Global Alpaca Apparel Market

Market Size in USD Million

CAGR :

%

USD

433.89 Million

USD

712.72 Million

2024

2032

USD

433.89 Million

USD

712.72 Million

2024

2032

| 2025 –2032 | |

| USD 433.89 Million | |

| USD 712.72 Million | |

|

|

|

|

Alpaca Apparel Market Size

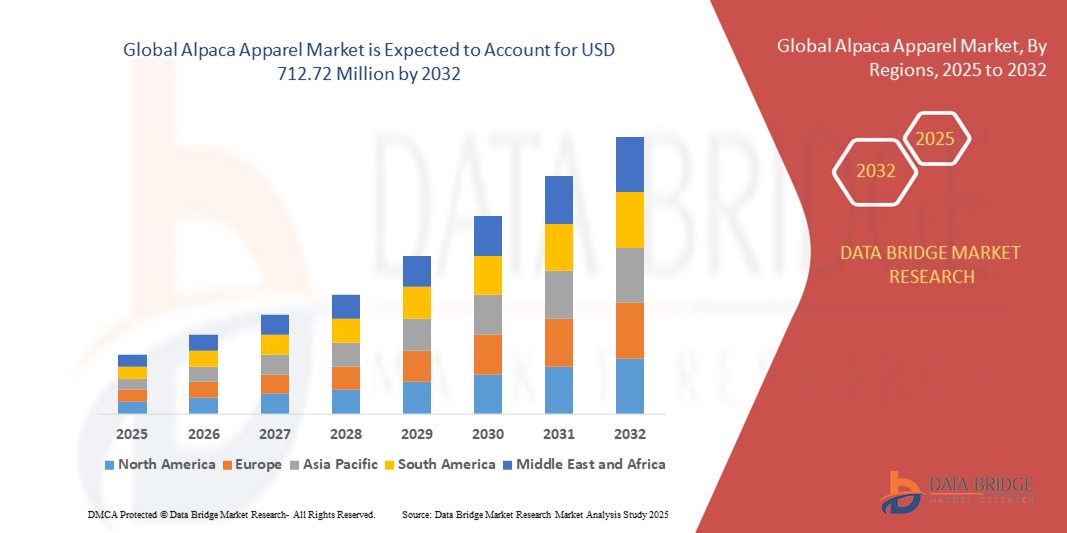

- The global alpaca apparel market size was valued at USD 433.89 million in 2024 and is expected to reach USD 712.72 million by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing consumer shift toward sustainable and ethically produced fashion, alongside rising awareness of the environmental impact of synthetic fibers. Alpaca apparel, known for its durability, biodegradability, and luxurious feel, is gaining popularity as a preferred eco-conscious clothing option across global markets

- Furthermore, the superior thermal properties, hypoallergenic nature, and versatility of alpaca fiber are driving its adoption across seasonal fashion segments. These converging factors are contributing to the rising demand for natural fiber-based garments, thereby significantly boosting the growth of the alpaca apparel industry

Alpaca Apparel Market Analysis

- Alpaca apparel includes garments and accessories made from alpaca fiber, a natural wool harvested from alpacas primarily in South America. Known for being lightweight, insulating, and softer than traditional wool, alpaca clothing ranges from sweaters and scarves to coats, socks, and luxury loungewear

- The escalating demand for alpaca apparel is driven by increasing global focus on sustainable fashion, the premium positioning of alpaca fiber in the natural textile market, and its growing inclusion in eco-luxury and slow fashion collections across North America, Europe, and Asia-Pacific

- North America dominated the alpaca apparel market with a share of 36.8% in 2024, due to increasing consumer preference for natural, sustainable fibers and the rising demand for premium winterwear

- Asia-Pacific is expected to be the fastest growing region in the alpaca apparel market during the forecast period due to rising disposable incomes, expanding winter apparel markets, and growing interest in sustainable textiles across developing economies

- Sweaters segment dominated the market with a market share of 37% in 2024, due to the premium warmth, lightweight comfort, and hypoallergenic properties of alpaca fibers. Sweaters made from alpaca are particularly favored in colder climates and luxury fashion circles due to their softness, breathability, and long-lasting wear. The natural sheen and variety of colors offered by alpaca wool further increase their appeal across both functional and fashion-forward categories. As sustainability becomes a key consumer preference, alpaca sweaters are also gaining traction for being eco-friendly and ethically sourced

Report Scope and Alpaca Apparel Market Segmentation

|

Attributes |

Alpaca Apparel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alpaca Apparel Market Trends

Rise of Eco-Luxury and Slow Fashion in Alpaca Apparel

- The alpaca apparel market is undergoing a transformation as eco-luxury and slow fashion gain global traction, with consumers seeking high-quality, long-lasting garments that are crafted sustainably and ethically rather than mass-produced. Alpaca fiber’s natural warmth, softness, hypoallergenic properties, and minimal environmental footprint make it a symbol of eco-luxury, positioning alpaca garments at the forefront of ethical and conscious fashion choices

- For instance, brands such as Fluff Alpaca and Stella McCartney are focusing on limited-edition pieces and heritage designs, elevating alpaca apparel through collaborations with rural artisans and family-run farms to showcase artisanal craftsmanship and foster traceable supply chains

- Artisans are blending traditional Andean techniques with modern silhouettes, enabling unique, heritage-rich garments that resonate with both luxury and authenticity-minded consumers

- The rise in sustainable consumerism has prompted manufacturers to use innovative, low-impact processing methods and environmentally friendly dyes, further lowering the carbon footprint of alpaca apparel

- Growing interest in performance-oriented natural fibers is boosting demand for alpaca activewear, base layers, and outdoor garments as eco-conscious alternatives to synthetic fabrics, with properties such as thermoregulation and moisture-wicking

- Expansion of e-commerce and direct-to-consumer channels enables wider distribution of small-batch, sustainably sourced alpaca products globally, supporting the proliferation of niche slow fashion brands and making eco-luxury more accessible

Alpaca Apparel Market Dynamics

Driver

Growing Consumer Preference for Sustainable and Natural Fibers

- The market is primarily driven by consumer demand for sustainable, biodegradable, and ethically sourced fibers, with alpaca wool offering substantial advantages over synthetic and conventional options. Its renewable production, gentle environmental impact, and absence of harsh processing chemicals appeal to eco-minded and health-conscious shoppers seeking comfort and social responsibility

- For instance, Paka and Indigenous are among leading brands sourcing alpaca wool from small family farms in the Andes and employing certified organic processes with traceable, cruelty-free supply chains to guarantee sustainable quality and fair labor practices

- Fashion designers, luxury houses, and mainstream retailers are increasingly including alpaca in their collections to meet sustainability targets and respond to shifts in consumer priorities toward conscious consumption

- Alpaca fiber’s unique properties—such as hypoallergenicity, breathability, and durability—enhance its popularity in high-end fashion, outdoor apparel, and luxury home textiles, expanding the market’s reach beyond traditional knitwear into new product categories

- Rising disposable incomes, especially in emerging economies, enable broader access to premium alpaca garments, while online retail channels support direct engagement with ethically minded global consumers

Restraint/Challenge

Limitation in Production Scalability

- Market growth faces key challenges related to production scalability, stemming from alpacas’ limited geographic distribution and the labor-intensive nature of their fiber’s processing. Most alpaca farming is concentrated in the Andes, restricting global availability and leading to seasonal and regional supply constraints

- For instance, expanding supply chains for alpaca fiber is complicated by the need for specialized breeding programs, skilled artisans, and expensive equipment—higher production costs that are difficult to offset through economies of scale

- High retail prices for alpaca apparel may restrict mass-market adoption by price-sensitive consumers, and competition from lower-cost fibers such as wool and cashmere remains a challenge where alpaca is less familiar

- Ethical sourcing, transparency, and traceability throughout the supply chain are critical, but often limited by the fragmented nature of global alpaca farming, further complicating scalability and consistent quality assurance

- The need to balance quality, production efficiency, and sustainable credentials pushes manufacturers to innovate continuously, but technical constraints and cost barriers persist, limiting expansion beyond luxury and niche slow fashion segments

Alpaca Apparel Market Scope

The market is segmented on the basis of product type, end use, and distribution channel.

- By Product Type

On the basis of product type, the alpaca apparel market is segmented into sweaters, scarves, gloves, socks, coats/jackets, hats, and blankets/throws. The sweaters segment dominated the largest market revenue share of 37% in 2024, owing to the premium warmth, lightweight comfort, and hypoallergenic properties of alpaca fibers. Sweaters made from alpaca are particularly favored in colder climates and luxury fashion circles due to their softness, breathability, and long-lasting wear. The natural sheen and variety of colors offered by alpaca wool further increase their appeal across both functional and fashion-forward categories. As sustainability becomes a key consumer preference, alpaca sweaters are also gaining traction for being eco-friendly and ethically sourced.

The coats/jackets segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for sustainable outerwear and increased product innovation in high-end winter fashion. Alpaca coats and jackets provide excellent thermal regulation while remaining lightweight and water-resistant, making them ideal for urban and outdoor use. Designers are increasingly incorporating alpaca in contemporary outerwear collections, appealing to environmentally conscious consumers seeking luxury alternatives to synthetic and down-filled options. The growing availability of alpaca outerwear through premium fashion outlets and online platforms is further expected to boost segment growth.

- By End Use

On the basis of end use, the alpaca apparel market is segmented into men, women, and children. The women segment held the largest market share in 2024, fueled by a wider variety of product offerings, stronger spending patterns in the fashion category, and increasing awareness of sustainable textile alternatives. Women's alpaca apparel, including sweaters, scarves, and accessories, has gained popularity for combining elegance with practicality, offering both warmth and style in colder seasons. The high-quality texture and natural aesthetic of alpaca fiber align with evolving consumer preferences for premium and ethically produced fashion goods.

The children segment is projected to witness the fastest CAGR from 2025 to 2032, as parents increasingly prioritize natural and hypoallergenic materials for children’s clothing. Alpaca fiber, being free of lanolin, is ideal for sensitive skin and is perceived as safer compared to conventional wool or synthetic fabrics. Demand is growing for soft, breathable, and durable children's sweaters, hats, and mittens that maintain warmth without causing irritation. With brands launching dedicated children’s alpaca lines and expanding into organic and fair-trade categories, this segment is expected to grow significantly in the coming years.

- By Distribution Channel

On the basis of distribution channel, the alpaca apparel market is segmented into online and offline. The offline segment accounted for the largest market revenue share in 2024, supported by the presence of alpaca specialty stores, boutiques, and high-end retail outlets that allow consumers to assess the fabric quality firsthand. Physical stores often provide a tactile shopping experience, which is critical in purchasing high-value, natural fiber garments. Brick-and-mortar outlets also cater to tourists in alpaca-producing countries such as Peru, where cultural and artisanal aspects influence buying behavior.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing internet penetration, direct-to-consumer brand models, and rising global awareness of alpaca fashion through digital marketing. E-commerce platforms offer a broader selection, easy comparison, and convenience, making alpaca apparel accessible to consumers beyond traditional markets. Brands are investing in virtual try-on features, storytelling around sustainability, and influencer partnerships to appeal to eco-conscious buyers. The surge in cross-border online retail and the growing preference for ethical fashion among younger consumers are expected to sustain strong online growth.

Alpaca Apparel Market Regional Analysis

- North America dominated the alpaca apparel market with the largest revenue share of 36.8% in 2024, driven by increasing consumer preference for natural, sustainable fibers and the rising demand for premium winterwear

- Consumers in this region are drawn to alpaca apparel for its hypoallergenic properties, superior warmth-to-weight ratio, and eco-friendly appeal, particularly in cold-weather fashion staples such as sweaters and coats

- A strong culture of ethical consumerism, combined with high disposable incomes and awareness of fair-trade and artisan-made products, supports the region’s adoption of alpaca apparel in both mainstream and niche fashion retail segments

U.S. Alpaca Apparel Market Insight

The U.S. alpaca apparel market captured the largest revenue share in 2024 within North America, driven by a growing consumer inclination toward eco-conscious and luxury fashion. Alpaca products are widely promoted in the U.S. through farm-to-fashion models and heritage branding, appealing to ethically minded buyers. The expansion of artisanal and sustainable textile movements, especially in urban and cold-climate regions, is fueling demand for alpaca clothing and accessories. Moreover, the growing popularity of online specialty platforms and boutique designers featuring Peruvian-sourced alpaca apparel is further accelerating market growth.

Europe Alpaca Apparel Market Insight

The Europe alpaca apparel market is projected to expand at a substantial CAGR during the forecast period, driven by rising demand for ethical fashion and sustainable material alternatives. European consumers are increasingly seeking biodegradable and animal-friendly fabrics, with alpaca wool meeting both fashion and environmental standards. Growth is especially strong in countries emphasizing green consumerism and artisanal craftsmanship. The region is witnessing rising interest in locally distributed, fair-trade certified products, and alpaca garments are gaining visibility in winter collections of major fashion retailers and concept stores.

U.K. Alpaca Apparel Market Insight

The U.K. alpaca apparel market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s focus on eco-luxury and slow fashion. Consumers are increasingly opting for long-lasting, natural fiber clothing, and alpaca products meet the demand for both warmth and sustainability. The rising popularity of independent designers and ethical brands featuring alpaca in winter wear collections is further propelling market expansion. Moreover, consumer events and pop-up shops showcasing South American textiles are helping raise awareness and sales within the U.K.

Germany Alpaca Apparel Market Insight

The Germany alpaca apparel market is expected to expand at a considerable CAGR during the forecast period, backed by a strong environmental consciousness and preference for organic clothing. German consumers value the durability and non-allergenic nature of alpaca fiber, which aligns with the country’s emphasis on functional yet sustainable fashion. A growing number of eco-retailers and fashion cooperatives are incorporating alpaca products into their lines, especially in outerwear and accessories. Increasing import partnerships with Andean producers are also helping Germany strengthen its position as a key European market.

Asia-Pacific Alpaca Apparel Market Insight

The Asia-Pacific alpaca apparel market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by rising disposable incomes, expanding winter apparel markets, and growing interest in sustainable textiles across developing economies. Countries such as China, Japan, South Korea, and Australia are witnessing rising consumer demand for niche, eco-luxury garments. Government efforts to promote natural fiber adoption and growing e-commerce access to international brands are enabling wider reach of alpaca apparel in urban centers. The region’s appetite for premium imports is also supporting strong growth.

Japan Alpaca Apparel Market Insight

The Japan alpaca apparel market is gaining momentum owing to its consumer focus on quality, craftsmanship, and sustainability. Japanese fashion markets are particularly receptive to unique textiles, and alpaca fiber is being embraced in both traditional and modern clothing styles. The integration of alpaca materials into minimalist and functional winter fashion aligns with the country's aesthetic sensibilities. In addition, Japan’s older population favors non-irritating, thermally efficient clothing, driving demand for soft, breathable alpaca products in outerwear and home textiles.

China Alpaca Apparel Market Insight

The China alpaca apparel market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s rising middle-class population and rapid growth in luxury and winter apparel segments. Increasing awareness of sustainable and natural clothing options is fueling demand for alpaca garments, particularly in urban regions and colder provinces. Domestic e-commerce platforms are offering international alpaca brands alongside locally produced collections, making the product more accessible. Moreover, the growing popularity of environmentally friendly fashion among younger Chinese consumers is expected to drive continued market expansion.

Alpaca Apparel Market Share

The alpaca apparel industry is primarily led by well-established companies, including:

- The Natural Fibre Company (U.K.)

- Alpaca Direct. (U.S.)

- Plymouth Yarn Company, Inc. (U.S.)

- Mary Maxim (Canada)

- Alpaca Owners Association, Inc (U.S.)

- Lion Brand Yarn (U.S.)

- Berroco, Inc. (U.S.)

- Cascade Yarns (U.S.),

- MALABRIGO YARN (Uruguay)

- Fil Katia (Spain)

Latest Developments in Global Alpaca Apparel Market

- In August 2024, Paka launched the Sol Hoodie, its first alpaca fiber-based sun protection garment, signaling the brand’s entry into functional summerwear. This innovative product merges alpaca's inherent breathability, odor resistance, and thermal regulation with UV protection, expanding alpaca's use beyond winter apparel. The introduction is expected to broaden alpaca clothing’s seasonal relevance and appeal to health-conscious consumers seeking sustainable alternatives for active outdoor wear, further diversifying the global alpaca apparel market

- In June 2023, Paka, a Peru-based leader in sustainable alpaca fashion, extended its product range by launching Paka Essentials, a line of nontoxic alpaca undergarments. This move marked the brand's expansion into the innerwear segment, a less explored but high-potential niche for alpaca fiber. By leveraging alpaca's soft, hypoallergenic, and moisture-wicking properties, the launch showcased alpaca’s versatility and also positioned the material as a viable natural alternative in daily wear, boosting market innovation and consumer engagement

- In January 2023, Bee & Alpaca presented their latest upcycled designs at the Just Around the Corner trade show held on January 8–9, 2023, highlighting pieces from their SS23 and FW23 collections. By showcasing fashion-forward, affordable, and eco-conscious garments, the brand reinforced the commercial viability of circular fashion using alpaca wool. This initiative amplified awareness of upcycled alpaca apparel and positioned Bee & Alpaca as a trendsetter in accessible sustainable fashion, positively influencing eco-fashion adoption rates in mainstream retail

- In November 2022, Japanese menswear brand Y. & SONS, in collaboration with design studio The Inoue Brothers, introduced a line of traditional garments—haori and kimono—crafted from royal alpaca wool. Made available for purchase in December 2022, the launch brought cultural innovation to the alpaca apparel market by blending premium Andean materials with Japanese design aesthetics. This cross-cultural collaboration helped elevate the perception of alpaca fiber in luxury and heritage fashion circles, fostering global appreciation for its craftsmanship and exclusivity

- In March 2021, Alpaca by Jaca, a U.S.-based alpaca clothing store, relocated to River Ridge Mall in Lynchburg, Virginia, from Graves Mill Shopping Center. The move to a higher foot-traffic location aimed to increase visibility and accessibility of alpaca apparel to local consumers. This strategic shift supported retail growth for the brand and also contributed to regional market expansion by familiarizing more U.S. consumers with alpaca-based products in mainstream shopping environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alpaca Apparel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alpaca Apparel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alpaca Apparel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.