Global Alcohol Wipes Market

Market Size in USD Million

CAGR :

%

USD

686.99 Million

USD

1,004.99 Million

2024

2032

USD

686.99 Million

USD

1,004.99 Million

2024

2032

| 2025 –2032 | |

| USD 686.99 Million | |

| USD 1,004.99 Million | |

|

|

|

|

Alcohol Wipes Market Size

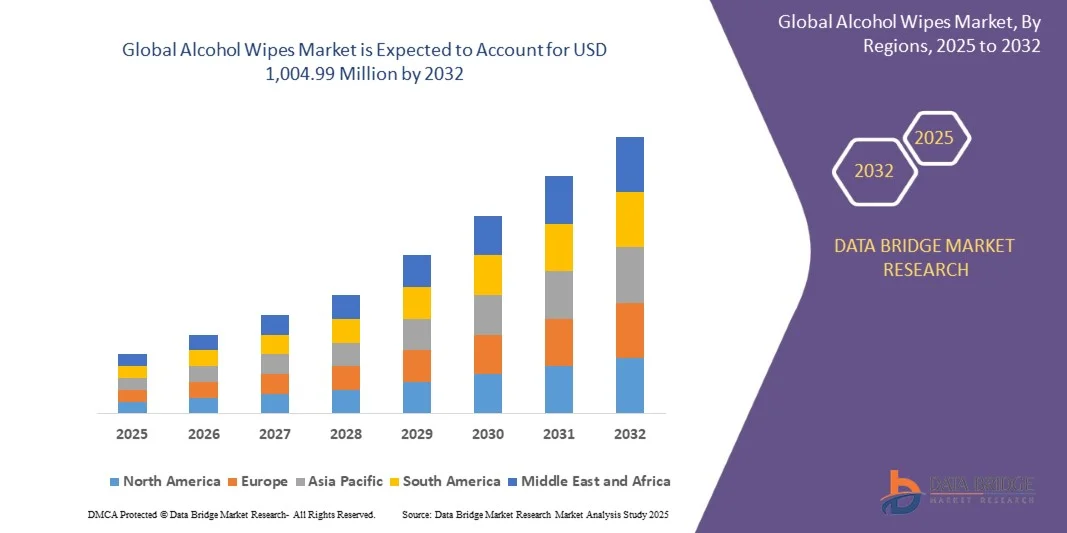

- The global alcohol wipes market size was valued at USD 686.99 million in 2024 and is expected to reach USD 1,004.99 million by 2032, at a CAGR of 4.87% during the forecast period

- The market growth is largely fuelled by the increasing adoption of hygiene and sanitization practices across healthcare, personal care, and industrial sectors

- Rising awareness regarding infection prevention, along with the growing demand for portable and disposable sanitization solutions, is further driving market expansion

Alcohol Wipes Market Analysis

- Alcohol wipes are increasingly preferred for quick and effective disinfection of hands, surfaces, and medical instruments due to their ease of use, portability, and rapid action against pathogens

- Growth in the healthcare and pharmaceutical sectors, coupled with heightened consumer awareness of hygiene and preventive care, is promoting widespread adoption of alcohol wipes globally

- North America dominated the alcohol wipes market with the largest revenue share of 38.5% in 2024, driven by rising awareness of hygiene, increased adoption of disposable sanitization solutions, and strong presence of healthcare and personal care industries

- Asia-Pacific region is expected to witness the highest growth rate in the global alcohol wipes market, driven by rapid urbanization, increasing disposable incomes, growing healthcare infrastructure, and rising consumer focus on personal hygiene

- The sensitive skin wipes segment held the largest market revenue share in 2024, driven by rising consumer awareness about skin-friendly hygiene products and increasing adoption in healthcare and personal care settings. These wipes are formulated to be gentle on skin while providing effective antimicrobial action, making them popular among hospitals, households, and childcare facilities

Report Scope and Alcohol Wipes Market Segmentation

|

Attributes |

Alcohol Wipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alcohol Wipes Market Trends

“Increasing Demand for Portable and Disposable Sanitization Solutions”

- The growing adoption of alcohol wipes is transforming personal hygiene and healthcare practices by providing quick, effective, and portable sanitization. Their convenience and ease of use enable instant disinfection of hands, surfaces, and medical instruments, reducing the risk of infections in hospitals, clinics, and households. Increasing consumer awareness about disease prevention and personal hygiene is further driving adoption, particularly in urban and high-traffic areas

- Rising awareness of hygiene and infection control in emerging and under-resourced regions is accelerating the use of alcohol wipes in public spaces, schools, and travel. These wipes are particularly effective where access to running water or handwashing facilities is limited, supporting timely and efficient sanitization. Governments and NGOs promoting public health initiatives are also reinforcing the adoption of disposable sanitization products

- The affordability and single-use nature of modern alcohol wipes make them attractive for both individual and institutional applications. Widespread adoption in healthcare, hospitality, and personal care improves overall hygiene standards while reducing contamination risks. Innovations in packaging, such as travel-sized and resealable packs, are making the products even more accessible for end-users

- For instance, in 2023, several hospitals across Southeast Asia reported lower surface contamination rates after incorporating alcohol wipe protocols for routine disinfection, improving patient safety and operational efficiency. Facilities also noted a reduction in cross-contamination and medical device-related infections, highlighting the practical benefits of alcohol wipes in clinical settings

- While alcohol wipes are gaining traction globally, sustained growth depends on continued product innovation, cost-effective production, and regulatory compliance. Manufacturers must focus on antimicrobial efficacy, packaging convenience, and eco-friendly formulations to fully leverage market demand. Strategic partnerships with healthcare providers and educational campaigns are expected to further boost product adoption

Alcohol Wipes Market Dynamics

Driver

“Increasing Awareness of Hygiene and Infection Control Across Healthcare and Personal Care”

- Rising concerns about hospital-acquired infections, community-transmitted diseases, and personal hygiene are driving the demand for alcohol wipes. Their fast-acting antimicrobial properties make them essential in healthcare, travel, and household applications. Increasing outbreaks of seasonal illnesses and stricter infection control protocols are further accelerating market growth

- Growth in hospitals, clinics, and public spaces, along with heightened consumer focus on hand and surface hygiene, is accelerating adoption. Institutions and individuals are increasingly leveraging alcohol wipes for their portability, effectiveness, and ease of use. Enhanced product formulations offering moisturizing and skin-friendly properties are also appealing to health-conscious consumers

- The trend toward disposable, single-use sanitization solutions is promoting the preference for alcohol wipes over traditional handwashing or cloth-based cleaning. This ensures convenience, safety, and reduced contamination risks across multiple environments. Rising demand in sectors such as hospitality, education, and travel is reinforcing the need for quick and reliable sanitization products

- For instance, in 2023, a leading U.S.-based personal care company reported a surge in alcohol wipe sales after launching travel-sized, individually wrapped packs for hospitals and consumers, driving market expansion. The company also noted improved brand recognition and recurring purchases due to the convenience and portability of the products

- While awareness and convenience are propelling growth, ensuring consistent product quality, antimicrobial efficacy, and sustainable packaging remains critical for long-term adoption. Manufacturers are increasingly investing in R&D for biodegradable wipes and eco-friendly alcohol formulations to meet sustainability requirements

Restraint/Challenge

“High Cost Of Premium Alcohol Wipes And Supply Chain Constraints”

- Production of high-quality alcohol wipes involves specialized materials, high alcohol content, and hygienic packaging, which increases manufacturing costs and limits adoption in price-sensitive markets. Premium formulations with added moisturizers or multi-surface efficacy further increase production complexity and cost. Smaller suppliers often struggle to compete with established global brands due to these high entry barriers

- Supply chain disruptions, including raw material shortages and packaging constraints, can impact consistent production and timely delivery. Seasonal demand fluctuations and import dependence further exacerbate supply challenges. Delays in logistics, particularly during health crises or high-demand periods, can result in stockouts and lost sales opportunities

- Storage and transportation requirements, such as flammability precautions due to high alcohol content, add operational complexity for manufacturers and distributors. Improper handling can reduce product efficacy and safety. Retailers and distributors must maintain careful inventory management and compliance with transport regulations, adding further operational costs

- For instance, in 2023, several European and North American manufacturers faced delays in alcohol wipe distribution due to supply chain bottlenecks and high raw material costs, affecting sales and market timelines. Companies also reported the need for contingency sourcing strategies to avoid production halts, emphasizing the fragility of supply chains

- While innovation in packaging and formulation continues, addressing cost, supply chain reliability, and product safety is essential to sustain broader adoption and long-term growth of the global alcohol wipes market. Collaboration with raw material suppliers, investment in automation, and regional manufacturing expansion are expected to mitigate these challenges and support market scalability

Alcohol Wipes Market Scope

The global alcohol wipes market is segmented on the basis of product type, fabric material, application, and end-use.

• By Product Type

On the basis of product type, the alcohol wipes market is segmented into sensitive skin wipes, soft sanitizing wipes, and others. The sensitive skin wipes segment held the largest market revenue share in 2024, driven by rising consumer awareness about skin-friendly hygiene products and increasing adoption in healthcare and personal care settings. These wipes are formulated to be gentle on skin while providing effective antimicrobial action, making them popular among hospitals, households, and childcare facilities.

The soft sanitizing wipes segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by their versatility, portability, and suitability for multi-surface cleaning. These wipes are widely used in offices, schools, and travel environments due to their convenience, ease of use, and quick drying properties, supporting efficient hygiene management.

• By Fabric Material

On the basis of fabric material, the market is segmented into natural and synthetic. The natural fabric segment dominated in 2024, driven by consumer preference for eco-friendly and biodegradable options that are gentle on the skin. Natural fabrics such as cotton and bamboo are increasingly used in premium wipes to combine sustainability with high absorbency and durability.

The synthetic fabric segment is projected to witness the fastest growth from 2025 to 2032, owing to its cost-effectiveness, higher durability, and suitability for mass production. Synthetic wipes, including non-woven polypropylene, offer efficient cleaning and are widely adopted in commercial and institutional applications.

• By Application

On the basis of application, the alcohol wipes market is segmented into pharmacy, online shop, mall and supermarket, and others. The pharmacy segment accounted for the largest revenue share in 2024 due to high consumer trust in healthcare outlets and easy accessibility of hygiene products. Pharmacies remain a primary distribution channel for both individual and institutional buyers seeking reliable sanitization solutions.

The online shop segment is expected to witness the fastest growth from 2025 to 2032, driven by the convenience of e-commerce, increasing digital literacy, and rising preference for doorstep delivery. Online channels allow consumers to purchase bulk packs and subscription-based wipes, enhancing market penetration.

• By End-Use

On the basis of end-use, the alcohol wipes market is segmented into personal and household, and commercial. The personal and household segment held the largest market revenue share in 2024, fueled by increasing awareness about home hygiene and individual safety. Consumers are increasingly using alcohol wipes for hand sanitization, surface cleaning, and childcare applications.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand from hospitals, hotels, restaurants, and offices. Institutions prefer bulk purchasing of wipes to maintain hygiene protocols, reduce infection risks, and comply with regulatory standards.

Alcohol Wipes Market Regional Analysis

- North America dominated the alcohol wipes market with the largest revenue share of 38.5% in 2024, driven by rising awareness of hygiene, increased adoption of disposable sanitization solutions, and strong presence of healthcare and personal care industries

- Consumers in the region highly value the convenience, portability, and fast-acting antimicrobial properties offered by alcohol wipes for both personal and institutional use

- This widespread adoption is further supported by high disposable incomes, well-established retail and e-commerce networks, and stringent hygiene regulations in healthcare and public spaces, positioning alcohol wipes as a preferred sanitization solution

U.S. Alcohol Wipes Market Insight

The U.S. alcohol wipes market captured the largest revenue share in 2024 within North America, fueled by growing concerns over infections, increasing demand for quick and portable hygiene solutions, and expansion of healthcare and personal care facilities. Consumers and institutions are increasingly prioritizing alcohol wipes for on-the-go sanitization and surface disinfection. The rising trend of individually packaged, travel-friendly wipes and integration in hospitals, offices, and schools is further propelling market growth, alongside regulatory support for infection control practices.

Europe Alcohol Wipes Market Insight

The Europe alcohol wipes market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by heightened hygiene awareness, regulatory mandates for infection control, and growth in healthcare and personal care sectors. Increasing urbanization and rising demand for disposable sanitization solutions in public spaces and workplaces are fostering adoption. The region is also witnessing higher integration of alcohol wipes in hospitals, pharmacies, and retail outlets, enhancing accessibility and usage across multiple applications.

U.K. Alcohol Wipes Market Insight

The U.K. alcohol wipes market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for convenient and effective sanitization, growing concerns about community-transmitted infections, and increasing adoption in households and commercial establishments. The country’s well-established retail and e-commerce infrastructure, along with government-led hygiene awareness campaigns, is expected to further boost market expansion.

Germany Alcohol Wipes Market Insight

The Germany alcohol wipes market is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent healthcare hygiene regulations, rising public awareness about sanitation, and preference for eco-friendly, single-use sanitization products. Germany’s focus on innovation, quality standards, and consumer safety promotes adoption in both commercial and personal use. Increasing usage in hospitals, clinics, offices, and educational institutions supports steady market growth.

Asia-Pacific Alcohol Wipes Market Insight

The Asia-Pacific alcohol wipes market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising hygiene awareness, rapid urbanization, and expanding healthcare and retail sectors in countries such as China, Japan, and India. The region's increasing inclination toward personal hygiene, supported by government initiatives for public health, is driving adoption. Furthermore, as APAC emerges as a manufacturing hub for alcohol wipes, the affordability and availability of high-quality products are enhancing market penetration.

Japan Alcohol Wipes Market Insight

The Japan alcohol wipes market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s high awareness of hygiene, strong healthcare infrastructure, and demand for portable and easy-to-use sanitization solutions. Consumers and institutions are increasingly adopting alcohol wipes for personal and professional applications. Integration with travel kits, hospitals, offices, and schools is supporting market expansion, while regulatory support and technological innovations in packaging and formulation further fuel growth.

China Alcohol Wipes Market Insight

The China alcohol wipes market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and increasing demand for personal and surface hygiene solutions. Alcohol wipes are becoming widely used in households, healthcare facilities, offices, and public spaces. The push for smart cities, coupled with domestic manufacturing capabilities and competitive pricing, is driving widespread adoption and market growth.

Alcohol Wipes Market Share

The Alcohol Wipes industry is primarily led by well-established companies, including:

- Cardinal Health (U.S.)

- Robinson Healthcare (U.K.)

- The Clorox Company (U.S.)

- GAMA Healthcare Ltd (U.K.)

- Whitminster International (U.K.)

- Diamond Wipes International Inc (U.S.)

- Clarisan (U.K.)

- Moldex-Metric (U.S.)

- BD (U.S.)

- McKesson Medical-Surgical Inc (U.S.)

- Medline Industries, Inc. (U.S.)

- Henleys Medical Supplies (U.K.)

- Pal International (U.K.)

- Xiaomi (China)

- Hero Wipes (U.S.)

- Sara Health Care (U.K.)

- Manward Healthcare Products Pvt. Ltd (India)

- Aeromech Equipments Private Limited (India)

- Ellsworth Adhesives (U.S.)

Latest Developments in Global Alcohol Wipes Market

- In July 2024, Ecolab launched Disinfectant 1 Wipe, a plastic-free and biodegradable EPA-registered disinfectant wipe. The product delivers hospital-grade disinfection within one minute, helping healthcare providers enhance patient safety while addressing environmental concerns. Its sustainable design reduces the ecological impact of traditional plastic-based wipes and strengthens Ecolab’s position in the North American disinfectant market

- In July 2022, MicroCare LLC introduced Standard Presaturated IPA Wipes for cleaning surfaces, tools, and equipment. These wipes provide effective cleaning performance, lower operational costs, and improve efficiency for manufacturers, supporting safer and more hygienic industrial and laboratory environments

- In May 2022, GOJO Industries, the maker of PURELL, unveiled PURELL Healthcare Surface Disinfecting Wipes, hospital-grade wipes powered by ethyl alcohol. Designed to eliminate 99.9% of bacteria and viruses, including all ESKAPE pathogens and seven drug-resistant strains within two minutes, the product enhances infection control in healthcare facilities and strengthens market adoption of high-performance surface disinfectants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.