Global Aluminium Curtain Wall Market

Market Size in USD Billion

CAGR :

%

USD

38.76 Billion

USD

77.80 Billion

2024

2032

USD

38.76 Billion

USD

77.80 Billion

2024

2032

| 2025 –2032 | |

| USD 38.76 Billion | |

| USD 77.80 Billion | |

|

|

|

|

Aluminium Curtain Wall Market Size

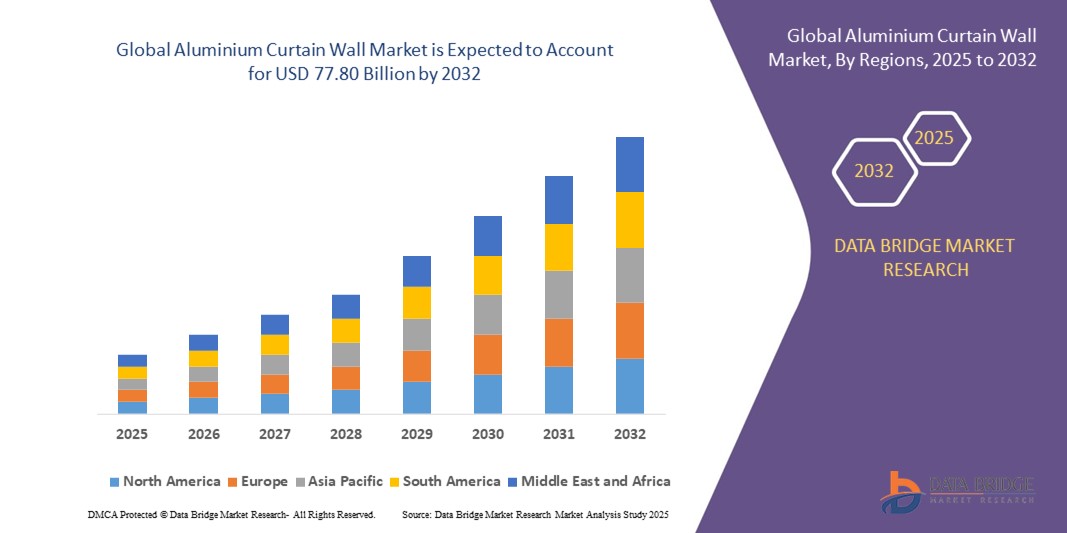

- The global aluminium curtain wall market size was valued at USD 38.76 billion in 2024 and is expected to reach USD 77.80 billion by 2032, at a CAGR of 9.6% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient building solutions, rapid urbanization leading to high-rise construction, and rising adoption of sustainable architectural designs that incorporate lightweight yet durable materials such as aluminium

- In addition, growing investments in commercial infrastructure projects such as corporate offices, shopping malls, and institutional buildings are driving large-scale installations, further boosting the demand for aluminium curtain walls worldwide

Aluminium Curtain Wall Market Analysis

- The aluminium curtain wall market is witnessing strong growth due to advancements in facade engineering, integration of double-skin and unitized systems for better thermal insulation, and a growing emphasis on aesthetic appeal in commercial and residential structures.

- Moreover, supportive government regulations promoting green building standards, coupled with the increasing penetration of aluminium curtain walls in emerging economies, are expected to further accelerate market expansion over the coming years

- North America dominated the aluminium curtain wall market with the largest revenue share of 38.5% in 2024, driven by rapid urbanization and increasing investments in commercial and residential construction projects

- Asia-Pacific region is expected to witness the highest growth rate in the global aluminium curtain wall market, driven by expanding construction activities, rising disposable incomes, and increased focus on energy-efficient and aesthetically appealing building designs in countries such as China, India, Japan, and Australia

- The stick built segment dominated the market with the largest revenue share in 2024, driven by its cost-effectiveness and flexibility for onsite assembly. This type is widely preferred for large-scale commercial buildings and renovation projects due to its adaptability to various architectural designs. The market also sees strong demand for stick built systems because of their easier customization and repair compared to unitized systems

Report Scope and Aluminium Curtain Wall Market Segmentation

|

Attributes |

Aluminium Curtain Wall Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Energy-Efficient and Sustainable Building Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminium Curtain Wall Market Trends

Increasing Adoption of Energy-Efficient Building Facades

- The growing emphasis on sustainable construction and energy efficiency is driving the adoption of aluminium curtain walls as they offer excellent thermal insulation and reduce energy consumption. These systems help building owners comply with green building standards and lower operational costs. The trend is particularly strong in commercial and institutional construction where energy performance is a priority

- Rising urbanization and infrastructure development worldwide are pushing demand for modern, durable, and aesthetically pleasing building envelopes. Aluminium curtain walls provide architects and builders with design flexibility, corrosion resistance, and ease of installation, making them a preferred choice in new constructions and renovations

- Government initiatives promoting green buildings and strict regulations on energy efficiency are accelerating market growth. For instance, regions with stringent environmental codes are witnessing increased retrofitting of older buildings with aluminium curtain walls to improve energy performance and occupant comfort

- For example, in 2023, several commercial projects across North America reported enhanced energy savings after upgrading to aluminium curtain wall systems compliant with LEED certification standards, highlighting the market’s environmental impact and cost benefits

- While energy efficiency is a key driver, manufacturers are investing in advanced coatings and smart glazing technologies to further improve thermal performance and appeal to eco-conscious clients. Continuous innovation is crucial to meet evolving regulations and customer expectations

Aluminium Curtain Wall Market Dynamics

Driver

Rising Demand for Lightweight and Durable Building Materials

• The demand for lightweight construction materials that provide structural strength without adding excessive load is boosting the use of aluminium curtain walls. Aluminium’s high strength-to-weight ratio facilitates faster construction and reduces foundation costs. This advantage is highly valued in high-rise and commercial buildings

• Increasing investments in commercial real estate and urban infrastructure development, particularly in Asia-Pacific and North America, are fueling the demand for aluminium curtain walls. Developers prefer these systems for their longevity, corrosion resistance, and low maintenance requirements

• The ability of aluminium curtain walls to integrate with other building systems such as HVAC and lighting enhances building efficiency and occupant comfort, making them popular among architects and engineers

• For instance, in 2022, a large-scale infrastructure project in Europe adopted aluminium curtain walls extensively due to their lightweight properties and durability, which helped meet project timelines and sustainability goals

• While demand is strong, the market growth is also supported by rising awareness about fire safety and the development of aluminium alloys with enhanced fire resistance

Restraint/Challenge

High Material Costs and Installation Complexity

• The cost of high-quality aluminium and associated fabrication processes makes curtain wall systems relatively expensive compared to traditional cladding materials. This limits adoption, especially in cost-sensitive markets and small-scale projects

• Installation of aluminium curtain walls requires skilled labor and precision engineering to ensure structural integrity and weather resistance. Shortages of trained installers and contractors can cause project delays and increase costs

• Maintenance and repair costs, although generally lower than other materials, can rise if improper installation leads to water leakage or thermal bridging, impacting building performance and occupant comfort

• For instance, in 2023, several construction projects in emerging economies faced delays due to lack of experienced curtain wall installers, increasing overall project costs and affecting timelines

• Addressing these challenges will require investments in workforce training, innovative installation technologies, and cost-effective material solutions to enable wider adoption and market growth

Aluminium Curtain Wall Market Scope

The market is segmented on the basis of type, installation, and end user industry.

- By Type

On the basis of type, the aluminium curtain wall market is segmented into stick built, semi unitized, and unitized. The stick built segment dominated the market with the largest revenue share in 2024, driven by its cost-effectiveness and flexibility for onsite assembly. This type is widely preferred for large-scale commercial buildings and renovation projects due to its adaptability to various architectural designs. The market also sees strong demand for stick built systems because of their easier customization and repair compared to unitized systems.

The unitized segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its superior quality control and faster installation times. Unitized curtain walls are pre-fabricated in controlled factory environments, reducing onsite labor and improving project timelines. This segment is increasingly favored in high-rise commercial constructions where speed and performance are critical.

- By Installation

On the basis of installation, the market is segmented into new construction and refurbishment. The new construction segment held the largest share in 2024, supported by rising urbanization and the development of commercial and residential infrastructure worldwide. New projects increasingly specify aluminium curtain walls for their aesthetic appeal, durability, and energy efficiency.

The refurbishment segment is expected to witness the fastest growth rate from 2025 to 2032, due to the rising need to upgrade older buildings with modern, energy-efficient facades. Refurbishment projects benefit from aluminium curtain walls’ ability to improve thermal performance and extend building lifespan while enhancing visual appeal.

- By End User Industry

On the basis of end user industry, the market is segmented into residential and commercial. The commercial segment dominated the market in 2024, driven by expanding office spaces, retail complexes, and institutional buildings requiring durable, high-performance curtain wall systems. Commercial developers value aluminium curtain walls for their strength, flexibility, and compliance with building codes.

The residential segment is expected to witness the fastest growth rate from 2025 to 2032, as demand rises for modern apartments and condominiums with sleek designs and enhanced energy efficiency. Increasing consumer preference for premium housing with sophisticated facade systems is driving adoption in this segment.

Aluminium Curtain Wall Market Regional Analysis

- North America dominated the aluminium curtain wall market with the largest revenue share of 38.5% in 2024, driven by rapid urbanization and increasing investments in commercial and residential construction projects

- The region’s focus on sustainable and energy-efficient building solutions, along with stringent building regulations, is boosting demand for aluminium curtain walls

- In addition, advanced manufacturing technologies and the presence of established suppliers support market growth

U.S. Aluminium Curtain Wall Market Insight

The U.S. aluminium curtain wall market held the largest revenue share within North America in 2024, fueled by rising commercial infrastructure developments and modernization of existing buildings. The growing preference for lightweight, durable, and aesthetically appealing façade systems is driving adoption. Government initiatives promoting green buildings and innovations in curtain wall technology further propel market expansion.

Europe Aluminium Curtain Wall Market Insight

Europe’s aluminium curtain wall market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict energy efficiency regulations and rising urbanization. Countries such as Germany, France, and the UK are witnessing increased demand due to renovation activities and new commercial construction projects. The region benefits from technological advancements and a strong emphasis on eco-friendly building materials.

U.K. Aluminium Curtain Wall Market Insight

The U.K. aluminium curtain wall market is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding commercial and residential construction activities. The market is driven by demand for energy-efficient façades and sustainable building practices. The growing adoption of aluminium curtain walls in refurbishment projects and new builds, alongside government sustainability initiatives, is expected to fuel growth.

Germany Aluminium Curtain Wall Market Insight

Germany’s aluminium curtain wall market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong regulatory frameworks promoting energy-saving building envelopes. The country’s emphasis on innovation, sustainability, and the refurbishment of aging infrastructure encourages the use of aluminium curtain walls. Increasing investments in commercial real estate and smart building projects also contribute to market growth.

Asia-Pacific Aluminium Curtain Wall Market Insight

The Asia-Pacific aluminium curtain wall market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising construction expenditures, and growing demand for modern architectural designs in countries such as China, India, Japan, and Australia. Government initiatives promoting energy-efficient buildings and green construction standards support adoption. Additionally, increasing public and private infrastructure investments are fueling market expansion.

Japan Aluminium Curtain Wall Market Insight

Japan’s aluminium curtain wall market is expected to witness the fastest growth rate from 2025 to 2032, due to its focus on advanced construction technologies and sustainable building solutions. The demand for earthquake-resistant, lightweight, and energy-efficient façade materials is increasing. Aging infrastructure and refurbishment activities also support the adoption of aluminium curtain walls in both residential and commercial sectors.

China Aluminium Curtain Wall Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, extensive infrastructure development, and government policies favoring energy conservation. The booming commercial real estate sector and smart city projects are key market drivers. Additionally, China’s strong manufacturing base and cost-effective raw materials boost the affordability and widespread use of aluminium curtain wall systems.

Aluminium Curtain Wall Market Share

The Aluminium Curtain Wall industry is primarily led by well-established companies, including:

- Kawneer (U.S.)

- YKK AP Inc. (Japan)

- Schüco International (Germany)

- Alcoa Corporation (U.S.)

- EFCO Corporation (U.S.)

- GUTMANN AG (Germany)

- HansenGroup (Denmark)

- Novum Structures LLC (U.S.)

- WICONA (Germany)

- Reynaers Aluminium (Belgium)

- Technal (France)

- Vitra (Switzerland)

- Alumil S.A. (Greece)

Latest Developments in Global Aluminium Curtain Wall Market

- In March 2023, aluminium curtain walling systems gained significant recognition for their versatility, lightweight structure, and low maintenance requirements. These systems enhance energy efficiency, durability, and sustainability in modern building designs. Architects are increasingly adopting these solutions to create innovative and visually appealing facades, promoting environmentally conscious construction. This development is expected to drive demand in the construction industry by supporting efficient and resilient building projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.