Global Aluminum Barrier Laminate Abl Tubes Market

Market Size in USD Million

CAGR :

%

USD

727.30 Million

USD

1,116.18 Million

2024

2032

USD

727.30 Million

USD

1,116.18 Million

2024

2032

| 2025 –2032 | |

| USD 727.30 Million | |

| USD 1,116.18 Million | |

|

|

|

|

Global Aluminum Barrier Laminate (ABL) Tubes Market Size

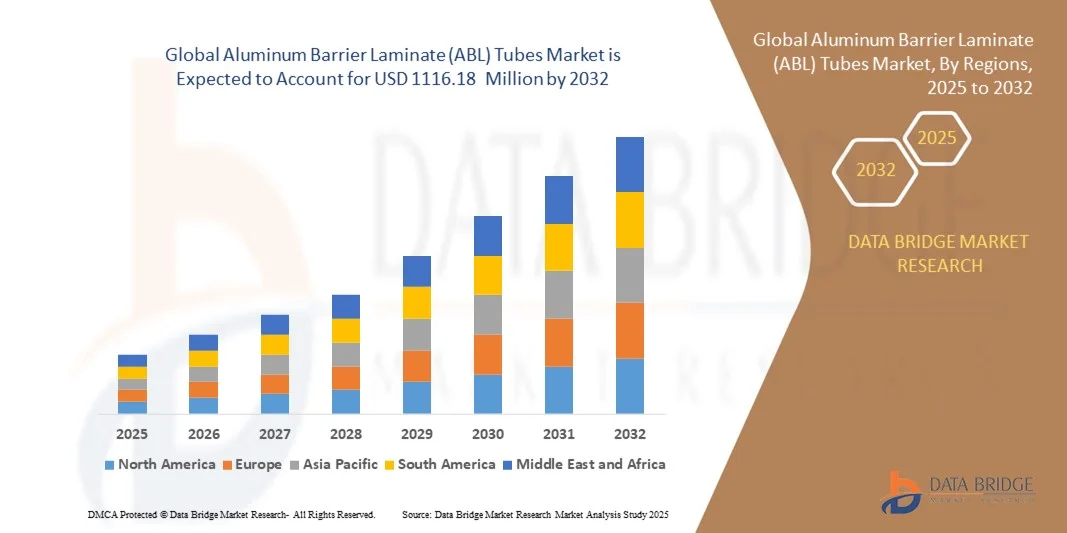

- The global aluminum barrier laminate (ABL) tubes market size was valued at USD 727.30 million in 2024 and is expected to reach USD 1116.18 million by 2032, at a CAGR of 5.50% during the forecast period.

- The market growth is primarily driven by increasing demand for sustainable and lightweight packaging solutions across the pharmaceutical, cosmetic, and food & beverage industries.

- Additionally, advancements in barrier technology to enhance product shelf life and protect contents from contamination are boosting the adoption of aluminum barrier laminate tubes, thereby propelling market expansion.

Global Aluminum Barrier Laminate (ABL) Tubes Market Analysis

- Aluminum barrier laminate tubes, providing durable and lightweight packaging solutions, are increasingly essential in pharmaceutical, cosmetic, and food & beverage industries due to their superior barrier properties, flexibility, and ability to extend product shelf life.

- The growing demand for aluminum barrier laminate tubes is primarily driven by the rising need for sustainable packaging, product safety, and regulatory compliance across various end-use sectors.

- Europe dominated the aluminum barrier laminate (ABL) tubes market with the largest revenue share of 36.7% in 2024, attributed to rapid industrialization, expanding pharmaceutical and personal care industries, and increasing consumer awareness about product safety, with countries like China and India witnessing significant production and consumption growth.

- Asia-Pacific is expected to be the fastest-growing region in the aluminum barrier laminate (ABL) tubes market during the forecast period, driven by stringent environmental regulations, increasing adoption of eco-friendly packaging, and innovation in barrier technology.

- The stand-up cap segment dominated the market in 2024 with the largest revenue share of approximately 40.5%, largely due to its user-friendly design that facilitates easy dispensing and stable tube placement on shelves

Report Scope and Global Aluminum Barrier Laminate (ABL) Tubes Market Segmentation

|

Attributes |

Aluminum Barrier Laminate (ABL) Tubes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Aluminum Barrier Laminate (ABL) Tubes Market Trends

Enhanced Performance Through Advanced Barrier Technologies and Sustainable Materials

- A significant and accelerating trend in the global Aluminum Barrier Laminate Tubes Market is the ongoing development and integration of advanced barrier materials combined with sustainable, eco-friendly components. These innovations are enhancing the protective qualities of tubes while addressing increasing environmental concerns.

- For instance, several manufacturers are incorporating multi-layer barrier films that improve resistance to oxygen, moisture, and UV light, thereby significantly extending the shelf life of pharmaceutical, cosmetic, and food products. Additionally, bio-based and recyclable materials are being adopted to reduce the environmental footprint of packaging.

- Advanced barrier technologies enable tubes to maintain product integrity even under harsh storage and transportation conditions. For example, some tubes now feature enhanced aluminum layers combined with biodegradable polymers that ensure both superior protection and environmental sustainability. Furthermore, these innovations allow for lighter packaging, which reduces shipping costs and carbon emissions.

- The seamless integration of sustainable materials with high-performance barrier properties supports regulatory compliance and aligns with growing consumer demand for greener packaging solutions. This trend is prompting industry leaders such as Huhtamaki and ALBEA to invest heavily in research and development focused on eco-friendly yet highly effective laminate tubes.

- This move toward combining environmental responsibility with enhanced functionality is fundamentally reshaping industry standards and customer expectations. Consequently, companies are launching new product lines that emphasize both protection and sustainability, catering to the evolving preferences of global markets.

- The demand for aluminum barrier laminate tubes featuring advanced barrier technology and sustainable materials is rapidly increasing across pharmaceutical, cosmetic, and food sectors, driven by regulatory pressures and a consumer shift towards environmentally conscious products.

Global Aluminum Barrier Laminate (ABL) Tubes Market Dynamics

Driver

Growing Demand Driven by Increasing Product Safety Requirements and Sustainable Packaging Trends

-

The rising emphasis on product safety and quality assurance across pharmaceutical, cosmetic, and food industries is a major driver for the growing demand for aluminum barrier laminate tubes. Increasing regulatory standards and consumer awareness about contamination and product degradation are pushing manufacturers to adopt advanced packaging solutions.

- For Instance, in early 2024, Huhtamaki announced the launch of a new sustainable barrier tube that enhances protection against moisture and oxygen, catering to the pharmaceutical sector’s stringent safety requirements. Such innovations by key players are expected to significantly boost the aluminum barrier laminate tubes market during the forecast period.

- As brands focus more on maintaining product integrity and extending shelf life, aluminum barrier laminate tubes offer superior protection compared to conventional packaging materials, preventing contamination and preserving the product’s efficacy and freshness.

- Furthermore, the growing global trend toward eco-friendly and sustainable packaging solutions is driving the adoption of aluminum barrier laminate tubes, which combine recyclability with effective barrier performance, aligning with both regulatory and consumer demands.

- The lightweight nature, versatility, and compatibility with automated filling and labeling systems further support the increasing integration of these tubes across various industries. Market expansion is also fueled by the rising demand in emerging markets, where consumers are becoming more quality-conscious and environmentally aware.

Restraint/Challenge

Challenges Related to Recycling Infrastructure and Higher Production Costs

- Limitations in existing recycling infrastructure for multi-layer laminate packaging pose a significant challenge to the broader adoption of aluminum barrier laminate tubes, despite their recyclability potential. The complexity of separating aluminum layers from polymers can hinder efficient recycling, raising environmental concerns among regulators and consumers.

- For instance, in regions with underdeveloped recycling systems, such as parts of Asia-Pacific and Latin America, this challenge is more pronounced, limiting market penetration.

- Addressing these challenges requires advancements in recycling technologies, improved collection systems, and increased industry collaboration to develop fully recyclable and biodegradable laminate solutions. Companies like ALBEA and CCL Industries are investing in R&D focused on designing easier-to-recycle barrier tubes and promoting circular economy initiatives.

- Additionally, the relatively higher production and raw material costs of aluminum barrier laminate tubes compared to conventional plastic tubes can be a barrier for cost-sensitive customers, especially in emerging economies. While these tubes offer superior protection and sustainability benefits, the price premium may limit adoption in price-competitive markets.

- Overcoming these challenges through innovation in cost-effective manufacturing processes, consumer education about the environmental benefits, and improved recycling infrastructure will be critical for sustained market growth.

Global Aluminum Barrier Laminate (ABL) Tubes Markets cope

The aluminum barrier laminate (ABL) tubes market is segmented on the basis of cap type, capacity and end-use.

- By Cap Type

On the basis of cap type, the aluminum barrier laminate (ABL) tubes market is segmented into stand-up cap, nozzle cap, fez cap, flip top cap, and other caps. The stand-up cap segment dominated the market in 2024 with the largest revenue share of approximately 40.5%, largely due to its user-friendly design that facilitates easy dispensing and stable tube placement on shelves. Stand-up caps are particularly favored in the cosmetics and personal care industries for their aesthetic appeal and practicality.

The flip top cap segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032. This growth is driven by increasing demand for convenience and hygiene, especially in oral care and pharmaceutical applications where quick, one-handed operation is valued. Flip top caps also reduce product contamination risks, making them a preferred choice for many manufacturers focused on user experience and safety.

- By Capacity

On the basis of capacity, the aluminum barrier laminate (ABL) tubes market is segmented into less than 50 ml, 50 ml to 100 ml, 101 ml to 150 ml, and above 150 ml. The 50 ml to 100 ml segment dominated the market with a revenue share of 42.7% in 2024, as this size is widely used across cosmetic, pharmaceutical, and personal care products, balancing portability and sufficient product volume for consumers.

The above 150 ml segment is projected to witness the fastest growth at a CAGR of 19.4% over the forecast period. This surge is fueled by increasing demand for larger packaging in food and commercial segments, where bulk quantities are preferred for cost-efficiency and reduced packaging waste. Additionally, rising urbanization and retail trends toward family-size or value packs are boosting demand for higher-capacity tubes.

- By End-Use

On the basis of end-use, the aluminum barrier laminate (ABL) tubes market is segmented into cosmetics, oral care, commercial, pharmaceuticals, home and other personal care, food, and others. The cosmetics segment held the largest market revenue share of 39.8% in 2024, driven by rising consumer demand for premium skincare, beauty products, and color cosmetics packaged in aluminum barrier laminate tubes that preserve product quality and aesthetics.

The pharmaceutical segment is expected to record the fastest CAGR of 20.3% from 2025 to 2032, owing to stringent regulatory requirements for drug packaging that ensures hygiene, chemical stability, and extended shelf life. Growing awareness about safe medication delivery, rising chronic disease prevalence, and expansion of pharmaceutical manufacturing in emerging markets are key factors propelling this growth.

Global Aluminum Barrier Laminate (ABL) Tubes Market Regional Analysis

- Europe dominated the aluminum barrier laminate (ABL) tubes market with the largest revenue share of 36.7% in 2024, driven by strong demand from the pharmaceutical, cosmetic, and personal care industries seeking high-quality, protective packaging solutions.

- Consumers and manufacturers in the region prioritize packaging that ensures product safety, extends shelf life, and meets strict regulatory standards, fueling the adoption of aluminum barrier laminate tubes.

- This widespread adoption is further supported by advanced production facilities, high consumer awareness of sustainable packaging, and significant investments in innovation, establishing aluminum barrier laminate tubes as the preferred packaging choice across various end-use sectors in both residential and commercial markets.

U.K. Aluminum Barrier Laminate (ABL) Tubes Market Insight

The U.K. aluminum barrier laminate tubes market is expected to grow at a noteworthy CAGR during the forecast period, fueled by the rising popularity of premium personal care and pharmaceutical products. Increasing consumer preference for sustainable and hygienic packaging solutions is encouraging market expansion. The U.K.’s robust cosmetic and pharmaceutical industries, coupled with heightened regulatory focus on eco-friendly packaging, are key growth drivers. Additionally, advancements in packaging technology and consumer demand for innovative, user-friendly designs are stimulating adoption.

Germany Aluminum Barrier Laminate (ABL) Tubes Market Insight

The Germany aluminum barrier laminate tubes market is forecasted to grow at a considerable CAGR during the forecast period, supported by the country’s strong industrial base and innovation-driven packaging sector. Germany’s emphasis on sustainability and high-quality standards in pharmaceuticals and cosmetics promotes the use of aluminum barrier laminate tubes. The integration of recyclable and eco-conscious materials aligns with local consumer expectations and regulatory frameworks. Furthermore, Germany’s advanced manufacturing infrastructure facilitates the production of technologically sophisticated barrier tubes, aiding market growth.

U.S. Aluminum Barrier Laminate (ABL) Tubes Market Insight

The U.S. aluminum barrier laminate tubes market captured the largest revenue share of 40.5% in North America in 2024, driven by strong demand from the pharmaceutical, personal care, and cosmetics sectors. The rising focus on product safety, extended shelf life, and sustainable packaging solutions is fueling adoption. Additionally, increasing investments in innovative packaging technologies and the presence of leading manufacturers contribute to market growth. The growing trend toward eco-friendly packaging and regulatory compliance further support the demand for high-performance aluminum barrier laminate tubes across various end-use industries.

Europe Aluminum Barrier Laminate (ABL) Tubes Market Insight

The Europe aluminum barrier laminate tubes market is projected to expand at a significant CAGR throughout the forecast period, driven by stringent regulations on packaging materials and growing consumer awareness about sustainability. The demand for high-barrier, recyclable packaging solutions is rising in pharmaceuticals, cosmetics, and food sectors. Urbanization and the increase in luxury personal care products are encouraging manufacturers to adopt aluminum barrier laminate tubes. The region is witnessing growing incorporation of these tubes in both new product launches and reformulations aimed at improved packaging performance and environmental impact.

Asia-Pacific Aluminum Barrier Laminate (ABL) Tubes Market Insight

The Asia-Pacific aluminum barrier laminate tubes market is expected to register the fastest CAGR of 22.3% during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expanding pharmaceutical and personal care industries in countries such as China, India, and Japan. The region’s increasing focus on product safety, shelf-life extension, and sustainable packaging is propelling demand. Additionally, government initiatives promoting advanced manufacturing and eco-friendly packaging solutions are accelerating market adoption. Growing domestic production capabilities and rising consumer awareness about premium packaging solutions further support market expansion.

Japan Aluminum Barrier Laminate (ABL) Tubes Market Insight

The Japan aluminum barrier laminate tubes market is gaining momentum due to the country’s advanced packaging technologies and high demand for quality and safety in pharmaceuticals and cosmetics. The aging population and focus on health and wellness products drive demand for reliable, hygienic packaging. Integration with smart packaging and eco-friendly innovations supports market growth. Moreover, Japan’s mature market and strong R&D infrastructure promote the continuous development of innovative aluminum barrier tubes with enhanced barrier properties and sustainable features.

China Aluminum Barrier Laminate (ABL) Tubes Market Insight

The China aluminum barrier laminate tubes market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, urbanization, and increasing domestic demand in pharmaceuticals, personal care, and food sectors. The country is a major manufacturing hub, benefiting from investments in advanced packaging technologies and government support for sustainable packaging practices. Growing consumer awareness about product safety and the environment, along with the expansion of e-commerce channels, is further driving demand for aluminum barrier laminate tubes in China’s diverse market landscape.

Global Aluminum Barrier Laminate (ABL) Tubes Market Share

The Aluminum Barrier Laminate Tubes industry is primarily led by well-established companies, including:

- ALBEA (France)

- Berry Global Inc. (U.S.)

- CCL Industries (Canada)

- MONTEBELLO PACKAGING (Italy)

- TUBOPRESS ITALIA S.R.L. (Italy)

- LINHARDT GmbH & Co. KG (Germany)

- Hoffmann Neopac AG (Switzerland)

- IntraPac International LLC (U.S.)

- Huhtamaki Global (Finland)

- Lajovic Tuba D.O.O (Slovenia)

- Plastube (India)

- TUBAPACK, a.s. (Czech Republic)

- Pirlo Holding GmbH (Germany)

- Bergen Plastics Group (India)

- Burhani Group of Industries (India)

- Essel Propack Limited (India)

What are the Recent Developments in Global Aluminum Barrier Laminate (ABL) Tubes Market Market?

- In April 2023, ALBEA, a global leader in sustainable packaging solutions headquartered in France, announced the launch of a new line of eco-friendly aluminum barrier laminate tubes designed specifically for the cosmetic and pharmaceutical sectors. This initiative highlights ALBEA’s commitment to reducing environmental impact while delivering high-performance packaging that meets stringent barrier and safety requirements, reinforcing its leadership in the global aluminum barrier laminate tubes market.

- In March 2023, Berry Global Inc., headquartered in the U.S., introduced advanced lightweight aluminum barrier laminate tubes featuring enhanced recyclability for the personal care industry. The new product line aims to reduce carbon footprint without compromising tube durability and barrier properties. This development showcases Berry Global’s focus on innovation and sustainability in packaging solutions, catering to increasing consumer demand for eco-conscious products.

- In March 2023, CCL Industries, a Canada-based packaging specialist, expanded its aluminum barrier laminate tube manufacturing capacity in Asia, targeting the fast-growing pharmaceutical and cosmetic markets in the region. This strategic move underscores CCL’s commitment to meeting rising demand for high-quality, protective packaging while strengthening its global supply chain and market presence.

- In February 2023, Essel Propack Limited, an India-headquartered global packaging provider, announced a collaboration with several leading pharmaceutical companies to develop customized aluminum barrier laminate tubes with enhanced barrier properties and improved user convenience. This partnership aims to address the evolving needs of pharmaceutical packaging, emphasizing safety, sustainability, and functionality.

- In January 2023, Hoffmann Neopac AG, based in Switzerland, unveiled a new series of ultra-thin aluminum barrier laminate tubes at the international packaging expo. These tubes combine superior barrier protection with reduced material usage, catering to the growing demand for lightweight and sustainable packaging solutions in cosmetics and personal care. The innovation reinforces Hoffmann Neopac’s dedication to pushing boundaries in packaging technology and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aluminum Barrier Laminate Abl Tubes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aluminum Barrier Laminate Abl Tubes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aluminum Barrier Laminate Abl Tubes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.