Global Allergy Treatment Market

Market Size in USD Billion

CAGR :

%

USD

23.05 Billion

USD

38.24 Billion

2024

2032

USD

23.05 Billion

USD

38.24 Billion

2024

2032

| 2025 –2032 | |

| USD 23.05 Billion | |

| USD 38.24 Billion | |

|

|

|

|

Allergy Treatment Market Size

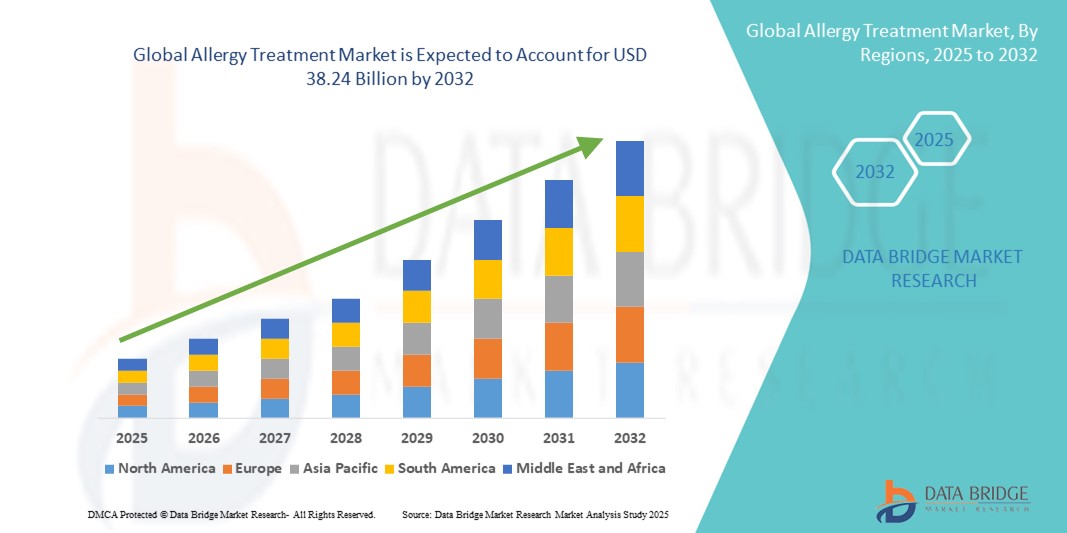

- The global allergy treatment market size was valued at USD 23.05 billion in 2024 and is expected to reach USD 38.24 billion by 2032, at a CAGR of 6.53% during the forecast period

- The market growth is largely fueled by the increasing prevalence of allergic conditions—such as allergic rhinitis, asthma, and food allergies—driven by urbanization, environmental pollution, and changing lifestyles across global populations

- Furthermore, advancements in immunotherapy, biologics, and personalized medicine are enhancing treatment options, leading to rising clinician confidence and patient adoption of cutting-edge allergy treatments

Allergy Treatment Market Analysis

- The global allergy treatment market is experiencing substantial growth, primarily driven by the increasing prevalence of allergic disorders such as asthma, allergic rhinitis, food allergies, eczema, and drug allergies. This surge is further supported by rising public health awareness regarding early diagnosis and appropriate treatment regimens, as well as growing concerns about environmental pollution and its impact on allergy development

- The demand for allergy treatments is being significantly propelled by the rising utilization of immunotherapy (allergy shots and sublingual tablets), second-generation antihistamines, intranasal corticosteroids, and biologics such as monoclonal antibodies. In addition, technological innovations in allergy diagnostics and drug delivery systems are enhancing treatment effectiveness and patient compliance

- North America dominated the allergy treatment market with the largest revenue share of 38.5% in 2024, largely due to high healthcare expenditure, widespread health insurance coverage, advanced allergy testing infrastructure, and the strong presence of major pharmaceutical and biotechnology firms developing targeted therapies. The U.S., in particular, is witnessing a surge in allergy treatment adoption across both urban and rural healthcare settings, driven by supportive government initiatives and continuous R&D investments

- Asia-Pacific is projected to be the fastest growing region in the allergy treatment market during the forecast period, attributed to rapid urbanization, increasing industrial pollution, rising disposable incomes, and expanding access to quality healthcare. Countries such as China, India, and Japan are seeing a sharp rise in cases of respiratory and skin allergies, prompting greater adoption of both prescription and over-the-counter allergy medications

- The anti-allergy drugs segment dominated the allergy treatment market with a share of 71.4% in 2024, as these medications are readily available, cost-effective, and suitable for managing mild to moderate allergy symptoms. These include antihistamines, decongestants, corticosteroids, and mast cell stabilizers

Report Scope and Allergy Treatment Market Segmentation

|

Attributes |

Allergy Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Allergy Treatment Market Trends

Enhanced Convenience Through AI and Digital Integration in Allergy Treatment

- A significant and accelerating trend in the global allergy treatment market is the growing integration of artificial intelligence (AI), machine learning algorithms, and digital health platforms into various aspects of allergy care, including diagnosis, symptom tracking, and treatment optimization. These innovations are significantly improving the convenience, personalization, and accessibility of allergy treatments

- For instance, AI-enabled diagnostic platforms can analyze patient health records, environmental factors, and symptom patterns to aid in the early identification of allergies—be it food allergies, drug hypersensitivities, or airborne allergens such as pollen and dust mites. This streamlines the diagnostic process and enhances accuracy

- Digital applications powered by AI are becoming essential tools for allergy sufferers, offering real-time allergen exposure forecasts, personalized symptom tracking, medication reminders, and adaptive management plans. These features not only improve adherence to treatment but also empower patients to manage their condition proactively

- Voice-assisted technologies, integrated with platforms such as Amazon Alexa and Google Assistant, are further enhancing user convenience by allowing patients to set reminders, log symptoms, or access treatment information using hands-free voice commands. This is especially helpful for individuals managing chronic allergic conditions on a daily basis

- In addition, AI-driven telehealth platforms now enable allergy specialists to remotely monitor patient progress and adjust therapies in real-time. This reduces the need for frequent in-person visits, making care more accessible and reducing overall healthcare costs

- The convergence of AI, voice-enabled tools, and remote care platforms is reshaping the allergy treatment landscape, leading to more efficient, personalized, and patient-centric care models. As a result, healthcare providers and companies are increasingly investing in intelligent digital ecosystems that support end-to-end allergy care management

Allergy Treatment Market Dynamics

Driver

Rising Prevalence of Allergic Conditions and Increased Awareness Drive Market Growth

- The growing global prevalence of various allergic conditions—including allergic rhinitis, asthma, food allergies, and drug allergies—is one of the primary drivers fueling the demand for allergy treatment solutions across healthcare systems. This trend is further amplified by increasing awareness of allergy symptoms and the availability of advanced treatment options among patients and healthcare providers

- For instance, in April 2024, Alladapt Immunotherapeutics Inc. announced promising clinical data for ADP101, its multi-food oral immunotherapy treatment. Such innovations by leading biopharmaceutical companies are accelerating the development and commercialization of novel therapies in the Allergy Treatment market

- Changing environmental conditions, increased pollution levels, and rising exposure to allergens due to urbanization are contributing to the surge in allergic disorders globally. This has led to a significant uptick in medical consultations and prescriptions for antihistamines, corticosteroids, decongestants, and allergen-specific immunotherapy

- In addition, public and private health organizations are conducting large-scale campaigns to educate people about allergy management and prevention strategies. These efforts are improving diagnosis rates and treatment adherence, further contributing to market expansion

- The convenience of modern treatment options such as sublingual immunotherapy (SLIT), self-administered epinephrine auto-injectors, and long-acting biologics is also attracting patient attention, particularly in developed markets. The trend toward personalized allergy treatment plans, supported by improved diagnostic tools such as skin prick testing and IgE blood testing, is significantly enhancing treatment efficacy

- Restraint/Challenge

Limited Access and High Cost of Advanced Allergy Treatments Pose Market Barriers

- A major challenge in the Allergy Treatment market is the unequal access to advanced therapies due to cost constraints, particularly in low- and middle-income countries. Biologic therapies and immunotherapy options, while effective, often come with high price tags, limiting their affordability and widespread adoption

- For instance, monoclonal antibody treatments such as omalizumab and dupilumab, although offering superior outcomes for severe allergies and asthma, remain financially out of reach for many patients due to limited insurance coverage and high out-of-pocket costs

- Further complicating access is the shortage of trained allergy specialists in several regions, particularly in rural and underserved areas. This hampers early diagnosis and appropriate treatment, resulting in under-treatment or mismanagement of allergic conditions

- Another key restraint is patient hesitancy toward long-term immunotherapy due to the need for repeated administration, potential side effects, and the extended duration of treatment. This lack of immediate relief compared to symptomatic treatments such as antihistamines can deter patient adherence

- Overcoming these limitations will require increased investment in healthcare infrastructure, the development of cost-effective treatment alternatives, and robust healthcare reimbursement policies. In addition, raising awareness about the long-term benefits of allergy immunotherapy through clinician and patient education can help improve acceptance and adherence

Allergy Treatment Market Scope

The market is segmented on the basis of type, treatment, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the allergy treatment market is segmented into eye allergy, food allergy, skin allergy, asthma, rhinitis, and others. The asthma segment accounted for the largest revenue share of 34.6% in 2024, owing to the increasing prevalence of allergic asthma triggered by pollution, dust mites, and environmental allergens. The rising urban population and deteriorating air quality in both developed and developing nations are key drivers. The rhinitis segment also holds a significant market share due to seasonal pollen allergies and increased sensitivity to airborne particles.

The skin allergy segment is the fastest growing segment with a CAGR of 12% due to heightened awareness, improved dermatological diagnostics, and growing use of allergen-containing products. Food allergies, especially among children, are on the rise, prompting growth in this subsegment. Overall, growing allergy awareness, better diagnosis, and rising environmental triggers are contributing to growth across all types.

- By Treatment

On the basis of treatment, the allergy treatment market is segmented into anti-allergy drugs and immunotherapy. The anti-allergy drugs segment held the largest market share of 71.4% in 2024, as these medications are readily available, cost-effective, and suitable for managing mild to moderate allergy symptoms. These include antihistamines, decongestants, corticosteroids, and mast cell stabilizers.

Their wide availability in retail and online pharmacies further boosts accessibility. However, the immunotherapy segment is projected to grow at a CAGR of 8.5% from 2025 to 2032, driven by increasing patient preference for long-term, disease-modifying treatments. This includes allergy shots and sublingual tablets that provide sustained relief by desensitizing the immune system. As allergic conditions become chronic, immunotherapy adoption is steadily rising.

- By Route of Administration

On the basis of route of administration, the allergy treatment market is segmented into oral, inhalation, intranasal, and others. The oral segment led the market with a share of 45.2% in 2024, supported by patient preference for easy and non-invasive treatment forms such as tablets and syrups. These are typically the first-line therapy for allergy management and widely distributed.

The inhalation segment is expanding at a CAGR of 7.2%, primarily due to the increasing prevalence of allergic asthma and advances in inhaler technology. Intranasal routes are particularly effective in rhinitis and sinus-related allergies, offering rapid local relief with minimal side effects. Routes such as subcutaneous injections are also gaining popularity under the immunotherapy segment. Convenience, compliance, and innovation in drug delivery devices are key growth enablers across all routes.

- By End-Users

On the basis of end-users, the allergy treatment market is segmented into hospitals, specialty clinics, homecare, and others. The hospital segment captured the largest share of 39.5% in 2024, as hospitals are equipped with advanced facilities for allergy testing, emergency care, and specialist consultations. In severe or life-threatening allergy cases, such as anaphylaxis, immediate hospital-based treatment is crucial. Specialty clinics cater to long-term management, especially immunotherapy, and are becoming preferred centers for tailored allergy care.

Homecare is witnessing fast growth with a CAGR of 8.1%, driven by increased patient awareness and adoption of home-based solutions such as OTC antihistamines, nebulizers, and teleconsultations. Patients with mild to moderate symptoms prefer convenient, self-managed options. This shift reflects the rising importance of decentralized care and remote monitoring.

- By Distribution Channel

On the basis of distribution channel, the allergy treatment market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment held the highest market share of 47.6% in 2024, as it offers quick access to both prescription and non-prescription allergy drugs. Chain pharmacies, local drugstores, and over-the-counter sales drive this segment.

The online pharmacy segment is expected to grow at a CAGR of 9.4%, supported by increasing digital health adoption, convenience, and availability of discounted rates. Online platforms also enable auto-refill services and doorstep delivery, making them popular among chronic allergy patients. Hospital pharmacies are critical for supplying specialty treatments, especially in immunotherapy and emergency care. The diversification of distribution channels ensures wider reach and accessibility of treatments across urban and rural populations.

Allergy Treatment Market Regional Analysis

- North America dominated the allergy treatment market with the largest revenue share of 38.5% in 2024, driven by the rising prevalence of allergic conditions such as allergic rhinitis, asthma, eczema, and food allergies

- The region's strong healthcare infrastructure, increased awareness about allergic diseases, and wide availability of advanced treatment options such as immunotherapy, antihistamines, corticosteroids, and biologics have significantly contributed to market growth

- Furthermore, the presence of leading pharmaceutical companies, ongoing research into personalized allergy treatments, and favorable reimbursement policies are enhancing patient access to innovative therapies across both pediatric and adult populations

U.S. Allergy Treatment Market Insight

The U.S. allergy treatment market captured the largest revenue share of 81% in 2024 within North America, supported by the high incidence of seasonal allergies and food-related hypersensitivities. The country is witnessing growing demand for sublingual immunotherapy and biologic drugs for severe allergic asthma and atopic dermatitis. Technological advancements in diagnostic tools, coupled with increased adoption of at-home allergy testing kits and digital health platforms, are enhancing patient engagement and management. In addition, strong R&D investment and FDA approvals for novel allergy medications are further driving market expansion in the U.S.

Europe Allergy Treatment Market Insight

The Europe allergy treatment market is projected to expand at a substantial CAGR throughout the forecast period, fueled by the growing burden of allergic diseases and increasing awareness about early diagnosis and treatment. Rising environmental pollution, climate change, and urban lifestyle factors are contributing to the surge in allergy cases across the region. Government initiatives focused on allergy prevention, expanding access to immunotherapy, and investment in clinical trials for novel drugs are significantly supporting the market. Moreover, strong collaborations between academic institutions and biotech firms are helping introduce more effective and safer allergy treatments.

U.K. Allergy Treatment Market Insight

The U.K. allergy treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rise in allergic rhinitis, asthma, and food allergies among children and adults. Growing awareness campaigns by organizations such as Allergy UK and National Health Service (NHS) programs focusing on allergy education and patient care are improving diagnosis rates. Moreover, the adoption of biologics and the expansion of specialized allergy clinics are enhancing treatment accessibility. The increasing focus on research into food allergy desensitization therapies is also expected to stimulate long-term market growth.

Germany Allergy Treatment Market Insight

The Germany allergy treatment market is expected to expand at a considerable CAGR during the forecast period, driven by strong government support for allergy prevention and research, and increasing demand for targeted therapies. Germany’s well-established healthcare system and widespread insurance coverage for allergy diagnostics and treatment are encouraging more patients to seek medical help. Rising adoption of immunotherapy for hay fever, allergic asthma, and insect venom allergies, along with the availability of minimally invasive diagnostic tools, are further fueling the market. Increased funding for academic research into environmental allergens also supports innovation in this field.

Asia-Pacific Allergy Treatment Market Insight

The Asia-Pacific allergy treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, owing to rapid urbanization, increasing pollution levels, changing dietary habits, and rising awareness of allergic conditions. Countries such as China, Japan, and India are witnessing a spike in allergic diseases, including asthma, allergic rhinitis, and food allergies. Government health programs aimed at improving access to healthcare, coupled with the rising penetration of private allergy clinics and e-health services, are promoting early diagnosis and treatment. Moreover, growing investments by pharmaceutical companies in APAC are expanding the availability of advanced allergy therapies.

Japan Allergy Treatment Market Insight

The Japan allergy treatment market is gaining momentum due to the high prevalence of pollen-related allergies, rising pollution levels, and an aging population prone to chronic allergic conditions. Innovations in allergy diagnostics, such as component-resolved diagnostics (CRD), and the development of targeted biologics for conditions such as eosinophilic asthma are contributing to market growth. In addition, public health initiatives focused on hay fever and the availability of over-the-counter allergy medications are increasing consumer awareness and accessibility to treatment. The demand for personalized allergy management solutions is also growing steadily in Japan.

China Allergy Treatment Market Insight

The China allergy treatment market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, industrialization, and lifestyle changes that have led to a rise in allergic diseases. China’s expanding healthcare infrastructure, increasing awareness about allergies, and the growing middle-class population are major factors propelling market growth. Domestic and international pharmaceutical companies are actively launching new drugs and therapies in the region, including traditional Chinese medicine-based formulations for allergy relief. Government-backed allergy awareness campaigns and improvements in allergy testing availability are further accelerating the market in China.

Allergy Treatment Market Share

The allergy treatment industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Boehringer Ingelheim International GmbH (Germany)

- AstraZeneca (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Prestige Consumer Healthcare Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Almirall, S.A (Spain)

- Zenomed Healthcare Private Limited (India)

- Cadila Pharmaceuticals (India)

- Astellas Pharma Inc. (Japan)

- Lilly (U.S.)

Latest Developments in Global Allergy Treatment Market

- In April 2025, Sanofi and Regeneron announced that the U.S. Food and Drug Administration (FDA) approved Dupixent (dupilumab) for treating chronic spontaneous urticaria (CSU) in patients aged 12 and older. This marks the first new targeted therapy approved for CSU in more than a decade, offering significant symptom relief across overlapping atopic conditions such as asthma and atopic dermatitis

- In July 2024, the FDA expanded the age eligibility for Palforzia, the first FDA-approved oral immunotherapy for peanut allergy, to include toddlers aged 1 through 3 years. Previously limited to ages 4–17, this expansion represents a major milestone for early intervention and broader accessibility of peanut desensitization therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ALLERGY TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ALLERGY TREATMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ALLERGY TREATMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S 5 FORCES

4.2 PESTEL ANALYSIS

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.1.1 PREVALENCE OF ASTHMA

5.1.2 PREVALENCE OF VENOM ALLERGY

5.1.3 PREVALENCE OF ALLERGIC RHINITIS

5.1.4 PREVALENCE OF CONJUNCTIVITIS

5.1.5 PREVALENCE OF ATOPIC DERMATITIS

5.1.6 PREVALENCE OF URTICARIA

5.1.7 PREVALENCE OF ANAPHYLAXIS

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH DOCTORS

6.8 INTERVIEWS WITH SALES EXECUTIVES

6.9 INTERVIEWS WITH PHARMACIES

6.1 OTHER KOL SNAPSHOTS

7 REGULATORY SCENARIO

7.1 FDA APPROVALS

7.2 EMA APPROVALS

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 PIPELINE ANALYSIS

9.1 PHASE III CANDIDATES

9.2 PHASE II CANDIDATES

9.3 PHASE I CANDIDATES

9.4 OTHERS (PRE-CLINICAL AND RESEARCH)

10 MARKET OVERVIEW

10.1 DRIVERS

10.2 RESTRAINTS

10.3 OPPORTUNITIES

10.4 CHALLENGES

11 GLOBAL ALLERGY TREATMENT MARKET, BY TREATMENT

11.1 OVERVIEW

11.2 MEDICATION

11.2.1 CORTICOSTEROIDS

11.2.1.1. BY DRUGS

11.2.1.1.1. BUDESONIDE

11.2.1.1.1.1 MARKET VALUE (USD MN)

11.2.1.1.1.2 MAKET VOLUME (IU)

11.2.1.1.1.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.2. FULTICASONE FUROATE

11.2.1.1.2.1 MARKET VALUE (USD MN)

11.2.1.1.2.2 MAKET VOLUME (IU)

11.2.1.1.2.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.3. FLUTICASONE PROPIONATE

11.2.1.1.3.1 MARKET VALUE (USD MN)

11.2.1.1.3.2 MAKET VOLUME (IU)

11.2.1.1.3.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.4. MOMETASONE

11.2.1.1.4.1 MARKET VALUE (USD MN)

11.2.1.1.4.2 MAKET VOLUME (IU)

11.2.1.1.4.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.5. TRIAMCINOLONE

11.2.1.1.5.1 MARKET VALUE (USD MN)

11.2.1.1.5.2 MAKET VOLUME (IU)

11.2.1.1.5.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.6. BECLOMETHASONE

11.2.1.1.6.1 MARKET VALUE (USD MN)

11.2.1.1.6.2 MAKET VOLUME (IU)

11.2.1.1.6.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.7. CICLESONIDE

11.2.1.1.7.1 MARKET VALUE (USD MN)

11.2.1.1.7.2 MAKET VOLUME (IU)

11.2.1.1.7.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.8. FLUOROMETHOLONE

11.2.1.1.8.1 MARKET VALUE (USD MN)

11.2.1.1.8.2 MAKET VOLUME (IU)

11.2.1.1.8.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.9. PREDNISOLONE

11.2.1.1.9.1 MARKET VALUE (USD MN)

11.2.1.1.9.2 MAKET VOLUME (IU)

11.2.1.1.9.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.10. PREDNISONE

11.2.1.1.10.1 MARKET VALUE (USD MN)

11.2.1.1.10.2 MAKET VOLUME (IU)

11.2.1.1.10.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.11. METHYLPREDNISOLONE

11.2.1.1.11.1 MARKET VALUE (USD MN)

11.2.1.1.11.2 MAKET VOLUME (IU)

11.2.1.1.11.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.12. BETAMETHASONE

11.2.1.1.12.1 MARKET VALUE (USD MN)

11.2.1.1.12.2 MAKET VOLUME (IU)

11.2.1.1.12.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.13. DESONIDE

11.2.1.1.13.1 MARKET VALUE (USD MN)

11.2.1.1.13.2 MAKET VOLUME (IU)

11.2.1.1.13.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.14. HYDROCORTISONE

11.2.1.1.14.1 MARKET VALUE (USD MN)

11.2.1.1.14.2 MAKET VOLUME (IU)

11.2.1.1.14.3 AVERAGE SELLING PRICE (USD)

11.2.1.1.15. OTHERS

11.2.1.2. BY ROUTE OF ADMINISTRATIONS

11.2.1.2.1. ORAL

11.2.1.2.1.1 PILLS

11.2.1.2.1.2 TABLETS

11.2.1.2.1.3 CAPSULES

11.2.1.2.1.4 OTHERS

11.2.1.2.2. TOPICALS

11.2.1.2.2.1 GELS

11.2.1.2.2.2 NASAL SPRAYS

11.2.1.2.2.3 EYE DROPS

11.2.1.2.2.4 CREAM

11.2.1.2.2.5 OTHERS

11.2.1.2.3. PARENTERAL

11.2.1.2.3.1 SOLUTIONS

11.2.1.2.3.2 SUSPENTIONS

11.2.1.2.3.3 OTHERS

11.2.1.3. BY DRUG TYPE

11.2.1.3.1. BRANDED

11.2.1.3.2. GENERICS

11.2.2 ANTIHISTAMINES

11.2.2.1. BY DRUGS

11.2.2.1.1. IORATADINE

11.2.2.1.1.1 MARKET VALUE (USD MN)

11.2.2.1.1.2 MAKET VOLUME (IU)

11.2.2.1.1.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.2. CETIRIZINE

11.2.2.1.2.1 MARKET VALUE (USD MN)

11.2.2.1.2.2 MAKET VOLUME (IU)

11.2.2.1.2.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.3. DIPHENHYDRAMINE

11.2.2.1.3.1 MARKET VALUE (USD MN)

11.2.2.1.3.2 MAKET VOLUME (IU)

11.2.2.1.3.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.4. CHLORPHENIRAMINE

11.2.2.1.4.1 MARKET VALUE (USD MN)

11.2.2.1.4.2 MAKET VOLUME (IU)

11.2.2.1.4.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.5. LEVOCETIRIZINE

11.2.2.1.5.1 MARKET VALUE (USD MN)

11.2.2.1.5.2 MAKET VOLUME (IU)

11.2.2.1.5.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.6. FEXOFENADINE

11.2.2.1.6.1 MARKET VALUE (USD MN)

11.2.2.1.6.2 MAKET VOLUME (IU)

11.2.2.1.6.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.7. DESLORATADINE

11.2.2.1.7.1 MARKET VALUE (USD MN)

11.2.2.1.7.2 MAKET VOLUME (IU)

11.2.2.1.7.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.8. KETOTIFEN

11.2.2.1.8.1 MARKET VALUE (USD MN)

11.2.2.1.8.2 MAKET VOLUME (IU)

11.2.2.1.8.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.9. OLOPATADINE

11.2.2.1.9.1 MARKET VALUE (USD MN)

11.2.2.1.9.2 MAKET VOLUME (IU)

11.2.2.1.9.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.10. PHENIRAMINE

11.2.2.1.10.1 MARKET VALUE (USD MN)

11.2.2.1.10.2 MAKET VOLUME (IU)

11.2.2.1.10.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.11. AZELASTINE

11.2.2.1.11.1 MARKET VALUE (USD MN)

11.2.2.1.11.2 MAKET VOLUME (IU)

11.2.2.1.11.3 AVERAGE SELLING PRICE (USD)

11.2.2.1.12. OTHERS

11.2.2.2. BY ROUTE OF ADMINISTRATIONS

11.2.2.2.1. ORAL

11.2.2.2.1.1 PILLS

11.2.2.2.1.2 TABLETS

11.2.2.2.1.3 CAPSULES

11.2.2.2.1.4 OTHERS

11.2.2.2.2. TOPICALS

11.2.2.2.2.1 GELS

11.2.2.2.2.2 NASAL SPRAYS

11.2.2.2.2.3 EYE DROPS

11.2.2.2.2.4 CREAM

11.2.2.2.2.5 OTHERS

11.2.2.2.3. PARENTERAL

11.2.2.2.3.1 SOLUTIONS

11.2.2.2.3.2 SUSPENTIONS

11.2.2.2.3.3 OTHERS

11.2.2.3. BY DRUG TYPE

11.2.2.3.1. BRANDED

11.2.2.3.2. GENERICS

11.2.3 DECONGESTANTS

11.2.3.1. BY DRUGS

11.2.3.1.1. PSEDOEPHRINE

11.2.3.1.1.1 MARKET VALUE (USD MN)

11.2.3.1.1.2 MARKET VOLUME (SU)

11.2.3.1.1.3 AVERAGE SELLING PRICE (USD)

11.2.3.1.2. PHENYLEPHRINE

11.2.3.1.2.1 MARKET VALUE (USD MN)

11.2.3.1.2.2 MARKET VOLUME (SU)

11.2.3.1.2.3 AVERAGE SELLING PRICE (USD)

11.2.3.1.3. OXYMETAZOLINE

11.2.3.1.3.1 MARKET VALUE (USD MN)

11.2.3.1.3.2 MARKET VOLUME (SU)

11.2.3.1.3.3 AVERAGE SELLING PRICE (USD)

11.2.3.1.4. PSEUDOEPHEDRINE

11.2.3.1.4.1 MARKET VALUE (USD MN)

11.2.3.1.4.2 MARKET VOLUME (SU)

11.2.3.1.4.3 AVERAGE SELLING PRICE (USD)

11.2.3.1.5. TETRAHYDROZOLINE

11.2.3.1.5.1 MARKET VALUE (USD MN)

11.2.3.1.5.2 MAKET VOLUME (IU)

11.2.3.1.5.3 AVERAGE SELLING PRICE (USD)

11.2.3.1.6. OTHERS

11.2.3.2. BY ROUTE OF ADMINISTRATIONS

11.2.3.2.1. ORAL

11.2.3.2.1.1 PILLS

11.2.3.2.1.2 TABLETS

11.2.3.2.1.3 CAPSULES

11.2.3.2.1.4 OTHERS

11.2.3.2.2. TOPICALS

11.2.3.2.2.1 GELS

11.2.3.2.2.2 NASAL SPRAYS

11.2.3.2.2.3 EYE DROPS

11.2.3.2.2.4 CREAM

11.2.3.2.2.5 OTHERS

11.2.3.2.3. PARENTERAL

11.2.3.2.3.1 SOLUTIONS

11.2.3.2.3.2 SUSPENTIONS

11.2.3.2.3.3 OTHERS

11.2.3.3. BY DRUG TYPE

11.2.3.3.1. BRANDED

11.2.3.3.2. GENERICS

11.3 MAST CELL STABILIZERS

11.3.1.1. BY DRUGS

11.3.1.1.1. CROMOLYN

11.3.1.1.1.1 MARKET VALUE (USD MN)

11.3.1.1.1.2 MAKET VOLUME (IU)

11.3.1.1.1.3 AVERAGE SELLING PRICE (USD)

11.3.1.1.2. LODOXAMIDE

11.3.1.1.2.1 MARKET VALUE (USD MN)

11.3.1.1.2.2 MAKET VOLUME (IU)

11.3.1.1.2.3 AVERAGE SELLING PRICE (USD)

11.3.1.1.3. NEDOCROMIL

11.3.1.1.3.1 MARKET VALUE (USD MN)

11.3.1.1.3.2 MAKET VOLUME (IU)

11.3.1.1.3.3 AVERAGE SELLING PRICE (USD)

11.3.1.1.4. OTHERS

11.3.1.2. BY DRUG TYPE

11.3.1.2.1. GENERICS

11.3.1.2.2. BRANDED

11.3.1.3. BY ROUTE OF ADMINISTRATIONS

11.3.1.3.1. ORAL

11.3.1.3.1.1 PILLS

11.3.1.3.1.2 TABLETS

11.3.1.3.1.3 CAPSULES

11.3.1.3.1.4 OTHERS

11.3.1.3.2. TOPICALS

11.3.1.3.2.1 GELS

11.3.1.3.2.2 NASAL SPRAYS

11.3.1.3.2.3 EYE DROPS

11.3.1.3.2.4 CREAM

11.3.1.3.2.5 OTHERS

11.3.1.3.3. PARENTERAL

11.3.1.3.3.1 SOLUTIONS

11.3.1.3.3.2 SUSPENTIONS

11.3.1.3.3.3 OTHERS

11.3.1.4. BY DRUG TYPE

11.3.1.4.1. BRANDED

11.3.1.4.2. GENERICS

11.4 EPINEPHRINE SHOTS

11.4.1.1. ADRENACLICK

11.4.1.1.1. MARKET VALUE (USD MN)

11.4.1.1.2. MAKET VOLUME (IU)

11.4.1.1.3. AVERAGE SELLING PRICE (USD)

11.4.1.2. AUVI-Q

11.4.1.2.1. MARKET VALUE (USD MN)

11.4.1.2.2. MAKET VOLUME (IU)

11.4.1.2.3. AVERAGE SELLING PRICE (USD)

11.4.1.3. EPIPEN

11.4.1.3.1. MARKET VALUE (USD MN)

11.4.1.3.2. MAKET VOLUME (IU)

11.4.1.3.3. AVERAGE SELLING PRICE (USD)

11.4.1.4. EPIPEN JR

11.4.1.4.1. MARKET VALUE (USD MN)

11.4.1.4.2. MAKET VOLUME (IU)

11.4.1.4.3. AVERAGE SELLING PRICE (USD)

11.4.1.5. OTHERS

11.4.2 LEUKOTRIENE INHIBITORS

11.4.2.1. BY DRUGS

11.4.2.1.1. MOTELUKAST

11.4.2.1.1.1 MARKET VALUE (USD MN)

11.4.2.1.1.2 MAKET VOLUME (IU)

11.4.2.1.1.3 AVERAGE SELLING PRICE (USD)

11.4.2.1.2. ZAFIRLUKAST

11.4.2.1.2.1 MARKET VALUE (USD MN)

11.4.2.1.2.2 MAKET VOLUME (IU)

11.4.2.1.2.3 AVERAGE SELLING PRICE (USD)

11.4.2.1.3. OTHERS

11.4.2.2. BY DRUG TYPE

11.4.2.2.1. BRANDED

11.4.2.2.2. GENERICS

11.4.3 OTHERS

11.5 IMMUNOTHERAPY

11.5.1 SUBLINGUAL IMMUNOTHERAPY (SLIT)

11.5.2 SUBCUTANEOUS IMMUNOTHERAPY (SCIT)

12 GLOBAL ALLERGY TREATMENT MARKET, BY DISEASE TYPE

12.1 OVERVIEW

12.2 FOOD ALLERGIES

12.2.1 MILK ALLERGY

12.2.2 EGG ALLLERGY

12.2.3 FISH ALLERGY

12.2.4 PEANUTS ALLERGY

12.2.5 WHEAT ALLERGY

12.2.6 SOYABEAN ALLERGY

12.2.7 SEASAME ALLERGY

12.2.8 TREE NUT ALLERGY

12.2.9 CRUSTACEAN SHELLFISH ALLERGY

12.2.10 OTHERS

12.3 DRUG ALLERGY

12.3.1 PENICILLIN ALLERGY

12.3.2 SULFONAMIDES ALLERGY

12.3.3 ANTICONVULSANT ALLERGY

12.3.4 NSAIDS ALLERGY

12.3.5 CHEMOTHERAPY ALLERGY

12.3.6 OTHERS

12.4 PET ALLERGY

12.4.1 CATS ALLERGY

12.4.2 DOG ALLERGY

12.4.3 OTYHERS

12.5 INSECT ALLERGY

12.5.1 MOSQUITOES ALLERGY

12.5.2 KISSING BUGS ALLERGY

12.5.3 BED BUGS ALLERGY

12.5.4 FLEAS ALLERGY

12.5.5 OTHERS

12.6 LATEX ALLERGY

12.6.1 IMMUNOGLOBULIN E (IGE ) MEDIATED

12.6.2 CONTACT DERMATITIS

12.7 MOLD ALLERGY

12.7.1 ALTERNARIA ALLERGY

12.7.2 ASPERGILLUS ALLERGY

12.7.3 CLADOSPORIUM ALLERGY

12.7.4 OTHERS

12.8 POLLEN ALLERGY

12.9 SKIN ALLERGY

12.9.1 ATOPIC DERMATITIS

12.9.2 URTICARIA

12.1 ASTHMA

12.11 ALLERGIC RHINITIS

12.12 CONJUNCTIVITIS

12.13 OTHERS

13 GLOBAL ALLERGY TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 ORAL

13.2.1 PILLS

13.2.2 TABLETS

13.2.3 CAPSULES

13.2.4 OTHERS

13.3 TOPICALS

13.3.1 GELS

13.3.2 NASAL SPRAYS

13.3.3 EYE DROPS

13.3.4 CREAM

13.3.5 OTHERS

13.4 PARENTERAL

13.4.1 SOLUTIONS

13.4.2 SUSPENTIONS

13.4.3 OTHERS

14 GLOBAL ALLERGY TREATMENT MARKET, BY DRUG TYPE

14.1 BRANDED

14.2 GENERICS

15 GLOBAL ALLERGY TREATMENT MARKET, BY MODE OF PURCHASE

15.1 OVERVIEW

15.2 OVER THE COUNTER

15.3 PRESCRIPTION

16 GLOBAL ALLERGY TREATMENT MARKET, BY AGE GROUP

16.1 OVERVIEW

16.2 PEDIATRIC

16.3 ADULTS

16.4 GERIATRIC

17 GLOBAL ALLERGY TREATMENT MARKET, BY END USER

17.1 OVERVIEW

17.2 HOSPITAL

17.3 CLINICS

17.4 HOME HEALTHCARE

17.5 OTHERS

18 GLOBAL ALLERGY TREATMENT MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 HOSPITAL PHARMACY

18.3 ONLINE PHARMACY

18.4 RETAIL PHARMACY

18.5 OTHERS

19 GLOBAL ALLERGY TREATMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 MERGERS & ACQUISITIONS

19.3 NEW PRODUCT DEVELOPMENT & APPROVALS

19.4 EXPANSIONS

19.5 REGULATORY CHANGES

19.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL ALLERGY TREATMENT MARKET, BY GEOGRAPHY

20.1 GLOBAL ADALIMUMAB BIOSIMILAR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.1.1. U.S. GOUT THERAPEUTICS MARKET, BY TREATMENT

20.2.1.2. U.S. GOUT THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION

20.2.1.3. U.S. GOUT THERAPEUTICS MARKET, BY END USER

20.2.1.4. U.S. GOUT THERAPEUTICS MARKET, BY DISTRIBUTION CHANNEL

20.3 CANADA

20.4 MEXICO

20.5 EUROPE

20.5.1 GERMANY

20.5.2 FRANCE

20.5.3 U.K.

20.5.4 FINLAND

20.5.5 DENMARK

20.5.6 NORWAY

20.5.7 POLAND

20.5.8 ITALY

20.5.9 SPAIN

20.5.10 RUSSIA

20.5.11 TURKEY

20.5.12 BELGIUM

20.5.13 NETHERLANDS

20.5.14 SWITZERLAND

20.5.15 SWEDEN

20.5.16 REST OF EUROPE

20.6 ASIA-PACIFIC

20.6.1 JAPAN

20.6.2 CHINA

20.6.3 SOUTH KOREA

20.6.4 INDIA

20.6.5 SINGAPORE

20.6.6 THAILAND

20.6.7 INDONESIA

20.6.8 MALAYSIA

20.6.9 PHILIPPINES

20.6.10 AUSTRALIA

20.6.11 NEW ZEALAND

20.6.12 VIETNAM

20.6.13 TAIWAN

20.6.14 REST OF ASIA-PACIFIC

20.6.15

20.7 SOUTH AMERICA

20.7.1 BRZIL

20.7.2 ARGENTINA

20.7.3 REST OF SOUTH AMERICA

20.8 MIDDLE EAST AND AFRICA

20.8.1 SOUTH AFRICA

20.8.2 SAUDI ARABIA

20.8.3 UAE

20.8.4 EGYPT

20.8.5 KUWAIT

20.8.6 OMAN

20.8.7 ISRAEL

20.8.8 BAHRAIN

20.8.9 REST OF MIDDLE EAST AND AFRICA

20.9 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21 GLOBAL ALLERGY TREATMENT MARKET, SWOT AND DBMR ANALYSIS

22 GLOBAL ALLERGY TREATMENT MARKET, COMPANY PROFILE

22.1 SANOFI

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHIC PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 GLAXOSMITHKLINE PLC

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHIC PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 PFIZER INC.

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHIC PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 JANSSEN GLOBAL SERVICES, LLC.

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHIC PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 ABBVIE

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHIC PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 NOVARTIS AG

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHIC PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 LUPIN

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHIC PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 AMNEAL PHARMACEUTICALS LLC

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHIC PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 DR. REDDY’S LABORATORIES LTD.

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHIC PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.1 SUN PHARMACEUTICAL INDUSTRIES LTD.

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHIC PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 TEVA PHARMACEUTICAL INDUSTRIES LTD

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHIC PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT DEVELOPMENTS

22.12 MYLAN N.V

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHIC PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT DEVELOPMENTS

22.13 ZYDUS CADILA

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHIC PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT DEVELOPMENTS

22.14 CIPLA

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHIC PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT DEVELOPMENTS

22.15 GENENTECH, USA INC.

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHIC PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT DEVELOPMENTS

22.16 STALLERGENES GREER

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHIC PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT DEVELOPMENTS

22.17 ALK

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHIC PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT DEVELOPMENTS

22.18 ALLERGY THERAPEUTICS

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHIC PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT DEVELOPMENTS

22.19 ADAMIS PHARMACEUTICALS CORPORATION

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHIC PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT DEVELOPMENTS

22.2 HOLLISTERSTIER ALLERGY. A JUBILANT PHARMA COMPANY

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHIC PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT DEVELOPMENTS

22.21 HAL ALLERGY B.V.

22.21.1 COMPANY OVERVIEW

22.21.2 REVENUE ANALYSIS

22.21.3 GEOGRAPHIC PRESENCE

22.21.4 PRODUCT PORTFOLIO

22.21.5 RECENT DEVELOPMENTS

22.22 SUNOVION

22.22.1 COMPANY OVERVIEW

22.22.2 REVENUE ANALYSIS

22.22.3 GEOGRAPHIC PRESENCE

22.22.4 PRODUCT PORTFOLIO

22.22.5 RECENT DEVELOPMENTS

22.23 APOTEX CORPORATION

22.23.1 COMPANY OVERVIEW

22.23.2 PRODUCT PORTFOLIO

22.23.3 REVENUE ANALYSIS

22.23.4 GEOGRAPHIC PRESENCE

22.23.5 PRODUCT PORTFOLIO

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.