Global Algorithm Trading Market

Market Size in USD Billion

CAGR :

%

USD

23.60 Billion

USD

58.87 Billion

2025

2033

USD

23.60 Billion

USD

58.87 Billion

2025

2033

| 2026 –2033 | |

| USD 23.60 Billion | |

| USD 58.87 Billion | |

|

|

|

|

What is the Global Algorithm Trading Market Size and Growth Rate?

- The global algorithm trading market size was valued at USD 23.60 billion in 2025 and is expected to reach USD 58.87 billion by 2033, at a CAGR of12.10% during the forecast period

- The increase in demand for fast, reliable and effective order execution across the globe acts as one of the major factors driving the growth of algorithm trading market

- The presence favorable government regulations and high utilization of the system by institutional investors and big brokerage houses with the purpose of reducing costs associated with bulk trading accelerate the algorithm trading market growth

What are the Major Takeaways of Algorithm Trading Market?

- The growth in demand for market surveillance, rise in the need to decline transaction costs and increase in the deployment of cloud-based algorithmic trading because of various offered benefits such as effective management, easy trade data maintenance, cost-effectiveness and scalability further influence the algorithm trading market

- In addition, limited requirement of human interaction, high acceptance of advanced systems, expansion of small and medium-sized enterprises (SMEs), large enterprises and surge in investment positively affect the algorithm trading market. Furthermore, the integration of artificial intelligence (AI) and emergence of cryptocurrency extend profitable opportunities to the algorithm trading market players

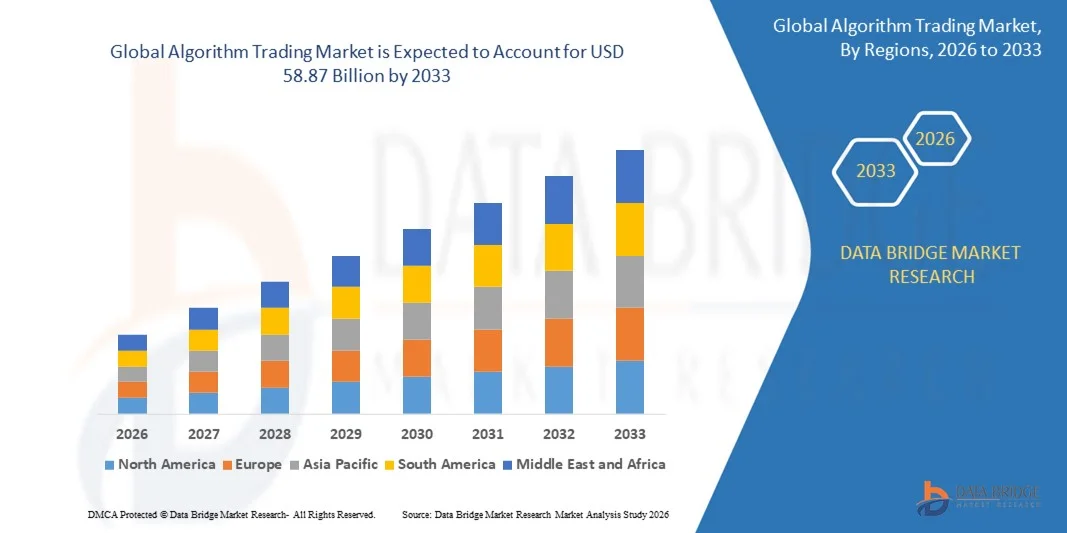

- North America dominated the algorithm trading market with a 38.84% revenue share in 2025, driven by strong adoption of AI-powered trading platforms, high-frequency trading systems, and cloud-integrated analytics across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.79% from 2026 to 2033, driven by rapid growth in financial markets, fintech innovation, and adoption of AI-powered and cloud-based trading platforms across China, Japan, India, South Korea, and Southeast Asia

- The Solutions segment dominated the market with a 55.3% share in 2025, driven by widespread adoption of advanced trading platforms that support AI-based strategy execution, low-latency order routing, and real-time analytics

Report Scope and Algorithm Trading Market Segmentation

|

Attributes |

Algorithm Trading Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Algorithm Trading Market?

Increasing Shift Toward AI-Enabled, High-Frequency, and Cloud-Integrated Algorithm Trading Platforms

- The algorithm trading market is witnessing growing adoption of AI-powered, low-latency, and cloud-based trading platforms designed to support high-frequency trading, automated order execution, and real-time risk management

- Vendors are introducing multi-asset, high-speed, and algorithmically adaptive trading solutions that offer advanced analytics, smart order routing, and integration with market data feeds

- Rising demand for cost-efficient, scalable, and cloud-deployable trading platforms is driving adoption across hedge funds, proprietary trading firms, investment banks, and retail trading platforms

- For instance, companies such as Virtu Financial, Trading Technologies, QuantCore, and AlgoTrader have enhanced their platforms with AI-based predictive analytics, low-latency execution, and multi-market connectivity, enabling faster and more efficient trading decisions

- Increasing need for rapid decision-making, real-time market insights, and automated strategy execution is accelerating the shift toward high-speed, cloud-integrated algorithmic trading platforms

- As trading volumes and market complexity rise, algorithm trading solutions will remain essential for real-time market analysis, strategy optimization, and competitive trading performance

What are the Key Drivers of Algorithm Trading Market?

- Rising demand for automated, low-latency trading solutions to support fast execution of complex trading strategies across multiple asset classes

- For instance, in 2025, leading providers such as Virtu Financial, AlgoTrader, Trading Technologies, and QuantCore upgraded their platforms with AI-driven analytics, smart order routing, and high-speed market connectivity

- Growing adoption of algorithmic strategies in equities, derivatives, forex, and cryptocurrency markets is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in AI-based predictive analytics, cloud computing, FPGA acceleration, and multi-market data integration have strengthened performance, scalability, and efficiency

- Increasing use of high-frequency trading algorithms, machine learning models, and risk management engines is driving demand for intelligent trading platforms

- Supported by steady investments in fintech innovation, market infrastructure, and digital trading ecosystems, the Algorithm Trading market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Algorithm Trading Market?

- High costs associated with premium, low-latency, multi-asset trading platforms and AI integration restrict adoption among small trading firms and retail investors

- For instance, during 2024–2025, fluctuations in exchange fees, high-performance hardware costs, and regulatory compliance expenses increased operational costs for global trading firms

- Complexity in developing, validating, and optimizing algorithmic trading strategies increases the need for skilled quantitative analysts and developers

- Limited awareness in emerging markets regarding AI-driven trading platforms, strategy optimization tools, and regulatory requirements slows adoption

- Competition from traditional trading software, manual execution tools, and low-cost retail platforms creates pricing pressure and reduces differentiation

- To address these challenges, companies are focusing on cloud-based deployment, modular platform design, AI integration, and training resources to increase adoption of algorithm trading solutions globally

How is the Algorithm Trading Market Segmented?

The market is segmented on the basis of components, trading types, deployment modes, and enterprise size.

- By Components

On the basis of components, the algorithm trading market is segmented into Solutions and Services. The Solutions segment dominated the market with a 55.3% share in 2025, driven by widespread adoption of advanced trading platforms that support AI-based strategy execution, low-latency order routing, and real-time analytics. Algorithm trading solutions offer comprehensive features for high-frequency trading, multi-asset strategy deployment, and automated risk management, making them essential for investment banks, hedge funds, and proprietary trading firms. Their integration with market data feeds, predictive analytics, and compliance modules ensures efficient trade execution and regulatory adherence.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing demand for managed algorithm trading services, consulting, system integration, and platform maintenance, particularly in emerging markets where smaller firms seek expert guidance to deploy AI-driven trading strategies without heavy infrastructure investment.

- By Trading Types

On the basis of trading types, the market is segmented into Foreign Exchange (FOREX), Stock Markets, Exchange-Traded Funds (ETF), Bonds, Cryptocurrencies, and Others. The Stock Markets segment dominated the market with a 41.2% share in 2025, due to high adoption of automated trading strategies for equities, derivatives, and index funds. Algorithm trading is widely used for strategy optimization, risk hedging, and high-speed execution in global stock exchanges.

The Cryptocurrencies segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of crypto trading platforms, volatility-driven algorithmic strategies, and increasing institutional participation in digital assets. Advanced platforms offering multi-exchange integration, AI-driven predictive analytics, and automated order execution are fueling growth in this high-potential trading type.

- By Deployment Modes

On the basis of deployment modes, the algorithm trading market is segmented into On-Premises and Cloud. The On-Premises segment dominated the market with a 52.7% share in 2025, preferred by large financial institutions and trading firms due to its control over infrastructure, data security, and low-latency execution. On-premises deployments provide high customization and integration with legacy trading systems, making them crucial for complex algorithmic strategies.

The Cloud segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for cost-efficient, scalable, and accessible algorithm trading platforms. Cloud deployment enables smaller firms, SMEs, and retail traders to leverage AI-driven strategies, real-time analytics, and global market access without heavy upfront investments in hardware and IT infrastructure.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. Large Enterprises dominated the market with a 60.1% share in 2025, owing to their extensive trading operations, high-frequency strategy deployment, and ability to invest in low-latency platforms, AI integration, and multi-market connectivity. Large firms benefit from advanced risk management tools, proprietary algorithms, and compliance modules, making them primary adopters of algorithm trading solutions.

The SME segment is expected to grow at the fastest CAGR from 2026 to 2033, as smaller trading firms increasingly adopt cloud-based, AI-enabled algorithm trading platforms to compete in global markets. Cost-effective subscription models, managed services, and plug-and-play platforms are driving SME adoption across emerging economies.

Which Region Holds the Largest Share of the Algorithm Trading Market?

- North America dominated the algorithm trading market with a 38.84% revenue share in 2025, driven by strong adoption of AI-powered trading platforms, high-frequency trading systems, and cloud-integrated analytics across the U.S. and Canada. Major financial hubs, hedge funds, investment banks, and proprietary trading firms increasingly leverage low-latency, algorithmic solutions to optimize trade execution and portfolio management. Continuous innovation in AI-driven predictive analytics, multi-asset trading, and risk management algorithms further fuels regional demand

- Leading companies in North America are introducing next-generation algorithm trading platforms with smart order routing, multi-market connectivity, and integrated compliance tools, strengthening the region’s technological advantage. Steady investment in fintech, cloud infrastructure, and digital trading ecosystems supports long-term growth

- High concentration of quantitative analysts, fintech startups, and institutional investors, combined with a strong regulatory framework, reinforces North America’s leadership in global algorithm trading adoption

U.S. Algorithm Trading Market Insight

The U.S. is the largest contributor in North America, supported by extensive fintech R&D, adoption of AI-powered trading strategies, and advanced market data infrastructure. Algorithm trading platforms are widely used across equities, derivatives, FX, and cryptocurrency markets to enable high-frequency trading, real-time risk management, and automated strategy execution. Presence of leading financial institutions, technology-driven hedge funds, and startup ecosystems ensures continuous adoption of sophisticated algorithmic solutions. Strong demand for cloud integration, predictive analytics, and low-latency execution platforms further propels market growth.

Canada Algorithm Trading Market Insight

Canada contributes significantly to regional growth, driven by expanding fintech hubs, rising adoption of automated trading platforms, and growing institutional interest in AI-driven market strategies. Financial firms, universities, and research centers increasingly deploy algorithm trading solutions for strategy backtesting, portfolio optimization, and multi-asset execution. Government-backed innovation programs, skilled workforce availability, and integration with North American trading networks further strengthen adoption across the country.

Asia-Pacific Algorithm Trading Market

Asia-Pacific is projected to register the fastest CAGR of 9.79% from 2026 to 2033, driven by rapid growth in financial markets, fintech innovation, and adoption of AI-powered and cloud-based trading platforms across China, Japan, India, South Korea, and Southeast Asia. Rising retail participation, expansion of investment banks, and high-frequency trading adoption increase demand for low-latency, multi-asset algorithm trading solutions. Growth in cryptocurrency markets, derivatives trading, and smart investment platforms further accelerates adoption.

China Algorithm Trading Market Insight

China is the largest contributor to Asia-Pacific, supported by strong government backing for fintech development, robust financial market growth, and high retail investor participation. Algorithm trading solutions with multi-exchange connectivity, AI-based predictive models, and risk management modules are increasingly adopted by banks, investment firms, and retail brokers. Competitive pricing, domestic fintech innovation, and integration with global trading platforms further enhance market penetration.

Japan Algorithm Trading Market Insight

Japan shows steady growth supported by well-established financial infrastructure, high-tech trading platforms, and advanced risk management frameworks. Large institutional investors and securities firms rely on AI-integrated algorithm trading platforms for low-latency execution and portfolio optimization. Continuous modernization of financial systems and increasing demand for quantitative trading strategies reinforce long-term market expansion.

India Algorithm Trading Market Insight

India is emerging as a high-growth hub, driven by expanding fintech startups, rising retail trading participation, and government initiatives supporting digital finance. Algorithm trading adoption is growing for derivatives, equities, and currency markets, particularly among SMEs and retail brokers. Increasing investments in cloud infrastructure, AI analytics, and trading automation further accelerate market penetration.

South Korea Algorithm Trading Market Insight

South Korea contributes significantly due to strong demand for advanced trading platforms, AI-driven analytics, and multi-asset execution capabilities. Rapid growth of fintech firms, high-frequency trading, and retail investment platforms drives adoption of cloud-based, low-latency algorithm trading solutions. Technological innovation, regulatory support, and strong market connectivity sustain growth in the region.

Which are the Top Companies in Algorithm Trading Market?

The algorithm trading industry is primarily led by well-established companies, including:

- Thomson Reuters (Canada)

- 63 moons technologies limited (India)

- VIRTU Financial Inc. (U.S.)

- Software AG (Germany)

- MetaQuotes Ltd (Cyprus)

- Symphony Limited (India)

- InfoReach, Inc. (U.S.)

- Argo Software Engineering (U.K.)

- Kuberre Systems, Inc. (U.S.)

- Tata Consultancy Services Limited (India)

- QuantCore Capital Management, LLC (U.S.)

- iRageCapital (India)

- Automated Trading Softtech Pvt. Ltd. (India)

- Trading Technologies International, Inc. (U.S.)

- uTrade (India)

- Vela Labs, Inc. (U.S.)

- AlgoTrader (Switzerland)

What are the Recent Developments in Global Algorithm Trading Market?

- In August 2023, MarketAxess Holdings Inc. announced the acquisition of Pragma, enabling accelerated development of quantitative execution algorithms and data-driven analytics for fixed-income markets, integrating AI-powered technology solutions and exclusive data to improve customer workflows and efficiency. This strategic move strengthens MarketAxess’ innovation capabilities in algorithm trading

- In August 2023, BingX, a global cryptocurrency exchange platform, partnered with ALGOGENE, an algorithmic trading platform, to enhance the trading experience for its customers, offering improved execution, automation, and strategy optimization across crypto markets. This collaboration significantly boosts user trading efficiency and platform capabilities

- In July 2023, MachineTrader launched a beta version of its software, enabling traders to automate investment strategies without coding or hiring programmers. Featuring a visual flow-based development interface enhanced with OpenAI, users can design complex trading programs with ease. This platform simplifies algorithmic trading for retail and institutional users asuch as

- In October 2022, Scotiabank launched a next-generation algorithmic trading platform in Canada, in collaboration with BestEx Research, specifically tailored for the Canadian equities market. The platform leverages research-based logic to reduce costs, optimize execution, and deliver top-tier trading performance for clients

- In October 2022, Scotiabank introduced an algorithmic trading platform with BestEx Research to provide clients with enhanced research-based trading strategies, significantly improving order execution, reducing transaction costs, and ensuring competitive performance in the Canadian equities market. This initiative highlights Scotiabank’s commitment to algorithmic innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.