Global Anaesthesia Machine Market

Market Size in USD Billion

CAGR :

%

USD

13.46 Billion

USD

25.26 Billion

2024

2032

USD

13.46 Billion

USD

25.26 Billion

2024

2032

| 2025 –2032 | |

| USD 13.46 Billion | |

| USD 25.26 Billion | |

|

|

|

|

Anaesthesia Machine Market Size

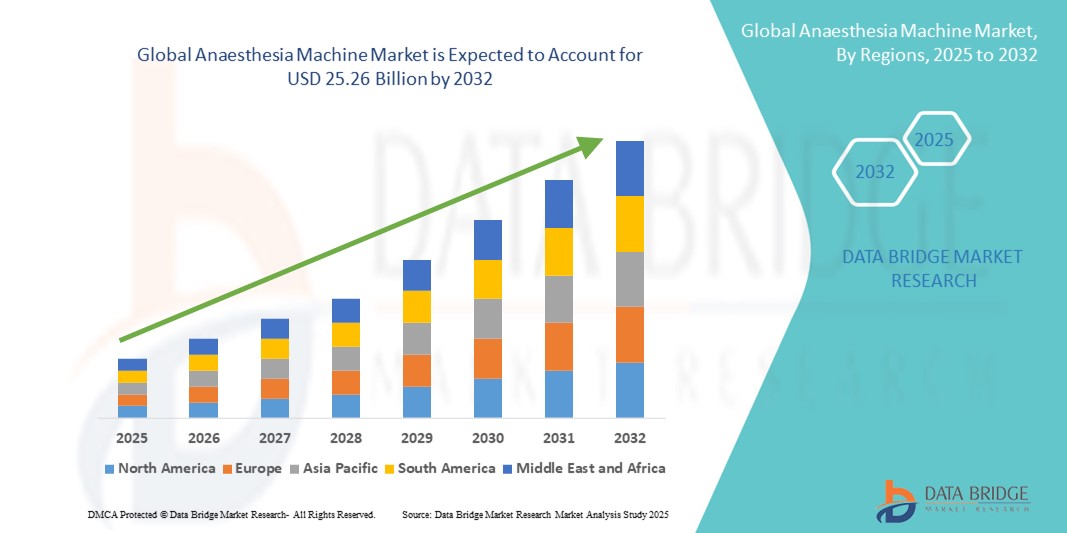

- The global anaesthesia machine market size was valued at USD 13.46 billion in 2024 and is expected to reach USD 25.26 billion by 2032, at a CAGR of 8.19% during the forecast period

- The market growth is largely fueled by the increasing number of surgical procedures worldwide, rising hospital infrastructure investments, and the ongoing advancements in anaesthesia delivery systems and monitoring technologies

- Furthermore, growing emphasis on patient safety, efficiency in operating rooms, and the integration of smart and automated features in anaesthesia machines are driving healthcare providers to adopt advanced anaesthesia solutions. These converging factors are accelerating the adoption of anaesthesia machines, thereby significantly boosting the industry's growth

Anaesthesia Machine Market Analysis

- Anaesthesia machines, providing controlled delivery of anaesthetic gases and vapours during surgical procedures, are increasingly essential in modern operating rooms across hospitals and ambulatory surgical centers due to their precision, patient safety features, and integration with advanced monitoring systems

- The rising demand for anaesthesia machines is primarily driven by the increasing number of surgeries worldwide, growing hospital infrastructure investments, and heightened focus on patient safety and operational efficiency in perioperative care

- North America dominated the anaesthesia machine market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high adoption of technologically sophisticated devices, and the presence of leading global manufacturers, with the U.S. witnessing substantial growth in surgical procedures and operating room upgrades incorporating automated and smart anaesthesia solutions

- Asia-Pacific is expected to be the fastest-growing region in the anaesthesia machine market during the forecast period due to rising healthcare expenditure, increasing number of hospitals and surgical centers, and improving access to modern medical technologies

- Stand-Alone anaesthesia machines dominated the anaesthesia machine market with a share of 46.1% in 2024, driven by their established reliability, comprehensive monitoring capabilities, and suitability for a wide range of surgical procedures in hospital settings

Report Scope and Anaesthesia Machine Market Segmentation

|

Attributes |

Anaesthesia Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anaesthesia Machine Market Trends

Integration of Advanced Monitoring and Automation Systems

- A significant and accelerating trend in the global anaesthesia machine market is the integration of advanced patient monitoring technologies and automated delivery systems, enhancing precision, patient safety, and operational efficiency in surgical procedures

- For instance, modern anaesthesia machines such as GE Healthcare’s Aisys CS^2 integrate automated ventilators and advanced gas monitoring, allowing anaesthesiologists to manage multiple parameters seamlessly. Similarly, Dräger’s Perseus A500 features automated workflow assistance and real-time data display, improving intraoperative decision-making

- Automation and AI-enabled features in anaesthesia machines enable real-time adjustments based on patient vitals, predictive alerts for potential complications, and improved efficiency in operating rooms. Some models also incorporate closed-loop ventilation and adaptive anaesthetic delivery systems to optimize dosing and reduce human error

- The seamless integration of anaesthesia machines with hospital information systems and perioperative management platforms facilitates centralized monitoring of patient vitals, surgical workflow, and equipment performance, creating a more cohesive and safe surgical environment

- This trend towards intelligent, automated, and interconnected anaesthesia systems is reshaping user expectations for operating room technology. Companies such as Mindray and Dräger are developing machines with smart monitoring features, automated dosing, and integration capabilities with electronic health records

- The demand for anaesthesia machines offering advanced monitoring, automation, and interoperability is growing rapidly across hospitals and surgical centers, as healthcare providers increasingly prioritize patient safety, efficiency, and data-driven perioperative management

Anaesthesia Machine Market Dynamics

Driver

Rising Surgical Procedures and Focus on Patient Safety

- The increasing number of surgeries worldwide, coupled with a growing emphasis on patient safety and operational efficiency, is a key driver for the heightened demand for anaesthesia machines

- For instance, in March 2024, GE Healthcare announced enhancements in its Aisys CS^2 anaesthesia platform, incorporating advanced ventilation monitoring and automated safety alerts, reflecting the industry focus on safer and more efficient perioperative care

- As hospitals and surgical centers expand their capacity, anaesthesia machines provide precise control of anaesthetic delivery, real-time monitoring, and integrated safety features, offering a significant advantage over older manual systems

- Furthermore, the growing trend of minimally invasive and complex surgeries necessitates machines with advanced monitoring, automated workflows, and integration with other surgical equipment

- The need for reliable, user-friendly, and technologically advanced anaesthesia machines in both established and emerging markets continues to drive adoption, with healthcare facilities seeking solutions that optimize patient outcomes and operating room efficiency

Restraint/Challenge

High Costs and Regulatory Compliance Barriers

- The relatively high initial investment required for advanced anaesthesia machines, coupled with ongoing maintenance costs, poses a challenge for market expansion, particularly in developing countries or smaller healthcare facilities

- For instance, delays in obtaining regulatory clearances for AI-enabled or automated anaesthesia machines can slow adoption, even when the technology offers enhanced patient safety and operational efficiency

- In addition, stringent regulatory requirements for medical devices, including approvals from agencies such as the FDA, CE, and ISO certification standards, can delay product launches and limit market entry for newer manufacturers

- Addressing cost constraints through tiered product offerings, leasing models, and training programs, alongside ensuring regulatory compliance, is crucial for driving broader adoption

- Manufacturers such as Dräger and Mindray emphasize compliance with international standards and provide after-sales support and training to overcome these barriers and build trust among healthcare providers

- Overcoming cost and regulatory challenges while continuing to innovate will be vital for sustained growth in the global anaesthesia machine market

Anaesthesia Machine Market Scope

The market is segmented on the basis of type, form, indications, subject, components, and end users.

- By Type

On the basis of type, the anaesthesia machine market is segmented into continuous anaesthesia machines, intermittent anaesthesia machines, and others. The continuous anaesthesia machines segment dominated the market with the largest revenue share of 46.5% in 2024. These machines are preferred in hospitals and surgical centers due to their ability to provide uninterrupted delivery of anaesthetic gases during complex and long-duration procedures, including neurosurgeries, cardiovascular surgeries, and organ transplants. Continuous machines ensure precise control of gas concentration, patient ventilation, and automated safety alarms, which are critical in high-risk surgeries. Their integration with advanced monitoring systems allows real-time tracking of patient vitals and anesthetic levels, reducing the risk of complications.

The intermittent anaesthesia machines segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing number of outpatient procedures, ambulatory surgeries, and emergency interventions. These machines are portable, cost-effective, and easy to operate, making them suitable for remote healthcare settings, mobile clinics, and field hospitals, where continuous monitoring is less feasible.

- By Form

On the basis of form, the anaesthesia machine market is segmented into portable anaesthesia machines and stand-alone anaesthesia machines. The stand-alone anaesthesia machines segment held the largest market revenue share of 46.1% in 2024 due to their comprehensive features and suitability for high-volume hospital operating rooms. These machines integrate multiple systems such as ventilators, vaporizers, and monitors, providing robust patient safety and continuous anaesthetic delivery. They are preferred for long-duration and complex surgeries that require advanced ventilation support and automated monitoring. Hospitals invest in these systems for their durability, modular design, and integration with hospital IT networks, ensuring seamless data collection and operational efficiency.

Portable anaesthesia machines are expected to witness the fastest CAGR from 2025 to 2032 because of growing demand in emergency care, ambulatory centers, veterinary surgeries, and remote field operations. Their lightweight, compact design allows rapid deployment, while their ease of operation ensures safe and accurate anaesthesia delivery in resource-limited or mobile healthcare environments. Portable machines are increasingly used in mobile surgical units, disaster relief operations, and veterinary applications, highlighting their versatility and importance.

- By Indications

On the basis of indications, the anaesthesia machine market is segmented into nervous system surgeries, eye, ear, and nasal surgeries, respiratory system surgeries, cardiovascular system surgeries, digestive system surgeries, urinary system surgeries, musculoskeletal system surgeries, skin system surgeries, and others. Nervous system surgeries dominated the market in 2024 due to the critical need for precise anaesthetic management, continuous monitoring, and ventilatory support during complex neurosurgical procedures. Cardiovascular and respiratory surgeries are expected to witness strong growth because of the increasing prevalence of heart and lung disorders and the complexity of associated interventions, which require advanced ventilation and safety monitoring. Eye, ear, nasal, digestive, urinary, musculoskeletal, and skin surgeries show moderate growth, particularly in outpatient and minimally invasive procedures, where compact and specialized anaesthesia machines are preferred.

The “others” category, which includes gynecological, obstetric, and pediatric surgeries, is gaining significant traction during the forecast period. This growth is largely driven by the increased use of portable and semi-automated anaesthesia machines in these specialized procedures. Hospitals and outpatient centers are adopting these machines to ensure precision, safety, and efficiency in surgeries that require careful anaesthetic management. The rise in surgical volumes across all specialties is creating sustained demand for versatile anaesthesia solutions. Additionally, ongoing hospital infrastructure development and expansion of surgical facilities support the adoption of advanced machines.

- By Subject

On the basis of subject, the market is segmented into human and veterinary applications. The human segment accounted for the largest revenue share in 2024 due to expanding hospital infrastructure, rising surgical volumes, and technological advancements in perioperative care. Hospitals, specialty clinics, and surgical centers prefer machines with automated monitoring, integrated ventilatory support, and safety alarms, ensuring patient safety during complex procedures.

The veterinary segment is projected to grow rapidly from 2025 to 2032, driven by rising pet ownership, expansion of veterinary healthcare services, and adoption of advanced surgical procedures for animals. Veterinary applications require machines capable of handling both small and large animals, delivering precise anaesthetic dosages, and enabling real-time monitoring for safety. Growth in veterinary healthcare is also fueled by mobile veterinary clinics and specialty hospitals, which require portable and versatile anaesthesia machines for field operations.

- By Components

On the basis of components, the market is segmented into machines, ventilators, monitors, disposables, and others. The machines segment dominated in 2024 as it forms the core component ensuring accurate, continuous, and safe anaesthesia delivery. Monitors and ventilators are expected to see strong growth due to the increasing focus on patient safety, real-time monitoring, and integration with automated anaesthesia systems. Disposables, such as breathing circuits, filters, masks, and tubing, generate recurring revenue streams and maintain hygiene, infection control, and operational efficiency.

The “others” category in anaesthesia machine components includes vaporizers, suction systems, and various safety accessories, all of which play a critical role in enhancing the reliability, safety, and overall operational performance of anaesthesia delivery. These components ensure accurate gas administration, efficient waste management, and adherence to safety protocols during surgical procedures. Hospitals are increasingly investing in modular and upgradable systems, which allow for easy replacement or enhancement of individual components as technology evolves. This modular approach also helps extend the lifespan of anaesthesia machines while maintaining high performance standards. Furthermore, the focus on regulatory compliance and adherence to perioperative safety standards compels healthcare providers to adopt high-quality components.

- By End Users

On the basis of end users, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers, point-of-care settings, and others. Hospitals dominated the anaesthesia machine market in 2024 due to several key factors. The high surgical volumes in hospitals create a constant demand for reliable and advanced anaesthesia machines. These facilities handle complex procedures such as neurosurgeries, cardiovascular surgeries, and organ transplants, which require continuous and precise delivery of anaesthetic gases.

Ambulatory surgical centers and specialty clinics are anticipated to witness the fastest growth from 2025 to 2032, driven by the rising number of outpatient surgeries, minimally invasive procedures, and demand for portable anaesthesia machines. Point-of-care settings, such as emergency response units and mobile healthcare facilities, increasingly adopt compact machines to ensure patient safety, rapid intervention, and operational efficiency. The “others” category, including research institutions and veterinary hospitals, is witnessing growth due to specialized surgical procedures, experimental studies, and surgical training programs.

Anaesthesia Machine Market Regional Analysis

- North America dominated the anaesthesia machine market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high adoption of technologically sophisticated devices, and the presence of leading global manufacturers

- Hospitals and surgical centers in the region prioritize machines with integrated monitoring systems, automated workflows, and advanced safety features to enhance patient outcomes and operational efficiency

- The widespread adoption is further supported by high healthcare spending, skilled medical professionals, and government initiatives promoting modernization of operating rooms, establishing anaesthesia machines as a critical component in perioperative care across both public and private healthcare facilities

U.S. Anaesthesia Machine Market Insight

The U.S. anaesthesia machine market captured the largest revenue share of 82% in 2024 within North America, driven by the high volume of surgical procedures, advanced hospital infrastructure, and early adoption of technologically sophisticated medical devices. Healthcare providers increasingly prioritize machines with integrated monitoring systems, automated ventilation, and smart safety features to enhance patient outcomes and operational efficiency. The growing trend of upgrading operating rooms, combined with government initiatives supporting modernized surgical facilities, is further propelling market growth.

Europe Anaesthesia Machine Market Insight

The Europe anaesthesia machine market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare regulations, increasing surgical volumes, and rising investments in hospital infrastructure. Adoption is further fueled by the integration of advanced anaesthesia machines in both public and private hospitals, offering precision, safety, and operational efficiency. Countries with well-established healthcare systems, such as France and Italy, are witnessing steady demand across multi-specialty hospitals and ambulatory surgical centers.

U.K. Anaesthesia Machine Market Insight

The U.K. anaesthesia machine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising number of surgeries, focus on patient safety, and adoption of smart surgical technologies. Hospitals and specialty clinics are increasingly upgrading operating rooms with automated anaesthesia delivery systems and advanced monitoring features. Moreover, growing awareness regarding perioperative safety, along with investments in healthcare technology, is expected to sustain market growth.

Germany Anaesthesia Machine Market Insight

The Germany anaesthesia machine market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, focus on surgical safety, and adoption of technologically advanced anaesthesia machines. Germany’s emphasis on precision healthcare and innovation promotes adoption in hospitals, specialty clinics, and ambulatory surgical centers. Integration with hospital information systems and automated ventilation features is becoming increasingly prevalent, supporting efficiency and patient safety.

Asia-Pacific Anaesthesia Machine Market Insight

The Asia-Pacific anaesthesia machine market is poised to grow at the fastest CAGR of 25% during 2025–2032, driven by rising surgical volumes, growing healthcare infrastructure, and increasing awareness of perioperative safety in countries such as China, Japan, and India. Government initiatives promoting healthcare modernization, along with rising investments in smart hospitals and outpatient surgical centers, are propelling market adoption. In addition, increasing availability of cost-effective anaesthesia machines and local manufacturing capabilities are improving accessibility across the region.

Japan Anaesthesia Machine Market Insight

The Japan anaesthesia machine market is gaining momentum due to the country’s advanced healthcare system, increasing number of surgeries, and high adoption of smart medical devices. Hospitals and surgical centers are focusing on precision, automation, and real-time monitoring, driving demand for integrated anaesthesia machines. Moreover, Japan’s aging population is such asly to spur demand for machines that enhance patient safety and facilitate efficient perioperative care in both hospitals and outpatient facilities.

India Anaesthesia Machine Market Insight

The India anaesthesia machine market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapidly expanding healthcare infrastructure, increasing number of surgeries, and high adoption of modern medical technologies. Hospitals, specialty clinics, and ambulatory surgical centers are increasingly upgrading operating rooms with advanced anaesthesia machines. Government initiatives promoting healthcare access, combined with the availability of affordable devices and local manufacturing, are key factors propelling market growth in India.

Anaesthesia Machine Market Share

The anaesthesia machine industry is primarily led by well-established companies, including:

- Drägerwerk AG & Co. KGaA (Germany)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare (New Zealand)

- Medtronic (Ireland)

- Mindray Medical International (China)

- B. Braun SE (Germany)

- Smiths Medical (U.K.)

- Teleflex Incorporated (U.S.)

- Nihon Kohden Corporation (Japan)

- Maquet (Getinge Group) (Germany)

- Penlon Ltd. (U.K.)

- Spacelabs Healthcare (U.S.)

- Beijing Aeonmed Co., Ltd. (China)

- Shenzhen Comen Medical Instruments Co., Ltd. (China)

- Heyer Medical AG (Germany)

- Supera Anesthesia Innovations (U.S.)

- Dameca A/S (Denmark)

- Midmark Corporation (U.S.)

- Chirana Medical (Slovakia)

What are the Recent Developments in Global Anaesthesia Machine Market?

- In June 2025, Iranian researchers unveiled the country's first anaesthesia machine equipped with artificial intelligence capable of real-time respiratory analysis. This innovation marks a significant milestone in the smart transformation of hospital equipment, reducing dependence on imported advanced medical devices

- In May 2025, Penlon exhibited its range of anaesthetic machines, patient monitors, and accessories at Euroanaesthesia in Lisbon, Portugal. This event marked Penlon's return to one of the world's largest and most influential scientific congresses for anaesthesia professionals, showcasing their latest innovations in anaesthesia technology

- In April 2025, Siemens Healthcare approved the Penlon Prima 451 MRI Anaesthetic Machine for use with their 7 Tesla MRI Systems. This approval ensures that clinicians can use the machine up to the 1000 gauss line without impairing the functionality of the MRI systems, enhancing safety and efficiency in MRI-guided procedures

- In October 2024, Mindray: Mindray officially launched its new A3 anesthesia system in Europe. This system, an addition to the Mindray A Series family, combines advanced technology and an adaptable design in a compact footprint, allowing anesthesia teams to provide optimal care in diverse clinical settings. The A3 system includes features such as a digital flowmeter, plug-and-play CO2 and anesthesia gas modules, and High Flow Nasal Cannula (HFNC) technology, reflecting a trend toward more versatile and connected machines

- In May 2022, Fisher & Paykel Healthcare: Fisher & Paykel Healthcare Corporation Limited launched two new products for anesthesia applications: the Optiflow Switch and Optiflow Trace nasal high flow connectors. This development expands the company's offerings within the hospital respiratory support sector by providing new interfaces specifically designed for use during general anesthesia and procedural sedation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANAESTHESIA MACHINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANAESTHESIA MACHINE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANAESTHESIA MACHINE MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTAL ANALYSIS

5.2 PORTER’S FIVE FORCES

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMWORK IN GLOBAL

8 GLOBAL ANAESTHESIA MACHINE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CONTINUOUS ANESTHESIA MACHINES

8.2.1 BY MODALITY

8.2.1.1. PORTABLE

8.2.1.1.1. MARKET VALUE (USD MILLION)

8.2.1.1.2. MARKET VOLULE (UNITS)

8.2.1.1.3. AVERAGE SELLING PRICE (USD)

8.2.1.2. STAND-ALONE

8.2.1.2.1. MARKET VALUE (USD MILLION)

8.2.1.2.2. MARKET VOLULE (UNITS)

8.2.1.2.3. AVERAGE SELLING PRICE (USD)

8.2.2 BY FLOW METER

8.2.2.1. SINGLE FLOWMETER

8.2.2.1.1. MARKET VALUE (USD MILLION)

8.2.2.1.2. MARKET VOLULE (UNITS)

8.2.2.1.3. AVERAGE SELLING PRICE (USD)

8.2.2.2. DUAL FLOWMETER

8.2.2.2.1. MARKET VALUE (USD MILLION)

8.2.2.2.2. MARKET VOLULE (UNITS)

8.2.2.2.3. AVERAGE SELLING PRICE (USD)

8.2.2.3. N20/02 FLOWMETER

8.2.2.3.1. MARKET VALUE (USD MILLION)

8.2.2.3.2. MARKET VOLULE (UNITS)

8.2.2.3.3. AVERAGE SELLING PRICE (USD)

8.2.3 BY SUBJECT

8.2.3.1. HUMAN

8.2.3.1.1. MARKET VALUE (USD MILLION)

8.2.3.1.2. MARKET VOLULE (UNITS)

8.2.3.1.3. AVERAGE SELLING PRICE (USD)

8.2.3.2. VETERINARY

8.2.3.2.1. MARKET VALUE (USD MILLION)

8.2.3.2.2. MARKET VOLULE (UNITS)

8.2.3.2.3. AVERAGE SELLING PRICE (USD)

8.3 INTERMITTENT ANESTHESIA MACHINES

8.3.1 BY MODALITY

8.3.1.1. PORTABLE

8.3.1.1.1. MARKET VALUE (USD MILLION)

8.3.1.1.2. MARKET VOLULE (UNITS)

8.3.1.1.3. AVERAGE SELLING PRICE (USD)

8.3.1.2. STAND-ALONE

8.3.1.2.1. MARKET VALUE (USD MILLION)

8.3.1.2.2. MARKET VOLULE (UNITS)

8.3.1.2.3. AVERAGE SELLING PRICE (USD)

8.3.2 BY FLOW METER

8.3.2.1. SINGLE FLOWMETER

8.3.2.1.1. MARKET VALUE (USD MILLION)

8.3.2.1.2. MARKET VOLULE (UNITS)

8.3.2.1.3. AVERAGE SELLING PRICE (USD)

8.3.2.2. DUAL FLOWMETER

8.3.2.2.1. MARKET VALUE (USD MILLION)

8.3.2.2.2. MARKET VOLULE (UNITS)

8.3.2.2.3. AVERAGE SELLING PRICE (USD)

8.3.2.3. N20/02 FLOWMETER

8.3.2.3.1. MARKET VALUE (USD MILLION)

8.3.2.3.2. MARKET VOLULE (UNITS)

8.3.2.3.3. AVERAGE SELLING PRICE (USD)

8.3.3 BY SUBJECT

8.3.3.1. HUMAN

8.3.3.1.1. MARKET VALUE (USD MILLION)

8.3.3.1.2. MARKET VOLULE (UNITS)

8.3.3.1.3. AVERAGE SELLING PRICE (USD)

8.3.3.2. VETERINARY

8.3.3.2.1. MARKET VALUE (USD MILLION)

8.3.3.2.2. MARKET VOLULE (UNITS)

8.3.3.2.3. AVERAGE SELLING PRICE (USD)

8.4 OTHERS

9 GLOBAL ANAESTHESIA MACHINE MARKET , BY MODALITY

9.1 OVERVIEW

9.2 PORTABLE

9.2.1 MARKET VALUE (USD MILLION)

9.2.2 MARKET VOLULE (UNITS)

9.2.3 AVERAGE SELLING PRICE (USD)

9.3 STAND-ALONE

9.3.1 MARKET VALUE (USD MILLION)

9.3.2 MARKET VOLULE (UNITS)

9.3.3 AVERAGE SELLING PRICE (USD)

10 GLOBAL ANAESTHESIA MACHINE MARKET , BY COMPONENT

10.1 OVERVIEW

10.2 MACHINES

10.2.1 MARKET VALUE (USD MILLION)

10.2.2 MARKET VOLULE (UNITS)

10.2.3 AVERAGE SELLING PRICE (USD)

10.3 VENTILATORS

10.3.1 MARKET VALUE (USD MILLION)

10.3.2 MARKET VOLULE (UNITS)

10.3.3 AVERAGE SELLING PRICE (USD)

10.4 MONITORS

10.4.1 MARKET VALUE (USD MILLION)

10.4.2 MARKET VOLULE (UNITS)

10.4.3 AVERAGE SELLING PRICE (USD)

10.5 DELIVERY SYSTEM

10.5.1 MARKET VALUE (USD MILLION)

10.5.2 MARKET VOLULE (UNITS)

10.5.3 AVERAGE SELLING PRICE (USD)

10.6 OTHERS

11 GLOBAL ANAESTHESIA MACHINE MARKET , BY FLOWMETER

11.1 OVERVIEW

11.2 SINGLE FLOWMETER

11.3 DUAL FLOWMETER

11.4 N20/02 FLOWMETER

12 GLOBAL ANAESTHESIA MACHINE MARKET , BY INDICATION

12.1 OVERVIEW

12.2 NERVOUS SYSTEM SURGERIES

12.2.1 PORTABLE

12.2.2 STAND-ALONE

12.3 EYE, EAR AND NASAL SURGERIES

12.3.1 PORTABLE

12.3.2 STAND-ALONE

12.4 RESPIRATORY SYSTEM SURGERIES

12.4.1 PORTABLE

12.4.2 STAND-ALONE

12.5 CARDIOVASCULAR SYSTEM SURGERIES

12.5.1 PORTABLE

12.5.2 STAND-ALONE

12.6 DIGESTIVE SYSTEM SURGERIES

12.6.1 PORTABLE

12.6.2 STAND-ALONE

12.7 URINARY SYSTEM SURGERIES

12.7.1 PORTABLE

12.7.2 STAND-ALONE

12.8 MUSCULOSKELETAL SYSTEM SURGERIES

12.8.1 PORTABLE

12.8.2 STAND-ALONE

12.9 SKIN SYSTEM SURGERIES

12.9.1 PORTABLE

12.9.2 STAND-ALONE

12.1 OTHERS

13 GLOBAL ANAESTHESIA MACHINE MARKET, BY SUBJECT

13.1 OVERVIEW

13.2 HUMAN

13.2.1 PORTABLE

13.2.2 STAND-ALONE

13.3 VETERINARY

13.3.1 PORTABLE

13.3.2 STAND-ALONE

14 GLOBAL ANAESTHESIA MACHINE MARKET, BY MODE

14.1 OVERVIEW

14.2 MANUAL

14.3 AUTOMATIC

15 GLOBAL ANAESTHESIA MACHINE MARKET, BY AGE

15.1 OVERVIEW

15.2 ADULTS

15.3 PEDIATRICS

15.4 NEONATE

16 GLOBAL ANAESTHESIA MACHINE MARKET , BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 SPECIALTY CLINICS

16.4 AMBULATORY SURGICAL CENTERS

16.5 HOME CARE

16.6 OTHERS

17 GLOBAL ANAESTHESIA MACHINE MARKET , BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDERS

17.3 RETAIL SALES

17.4 OTHERS

18 GLOBAL ANAESTHESIA MACHINE MARKET , SWOT AND DBR ANALYSIS

19 GLOBAL ANAESTHESIA MACHINE MARKET , COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT & APPROVALS

19.7 EXPANSIONS

19.8 REGULATORY CHANGES

19.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL ANAESTHESIA MACHINE MARKET, BY REGION

GLOBAL ANAESTHESIA MACHINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 FRANCE

20.2.3 U.K.

20.2.4 HUNGARY

20.2.5 LITHUANIA

20.2.6 AUSTRIA

20.2.7 IRELAND

20.2.8 NORWAY

20.2.9 POLAND

20.2.10 ITALY

20.2.11 SPAIN

20.2.12 RUSSIA

20.2.13 TURKEY

20.2.14 NETHERLANDS

20.2.15 SWITZERLAND

20.2.16 REST OF EUROPE

20.3 ASIA-PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 SINGAPORE

20.3.6 THAILAND

20.3.7 INDONESIA

20.3.8 MALAYSIA

20.3.9 PHILIPPINES

20.3.10 AUSTRALIA

20.3.11 NEW ZEALAND

20.3.12 VIETNAM

20.3.13 TAIWAN

20.3.14 REST OF ASIA-PACIFIC

20.4 SOUTH AMERICA

20.4.1 BRAZIL

20.4.2 ARGENTINA

20.4.3 REST OF SOUTH AMERICA

20.5 MIDDLE EAST AND AFRICA

20.5.1 SOUTH AFRICA

20.5.2 EGYPT

20.5.3 BAHRAIN

20.5.4 UNITED ARAB EMIRATES

20.5.5 KUWAIT

20.5.6 OMAN

20.5.7 QATAR

20.5.8 SAUDI ARABIA

20.5.9 REST OF MEA

20.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21 GLOBAL ANAESTHESIA MACHINE MARKET , COMPANY PROFILE

21.1 DRÄGERWERK AG & CO

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHIC PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 FISHER & PAYKEL HEALTHCARE LIMITED.

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 GEOGRAPHIC PRESENCE

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENTS

21.3 GE HEALTHCARE.

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 GEOGRAPHIC PRESENCE

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 MEDTRONIC

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 GEOGRAPHIC PRESENCE

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 SMITHS MEDICAL

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 GEOGRAPHIC PRESENCE

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 GEOGRAPHIC PRESENCE

21.6.4 PRODUCT PORTFOLIO

21.6.5 RECENT DEVELOPMENTS

21.7 GETINGE AB

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 GEOGRAPHIC PRESENCE

21.7.4 PRODUCT PORTFOLIO

21.7.5 RECENT DEVELOPMENTS

21.8 DRE MEDICAL

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 GEOGRAPHIC PRESENCE

21.8.4 PRODUCT PORTFOLIO

21.8.5 RECENT DEVELOPMENTS

21.9 MIDMARK CORPORATION

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHIC PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENTS

21.1 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 GEOGRAPHIC PRESENCE

21.10.4 PRODUCT PORTFOLIO

21.10.5 RECENT DEVELOPMENTS

21.11 HEYER MEDICAL AG

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 GEOGRAPHIC PRESENCE

21.11.4 PRODUCT PORTFOLIO

21.11.5 RECENT DEVELOPMENTS

21.12 DAMECA

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 GEOGRAPHIC PRESENCE

21.12.4 PRODUCT PORTFOLIO

21.12.5 RECENT DEVELOPMENTS

21.13 INFINIUM MEDICAL

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 GEOGRAPHIC PRESENCE

21.13.4 PRODUCT PORTFOLIO

21.13.5 RECENT DEVELOPMENTS

21.14 KONINKLIJKE PHILIPS N.V.

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 GEOGRAPHIC PRESENCE

21.14.4 PRODUCT PORTFOLIO

21.14.5 RECENT DEVELOPMENTS

21.15 PENLON LIMITED

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 GEOGRAPHIC PRESENCE

21.15.4 PRODUCT PORTFOLIO

21.15.5 RECENT DEVELOPMENTS

21.16 LÖWENSTEIN MEDICAL UK LTD.

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 GEOGRAPHIC PRESENCE

21.16.4 PRODUCT PORTFOLIO

21.16.5 RECENT DEVELOPMENTS

21.17 HEAL FORCE

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 GEOGRAPHIC PRESENCE

21.17.4 PRODUCT PORTFOLIO

21.17.5 RECENT DEVELOPMENTS

21.18 SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 GEOGRAPHIC PRESENCE

21.18.4 PRODUCT PORTFOLIO

21.18.5 RECENT DEVELOPMENTS

21.19 AXCENT MEDICAL

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 GEOGRAPHIC PRESENCE

21.19.4 PRODUCT PORTFOLIO

21.19.5 RECENT DEVELOPMENTS

21.2 BEIJING AEONMED CO., LTD

21.20.1 COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHIC PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENTS

21.21 SHVABE‑ZURICH GMBH

21.21.1 COMPANY OVERVIEW

21.21.2 REVENUE ANALYSIS

21.21.3 GEOGRAPHIC PRESENCE

21.21.4 PRODUCT PORTFOLIO

21.21.5 RECENT DEVELOPMENTS

21.22 BPL MEDICAL TECHNOLOGIES

21.22.1 COMPANY OVERVIEW

21.22.2 REVENUE ANALYSIS

21.22.3 GEOGRAPHIC PRESENCE

21.22.4 PRODUCT PORTFOLIO

21.22.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.