Global Alumina Trihydrate Market

Market Size in USD Billion

CAGR :

%

USD

4.36 Billion

USD

6.60 Billion

2024

2032

USD

4.36 Billion

USD

6.60 Billion

2024

2032

| 2025 –2032 | |

| USD 4.36 Billion | |

| USD 6.60 Billion | |

|

|

|

|

Alumina Trihydrate Market Size

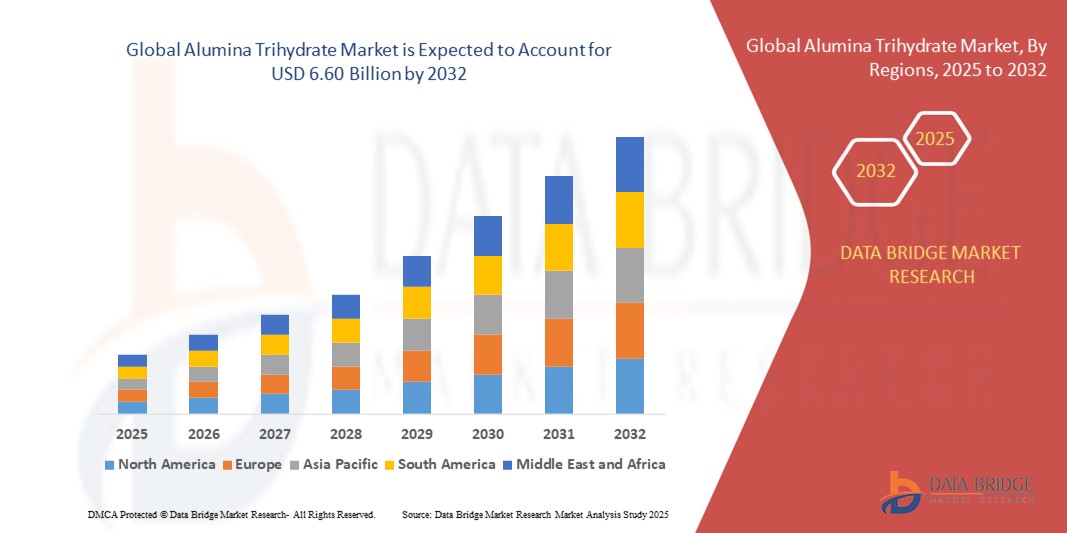

- The global alumina trihydrate market size was valued at USD 4.36 billion in 2024 and is expected to reach USD 6.60 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is primarily driven by increasing demand across the flame retardant industry, as alumina trihydrate serves as a halogen-free additive in plastic and rubber manufacturing

- Moreover, its wide usage in water treatment, paper, and paint applications due to its affordability, non-toxicity, and chemical stability is reinforcing its industrial significance. These versatile applications are propelling global demand and are expected to continue shaping the market trajectory through 2032

Alumina Trihydrate Market Analysis

- Alumina trihydrate, a non-toxic and halogen-free compound, plays a critical role as a flame retardant additive and filler in various industries, including plastics, rubber, paper, and paints, due to its cost-effectiveness, chemical stability, and environmental friendliness

- The rising demand for flame retardant materials in construction, automotive, and electronics sectors combined with tightening fire safety regulations is a key driver behind the increasing global consumption of alumina trihydrate

- Asia-Pacific dominated the alumina trihydrate market with the largest revenue share of 42.2% in 2024, attributed to rapid industrialization, significant manufacturing output, and high consumption of ATH in construction and polymer applications, especially in China and India

- North America is expected to witness the fastest growth in the alumina trihydrate market during the forecast period, supported by robust demand from flame retardants, strict fire safety regulations, and rising interest in sustainable and non-toxic alternatives

- The flame retardant segment dominated the alumina trihydrate market with a market share of 45% in 2024, driven by ATH’s widespread usage in wire & cable insulation, roofing, and electronic casings for fire protection

Report Scope and Alumina Trihydrate Market Segmentation

|

Attributes |

Alumina Trihydrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alumina Trihydrate Market Trends

Rising Demand for Halogen-Free Flame Retardants and Eco-Friendly Additives

- A key and accelerating trend in the global alumina trihydrate (ATH) market is the growing preference for halogen-free flame retardants in compliance with stricter environmental and safety regulations across multiple industries, including construction, automotive, and electronics

- For instance, companies such as Huber Engineered Materials and Nabaltec AG are enhancing their ATH offerings to meet evolving fire safety and environmental standards, such as REACH and RoHS, which limit the use of hazardous substances in manufacturing

- ATH is increasingly being integrated into wire & cable insulation, thermoset composites, and engineered plastics as a non-toxic, cost-effective, and multifunctional flame retardant solution. Its decomposition into water vapor on heating not only delays combustion but also reduces smoke and toxic gas emissions

- In addition to flame retardancy, ATH is gaining popularity as a filler in paper, coatings, and adhesives due to its opacity-enhancing and brightening properties, further expanding its industrial relevance

- This growing focus on sustainable and low-emission materials is prompting manufacturers to invest in advanced processing technologies that enhance ATH purity and particle uniformity for better end-product performance

- The demand for alumina trihydrate as a safe, eco-conscious material is expanding rapidly, especially in developed markets and regulatory-driven sectors, positioning it as a crucial component in the shift toward greener material choices

Alumina Trihydrate Market Dynamics

Driver

Regulatory Push for Fire Safety and Growth in End-Use Application

- The tightening of fire safety regulations and environmental directives worldwide is a major factor fueling demand for alumina trihydrate as a halogen-free flame retardant

- For instance, the European Union’s stringent building and electrical safety standards are pushing the adoption of ATH in construction and electronics. Manufacturers such as Alcoa and Sumitomo are responding with specialized ATH grades for fire-sensitive applications

- Moreover, the expansion of the automotive, construction, and electrical industries particularly in Asia-Pacific is increasing the consumption of ATH in various composite and polymer formulations

- ATH also finds rising use in water treatment as a coagulant, and in pharmaceuticals and ceramics, thereby broadening its market footprint. The compound’s low toxicity and multifunctional nature make it suitable for regulatory-sensitive industries seeking performance with compliance

- Overall, increased public and regulatory focus on fire resistance, sustainability, and occupational safety is strongly driving ATH’s uptake across diverse sectors

Restraint/Challenge

Processing Challenges and Availability of Substitutes

- Despite its wide utility, the alumina trihydrate market faces challenges related to processing limitations at high temperatures, as ATH decomposes at around 200°C, making it unsuitable for high-temperature applications without additional formulation support

- In highly technical or performance-critical sectors, alternative flame retardants such as magnesium hydroxide or organophosphorus compounds may be preferred for their thermal stability or compatibility, limiting ATH’s usage in some applications

- Furthermore, fluctuations in bauxite supply ATH’s primary raw material can lead to pricing volatility and supply chain concerns. Political instability or export restrictions in bauxite-producing countries may impact ATH production and costs

- Addressing these challenges requires ongoing innovation in composite formulation, exploration of alternative raw materials, and optimization of ATH processing techniques. Key players are also exploring hybrid flame retardant systems to extend ATH usability and remain competitive in the evolving material science landscape

- The production of high-purity alumina trihydrate involves energy-intensive processes such as the Bayer process, which contributes to higher operational costs and carbon emissions, especially in regions with limited access to low-cost energy sources

- As sustainability and energy efficiency become major concerns in industrial production, the environmental impact and energy demands associated with ATH manufacturing may prompt some manufacturers or end-users to seek lower-carbon or more energy-efficient alternatives

Alumina Trihydrate Market Scope

The market is segmented on the basis of type, application, and end-use industry.

- By Type

On the basis of type, the alumina trihydrate market is segmented into ground, wet, dry, and precipitate. The ground segment dominated the market with the largest market revenue share in 2024 due to its wide availability, consistent particle size, and cost-effectiveness, making it suitable for use as a flame retardant and functional filler in plastics, rubbers, and composites. Ground alumina trihydrate is often favored in applications requiring good dispersibility and thermal stability.

The precipitate segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its high purity, fine particle size, and increasing demand in specialized applications such as pharmaceuticals, ceramics, and advanced flame retardant formulations. Its suitability for use in high-performance materials and regulatory-sensitive sectors is further contributing to its accelerated adoption.

- By Application

On the basis of application, the alumina trihydrate market is segmented into flame retardant, filler, and antacid. The flame retardant segment held the largest market revenue share of 45% in 2024 due to growing regulatory pressure for halogen-free flame retardants and increasing fire safety requirements in construction, automotive, and electrical sectors. Alumina trihydrate's ability to release water vapor when heated helps suppress fire and smoke, making it the preferred choice in polymer-based flame retardant systems.

The antacid segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising demand in the pharmaceutical industry. Alumina trihydrate's neutralizing properties make it suitable for use in over-the-counter medications to treat acidity and gastric discomfort, driving its growth in health-focused consumer markets.

- By End Use Industry

On the basis of end-use industry, the alumina trihydrate market is segmented into plastic, building & construction, paints & coatings, pharmaceuticals, glass, rubber, and others. The plastic segment dominated the market in 2024, driven by the widespread use of ATH as a flame retardant and filler in thermoplastics, thermosets, and elastomers used across automotive, wire & cable, and electronics applications.

The paints & coatings segment is projected to exhibit the fastest growth rate from 2025 to 2032, attributed to the compound’s ability to improve opacity, brightness, and fire resistance in coating formulations. Increasing infrastructure development and rising demand for fire-resistant paints in commercial and industrial buildings are fueling growth in this segment.

Alumina Trihydrate Market Regional Analysis

- Asia-Pacific dominated the alumina trihydrate market with the largest revenue share of 42.2% in 2024, attributed to rapid industrialization, significant manufacturing output, and high consumption of ATH in construction and polymer applications, especially in China and India

- Countries such as China, India, and Japan are leading in consumption due to their large-scale manufacturing bases, infrastructure development, and rising environmental and fire safety regulations mandating halogen-free solutions

- This widespread demand is further supported by low production costs, abundant bauxite reserves, and government initiatives promoting sustainable material use, positioning the region as a key hub for both production and consumption of alumina trihydrate across diverse end-use industries

North America Alumina Trihydrate Market Insight

The North America alumina trihydrate market is projected to grow at the fastest CAGR during the forecast period, driven by increasing enforcement of fire safety standards and growing demand for environmentally friendly, halogen-free flame retardants across key sectors. The market is benefiting from the region’s shift toward sustainable construction practices, rising demand in electrical insulation applications, and the growing presence of advanced manufacturing and R&D infrastructure. In addition, increased investment in infrastructure modernization and regulatory compliance is encouraging broader ATH adoption across both the U.S. and Canada.

U.S. Alumina Trihydrate Market Insight

The U.S. alumina trihydrate market is expected to expand at the fastest CAGR in North America during the forecast period, driven by tightening fire safety regulations and a growing shift toward halogen-free flame retardants. Rising demand in construction, electrical insulation, and plastic compounding sectors is fueling market growth. The presence of key manufacturers, combined with the adoption of sustainable building practices and regulatory compliance standards such as NFPA and EPA, further boosts ATH demand across industrial applications.

Europe Alumina Trihydrate Market Insight

The Europe alumina trihydrate market is projected to grow steadily, fueled by strict environmental regulations such as REACH and an increasing preference for eco-friendly flame retardants. The region's focus on sustainable infrastructure, especially in Germany, France, and the U.K., supports ATH usage in construction, wire & cable, and paints & coatings. Investments in green construction and renovation projects—alongside efforts to replace halogenated materials—are propelling ATH market growth across Europe.

U.K. Alumina Trihydrate Market Insight

The U.K. alumina trihydrate market is anticipated to register a healthy CAGR over the forecast period, driven by fire safety concerns in residential and public infrastructure and the push for sustainable, low-smoke additives. Growth is further supported by government mandates for fire-retardant construction materials and increasing use of ATH in paints, coatings, and composites within urban development projects.

Germany Alumina Trihydrate Market Insight

The Germany alumina trihydrate market is expected to grow at a notable rate, supported by the country's innovation-driven industrial landscape and strict regulatory compliance. ATH is increasingly used in flame-retardant electrical components, engineered plastics, and green building materials. Germany’s emphasis on material safety, recyclability, and reduced emissions continues to position ATH as a preferred additive across diverse end-use sectors.

Japan Alumina Trihydrate Market Insight

The Japan alumina trihydrate market is gaining momentum due to stringent fire safety norms and demand for high-purity flame retardants in electronics and industrial sectors. Japan’s strong R&D ecosystem and preference for non-toxic, eco-efficient materials are propelling the use of ATH in high-value applications. Integration into smart construction and electronics is also supporting market expansion.

India Alumina Trihydrate Market Insight

The India alumina trihydrate market held a significant share within Asia-Pacific in 2024, driven by rapid urbanization, expanding construction activity, and growing demand for fire-retardant materials in wires, cables, and building materials. The government’s Smart City initiatives, combined with increased availability of affordable ATH products and domestic manufacturing capacity, are key contributors to the country’s market leadership in the region.

Alumina Trihydrate Market Share

The Alumina Trihydrate industry is primarily led by well-established companies, including:

- J.M. Huber Corporation (U.S.)

- Nabaltec AG (Germany)

- Almatis GmbH (Germany)

- Sumitomo Chemical Co., Ltd. (Japan)

- AluChem Inc. (U.S.)

- Alcoa Corporation (U.S.)

- Aluminum Corporation of China Limited (China)

- Huber Engineered Materials (U.S.)

- Zibo Pengfeng New Material Technology Co., Ltd. (China)

- R.J. Marshall Company (U.S.)

- Showa Denko K.K. (Japan)

- PT Indonesia Chemical Alumina (Indonesia)

- Sibelco (Belgium)

- Nippon Light Metal Holdings Co., Ltd. (Japan)

- Almatis, Inc. (U.S.)

- Hindalco Industries Limited (India)

- Aluminum Bahrain B.S.C. (Bahrain)

- MAL Magyar Aluminium (Hungary)

- Gujarat Mineral Development Corporation Ltd. (India)

What are the Recent Developments in Global Alumina Trihydrate Market?

- In June 2025, Hindalco Industries Ltd., the flagship metals company of the Aditya Birla Group, announced an all-cash acquisition of U.S.-based AluChem Companies Inc. for USD 125 million, aiming to enhance its global specialty alumina portfolio and reach a production target of 1 million tonnes by FY 2030

- In May 2025, J.M. Huber Corporation acquired The R.J. Marshall Company’s ATH, antimony-free flame retardant, and molybdate-based smoke suppressant assets, integrating them into its Huber Advanced Materials business to bolster its halogen-free fire retardant portfolio

- In December 2023, the Aluminum Corporation of China Limited (Chalco) approved a significant energy-saving retrofit project at its Shanxi alumina production facility. This initiative emphasizes the company’s commitment to production efficiency, environmental performance, and technological advancement

- In June 2023, Aluminum Corporation of China Limited (Chalco) approved a significant expansion project through its subsidiary Guangxi Huasheng New Materials Co., Ltd., authorizing the construction of two new alumina production lines, each with a capacity of 1 million tonnes per year. The total investment for the project was estimated at approximately CNY 4.3 billion, equivalent to around USD 598 million

- In June 2023, Huber Engineered Materials, part of J.M. Huber Corporation, introduced Hydral Coat 2 Ultrafine Alumina Trihydrate (ATH) a highly refined ATH grade crafted for demanding coating applications such as coil coatings and other high-performance scenarios

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alumina Trihydrate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alumina Trihydrate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alumina Trihydrate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.