport modernization initiatives, and the adoption of self-service technologies to enhance operational efficiency

- Airports in the region are prioritizing interactive kiosks to streamline check-in, baggage drop, and passenger information services, improving overall traveler experience

- The region’s technologically advanced infrastructure and high disposable incomes support the deployment of kiosks with advanced hardware and AI-enabled software

U.S. Airport Interactive Kiosk Market Insight

The U.S. airport interactive kiosk market captured the largest revenue share within North America in 2024, propelled by widespread adoption of common-use self-service (CUSS) kiosks and automated passport control solutions. Major airports are investing in modern, contactless, and AI-enabled kiosks to reduce queues and enhance passenger throughput. The growing preference for cloud-based management and mobile-accessible kiosks, combined with the integration of biometric authentication and self-service check-in, is further fueling market growth.

Europe Airport Interactive Kiosk Market Insight

The Europe airport interactive kiosk market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent aviation regulations, rising passenger expectations, and the modernization of airport infrastructure. Airports are increasingly integrating kiosks for check-in, baggage handling, and information services to improve operational efficiency and reduce human dependency. The demand is also boosted by the adoption of cloud-based kiosk solutions and self-service models across major European airports.

U.K. Airport Interactive Kiosk Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, driven by the adoption of automated check-in and passport control systems. The increase in passenger traffic, coupled with airport modernization programs and the demand for faster, contactless services, encourages the deployment of interactive kiosks. In addition, the U.K.’s strong digital infrastructure and emphasis on enhancing traveler convenience further support market expansion.

Germany Airport Interactive Kiosk Market Insight

The Germany market is anticipated to expand at a considerable CAGR, fueled by airports adopting advanced kiosk solutions to streamline operations and reduce waiting times. Germany’s focus on smart airport infrastructure, combined with the deployment of software-driven kiosks for passenger information and baggage handling, is driving adoption. Increasing emphasis on security, efficiency, and passenger satisfaction further supports the growth of interactive kiosk solutions across commercial and regional airports.

Asia-Pacific Airport Interactive Kiosk Market Insight

The Asia-Pacific airport interactive kiosk market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising air travel, airport expansions, and government initiatives promoting smart infrastructure. The region’s adoption of self-service kiosks, automated passport control, and baggage check-in solutions is accelerating, particularly in technologically advanced countries. Increasing investments in cloud-based and mobile-accessible kiosk solutions are also contributing to rapid market growth.

Japan Airport Interactive Kiosk Market Insight

The Japan market is gaining momentum due to high passenger volumes, technological adoption, and a focus on convenience and efficiency in airport operations. Airports are deploying advanced interactive kiosks for automated passport control and self-service check-in to reduce congestion and enhance traveler experience. Integration with mobile apps, biometric authentication, and other smart airport systems is further driving market expansion.

China Airport Interactive Kiosk Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s massive passenger base, rapid airport modernization, and adoption of self-service and automated solutions. The deployment of common-use self-service kiosks, baggage drop, and information kiosks is rising steadily across major airports. Government initiatives for smart airports and growing domestic manufacturing capabilities for kiosk hardware and software are key factors propelling the market in China.

Airport Interactive Kiosk Market Share

The airport interactive kiosk industry is primarily led by well-established companies, including:

- KIOSK Information Systems (U.S.)

- Siemens AG (Germany)

- IBM Corporation (U.S.)

- NCR Corporation (U.S.)

- Toshiba Tec Corporation (Japan)

- FUJITSU Corporation (Japan)

- Embross (Australia)

- Collins Aerospace (U.S.)

- TBOTECH Safety & Security, LLC (U.S.)

- March Group (U.S.)

- Safariland, LLC (U.S.)

- OBERON-ALPHA COMPANY (U.S.)

- Advanced Resources Equipment Limited (U.K.)

- Phoenix Industrial (Shenzhen) Co., Limited (China)

Latest Developments in Airport Interactive Kiosk Market

- In August 2025, Zebra Technologies Corporation announced its acquisition of Elo Touch Solutions for $1.3 billion in cash. This strategic move is set to enhance Zebra’s portfolio by integrating Elo’s self-service kiosks, touchscreen systems, and payment terminals, strengthening its presence across retail, hospitality, QSR, healthcare, and industrial markets. The acquisition is expected to expand Zebra’s addressable market and drive additional revenue, positioning the company to offer more comprehensive solutions in the airport interactive kiosk market

- In April 2025, IBM and Tokyo Electron (TEL) extended their five-year partnership focused on advancing semiconductor technologies. This collaboration aims to develop next-generation semiconductor nodes and architectures, which are critical for powering AI-enabled systems. The advancements from this partnership are expected to enhance the performance, intelligence, and efficiency of airport interactive kiosks, supporting smoother operations and faster passenger processing

- In April 2025, Fujitsu Limited and Isuzu Motors Limited signed a partnership agreement to develop software-defined vehicles (SDVs) for commercial mobility. This collaboration targets improving efficiency and achieving carbon neutrality in logistics operations. The technologies and software frameworks developed are expected to indirectly impact airport operations, particularly in automated transportation, baggage handling, and the integration of kiosks with airport mobility solutions

- In March 2025, SITA, a global air transport IT provider, launched its next-generation airport kiosk platform aimed at improving passenger self-service experiences. The platform integrates AI and cloud-based analytics to optimize passenger flow, enhance check-in efficiency, and provide personalized information. This development is projected to accelerate the adoption of interactive kiosks across airports, enabling faster and more seamless passenger processing

- In February 2025, Diebold Nixdorf introduced an upgraded series of self-service kiosks for airports with enhanced biometric authentication, contactless payment options, and modular hardware components. These kiosks are designed to streamline check-in, baggage drop, and information services, improving operational efficiency and passenger satisfaction. The launch reflects the growing trend toward contactless, secure, and technologically advanced solutions in the airport interactive kiosk market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.