Global Anaplastic Astrocytoma Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.50 Billion

USD

2.39 Billion

2025

2033

USD

1.50 Billion

USD

2.39 Billion

2025

2033

| 2026 –2033 | |

| USD 1.50 Billion | |

| USD 2.39 Billion | |

|

|

|

|

Anaplastic Astrocytoma Treatment Market Size

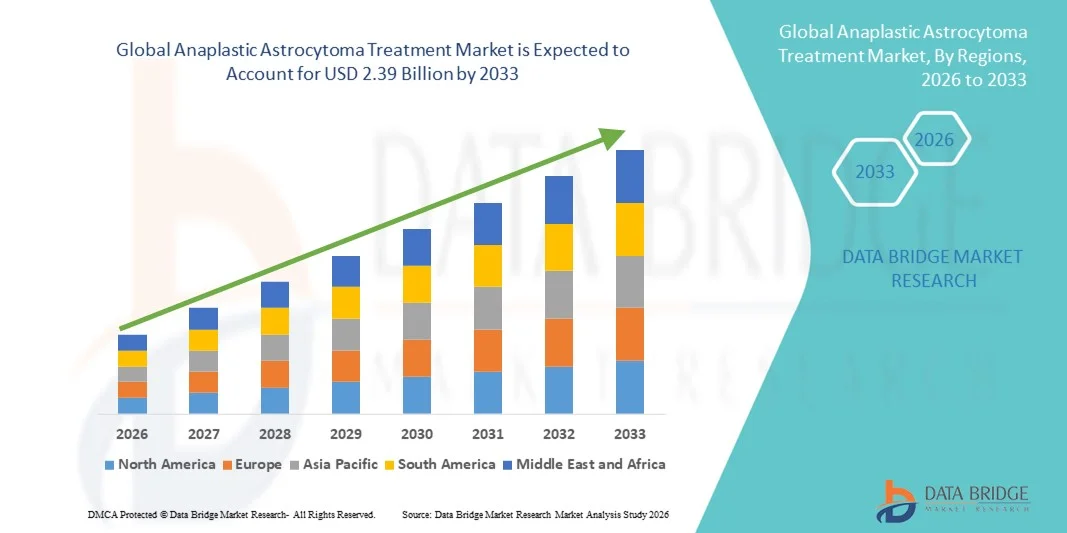

- The global anaplastic astrocytoma treatment market size was valued at USD 1.50 billion in 2025 and is expected to reach USD 2.39 billion by 2033, at a CAGR of 6.00 % during the forecast period

- The market growth is largely fueled by the growing adoption of advanced therapeutic modalities and technological progress in oncology, leading to improved diagnosis, treatment precision, and patient outcomes for anaplastic astrocytoma

- Furthermore, rising patient awareness, increasing prevalence of central nervous system tumors, and growing demand for effective, targeted, and minimally invasive treatment options are driving the uptake of anaplastic astrocytoma treatment solutions, thereby significantly boosting the industry’s growth

Anaplastic Astrocytoma Treatment Market Analysis

- The Anaplastic Astrocytoma Treatment market is witnessing significant growth, driven by the increasing adoption of advanced therapeutic modalities such as precision radiotherapy, targeted chemotherapy, and surgical innovations, along with improvements in diagnostic and treatment technologies that enhance patient outcomes

- The rising prevalence of central nervous system tumors, growing patient awareness of treatment options, and increasing investment in oncology healthcare infrastructure are fueling the demand for effective anaplastic astrocytoma treatment solutions across global markets.

- North America dominated the anaplastic astrocytoma treatment market with the largest revenue share of 38.7% in 2025, supported by well-established healthcare infrastructure, high adoption of advanced oncology treatments, and strong presence of key pharmaceutical and biotech companies. The U.S. leads the regional market due to early adoption of innovative therapies, robust R&D, and government initiatives supporting cancer care

- Asia-Pacific is expected to be the fastest-growing region in the Anaplastic Astrocytoma Treatment market during the forecast period, driven by increasing healthcare expenditure, rising awareness of cancer treatment options, and expanding access to advanced treatment modalities in countries such as China and India

- The clinical trial phase segment dominated with a revenue share of 52.1% in 2025, driven by the high number of ongoing trials evaluating new chemotherapeutic agents, targeted therapies, and combination regimens for Anaplastic Astrocytoma

Report Scope and Anaplastic Astrocytoma Treatment Market Segmentation

|

Attributes |

Anaplastic Astrocytoma Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Anaplastic Astrocytoma Treatment Market Trends

Advancements in Targeted Therapies and Personalized Treatment Approaches

- A significant trend in the global anaplastic astrocytoma treatment market is the increasing development and adoption of targeted therapies, including novel chemotherapeutic agents, immunotherapy, and molecularly guided treatments. These advancements are enhancing patient outcomes, improving survival rates, and reducing systemic side effects associated with traditional chemotherapy

- Personalized medicine approaches, guided by genetic and molecular profiling of tumors, are becoming standard practice in leading oncology centers

- For instance, in 2023, a clinical study at the Mayo Clinic demonstrated improved response rates in Anaplastic Astrocytoma patients receiving therapy selected based on molecular tumor profiling, highlighting the effectiveness of personalized approaches

- Research institutions and biotech companies are focusing on innovative treatment modalities such as combination therapies and precision radiotherapy techniques, aimed at maximizing tumor control while minimizing harm to healthy tissue

- The growing emphasis on early diagnosis, molecular testing, and integrated care pathways is driving innovation in treatment strategies and influencing clinical decision-making for Anaplastic Astrocytom

Anaplastic Astrocytoma Treatment Market Dynamics

Driver

Rising Incidence of Anaplastic Astrocytoma and Increasing Healthcare Investments

- The increasing prevalence of aggressive brain tumors, particularly anaplastic astrocytoma, is a major driver of market growth. Improved awareness and advanced diagnostic technologies enable earlier detection and timely intervention, which in turn drives demand for effective treatment options

- Expanding healthcare infrastructure and rising investments in oncology research are accelerating the availability and adoption of advanced therapies

- For instance, in 2022, the European Organisation for Research and Treatment of Cancer (EORTC) funded a multicenter study evaluating novel combination chemotherapies for high-grade gliomas, including Anaplastic Astrocytoma, supporting wider clinical adoption

- Increasing focus on clinical trials and multidisciplinary treatment approaches is facilitating the development of safer, more effective therapeutic regimen

- The rising demand for therapies that improve patient quality of life, reduce recurrence rates, and extend survival is motivating pharmaceutical companies to innovate and expand treatment options globally

Restraint/Challenge

High Treatment Costs and Limited Access to Advanced Therapies

- The high cost of Anaplastic Astrocytoma therapies—including targeted drugs, immunotherapy, and advanced radiotherapy—poses a significant challenge, particularly in developing regions or for patients lacking comprehensive insurance coverage

- Limited access to specialized oncology centers and trained medical professionals can restrict patient access to optimal treatment

- For instance, a 2023 report by the World Health Organization highlighted that less than 50% of eligible Anaplastic Astrocytoma patients in rural India received access to advanced radiotherapy due to infrastructure limitations, underscoring geographic disparities

- Variability in regulatory approvals, reimbursement policies, and healthcare infrastructure across countries can delay the introduction of innovative therapies in some markets

- To overcome these challenges, strategies such as patient assistance programs, cost-effective treatment delivery models, and expanded insurance coverage are critical to improving treatment accessibility and sustaining market growth

Anaplastic Astrocytoma Treatment Market Scope

The market is segmented on the basis of product type, treatment, diagnosis, application, end-users, and distribution channel.

- By Product Type

On the basis of product type, the Anaplastic Astrocytoma Treatment market is segmented into alkylating agents, kinase inhibitors, and others. The alkylating agents segment dominated the market with a revenue share of 45.3% in 2025. Alkylating agents have been a cornerstone of chemotherapy for brain tumors due to their ability to directly interfere with DNA replication in cancer cells, effectively controlling tumor growth. Their widespread adoption across hospitals and oncology centers is fueled by decades of clinical evidence supporting their efficacy. Many treatment protocols incorporate alkylating agents as first-line therapy, making them a standard of care in Anaplastic Astrocytoma management. The segment benefits from strong integration with combination therapies, including radiation and temozolomide, which further improves patient outcomes. In addition, ongoing research continues to enhance the safety profile and dosing strategies, making these agents suitable even for older or high-risk patients. Their global availability, established supply chains, and affordability relative to newer targeted therapies further reinforce their dominance. Moreover, healthcare professionals are highly familiar with their administration, monitoring, and side-effect management. Hospitals and cancer treatment centers prioritize alkylating agents for both adult and pediatric patient groups. The segment also benefits from regulatory approvals across multiple regions, supporting consistent market growth. Overall, these factors collectively secure alkylating agents’ position as the leading product type in the Anaplastic Astrocytoma treatment market.

The kinase inhibitors segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033. This growth is driven by the rising focus on targeted therapies that specifically inhibit cancer-promoting enzymes and signaling pathways, offering more personalized treatment. Kinase inhibitors are increasingly used in patients with specific genetic mutations, enhancing therapeutic efficacy and reducing off-target side effects. Rapid advancements in molecular diagnostics allow physicians to identify patients who will benefit most from these therapies. Clinical trials conducted between 2023 and 2025 have shown promising results in tumor reduction and progression-free survival, encouraging adoption in specialized oncology centers. Biotech companies are investing heavily in the development of next-generation inhibitors with improved selectivity and reduced toxicity. The growing awareness among oncologists and patients about the benefits of targeted therapy is further propelling market penetration. In addition, collaborations between research institutions and pharmaceutical firms are accelerating the introduction of novel inhibitors. Reimbursement policies and increasing insurance coverage for innovative therapies are also supporting market growth. Market expansion is particularly notable in North America and Europe, where precision medicine is widely adopted. Overall, the kinase inhibitors segment is expected to maintain strong double-digit growth due to ongoing innovation, favorable clinical outcomes, and increasing physician acceptance.

- By Treatment

On the basis of treatment, the market is segmented into Temodar, surgery, radiation therapy, and chemotherapy. The Temodar segment dominated with a revenue share of 41.8% in 2025, primarily due to its established effectiveness in improving survival outcomes for Anaplastic Astrocytoma patients. Temodar (temozolomide) is widely preferred because of its oral administration, which enhances patient compliance and convenience compared to intravenous chemotherapy. The drug is often used in combination with radiation therapy, forming a standard-of-care protocol recommended by oncology guidelines worldwide. Clinical studies and real-world evidence consistently demonstrate its efficacy in delaying tumor progression and improving overall survival. Temodar also benefits from a well-understood safety profile, with manageable side effects that allow long-term treatment in many patients. The drug’s approval across multiple global markets ensures widespread availability, supporting its market dominance. Hospital pharmacies and oncology centers routinely stock Temodar due to high patient demand, and it is often the first-line therapy for newly diagnosed cases. Insurance coverage and government reimbursement programs in key regions further strengthen its adoption. In addition, continuous research into dosing regimens and combination therapies enhances its clinical value. The global familiarity among oncologists with Temodar administration and monitoring adds to its sustained preference.

The surgery segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033. Surgical resection is critical for Anaplastic Astrocytoma management, particularly for patients with operable tumors. Advancements in minimally invasive neurosurgery, intraoperative imaging, and neuronavigation systems have improved precision, reduced complications, and enhanced postoperative outcomes. Surgeons can now remove tumors more completely while minimizing damage to healthy brain tissue. Rising investments in hospital infrastructure, particularly in emerging markets, are expanding access to advanced neurosurgical procedures. The increasing availability of specialized neuro-oncology centers supports broader adoption. Collaboration between surgical teams, oncologists, and radiologists enables integrated care, further boosting surgery’s role in treatment plans. Patient awareness about early intervention and better prognosis post-surgery is growing, encouraging uptake. In addition, the introduction of 3D imaging and robotic-assisted surgery is enhancing procedure accuracy and safety. Clinical studies continue to demonstrate improved survival rates for patients undergoing maximal safe resection. Consequently, the surgery segment is projected to grow rapidly over the forecast period.

- By Diagnosis

On the basis of diagnosis, the market is segmented into MRI, CT scan, X-ray, and biopsy. The MRI segment dominated with a revenue share of 47.5% in 2025, driven by its superior soft-tissue contrast, high-resolution imaging, and ability to accurately detect tumor boundaries. MRI enables oncologists to assess tumor size, infiltration, and location, which is critical for planning surgical interventions and radiation therapy. Hospitals and cancer centers increasingly rely on MRI for initial diagnosis, treatment monitoring, and post-treatment follow-up, as it allows non-invasive evaluation of tumor progression. In addition, advancements such as functional MRI and diffusion tensor imaging provide more precise mapping of critical brain regions, improving surgical outcomes. MRI’s ability to guide personalized treatment decisions, combined with widespread availability in developed regions, strengthens its market dominance. Growing awareness among physicians and patients regarding the importance of accurate tumor imaging further supports adoption. The segment benefits from continuous technological improvements, including faster scan times and enhanced image quality. Insurance coverage and reimbursement policies in North America and Europe also drive usage. Overall, MRI remains the preferred diagnostic tool for Anaplastic Astrocytoma due to its accuracy, reliability, and comprehensive clinical utility.

The CT scan segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by its increasing role in emergency diagnostics, preoperative evaluation, and treatment planning. CT scans provide rapid imaging, making them particularly valuable for patients presenting with acute neurological symptoms. Hospitals are integrating advanced CT technologies with 3D reconstruction and AI-assisted imaging to improve tumor visualization and guide clinical decisions. The rising availability of CT scanners in emerging markets allows earlier diagnosis and broader access to care. CT imaging is often used in combination with MRI to enhance diagnostic accuracy and treatment monitoring. Technological improvements, such as low-dose imaging protocols and enhanced contrast agents, further increase clinical adoption. Growth is also supported by awareness campaigns highlighting the importance of early detection in improving patient outcomes. Overall, CT scans are rapidly gaining traction as a complementary imaging modality to MRI, especially in fast-paced clinical environments.

- By Application

On the basis of application, the market is segmented into pre-registration phase and clinical trial phase. The clinical trial phase segment dominated with a revenue share of 52.1% in 2025, driven by the high number of ongoing trials evaluating new chemotherapeutic agents, targeted therapies, and combination regimens for Anaplastic Astrocytoma. Clinical trials provide critical evidence supporting safety and efficacy, helping physicians make informed treatment decisions. The increasing collaboration between pharmaceutical companies, research institutes, and academic hospitals ensures a steady pipeline of novel therapies entering trials. This phase also attracts significant investment from government bodies and private organizations aiming to accelerate innovation in neuro-oncology. Patient enrollment is facilitated by well-established trial networks, increasing access to experimental treatments. In addition, regulatory support for accelerated approval pathways enhances trial activity. Continuous monitoring of trial outcomes informs clinical practice guidelines and improves therapy adoption rates. The segment also benefits from growing public awareness of clinical trials as a treatment opportunity. Advanced analytics and digital platforms streamline patient recruitment and trial management. Overall, the clinical trial phase continues to play a critical role in shaping treatment standards and market growth.

The pre-registration phase segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by increased early-stage drug discovery, investment in novel therapeutics, and regulatory incentives for rare and aggressive cancers. Pharmaceutical companies are focusing on preclinical studies to identify promising molecules and optimize formulations before human trials. Growing emphasis on personalized medicine accelerates the pre-registration pipeline, ensuring therapies are tailored to patient-specific genetic profiles. Early-stage research also benefits from partnerships between biotech startups and academic institutions, expanding innovation capacity. Improved preclinical testing models reduce development risks and enhance success rates in later trial phases. Government grants, research funding, and venture capital investment further support this growth. Adoption of advanced screening technologies, such as high-throughput assays and molecular modeling, accelerates the evaluation of candidate compounds. This proactive focus on early development ensures a continuous flow of innovative therapies, positioning the pre-registration segment for strong growth over the forecast period.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospitals segment dominated with a revenue share of 48.6% in 2025, owing to the availability of advanced oncology infrastructure, specialized neurosurgical teams, and comprehensive treatment protocols. Hospitals serve as primary treatment centers for Anaplastic Astrocytoma patients, providing access to surgery, radiotherapy, chemotherapy, and supportive care in an integrated setting. The presence of multidisciplinary teams ensures coordinated care, improving treatment outcomes and patient satisfaction. Hospitals also facilitate clinical trial participation, further enhancing adoption of innovative therapies. In addition, large-scale hospitals benefit from established procurement systems, ensuring consistent availability of high-demand drugs like Temodar and alkylating agents. Growing patient awareness and the emphasis on evidence-based care reinforce hospital dominance. Training programs and specialized centers of excellence increase the capacity to treat complex cases effectively. Hospitals are also investing in advanced imaging and surgical equipment, supporting the adoption of state-of-the-art treatment modalities. Overall, hospitals remain the most significant end-user segment due to infrastructure, expertise, and comprehensive care delivery.

The clinics segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, fueled by the expansion of outpatient oncology services, increased availability of targeted therapy administration, and growing demand for convenient treatment options. Clinics offer accessible care for patients requiring regular chemotherapy, oral medications, and follow-up visits. The proliferation of specialized cancer clinics in urban and suburban areas allows more patients to access care without traveling to large hospitals. Partnerships with diagnostic labs and telemedicine integration enhance patient monitoring and adherence. Clinics are increasingly participating in decentralized clinical trials, supporting early adoption of innovative therapies. Cost-effective care models and patient-focused services attract more individuals to clinic-based treatment. Rising awareness about early intervention and ongoing support programs also contribute to growth. In addition, government initiatives and insurance coverage expansion facilitate outpatient therapy delivery. Clinics’ flexible scheduling and personalized care strengthen their adoption, making them the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated with a revenue share of 46.9% in 2025, due to direct procurement of Anaplastic Astrocytoma therapies for in-hospital treatment and integrated inventory management. Hospitals maintain continuous supplies of critical medications like Temodar, alkylating agents, and targeted therapies to ensure uninterrupted patient care. Hospital pharmacies provide counseling, dosing guidance, and monitoring services, increasing adherence and safety. Bulk procurement agreements and established supply chains reduce costs and support predictable revenue streams. Close coordination with clinicians ensures timely availability of drugs aligned with treatment schedules. Hospitals’ ability to store and handle specialized therapies, including parenteral formulations, reinforces their dominance. They also act as centers for clinical trial distribution, expanding access to new drugs. The growing volume of oncology cases in tertiary care hospitals strengthens the segment further. Advanced hospital pharmacy IT systems enable better inventory management, minimize errors, and optimize workflow. Overall, hospital pharmacies remain the leading distribution channel due to infrastructure, expertise, and consistent supply.

The online pharmacy segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by the increasing adoption of e-pharmacy platforms, home delivery services, and patient preference for convenience. Online pharmacies provide access to oral therapies, follow-up medications, and supportive care drugs for patients unable to frequently visit hospitals or retail pharmacies. Growth is further supported by telemedicine integration, allowing physicians to prescribe treatments directly to patients’ homes. E-pharmacy platforms are investing in secure logistics, cold-chain management, and patient education to ensure safe and timely delivery. Increased smartphone penetration and digital literacy accelerate adoption in urban and semi-urban regions. Insurance reimbursements and patient assistance programs are also being extended to online purchases, enhancing affordability. Marketing campaigns highlight convenience, privacy, and rapid delivery, driving consumer preference. Partnerships with pharmaceutical manufacturers streamline distribution and inventory management. The segment is particularly attractive in regions with high internet penetration and healthcare accessibility challenges. Overall, online pharmacies are positioned for robust growth due to their convenience, accessibility, and expanding adoption.

Anaplastic Astrocytoma Treatment Market Regional Analysis

- North America dominated the anaplastic astrocytoma treatment market with the largest revenue share of 38.7% in 2025, supported by well-established healthcare infrastructure, high adoption of advanced oncology treatments, and strong presence of key pharmaceutical and biotech companies

- The region’s early adoption of innovative therapies, robust R&D, and government initiatives promoting cancer care are further accelerating market growth

- Increasing patient awareness, expanding specialized treatment centers, and the availability of cutting-edge therapeutic options are driving demand for anaplastic astrocytoma treatments across hospitals, clinics, and research institutes in North America

U.S. Anaplastic Astrocytoma Treatment Market Insight

The U.S. anaplastic astrocytoma treatment market captured the largest revenue share in 2025 within North America, fueled by widespread access to advanced therapies, strong government support, and the presence of leading pharmaceutical and biotechnology companies. Early adoption of innovative treatment protocols, integration of precision medicine, and ongoing oncology research further support the country’s market leadership.

Europe Anaplastic Astrocytoma Treatment Market Insight

The Europe anaplastic astrocytoma treatment market is projected to expand at a substantial CAGR during the forecast period, driven by well-developed healthcare infrastructure, increasing cancer awareness, and rising adoption of advanced treatment options. Growth is supported by specialized oncology centers and integration of clinical research with hospital treatment facilities.

U.K. Anaplastic Astrocytoma Treatment Market Insight

The U.K. anaplastic astrocytoma treatment market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising incidence of CNS tumors, increasing adoption of modern therapeutic modalities, and strong government support for oncology healthcare programs. Patient awareness and advanced hospital infrastructure are further contributing to market expansion.

Germany Anaplastic Astrocytoma Treatment Market Insight

The Germany anaplastic astrocytoma treatment market is anticipated to expand at a considerable CAGR, supported by advanced healthcare infrastructure, increasing focus on precision medicine, and growing demand for innovative oncology treatments. The country’s emphasis on patient-centric care and research-driven therapy adoption is boosting market growth.

Asia-Pacific Anaplastic Astrocytoma Treatment Market Insight

Asia-Pacific anaplastic astrocytoma treatment market is expected to be the fastest-growing region in the Anaplastic Astrocytoma Treatment market during the forecast period, driven by increasing healthcare expenditure, rising awareness of cancer treatment options, and expanding access to advanced treatment modalities in countries such as China and India. Government initiatives and rising healthcare infrastructure are also supporting rapid adoption.

Japan Anaplastic Astrocytoma Treatment Market Insight

Japan anaplastic astrocytoma treatment market is witnessing significant growth due to a technologically advanced healthcare system, increasing patient awareness, and strong demand for precision oncology treatments. Expansion of specialized treatment centers and adoption of modern therapeutic protocols are further fueling the market.

China Anaplastic Astrocytoma Treatment Market Insight

China anaplastic astrocytoma treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid urbanization, increasing healthcare infrastructure, and growing patient access to advanced therapies. Rising incidence of CNS tumors, government initiatives, and strong domestic pharmaceutical capabilities are key factors driving market growth.

Anaplastic Astrocytoma Treatment Market Share

The Anaplastic Astrocytoma Treatment industry is primarily led by well-established companies, including:

- Novartis (Switzerland)

- Merck & Co. (U.S.)

- Roche (Switzerland)

- Bristol-Myers Squibb (U.S.)

- Pfizer (U.S.)

- GlaxoSmithKline (U.K.)

- AbbVie (U.S.)

- Johnson & Johnson (U.S.)

- Eli Lilly (U.S.)

- Takeda Pharmaceutical (Japan)

- Biogen (U.S.)

- AstraZeneca (U.K.)

- Bayer (Germany)

- Sanofi (France)

- Teva Pharmaceuticals (Israel)

- Sumitomo Dainippon Pharma (Japan)

- Daiichi Sankyo (Japan)

- Celgene (U.S.)

- Amgen (U.S.)

- Medivation (U.S.)

Latest Developments in Global Anaplastic Astrocytoma Treatment Market

- In September 2023, the U.S. FDA approved new and updated indications for temozolomide (Temodar) under its Project Renewal program, including adjuvant treatment of adults with newly diagnosed anaplastic astrocytoma and treatment of adults with refractory anaplastic astrocytoma. This approval strengthens the role of temozolomide as a frontline and recurrent therapy, providing broader access for patients and supporting improved clinical outcomes

- In June 2022, the FDA granted accelerated approval to the combination of dabrafenib + trametinib for unresectable or metastatic solid tumors with the BRAF V600E mutation, which is relevant for high-grade gliomas, including some cases of anaplastic astrocytoma. This development highlights the increasing focus on targeted therapies based on genetic profiling, enabling personalized treatment approaches

- In August 2024, the FDA approved vorasidenib (Voranigo), a dual IDH1/IDH2 inhibitor, for patients aged 12 years and older with grade 2 astrocytoma or oligodendroglioma harboring a susceptible IDH1 or IDH2 mutation. This milestone emphasizes the growing availability of mutation-specific therapies for gliomas, improving precision medicine options for patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.