Global Amplitude Electro Optic Modulators Market

Market Size in USD Billion

CAGR :

%

USD

28.02 Billion

USD

64.10 Billion

2024

2032

USD

28.02 Billion

USD

64.10 Billion

2024

2032

| 2025 –2032 | |

| USD 28.02 Billion | |

| USD 64.10 Billion | |

|

|

|

|

Global Amplitude Electro Optic Modulators Market Size

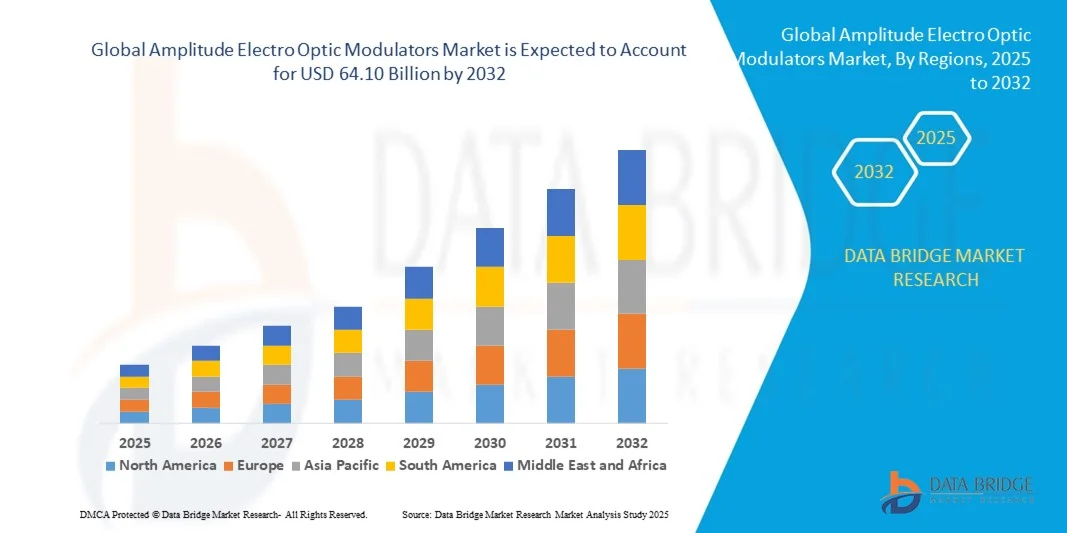

- The global Amplitude Electro Optic Modulators Market size was valued at USD 28.02 billion in 2024 and is projected to reach USD 64.10 billion by 2032, growing at a CAGR of 10.90% during the forecast period.

- The market expansion is primarily driven by rising demand for high-speed data transmission and advanced optical communication systems, particularly within telecommunications, data centers, and aerospace sectors.

- Moreover, the push for miniaturization and integration of photonic devices in next-gen communication networks is spurring innovation and adoption, significantly accelerating the market’s growth trajectory globally.

Global Amplitude Electro Optic Modulators Market Analysis

- Amplitude electro optic modulators, which manipulate the amplitude of light waves through an electric signal, are increasingly critical in modern optical communication systems due to their high-speed performance, low power consumption, and precision in signal modulation for data transmission across telecommunications and defense sectors.

- The rising demand for amplitude electro optic modulators is primarily driven by the rapid expansion of data centers, the rollout of 5G networks, and the growing need for high-bandwidth communication technologies in industries such as aerospace, healthcare, and research.

- North America dominated the Global Amplitude Electro Optic Modulators Market with the largest revenue share of 32.2% in 2024, attributed to strong investments in photonics research, the presence of leading optical component manufacturers, and significant adoption in telecom infrastructure, particularly in the U.S. where technological innovation and government-backed R&D initiatives are boosting market penetration.

- Asia-Pacific is expected to be the fastest growing region in the Global Amplitude Electro Optic Modulators Market during the forecast period due to rapid industrialization, increasing demand for high-speed internet, and growing investments in fiber-optic communication infrastructure.

- The amplitude segment dominated the market with the largest revenue share of 31.8% in 2024, driven by its critical role in optical communication systems, where modulating light intensity is essential for high-speed data transmission.

Report Scope and Global Amplitude Electro Optic Modulators Market Segmentation

|

Attributes |

Amplitude Electro Optic Modulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global Amplitude Electro Optic Modulators Market Trends

Enhanced Performance Through AI-Driven Signal Optimization

- A significant and accelerating trend in the global Amplitude Electro Optic Modulators Market is the integration of artificial intelligence (AI) for advanced signal optimization, system calibration, and real-time data processing across high-speed optical communication networks. This synergy is redefining performance standards in fields such as telecommunications, defense, and quantum computing.

- For Instance, AI-enabled modulation systems can dynamically adjust signal parameters to reduce noise, correct phase distortions, and enhance overall bandwidth efficiency. Leading companies are developing modulators that incorporate machine learning algorithms to optimize electro-optic performance in rapidly changing network environments.

- AI integration in electro optic modulators enables predictive maintenance and adaptive modulation schemes, improving device reliability and lifespan. By analyzing operational data, AI systems can forecast potential performance degradation and auto-tune the modulators for maximum efficiency. This is especially useful in large-scale telecom infrastructure and data centers where precision and uptime are critical.

- The combination of electro-optic technology with AI also allows for faster configuration of modulators in complex photonic systems. In applications like LiDAR, defense communications, and aerospace instrumentation, AI helps streamline calibration processes and minimize manual intervention, resulting in faster deployment and reduced error rates.

- This trend toward intelligent, self-optimizing photonic components is pushing manufacturers to innovate in hybrid systems that blend optical hardware with software intelligence. Companies such as Lightwave Logic and Gooch & Housego are investing in AI-enhanced modulation platforms to offer smarter, more adaptive solutions for next-generation optical networks.

- The demand for AI-integrated electro optic modulators is growing rapidly across various industries, as organizations seek enhanced performance, reduced latency, and smarter automation in their optical communication and sensing systems.

Global Amplitude Electro Optic Modulators Market Dynamics

Driver

Growing Demand Driven by High-Speed Data Needs and Optical Network Expansion

-

The rising global demand for high-speed internet, cloud computing, and bandwidth-intensive applications is a major factor propelling the growth of the Amplitude Electro Optic Modulators Market. These modulators play a critical role in enabling efficient signal transmission in fiber-optic communication systems.

- For instance, with the rapid rollout of 5G networks and the ongoing expansion of data centers, telecom providers and hyperscale cloud companies are increasingly investing in high-performance photonic components to handle greater data volumes at faster speeds. Amplitude electro optic modulators are essential in achieving low-latency, high-fidelity data transmission in such environments.

- The need for scalable and energy-efficient optical communication infrastructure is also increasing in industries such as aerospace, defense, and medical imaging. These sectors rely on the precision and speed offered by electro optic modulators for applications ranging from satellite communications to high-resolution diagnostics.

- Furthermore, global government initiatives promoting digital transformation and investments in national fiber-optic infrastructure—especially in emerging markets—are accelerating adoption. In countries across Asia-Pacific and Latin America, enhanced broadband infrastructure is creating significant demand for advanced optical modulation technologies.

- The growing shift toward integrated photonics and miniaturized optical systems is driving innovation in modulator design, with manufacturers focusing on compact, low-power, and high-speed devices compatible with next-generation optical platforms. As a result, companies such as Lumentum and Fujitsu Optical Components are expanding their product portfolios to meet this surging demand across a variety of commercial and industrial applications.

Restraint/Challenge

High Complexity and Cost of Advanced Photonic Integration

- Despite the market’s growth potential, the high complexity involved in the design, fabrication, and integration of amplitude electro optic modulators presents a significant challenge. These components require advanced materials, such as lithium niobate or indium phosphide, and precision manufacturing processes, which increase production costs.

- For instance, the transition toward integrated photonics requires a high level of technical expertise and infrastructure investment, which can be a barrier for smaller players or new entrants in the market. This challenge is particularly relevant in regions with limited access to specialized fabrication facilities.

- Additionally, modulator performance is highly sensitive to environmental conditions such as temperature and vibration, necessitating costly packaging solutions and stringent quality control. This further contributes to higher initial costs for end users, particularly in applications where long-term reliability is critical, such as aerospace and defense.

- The adoption of these advanced modulators is also constrained by the limited availability of skilled personnel capable of designing and maintaining complex optical systems. While larger companies may have in-house R&D capabilities, smaller firms often face technical limitations in deploying such technology effectively.

- Addressing these barriers will require industry-wide efforts, including investment in education and training, development of cost-effective manufacturing methods, and the creation of standardized platforms for easier integration. Continued innovation aimed at simplifying device architecture and lowering costs will be essential for driving broader adoption in the global market.

Global Amplitude Electro Optic Modulators Market Scope

Amplitude electro optic modulators market is segmented on the basis of type, application, and sales channel.

- By Type

On the basis of type, the Global Amplitude Electro Optic Modulators Market is segmented into polarization, amplitude, phase, analog, liquid crystal, free space, travelling wave, and thermally compensated modulators. The amplitude segment dominated the market with the largest revenue share of 31.8% in 2024, driven by its critical role in optical communication systems, where modulating light intensity is essential for high-speed data transmission. Amplitude modulators are widely used in telecom networks, research laboratories, and aerospace communication systems due to their accuracy and compatibility with fiber-optic setups.

The travelling wave segment is anticipated to witness the fastest growth from 2025 to 2032, owing to its superior performance in broadband applications and high-frequency operations. These modulators offer low insertion loss and are ideal for next-generation high-capacity communication systems, including 5G networks and LiDAR systems. The rising demand for ultra-fast modulation across long-distance communication infrastructures is driving adoption of travelling wave technologies.

- By Application

On the basis of application, the market is segmented into fiber optic sensors, space & defence, and industrial systems. The fiber optic sensors segment held the largest market revenue share of 39.6% in 2024, owing to its broad use in structural health monitoring, oil & gas exploration, and environmental sensing. Amplitude electro optic modulators are essential in these systems to convert physical changes into modulated optical signals with high precision. Their stability, responsiveness, and immunity to electromagnetic interference make them ideal for these demanding environments.

The space & defence segment is expected to witness the fastest CAGR during the forecast period. Increased government spending on space exploration and military-grade communication systems is fueling demand for high-performance optical modulators. These applications require rugged, miniaturized, and thermally stable components that can operate reliably under extreme conditions. Continued investments in satellite communication, directed energy weapons, and secure data transmission are accelerating the adoption in this sector.

- By Sales Channel

On the basis of sales channel, the market is bifurcated into direct channel and distribution channel. The direct channel segment dominated the market with the largest revenue share of 57.4% in 2024, largely due to the complex and specialized nature of amplitude electro optic modulators, which often require customization and technical consultation. OEMs and industrial users frequently prefer purchasing directly from manufacturers to ensure performance specifications and product compatibility are met, especially in mission-critical applications such as defense and aerospace.

The distribution channel is projected to be the fastest growing segment from 2025 to 2032, driven by the increasing global demand from smaller research institutions, regional telecom operators, and academic facilities. Distributors enable broader market reach by offering ready availability, localized support, and access to various brands under one roof. The rise of e-commerce and technical distributors specializing in photonics and electronics is also contributing to the rapid growth of this channel.

Global Amplitude Electro Optic Modulators Market Regional Analysis

- North America dominated the Global Amplitude Electro Optic Modulators Market with the largest revenue share of 32.2% in 2024, driven by robust investments in telecommunications infrastructure, advanced research activities, and early adoption of cutting-edge photonic technologies.

- The region’s strong presence of key industry players, extensive R&D capabilities, and supportive government initiatives for digital transformation have accelerated the deployment of high-performance optical communication systems utilizing amplitude electro optic modulators.

- Additionally, North America’s demand is fueled by growing applications across data centers, aerospace, and defense sectors, where high-speed, reliable optical modulation is critical. The availability of skilled technical workforce and advanced manufacturing facilities further strengthen the region’s market dominance.

U.S. Amplitude Electro Optic Modulators Market Insight

The U.S. amplitude electro optic modulators market captured the largest revenue share of 81% in North America in 2024, driven by extensive deployment in telecommunications, data centers, and defense applications. The country’s strong emphasis on next-generation communication infrastructure, including 5G networks and high-capacity optical fiber systems, fuels demand for advanced modulators. Additionally, the presence of major technology companies and robust R&D activities accelerates innovation and adoption. Government initiatives supporting photonics and quantum technology development further bolster market growth.

Europe Amplitude Electro Optic Modulators Market Insight

The Europe amplitude electro optic modulators market is projected to expand at a substantial CAGR over the forecast period, primarily driven by increasing investments in fiber-optic communication networks and rising applications in aerospace and defense sectors. Stringent quality standards and regulatory frameworks ensure the adoption of high-performance, reliable optical components. Growing urbanization and digitalization across the region, alongside strong industrial automation trends, contribute to the rising demand for modulators in commercial and industrial systems.

U.K. Amplitude Electro Optic Modulators Market Insight

The U.K. market for amplitude electro optic modulators is expected to grow at a noteworthy CAGR during the forecast period, supported by the country’s drive towards smart infrastructure and digital communication upgrades. The increasing demand for high-speed data transfer in both public and private sectors, coupled with advancements in photonic research at leading universities, promotes market expansion. The U.K.’s robust technology ecosystem and government incentives for innovation encourage adoption in telecommunications and space applications.

Germany Amplitude Electro Optic Modulators Market Insight

Germany’s amplitude electro optic modulators market is anticipated to grow significantly, driven by the country’s strong industrial base and focus on technological innovation. The emphasis on Industry 4.0 and automation in manufacturing sectors fuels demand for high-precision optical modulators used in sensing and communication. Germany’s commitment to sustainable technologies and energy efficiency also propels adoption of modulators that support low-power and high-speed optical networks, particularly in commercial and defense applications.

Asia-Pacific Amplitude Electro Optic Modulators Market Insight

The Asia-Pacific market is poised to record the fastest CAGR of 24% during 2025 to 2032, fueled by rapid urbanization, expanding telecom infrastructure, and increasing investments in smart city projects. Countries such as China, Japan, and India are major contributors due to their growing digital economies and rising demand for high-speed data transmission technologies. The region is also becoming a manufacturing hub for photonic components, making amplitude electro optic modulators more accessible and affordable across diverse applications including fiber optic sensors and industrial systems.

Japan Amplitude Electro Optic Modulators Market Insight

Japan’s market growth is driven by its advanced technology landscape, emphasis on R&D, and increasing use of optical modulators in communications, medical devices, and aerospace sectors. The country’s aging population and focus on automation heighten demand for precision sensing and data transfer solutions. Integration with IoT and AI technologies further propels the need for reliable and high-speed modulation devices, enabling Japan to maintain its competitive edge in the global photonics market.

China Amplitude Electro Optic Modulators Market Insight

China accounted for the largest revenue share in the Asia-Pacific amplitude electro optic modulators market in 2024, driven by expansive investments in telecommunications infrastructure and smart city initiatives. The rising middle class and surge in digital services fuel demand for high-capacity optical networks requiring advanced modulators. Domestic manufacturers’ increasing capabilities and government support for innovation accelerate market penetration across residential, commercial, and industrial applications. The country’s growing export of photonic components also positions it as a key global player.

Global Amplitude Electro Optic Modulators Market Share

The Amplitude Electro Optic Modulators industry is primarily led by well-established companies, including:

• Thorlabs, Inc. (U.S.)

• Lumentum Holdings Inc. (U.S.)

• AA Opto-Electronic (France)

• Fujitsu Optical Components Limited (Japan)

• Gooch & Housego PLC (U.K.)

• Lightwave Logic, Inc. (U.S.)

• Hamamatsu Photonics K.K. (Japan)

• APE GmbH (Germany)

• Versawave Technologies Inc. (U.S.)

• L3 Harris Technologies Inc. (U.S.)

• AMS Technologies AG (Germany)

• Photon Laseroptik GmbH (Germany)

• Conoptics Inc. (U.S.)

• Qubig GmbH (Germany)

• Gleam Optics (U.S.)

• Brimrose Corporation of America (U.S.)

• Inrad Optics Inc. (U.S.)

• Fast Pulse Technology (Netherlands)

• Newport Corporation (U.S.)

What are the Recent Developments in Global Amplitude Electro Optic Modulators Market?

- In April 2023, Thorlabs Inc., a global leader in photonics technology, announced the launch of a new series of high-performance amplitude electro optic modulators tailored for fiber optic communication systems. This initiative reflects Thorlabs’ commitment to advancing optical modulation technology by offering modulators with improved speed, efficiency, and reliability. By addressing critical needs in telecommunications and data center applications, Thorlabs aims to strengthen its position in the expanding global amplitude electro optic modulators market.

- In March 2023, Lumentum Holdings Inc., a key player in optical and photonic products, introduced its next-generation amplitude electro optic modulators designed specifically for 5G and data center networks. The new modulators offer enhanced bandwidth and low insertion loss, providing significant improvements in signal integrity. This product launch demonstrates Lumentum’s focus on innovation and its role in enabling the global transition to faster, more reliable optical networks, driving growth in the amplitude electro optic modulators market.

- In March 2023, Hamamatsu Photonics K.K. successfully implemented advanced amplitude electro optic modulator technology in a space communication project aimed at improving data transmission efficiency in satellite systems. This initiative highlights Hamamatsu’s dedication to pioneering photonic solutions in high-demand applications such as aerospace and defense. The project underscores the growing importance of modulators in emerging sectors, contributing to the company’s expanding influence in the global amplitude electro optic modulators market.

- In February 2023, Gooch & Housego PLC, a leading supplier of photonics components, announced a strategic collaboration with a major fiber optic sensor manufacturer to develop customized amplitude electro optic modulators for industrial sensing applications. This partnership is designed to enhance sensor accuracy and reliability in harsh environments, addressing critical industry needs. Gooch & Housego’s effort emphasizes its commitment to innovation and market expansion within the industrial systems segment of the global amplitude electro optic modulators market.

- In January 2023, Fujitsu Optical Components Limited unveiled its latest line of thermally compensated amplitude electro optic modulators at the International Photonics Expo 2023. Equipped with advanced temperature stabilization features, these modulators deliver consistent performance under varying environmental conditions. Fujitsu’s product launch reinforces its dedication to providing robust, high-quality modulators that meet the evolving demands of telecommunications and defense sectors, thereby strengthening its foothold in the global amplitude electro optic modulators market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Amplitude Electro Optic Modulators Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Amplitude Electro Optic Modulators Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Amplitude Electro Optic Modulators Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.