Global Aluminum Systems Market

Market Size in USD Billion

CAGR :

%

USD

211.20 Billion

USD

321.67 Billion

2024

2032

USD

211.20 Billion

USD

321.67 Billion

2024

2032

| 2025 –2032 | |

| USD 211.20 Billion | |

| USD 321.67 Billion | |

|

|

|

|

Aluminum Systems Market Size

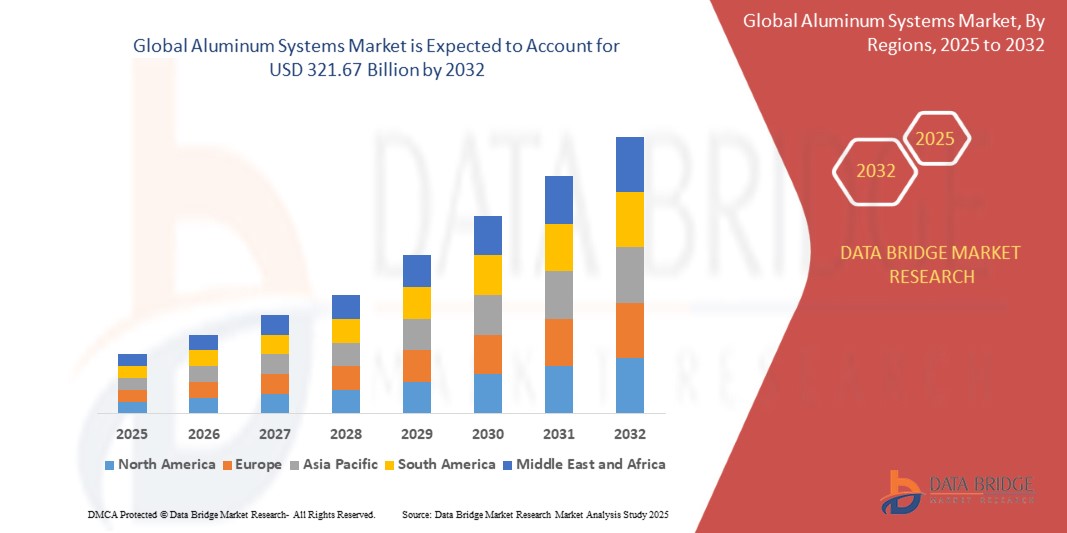

- The global active, smart, and intelligent packaging market size was valued at USD 211.20 billion in 2024 and is expected to reach USD 321.67 billion by 2032, at a CAGR of 5.4% during the forecast period

- Rise in technological advancements is the vital factor escalating the market growth, also rising demand of products from the end-users, increasing demand for aluminum cans in the beverage industry and increasing demand of aluminum in electric vehicles and rising demand for aluminum cans in the beverage industry are the major factors among others driving the aluminum systems market. Moreover, rising demand for recycled and value-added aluminum products and increasing demand for aluminum in emerging economies will further create new opportunities for the aluminum systems market

Aluminum Systems Market Analysis

- The Global Aluminum Systems Market encompasses a range of structural, architectural, and industrial components made primarily from aluminum alloys, offering advantages such as light weight, high corrosion resistance, and superior strength-to-weight ratio across diverse applications including construction, transportation, and aerospace.

- The growth of this market is primarily driven by increasing infrastructure development, the rising trend of lightweight materials in automotive and aerospace industries, and a growing emphasis on energy-efficient and sustainable construction practices.

- Asia-Pacific dominated the global Aluminum Systems Market with a market share of 41.98% in 2025, owing to rapid urbanization, large-scale infrastructure investments, and a robust manufacturing base, especially in China and India. The region is also projected to be the fastest-growing during the forecast period due to expanding end-use industries and favorable government initiatives.

- Wrought aluminum alloy accounted for the largest market share of 74.22% in 2025, driven by its extensive use in structural applications due to its enhanced mechanical properties, recyclability, and versatility in extrusion and rolling processes.

- Silicon is projected to be the fastest-growing alloying element over the forecast period, owing to its ability to improve casting performance, reduce thermal expansion, and enhance wear resistance—making it increasingly valuable in automotive, electronics, and construction applications.

Report Scope and Aluminum Systems Market Segmentation

|

Attributes |

Active, Smart and Intelligent Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Aluminum Systems Market Trends

“Integration of Advanced Aluminum Alloys and Smart Manufacturing for Sustainable Infrastructure”

- A significant trend in the global aluminum systems market is the growing adoption of high-performance aluminum alloys and smart manufacturing technologies to meet rising demands for lightweight, durable, and eco-friendly materials in sectors like construction, automotive, and aerospace.

- These advancements are particularly prominent in architectural systems—such as facades, curtain walls, and modular structures—where aluminum's corrosion resistance, flexibility, and aesthetic appeal are highly valued.

➤ For instance, Hydro Building Systems has introduced WICONA and TECHNAL aluminum building solutions that incorporate recycled aluminum with 75% post-consumer scrap, reducing carbon emissions and promoting green construction initiatives in Europe and North America.

-

Smart manufacturing techniques, such as automation, digital twins, and AI-driven process optimization, are enhancing production efficiency, lowering waste, and supporting low-carbon aluminum production—accelerating sustainability in the supply chain.

➤ For instance, Rio Tinto and Alcoa's joint venture, Elysis, is scaling up carbon-free aluminum smelting technology that eliminates direct GHG emissions and replaces them with oxygen, creating a disruptive innovation in the global aluminum systems market.

Global Aluminum Systems Market Dynamics

Driver

“Rising Demand for Lightweight and Sustainable Materials in Construction and Automotive Industries”

- Increasing emphasis on energy efficiency, low-carbon infrastructure, and fuel economy is propelling the use of aluminum systems across high-growth sectors. Aluminum’s recyclability, lightweight properties, and strength make it a go-to material for modern engineering and architecture.

- The automotive sector is rapidly shifting to aluminum-intensive body structures to comply with stricter emission norms and improve EV performance.

➤ For instance, Tesla’s Model S and Audi’s e-tron heavily rely on aluminum-intensive platforms for reducing vehicle weight, increasing efficiency, and extending battery range—driving aluminum demand among OEMs and Tier-1 suppliers.

-

In construction, aluminum systems are replacing heavier and less durable materials, especially in modular buildings, residential fenestration, and smart infrastructure.

➤ For instance, Schüco International KG has launched smart aluminum window systems with integrated automation and thermal insulation, enhancing building energy performance in commercial real estate projects.

Opportunity

“Expansion in Renewable Energy and Electric Vehicle Sectors”

- The transition toward renewable energy and clean mobility is opening new avenues for aluminum system applications in solar PV frames, battery enclosures, EV chassis, and offshore wind structures.

- Aluminum's high strength-to-weight ratio, weather resistance, and conductivity make it indispensable in these green technology systems.

➤ For instance, Novelis supplies high-grade aluminum solutions for solar panel mounting systems and EV battery trays to companies like Hyundai and First Solar, capitalizing on the green energy surge.

-

Government incentives for net-zero targets and energy transition are pushing OEMs and fabricators to invest in aluminum-based solutions for cleaner production.

➤ For instance, in 2023, India's JSW Aluminium announced plans to triple its extrusion capacity to serve the growing demand for lightweight solutions in EV and solar sectors, particularly in Asia-Pacific.

Restraint/Challenge

“High Energy Consumption and Integration Challenges with Sustainable Supply Chains”

- Despite aluminum’s recyclability, its primary production (smelting) is energy-intensive, accounting for a significant portion of global industrial emissions.

- Fluctuating raw material prices, environmental regulations, and carbon taxes increase the cost pressures on producers—especially in regions reliant on coal-based energy.

➤ For instance, a 2022 IEA report noted that producing 1 tonne of primary aluminum emits nearly 12 tons of CO₂ in China, making it one of the most carbon-intensive base metals and leading to scrutiny from global buyers.

-

Integrating low-carbon aluminum solutions into existing supply chains can be technologically and financially challenging, especially for SMEs with limited capital and digital maturity.

➤ For instance, according to the Aluminum Association, while large producers like Norsk Hydro have committed to low-carbon aluminum via hydropower-based smelting, smaller fabricators in emerging economies struggle to align with green procurement standards due to infrastructure gaps and lack of traceability tools.

Aluminum Systems Market Scope

The market is segmented on the basis of alloy type, alloying element and application.

|

Segmentation |

Sub-Segmentation |

|

By Alloy Type |

|

|

By Alloying Element |

|

|

By Application |

|

Silicon to be the Fastest-Growing Alloying Element During the Forecast Period

Silicon is projected to register the fastest growth rate among alloying elements during the forecast period. This surge is attributed to its ability to enhance casting properties, improve thermal conductivity, reduce thermal expansion, and increase wear resistance—factors critical to industries such as electronics, automotive, and construction.

➤ For instance, silicon-enhanced aluminum alloys are widely used in engine blocks, heat sinks, and structural parts in EVs, where heat management and strength are essential.

As industries continue to seek lightweight and thermally efficient materials, especially for electronic devices and electric vehicles, silicon’s relevance as a key alloying component is set to rise.

Global Aluminum Systems Market Regional Analysis

“Asia-Pacific Dominates the Global Aluminum Systems Market”

- Asia-Pacific leads the global aluminum systems market with a market share of 41.98% in 2025, driven by rapid urbanization, ongoing mega infrastructure projects, and robust demand from the region's expansive manufacturing sector.

- China and India are at the forefront due to high investments in construction, automotive, and renewable energy sectors, where aluminum systems play a critical role in lightweight, corrosion-resistant, and energy-efficient applications.

- Government-backed initiatives such as “Make in India” and “New Urbanization Plan” in China are fostering a favorable business environment for aluminum producers and extruders.

➤ For instance, China Zhongwang and Hindalco Industries have significantly ramped up their aluminum system capacities to meet growing domestic and export demand from the construction and transportation industries.

- The region's extensive base of aluminum smelters, integrated production facilities, and R&D centers are further strengthening its market position.

“Asia-Pacific Also Projected to Register the Highest CAGR”

- Apart from dominating in 2025, Asia-Pacific is also expected to be the fastest-growing regional market for aluminum systems throughout the forecast period.

- The expansion of automotive manufacturing hubs, rise in EV production, and increasing emphasis on renewable infrastructure are propelling the demand for advanced aluminum solutions.

- Continued focus on smart cities, high-speed rail networks, and energy-efficient construction is prompting the integration of aluminum curtain walls, roofing systems, and solar panel frames.

➤ For example, the Indian government’s Smart Cities Mission and Southeast Asia’s rapid metro rail expansions are significantly contributing to aluminum systems uptake across the region.

- Global companies are strategically expanding their footprints in Asia-Pacific through partnerships, acquisitions, and capacity expansions to tap into this high-growth market.

Aluminum Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- RusAL (Russia)

- Alcoa Corporation (U.S.)

- Aluminum Corporation of China Limited (China)

- Rio Tinto Group (UK)

- BHP (Australia)

- Control And Framing Systems (U.S.)

- Overseas Aluminium (India)

- Agriplast Tech India Private Limited (India)

- Simplex Profilo Systems (India)

- Norsk Hydro ASA (Norway)

- Century Aluminum Company (U.S.)

- Aluminium Bahrain (Alba) (Bahrain)

- Aditya Birla Management Corporation Pvt. Ltd. (India)

- Emirates Global Aluminium PJSC (UAE)

- China Hongqiao Group Limited (China)

Latest Developments in Global Aluminum Systems Market

- In March 2025, Novelis Inc., a global leader in aluminum rolling and recycling, announced its strategic initiative to achieve net-zero carbon emissions by 2050. The plan involves heavy investments in advanced recycling facilities, transitioning to renewable energy across its operations, and developing low-carbon aluminum products for automotive and building sectors to support circular economy goals.

- In February 2025, Norsk Hydro ASA introduced its next-generation low-carbon aluminum product line under the brand “Hydro CIRCAL,” featuring at least 75% recycled post-consumer aluminum content. Targeted towards construction and façade systems, Hydro CIRCAL aims to reduce embodied carbon emissions significantly, meeting increasing regulatory and client demand for green building materials.

- In January 2025, Alcoa Corporation advanced its ELYSIS joint venture technology by beginning pilot production of aluminum using inert anode technology. This breakthrough smelting process eliminates direct greenhouse gas emissions and generates only oxygen as a byproduct, positioning it as a transformative innovation for sustainable primary aluminum production.

- In December 2024, RUSAL announced the expansion of its alloy development program to meet the growing demand for high-performance aluminum in aerospace and electric vehicle (EV) applications. The company launched new grades of high-strength and heat-resistant aluminum alloys, offering improved fatigue resistance and corrosion protection.

- In November 2024, Emirates Global Aluminium (EGA) signed a strategic partnership with BMW Group to supply solar-powered aluminum for automotive manufacturing. The agreement supports BMW’s goals to reduce Scope 3 emissions and leverages EGA’s use of renewable energy in aluminum smelting at its UAE-based facility.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aluminum Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aluminum Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aluminum Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.