Global Airport Retailing Market

Market Size in USD Billion

CAGR :

%

USD

29.57 Billion

USD

90.47 Billion

2025

2033

USD

29.57 Billion

USD

90.47 Billion

2025

2033

| 2026 –2033 | |

| USD 29.57 Billion | |

| USD 90.47 Billion | |

|

|

|

|

Airport Retailing Market Size

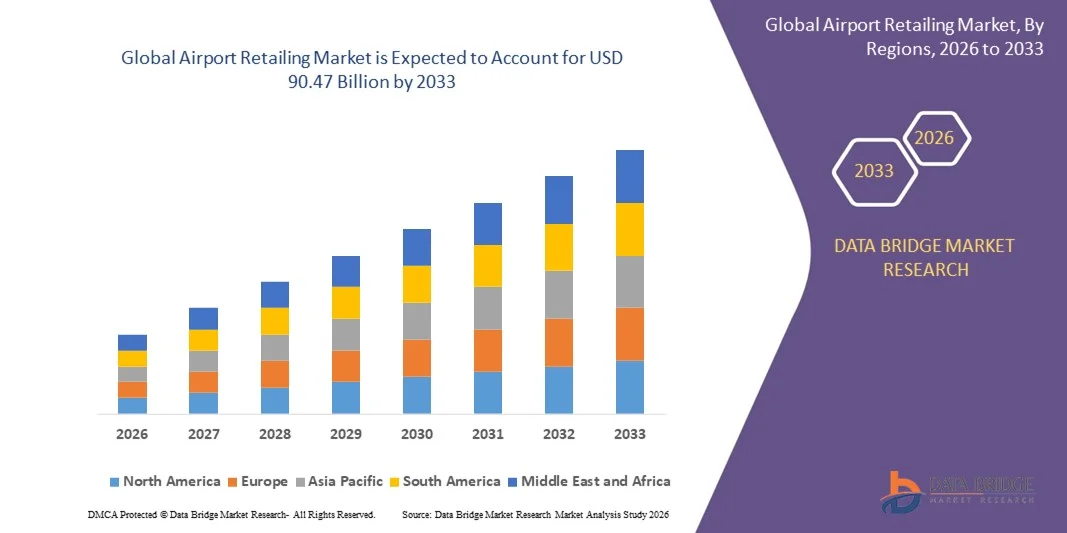

- The global airport retailing market size was valued at USD 29.57 billion in 2025 and is expected to reach USD 90.47 billion by 2033, at a CAGR of 15.00% during the forecast period

- The market growth is largely fueled by the rising passenger traffic across global airports, increasing international and domestic travel, and expanding airport infrastructure that supports diverse retail outlets and duty-free stores

- Furthermore, growing consumer preference for convenience, luxury, and exclusive shopping experiences during travel is driving demand for airport retailing, establishing airports as key retail hubs. These converging factors are accelerating the expansion of retail spaces and enhancing per-passenger spend, thereby significantly boosting the industry’s growth

Airport Retailing Market Analysis

- Airport retailing, encompassing duty-free stores, specialty shops, food and beverage outlets, and travel convenience stores, is becoming an essential component of the passenger experience, offering products and services that cater to both domestic and international travelers. The availability of global brands, curated product assortments, and premium retail experiences is increasingly influencing traveler purchasing behavior

- The escalating demand for airport retailing is primarily fueled by higher disposable incomes, rising traveler expectations for convenience and luxury, and the integration of digital and mobile shopping solutions within terminals, enhancing the overall shopping experience and operational efficiency

- North America dominated airport retailing market with a share of 32.6% in 2025, due to high passenger traffic, extensive airport infrastructure, and the presence of global luxury and duty-free brands

- Asia-Pacific is expected to be the fastest growing region in the airport retailing market during the forecast period due to rapid urbanization, rising middle-class incomes, and the expansion of international and domestic air travel in countries such as China, Japan, and India

- Large airport segment dominated the market with a market share of 52.7% in 2025, due to higher passenger footfall, extensive retail space, and presence of international and premium brand outlets. These airports benefit from global travelers with higher spending power, making them attractive locations for flagship retail stores and luxury product launches

Report Scope and Airport Retailing Market Segmentation

|

Attributes |

Airport Retailing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Airport Retailing Market Trends

Rising Adoption of Duty-Free and Luxury Shopping at Airports

- A significant trend in the airport retailing market is the increasing adoption of duty-free and luxury shopping experiences, driven by higher passenger expectations and the pursuit of premium travel experiences. This trend is elevating airport retail spaces as strategic hubs for brand engagement and high-margin sales opportunities

- For instance, Dufry Group and Lotte Duty Free have expanded their luxury retail offerings across major international airports, providing exclusive products and personalized shopping services that enhance traveler satisfaction and generate substantial revenue. These initiatives strengthen the positioning of airports as destinations for high-end retail experiences

- The integration of digital technologies and omnichannel strategies is transforming airport retailing, with features such as mobile pre-order, self-checkout, and personalized promotions enhancing convenience and consumer engagement. Airports are leveraging these innovations to create seamless shopping journeys that attract frequent and premium travelers

- Passenger loyalty programs and collaborations with leading luxury brands are gaining traction, enabling airports to increase footfall and repeat purchases. Retailers are using targeted marketing strategies and curated product selections to maximize sales and encourage brand affinity among high-spending travelers

- The rise in international travel and cross-border tourism is expanding the customer base for airport retail, increasing demand for duty-free products, luxury fashion, cosmetics, and local specialties. Airports are increasingly positioning themselves as shopping destinations that complement travel experiences and cater to diverse passenger preferences

- Sustainability and experiential retail concepts are emerging as key trends, with airports introducing eco-friendly stores, interactive brand experiences, and lifestyle-focused retail spaces. This approach is redefining airport retailing as more than a transactional environment, enhancing traveler engagement and long-term revenue potential

Airport Retailing Market Dynamics

Driver

Increasing Passenger Traffic and Growing Disposable Incomes

- The growth of global passenger traffic and rising disposable incomes are driving the demand for enhanced airport retail experiences, supporting higher sales of luxury goods, electronics, and lifestyle products. Airports are capitalizing on increased footfall to expand retail offerings and optimize revenue per passenger

- For instance, Dubai International Airport reported record-breaking passenger numbers in 2025, which contributed to a significant increase in duty-free and luxury sales managed by DFS Group. The combination of high traveler volume and purchasing power is reinforcing airport retail as a key revenue stream

- The expansion of international travel networks and airline connectivity is boosting the potential customer base for airport retailers, attracting travelers with diverse spending capacities. Retailers are tailoring product mixes to meet the preferences of premium and business travelers, increasing conversion rates and overall sales

- Higher disposable incomes, particularly in emerging markets, are enabling travelers to spend more on luxury, fashion, and lifestyle products while at airports. This economic shift is encouraging airports to invest in upscale retail spaces, premium lounges, and exclusive brand partnerships

- The continued recovery and growth of the global travel industry following disruptions are reinforcing the role of airports as profitable retail destinations. Airports are increasingly recognized as strategic venues for luxury and duty-free commerce, driving market expansion

Restraint/Challenge

High Operational and Rental Costs for Airport Retail Spaces

- The airport retailing market faces challenges due to high operational and rental costs associated with premium retail spaces, which can limit profitability and constrain new entrants. Airports typically charge elevated rents and service fees for high-traffic locations, impacting overall margins for retailers

- For instance, Heinemann Duty Free has highlighted the financial pressures of operating in major European airports, where rental and operational costs constitute a substantial portion of revenue. These costs necessitate careful financial planning and impact pricing strategies for luxury and duty-free products

- Operating within stringent airport regulations, including security, layout, and operating hour requirements, adds complexity and expense to airport retail management. Retailers must invest in compliance, staff training, and specialized infrastructure to meet regulatory standards

- High costs can restrict the expansion of smaller or mid-sized retailers, limiting diversity and competition within airport retail spaces. This may reduce consumer choice and slow market growth in certain regions

- The combination of elevated rental fees, operational expenses, and variable passenger flows continues to act as a significant restraint on market growth. This challenge necessitates strategic planning and innovation to optimize revenue while managing cost pressures

Airport Retailing Market Scope

The market is segmented on the basis of type, airport size, ownership, applications, and distribution channel.

- By Type

On the basis of type, the airport retailing market is segmented into liquor and tobacco, perfumes and cosmetics, fashion and accessories, food and beverages, pharmacy products, electronic products, arts, fashion, and others. The liquor and tobacco segment dominated the market with the largest revenue share in 2025, driven by strong demand from international travelers seeking duty-free products and premium brands. Travelers often prioritize liquor and tobacco for tax savings and exclusive product availability, and airports frequently promote these categories through prominent store placements and promotional campaigns.

The perfumes and cosmetics segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer interest in luxury beauty products and the rise of brand-conscious travelers. Perfume and cosmetic retailers are increasingly integrating experiential displays and personalized services to attract customers, enhancing purchase intent. The segment’s growth is further supported by frequent product launches, collaborations with luxury brands, and the convenience of purchasing premium products while traveling.

- By Airport Size

On the basis of airport size, the market is segmented into large, medium, and small airports. Large airports dominated the market in 2025, capturing the highest revenue share of 52.7% due to higher passenger footfall, extensive retail space, and presence of international and premium brand outlets. These airports benefit from global travelers with higher spending power, making them attractive locations for flagship retail stores and luxury product launches. In addition, large airports often host a diverse mix of retail categories, maximizing sales across liquor, cosmetics, fashion, and electronics.

Medium airports are expected to witness the fastest growth rate from 2026 to 2033, driven by expanding regional connectivity and increasing passenger traffic in secondary cities. The rise of domestic and regional airlines has encouraged medium airports to invest in improved retail infrastructure and curated product offerings. Retailers targeting medium airports benefit from lower competition compared with large airports while capitalizing on rising disposable incomes and growing travel frequency among domestic passengers.

- By Ownership

On the basis of ownership, the market is segmented into corporate chains, independent owners, and franchises. Corporate chains dominated the market with the largest revenue share in 2025, supported by their ability to offer a wide range of products, consistent brand experience, and strong supplier partnerships. Travelers often prefer corporate chain outlets for reliable quality, loyalty programs, and international brand recognition, increasing purchase confidence. These chains also leverage advanced retail technologies such as automated checkouts and mobile payment solutions to enhance customer experience and drive higher sales volumes.

Franchises are expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing expansion of popular retail brands through franchise agreements at airports. Franchises offer the advantage of brand recognition and operational expertise while enabling rapid market penetration. The segment growth is further enhanced by traveler preference for familiar brands during transit and airport authorities’ support for diverse retail formats to improve passenger experience.

- By Applications

On the basis of applications, the market is segmented into airside, landside, and other areas. Airside retailing dominated the market with the largest revenue share in 2025, driven by restricted access areas attracting high-spending passengers with longer dwell times. Airside shops often offer premium and duty-free products, targeting international travelers seeking convenience and exclusive items. The segment benefits from strategic store placements near boarding gates, lounges, and transit areas, ensuring visibility and accessibility for high-value purchases.

Landside retailing is anticipated to witness the fastest growth rate from 2026 to 2033, supported by increasing footfall in pre-security zones and enhanced passenger engagement strategies. Landside retail allows travelers and visitors to shop before passing through security checks, expanding the potential customer base. Retailers in landside areas are increasingly incorporating omnichannel strategies and experiential marketing to drive engagement and sales.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct retailer, convenience store, specialty retailer, and departmental store. Direct retailers dominated the market with the largest revenue share in 2025, driven by the ability to offer exclusive products, promotional bundles, and personalized customer interactions. Airports favor direct retail setups for high-value product categories such as liquor, cosmetics, and fashion, allowing brands to directly influence purchasing decisions. The direct retailer model also facilitates loyalty programs and targeted marketing initiatives, increasing overall revenue and repeat purchases.

Specialty retailers are expected to witness the fastest growth rate from 2026 to 2033, fueled by the growing demand for niche products and curated shopping experiences. Specialty stores focus on specific categories, offering expert knowledge and exclusive items that attract discerning travelers. The growth is further supported by airport authorities encouraging unique retail concepts to enhance passenger satisfaction and differentiate airport retail offerings.

Airport Retailing Market Regional Analysis

- North America dominated the airport retailing market with the largest revenue share of 32.6% in 2025, driven by high passenger traffic, extensive airport infrastructure, and the presence of global luxury and duty-free brands

- Consumers in the region highly value convenience, product variety, and exclusive offers available at airport retail outlets, particularly for liquor, cosmetics, and fashion products

- This widespread adoption is further supported by strong disposable incomes, frequent international travel, and travelers’ preference for premium duty-free purchases, establishing airport retailing as a key revenue driver for airports and brands alike

U.S. Airport Retailing Market Insight

The U.S. airport retailing market captured the largest revenue share in 2025 within North America, fueled by increasing international and domestic air travel and the growing trend of airport-based shopping experiences. Travelers are increasingly prioritizing convenience and time-efficient shopping, especially for high-value categories such as liquor, perfumes, and electronics. The proliferation of luxury retail outlets and enhanced in-terminal shopping experiences, combined with strong e-commerce integration for pre-order and pick-up services, further drives the market. In addition, U.S. airports continue to attract flagship stores from global brands, boosting overall retail revenue.

Europe Airport Retailing Market Insight

The Europe airport retailing market is projected to expand at a substantial CAGR during the forecast period, driven by increasing passenger volumes, urbanization, and a preference for luxury and duty-free shopping. Travelers in the region are drawn to high-end brands, convenience, and curated shopping experiences offered within airports. European airports are investing in modern retail infrastructure and experiential store concepts, enhancing traveler engagement and encouraging repeat purchases. The growth is further supported by the rising number of business travelers and cross-border tourism, establishing airports as significant retail hubs.

U.K. Airport Retailing Market Insight

The U.K. airport retailing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing flow of international travelers and rising demand for luxury, fashion, and beauty products. Travelers are prioritizing duty-free shopping for value savings and exclusive access to global brands. The U.K.’s well-developed airport infrastructure, combined with the integration of digital retail solutions such as mobile ordering and self-checkout, continues to stimulate market growth. In addition, brand loyalty programs and in-terminal promotions further enhance traveler spending.

Germany Airport Retailing Market Insight

The Germany airport retailing market is expected to expand at a considerable CAGR during the forecast period, driven by rising passenger traffic, growing tourism, and increasing consumer spending on luxury and lifestyle products. Germany’s strong airport infrastructure, efficient operations, and focus on passenger convenience promote the adoption of premium retail formats. Travelers are drawn to curated shopping experiences, duty-free pricing, and a variety of product categories including fashion, electronics, and food and beverages. The integration of technology-enabled retail solutions, such as mobile payment and pre-order services, is also enhancing market adoption.

Asia-Pacific Airport Retailing Market Insight

The Asia-Pacific airport retailing market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising middle-class incomes, and the expansion of international and domestic air travel in countries such as China, Japan, and India. The region’s growing inclination toward luxury and premium duty-free shopping, combined with government initiatives to modernize airports, is driving market adoption. Furthermore, as APAC emerges as a hub for both domestic and international retail brands, the accessibility and affordability of airport retail products are increasing, attracting a wider consumer base.

Japan Airport Retailing Market Insight

The Japan airport retailing market is gaining momentum due to the country’s high passenger traffic, emphasis on premium shopping experiences, and increasing international tourism. Japanese travelers are drawn to high-quality products, convenience, and exclusive airport offerings, particularly in cosmetics, liquor, and electronics. Retailers are integrating technology-driven solutions such as mobile pre-orders, loyalty apps, and automated checkouts to enhance shopping efficiency. Moreover, Japan’s aging population is likely to drive demand for easy-to-access retail formats, ensuring inclusive shopping experiences across terminals.

China Airport Retailing Market Insight

The China airport retailing market accounted for the largest market revenue share in Asia Pacific in 2025, driven by a growing middle class, high international travel volumes, and rising disposable incomes. Chinese travelers increasingly prefer duty-free and premium retail options, including liquor, cosmetics, and fashion products. The rapid development of modern airports and the introduction of experiential retail concepts, such as interactive brand displays and technology-enabled shopping, are further boosting market growth. In addition, domestic and international brands are expanding their presence in major Chinese airports, strengthening the retail ecosystem.

Airport Retailing Market Share

The airport retailing industry is primarily led by well-established companies, including:

- InMotion Hosting (U.S.)

- Delaware North Companies, Inc. (U.S.)

- XpresSpa Group (U.S.)

- Areas (France)

- Paradies Lagardère Travel Retail (U.S.)

- HMSHost (U.S.)

- Hudson (U.S.)

- SSP Group plc (U.K.)

- Sodexo (France)

- Concessions International (U.S.)

- Dubai Duty Free (U.A.E.)

- Dufry (Switzerland)

- DFS Group Ltd (Hong Kong)

- KING POWER International (Thailand)

- THE SHILLA DUTY FREE (South Korea)

- China Duty Free Group Co., Ltd (China)

- Gebr. Heinemann SE & Co. KG (Germany)

- Japan Airport Terminal Co. Ltd. (Japan)

- Flemingo International (India)

Latest Developments in Global Airport Retailing Market

- In February 2026, Avolta AG announced a major expansion of its retail and food-and-beverage operations at Shanghai Pudong International Airport, securing a contract to operate multiple outlets across the airport’s central public areas. This strategic move is aimed at creating an integrated dining and shopping experience that encourages passengers to spend more time within the airport, increasing dwell-time engagement and per-passenger retail spending. The expansion strengthens Avolta’s presence in the high-growth Asia-Pacific region, allowing the company to capture rising demand from both domestic and international travelers. By combining diverse retail formats with food and beverage offerings, Avolta is positioning itself to meet evolving traveler expectations for convenience, variety, and premium experiences

- In October 2025, Lagardère Travel Retail opened the largest retail store ever at Amsterdam Schiphol Airport under its new “Today Duty Free” concept. The store significantly expands its footprint at one of Europe’s busiest airports and introduces immersive, experiential retail elements designed to enhance passenger engagement. By offering a wide range of products across categories such as liquor, cosmetics, fashion, and electronics, the initiative maximizes shopper convenience and encourages higher spend per traveler. This development reinforces Lagardère’s competitive position in the European airport retail sector and sets a new benchmark for modern duty-free environments, combining both luxury shopping and seamless customer experiences

- In November 2025, Dufry AG announced a strategic partnership with a leading technology firm to enhance its digital retail capabilities. This initiative focuses on leveraging data analytics to provide personalized shopping experiences, enabling the company to understand consumer behavior and preferences more accurately. By integrating advanced digital tools, Dufry aims to improve customer engagement, boost operational efficiency, and strengthen brand loyalty. The move positions Dufry as a leader in the digital transformation of airport retailing, with technology-driven strategies likely to influence broader market trends and set new standards for customer experience innovation

- In October 2025, Lagardère Travel Retail launched an innovative mobile app designed to streamline the shopping experience for travelers. The app includes features such as pre-ordering, contactless payments, and personalized recommendations, significantly improving convenience and customer satisfaction. By catering to tech-savvy travelers, the company enhances its competitive advantage and encourages higher engagement with its retail outlets. This initiative reflects a proactive approach to digital retail innovation and demonstrates Lagardère’s commitment to adapting to changing consumer expectations in the airport retail sector

- In September 2025, Heinemann Duty Free expanded its product range to include more sustainable and locally sourced items in response to growing consumer demand for environmentally friendly options. This strategic shift aligns with global sustainability trends and also strengthens the company’s brand image as a responsible and ethically conscious retailer. By incorporating eco-friendly products, Heinemann attracts a broader customer base that values sustainability, while simultaneously enhancing its relevance in a market increasingly influenced by ethical consumption and green purchasing behaviors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.