Global Aluminum Trihydrate Ath Market

Market Size in USD Billion

CAGR :

%

USD

2.63 Billion

USD

4.52 Billion

2024

2032

USD

2.63 Billion

USD

4.52 Billion

2024

2032

| 2025 –2032 | |

| USD 2.63 Billion | |

| USD 4.52 Billion | |

|

|

|

|

Aluminum Trihydrate (ATH) Market Size

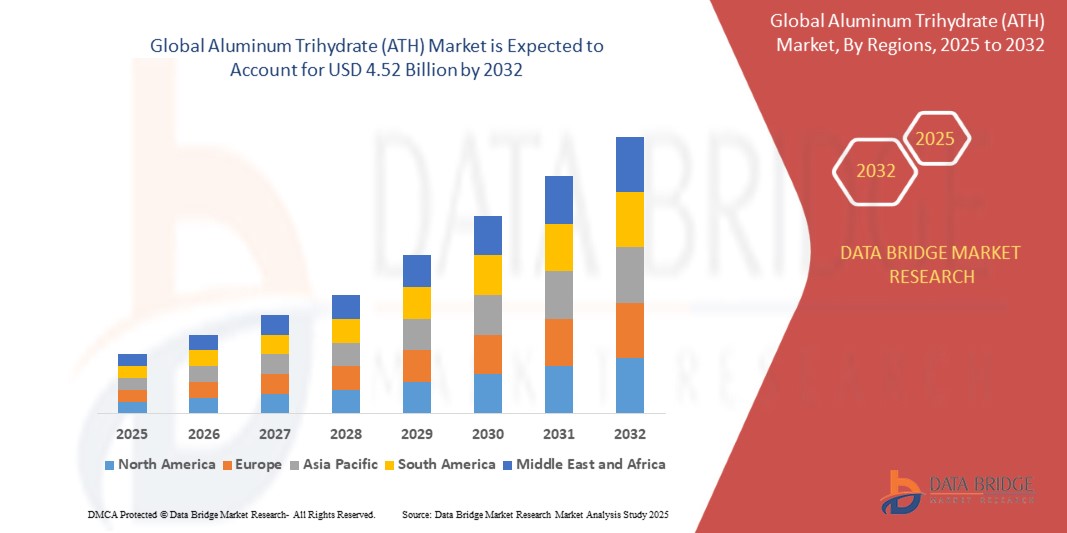

- The global Aluminum Trihydrate (ATH) market size was valued at USD 2.63 billion in 2024 and is expected to reach USD 4.52 billion by 2032, at a CAGR of 7.0% during the forecast period

- The market growth is largely fueled by the increasing demand for halogen-free flame retardants and non-toxic fillers across construction, electrical, automotive, and polymer industries, driven by stringent fire safety regulations and environmental compliance standards across global markets

- Furthermore, rising industrial usage of ATH in wire and cable insulation, coatings, adhesives, and sealants is reinforcing its role as a cost-effective, multifunctional additive. These converging factors are accelerating ATH adoption across end-use sectors, thereby significantly boosting the industry’s growth

Aluminum Trihydrate (ATH) Market Analysis

- Aluminum trihydrate is a widely used flame retardant and filler material known for its non-halogenated, smoke-suppressing properties. It decomposes endothermically, releasing water that dilutes combustible gases and cools materials, making it ideal for enhancing fire resistance in various applications

- The escalating demand for ATH is primarily driven by growing awareness of fire safety, tightening environmental norms against halogenated retardants, and increasing use in construction, cables, paints, and personal care formulations requiring high-purity, multifunctional additives

- Asia-Pacific dominated the Aluminum Trihydrate (ATH) market with a share of 44.92% in 2024, due to extensive use of ATH in construction, electrical insulation, and polymer applications across rapidly industrializing economies

- North America is expected to be the fastest growing region in the Aluminum Trihydrate (ATH) market during the forecast period due to rising regulatory pressure to adopt halogen-free flame retardants and the growing need for ATH in construction, electrical, and plastic industries

- Wire and cables segment dominated the market with a market share of 35.1% in 2024, due to ATH’s role as a cost-effective, halogen-free flame retardant widely used in the electrical insulation of wires and cables. Its ability to release water molecules at high temperatures reduces flammability, making it highly favored in industries prioritizing fire safety compliance. Moreover, ATH’s thermal stability and insulation properties contribute to its continued preference in wire and cable sheathing materials across various industrial applications

Report Scope and Aluminum Trihydrate (ATH) Market Segmentation

|

Attributes |

Aluminum Trihydrate (ATH) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminum Trihydrate (ATH) Market Trends

“Growing Demand in Flame Retardants”

- The aluminum trihydrate (ATH) market is strongly driven by its widespread use as a halogen-free flame retardant across electrical, construction, and plastic industries. Heightened fire safety standards and environmental regulations are pushing manufacturers to replace traditional, halogen-based retardants with ATH due to its non-toxic, efficient, and cost-effective properties

- For instance, leading industry players such as Huber Engineered Materials and Nabaltec have ramped up their ATH production to meet surging demand from cable manufacturers and construction material suppliers seeking compliance with new fire safety codes in the U.S., China, and Europe

- Rising emphasis on fire-resistant materials in building codes (NFPA 70, EN 13501) and eco-friendly product mandates is accelerating ATH adoption in insulation, wire coatings, paints, and adhesives

- Technological advances in ATH-based flame retardant formulations continue to enhance performance, enabling use in thermoplastics, thermosets, and advanced composites

- Asia-Pacific leads global consumption—driven by construction booms, fast industrialization, and heightened regulatory enforcement

- ATH’s roles as both fire retardant and functional filler in paints, coatings, water treatment, and adhesives add to its robust and diversified market demand

Aluminum Trihydrate (ATH) Market Dynamics

Driver

“Increasing Demand from Construction Industry”

- The construction sector is a major driver of ATH demand due to stricter fire safety regulations and the expanding use of non-halogenated fire-retardant building materials

- For instance, the rapid growth in residential and commercial construction projects in the U.S. and Asia-Pacific has led major suppliers such as Almatis and Hindalco Industries Limited to increase ATH supply for use in fire-resistant panels, coatings, sealants, and insulation—especially as spending on new infrastructure has surged in response to urbanization and disaster-resilience measures

- ATH’s dual function as a flame retardant and a filler makes it highly sought after in construction materials, contributing to safer, higher-performance buildings

- National building codes are mandating materials that provide enhanced fire safety, prompting manufacturers and developers to adopt ATH-based solutions in both new builds and renovations

- Growth in “green” construction and sustainable building certifications (such as LEED) is also boosting adoption of non-toxic, eco-friendly flame retardants. Sturdy partnerships between ATH suppliers and construction material manufacturers facilitate larger, long-term projects and quick adaptation to regulatory changes

Restraint/Challenge

“Volatility in Raw Material Prices”

- Raw material price fluctuations—including those for bauxite and energy—pose significant challenges in the ATH market, directly impacting manufacturing costs and product pricing

- For instance, Sumitomo Chemical Advanced Technologies has cited unpredictable bauxite supply and energy costs as obstacles to long-term price stability for ATH, forcing periodic adjustments and selective supply contracts in volatile periods

- Global supply chain disruptions, transportation costs, and regulatory changes in mining and processing amplify the volatility, particularly affecting smaller suppliers or those dependent on limited regional sources

- Competition from alternative flame retardants, and the growing price sensitivity among end-users in cost-driven industries, adds further margin pressure for ATH producers

- Manufacturers are responding by investing in technological improvements for resource efficiency, forward contracts, and diversified sourcing, but raw material volatility remains a persistent risk for the sector’s profit margins and planning

Aluminum Trihydrate (ATH) Market Scope

The market is segmented on the basis of application and end-users.

• By Application

On the basis of application, the Aluminum Trihydrate (ATH) market is segmented into chemicals, caulks and sealants, adhesives, wire and cables, coatings, printing inks, ceramics, and rubber. The wire and cables segment dominated the largest market revenue share of 35.1% in 2024, primarily due to ATH’s role as a cost-effective, halogen-free flame retardant widely used in the electrical insulation of wires and cables. Its ability to release water molecules at high temperatures reduces flammability, making it highly favored in industries prioritizing fire safety compliance. Moreover, ATH’s thermal stability and insulation properties contribute to its continued preference in wire and cable sheathing materials across various industrial applications.

The coatings segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for fire-resistant and environmentally friendly coatings across construction and infrastructure sectors. ATH serves as both a functional filler and flame retardant in coatings, offering improved smoke suppression and surface durability. Regulatory shifts toward non-toxic, halogen-free additives in architectural and industrial coatings further drive ATH adoption in this segment.

• By End-Users

On the basis of end-users, the Aluminum Trihydrate (ATH) market is segmented into construction, electrical, automotive, paints and coatings, paper, plastic, textile, pharmaceuticals, and cosmetics and personal care. The construction segment held the largest market revenue share in 2024, attributed to ATH’s widespread use in building materials such as sealants, adhesives, and flame-retardant panels. Its non-toxic nature, smoke-suppressing capabilities, and cost-efficiency make it a material of choice for enhancing fire safety in residential and commercial building projects. Increasing construction activities in urban centers and stricter fire regulations continue to bolster demand from this sector.

The cosmetics and personal care segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing preference for mineral-based, non-toxic ingredients in personal care formulations. ATH is valued in cosmetics for its mild abrasiveness, opacifying effects, and absorbent properties, making it suitable for use in toothpaste, deodorants, and skin care products. Rising consumer awareness of ingredient transparency and regulatory support for clean-label formulations are key factors accelerating ATH usage in this segment.

Aluminum Trihydrate (ATH) Market Regional Analysis

- Asia-Pacific dominated the Aluminum Trihydrate (ATH) market with the largest revenue share of 44.92% in 2024, driven by extensive use of ATH in construction, electrical insulation, and polymer applications across rapidly industrializing economies

- The region’s expansion in manufacturing infrastructure, growing demand for fire-retardant materials, and increasing investments in electronics and construction sectors are contributing significantly to market growth

- Supportive regulatory frameworks promoting non-halogenated flame retardants, combined with cost-effective domestic production and increasing awareness of environmental safety, are further propelling ATH adoption across diverse industries

Japan Aluminum Trihydrate (ATH) Market Insight

The Japan ATH market is growing steadily due to high regulatory standards around fire safety and environmentally safe additives in industrial and consumer products. Local demand is fueled by ATH’s use in precision applications such as ceramics and coatings, where purity and performance consistency are critical. Japan’s focus on advanced materials and sustainable product formulations continues to support stable market expansion.

China Aluminum Trihydrate (ATH) Market Insight

China held the largest share in the Asia-Pacific ATH market in 2024, supported by its massive production capacity and strong consumption across plastics, cables, and construction materials. Government initiatives to phase out halogen-based flame retardants and promote eco-safe industrial inputs are accelerating demand. Rapid urban development and infrastructure expansion further drive ATH usage in fire-resistant panels, sealants, and insulation.

Europe Aluminum Trihydrate (ATH) Market Insight

The Europe ATH market is projected to grow at a significant CAGR over the forecast period, fueled by stringent environmental regulations and high demand for sustainable flame retardants. The region leads in polymer innovation and non-toxic material adoption across building, automotive, and electrical sectors. Increasing investment in recyclable and halogen-free formulations continues to strengthen ATH’s position across Western Europe.

U.K. Aluminum Trihydrate (ATH) Market Insight

The U.K. ATH market is anticipated to grow steadily, driven by national commitments to fire safety in public and residential buildings, and rising use of eco-friendly ingredients in cosmetics and pharmaceuticals. Shifts toward clean-label personal care products and non-toxic industrial inputs support ATH’s broader penetration across both end-user and consumer-oriented sectors.

Germany Aluminum Trihydrate (ATH) Market Insight

Germany’s ATH market is expanding significantly, underpinned by its leadership in industrial innovation and materials engineering. The country’s strong demand for ATH in wire and cable insulation, along with its emphasis on safe, sustainable additives in paints, polymers, and personal care, is driving uptake. Germany’s robust infrastructure and R&D investments also foster continued adoption of ATH in high-performance applications.

North America Aluminum Trihydrate (ATH) Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rising regulatory pressure to adopt halogen-free flame retardants and the growing need for ATH in construction, electrical, and plastic industries. Increasing focus on green building codes, coupled with the use of ATH in eco-friendly coatings and polymer additives, is accelerating demand. Technological innovation and material safety regulations continue to shape adoption trends across the U.S. and Canada.

U.S. Aluminum Trihydrate (ATH) Market Insight

The U.S. ATH market captured the largest revenue share in North America in 2024, driven by high consumption across construction, wire & cable, and paper industries. Federal fire safety mandates and environmental standards are encouraging the transition to halogen-free alternatives such as ATH. Demand is also rising in the pharmaceutical and personal care industries for ATH as a functional filler in formulations prioritizing consumer safety and regulatory compliance.

Aluminum Trihydrate (ATH) Market Share

The Aluminum Trihydrate (ATH) industry is primarily led by well-established companies, including:

- Huber Group Holding SE (Germany)

- Alfa Aesar (U.S.)

- Thermo Fisher Scientific (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- Albemarle Corporation (U.S.)

- Showa Denko K.K. (Japan)

- Alcoa Corporation (U.S.)

- Aluminium Corporation of China Limited (China)

- Nabaltec AG (Germany)

- NALCO India (India)

- M.A.L. (Magyar Alumínium Termelo és Kereskedelmi Zrt (Hungary)

- Hindalco Industries Ltd (India)

- Magna International Inc. (Canada)

- Norsk Hydro ASA (Norway)

- Dubai Aluminium Company Ltd. (U.A.E.)

- KOBE STEEL LTD. (Japan)

- Rio Tinto (U.K.)

- Constellium (France)

- Eramet (France)

- RusAL (Russia)

- TALCO ALUMINIUM COMPANY (Tajikistan)

Latest Developments in Global Aluminum Trihydrate (ATH) Market

- In May 2025, J.M. Huber Corporation’s acquisition of The R.J. Marshall Company’s alumina trihydrate (ATH), antimony-free flame retardant, and molybdate-based smoke suppressant assets strengthens Huber Advanced Materials’ portfolio and solidifies its leadership in the North American flame retardant market. This move enhances product offerings and reinforces the company’s competitive positioning in the ATH segment

- In January 2023, ChemIndia launched a new line of extender pigment products featuring alumina hydrate as a key ingredient, signaling its commitment to product innovation. This initiative expands ATH’s use in the pigment and coatings industry, supporting growth in the Indian market by addressing increasing demand for high-quality, multifunctional pigment extenders

- In August 2022, Cimbar Resources Inc. completed the acquisition of manufacturing assets from Imerys Carbonates USA Inc., bolstering its overall production capabilities. Although primarily focused on calcium carbonate, this strategic expansion indirectly enhances Cimbar’s ability to serve the ATH market by strengthening its operational infrastructure and market presence

- In January 2022, Huber Engineered Materials acquired RHI Magnesita’s 50% stake in the MAGNIFIN joint venture, gaining full control of its fire-retardant product line. This acquisition reinforces Huber’s leadership in halogen-free flame retardants, including ATH, while expanding its global reach and aligning with the growing demand for sustainable fire safety solutions

- In March 2021, TOR Minerals International sold its ATH and barite operational assets in Corpus Christi, Texas, to Cimbar Performance Minerals. This transfer marks a significant consolidation in the market, allowing Cimbar to expand its footprint and enhance its ability to supply ATH for flame retardant and filler applications across key industrial sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aluminum Trihydrate Ath Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aluminum Trihydrate Ath Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aluminum Trihydrate Ath Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.