Global Airport Stands Equipment Market

Market Size in USD Billion

CAGR :

%

USD

7.53 Billion

USD

12.90 Billion

2024

2032

USD

7.53 Billion

USD

12.90 Billion

2024

2032

| 2025 –2032 | |

| USD 7.53 Billion | |

| USD 12.90 Billion | |

|

|

|

|

Airport Stand Equipment Market Size

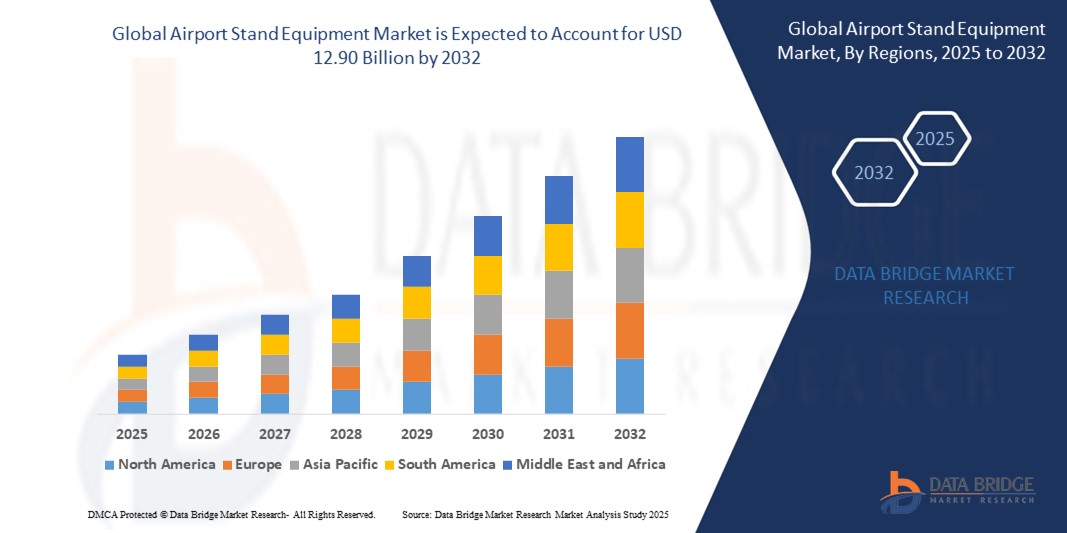

- The global airport stand equipment market size was valued at USD 7.53 billion in 2024 and is expected to reach USD 12.90 billion by 2032, at a CAGR of 6.95% during the forecast period

- The market growth is largely fueled by the rising global air traffic, expansion of airport infrastructure, and increased emphasis on operational efficiency and aircraft turnaround time at both international and regional airports

- Furthermore, growing investments in MRO (Maintenance, Repair, and Overhaul) facilities and airport modernization initiatives are creating substantial demand for advanced, durable, and ergonomically designed stand systems that enhance safety and productivity during aircraft servicing operations. These converging factors are accelerating the adoption of airport stand equipment, thereby significantly boosting the industry's growth

Airport Stand Equipment Market Analysis

- Airport stand equipment includes a wide range of ground support tools such as engine access stands, cabin interior stands, and landing gear access stands, which enable safe and efficient maintenance and servicing of aircraft on the ground. These systems play a critical role in supporting daily operations, MRO tasks, and emergency repairs

- The escalating demand for airport stand equipment is primarily driven by the construction of new airports, upgrades of aging infrastructure, and the growing need for fast, safe, and standardized ground handling processes across civil and commercial aviation segments

- North America dominated the airport stand equipment market with a share of 33.5% in 2024, due to robust investments in aviation infrastructure and a strong presence of major MRO providers

- Asia-Pacific is expected to be the fastest growing region in the airport stand equipment market during the forecast period due to rapid expansion in aviation infrastructure, surging air traffic, and the emergence of the region as a key hub for global travel and commerce

- Maintenance, Repair, & Overhaul (MRO) segment dominated the market with a market share of 59.2% in 2024, due to the ongoing need for aircraft longevity, safety compliance, and performance optimization. Airlines are increasingly outsourcing MRO services to specialized providers who rely heavily on precision-engineered stand equipment to perform structural inspections, part replacements, and system overhauls efficiently. The aging global aircraft fleet and rising air traffic volumes further amplify the demand for MRO-specific equipment

Report Scope and Airport Stand Equipment Market Segmentation

|

Attributes |

Airport Stand Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Airport Stand Equipment Market Trends

“Expanding Tourism Industries Globally”

- The airport stand equipment market is experiencing strong growth driven by the rapid expansion of global tourism sectors, which increases demand for efficient and safe ground support services

- For instance, major airports across Europe, Asia-Pacific, and the Middle East are upgrading infrastructure with modern stand equipment from suppliers such as TLD Group and Mallaghan Engineering to accommodate rising passenger volumes and enhance turnaround times

- Increasing investments in airport modernization projects, including expansions and new terminal developments, are fueling the adoption of advanced stand equipment such as passenger boarding bridges (PBBs) and ground power units (GPUs)

- Technological advancements such as integration with airport management systems, IoT-enabled remote monitoring, and energy-efficient machinery are becoming standard to improve operational efficiency and reduce costs

- Growth in air freight traffic also boosts demand for specialized ground equipment to handle cargo aircraft servicing and expedite logistics processes

- The rising focus on safety features, modular equipment designs, and adaptability to various aircraft types supports market expansion by enabling flexibility amid diverse operational needs

Airport Stand Equipment Market Dynamics

Driver

“Rising Passenger Traffic”

- Increasing global passenger traffic is a primary driver, requiring airports to enhance ground support facilities to maintain efficient aircraft handling and quick turnaround

- For instance, per IATA data, international passenger traffic surged by over 300% in May 2022 compared to May 2021, pushing airports in high-growth regions such as Asia-Pacific and the Middle East to invest heavily in stand equipment upgrading for higher capacity and reliability

- The growth in low-cost carriers and expansion of existing hubs intensify need for scalable and modular stand equipment solutions that can be tailored to varying aircraft sizes and operations

- Rising disposable incomes and expanding middle classes are expected to sustain passenger growth long term, continuously boosting demand for advanced airport ground equipment

- Increasing emphasis on passenger experience and minimizing delays further motivates investment in smart, automated equipment that supports smooth boarding and deboarding processes

Restraint/Challenge

“High Initial Investment Costs”

- The high upfront expenditure for procuring, installing, and integrating modern airport stand equipment remains a significant challenge, especially for developing countries and smaller airports

- For instance, airports upgrading to advanced passenger boarding bridges, electric ground power units, and automated systems often face budget constraints that delay or limit adoption, as reported by operators working with vendors such as TLD and Mallaghan Engineering

- Installation of specialized and modular equipment necessitates infrastructure adaptations or expansions, leading to additional capital costs and potential operational downtime during upgrades

- The integration of IoT and sensor technologies, although beneficial, further increases system complexity and investment requirements requiring skilled technical personnel

- Operators must also consider maintenance, training, and lifecycle costs, which can be prohibitive for entities with limited financial flexibility, impacting overall market penetration

Airport Stand Equipment Market Scope

The market is segmented on the basis of stand type and application.

- By Stands

On the basis of stands, the airport stand equipment market is segmented into engine access, landing gear access, wheel, aircraft entry, cabin interior, and others. The engine access segment dominated the largest market revenue share in 2024 due to the high frequency of engine inspections and maintenance operations required to ensure aircraft safety and performance. Airlines and MRO providers prioritize engine access equipment to streamline servicing procedures, reduce downtime, and maintain compliance with stringent safety regulations. Its versatility across various aircraft models and its critical role in both routine checks and deep maintenance activities further reinforce its dominance in the market.

The cabin interior segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for passenger experience enhancement and growing investments in aircraft cabin retrofitting. Cabin interior stands are essential for accessing overhead compartments, lighting systems, and entertainment units, particularly during cabin refurbishments and upgrades. Their lightweight construction, modular design, and ease of deployment make them increasingly popular among ground support teams working in confined aircraft interiors.

- By Application

On the basis of application, the airport stand equipment market is segmented into aircraft operations and maintenance, repair, & overhaul (MRO). The MRO segment accounted for the largest revenue share of 59.2% in 2024, attributed to the ongoing need for aircraft longevity, safety compliance, and performance optimization. Airlines are increasingly outsourcing MRO services to specialized providers who rely heavily on precision-engineered stand equipment to perform structural inspections, part replacements, and system overhauls efficiently. The aging global aircraft fleet and rising air traffic volumes further amplify the demand for MRO-specific equipment.

The aircraft operations segment is projected to register the fastest growth from 2025 to 2032, propelled by expanding ground handling services and the need for swift aircraft turnaround times. Stand equipment used in daily operations—such as for cargo loading, passenger boarding, and system checks—ensures operational efficiency and safety on the tarmac. As airports focus on minimizing gate occupancy times and enhancing ground handling processes, demand for agile and durable stand systems in day-to-day aircraft operations continues to rise.

Airport Stand Equipment Market Regional Analysis

- North America dominated the airport stand equipment market with the largest revenue share of 33.5% in 2024, driven by robust investments in aviation infrastructure and a strong presence of major MRO providers

- The region’s airports are continuously modernizing their ground support systems, and the rising frequency of air travel is increasing the need for efficient aircraft servicing and turnaround capabilities

- The combination of advanced aerospace manufacturing, established airline fleets, and growing passenger volumes reinforces North America’s leadership in the adoption of high-performance airport stand equipment

U.S. Airport Stand Equipment Market Insight

The U.S. airport stand equipment market captured the largest share within North America in 2024, propelled by ongoing upgrades to airport infrastructure, a mature aviation ecosystem, and the rapid expansion of airline fleets. The country’s focus on enhancing aircraft servicing capabilities and ensuring compliance with stringent FAA safety standards is driving the demand for high-performance stand systems. With the rise in domestic and international flights, U.S. airports are adopting modular and mobile stand solutions that support both commercial and cargo operations efficiently. In addition, increasing automation in ground handling operations is fueling the need for intelligent, ergonomic, and easily deployable equipment.

Europe Airport Stand Equipment Market Insight

Europe is projected to witness steady growth in the airport stand equipment market during the forecast period, supported by airport modernization programs and the expanding scope of MRO services across the region. As European airports aim to reduce delays and increase throughput, there is a growing emphasis on outfitting ground crews with flexible and efficient stand systems that can accommodate a variety of aircraft configurations. Stricter aviation regulations concerning maintenance standards and safety have also intensified demand for precision-engineered stand equipment. Rising air travel, especially across intra-European routes, continues to fuel the need for fast and safe aircraft servicing.

U.K. Airport Stand Equipment Market Insight

The U.K. airport stand equipment market is expected to grow at a notable CAGR over the coming years, driven by significant investments in airport expansion and a renewed focus on operational excellence post-Brexit. Key airports such as Heathrow, Gatwick, and Manchester are upgrading their maintenance and servicing facilities, increasing the demand for technologically advanced and highly mobile stand systems. The country's aviation sector is also seeing a surge in international and low-cost carrier activity, which elevates the need for faster aircraft turnaround and highly efficient ground handling equipment. Moreover, environmental and ergonomic standards are encouraging the adoption of lightweight and energy-efficient stand solutions.

Germany Airport Stand Equipment Market Insight

Germany’s airport stand equipment market is poised for strong growth, fueled by the country’s robust aviation infrastructure, leading MRO capabilities, and a deep commitment to precision engineering. German airports are prioritizing advanced aircraft servicing systems to handle both growing passenger volumes and the complexity of modern aircraft. The rise in retrofitting and modernization of airport ground systems, particularly at major hubs such as Frankfurt and Munich, is creating a favorable environment for the adoption of durable and multifunctional stand equipment. Furthermore, the German market values eco-conscious design, spurring interest in sustainable materials and energy-saving stand systems.

Asia-Pacific Airport Stand Equipment Market Insight

Asia-Pacific is anticipated to register the fastest CAGR from 2025 to 2032, driven by rapid expansion in aviation infrastructure, surging air traffic, and the emergence of the region as a key hub for global travel and commerce. Countries such as China, India, Vietnam, and Indonesia are witnessing exponential growth in airport development projects, which in turn boosts demand for high-capacity and adaptable stand equipment. The increasing focus on reducing aircraft turnaround time and supporting fleet expansion by budget airlines is also driving adoption. Furthermore, Asia-Pacific’s growing role as a manufacturing base for ground support equipment is improving access to cost-effective and high-performance solutions across emerging markets.

Japan Airport Stand Equipment Market Insight

Japan’s airport stand equipment market is advancing steadily, supported by a well-established aviation sector, strong regulatory compliance, and a focus on passenger safety and operational reliability. Japanese airports, known for their technological sophistication and attention to detail, are investing in smart and modular stand systems to accommodate a growing number of domestic and international flights. The country’s aging population is influencing demand for ergonomic equipment that enhances the efficiency of ground crews while maintaining strict safety standards. In addition, Japan’s focus on sustainability is leading to the adoption of lightweight and reusable materials in airport support systems

China Airport Stand Equipment Market Insight

China accounted for the largest revenue share in the Asia-Pacific airport stand equipment market in 2024, backed by aggressive airport infrastructure development and the nation’s position as a global leader in aviation growth. The rapid expansion of both international and regional airports across China is fueling a high demand for aircraft maintenance and servicing tools, including a wide range of access stands. China’s smart airport initiatives, combined with its advanced manufacturing capabilities, are enabling large-scale adoption of intelligent ground handling systems. The country's strong domestic aviation ecosystem and government support for aviation modernization continue to make it a dominant force in the regional market.

Airport Stand Equipment Market Share

The airport stand equipment industry is primarily led by well-established companies, including:

- Adelte Group S.L. (Spain)

- AERO SPECIALTIES, INC (U.S.)

- Cavotec SA (Switzerland)

- CIMC Tianda Holdings Limited (China)

- FMT Aircraft Gate Support Systems AB (Sweden)

- John Bean Technologies Corp (U.S.)

- Omega Aviation Services, Inc. (U.S.)

- ShinMaywa Industries, Ltd (Japan)

- Textron Ground Support Equipment Inc (U.S.)

- TK Elevator (Germany)

Latest Developments in Global Airport Stand Equipment Market

- In 2024, Aberdeen International Airport in Scotland implemented a digital twin architecture that enables real-time 2D and 3D visualization of aircraft stand operations. This technological upgrade is anticipated to positively impact the airport stand equipment market by improving stand utilization, reducing aircraft idle time, and promoting the integration of smart stand systems with digital airside operations

- In 2023, United Airlines commenced construction of a USD 177 million ground service equipment (GSE) maintenance facility at George Bush Intercontinental Airport (IAH) in Houston. Designed to support more than 1,800 ground service vehicles, including electric and battery-powered units, this facility is expected to boost demand in the airport stand equipment market through the adoption of sustainable, efficient, and electric-ready servicing infrastructure

- In 2023, Beijing Daxing International Airport initiated expansion plans to accommodate rising international passenger volumes. The plans include building new aircraft parking stands and extending maintenance zones. This expansion is likely to accelerate the airport stand equipment market by driving demand for high-capacity, wide-body-compatible stand systems tailored for modern aviation needs

- In February 2022, the Canadian government allocated USD 2.6 million to Regina International Airport for critical infrastructure repairs, along with an additional commitment of approximately USD 16 million announced by Transportation Minister Omar Alghabra. These investments are expected to positively influence the airport stand equipment market by enhancing ground handling capabilities, modernizing servicing infrastructure, and driving demand for advanced stand systems to support increased operational efficiency and safety at the airport

- In 2021, India’s Ministry of Civil Aviation approved a series of airport development projects under the UDAN scheme, targeting airports such as Navi Mumbai, Jewar, and Bhogapuram. These projects are expected to positively influence the airport stand equipment market by increasing demand for modern and flexible ground handling systems to support the growing regional and domestic air traffic across the country

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.