Global Amphibious Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

4.36 Billion

USD

8.29 Billion

2025

2033

USD

4.36 Billion

USD

8.29 Billion

2025

2033

| 2026 –2033 | |

| USD 4.36 Billion | |

| USD 8.29 Billion | |

|

|

|

|

Amphibious Vehicle Market Size

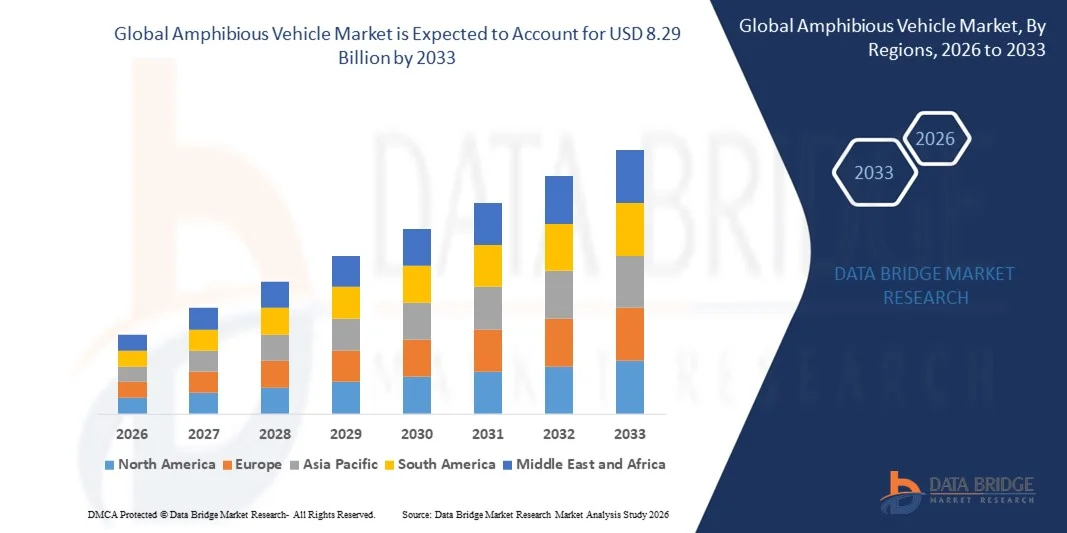

- The global amphibious vehicle market size was valued at USD 4.36 billion in 2025 and is expected to reach USD 8.29 billion by 2033, at a CAGR of 8.35% during the forecast period

- The market growth is largely driven by increasing defense modernization programs and rising investments in multi-terrain mobility solutions, enabling military and civil agencies to operate effectively across land, shallow water, and coastal environments

- Furthermore, the growing frequency of natural disasters, particularly floods and cyclones, is increasing demand for amphibious vehicles in emergency response, rescue, and humanitarian operations. These combined factors are accelerating the adoption of amphibious platforms and significantly supporting overall market growth

Amphibious Vehicle Market Analysis

- Amphibious vehicles, designed to operate seamlessly on both land and water, are becoming essential assets for military forces, disaster management agencies, and construction operators due to their operational flexibility, mobility in inaccessible terrains, and ability to reduce response time

- The expanding application of amphibious vehicles is primarily driven by heightened focus on disaster preparedness, increasing infrastructure and dredging activities in water-rich regions, and continuous advancements in propulsion, armor, and navigation technologies

- North America dominated the amphibious vehicle market with a share of 46.3% in 2025, due to strong defense spending, advanced military modernization programs, and increasing deployment of amphibious platforms for disaster response and flood management

- Asia-Pacific is expected to be the fastest growing region in the amphibious vehicle market during the forecast period due to rapid urbanization, increasing infrastructure development, and rising frequency of natural disasters

- Track-based propulsion segment dominated the market with a market share of 51.8% in 2025, due to its superior traction and stability across challenging terrains such as mud, sand, snow, and shallow water zones. These systems are widely used in military and heavy-duty applications where reliability in extreme environments is critical. Track-based propulsion enables seamless transition between land and water operations, enhancing operational flexibility. Defense forces prefer tracked amphibious vehicles due to their load-bearing capacity and off-road performance. The segment continues to benefit from ongoing investments in military modernization programs. Its proven performance record strengthens long-term adoption across defense and disaster response operations

Report Scope and Amphibious Vehicle Market Segmentation

|

Attributes |

Amphibious Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Amphibious Vehicle Market Trends

Rising Adoption of Advanced and Multi-Terrain Amphibious Platforms

- A prominent trend in the amphibious vehicle market is the rising adoption of advanced platforms capable of seamless operation across land, shallow water, wetlands, and coastal environments, driven by increasing operational complexity in military, disaster response, and infrastructure projects. These vehicles realy on improved propulsion systems, enhanced hull designs, and integrated navigation technologies to deliver higher mobility and reliability across diverse terrains

- For instance, BAE Systems has been advancing its Amphibious Combat Vehicle program for the U.S. Marine Corps, delivering platforms designed for ship-to-shore operations and inland maneuverability under demanding conditions. These developments demonstrate how defense organizations are prioritizing vehicles that can perform effectively across multiple operational environments

- The integration of reinforced armor, remote weapon stations, and digital command systems is becoming more prevalent as military users demand survivability and mission adaptability. This trend is strengthening the role of amphibious vehicles in modern expeditionary warfare and coastal defense strategies

- Civil and commercial applications are also adopting advanced amphibious designs, particularly in flood-prone and wetland regions where conventional vehicles face limitations. Companies such as Hydratrek are deploying amphibious utility vehicles for rescue, agriculture, and infrastructure maintenance tasks

- Technological improvements in propulsion efficiency and load capacity are supporting broader adoption across construction and dredging operations. Amphibious excavators from manufacturers such as Hitachi Construction Machinery are increasingly used for riverbank stabilization and waterway maintenance

- Overall, the shift toward advanced and multi-terrain amphibious platforms reflects growing demand for versatile mobility solutions that can reduce operational downtime and improve access in challenging environments

Amphibious Vehicle Market Dynamics

Driver

Increasing Demand for Rapid Disaster Response and Military Mobility

- The increasing demand for rapid disaster response and enhanced military mobility is a major driver of growth in the amphibious vehicle market, as governments and defense forces prioritize readiness in flood, cyclone, and coastal risk zones. Amphibious vehicles enable quick deployment in areas where damaged infrastructure restricts access for standard transport

- For instance, the U.S. Marine Corps continues to invest in next-generation amphibious platforms through programs led by BAE Systems, reinforcing the importance of mobility during amphibious assaults and humanitarian missions. These vehicles support troop transport, logistics, and evacuation operations under time-critical conditions

- Rising climate-related disasters are prompting disaster management agencies to strengthen their amphibious response capabilities. Countries experiencing frequent flooding are increasingly incorporating amphibious vehicles into emergency fleets to improve rescue efficiency and response time

- Military organizations value amphibious vehicles for their ability to transition seamlessly between sea and land, enhancing strategic flexibility during coastal and riverine operations. This capability is becoming increasingly relevant as geopolitical tensions emphasize expeditionary and littoral warfare readiness

- The growing involvement of armed forces in humanitarian assistance and disaster relief missions further supports demand for amphibious mobility solutions. These combined military and civil requirements continue to reinforce this driver and sustain market growth

Restraint/Challenge

High Development, Procurement, and Maintenance Costs

- The amphibious vehicle market faces significant challenges due to high development, procurement, and maintenance costs associated with designing and operating multi-terrain platforms. These vehicles require specialized materials, advanced propulsion systems, and corrosion-resistant components to ensure performance across land and water environments

- For instance, armored amphibious platforms produced by companies such as Rheinmetall and Iveco Defense Vehicles involve complex engineering processes to meet stringent military protection and performance standards. These requirements increase production costs and extend development timelines

- Maintenance expenses are also elevated due to exposure to water, salt, and harsh operating conditions, which accelerate wear on mechanical and structural components. This places long-term cost pressure on defense forces and civil operators managing fleet lifecycles

- Smaller government agencies and commercial operators often face budget constraints that limit large-scale adoption of amphibious vehicles. High upfront investment can delay procurement decisions despite operational benefits

- The challenge of balancing advanced capability with cost efficiency continues to influence purchasing strategies and market penetration. Manufacturers are under pressure to optimize designs and reduce lifecycle costs while maintaining reliability and performance standards

Amphibious Vehicle Market Scope

The market is segmented on the basis of propulsion type, vehicle type, application, and end use.

- By Propulsion Type

On the basis of propulsion type, the amphibious vehicle market is segmented into track-based propulsion, water jet propulsion, and screw propeller. The track-based propulsion segment dominated the market with the largest share of 51.8% in 2025, supported by its superior traction and stability across challenging terrains such as mud, sand, snow, and shallow water zones. These systems are widely used in military and heavy-duty applications where reliability in extreme environments is critical. Track-based propulsion enables seamless transition between land and water operations, enhancing operational flexibility. Defense forces prefer tracked amphibious vehicles due to their load-bearing capacity and off-road performance. The segment continues to benefit from ongoing investments in military modernization programs. Its proven performance record strengthens long-term adoption across defense and disaster response operations.

The water jet propulsion segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for high-speed and maneuverable amphibious platforms. Water jet systems offer enhanced agility, reduced underwater drag, and improved safety due to the absence of exposed propellers. These features make them suitable for rescue missions, coastal patrol, and commercial transport applications. Increasing use of amphibious vehicles in flood-prone regions supports growth for water jet propulsion. Advancements in propulsion efficiency and noise reduction further boost adoption. Growing emphasis on rapid-response mobility contributes to sustained market expansion.

- By Vehicle Type

On the basis of vehicle type, the amphibious vehicle market is segmented into armored amphibious vehicles, amphibious excavators, light amphibious utility vehicles, and commercial amphibious transport. The armored amphibious vehicles segment accounted for the largest revenue share in 2025, driven by strong demand from defense forces worldwide. These vehicles are essential for troop transport, amphibious assaults, and border security operations. High investment in military-grade protection systems and advanced navigation technologies supports segment dominance. Armored amphibious vehicles offer enhanced survivability and payload capacity. Their integration with modern combat systems strengthens battlefield effectiveness. Ongoing geopolitical tensions continue to support procurement growth.

The amphibious excavators segment is projected to grow at the fastest rate during the forecast period, supported by expanding infrastructure and dredging activities. These vehicles are increasingly used in wetlands, riverbanks, ports, and coastal construction projects. Their ability to operate efficiently on land and in shallow water reduces project downtime. Governments are investing in flood control and waterway maintenance, boosting demand. Technological improvements in hydraulic systems enhance operational efficiency. Rising environmental restoration projects further accelerate segment growth.

- By Application

On the basis of application, the amphibious vehicle market is segmented into military combat & troop transport, disaster response & humanitarian aid, construction & dredging, and commercial & recreational transport. The military combat & troop transport segment dominated the market in 2025, driven by sustained defense spending and strategic emphasis on amphibious warfare capabilities. Amphibious vehicles enable rapid deployment across coastal and riverine environments. Their role in logistical support and tactical mobility strengthens military readiness. Integration with advanced communication and weapon systems enhances mission effectiveness. Defense modernization initiatives across multiple regions support continued dominance. Long-term defense contracts ensure stable revenue generation.

The disaster response & humanitarian aid segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing frequency of floods, cyclones, and natural disasters. Amphibious vehicles play a critical role in rescue operations where conventional vehicles cannot operate. Governments and relief agencies rely on these vehicles for evacuation and supply distribution. Climate change impacts intensify the need for rapid-response mobility solutions. Enhanced vehicle designs focused on safety and capacity support adoption. Rising investment in emergency preparedness accelerates segment expansion.

- By End Use

On the basis of end use, the amphibious vehicle market is segmented into defense forces, disaster management agencies, construction & dredging contractors, tourism & transport operators, and government municipalities. The defense forces segment held the largest market share in 2025, driven by continuous procurement of amphibious platforms for strategic and tactical operations. Amphibious vehicles provide critical mobility advantages in coastal and riverine combat scenarios. High defense budgets support acquisition of technologically advanced vehicles. Long service life and upgrade potential strengthen return on investment. Ongoing geopolitical uncertainties reinforce sustained demand. Defense-focused research and development further supports segment leadership.

The disaster management agencies segment is anticipated to grow at the fastest rate during the forecast period, supported by increasing government focus on disaster preparedness and response infrastructure. Amphibious vehicles are essential for emergency access in flooded and inaccessible regions. Public safety agencies are expanding their vehicle fleets to improve response times. Urban flooding risks drive demand at municipal levels. International funding for disaster resilience programs supports procurement. Growing awareness of climate-related risks accelerates long-term adoption.

Amphibious Vehicle Market Regional Analysis

- North America dominated the amphibious vehicle market with the largest revenue share of 46.3% in 2025, driven by strong defense spending, advanced military modernization programs, and increasing deployment of amphibious platforms for disaster response and flood management

- The region places high importance on multi-terrain mobility solutions capable of operating across land, shallow waters, and coastal zones, particularly for defense forces and emergency services

- This dominance is further supported by well-established defense contractors, robust research and development capabilities, and growing investments by government agencies in disaster preparedness and resilient infrastructure, positioning amphibious vehicles as critical assets across military and civil applications

U.S. Amphibious Vehicle Market Insight

The U.S. amphibious vehicle market captured the largest revenue share within North America in 2025, fueled by sustained investments in defense and homeland security. The U.S. military continues to prioritize amphibious assault and transport vehicles to strengthen coastal and expeditionary capabilities. Increasing use of amphibious platforms by federal and state agencies for flood rescue and emergency logistics further supports demand. The presence of leading manufacturers and continuous technological upgrades in propulsion, armor, and navigation systems significantly contribute to market growth.

Europe Amphibious Vehicle Market Insight

The Europe amphibious vehicle market is projected to expand at a steady CAGR during the forecast period, primarily driven by rising focus on border security, coastal surveillance, and disaster management. Increasing flooding incidents across several European countries are encouraging governments to invest in amphibious rescue and transport solutions. The region also benefits from strong adoption of amphibious excavators for dredging and waterway maintenance. Ongoing investments in infrastructure modernization and environmental protection projects are supporting wider deployment of amphibious vehicles across civil and defense sectors.

U.K. Amphibious Vehicle Market Insight

The U.K. amphibious vehicle market is anticipated to grow at a notable CAGR during the forecast period, driven by defense modernization initiatives and heightened focus on flood risk management. Amphibious vehicles are increasingly used by emergency services for rescue operations in flood-prone regions. The country’s emphasis on rapid-response mobility and coastal defense capabilities supports adoption within military applications. Continued government funding for disaster resilience and infrastructure protection is expected to further stimulate market growth.

Germany Amphibious Vehicle Market Insight

The Germany amphibious vehicle market is expected to grow at a considerable CAGR, supported by strong demand for technologically advanced engineering solutions. Germany’s focus on infrastructure development, inland waterway maintenance, and environmental restoration drives adoption of amphibious excavators and utility vehicles. The country’s well-developed industrial base and emphasis on efficiency and sustainability promote innovation in amphibious vehicle design. Increasing involvement of government and municipal authorities in flood prevention projects further strengthens market expansion.

Asia-Pacific Amphibious Vehicle Market Insight

The Asia-Pacific amphibious vehicle market is expected to register the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing infrastructure development, and rising frequency of natural disasters. Governments across the region are investing heavily in disaster response capabilities, particularly in flood- and cyclone-prone areas. Expanding defense budgets and border security initiatives are also supporting demand for armored amphibious vehicles. The growing construction and dredging activities across coastal and riverine regions further accelerate market growth.

Japan Amphibious Vehicle Market Insight

The Japan amphibious vehicle market is gaining traction due to the country’s vulnerability to floods, tsunamis, and other natural disasters. Amphibious vehicles play a critical role in emergency response, evacuation, and infrastructure recovery operations. Japan’s strong focus on technological innovation supports the development of advanced, compact, and efficient amphibious platforms. Increasing deployment by disaster management agencies and local municipalities is contributing to steady market growth.

China Amphibious Vehicle Market Insight

The China amphibious vehicle market accounted for the largest revenue share in Asia-Pacific in 2025, driven by large-scale infrastructure projects, expanding defense capabilities, and significant investments in disaster management. Rapid urbanization and frequent flooding events are increasing the need for amphibious transport and rescue vehicles. China’s strong domestic manufacturing base enables cost-effective production and widespread deployment of amphibious platforms. Government-led initiatives focused on flood control, waterway development, and military modernization continue to propel market expansion.

Amphibious Vehicle Market Share

The amphibious vehicle industry is primarily led by well-established companies, including:

- BAE Systems plc (U.K.)

- General Dynamics Corporation (U.S.)

- Rheinmetall AG (Germany)

- Hanwha Aerospace (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- EIK Engineering Sdn. Bhd. (Malaysia)

- Wetland Equipment Company (U.S.)

- Wilco Manufacturing L.L.C. (U.S.)

- Griffon Hoverwork Ltd. (GHL) (U.K.)

- Iveco Defense Vehicles (Italy)

- Science Applications International Corporation (SAIC) (U.S.)

- Hydratrek, Inc. (U.S.)

- Marsh Buggies Incorporated (U.S.)

Latest Developments in Global Amphibious Vehicle Market

- In April 2025, BAE Systems strengthened its position in the amphibious vehicle market after securing a USD 188.5 million contract from the U.S. Marine Corps for 30 ACV-30mm vehicles, including spares and fielding support. This contract reinforces sustained demand for advanced amphibious combat platforms capable of ship-to-shore and complex land operations. The inclusion of a 30mm remote turret reflects increasing market emphasis on enhanced firepower and survivability. Such large-scale defense orders support long-term revenue stability and encourage continued technological advancement across the amphibious combat vehicle segment

- In February 2025, BAE Systems expanded its global market footprint by showcasing its Amphibious Combat Vehicle at the IDEX defense exhibition in the UAE. This move highlights the growing focus on international expansion and export-oriented growth within the amphibious vehicle market. The ACV’s ability to operate across rugged terrain and open-ocean environments aligns with rising demand from allied militaries for flexible, multi-mission platforms. Increased international exposure is expected to strengthen competitive positioning and drive future contract opportunities

- In April 2024, Metal Shark Boats contributed to market innovation by launching a 30-foot autonomous amphibious surface vehicle tailored to U.S. Navy and Marine Corps requirements. The combination of semi-submersible capability, amphibious navigation, and autonomous operation reflects a broader shift toward unmanned and hybrid solutions in the market. High speed, extended range, and simplified launch and recovery improve operational efficiency. This development signals growing interest in autonomous amphibious systems for surveillance, logistics, and tactical missions

- In March 2023, BAE Systems reinforced its market presence after receiving a production contract from the U.S. Marine Corps covering Amphibious Combat Vehicle Personnel and Command variants. The contract implemented existing procurement options valued at USD 145.3 million for more than 25 ACV-P units and USD 111.5 million for over 15 ACV-C units. This award highlights continued fleet expansion and modernization efforts by the Marine Corps. Sustained procurement of multiple ACV variants strengthens demand visibility and supports scalable production within the amphibious vehicle market

- In January 2023, Iveco Defence Vehicles strengthened the European amphibious vehicle market by signing a contract with the Italian Navy to supply 36 Amphibious Armoured Vehicles based on the SUPERAV 8×8 platform. The agreement supports fleet reinforcement and enhances national sea projection capabilities for the San Marco Marine Brigade. Advanced protection systems, remote turrets, and strong maritime performance underscore growing demand for high-end armored amphibious platforms. This development reflects consistent defense investment and long-term growth potential in the amphibious armored vehicle segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.