Global Analytical Instrument Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

52.25 Billion

USD

85.18 Billion

2025

2033

USD

52.25 Billion

USD

85.18 Billion

2025

2033

| 2026 –2033 | |

| USD 52.25 Billion | |

| USD 85.18 Billion | |

|

|

|

|

Analytical Instrument Manufacturing Market Size

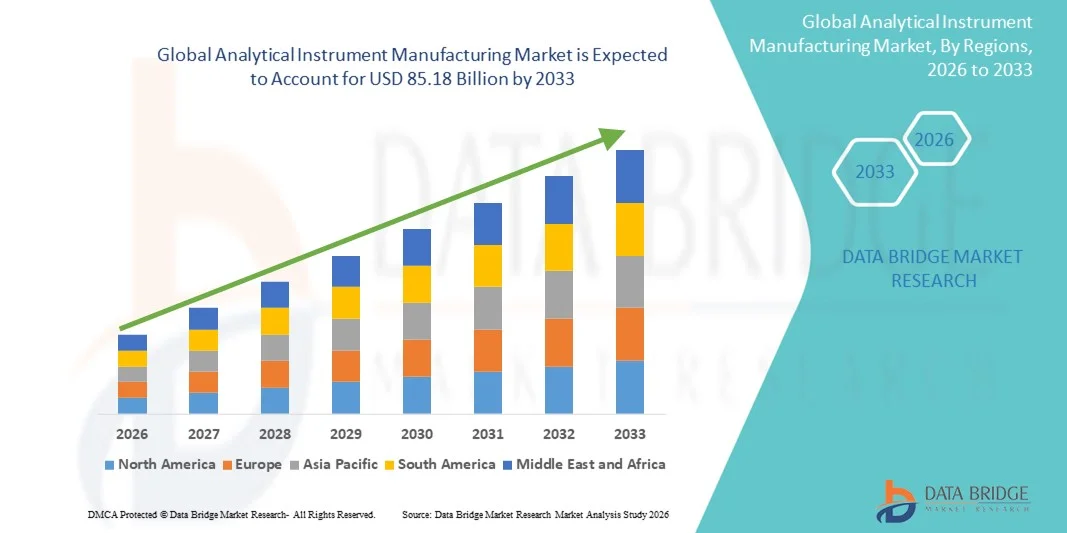

- The global analytical instrument manufacturing market size was valued at USD 52.25 billion in 2025 and is expected to reach USD 85.18 billion by 2033, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced laboratory technologies and the growing need for precise and automated analytical solutions across pharmaceutical, chemical, and biotechnology industries

- Furthermore, rising demand for high-throughput testing, quality control, and research and development is driving investments in innovative analytical instruments, enhancing efficiency, accuracy, and reproducibility, which is accelerating the uptake of Analytical Instrument Manufacturing solutions, thereby significantly boosting the industry's growth

Analytical Instrument Manufacturing Market Analysis

- Analytical instruments, including spectrometers, chromatographs, and lab automation systems, are increasingly vital components in pharmaceutical, chemical, biotechnology, and food industries due to their enhanced precision, efficiency, and ability to support high-throughput testing and R&D workflows

- The escalating demand for analytical instruments is primarily fueled by the growing emphasis on quality control, regulatory compliance, and the adoption of automated and integrated laboratory solutions, as well as the need for accurate and reproducible results across research and industrial applications

- North America dominated the Analytical Instrument Manufacturing market with the largest revenue share of 38.7% in 2025, driven by early adoption of advanced laboratory technologies, strong R&D infrastructure, high investment in life sciences and chemical industries, and the presence of leading analytical instrument manufacturers

- Asia-Pacific is expected to be the fastest growing region in the Analytical Instrument Manufacturing market during the forecast period, registering a CAGR of 8.5%, due to rapid industrialization, expansion of pharmaceutical and biotechnology sectors, increasing government investments in research, and rising demand for high-precision laboratory instruments

- The chromatography segment dominated the largest market revenue share of 47.5% in 2025, driven by its widespread adoption across pharmaceutical, biotechnology, and environmental testing laboratories

Report Scope and Analytical Instrument Manufacturing Market Segmentation

|

Attributes |

Analytical Instrument Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Agilent Technologies (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Analytical Instrument Manufacturing Market Trends

Rising Adoption of Automated and High-Throughput Analytical Instruments

- A key trend in the global analytical instrument manufacturing market is the increasing adoption of automated, high-throughput instruments across pharmaceutical, biotechnology, and environmental testing laboratories

- Automation reduces human error, improves reproducibility, and accelerates experimental workflows, making instruments such as liquid chromatography systems, mass spectrometers, and automated PCR machines highly desirable

- For instance, in June 2024, Agilent Technologies launched its 1290 Infinity II UHPLC system with integrated automation capabilities, significantly enhancing laboratory throughput

- The trend is also driven by the increasing need for multi-parameter analysis and the integration of instruments with laboratory information management systems (LIMS) for data management

- Laboratories are increasingly focusing on precision, speed, and efficiency, fueling demand for instruments capable of high-resolution analysis

- Technological advancements, such as miniaturized microfluidic systems and modular instrument platforms, are enabling flexible and customizable workflows

- Growing applications in drug discovery, environmental monitoring, and clinical diagnostics are further supporting adoption

- Companies like Thermo Fisher Scientific and Shimadzu are investing in R&D to develop next-generation instruments that combine automation, sensitivity, and versatility

- The shift toward automated analytical systems is particularly pronounced in pharmaceutical R&D, where accuracy and reproducibility are critical for regulatory compliance

- In emerging markets, increasing laboratory modernization initiatives are accelerating uptake of automated instruments

- High-throughput and multi-analyte capabilities allow simultaneous detection of multiple biomarkers, saving time and resources

- Overall, the trend toward automation and integration in analytical instrumentation is reshaping laboratory operations globally, enhancing efficiency and output quality

Analytical Instrument Manufacturing Market Dynamics

Driver

Growing Demand from Pharmaceutical, Biotech, and Academic Research

- The global Analytical Instrument Manufacturing market is being significantly driven by rising R&D activities in pharmaceuticals, biotechnology, and academic research institutions

- For instance: In March 2025, Waters Corporation expanded its analytical instrument portfolio to support high-throughput drug screening, illustrating increased industry demand

- The need for accurate, sensitive, and reproducible analytical measurements in drug discovery, quality control, and diagnostics is fueling instrument adoption

- Analytical instruments are critical for molecular characterization, biomarker detection, and quality assurance in pharmaceuticals and biologics

- Rising prevalence of chronic diseases and increasing focus on personalized medicine are driving demand for instruments capable of high-resolution analysis

- Environmental and food safety testing laboratories also contribute to market growth, requiring instruments such as gas chromatographs and spectrometers

- Technological advancements that improve sensitivity, throughput, and ease of use further encourage adoption

- Research institutions and contract research organizations (CROs) are increasingly investing in state-of-the-art instruments to enhance their capabilities

- The surge in government-funded research projects and increasing collaborations between academia and industry are additional growth drivers

- Expansion of biotechnology hubs in North America, Europe, and Asia-Pacific strengthens instrument demand

- Overall, the increasing need for reliable, accurate, and advanced analytical tools across multiple sectors is driving sustained growth in the market

Restraint/Challenge

High Costs and Maintenance Requirements Limit Adoption

- Despite strong demand, the high initial cost of advanced analytical instruments poses a significant restraint to market growth

- For instance, ultra-high-performance liquid chromatography (UHPLC) and high-resolution mass spectrometry systems often cost several hundred thousand dollars, making them inaccessible for smaller laboratories

- Ongoing maintenance, calibration, and service requirements further increase operational expenses, deterring some end-users. In developing regions, limited budgets and infrastructure gaps restrict the widespread adoption of sophisticated analytical systems

- Instrument complexity often necessitates trained personnel for operation, increasing staffing costs and dependency on specialized expertise. Delays in service or technical support can impact laboratory workflows, affecting productivity and ROI

- Consumables, reagents, and software upgrades add to the total cost of ownership, discouraging small-scale adoption. High costs may also slow the replacement of legacy instruments, limiting the penetration of new technologies

- Some laboratories rely on outsourcing testing to CROs to avoid capital expenditure, indirectly impacting instrument sales. Addressing these challenges through affordable models, modular instruments, and extended service contracts is essential for market growth

- Companies such as Agilent and Shimadzu have started offering lease and rental options to improve accessibility for smaller labs. Managing high upfront costs and operational expenses remains a key barrier, particularly for institutions with budget constraints

Analytical Instrument Manufacturing Market Scope

The market is segmented on the basis of type, end user, and application.

- By Type

On the basis of type, the Analytical Instrument Manufacturing market is segmented into chromatography and spectrometers. The chromatography segment dominated the largest market revenue share of 47.5% in 2025, driven by its widespread adoption across pharmaceutical, biotechnology, and environmental testing laboratories. Chromatography instruments such as HPLC, GC, and UHPLC are highly valued for their accuracy, sensitivity, and ability to separate and quantify complex mixtures. The segment’s dominance is further supported by growing demand in drug discovery, quality control, and regulatory compliance. Continuous technological innovations, including ultra-high-performance chromatography and automated sample handling, enhance laboratory efficiency and reproducibility. North America and Europe represent the largest markets due to the high prevalence of pharmaceutical R&D and stringent regulatory requirements. The integration of chromatography instruments with laboratory information management systems (LIMS) and automation platforms increases operational efficiency and data accuracy. Academic institutions, contract research organizations (CROs), and biotech firms also contribute significantly to market revenue. Moreover, increasing environmental monitoring and food safety testing further expand the segment’s adoption. The segment’s versatility in applications, including proteomics, metabolomics, and clinical analysis, cements its market leadership. Overall, chromatography remains the preferred analytical technique due to precision, reliability, and regulatory acceptance.

The spectrometers segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by rising demand for advanced molecular characterization, structural elucidation, and high-throughput analysis. Mass spectrometers, UV-Vis spectrometers, and atomic absorption spectrometers are increasingly adopted across pharmaceutical, biotechnology, and environmental labs. Spectrometers offer rapid, sensitive, and precise analysis, making them ideal for drug development, proteomics, and metabolomics research. The growing need for quality control and real-time monitoring in pharmaceutical production accelerates adoption. Technological advancements, such as miniaturization, portability, and high-resolution mass spectrometry, further boost market growth. Emerging economies are adopting spectrometers due to increasing laboratory modernization initiatives. Integration with automated sample handling and data analytics tools enhances workflow efficiency. In addition, spectrometers are increasingly used in academic and government research for advanced material and chemical analysis. The segment benefits from rising investments in biotechnology and personalized medicine. Cloud-based data management and connectivity improve operational efficiency, supporting broader adoption. Overall, spectrometers are rapidly gaining traction as laboratories seek more versatile and high-performance analytical tools.

- By End User

On the basis of end user, the market is segmented into pharma and biotech, industrial & applied, academia & government, and others. The pharma and biotech segment accounted for the largest market revenue share of 49.1% in 2025, propelled by high R&D expenditure, stringent regulatory compliance, and a growing focus on biologics and personalized medicine. Analytical instruments are critical for drug discovery, formulation development, and quality assurance. Continuous innovation in analytical technologies, including chromatography and spectrometry, drives demand. The segment benefits from increasing outsourcing to contract research organizations (CROs), expansion of pharmaceutical hubs, and the need for high-throughput testing. Automated analytical instruments are gaining traction for improving efficiency, reproducibility, and data management. North America and Europe dominate due to mature pharmaceutical industries and strong regulatory frameworks. Growing prevalence of chronic diseases and emphasis on precision medicine further enhance adoption. Increasing collaborations between academia and industry also contribute to demand. Overall, pharma and biotech remain the leading end users due to sustained investment in research and compliance-driven analytical requirements.

The industrial & applied segment is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by rising demand for analytical instruments in environmental testing, food safety, chemical manufacturing, and materials analysis. Industries increasingly adopt high-precision instruments for monitoring product quality, regulatory compliance, and process optimization. The growing focus on sustainable manufacturing, pollution monitoring, and safety testing fuels adoption. Automated analytical instruments that reduce human error and enhance reproducibility are particularly favored. Emerging economies are modernizing laboratories to meet international standards, further supporting market growth. Instrument integration with data analytics and cloud platforms enables remote monitoring and predictive maintenance. Industrial sectors benefit from rapid testing, multi-analyte capabilities, and flexible workflows. Overall, industrial & applied applications are the fastest-growing segment due to increasing regulatory pressure and demand for high-quality analytical outputs.

- By Application

On the basis of application, the market is segmented into research applications, clinical applications, diagnostic applications, and others. The research applications segment held the largest market revenue share of 45.8% in 2025, driven by extensive use in academic, pharmaceutical, and biotechnology research. Analytical instruments support drug discovery, molecular biology, genomics, proteomics, and metabolomics studies. High-throughput screening, automation, and advanced analytical technologies enhance research efficiency. The growing emphasis on personalized medicine, novel therapeutics, and innovative biological research drives adoption. North America and Europe dominate the segment due to advanced research infrastructure and funding. The integration of instruments with laboratory information management systems (LIMS) improves workflow efficiency. CROs, biotech startups, and universities are significant contributors to revenue. The segment benefits from increasing collaboration between public and private research institutions. Overall, research applications remain the primary driver of analytical instrument demand.

The diagnostic applications segment is projected to witness the fastest CAGR of 21.4% from 2026 to 2033, fueled by rising demand for clinical testing, molecular diagnostics, and personalized healthcare. Analytical instruments enable accurate detection of biomarkers, pathogens, and genetic mutations. Hospitals, diagnostic centers, and clinical laboratories are increasingly adopting high-throughput and automated instruments for faster and reliable results. The COVID-19 pandemic accelerated investments in diagnostic infrastructure, enhancing long-term adoption. Technological advancements in spectrometry and chromatography enable precise and rapid testing. Integration with electronic health records (EHR) and laboratory information systems (LIS) improves operational efficiency. Emerging regions are expanding diagnostic capabilities to improve healthcare access. Growing awareness of early disease detection and preventive healthcare supports adoption. Overall, the diagnostic applications segment is the fastest-growing due to expanding clinical and molecular testing requirements.

Analytical Instrument Manufacturing Market Regional Analysis

- North America dominated the analytical instrument manufacturing market with the largest revenue share of 38.7% in 2025

- Driven by early adoption of advanced laboratory technologies, strong R&D infrastructure, high investment in life sciences and chemical industries, and the presence of leading analytical instrument manufacturers

- The region’s pharmaceutical, biotechnology, and chemical sectors are major contributors to market growth

U.S. Analytical Instrument Manufacturing Market Insight

The U.S. analytical instrument manufacturing market captured the largest revenue share within North America in 2025, fueled by high adoption of automated and high-throughput laboratory systems. Academic and industrial research centers increasingly rely on advanced analytical instruments for chemical, biological, and pharmaceutical applications, driving market expansion.

Europe Analytical Instrument Manufacturing Market Insight

The Europe analytical instrument manufacturing market is projected to expand at a substantial CAGR during the forecast period, driven by growing industrial automation, strong pharmaceutical and biotech sectors, and increasing demand for high-quality analytical instruments.

U.K. Analytical Instrument Manufacturing Market Insight

The U.K. analytical instrument manufacturing market is expected to grow steadily due to increasing investments in scientific research, rising adoption of advanced laboratory instrumentation, and growing demand for automated solutions in academic and industrial labs.

Germany Analytical Instrument Manufacturing Market Insight

The Germany analytical instrument manufacturing market is set to expand significantly, driven by the country’s well-established industrial and pharmaceutical infrastructure. The market growth is further supported by Germany’s strong emphasis on innovation and precision in manufacturing, along with the increasing adoption of eco-friendly, energy-efficient, and digitally integrated analytical instruments across laboratories. The rising focus on quality control, regulatory compliance, and advanced research in pharmaceuticals and chemicals continues to propel demand for high-performance analytical solutions.

Asia-Pacific Analytical Instrument Manufacturing Market Insight

The Asia-Pacific analytical instrument manufacturing market is poised to grow at the fastest CAGR of 8.5% during the forecast period, fueled by rapid industrialization and the expansion of pharmaceutical and biotechnology sectors in the region. Increasing government investments in scientific research, growing focus on life sciences and chemical industries, and the rising adoption of high-precision, automated laboratory instruments are key factors driving market growth. In addition, the region’s expanding academic and industrial research initiatives are contributing to higher demand for advanced analytical solutions.

Japan Analytical Instrument Manufacturing Market Insight

Japan’s analytical instrument manufacturing market is gaining momentum due to the early adoption of advanced laboratory technologies, strong industrial and academic R&D activities, and increasing demand for high-performance analytical systems in pharmaceutical, chemical, and biotech research. The growing emphasis on precision, efficiency, and innovation in laboratories, along with government support for research infrastructure, is further strengthening the market’s growth trajectory.

China Analytical Instrument Manufacturing Market Insight

China analytical instrument manufacturing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrialization, strong government support for scientific research, and high adoption of advanced analytical laboratory instruments. The country’s expanding pharmaceutical and biotechnology industries, coupled with increasing investment in R&D and the presence of strong domestic instrument manufacturers, are major contributors to market growth. In addition, rising academic research initiatives and industrial quality control requirements continue to boost demand for sophisticated analytical solutions.

Analytical Instrument Manufacturing Market Share

The Analytical Instrument Manufacturing industry is primarily led by well-established companies, including:

• Agilent Technologies (U.S.)

• Thermo Fisher Scientific (U.S.)

• Shimadzu Corporation (Japan)

• PerkinElmer (U.S.)

• Waters Corporation (U.S.)

• Bruker Corporation (U.S.)

• Danaher Corporation (U.S.)

• Mettler-Toledo International (Switzerland)

• HORIBA, Ltd. (Japan)

• JEOL Ltd. (Japan)

• Hitachi High-Technologies Corporation (Japan)

• Bio-Rad Laboratories (U.S.)

• Analytik Jena (Germany)

• Malvern Panalytical (U.K.)

• Oxford Instruments (U.K.)

• Metrohm AG (Switzerland)

• Eppendorf AG (Germany)

• Thermo Electron Corporation (U.S.)

• Waters India Pvt. Ltd. (India)

• Agilent Technologies India Pvt. Ltd. (India)

Latest Developments in Global Analytical Instrument Manufacturing Market

- In June 2021, Agilent Technologies, Inc. launched new LC/MS and GC/MS quadrupole mass spectrometers equipped with built‑in instrument intelligence to streamline laboratory operations and improve analytical performance in complex sample analysis

- In March 2022, Sartorius AG announced the acquisition of Novasep’s chromatography division, adding innovative chromatography systems for biomolecule analysis to its analytical instrument portfolio — broadening its offerings for continuous biologics manufacturing workflows

- In February 2022, Thermo Fisher Scientific expanded its chromatography and mass spectrometry consumables portfolio, aimed at improving analytical performance and sample handling for chromatography and MS workflows in research and routine labs

- In June 2023, Malvern Panalytical Ltd launched the NanoSight Pro nanoparticle tracking analysis system, offering ultra‑high‑resolution measurements with machine learning enhancements to provide faster particle analysis for research and materials science applications

- In April 2024, Agilent Technologies introduced the Advanced Dilution System (ADS 2) for ICP‑MS and ICP‑OES workflows, designed to enhance laboratory throughput and streamline sample preparation in environmental, pharmaceutical, and industrial testing

- In July 2024, Malvern Panalytical acquired Micromeritics Instrument Corporation, aiming to expand its analytical solutions portfolio in particle sizing, surface area, and porosity measurement — strengthening its material characterization capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.