Global Ammonium Nitrate Market

Market Size in USD Billion

CAGR :

%

USD

20.02 Billion

USD

29.13 Billion

2024

2032

USD

20.02 Billion

USD

29.13 Billion

2024

2032

| 2025 –2032 | |

| USD 20.02 Billion | |

| USD 29.13 Billion | |

|

|

|

|

Ammonium Nitrate Market Size

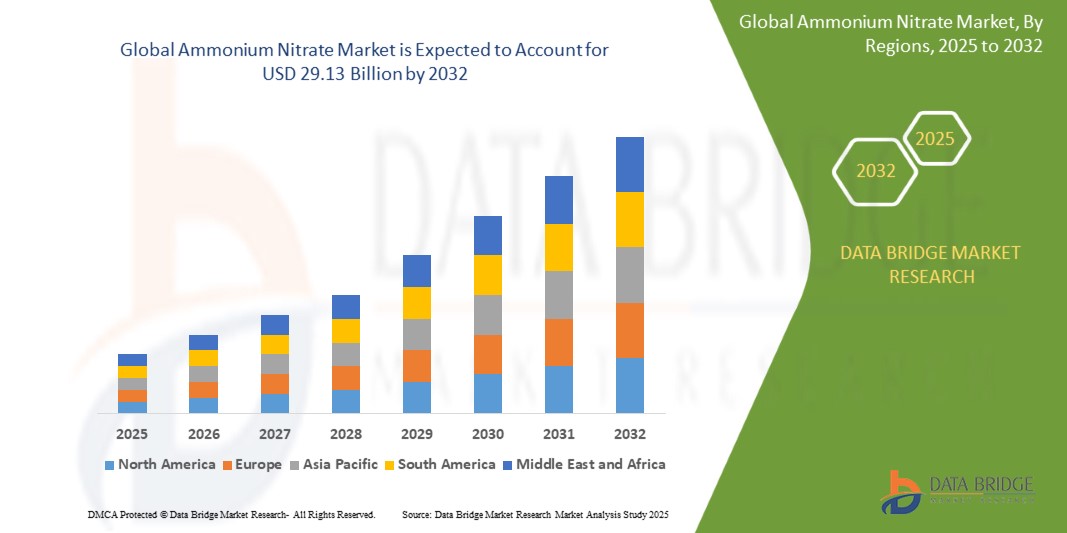

- The global ammonium nitrate market size was valued at USD 20.02 billion in 2024 and is expected to reach USD 29.13 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the increasing use of ammonium nitrate in agriculture to enhance crop yields, coupled with rising global food demand and the need for high-efficiency nitrogen-based fertilizers to support sustainable farming practices

- Furthermore, the expanding mining and construction industries, along with the growing demand for industrial explosives, are driving the widespread application of ammonium nitrate in blasting operations. These factors are collectively accelerating market expansion, solidifying ammonium nitrate’s role as a critical input across agriculture and industrial sectors

Ammonium Nitrate Market Analysis

- Ammonium nitrate is a chemical compound widely used as a high-efficiency nitrogen fertilizer and a key ingredient in industrial explosives. It plays a critical role in agriculture by enhancing soil fertility and supporting higher crop yields, while also being essential in mining, construction, and defense sectors for blasting applications

- The escalating demand for ammonium nitrate is primarily fueled by the growing global need for food production, expansion of large-scale mining operations, and rising infrastructure development, all of which require reliable fertilizers and efficient explosives

- Europe dominated the ammonium nitrate market with a share of 43.2% in 2024, due to the region’s well-established agricultural sector, stringent environmental regulations, and significant demand for high-quality fertilizers

- North America is expected to be the fastest growing region in the ammonium nitrate market during the forecast period due to expanding mining activities, defense sector modernization, and increased agricultural productivity initiatives

- Fertilizers segment dominated the market with a market share of 61.5% in 2024, due to the critical role of ammonium nitrate as a high-efficiency nitrogen source that enhances crop productivity. Growing global food security concerns, shrinking arable land, and the push for improved agricultural output are key factors fueling the demand for ammonium nitrate-based fertilizers. Its high nutrient content and rapid action make it particularly suitable for cereals, vegetables, and industrial crops across both developed and emerging regions

Report Scope and Ammonium Nitrate Market Segmentation

|

Attributes |

Ammonium Nitrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ammonium Nitrate Market Trends

“Rising Use in Mining and Explosives”

- A significant and accelerating trend in the global ammonium nitrate market is the rising use of ammonium nitrate in mining and explosives applications, particularly in regions with expanding infrastructure and resource extraction projects

- For instance, companies such as Orica and Enaex are supplying bulk ammonium nitrate for use in blasting agents and explosives formulations, supporting the demand from mining, quarrying, and construction sectors

- The adoption of advanced explosives technologies, such as emulsion and ANFO (ammonium nitrate fuel oil) blends, is driving efficiency and safety in large-scale mining operations

- Ammonium nitrate’s properties such as high oxygen content and stable storage characteristics make it a preferred choice for controlled blasting and rock fragmentation

- This trend toward increased use of ammonium nitrate in industrial explosives is fundamentally reshaping procurement and logistics strategies for mining companies. Companies such as Yara International and CF Industries are expanding production capacity and distribution networks to meet this growing demand

- The demand for ammonium nitrate-based explosives is growing rapidly across both developed and emerging markets, as mining and infrastructure projects accelerate to meet global resource and construction needs

Ammonium Nitrate Market Dynamics

Driver

“Growing Agricultural Industry”

- The expansion of the global agricultural industry, coupled with the need for high-efficiency fertilizers, is a significant driver for the increased demand for ammonium nitrate

- For instance, Yara International and EuroChem are investing in new ammonium nitrate production facilities to supply large-scale farming operations with nitrogen-rich fertilizers

- As farmers seek to improve crop yields and optimize nutrient management, ammonium nitrate offers advantages such as rapid nitrogen availability and compatibility with precision agriculture practices

- The trend toward intensive farming and the adoption of modern agricultural techniques is making ammonium nitrate a key input for cereal, vegetable, and cash crop cultivation

- The convenience of using ammonium nitrate-based fertilizers in both broadcast and localized application methods is propelling adoption in diverse agricultural regions. The growth of agribusiness and government initiatives to boost food production further contribute to market expansion

Restraint/Challenge

“Regulatory Compliance of Production of Ammonium Nitrate”

- Concerns surrounding the regulatory compliance of ammonium nitrate production, including stringent safety, environmental, and security requirements, pose a significant challenge to manufacturers and distributors

- For instance, high-profile incidents involving ammonium nitrate have led to stricter regulations on its production, storage, and transport in major markets such as the United States and European Union

- Addressing these compliance challenges through investment in advanced safety systems, secure packaging, and transparent supply chain practices is crucial for maintaining market access. Companies such as CF Industries and Orica are emphasizing regulatory compliance and risk management in their operations

- The cost and complexity of meeting regulatory standards can be a barrier for smaller producers and new entrants, impacting overall market competitiveness

- Overcoming these challenges through industry collaboration, adoption of best practices, and ongoing engagement with regulators will be vital for sustained market growth and reputation management

Ammonium Nitrate Market Scope

The market is segmented on the basis of application, product, form, end-user, and application type.

• By Product

On the basis of product, the ammonium nitrate market is segmented into low-density, high-density, and solution. The high-density segment dominates the largest market revenue share in 2024, driven by its extensive use in the mining and construction industries for producing explosives such as ANFO (Ammonium Nitrate Fuel Oil). High-density ammonium nitrate offers excellent stability, higher oxygen balance, and enhanced blasting performance, making it the preferred choice for large-scale mining operations and infrastructure development projects across regions rich in mineral resources. The product’s critical role in facilitating efficient rock fragmentation and reducing overall blasting costs sustains its widespread demand globally.

The low-density segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its rising consumption in agriculture as a nitrogen-based fertilizer. Low-density ammonium nitrate is favored for its high solubility and rapid nutrient release, supporting improved crop yield and soil fertility. Increasing global food demand, coupled with the need for high-efficiency fertilizers, is expected to significantly drive the adoption of low-density ammonium nitrate in both developed and emerging agricultural markets.

• By Form

On the basis of form, the ammonium nitrate market is segmented into dry and liquid. The dry segment accounted for the largest revenue share in 2024, supported by its dominant use in the production of fertilizers and explosives. Dry ammonium nitrate is valued for its ease of handling, storage stability, and versatility across various application sectors, making it a staple component in agricultural and industrial operations worldwide. Its granular or prilled form ensures efficient spreading and mixing, particularly in large-scale agricultural fields and explosive manufacturing plants.

The liquid segment is projected to witness the fastest growth from 2025 to 2032, attributed to its growing application in precision agriculture and controlled fertilizer delivery systems. Liquid ammonium nitrate facilitates uniform application, quick plant absorption, and compatibility with irrigation systems, supporting sustainable farming practices. Rising focus on precision farming and efficient resource management is expected to boost demand for liquid ammonium nitrate among progressive farming communities.

• By Application

On the basis of application, the ammonium nitrate market is segmented into fertilizers, explosives, and others. The fertilizers segment held the largest market revenue share of 61.5% in 2024, driven by the critical role of ammonium nitrate as a high-efficiency nitrogen source that enhances crop productivity. Growing global food security concerns, shrinking arable land, and the push for improved agricultural output are key factors fueling the demand for ammonium nitrate-based fertilizers. Its high nutrient content and rapid action make it particularly suitable for cereals, vegetables, and industrial crops across both developed and emerging regions.

The explosives segment is expected to register the fastest CAGR from 2025 to 2032, driven by robust growth in mining, quarrying, and construction activities worldwide. Ammonium nitrate is a fundamental ingredient in commercial explosives such as ANFO, widely used for blasting operations due to its cost-effectiveness, energy release efficiency, and safety profile. The expanding global infrastructure projects and resource extraction industries, particularly in developing economies, are set to propel demand for ammonium nitrate in explosive applications.

• By End-User

On the basis of end-user, the ammonium nitrate market is segmented into agriculture, mining, defense, and others. The agriculture segment dominated the market revenue share in 2024, underpinned by the extensive use of ammonium nitrate fertilizers to support high-yield farming and meet escalating food production needs. Governments and private sector initiatives promoting agricultural modernization, alongside rising demand for food crops and biofuels, continue to drive substantial consumption of ammonium nitrate across global farming landscapes.

The mining segment is projected to witness the fastest growth from 2025 to 2032, supported by surging mineral exploration, extraction projects, and infrastructure development worldwide. Mining companies favor ammonium nitrate-based explosives for their proven reliability, efficiency in rock blasting, and adaptability across diverse geological conditions. Growing investments in mining operations, particularly in resource-rich regions of Asia-Pacific and Latin America, are expected to significantly boost ammonium nitrate demand in the coming years.

Ammonium Nitrate Market Regional Analysis

- Europe dominated the ammonium nitrate market with the largest revenue share of 43.2% in 2024, driven by the region’s well-established agricultural sector, stringent environmental regulations, and significant demand for high-quality fertilizers

- The widespread application of ammonium nitrate in both agriculture and mining across countries such as France, Germany, and Russia sustains the region’s leading market position

- In addition, Europe’s advanced defense and mining industries utilize ammonium nitrate for explosives, further boosting market demand. Strict regulatory frameworks focusing on controlled and safe ammonium nitrate usage contribute to steady market growth

France Ammonium Nitrate Market Insight

The France ammonium nitrate market is projected to grow steadily in Europe in 2024, supported by the country’s large-scale agricultural production and strong demand for nitrogen-based fertilizers. French farmers heavily rely on ammonium nitrate to enhance soil fertility and improve crop yields, particularly in cereal and vegetable cultivation. Moreover, regulatory compliance regarding fertilizer efficiency and environmental impact drives the adoption of high-quality ammonium nitrate products in the country.

Germany Ammonium Nitrate Market Insight

The Germany ammonium nitrate market is held the largest market share in Europe, driven by the country's advanced industrial base and commitment to sustainable agriculture. German farmers prefer ammonium nitrate for its high nutrient efficiency, while the country’s mining and construction sectors increasingly utilize it for controlled blasting operations. Germany’s focus on eco-friendly, efficient farming practices and technological innovation in fertilizer application supports the continued demand for ammonium nitrate.

North America Ammonium Nitrate Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, fueled by expanding mining activities, defense sector modernization, and increased agricultural productivity initiatives. The growing consumption of ammonium nitrate for explosives in mining and infrastructure projects, particularly in the U.S. and Canada, is a key market driver. Additionally, rising food demand and precision farming practices are boosting fertilizer use, propelling the market’s upward trajectory across North America.

U.S. Ammonium Nitrate Market Insight

The U.S. ammonium nitrate market dominated the North American region in 2024, supported by robust mining operations, defense applications, and extensive use in large-scale agriculture. Ammonium nitrate remains a critical component in commercial explosives for mining and construction industries, with rising infrastructure investments further accelerating demand. The U.S. agricultural sector also relies heavily on ammonium nitrate fertilizers to enhance crop yields, driven by advanced farming technologies and the growing need for food security.

Asia-Pacific Ammonium Nitrate Market Insight

The Asia-Pacific ammonium nitrate market holds significant growth potential, driven by rapid industrialization, expanding agriculture, and mining operations across China, India, and Australia. The region benefits from growing demand for high-efficiency fertilizers to meet food security challenges, alongside increasing mining and construction activities that utilize ammonium nitrate-based explosives. Government initiatives promoting agricultural productivity and infrastructure development are expected to further support market expansion.

China Ammonium Nitrate Market Insight

The China ammonium nitrate market accounted for the largest share in Asia-Pacific in 2024, driven by the country’s strong agricultural output and rapid urban development. Chinese industries utilize ammonium nitrate extensively for both fertilizer and explosive production, supporting growth across agriculture, construction, and mining sectors. The government’s focus on food security, alongside technological advancements in fertilizer efficiency, continues to bolster market demand.

India Ammonium Nitrate Market Insight

The India ammonium nitrate market is poised for notable growth, supported by the country’s large agricultural base and increasing infrastructure projects. Ammonium nitrate fertilizers are widely used to enhance crop productivity, especially in cereal and vegetable cultivation. The growing mining sector and demand for construction explosives further drive ammonium nitrate consumption in India, supported by favorable government policies and economic expansion.

Ammonium Nitrate Market Share

The ammonium nitrate industry is primarily led by well-established companies, including:

- Orica Limited (Australia)

- Incitec Pivot Fertilisers (Australia)

- Neochim Plc. (Bulgaria)

- URALCHEM JSC (Russia)

- CF Industries Holdings, Inc. (U.S.)

- EuroChem Group (Switzerland)

- Austin Powder (U.S.)

- Abu Qir Fertilizers and Chemicals Company (Egypt)

- Yara (Norway)

- ENAEX (Chile)

- OSTCHEM (Ukraine)

- Fertiberia (Spain)

- CSBP Limited (Australia)

- DFPCL (India)

Latest Developments in Global Ammonium Nitrate Market

- In January 2024, Dyno Nobel signed a Memorandum of Understanding (MoU) with Saudi Chemical Company Limited to establish Saudi Arabia’s first technical ammonium nitrate plant. This development is expected to strengthen regional ammonium nitrate production capacity and reduce dependence on imports, thereby enhancing supply chain stability for mining and industrial users in the Middle East. The agreement also enables Dyno Nobel to expand its global supply footprint, boosting market competitiveness and availability of technical ammonium nitrate for international mining sectors

- In November 2023, Acron Group successfully completed industrial trials of its Grade A Ammonium Calcium Nitrate (CN) on greenhouse tomatoes, demonstrating 100% water solubility. This advancement is likely to fuel demand for premium, water-soluble fertilizers that support efficient nutrient delivery and improved crop yields. The innovation aligns with the market's growing preference for high-performance agricultural inputs, contributing to the expansion of the ammonium nitrate market within the controlled-environment agriculture sector

- In September 2023, Fertiberia launched the world’s first low-carbon technical ammonium nitrate (TAN) produced using renewable hydrogen instead of natural gas. This milestone is set to transform the ammonium nitrate industry by promoting environmentally sustainable production methods. The initiative addresses the rising demand for eco-friendly fertilizers and explosives, positioning low-carbon TAN as a critical solution for reducing carbon emissions while meeting global market needs. The signed MoU with Orica to supply this innovative product further supports market growth by accelerating the availability of sustainable TAN solutions

- In July 2023, Yara Clean Ammonia and Bunker Holding entered into a Memorandum of Understanding (MOU) to advance the ammonia market as a shipping fuel, as ammonia is increasingly utilized for environmentally sustainable maritime transportation

- In April 2023, Chambal Fertilisers revealed plans to construct a new 240,000 tonne/year technical ammonium nitrate (TAN) plant at its Gadepan complex in Rajasthan, India. The plant is scheduled to start operating by October 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.