Global Alcohol Free Spirits Market

Market Size in USD Billion

CAGR :

%

USD

9.68 Billion

USD

16.63 Billion

2024

2032

USD

9.68 Billion

USD

16.63 Billion

2024

2032

| 2025 –2032 | |

| USD 9.68 Billion | |

| USD 16.63 Billion | |

|

|

|

|

Alcohol Free Spirits Market Size

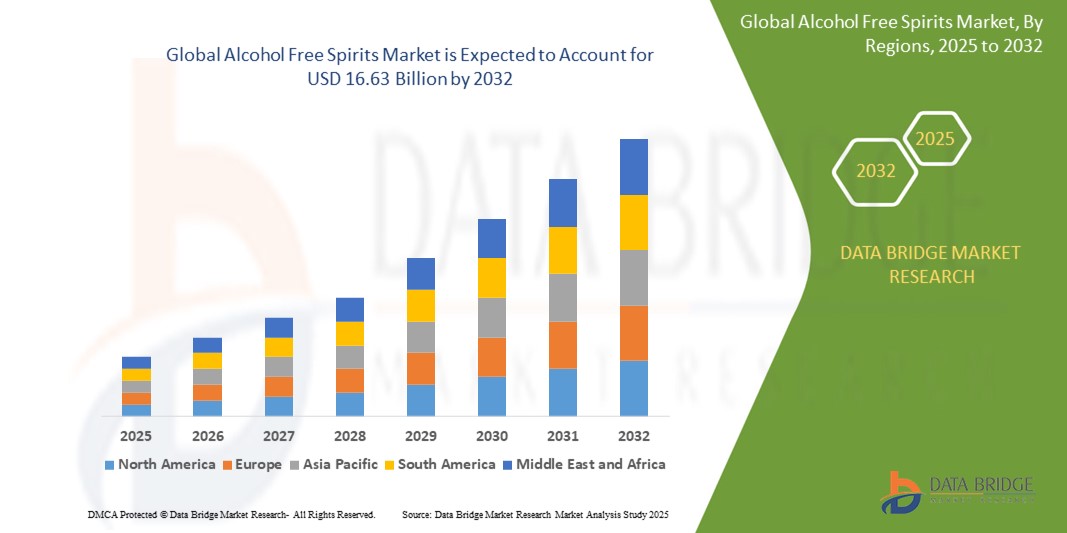

- The global alcohol free spirits market size was valued at USD 9.68 billion in 2024 and is expected to reach USD 16.63 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by rising health consciousness and the global shift toward mindful drinking, driving increased adoption of alcohol-free spirits as alternatives to traditional alcoholic beverages

- Furthermore, the expanding availability of sophisticated non-alcoholic formulations that replicate the taste, aroma, and mouthfeel of conventional spirits is attracting health-conscious consumers and social drinkers alike. These converging factors are accelerating demand, thereby significantly boosting the industry's growth

Alcohol Free Spirits Market Analysis

- Alcohol-free spirits are beverages crafted to mimic the flavor and complexity of traditional spirits while containing 0% ABV, often using botanicals, herbs, and advanced distillation or extraction techniques

- The growing popularity of sober-curious lifestyles, increasing demand for premium non-alcoholic options, and the entry of major beverage players into the segment are key factors propelling market expansion across retail and hospitality channels

- North America dominated the alcohol free spirits market with a share of 36.1% in 2024, due to rising consumer interest in health-conscious lifestyles and the growing trend of mindful drinking

- Asia-Pacific is expected to be the fastest growing region in the alcohol free spirits market during the forecast period due to rising health awareness, cultural shifts, and increasing disposable incomes in countries such as China, Japan, and Australia

- Bottles segment dominated the market with a market share of 39.2% in 2024, due to their traditional association with premium beverages and superior preservation qualities. Bottled packaging enhances the aesthetic appeal and perceived value of alcohol-free spirits, particularly in retail and gifting segments. Glass bottles also offer recyclability and inertness, making them favorable from both a branding and sustainability standpoint

Report Scope and Alcohol Free Spirits Market Segmentation

|

Attributes |

Alcohol Free Spirits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alcohol Free Spirits Market Trends

“Growing Demand for Health-Conscious Alternatives”

- The alcohol free spirits market is expanding rapidly as consumers seek healthier lifestyle choices, wellness-oriented products, and reduced alcohol consumption without compromising on the social and sensory experience of traditional spirits

- For instance, Seedlip, a pioneer in the category, has successfully captured market share with its distilled non-alcoholic spirits that offer sophisticated flavor profiles and have gained popularity in premium bars and retail globally

- Increasing interest in mindful drinking and alcohol-free socializing is driving innovation in diverse flavor variants and premium packaging that appeal to discerning adult consumers seeking alternatives to wine, beer, and liquor

- The rise of wellness and clean-label trends encourages the use of natural botanicals, low-calorie ingredients, and sugar-free formulations to address health-conscious consumer demands

- Expansion of retail availability—from supermarkets to specialty wellness stores and online platforms—is enhancing consumer access and encouraging trial and repeat purchases of alcohol free spirits

- Collaborations between alcohol-free brands and cocktail influencers or mixologists are educating consumers on how to enjoy complex cocktails without alcohol, fostering market growth and acceptance

Alcohol Free Spirits Market Dynamics

Driver

“Rise in Non-Alcoholic Beverage Consumption”

- The global increase in preference for non-alcoholic beverages is strongly fueling demand for alcohol free spirits as consumers shift towards reducing alcohol intake while retaining sophisticated drinking experiences

- For instance, Diageo’s launch of non-alcoholic versions of top spirit brands underlines the growing corporate commitment to capturing this expanding segment driven by changing consumer behaviors

- Increased government regulations, health recommendations, and workplace policies encouraging lower alcohol consumption are reinforcing consumer shifts towards non-alcoholic options

- Younger generations, including Gen Z and Millennials, are demonstrating growing interest in alcohol-free alternatives for social occasions that emphasize wellness and mindfulness

- Rising social acceptance, along with improved product innovation providing premium taste and texture experiences, is widening the customer base beyond traditional teetotalers to everyday consumers

Restraint/Challenge

“Flavor and Quality Consistency”

- Achieving consistent, high-quality flavor profiles that closely mimic or complement traditional alcoholic spirits remains a major challenge for producers of alcohol free spirits, impacting consumer satisfaction and market retention

- For instance, small-scale producers such as Lyre’s have communicated challenges related to replicating complex distillation and aging processes in non-alcoholic formats without compromising on flavor depth or mouthfeel

- Variations in botanical ingredient quality and formulation complexity can lead to batch inconsistencies, which may affect brand reputation and consumer trust

- Consumer expectations for both taste and sophisticated sensory experiences are high, requiring continuous R&D investment and expert craftsmanship that can strain smaller manufacturers

- The absence of alcohol’s preservative effect creates challenges for shelf life and product stability, necessitating advanced preservation techniques that add complexity and cost

Alcohol Free Spirits Market Scope

The market is segmented on the basis of source, packaging, and distribution channel.

- By Source

On the basis of source, the alcohol-free spirits market is segmented into fruits, vegetables, cereals, tea, coffee, milk, cocoa/chocolate, plant extracts/herbal extracts, microbial extracts, nuts, soybean, floral extracts, colorants, sweeteners, flavours, preservatives, and CO₂. The fruits segment dominated the largest market revenue share in 2024, attributed to their versatility, natural flavor appeal, and wide consumer acceptance. Fruit-based alcohol-free spirits are often perceived as healthier alternatives due to their natural origin, clean label positioning, and association with wellness trends. The abundance of tropical, citrus, and berry variants also enables diverse flavor profiles, catering to a wide range of taste preferences among consumers seeking vibrant and refreshing non-alcoholic beverages.

The plant extracts/herbal extracts segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for botanically-infused beverages that mimic the complexity of traditional alcoholic spirits. These extracts provide depth of flavor and aromatic complexity while aligning with the growing consumer preference for clean, functional, and wellness-enhancing ingredients. Their appeal is further reinforced by their traditional medicinal connotations and their growing use in premium alcohol-free formulations marketed for mindful drinking occasions.

- By Packaging

On the basis of packaging, the alcohol-free spirits market is segmented into bottles, metal can, liquid carton, slim plastic containers, pouch, tetra pak, sachet, and takeaway cups and tumblers. The bottles segment accounted for the largest revenue share of 39.2% in 2024, driven by their traditional association with premium beverages and superior preservation qualities. Bottled packaging enhances the aesthetic appeal and perceived value of alcohol-free spirits, particularly in retail and gifting segments. Glass bottles also offer recyclability and inertness, making them favorable from both a branding and sustainability standpoint.

The tetra pak segment is projected to register the fastest CAGR from 2025 to 2032, owing to its lightweight, space-efficient, and eco-friendly nature. Tetra pak packaging is increasingly adopted for its extended shelf life, lower transportation costs, and compatibility with aseptic filling processes. The format is especially gaining traction among brands targeting younger, sustainability-conscious consumers and expanding into on-the-go and mass-market retail channels.

- By Distribution Channel

On the basis of distribution channel, the alcohol-free spirits market is segmented into hypermarket, supermarket, convenience stores, e-commerce, and others. The supermarket segment held the largest market share in 2024, supported by its ability to showcase a wide variety of products and offer consumers an immersive, in-person exploration of alcohol-free options. Supermarkets benefit from established supply chains, strategic shelf placements, and promotional activities, which boost product visibility and influence impulse purchases.

The e-commerce segment is expected to experience the highest growth rate from 2025 to 2032, propelled by shifting consumer behavior toward online shopping and the growing availability of niche, craft, and premium alcohol-free spirit brands on digital platforms. Online channels allow for wider reach, personalized marketing, and direct-to-consumer business models, while enabling users to read reviews, access detailed product information, and receive home delivery—factors that are accelerating adoption among digitally active, health-conscious consumers.

Alcohol Free Spirits Market Regional Analysis

- North America dominated the alcohol free spirits market with the largest revenue share of 36.1% in 2024, driven by rising consumer interest in health-conscious lifestyles and the growing trend of mindful drinking

- Consumers in the region are increasingly choosing alcohol-free alternatives for social occasions, wellness, and moderation without compromising on taste or experience

- This widespread adoption is further supported by strong distribution networks, premium product availability, and the growing influence of sober-curious movements and alcohol-free bar concepts across the region

U.S. Alcohol-Free Spirits Market Insight

The U.S. alcohol-free spirits market captured the largest revenue share in 2024 within North America, fueled by a surge in demand for low- and no-alcohol beverages among millennials and Gen Z consumers. This demographic shift, coupled with growing concerns about physical and mental well-being, is reshaping the beverage landscape. Product innovations that replicate the complexity of traditional spirits, combined with the expansion of online sales channels and the rise of alcohol-free social venues, are further accelerating market growth.

Europe Alcohol-Free Spirits Market Insight

The Europe alcohol-free spirits market is projected to grow at a robust CAGR during the forecast period, driven by a growing cultural shift towards moderate drinking and increasing support for health and wellness. Countries across the region are witnessing strong traction for alcohol-free alternatives, supported by premiumization and greater visibility in retail and hospitality sectors. The rise of Dry January and other sobriety-led movements are contributing to heightened awareness and sustained consumer demand across the continent.

U.K. Alcohol-Free Spirits Market Insight

The U.K. alcohol-free spirits market is expected to expand significantly, fueled by the nation’s early adoption of the low-and-no-alcohol trend. Consumers are drawn to alcohol-free spirits for their sophisticated taste, health benefits, and suitability in social settings without the drawbacks of alcohol. Retailers and on-trade establishments are increasing shelf space and menu offerings for these products, while strong marketing campaigns and celebrity-backed brands are further boosting popularity.

Germany Alcohol-Free Spirits Market Insight

The Germany alcohol-free spirits market is poised for considerable growth, supported by an established culture of non-alcoholic beverages and a well-informed consumer base. Increasing interest in natural and functional ingredients, coupled with innovation in herbal and botanical blends, is driving product uptake. Germany’s mature beverage industry, strong retail penetration, and commitment to sustainable, health-oriented products are expected to enhance the visibility and demand for alcohol-free spirits.

Asia-Pacific Alcohol-Free Spirits Market Insight

The Asia-Pacific alcohol-free spirits market is projected to witness the fastest CAGR from 2025 to 2032, driven by rising health awareness, cultural shifts, and increasing disposable incomes in countries such as China, Japan, and Australia. Rapid urbanization and westernization of lifestyle choices, along with the influence of global wellness trends, are boosting market momentum. Growing product availability in premium retail outlets and online platforms is also enabling faster market penetration across the region.

Japan Alcohol-Free Spirits Market Insight

The Japan alcohol-free spirits market is expanding steadily, driven by a rising health-conscious population and growing interest in functional beverages. Japanese consumers appreciate innovation and quality, and alcohol-free spirits that offer refined flavors and align with traditional tea, fruit, and herbal profiles are gaining traction. Increasing interest in responsible drinking and social acceptability of non-alcoholic options is also supporting the growth of this market.

China Alcohol-Free Spirits Market Insight

The China alcohol-free spirits market accounted for the largest revenue share in Asia Pacific in 2024, propelled by a growing middle-class population, evolving consumer preferences, and the popularity of wellness-centric products. The expanding availability of international and domestic brands, combined with robust e-commerce platforms and social media influence, is accelerating product adoption. The market is also benefiting from rising awareness of alcohol-related health risks and increasing demand for premium, non-alcoholic experiences.

Alcohol Free Spirits Market Share

The alcohol free spirits industry is primarily led by well-established companies, including:

- Diageo (U.K.)

- Kin Social Tonics, Inc. (U.S.)

- CELTIC SOUL (U.K.)

- Spiritless (U.S.)

- Monday Distillery (Australia)

- FLUÈRE Non-Alcoholic Distilled Spirits (Netherlands)

- Arkaybeverages (U.S.)

- Ritual Zero Proof (U.S.)

- Lyre's Spirit Co U.S.A (U.S.)

- Three Spirit Drinks Ltd. (U.K.)

- Caleño Drinks Ltd (U.K.)

- Everleaf (U.K.)

- Heineken (Netherlands)

- JUKES CORDIALITIES (U.K.)

Latest Developments in Global Alcohol Free Spirits Market

- In June 2025, DeVANS Modern Breweries Ltd entered the non-alcoholic beverage market with the official launch of Godfather Soda, marking a strategic diversification from its alcoholic beverage portfolio. This move caters to the increasing consumer demand for convenient, on-the-go drink options, particularly among younger demographics. By partnering with celebrity choreographer Melvin Louis to lead a nationwide campaign, the brand is positioning itself to effectively capture attention and market share among Gen Z and millennials, further intensifying competition in India’s growing alcohol-free beverage segment

- In March 2024, London-based spirits company KAHOL introduced its full lineup of 0% ABV non-alcoholic spirits, leveraging traditional distillation methods combined with proprietary technology to replicate the flavor and mouthfeel of alcoholic spirits. This innovation reflects a significant advancement in product authenticity and quality in the alcohol-free spirits market. By offering a sensory experience similar to conventional spirits, KAHOL is expected to appeal to health-conscious consumers and sober-curious individuals, thereby strengthening its position in Europe’s rapidly evolving no- and low-alcohol beverage sector

- In October 2022, Pernod Ricard secured a majority stake in Código 1530, known for its ultra-premium tequila, Skrewball, a highly regarded super-premium whiskey, and ACE Beverage Group, the leading Canadian RTD market player. This strategic move expands their premium spirits portfolio and market reach

- In October 2023, Coca-Cola Company and Pernod Ricard partnered to launch Absolut Vodka with Sprite, combining the iconic vodka brand with Coca-Cola’s popular Sprite for a refreshing new drink offering. This collaboration aims to capture new consumer interest and boost both brands' market presence

- In March 2023, Diageo finalized the acquisition of Don Papa Rum, a renowned super-premium dark rum from the Philippines. This acquisition enhances Diageo’s portfolio with a prestigious rum brand, expanding its presence in the high-end spirits market and diversifying its global offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alcohol Free Spirits Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alcohol Free Spirits Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alcohol Free Spirits Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.