Global Alpha Emitter Radioligand Therapy Market

Market Size in USD Million

CAGR :

%

USD

621.45 Million

USD

1,232.83 Million

2024

2032

USD

621.45 Million

USD

1,232.83 Million

2024

2032

| 2025 –2032 | |

| USD 621.45 Million | |

| USD 1,232.83 Million | |

|

|

|

|

Alpha-emitter Radioligand Therapy Market Size

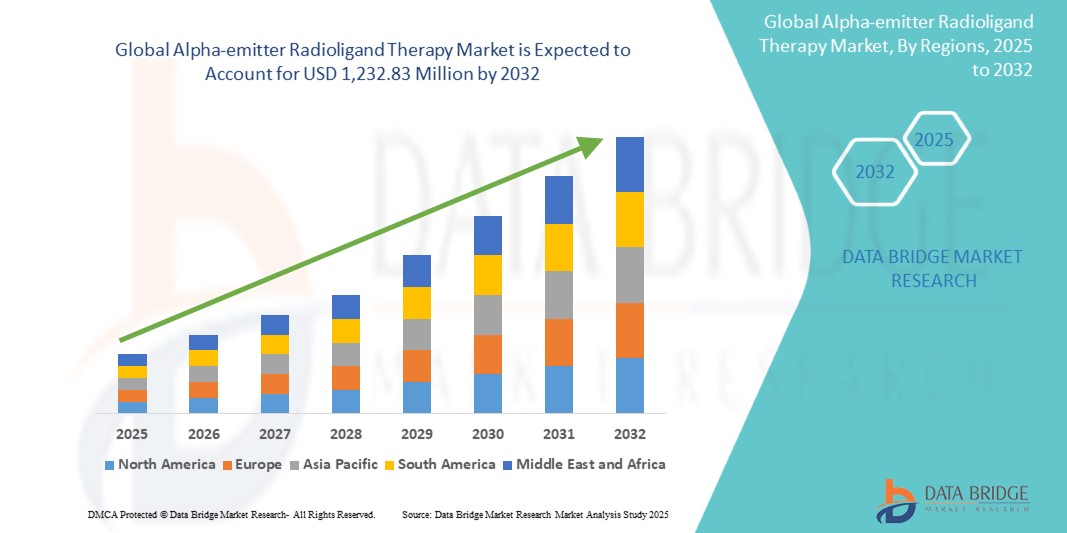

- The global alpha-emitter radioligand therapy market size was valued at USD 621.45 million in 2024 and is expected to reach USD 1,232.83 million by 2032, at a CAGR of 8.94% during the forecast period

- The market growth is largely fueled by increasing cancer prevalence and the growing shift toward targeted alpha therapies, which offer high tumor-killing efficiency with minimal damage to surrounding healthy tissue

- Furthermore, rising investments in nuclear medicine, advancements in radiopharmaceutical production, and expanding clinical research on alpha-emitting isotopes are establishing alpha radioligand therapy as a transformative approach in oncology. These converging factors are accelerating its clinical adoption, thereby significantly boosting the industry's growth

Alpha-emitter Radioligand Therapy Market Analysis

- Alpha-emitter radioligand therapy, which uses targeted alpha-emitting isotopes to deliver high-energy radiation directly to cancer cells, is emerging as a transformative modality in oncology due to its precision, minimal off-target toxicity, and potential to treat resistant or metastatic cancers effectively

- The escalating demand for alpha therapies is primarily fueled by the rising global cancer burden, advancements in radiopharmaceutical development, and increased clinical focus on targeted therapies that offer improved efficacy and patient outcomes

- North America dominated the alpha-emitter radioligand therapy market with the largest revenue share of over 40.5% in 2024, supported by robust nuclear medicine infrastructure, high research funding, and the presence of leading pharmaceutical and biotechnology firms driving innovation and clinical trials in radioligand-based treatments

- Asia-Pacific is expected to be the fastest growing region in the alpha-emitter radioligand therapy market during the forecast period due to expanding healthcare access, increasing cancer incidence, and growing government and private sector investment in nuclear medicine

- The Radium-223 segment dominated the alpha-emitter market with a market share of over 45.5% in 2024, driven by its FDA approval and established use in treating metastatic prostate cancer, along with ongoing research expanding its application to other cancer types

Report Scope and Alpha-emitter Radioligand Therapy Market Segmentation

|

Attributes |

Alpha-emitter Radioligand Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alpha-emitter Radioligand Therapy Market Trends

Precision Oncology Through Targeted Alpha Therapies

- A significant and accelerating trend in the global alpha-emitter radioligand therapy market is the growing shift toward precision oncology using alpha-emitting isotopes that deliver potent radiation directly to cancer cells while sparing surrounding healthy tissue. This highly targeted approach is transforming the treatment landscape for hard-to-treat cancers, particularly in metastatic and radiation-resistant cases

- For instance, therapies using Actinium-225-labeled PSMA ligands are showing promising results in prostate cancer, providing an alternative for patients who have exhausted conventional therapies. Similarly, Radium-223, the first FDA-approved alpha-emitter, is being explored for expanded indications beyond bone metastases

- The increased interest in alpha-emitters stems from their high linear energy transfer (LET), which causes irreparable double-strand DNA breaks in cancer cells, leading to enhanced efficacy even in micro-metastatic disease. Ongoing clinical research is broadening applications across multiple tumor types, including neuroendocrine, pancreatic, and ovarian cancers

- Integration with diagnostic imaging platforms is enhancing treatment personalization by allowing real-time tracking of radioligand distribution and efficacy. Leading companies such as Telix Pharmaceuticals and Actinium Pharmaceuticals are advancing next-generation alpha therapies that combine imaging and therapy in a single platform

- This trend toward precision-targeted, minimally toxic therapies is fundamentally reshaping oncology treatment protocols and patient expectations. Consequently, the demand for radioligand therapies using alpha emitters is accelerating across both academic and commercial oncology centers, positioning this modality as a critical pillar in the future of personalized cancer care

Alpha-emitter Radioligand Therapy Market Dynamics

Driver

Rising Cancer Burden and Advancements in Radiopharmaceutical Innovation

- The rising global incidence of cancer, particularly advanced and treatment-resistant forms, is a primary driver of growth in the alpha-emitter radioligand therapy market. These therapies offer a unique and highly effective treatment option for patients with limited alternatives

- For instance, the FDA’s approval of Radium-223 for metastatic castration-resistant prostate cancer has paved the way for a surge in clinical trials evaluating new alpha-emitting isotopes such as Actinium-225, Astatine-211, and Lead-212 for broader indications

- As pharmaceutical and radiopharmaceutical companies increasingly invest in targeted alpha therapies, partnerships with nuclear medicine suppliers and isotope production facilities are expanding the commercial potential of these treatments

- The appeal of minimal toxicity, strong tumor selectivity, and improved survival rates is drawing attention from oncologists and health systems worldwide. The combination of radioligand therapy with other modalities such as immunotherapy is also being explored, amplifying interest in alpha-emitter–based treatments as a cornerstone of multimodal cancer care

- The growing trend of theranostics combining diagnostic imaging with radioligand therapy is creating new opportunities for more personalized, efficient treatment strategies and enhancing physician confidence in therapy outcomes

- Increasing public and private funding, particularly in the U.S. and Europe, to support nuclear medicine R&D and radiopharmaceutical manufacturing infrastructure is accelerating innovation and clinical translation of alpha-emitter therapies

- Rising awareness among clinicians and patients about the benefits of alpha-based targeted therapies is improving early adoption rates and creating a favorable environment for product development and commercialization

Restraint/Challenge

Limited Isotope Supply and Regulatory Complexity

- A major challenge hindering the widespread adoption of alpha-emitter radioligand therapy is the limited and costly supply of key isotopes such as Actinium-225 and Astatine-211, which require specialized facilities and complex production processes. The current supply infrastructure is insufficient to meet growing clinical and commercial demand

- For instance, delays in isotope availability can restrict the launch of clinical trials or slow the expansion of treatment programs. In addition, logistical challenges in handling and transporting radioactive materials further complicate access, particularly in regions with underdeveloped nuclear medicine capabilities

- Regulatory hurdles add another layer of complexity, as alpha-emitter therapies must meet stringent safety, manufacturing, and handling standards. Navigating these multi-agency approval processes across different countries can lead to prolonged timelines and increased development costs

- High manufacturing and operational costs associated with radiopharmaceutical production, including requirements for shielding, specialized workforce, and short half-life management, can limit scalability and affordability

- The need for advanced infrastructure, such as cyclotrons or nuclear reactors for isotope generation, restricts participation to a small group of technically equipped countries and companies, creating supply bottlenecks. Limited clinician training and lack of awareness about handling alpha-emitting radiopharmaceuticals can slow adoption rates, especially in developing healthcare systems

- Variability in reimbursement policies across regions and unclear coding systems for radioligand therapies can create economic uncertainty for providers and developers, hindering market penetration in price-sensitive settings

Alpha-emitter Radioligand Therapy Market Scope

The market is segmented on the basis of radionuclide type, indication, source of nuclide, and end user.

- By Radionuclide Type

On the basis of radionuclide type, the alpha-emitter radioligand therapy market is segmented into Radium-223, Actinium-225, Astatine-211, Lead-212, Bismuth-213, and Others. The Radium-223 segment dominated the market with the largest revenue share of 45.5% in 2024, driven by its FDA approval and clinical validation for treating metastatic castration-resistant prostate cancer with bone involvement. Its established safety profile and commercial availability make it the most widely adopted alpha-emitting therapeutic isotope. Radium-223 continues to be a foundational product in the market, especially across North America and Europe.

The Actinium-225 segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its high linear energy transfer and expanding research in PSMA-targeted therapies for prostate and other solid tumors. Ongoing clinical trials and increasing investments in Ac-225 production capabilities are expected to significantly accelerate its commercialization over the forecast period.

- By Indication

On the basis of indication, the alpha-emitter radioligand therapy market is segmented into bone metastases, prostate cancer, pancreatic cancer, ovarian cancer, blood cancers, neuroendocrine tumors, and other rare or pediatric tumors. Prostate cancer held the largest market share in 2024, primarily due to the clinical success and commercial deployment of Radium-223 for metastatic cases. The demand for effective, minimally toxic treatments in late-stage prostate cancer is driving continued adoption of alpha-emitter therapies.

Neuroendocrine tumors and pancreatic cancer are expected to register the highest growth rates during the forecast period, supported by a surge in preclinical and clinical research demonstrating the potential of alpha-radioligand therapy in treating small-volume or disseminated disease. These cancers are often resistant to conventional therapies, making alpha therapies an attractive therapeutic alternative.

- By Source of Nuclide

On the basis of source, the alpha-emitter radioligand therapy market is segmented into natural sources, artificially produced sources, and others. Artificially produced sources dominated the market in 2024, accounting for the largest share due to the reliance on medical cyclotrons and reactors to produce isotopes such as Actinium-225, Astatine-211, and Lead-212. As demand for targeted therapies increases, the ability to synthesize high-purity isotopes in controlled environments has become critical to meet both clinical and regulatory standards.

Natural sources, such as Radium-226, are anticipated to witness fastest growth during forecast period, particularly in legacy applications and low-volume indications. However, ongoing innovation in isotope generation is expected to reduce dependency on natural materials over time.

- By End User

On the basis of end user, the alpha-emitter radioligand therapy market is segmented into hospitals, medical research institutions, and others. Hospitals dominated the market with the largest revenue share in 2024, as these settings are the primary point of care for radioligand therapy. Growing infrastructure in nuclear medicine departments, combined with access to specialized personnel and safety systems, makes hospitals the leading adopters of alpha therapies.

Medical research institutions are projected to witness the fastest growth from 2025 to 2032, driven by increased funding for radiopharmaceutical research, early-phase clinical trials, and innovation in targeted alpha therapy platforms. These institutions play a crucial role in therapy development and pre-commercial validation, expanding the pipeline of next-generation treatments.

Alpha-emitter Radioligand Therapy Market Regional Analysis

- North America dominated the alpha-emitter radioligand therapy market with the largest revenue share of over 40.5% in 2024, supported by robust nuclear medicine infrastructure, high research funding, and the presence of leading pharmaceutical and biotechnology firms driving innovation and clinical trials in radioligand-based treatments

- The region’s leadership is further reinforced by the availability of specialized radiopharmaceutical production facilities and growing clinical adoption of targeted alpha therapies across oncology centers

- Increased prevalence of cancers such as metastatic prostate cancer, combined with favorable reimbursement frameworks and active participation in clinical trials, continue to support the strong market growth trajectory for alpha-emitter therapies in North America

U.S. Alpha-emitter Radioligand Therapy Market Insight

The U.S. alpha-emitter radioligand therapy market captured the largest revenue share within North America in 2024, driven by rapid advancements in nuclear medicine and a growing demand for targeted cancer therapies. Increased FDA approvals for alpha-emitting agents, robust clinical trial activity, and access to isotope production facilities are accelerating adoption. In addition, strong government and private investment in oncology R&D, along with the rising burden of prostate and bone metastasis cancers, continue to fuel market growth.

Europe Alpha-emitter Radioligand Therapy Market Insight

The Europe alpha-emitter radioligand therapy market is projected to grow at a steady CAGR throughout the forecast period, propelled by increasing healthcare expenditure and growing awareness of radiopharmaceutical treatments. Key European nations are investing in clinical trials and infrastructure to support alpha therapy availability. The region’s stringent regulatory oversight ensures high standards for radiotherapy safety and effectiveness, while pan-European cancer research initiatives are fostering market expansion in both common and rare oncology indications.

U.K. Alpha-emitter Radioligand Therapy Market Insight

The U.K. alpha-emitter radioligand therapy market is expected to expand at a notable CAGR, underpinned by the country's commitment to personalized medicine and innovation in cancer therapeutics. Government initiatives supporting radiopharmaceutical research and the availability of specialized oncology centers are helping to promote the adoption of alpha-emitting therapies. In addition, a rising number of collaborations between academia, hospitals, and biotech firms is enhancing access to cutting-edge treatments.

Germany Alpha-emitter Radioligand Therapy Market Insight

The Germany alpha-emitter radioligand therapy market is set to grow significantly, driven by its strong medical infrastructure and robust nuclear medicine capabilities. Germany's focus on precision oncology, combined with rising cancer incidence rates, is spurring demand for targeted therapies such as Actinium-225 and Radium-223. The country’s emphasis on quality and innovation makes it a strategic hub for clinical development and commercial deployment of alpha-emitting treatments.

Asia-Pacific Alpha-emitter Radioligand Therapy Market Insight

The Asia-Pacific alpha-emitter radioligand therapy market is poised to grow at the fastest CAGR of the forecast period, fueled by the increasing cancer burden and improving healthcare access in emerging economies such as China and India. Ongoing investments in healthcare infrastructure, coupled with rising awareness of nuclear medicine, are creating favorable conditions for market growth. Regional governments are also supporting domestic isotope production to reduce dependency on imports and expand access to these advanced therapies.

Japan Alpha-emitter Radioligand Therapy Market Insight

The Japan alpha-emitter radioligand therapy market is gaining traction owing to its aging population and high prevalence of cancer. Japan’s established nuclear medicine industry and proactive approach to incorporating innovative treatments are accelerating the use of alpha therapies in oncology. Integration of radioligand therapy into national cancer treatment protocols, along with government support for radiopharmaceutical research, positions Japan as a key growth market in the Asia-Pacific region.

India Alpha-emitter Radioligand Therapy Market Insight

The India alpha-emitter radioligand therapy market accounted for a notable revenue share in Asia-Pacific in 2024, supported by increasing cancer incidence and expanding nuclear medicine infrastructure. India is witnessing a surge in medical tourism and government-backed cancer care programs, creating demand for cost-effective and targeted therapies. Collaborations between public health institutions and private nuclear medicine firms are helping to scale production and distribution of alpha-emitting isotopes to meet growing clinical needs.

Alpha-emitter Radioligand Therapy Market Share

The alpha-emitter radioligand therapy industry is primarily led by well-established companies, including:

- Telix Pharmaceuticals Limited (Australia)

- Actinium Pharmaceuticals, Inc. (U.S.)

- Fusion Pharmaceuticals Inc. (Canada)

- RayzeBio, Inc. (U.S.)

- Bayer AG (Germany)

- Alpha Tau Medical Ltd. (Israel)

- Orano Med SAS (France)

- RadioMedix, Inc. (U.S.)

- Clarity Pharmaceuticals Ltd (Australia)

- POINT Biopharma Global Inc. (U.S.)

- NorthStar Medical Radioisotopes, LLC (U.S.)

- Isotopia Molecular Imaging Ltd. (Israel)

- ImaginAb, Inc. (U.S.)

- Eckert & Ziegler Strahlen- und Medizintechnik AG (Germany)

- ARTMS Inc. (Canada)

- Nucleus RadioPharma, Inc. (U.S.)

- ITM Isotope Technologies Munich SE (Germany)

- Theragnostics Ltd. (U.K.)

- Lantheus Holdings, Inc. (U.S.)

- Eczacıbaşı-Monrol Nuclear Products Co. (Turkey)

What are the Recent Developments in Global Alpha-emitter Radioligand Therapy Market?

- In June 2025, Alpha Tau Medical Ltd. received FDA approval for an Investigational Device Exemption (IDE) to initiate a clinical trial for its Alpha DaRT (Diffusing Alpha-emitters Radiation Therapy) technology in patients with recurrent glioblastoma. This groundbreaking approach uses localized alpha radiation to destroy solid tumors, marking a key advancement in brain cancer treatment. The approval reflects growing regulatory support for alpha‑emitter‑based therapies targeting hard-to-treat cancers

- In June 2025, Orano Med, a pioneer in Lead‑212‑based radioligand therapies, expanded its GMP manufacturing and R&D facility in Plano, Texas. The USD 5 million investment aims to support the growing demand for targeted alpha therapies by increasing the supply of Lead‑212 isotopes. This expansion is a strategic step toward strengthening U.S. production capabilities in precision oncology

- In May 2025, Clarivate Plc released a report identifying the top six companies leading innovation in radioligand therapy, with a particular focus on alpha-emitting isotopes such as Actinium‑225 and Lead‑212. The report emphasizes novel RLT development strategies, including improved isotope supply chains and advanced targeting vectors for cancer treatment

- In October 2024, Sanofi invested €300 million for a 16% stake in OranoMed, leveraging its control over isotope production to develop a Lead‑212–based alpha therapy for neuroendocrine tumors. The drug has received U.S. FDA breakthrough designation, signaling fast-tracked development. This strategic move highlights Sanofi’s drive to secure the supply chain and advance medical leadership in targeted alpha therapy

- In March 2024, AstraZeneca completed the USD 2.4 billion acquisition of Fusion Pharmaceuticals, gaining access to a promising Actinium‑based radioconjugate for prostate cancer. The deal includes Fusion’s manufacturing capabilities, helping to overcome critical isotope supply chain challenges

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.