Global Alpha Amylase Baking Enzyme Market

Market Size in USD Million

CAGR :

%

USD

329.81 Million

USD

430.95 Million

2024

2032

USD

329.81 Million

USD

430.95 Million

2024

2032

| 2025 –2032 | |

| USD 329.81 Million | |

| USD 430.95 Million | |

|

|

|

|

Alpha-Amylase Baking Enzyme Market Size

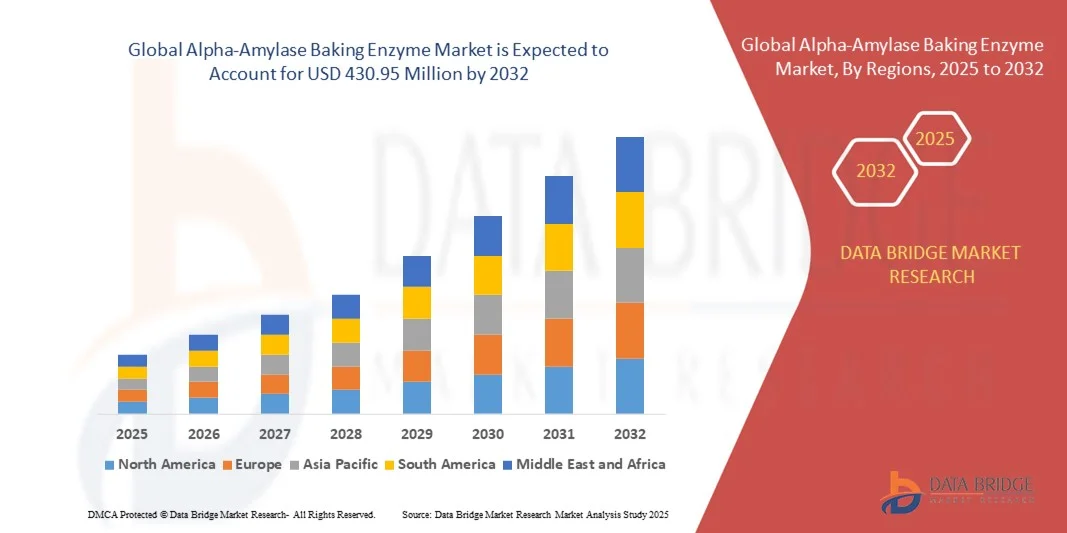

- The global alpha-amylase baking enzyme market size was valued at USD 329.81 million in 2024 and is expected to reach USD 430.95 million by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is largely driven by the increasing utilization of enzyme-based formulations in the bakery industry to enhance product quality, texture, and shelf life. Growing consumer preference for clean-label, additive-free, and natural bakery products has accelerated the shift from chemical improvers to bio-based alpha-amylase solutions, supporting sustainable and efficient baking processes across commercial and industrial setups

- Furthermore, the rising demand for convenience foods and ready-to-eat bakery items, coupled with technological advancements in enzyme engineering, is strengthening the market outlook. These factors collectively contribute to improved baking performance, reduced waste, and optimized production, positioning alpha-amylase as a critical ingredient in modern bakery manufacturing

Alpha-Amylase Baking Enzyme Market Analysis

- Alpha-amylase baking enzymes, essential for starch hydrolysis and dough conditioning, play a vital role in improving fermentation, crumb structure, and product freshness in bread, biscuits, and other baked goods. Their ability to maintain consistent baking quality and enhance sensory attributes has made them a key ingredient across large-scale and artisanal bakeries globally

- The growing focus on process optimization and product differentiation within the bakery industry, along with the expansion of enzyme technology into clean-label and gluten-free formulations, continues to fuel market growth. These developments underscore the enzyme’s significance as a performance-enhancing and sustainability-driven solution within the global baking sector

- North America dominated the alpha-amylase baking enzyme market with a share of 37.5% in 2024, due to the strong presence of established bakery industries and increasing demand for processed and convenience bakery products

- Asia-Pacific is expected to be the fastest growing region in the alpha-amylase baking enzyme market during the forecast period due to rapid urbanization, rising disposable incomes, and the expansion of the bakery sector in countries such as China, Japan, and India

- Bacteria segment dominated the market with a market share of 68.77% in 2024, due to its superior thermostability and suitability for high-temperature baking processes. Bacterial alpha-amylases are increasingly favored in industrial bakeries where rapid baking cycles demand high heat endurance and process flexibility. Their use helps optimize starch breakdown during dough preparation, improving sugar release for yeast fermentation and achieving better crust coloration and flavor. Growing R&D advancements in bacterial strain engineering for improved enzyme activity and reduced production costs are expected to fuel segment growth over the forecast period

Report Scope and Alpha-Amylase Baking Enzyme Market Segmentation

|

Attributes |

Alpha-Amylase Baking Enzyme Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alpha-Amylase Baking Enzyme Market Trends

Rising Shift Toward Clean-Label and Natural Baking Enzymes

- The adoption of clean-label and naturally sourced enzymes is a leading trend shaping the alpha-amylase baking enzyme market, driven by increasing consumer preference for transparency, minimal additives, and sustainable production. Food manufacturers are prioritizing enzyme formulations that provide functional baking benefits while meeting natural ingredient standards demanded by health-conscious consumers

- For instance, DuPont Nutrition & Biosciences and Novozymes A/S have launched clean-label alpha-amylase enzyme ranges derived from non-GMO microbial fermentation. These enzyme products cater to bakery manufacturers seeking to replace chemical improvers while maintaining desirable product quality and consistency across applications such as bread, rolls, and cakes

- The growing awareness around ingredient labeling and consumer scrutiny of food additives is pushing the baking industry toward enzyme solutions that help reduce artificial emulsifiers and preservatives. Alpha-amylase derived from microbial or plant-based sources provides a natural approach to dough improvement and shelf-life extension without synthetic additives

- In addition, technological improvements in enzyme extraction and DNA-free fermentation techniques are enabling the production of highly stable, food-safe, and allergen-free alpha-amylase solutions. These advancements help manufacturers cater to niche segments demanding vegan, gluten-free, or allergen-conscious bakery products

- The trend toward sustainability is further reinforcing the clean-label shift, as enzyme producers focus on bio-based production processes that lower environmental impact and optimize raw material use. This aligns with the bakery industry’s broader move toward greener manufacturing and reduced reliance on artificial ingredients

- The increasing consumer focus on health, authenticity, and environmental responsibility is expected to make clean-label alpha-amylase enzymes a standard requirement for bakery formulations globally, shaping the long-term direction of product innovation and brand differentiation

Alpha-Amylase Baking Enzyme Market Dynamics

Driver

Growing Demand for Better Texture and Longer Shelf Life in Bakery Goods

- The demand for alpha-amylase baking enzymes is primarily driven by the baking industry’s focus on improving product texture, crumb softness, and shelf life. Consumers expect baked goods to remain fresh and appealing over extended periods, leading manufacturers to integrate efficient enzyme-based formulations that enhance starch conversion and moisture retention in dough

- For instance, Amano Enzyme Inc. and DSM-Firmenich have developed advanced alpha-amylase variants designed to maintain bread softness and elasticity during distribution and storage. These enzymes play a significant role in extending product freshness, helping bakeries reduce waste and meet consumer demand for quality and convenience

- The enzymatic breakdown of starch molecules improves the dough’s handling properties, resulting in consistent volume and structure across diverse baking processes. Alpha-amylase assists in maintaining the softness of final bakery products, ensuring a desirable mouthfeel and improved sensory quality even after packaging

- In addition, evolving urban lifestyles and growing consumption of packaged bakery items have heightened the industry’s focus on extended shelf life. Enzyme innovation offers an efficient and natural solution for product stability, minimizing the dependence on artificial preservatives that are increasingly rejected by clean-label consumers

- The sustained need for texture enhancement, freshness retention, and reduced food waste continues to position alpha-amylase as a crucial additive in industrial baking applications. This driver will likely remain central to the market’s growth, ensuring consistent demand across both premium and mass-market baked goods

Restraint/Challenge

High Production Cost and Formulation Stability Concerns

- High production and purification costs associated with enzyme manufacturing remain a significant challenge in the alpha-amylase baking enzyme market. Complex fermentation processes, purification steps, and necessary quality controls make large-scale enzyme production expensive, especially for clean-label or specialty variants

- For instance, companies such as Novozymes A/S have reported that maintaining consistent enzyme activity across different baking conditions requires continuous R&D investment, adding to production cost pressures. The optimization of enzyme blends for specific dough formulations often increases both development time and overhead expenses for manufacturers

- Maintaining enzyme stability under varying heat and pH conditions poses another restraint, as alpha-amylase is sensitive to temperature fluctuations during bakery processing. This instability can affect enzyme efficacy, leading to challenges in achieving uniform product performance across different bakery environments

- In addition, smaller bakery producers may find it difficult to justify the high initial procurement costs or storage requirements of enzyme ingredients, slowing the overall pace of adoption in price-sensitive markets. Limited awareness about optimal enzyme use among smaller manufacturers further compounds this issue

- Overcoming these challenges through cost-efficient fermentation technologies, improved enzyme delivery systems, and collaborative product development between ingredient suppliers and bakery brands will be critical for enabling stable, affordable, and scalable enzyme solutions suitable for global baking applications

Alpha-Amylase Baking Enzyme Market Scope

The market is segmented on the basis of source and application.

- By Source

On the basis of source, the alpha-amylase baking enzyme market is segmented into fungi, bacteria, and plant-based. The bacteria segment dominated the market with the largest revenue share of 68.77% in 2024, owing to its superior thermostability and suitability for high-temperature baking processes. Bacterial alpha-amylases are increasingly favored in industrial bakeries where rapid baking cycles demand high heat endurance and process flexibility. Their use helps optimize starch breakdown during dough preparation, improving sugar release for yeast fermentation and achieving better crust coloration and flavor. Growing R&D advancements in bacterial strain engineering for improved enzyme activity and reduced production costs are expected to fuel segment growth over the forecast period.

The fungi segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its high enzyme yield, stability at varying pH levels, and effective starch hydrolysis properties that enhance dough texture and volume. Fungal alpha-amylases are widely used across commercial bakeries for consistent fermentation and improved crumb softness, which ensures longer shelf life of baked products. Their cost efficiency and adaptability across diverse bakery formulations have further strengthened their adoption among large-scale manufacturers focused on productivity and product uniformity.

- By Application

On the basis of application, the alpha-amylase baking enzyme market is segmented into breads, cookies and biscuits, desserts, and others. The breads segment held the largest market revenue share in 2024, supported by the global rise in bread consumption and the enzyme’s essential role in enhancing dough elasticity, fermentation efficiency, and crumb structure. Alpha-amylases help break down starch into fermentable sugars, ensuring consistent yeast performance and volume expansion, resulting in softer and fresher loaves. The demand for high-quality and additive-free bread varieties has further boosted the use of enzyme-based improvers among both artisanal and commercial bakeries worldwide.

The cookies and biscuits segment is projected to record the fastest CAGR from 2025 to 2032, fueled by the rising consumption of convenience snacks and the growing focus on texture improvement and browning uniformity. Alpha-amylases in cookie and biscuit formulations aid in controlling dough viscosity and sugar release, improving spread characteristics and overall mouthfeel. Manufacturers are increasingly adopting enzyme-based processing to replace chemical emulsifiers and achieve cleaner labels, aligning with consumer preferences for natural ingredients. The segment’s growth is also reinforced by expanding bakery production capacities and innovations in enzyme blends tailored for confectionery baking.

Alpha-Amylase Baking Enzyme Market Regional Analysis

- North America dominated the alpha-amylase baking enzyme market with the largest revenue share of 37.5% in 2024, driven by the strong presence of established bakery industries and increasing demand for processed and convenience bakery products

- The region’s advanced food processing infrastructure and continuous innovation in enzyme formulations support the widespread adoption of alpha-amylase in commercial baking operations

- Growing health awareness and consumer preference for clean-label, additive-free bakery products have encouraged manufacturers to replace chemical improvers with enzyme-based alternatives, boosting market growth across the U.S. and Canada

U.S. Alpha-Amylase Baking Enzyme Market Insight

The U.S. alpha-amylase baking enzyme market captured the largest share within North America in 2024, propelled by the high consumption of bread, cookies, and other baked goods. The presence of major bakery chains and enzyme manufacturers, coupled with ongoing R&D for high-performance and temperature-stable enzyme formulations, supports steady market expansion. Rising adoption of automation in baking facilities and demand for consistent dough texture and volume enhancement continue to drive the use of alpha-amylase across large-scale bakery operations.

Europe Alpha-Amylase Baking Enzyme Market Insight

The Europe alpha-amylase baking enzyme market is projected to expand at a significant CAGR throughout the forecast period, supported by strict food quality standards and a mature bakery industry. The region’s demand for high-quality baked products with longer shelf life and improved texture has encouraged greater integration of enzyme technology. European consumers’ growing inclination toward natural ingredients and sustainable production methods aligns with the industry’s shift toward enzyme-based processing solutions.

U.K. Alpha-Amylase Baking Enzyme Market Insight

The U.K. alpha-amylase baking enzyme market is expected to grow at a notable CAGR during the forecast period, driven by the rising popularity of artisanal and specialty bakery products. Bakeries are increasingly focusing on product differentiation through improved texture, flavor, and freshness, achieved using advanced enzyme formulations. The country’s emphasis on clean-label and non-chemical processing ingredients is also accelerating enzyme adoption across both industrial and small-scale bakeries.

Germany Alpha-Amylase Baking Enzyme Market Insight

The Germany alpha-amylase baking enzyme market is anticipated to expand steadily, supported by the country’s strong bakery tradition and advanced food technology landscape. The demand for consistent baking performance and reduced food waste has increased enzyme usage among major bakery producers. Furthermore, the industry’s focus on environmentally sustainable and energy-efficient baking processes promotes the use of bio-based enzymes, reinforcing Germany’s position as a key European hub for enzyme innovation.

Asia-Pacific Alpha-Amylase Baking Enzyme Market Insight

The Asia-Pacific alpha-amylase baking enzyme market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and the expansion of the bakery sector in countries such as China, Japan, and India. Increasing consumer inclination toward Western-style bakery items and convenience foods is driving enzyme adoption to ensure product consistency and extended shelf life. Moreover, the region’s growing investment in food biotechnology and cost-effective enzyme production supports widespread market expansion.

China Alpha-Amylase Baking Enzyme Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, supported by its massive bakery industry and strong domestic enzyme manufacturing base. Rapid urbanization and evolving dietary habits have driven higher consumption of bread and confectionery products, spurring enzyme demand. Local manufacturers are also focusing on producing cost-efficient and high-yield enzyme variants tailored to industrial-scale baking, strengthening China’s leadership in the regional market.

Japan Alpha-Amylase Baking Enzyme Market Insight

Japan’s alpha-amylase baking enzyme market is gaining momentum, driven by its advanced food processing sector and demand for premium-quality bakery products. The growing adoption of enzyme-based dough improvers enhances softness, freshness, and flavor retention, aligning with the country’s preference for quality and efficiency. Japan’s technological expertise and emphasis on innovation are also supporting collaborations between enzyme producers and bakery companies to develop customized, high-performance enzyme formulations.

Alpha-Amylase Baking Enzyme Market Share

The alpha-amylase baking enzyme industry is primarily led by well-established companies, including:

- Novozymes A/S (Denmark)

- DSM-Firmenich (Netherlands)

- DuPont de Nemours, Inc. (U.S.)

- Specialty Enzymes & Probiotics (U.S.)

- PURATOS Group (Belgium)

- Dyadic International Inc. (U.S.)

- ENMEX S.A. de C.V. (Mexico)

- AB Enzymes GmbH (Germany)

- Aumgene Biosciences (India)

- Takabio (France)

- Noor Enzymes Pvt. Ltd. (India)

- Verenium Corporation (U.S.)

- Valley Research Corporation (U.S.)

- Maps Enzymes Ltd. (India)

- Merck KGaA (Germany)

- Aumenzymes (India)

Latest Developments in Global Alpha-Amylase Baking Enzyme Market

- In June 2024, DSM-Firmenich introduced a cutting-edge enzyme innovation under its BakeZyme portfolio, aimed at improving dough stability, elasticity, and crumb softness in reduced-sugar and clean-label bakery formulations. This advanced alpha-amylase solution enables manufacturers to enhance product quality while meeting the increasing demand for health-conscious and natural bakery products. By optimizing freshness retention and processing efficiency, the product helps bakeries reduce reliance on chemical improvers and synthetic additives. The launch underscores DSM-Firmenich’s strategic focus on sustainable enzyme innovation and strengthens its competitive positioning in the global baking enzyme industry

- In September 2023, Novozymes A/S launched Novamyl BestBite, an advanced alpha-amylase enzyme designed to significantly extend the softness and freshness of packaged baked goods throughout their shelf life. The enzyme helps maintain an ideal crumb texture and elasticity, ensuring consistent sensory quality over time, which is essential for both industrial and commercial bakers. This innovation addresses the growing consumer preference for longer-lasting, preservative-free baked products and enables manufacturers to reduce product waste. The launch reinforced Novozymes’ leadership in enzyme-based bakery solutions and expanded its influence in high-performance baking applications

- In December 2023, Kerry Group Plc entered into a definitive agreement to acquire a portion of the global lactase enzyme business from Chr. Hansen Holding A/S and Novozymes A/S, collectively referred to as the “Lactase Enzymes Business.” The acquisition, pending European Commission approval, forms part of the merger approval process involving the two enzyme leaders. This move strategically enhances Kerry’s enzyme production capabilities and broadens its biotechnology portfolio, allowing it to strengthen its position across the specialty enzymes market, including bakery and dairy applications. The deal reflects Kerry’s commitment to advancing its presence in high-value enzyme solutions with strong growth potential

- In May 2023, International Flavors & Fragrances, Inc. (IFF) launched its ENOVERA 2000 range in Europe, a next-generation enzyme dough strengthener engineered to serve as a sustainable substitute for vital gluten in bakery formulations. Designed for demanding applications such as whole wheat and high-fiber bread production, the range offers enhanced dough strength, stability, and process tolerance. By reducing dependence on traditional gluten sources, this innovation supports the growing trend toward cost-effective, plant-based, and clean-label bakery solutions. The launch reinforced IFF’s innovation-driven strategy and its leadership in providing enzyme solutions that meet evolving consumer and industry needs

- In February 2023, AB Enzymes expanded its long-term distribution partnership with Barentz for bake and food enzymes across major European markets through a 5-year strategic agreement. This collaboration aims to strengthen AB Enzymes’ reach and customer support across the bakery sector, ensuring more efficient access to enzyme-based solutions for industrial bakers. The extended partnership enhances both companies’ ability to address rising regional demand for sustainable and high-performance enzyme formulations. By reinforcing its European distribution network, AB Enzymes has positioned itself to capitalize on the expanding adoption of enzyme-driven production efficiency in bakery manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alpha Amylase Baking Enzyme Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alpha Amylase Baking Enzyme Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alpha Amylase Baking Enzyme Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.