Global Alginate And Derivatives Market

Market Size in USD Million

CAGR :

%

USD

501.58 Million

USD

691.75 Million

2025

2033

USD

501.58 Million

USD

691.75 Million

2025

2033

| 2026 –2033 | |

| USD 501.58 Million | |

| USD 691.75 Million | |

|

|

|

|

Alginate and Derivatives Market Size

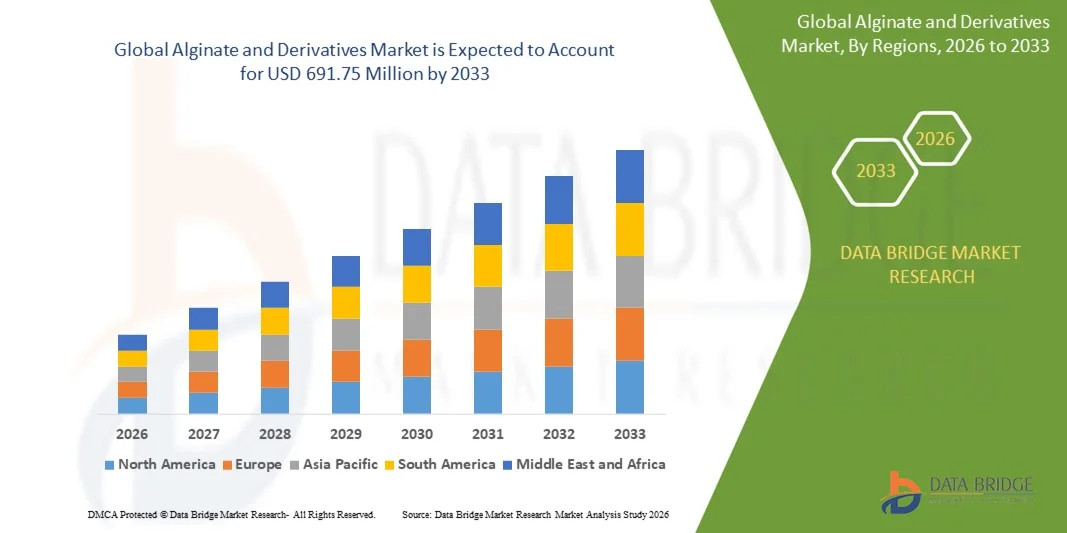

- The global alginate and derivatives market size was valued at USD 501.58 million in 2025 and is expected to reach USD 691.75 million by 2033, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of alginate and derivatives across food, pharmaceutical, and industrial applications, driven by their multifunctional properties such as gelling, thickening, stabilizing, and encapsulation

- Furthermore, rising consumer preference for natural, clean-label, and sustainable ingredients in processed foods, nutraceuticals, and pharmaceuticals is driving higher demand for alginate solutions. For instance, companies such as FMC Corporation are expanding their production capacities to meet this growing need, thereby boosting overall market growth

Alginate and Derivatives Market Analysis

- Alginate and derivatives, derived from seaweed, are increasingly utilized across various sectors due to their functional benefits in food processing, pharmaceutical formulations, wound care, and industrial applications. Their versatility, biocompatibility, and natural origin make them critical ingredients in both commercial and specialty products

- The escalating demand for alginate is primarily fueled by growth in processed food and beverage industries, expanding pharmaceutical and biomedical applications, and rising industrial use for eco-friendly and sustainable products. In addition, regulatory approvals and consumer awareness of health and sustainability factors are reinforcing alginate adoption across regions

- North America dominated the alginate and derivatives market with a share of over 40% in 2025, due to high demand from food, pharmaceutical, and industrial sectors, as well as strong awareness of natural and functional ingredients

- Asia-Pacific is expected to be the fastest growing region in the Alginate and Derivatives market during the forecast period due to rapid urbanization, increasing disposable incomes, and rising demand from food, pharmaceutical, and industrial sectors in countries such as China, Japan, and India

- Food and beverage segment dominated the market with a market share of 41.5% in 2025, due to the extensive use of alginates as thickeners, stabilizers, and gelling agents in products such as dairy, sauces, and beverages. Its ability to improve texture, shelf life, and consistency across a variety of food formulations has made it indispensable in the food processing industry. In addition, the rising consumer preference for natural and clean-label ingredients has strengthened demand for alginate-based solutions. Leading companies focus on innovation in food-grade alginate derivatives, enhancing solubility and functional performance to meet diverse industrial needs

Report Scope and Alginate and Derivatives Market Segmentation

|

Attributes |

Alginate and Derivatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alginate and Derivatives Market Trends

Rising Demand for Clean-Label and Natural Ingredients

- A significant trend in the global alginate and derivatives market is the growing consumer preference for natural, clean-label, and plant-derived ingredients across food, pharmaceutical, and industrial applications. Consumers are increasingly health-conscious and seek functional ingredients that offer benefits such as gelling, thickening, stabilizing, and encapsulation without synthetic additives, driving manufacturers to reformulate products using alginate and derivatives

- For instance, FMC Corporation has expanded its high-purity sodium and calcium alginate portfolio to meet the growing demand for clean-label ingredients in processed foods and nutraceutical products. Such initiatives by leading companies are accelerating alginate adoption across multiple industries and increasing the overall market footprint

- The increasing use of alginate and derivatives in processed foods, functional beverages, and dietary supplements for texture enhancement, shelf-life extension, and nutritional fortification is reshaping consumer expectations for product quality and naturalness. This trend is further supported by the rising popularity of functional and fortified food products that provide additional health benefits

- In addition, sustainability considerations are driving manufacturers to adopt alginate derived from renewable seaweed sources, appealing to environmentally conscious consumers and strengthening the market’s natural positioning. Alginate’s renewable origin and biodegradable properties enhance its attractiveness as a clean-label ingredient, supporting broader adoption

- The integration of alginate derivatives into advanced pharmaceutical formulations, wound care products, and controlled-release drug delivery systems highlights the growing trend of multifunctional applications. Companies are innovating to develop alginate-based solutions that offer performance, safety, and regulatory compliance, enhancing product value and market growth

- Overall, the trend towards clean-label, natural, and multifunctional ingredients is redefining product development strategies in the alginate market. The focus on health, sustainability, and functionality is expected to continue driving growth across food, pharmaceutical, and industrial sectors, consolidating alginate’s role as a key natural ingredient

Alginate and Derivatives Market Dynamics

Driver

Expanding Applications in Food, Pharmaceutical, and Industrial Sectors

- The versatility of alginate and derivatives across multiple applications is a critical driver of market growth. Their functional properties, including gelling, thickening, stabilizing, water retention, and biocompatibility, make them highly suitable for diverse food, pharmaceutical, and industrial uses

- For instance, Cargill, Incorporated has introduced alginate-based ingredients for plant-based meat alternatives that improve texture, moisture retention, and structural integrity. Such targeted applications are expanding alginate adoption in emerging food segments and driving higher market penetration

- Rising demand in pharmaceuticals for wound care products, encapsulated drug delivery systems, and controlled-release formulations is further propelling the utilization of alginate derivatives. Their biocompatibility, safety, and versatility make them a preferred choice for innovative healthcare applications

- In addition, industrial sectors such as water treatment, textile processing, packaging, and specialty coatings are increasingly incorporating alginate-based materials for their functional and sustainable properties. The ability to replace synthetic or non-renewable materials with natural alginate derivatives strengthens the market across non-food applications

- The combination of broad applicability, regulatory approvals, and rising consumer preference for natural and functional ingredients is driving sustained expansion of the alginate and derivatives market. Continuous research, development, and commercialization of innovative formulations are expected to further enhance market growth and adoption in the forecast period

Restraint/Challenge

Fluctuating Raw Material Supply and Seaweed Availability

- The market faces challenges due to its reliance on seaweed as the primary raw material for alginate production. Environmental factors, such as climate variability, ocean pollution, and seasonal changes, can impact seaweed yields, causing supply instability and affecting overall production capacity

- For instance, fluctuations in brown seaweed harvests in China and Norway have affected production schedules of companies such as Algaia SA. Such inconsistencies in raw material availability can result in higher costs, limited supply, and operational challenges for manufacturers relying on alginate derivatives

- Limited geographic regions suitable for cultivating high-quality seaweed and sensitivity of growth to environmental conditions present long-term supply risks. Manufacturers must contend with these constraints while meeting rising global demand across food, pharmaceutical, and industrial sectors

- In addition, price volatility and logistical challenges in sourcing and transporting seaweed can impact the affordability and timely availability of alginate-based products. Maintaining consistent quality and volume becomes a critical concern for companies aiming to deliver standardized solutions

- Overcoming these challenges through sustainable cultivation, strategic sourcing, and the development of alternative or supplementary raw material sources is vital for ensuring market stability. Effective management of supply chain risks will be essential to support continued growth and satisfy the expanding demand for alginate and derivatives across multiple applications

Alginate and Derivatives Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the alginate and derivatives market is segmented into sodium alginate, calcium alginate, potassium alginate, PGA, and others. The sodium alginate segment dominated the market with the largest market revenue share in 2025, driven by its widespread use in food and beverage applications and its versatile functionality as a thickening, gelling, and stabilizing agent. Manufacturers favor sodium alginate for its cost-effectiveness and compatibility with a broad range of industrial formulations, which enhances its adoption across multiple sectors. Its solubility in water and ability to form gels with calcium ions further strengthen its position as a preferred type. In addition, regulatory approvals and established safety profiles boost confidence among food, pharmaceutical, and industrial users, reinforcing its market dominance.

The calcium alginate segment is anticipated to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by increasing demand in wound care and biomedical applications. For instance, companies such as FMC Corporation are expanding their production capacities to meet rising demand for calcium alginate-based dressings and scaffolds. Its high biocompatibility, biodegradability, and ability to form hydrogels make it ideal for advanced pharmaceutical and healthcare applications. Furthermore, calcium alginate is gaining traction in specialty food applications where controlled gel formation is critical, driving its rapid adoption. Rising research and development in regenerative medicine and drug delivery systems is expected to further accelerate the growth of this segment.

- By Application

On the basis of application, the alginate and derivatives market is segmented into dry, food and beverage, industrial, pharmaceutical, and others. The food and beverage segment dominated the market with the largest revenue share of 41.5% in 2025, owing to the extensive use of alginates as thickeners, stabilizers, and gelling agents in products such as dairy, sauces, and beverages. Its ability to improve texture, shelf life, and consistency across a variety of food formulations has made it indispensable in the food processing industry. In addition, the rising consumer preference for natural and clean-label ingredients has strengthened demand for alginate-based solutions. Leading companies focus on innovation in food-grade alginate derivatives, enhancing solubility and functional performance to meet diverse industrial needs.

The pharmaceutical segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, driven by the increasing use of alginates in drug delivery, wound care, and medical devices. For instance, FMC Corporation and NovaMatrix are investing in high-purity pharmaceutical-grade alginates for controlled-release formulations. Alginate’s biocompatibility, non-toxicity, and gel-forming properties make it ideal for encapsulation and sustained-release applications. Growth is further supported by increasing healthcare expenditure, rising chronic disease prevalence, and the expansion of advanced wound care solutions. In addition, research into novel alginate-based materials for regenerative medicine is expected to fuel long-term market growth in this application segment.

Alginate and Derivatives Market Regional Analysis

- North America dominated the alginate and derivatives market with the largest revenue share of over 40% in 2025, driven by high demand from food, pharmaceutical, and industrial sectors, as well as strong awareness of natural and functional ingredients

- Manufacturers and consumers in the region highly value the versatility, safety, and functional benefits offered by alginate derivatives such as thickening, gelling, and stabilizing properties in various applications

- Widespread adoption is further supported by advanced food processing infrastructure, stringent quality standards, and increasing investment in pharmaceutical and biomedical applications, establishing alginate derivatives as a preferred solution across multiple industries

U.S. Alginate and Derivatives Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by increasing use of alginates in food and beverage products, pharmaceuticals, and industrial applications. Consumers and manufacturers are prioritizing high-purity and sustainable ingredients for functional and medical formulations. Rising research and development in wound care, drug delivery, and dietary supplements further propels the market. In addition, growing preference for plant-based and natural ingredients is encouraging manufacturers to adopt sodium and calcium alginate solutions.

Europe Alginate and Derivatives Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by increasing demand in food, pharmaceutical, and industrial applications. Regulatory frameworks promoting food safety and natural additives are fostering adoption. Consumers in Europe favor high-quality and multifunctional ingredients, encouraging innovation in alginate derivatives. The market growth is supported by rising health awareness, urbanization, and the demand for clean-label and sustainable products across multiple industries.

U.K. Alginate and Derivatives Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, driven by the rising trend of functional foods, nutraceuticals, and pharmaceutical applications. For instance, manufacturers are increasingly using sodium and calcium alginate in dietary supplements and controlled-release formulations. Increasing health consciousness and demand for natural stabilizers in processed foods support market expansion. The robust food processing and pharmaceutical infrastructure, alongside innovation in biomedical uses, further stimulate market growth.

Germany Alginate and Derivatives Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing use of alginates in pharmaceutical and industrial applications. Germany’s strong emphasis on food safety, regulatory compliance, and innovation promotes adoption of alginate-based solutions. Manufacturers are focusing on high-quality derivatives for drug delivery, wound care, and specialty food applications. In addition, research initiatives and collaborations are enhancing functional properties and production efficiency of alginate derivatives in the region.

Asia-Pacific Alginate and Derivatives Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and rising demand from food, pharmaceutical, and industrial sectors in countries such as China, Japan, and India. The region’s expanding food processing and pharmaceutical industries are accelerating alginate adoption. For instance, China is witnessing increased use of alginate derivatives in processed foods, pharmaceuticals, and industrial applications. Government initiatives supporting biotechnology and natural ingredients further support growth.

Japan Alginate and Derivatives Market Insight

The Japan market is gaining momentum due to a high-tech food and pharmaceutical industry, urbanization, and demand for functional ingredients. Japanese manufacturers emphasize quality, safety, and innovation in alginate applications for dietary supplements, food processing, and biomedical uses. Rising interest in natural and clean-label ingredients is supporting market growth. In addition, Japan’s aging population drives demand for pharmaceutical and nutraceutical applications that utilize alginate derivatives for controlled-release and wound care formulations.

China Alginate and Derivatives Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and rising consumption of processed foods and pharmaceuticals. China is emerging as a major production hub for alginate derivatives, offering cost-effective and high-quality solutions. The increasing adoption of alginates in food stabilization, gelling, and pharmaceutical applications is driving market growth. Strong domestic manufacturers and government support for biotechnology and natural ingredient industries further propel the market in China.

Alginate and Derivatives Market Share

The alginate and derivatives industry is primarily led by well-established companies, including:

- FMC Corporation (U.S.)

- KIMICA Corporation (Japan)

- Cargill, Incorporated (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Ashland Global Holdings, Inc. (U.S.)

- Brenntag AG (Germany)

- Döhler GmbH (Germany)

- QINGDAO GFURI SEAWEED INDUSTRIAL CO., LTD. (China)

- Bright Moon Group (China)

- K N International (India)

- Mytech, Inc. (U.S.)

- Shandong Jiejing Group Corporation (China)

- SNAP Natural & Alginate Products Pvt. Ltd. (India)

- SNP, Inc. (U.S.)

- Qingdao Allforlong Bio-Tech Co., Ltd. (China)

- IRO Alginate Industry Co., Ltd. (South Korea)

- Algea ASA (Norway)

- MBL Bio-Products (Japan)

- ALGAIA SA (France)

- Ingredients Solutions, Inc. (U.S.)

Latest Developments in Global Alginate and Derivatives Market

- In June 2024, Handtmann launched the ConProSachet system, an innovative edible alginate packaging solution that co-extrudes alginate-based sachets for fillings such as cheese, jams, and energy gels. This development is significant for the market as it opens new opportunities in sustainable and biodegradable packaging, reducing reliance on plastics and increasing demand for alginate in eco-friendly food packaging applications. The product’s adoption is expected to drive innovation in packaging solutions and enhance alginate’s position in the sustainable ingredients market

- In 2024, AEP Colloids formed a strategic partnership with a pharmaceutical company to co-develop alginate-based controlled-release drug delivery platforms. This collaboration strengthens alginate’s presence in the pharmaceutical sector, enabling the creation of advanced wound care and sustained-release formulations. The partnership is expected to boost market adoption in medical applications, highlighting alginate’s versatility and biocompatibility, and supporting growth in high-value pharmaceutical applications

- In October 2023, KIMICA launched a high-purity sodium alginate product called KIMI‑AL™, designed specifically for food and pharmaceutical applications. This launch addresses rising demand for clean-label and high-performance gelling agents, enhancing the functionality of food products and enabling precise formulation in pharmaceuticals. The market impact is notable, as it reinforces alginate’s position as a preferred natural ingredient in industries that prioritize safety, performance, and regulatory compliance

- In March 2023, JRS Group acquired Algaia SA, a company specializing in seaweed extracts and hydrocolloids. This acquisition expands JRS Group’s capacity to produce sustainable alginate solutions and strengthens its global footprint in functional ingredients. The move is expected to enhance the supply of high-quality alginate products, accelerate innovation, and consolidate the market by bringing together complementary expertise in seaweed-derived ingredients

- In 2023, Gelymar introduced a new line of alginate-based products for sustainable packaging applications. This development supports the growing shift toward biodegradable and eco-friendly packaging materials, creating new industrial demand for alginate. By improving the functionality and applicability of alginate in packaging, this launch contributes to expanding its adoption in the food and beverage sector as well as other industries seeking natural alternatives to plastics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alginate And Derivatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alginate And Derivatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alginate And Derivatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.