Global Aluminium Food Cans Market

Market Size in USD Billion

CAGR :

%

USD

18.86 Billion

USD

31.92 Billion

2024

2032

USD

18.86 Billion

USD

31.92 Billion

2024

2032

| 2025 –2032 | |

| USD 18.86 Billion | |

| USD 31.92 Billion | |

|

|

|

|

Aluminium Food Cans Market Size

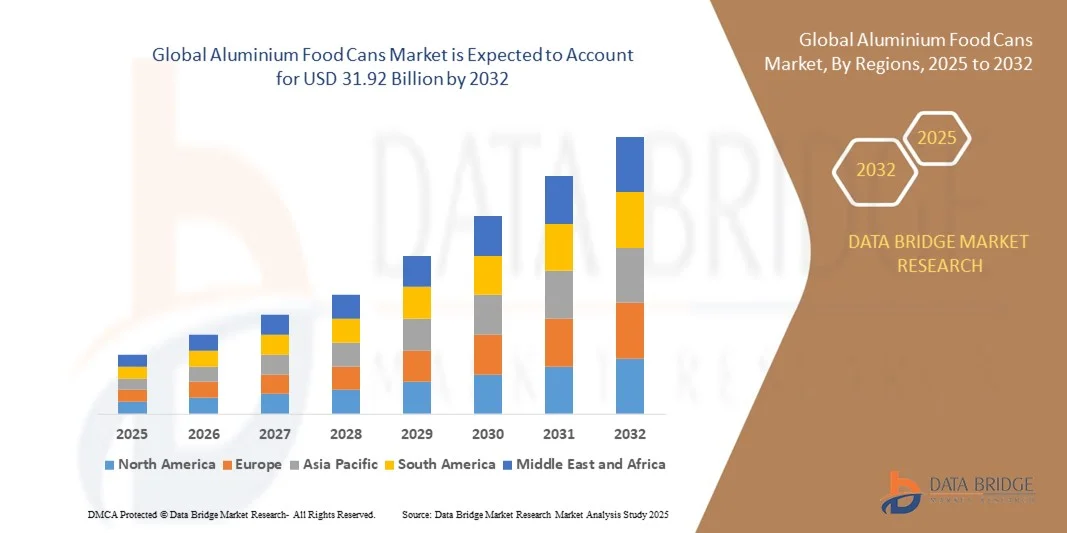

- The global aluminium food cans market size was valued at USD 18.86 billion in 2024 and is expected to reach USD 31.92 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by the rising demand for packaged and convenience foods across residential, retail, and foodservice sectors, coupled with increasing awareness of sustainable and recyclable packaging solutions

- Furthermore, manufacturers’ focus on lightweight, durable, and corrosion-resistant aluminum cans is enhancing product appeal, while the growing adoption of automated production and filling lines is accelerating market expansion. These factors are driving the widespread use of aluminum food cans, thereby significantly boosting industry growth

Aluminium Food Cans Market Analysis

- Aluminium food cans, providing lightweight, durable, and recyclable packaging for a variety of food products, are becoming increasingly vital in both commercial and retail food sectors due to their ability to preserve freshness, extend shelf life, and maintain product quality

- The escalating demand for aluminium cans is primarily fueled by urbanization, changing consumer lifestyles favoring ready-to-eat and processed foods, and stringent food safety regulations that emphasize safe and hygienic packaging solutions

- North America dominated the aluminium food cans market with a share of over 45% in 2024, due to rising demand for packaged and convenience foods, coupled with a well-established food processing industry

- Asia-Pacific is expected to be the fastest growing region in the aluminium food cans market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing demand for packaged and convenience foods in countries such as China, India, and Japan

- 2 piece cans segment dominated the market with a market share of 55.7% in 2024, due to its enhanced structural integrity, reduced risk of leakage, and seamless design that eliminates side seams. These cans are widely preferred for beverages, pet foods, and high-acid foods, as they maintain product safety while allowing efficient production at scale. The lightweight nature of 2-piece cans reduces transportation costs and energy consumption during manufacturing, making them a cost-effective solution for large-scale producers

Report Scope and Aluminium Food Cans Market Segmentation

|

Attributes |

Aluminium Food Cans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminium Food Cans Market Trends

Rise in Sustainable, Recyclable Packaging

- The aluminium food cans market is experiencing strong growth driven by global sustainability trends and the increasing demand for fully recyclable, environmentally responsible packaging solutions. As consumer and regulatory focus on circular economy practices intensifies, aluminium cans are emerging as a preferred alternative to multi-layer plastics due to their recyclability, durability, and low environmental footprint

- For instance, Ball Corporation has expanded production of lightweight aluminium packaging with near-infinite recyclability, emphasizing the sustainability advantages of aluminium over single-use plastic containers. The company’s efforts to reduce carbon emissions and increase recycled content highlight the industry’s ongoing shift toward sustainable metal packaging solutions

- Recyclable aluminium cans are widely used in the packaging of ready-to-eat meals, fruits, vegetables, and soups, where extended shelf life and product safety are critical. Their impermeability to light, oxygen, and moisture ensures product freshness without chemical additives, making them suitable for both mass-market and premium food categories

- In addition, growing consumer awareness of sustainable packaging choices has prompted food manufacturers to rebrand products using eco-friendly metal packaging. Aluminium’s recyclability—requiring up to 95% less energy compared to producing new metal—further strengthens its position as a leading circular packaging option

- Technological advancements in can forming, coating, and lightweighting have improved production efficiency and design flexibility, enabling manufacturers to offer aesthetically appealing, cost-optimized packaging. Emerging trends such as refillable food cans and eco-printed labeling also align with global decarbonization initiatives

- As governments impose stricter regulations on plastic packaging waste, the shift toward 100% recyclable aluminium packaging is accelerating. Aluminium food cans are rapidly becoming a cornerstone of sustainable packaging innovation, addressing both environmental obligations and consumer demand for responsible, high-performance packaging formats

Aluminium Food Cans Market Dynamics

Driver

Growing Demand for Convenience Foods

- The accelerating consumer preference for ready-to-eat (RTE) and long-shelf-life food products is a key driver of the aluminium food cans market. Urbanization, rising workforce participation, and changing dietary habits have increased demand for packaged foods that combine portability, freshness, and ease of storage—benefits ideally delivered by aluminium cans

- For instance, Crown Holdings, Inc. has optimized aluminium food can packaging for processed foods and pet foods, focusing on lightweight structures and improved sealing to meet the convenience-driven food market. The company’s advances demonstrate how packaging innovation supports the growing consumer need for accessible, on-the-go nutrition options

- Aluminium food cans offer superior protection against contamination and environmental exposure, maintaining the taste and nutritional quality of packaged foods for extended periods. This reliability makes them particularly suitable for shelf-stable meals, sauces, and beverages that dominate the convenience food segment

- In addition, the expanding global retail infrastructure, particularly in developing markets, is boosting the availability and distribution of canned food products. E-commerce penetration further amplifies this demand as aluminium cans ensure safe transport and long shelf life without refrigeration, aligning with logistics efficiency goals

- The fusion of convenience, safety, and sustainability is strengthening aluminium cans’ role as a preferred packaging choice in the food packaging industry. With expanding production capacity and consumer awareness of product longevity, the sector is poised for continued growth across multiple application areas globally

Restraint/Challenge

Volatile Aluminum Prices

- Price volatility in the global aluminium market remains a significant challenge for food can manufacturers, directly impacting production costs and profit margins. Fluctuations in raw material prices—driven by supply-demand imbalances, energy costs, and geopolitical factors—create instability throughout the packaging value chain

- For instance, Ardagh Group S.A. has highlighted that sharp increases in energy and metal sourcing costs significantly affect the pricing of aluminium-based packaging, prompting manufacturers to revise procurement and cost-control strategies. This volatility disrupts long-term pricing contracts with food brands and affects revenue predictability

- High dependence on primary aluminium supply, influenced by global mining and smelting conditions, further exacerbates cost uncertainties. In addition, regional trade tariffs and environmental policies regulating carbon emissions from smelting operations contribute to unpredictable price movements

- Manufacturers face limited flexibility to offset such cost variations, as food packaging buyers often resist price increases within competitive retail markets. The resulting margin pressure discourages smaller producers from scaling operations or investing in capacity expansion

- To mitigate these challenges, industry participants are increasingly adopting closed-loop recycling systems, using high-recycled-content aluminium sources, and diversifying procurement channels. These strategies aim to stabilize costs and reduce exposure to raw material fluctuations while supporting the sustainability goals driving the aluminium food cans industry forward

Aluminium Food Cans Market Scope

The market is segmented on the basis of thickness, application, and structure type.

- By Thickness

On the basis of thickness, the aluminium food cans market is segmented into less than 50mm, 50–100mm, and more than 100mm. The less than 50mm segment dominated the market in 2024 with the largest market revenue share, driven by its widespread use in standard-sized canned food products and cost-effectiveness in mass production. These thinner cans offer advantages in terms of material savings while maintaining adequate structural integrity and protection for food items. The compatibility of thinner cans with automated filling and sealing lines also contributes to their extensive adoption across the food processing industry. Consumers and manufacturers alike prefer them for their lightweight nature, ease of storage, and reduced transportation costs.

The 50–100mm segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for medium-sized canned foods in convenience and ready-to-eat segments. This thickness range provides a balance between durability and material efficiency, making it suitable for products requiring slightly enhanced protection or longer shelf life. Growth is further supported by increasing adoption in export markets where medium-sized packaging is preferred for portion control and retail display flexibility.

- By Application

On the basis of application, the aluminium food cans market is segmented into fruits and vegetables, convenience food, pet food, meat and seafood, and other applications. The fruits and vegetables segment dominated the market in 2024, capturing the largest revenue share due to the global preference for canned fruits and vegetables as a convenient, long-lasting, and safe food option. Aluminium cans in this segment provide excellent corrosion resistance, preserve nutritional quality, and support extended shelf life, making them highly favored by both manufacturers and consumers. Strong demand in both developed and emerging regions, along with extensive distribution channels in supermarkets and retail chains, further drives this segment’s market dominance.

The convenience food segment is projected to register the fastest growth rate from 2025 to 2032, driven by increasing urbanization and changing consumer lifestyles favoring ready-to-eat meals. Aluminium cans offer superior protection against spoilage, easy portability, and compatibility with modern heating and cooking methods, supporting their adoption in soups, pasta, and other convenience products. Rising demand in fast-food chains, cafeterias, and meal-kit providers also accelerates the growth of this segment.

- By Structure Type

On the basis of structure type, the aluminium food cans market is segmented into 2-piece cans and 3-piece cans. The 2-piece cans segment dominated the market in 2024, accounting for the largest revenue share of 55.7% due to its enhanced structural integrity, reduced risk of leakage, and seamless design that eliminates side seams. These cans are widely preferred for beverages, pet foods, and high-acid foods, as they maintain product safety while allowing efficient production at scale. The lightweight nature of 2-piece cans reduces transportation costs and energy consumption during manufacturing, making them a cost-effective solution for large-scale producers.

The 3-piece cans segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing usage in processed meat, seafood, and specialty foods that require larger diameters or customized sizes. The flexibility of 3-piece construction allows for easier adaptation to varying product volumes and enhanced labeling options, supporting both marketing and functional needs. Growth is also fueled by demand in developing regions where 3-piece cans remain a preferred option for traditional food packaging applications.

Aluminium Food Cans Market Regional Analysis

- North America dominated the aluminium food cans market with the largest revenue share of over 45% in 2024, driven by rising demand for packaged and convenience foods, coupled with a well-established food processing industry

- Consumers and manufacturers in the region prefer aluminium cans for their recyclability, lightweight properties, and extended shelf life

- This widespread adoption is further supported by strong retail networks, high consumer awareness regarding food safety, and the increasing trend of ready-to-eat and processed food consumption

U.S. Aluminium Food Cans Market Insight

The U.S. aluminium food cans market captured the largest revenue share in North America in 2024, fueled by the high consumption of canned fruits, vegetables, and convenience foods. The growing trend of on-the-go lifestyles, coupled with a preference for sustainable and recyclable packaging, is driving demand. Manufacturers are increasingly adopting aluminium cans due to their durability, light weight, and compatibility with modern automated production lines. In addition, the rise in e-commerce and organized retail channels supports the widespread distribution of canned food products.

Europe Aluminium Food Cans Market Insight

The Europe aluminium food cans market is projected to expand at a steady CAGR during the forecast period, primarily driven by strict food safety regulations, sustainability initiatives, and the growing adoption of convenient packaging solutions. European consumers favor aluminium cans for their recyclability, ease of storage, and preservation of product quality. The market is witnessing significant growth across fruits and vegetables, pet food, and processed meat segments, supported by urbanization, changing lifestyles, and demand for ready-to-eat meals.

U.K. Aluminium Food Cans Market Insight

The U.K. aluminium food cans market is expected to grow at a notable CAGR, fueled by increasing consumer awareness of sustainable packaging and the rising consumption of canned foods. The shift toward convenience foods and processed products in both retail and foodservice channels is encouraging manufacturers to adopt aluminium cans. The market is also supported by a strong e-commerce infrastructure and rising demand for long shelf-life products in urban centers.

Germany Aluminium Food Cans Market Insight

The Germany aluminium food cans market is poised to expand at a considerable CAGR, driven by a focus on high-quality, safe, and eco-friendly packaging solutions. German consumers prefer aluminium cans due to their recyclability, durability, and protection against spoilage, especially in fruits, vegetables, and meat products. The region’s emphasis on sustainability and technological advancements in food packaging promotes the adoption of aluminium cans across both industrial and retail segments.

Asia-Pacific Aluminium Food Cans Market Insight

The Asia-Pacific aluminium food cans market is expected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged and convenience foods in countries such as China, India, and Japan. The region’s expanding food processing industry and growing e-commerce penetration are boosting the adoption of aluminium cans. Government initiatives promoting food safety and sustainable packaging are further accelerating market growth.

Japan Aluminium Food Cans Market Insight

The Japan aluminium food cans market is gaining traction due to the country’s high consumption of convenience and ready-to-eat meals. Consumers highly value aluminium cans for their recyclability, portability, and ability to preserve taste and nutrition. The market is also supported by advanced manufacturing infrastructure and the integration of modern automated canning processes in food production.

China Aluminium Food Cans Market Insight

The China aluminium food cans market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly growing processed food sector, urbanization, and rising middle-class population. The adoption of aluminium cans is fueled by affordability, durability, and government initiatives promoting recyclable packaging. Strong domestic production capabilities and expanding retail and e-commerce channels are key factors propelling market growth.

Aluminium Food Cans Market Share

The aluminium food cans industry is primarily led by well-established companies, including:

- COFCO (China)

- ORG Technology Co., Ltd. (China)

- BALL CORPORATION (U.S.)

- Tecnocap S.p.A. (Italy)

- Amcor plc (Australia)

- Shengxing Group (China)

- Toyo Seikan Co., Ltd. (Japan)

- Crown (U.S.)

- Exal Corporation (Canada)

- Silgan Containers (U.S.)

- Great China Metal Ind. Co., Ltd. (China)

Latest Developments in Global Aluminium Food Cans Market

- In August 2025, Alamance Foods initiated strategic collaborations to drive innovation in the aluminum food cans market. By partnering with industry leaders and leveraging new technology, the company aims to expand its product offerings and improve the functionality and design of aluminum cans. These collaborations focus on developing cans that meet evolving consumer demands for convenience, sustainability, and enhanced food preservation. Through these efforts, Alamance Foods is positioning itself as a key player in advancing the aluminum packaging sector and supporting growth across multiple food categories

- In November 2024, Ball Corporation acquired Alucan, a European manufacturer specializing in large-diameter aerosol cans and impact-extruded bottles. This acquisition strengthened Ball’s ability to produce sustainable and innovative aluminum packaging solutions, expanding its product portfolio to meet the increasing demand for eco-friendly and recyclable cans. By integrating Alucan’s technology and expertise, Ball can now offer a wider range of high-quality cans suitable for diverse food and beverage products, enhancing operational efficiency and reinforcing its commitment to environmental responsibility

- In May 2024, Ball Corporation partnered with CavinKare, an Indian company, to launch retort aluminum cans specifically designed for milkshakes. These two-piece cans can withstand high-temperature processing, ensuring the safety, quality, and extended shelf life of dairy-based beverages. This partnership highlights the growing trend of aluminum cans being used beyond traditional beverages, expanding into dairy and other perishable food segments. It also demonstrates a focus on meeting consumer demand for convenient, ready-to-drink products with robust packaging solutions

- In January 2024, Novelis Inc., a global provider of sustainable aluminum solutions, signed a supply agreement with Ardagh Metal Packaging to provide aluminum sheet for beverage and food cans. This agreement strengthens the supply chain for aluminum cans in North America and addresses the increasing demand for high-quality, sustainable packaging. By ensuring a steady supply of aluminum sheet, Novelis supports manufacturers in maintaining consistent production while promoting eco-friendly practices and lightweight, durable packaging options for the food and beverage industry

- In October 2023, TricorBraun acquired CanSource, a leading supplier of aluminum cans for both alcoholic and non-alcoholic beverages. CanSource’s capabilities in producing printed, brite, and shrink-sleeved cans enhance TricorBraun’s existing offerings and allow it to cater to a wider range of customers in the food and beverage packaging sector. The acquisition also enables TricorBraun to strengthen its market position by providing high-quality, customizable aluminum cans that meet evolving consumer preferences for visually appealing, sustainable, and convenient packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aluminium Food Cans Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aluminium Food Cans Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aluminium Food Cans Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.