Global Alkoxide Market

Market Size in USD Billion

CAGR :

%

USD

5.19 Billion

USD

8.22 Billion

2025

2033

USD

5.19 Billion

USD

8.22 Billion

2025

2033

| 2026 –2033 | |

| USD 5.19 Billion | |

| USD 8.22 Billion | |

|

|

|

|

Alkoxide Market Size

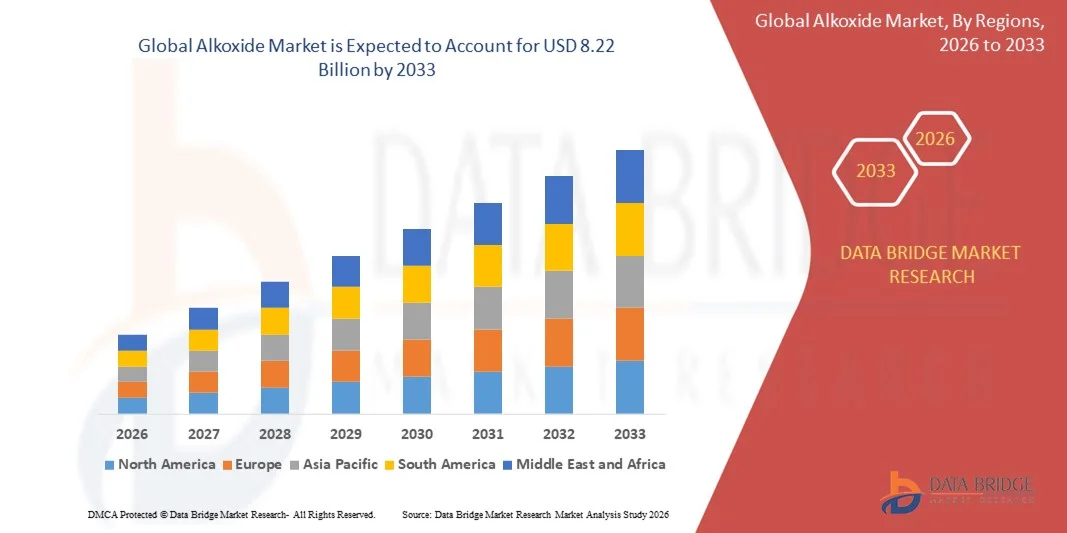

- The global alkoxide market size was valued at USD 5.19 billion in 2025 and is expected to reach USD 8.22 billion by 2033, at a CAGR of 5.9% during the forecast period

- The market growth is largely fueled by the increasing demand for high-purity chemical intermediates in pharmaceuticals, electronics, and specialty chemicals, driving widespread adoption of aluminium, titanium, and other metal alkoxides across industrial applications

- Furthermore, growing focus on advanced materials, green chemistry, and sustainable production processes is encouraging manufacturers to integrate alkoxides into coatings, catalysts, and sol-gel processes. These converging factors are accelerating the adoption of alkoxides, thereby significantly boosting the industry's growth

Alkoxide Market Analysis

- Alkoxides, serving as key precursors in fine chemicals, drug intermediates, coatings, and electronic materials, are increasingly vital in modern industrial and pharmaceutical applications due to their high reactivity, purity, and versatility

- The escalating demand for alkoxides is primarily fueled by expansion in pharmaceuticals, rising production of specialty chemicals, advancements in electronics and materials science, and increasing preference for environmentally friendly and efficient chemical processes

- Asia-Pacific dominated the alkoxide market in 2025, due to expanding electronics manufacturing, growing demand for specialty chemicals, and a strong presence of chemical production hubs

- North America is expected to be the fastest growing region in the alkoxide market during the forecast period due to robust demand for alkoxides in pharmaceuticals, electronics, and specialty chemical production

- Aluminium segment dominated the market with a market share of 43% in 2025, due to its widespread use in coating, catalysis, and thin-film deposition processes. Manufacturers and end-users often prioritize Aluminium alkoxides due to their high reactivity, stability, and versatility across multiple industrial applications. The market also experiences strong demand for Aluminium types owing to their cost-effectiveness and compatibility with advanced materials in electronics and automotive sectors. Their role in producing high-purity alumina and as precursors for sol-gel processes further reinforces their leadership in the segment

Report Scope and Alkoxide Market Segmentation

|

Attributes |

Alkoxide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alkoxide Market Trends

Rising Adoption of Sustainable and Bio-Based Alkoxides

- A significant trend in the alkoxide market is the increasing adoption of sustainable and bio-based alkoxides across pharmaceutical, fine chemical, and electronics industries. This trend is driven by rising global emphasis on green chemistry and environmentally friendly production processes, positioning alkoxides as essential intermediates in modern industrial applications

- For instance, BASF SE and Evonik Industries AG are expanding their portfolios with renewable and bio-based alkoxides that cater to eco-conscious chemical manufacturers and R&D-driven clients. Such products are enhancing process sustainability and supporting reduced environmental impact across multiple chemical applications

- The demand for high-performance aluminium, titanium, and silicon alkoxides is growing as manufacturers utilize these compounds in coatings, catalysts, and sol-gel processes, reinforcing their importance in specialty chemical production

- Rising investments in advanced materials and electronics are further accelerating the adoption of alkoxides for high-precision applications, including thin-film deposition, semiconductors, and functional coatings

- Industries are increasingly integrating alkoxides into formulations that improve product durability, efficiency, and performance, which is strengthening their adoption across pharmaceuticals and industrial sectors

- The expanding focus on regulatory compliance and eco-friendly chemical manufacturing practices is motivating companies to incorporate sustainable alkoxides, thus fostering market growth and positioning these compounds as vital industrial intermediates

Alkoxide Market Dynamics

Driver

Increasing Demand for High-Purity Chemical Intermediates

- The growing requirement for high-purity chemical intermediates in pharmaceuticals, fine chemicals, and advanced materials is driving the alkoxide market. These intermediates are critical for achieving consistent quality, precise reactions, and improved efficiency in end-product manufacturing

- For instance, companies such as Gelest Inc. supply high-purity aluminium and titanium alkoxides for electronic and pharmaceutical applications. These intermediates support product innovation, enable precise formulation processes, and enhance operational reliability

- Rising pharmaceutical production, expansion in fine chemical manufacturing, and growing electronics industry needs are collectively strengthening the market demand for alkoxides with stringent purity and performance standards

- In addition, the focus on tailored chemical solutions and specialized industrial applications is encouraging manufacturers to adopt alkoxides as versatile intermediates, further fueling market growth

- The increasing reliance on alkoxides for advanced coatings, catalysts, and sol-gel processes continues to reinforce their status as essential compounds in modern chemical production

Restraint/Challenge

High Production Costs and Complex Synthesis Processes

- The alkoxide market faces challenges due to high production costs and the complexity of synthesizing metal and organic alkoxides, which require stringent purity, controlled reaction conditions, and specialized equipment

- For instance, companies such as Strem Chemicals and Tosoh Corporation employ advanced synthesis and purification techniques for high-performance alkoxides. These intricate processes demand skilled labor and sophisticated technology, increasing overall production costs

- Scaling up production while maintaining product consistency and reactivity adds further operational and financial pressures on manufacturers

- The reliance on rare or sensitive raw materials and the need for stringent quality control protocols increase supply-side complexity and constrain cost-efficiency

- Manufacturers must continuously optimize synthesis methods and streamline production processes to balance quality, performance, and economic feasibility, which remains a persistent challenge in the alkoxide market

Alkoxide Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Alkoxide market is segmented into Aluminium, Antimony, Hafnium, Silicon, Titanium, and Other. The Aluminium segment dominated the market with the largest market revenue share of 43% in 2025, driven by its widespread use in coating, catalysis, and thin-film deposition processes. Manufacturers and end-users often prioritize Aluminium alkoxides due to their high reactivity, stability, and versatility across multiple industrial applications. The market also experiences strong demand for Aluminium types owing to their cost-effectiveness and compatibility with advanced materials in electronics and automotive sectors. Their role in producing high-purity alumina and as precursors for sol-gel processes further reinforces their leadership in the segment.

The Titanium segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in the electronics, aerospace, and pharmaceutical industries. Titanium alkoxides are valued for their ability to form highly durable oxide coatings and as precursors in advanced ceramic materials. Their application in photocatalysis and biomedical fields further boosts market adoption. The growth is supported by rising R&D activities aimed at developing innovative titanium-based materials for specialty applications. In addition, Titanium alkoxides’ role in environmentally friendly manufacturing processes contributes to their growing demand.

- By Application

On the basis of application, the Alkoxide market is segmented into Drug, Fine Chemicals, Electronics, and Other. The Fine Chemicals segment held the largest market revenue share in 2025, driven by the extensive use of alkoxides as intermediates in the synthesis of specialty chemicals and catalysts. Fine chemical manufacturers often prefer alkoxides due to their high purity, precise reactivity, and ability to facilitate controlled chemical transformations. The segment benefits from the increasing demand for high-performance chemicals in coatings, adhesives, and polymer industries. Alkoxides’ role in enhancing product efficiency and process optimization further strengthens their dominance in fine chemical applications.

The Electronics segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising demand for alkoxides in thin-film deposition, semiconductors, and advanced electronic materials. Electronics manufacturers favor alkoxides for their precision in producing metal oxides and other high-quality materials critical for device performance. The segment growth is driven by the expansion of consumer electronics, automotive electronics, and energy storage technologies. For instance, titanium and aluminium alkoxides are increasingly utilized in next-generation semiconductor fabrication. The scalability of alkoxide-based processes for industrial electronics further accelerates their adoption across the sector.

Alkoxide Market Regional Analysis

- Asia-Pacific dominated the alkoxide market with the largest revenue share in 2025, driven by expanding electronics manufacturing, growing demand for specialty chemicals, and a strong presence of chemical production hubs

- The region’s cost-effective manufacturing landscape, rising investments in fine chemicals and drug intermediates, and growing exports of metal alkoxides are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of alkoxides in both pharmaceutical and industrial sectors

China Alkoxide Market Insight

China held the largest share in the Asia-Pacific alkoxide market in 2025, owing to its leadership in chemical manufacturing and high-volume production of aluminium and titanium alkoxides. The country's strong industrial base, supportive government policies for chemical sector expansion, and extensive export capabilities for specialty chemicals are major growth drivers. Demand is further bolstered by ongoing investments in fine chemicals, drug intermediates, and electronic-grade alkoxide production for both domestic and international markets.

India Alkoxide Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding pharmaceutical sector, increasing generic drug production, and rising investments in specialty chemical infrastructure. Initiatives promoting self-reliance in chemical manufacturing and growing exports of fine chemicals are strengthening demand for alkoxides. In addition, expanding R&D capabilities in advanced materials and increasing use of alkoxides in electronics and coatings are contributing to robust market growth.

Europe Alkoxide Market Insight

The Europe alkoxide market is expanding steadily, supported by stringent regulatory standards, high demand for high-purity intermediates, and growing investments in sustainable and specialty chemical production. The region emphasizes quality, environmental compliance, and advanced chemical formulations, particularly in pharmaceuticals, coatings, and high-performance materials. Rising use of metal alkoxides in sol-gel processes and catalyst development is further enhancing market adoption.

Germany Alkoxide Market Insight

Germany’s alkoxide market is driven by its leadership in high-precision pharmaceutical and fine chemical manufacturing, strong chemical industry heritage, and export-oriented production model. The country has well-established R&D networks and collaborations between academic institutions and chemical manufacturers, fostering continuous innovation in alkoxide synthesis. Demand is particularly strong for aluminium and titanium alkoxides used in drug intermediates, coatings, and advanced materials.

U.K. Alkoxide Market Insight

The U.K. market is supported by a mature chemical and life sciences industry, growing efforts to localize specialty chemical production post-Brexit, and increased demand for high-purity alkoxides. With rising focus on R&D, academic-industry partnerships, and investments in lab-scale synthesis of niche metal alkoxides, the U.K. continues to play a significant role in high-value chemical markets.

North America Alkoxide Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for alkoxides in pharmaceuticals, electronics, and specialty chemical production. Focus on drug discovery, advanced material development, and high-purity intermediates is boosting adoption. In addition, reshoring of chemical manufacturing and increasing collaborations between pharma and specialty chemical companies are supporting market expansion.

U.S. Alkoxide Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive pharmaceutical and specialty chemical industry, strong R&D infrastructure, and significant investments in advanced material production. The country’s focus on innovation, regulatory compliance, and sustainability is encouraging the use of high-purity aluminium and titanium alkoxides in drug synthesis, coatings, and electronics. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Alkoxide Market Share

The alkoxide industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Albemarle Corporation (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- Gelest Inc. (U.S.)

- Chemtech Acids and Chemicals Private Limited (India)

- Catalytic Technologies Ltd. (U.K.)

- Norquay Technology (Canada)

- Suparna Chemicals Ltd. (India)

- Ascensus (U.S.)

- Strem Chemicals Inc. (U.S.)

- Sasol Limited (South Africa)

- Callery, LLC (U.S.)

- American Elements (U.S.)

- MPD Chemicals (U.S.)

- Tosoh Corporation (Japan)

- New Heaven Chemicals INC Iowa LLC (U.S.)

- BASF SE (Germany)

- Envirocat (U.S.)

- Inner Mongolia Lantai Industrial Co., Ltd (China)

- LIAN Chemical Development Company (China)

Latest Developments in Global Alkoxide Market

- In September 2025, Evonik Industries AG announced a partnership with a leading biotechnology firm to develop bio-based alkoxides. This collaboration reinforces Evonik’s commitment to innovation and sustainability, enabling the company to address the growing global demand for eco-friendly chemical solutions. The strategic importance of this partnership lies in its potential to expand Evonik’s product portfolio, access new markets, and strengthen its competitive position in the alkoxide sector by offering bio-based alternatives to traditional chemical products

- In August 2025, BASF SE launched a new line of sustainable alkoxides derived from renewable resources. This move aligns with the rising global focus on green chemistry and positions BASF as a leader in environmentally conscious chemical manufacturing. The introduction of these products is expected to attract environmentally conscious customers, enhance the company’s market share, and support long-term growth in the expanding eco-friendly alkoxide segment

- In July 2025, Huntsman Corporation completed the acquisition of a specialty chemicals manufacturer, significantly expanding its alkoxide production capabilities. This acquisition is expected to improve operational efficiency and broaden Huntsman’s product offerings, allowing the company to better serve diverse industrial sectors. Leveraging synergies from the acquisition is likely to reduce production costs, enhance competitiveness, and strengthen Huntsman’s position in the global alkoxide market

- In May 2025, Solvay S.A. inaugurated a state-of-the-art alkoxide manufacturing facility focused on high-purity aluminium and titanium derivatives. This development is expected to increase production capacity, meet rising demand from pharmaceuticals and electronics industries, and support rapid delivery to global customers. The facility’s advanced technology and sustainable production practices are likely to improve product quality, reduce environmental impact, and solidify Solvay’s leadership in high-performance alkoxide solutions

- In March 2025, Dow Inc. announced a strategic expansion of its alkoxide product portfolio to include customized solutions for fine chemicals and coatings applications. This initiative is anticipated to enhance Dow’s ability to address specialized customer requirements, penetrate new markets, and respond to emerging trends in industrial and pharmaceutical sectors. The expansion strengthens Dow’s market presence and positions the company for sustained growth amid increasing demand for tailored alkoxide products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alkoxide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alkoxide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alkoxide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.