Global Anastomosis Device Market

Market Size in USD Billion

CAGR :

%

USD

4.11 Billion

USD

6.25 Billion

2025

2033

USD

4.11 Billion

USD

6.25 Billion

2025

2033

| 2026 –2033 | |

| USD 4.11 Billion | |

| USD 6.25 Billion | |

|

|

|

|

Anastomosis Device Market Size

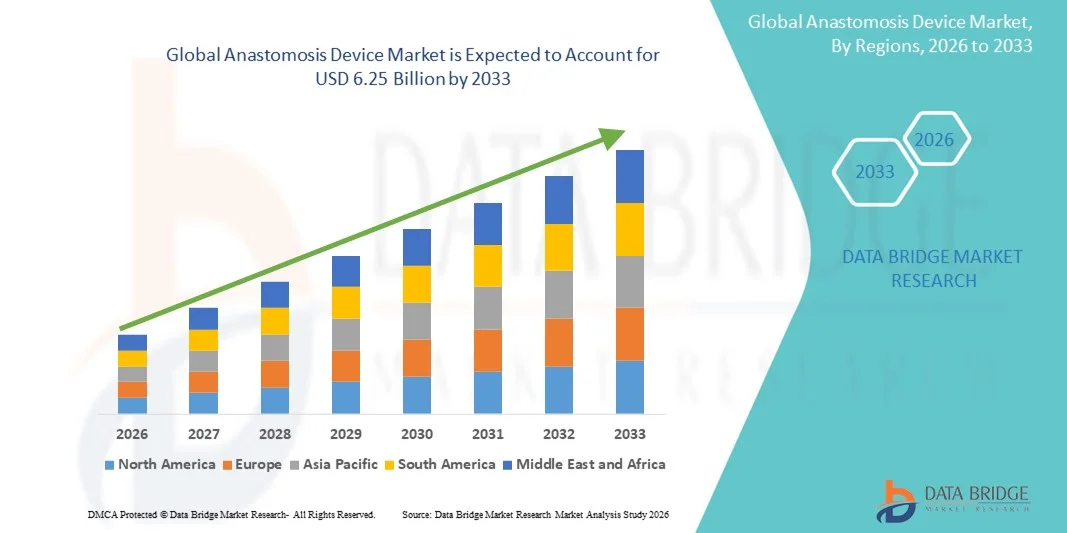

- The global anastomosis device market size was valued at USD 4.11 billion in 2025 and is expected to reach USD 6.25 billion by 2033, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising number of gastrointestinal and cardiovascular surgeries, and growing adoption of minimally invasive surgical procedures, leading to higher demand for advanced anastomosis devices across hospitals and surgical centers

- Furthermore, continuous technological advancements in stapling and suturing systems, improved surgical precision, reduced operative time, and better patient outcomes are accelerating the uptake of anastomosis device solutions, thereby significantly boosting the overall growth of the Anastomosis Device market

Anastomosis Device Market Analysis

- Anastomosis devices, which are advanced surgical tools used to connect blood vessels or sections of the intestine during surgical procedures, are increasingly critical in gastrointestinal, cardiovascular, and colorectal surgeries due to their ability to improve precision, reduce operative time, and enhance patient outcomes

- The growing demand for anastomosis devices is primarily driven by the rising incidence of chronic diseases, increasing number of complex surgical procedures, and the widespread adoption of minimally invasive and robotic-assisted surgeries across healthcare settings

- North America dominated the anastomosis device market, accounting for approximately 42.6% of the global revenue share in 2025, supported by advanced healthcare infrastructure, high surgical volumes, strong reimbursement policies, and the presence of leading medical device manufacturers, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the anastomosis device market during the forecast period, registering an estimated CAGR of 8.8%, driven by expanding healthcare infrastructure, increasing surgical procedures, rising healthcare expenditure, and growing adoption of advanced surgical technologies across emerging economies

- The Disposable Devices segment dominated the largest market revenue share of 58.1% in 2025, driven by sterility, ease of use, and reduced infection risk

Report Scope and Anastomosis Device Market Segmentation

|

Attributes |

Anastomosis Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• B. Braun SE (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Anastomosis Device Market Trends

Increasing Adoption of Minimally Invasive and Automated Anastomosis Technologies

- A significant and accelerating trend in the global anastomosis device market is the increasing adoption of minimally invasive and automated anastomosis solutions aimed at improving surgical precision, reducing procedure time, and enhancing patient outcomes

- For instance, in September 2024, Medtronic expanded its surgical portfolio with advanced circular stapling and powered anastomosis systems designed to improve consistency and reduce surgeon fatigue during gastrointestinal and colorectal surgeries

- Surgeons are increasingly favoring mechanical and powered anastomosis devices over traditional suturing techniques due to their reliability and reproducibility

- These devices help reduce intraoperative complications such as leakage and bleeding

- The growing volume of laparoscopic and robotic-assisted surgeries is further accelerating adoption

- Technological advancements have led to better tissue compression control and uniform staple formation

- Hospitals are adopting advanced anastomosis devices to standardize surgical outcomes

- This trend is reshaping surgical practices across gastrointestinal, cardiovascular, and bariatric procedures

Anastomosis Device Market Dynamics

Driver

Rising Surgical Volume and Growing Prevalence of Chronic Diseases

- The increasing prevalence of chronic diseases such as colorectal cancer, cardiovascular disorders, and gastrointestinal conditions is a major driver of the Anastomosis Device market

- For instance, in February 2025, Johnson & Johnson MedTech reported expanded adoption of its ECHELON circular staplers across hospitals in North America and Europe, driven by rising colorectal and bariatric surgery volumes

- Growing global surgical volumes, particularly in gastrointestinal and cardiovascular procedures, are significantly boosting demand for anastomosis devices

- Aging populations are more susceptible to chronic conditions requiring surgical intervention, further driving market growth

- Anastomosis devices help reduce operative time and improve procedural consistency, making them highly attractive in high-throughput surgical environments

- Hospitals increasingly prioritize technologies that enhance surgical efficiency and patient safety

- The rapid expansion of minimally invasive and laparoscopic surgery programs worldwide is accelerating adoption

- Technological advancements encouraging surgeons to transition from manual suturing to device-based solutions are strengthening market growth

Restraint/Challenge

High Device Cost and Limited Accessibility in Resource-Constrained Settings

- The high cost of advanced anastomosis devices remains a key challenge, particularly for healthcare facilities in low- and middle-income regions

- For instance, budget constraints in public hospitals across several developing countries limit access to powered and disposable anastomosis devices, leading continued reliance on conventional suturing methods

- Advanced devices require significant upfront investment and recurring consumable costs

- Smaller hospitals and surgical centers often face procurement limitations

- Limited reimbursement coverage for premium surgical devices further restricts adoption

- The need for specialized surgeon training also poses a barrier in some regions

- Supply chain dependencies and pricing pressures affect affordability

- Addressing these challenges through cost-effective product innovation and improved reimbursement policies will be essential for long-term market growth

Anastomosis Device Market Scope

The market is segmented on the basis of product, application, end-users, and product type.

- By Product

On the basis of product, the Anastomosis Device market is segmented into Surgical Staplers, Surgical Sutures, and Surgical Sealants & Adhesives. The Surgical Staplers segment dominated the largest market revenue share of 43.5% in 2025, driven by their ability to reduce operative time, improve tissue approximation, and lower postoperative complications. Hospitals prefer staplers in gastrointestinal and bariatric surgeries for their precision and reliability. Minimally invasive and robotic-assisted procedures further boost demand. Single-use staplers reduce cross-contamination, while circular and linear designs support diverse surgical needs. Staplers enhance safety, decrease blood loss, and improve clinical outcomes. Technological innovations such as powered staplers and reinforced staples increase efficiency. High surgical volumes and expanding hospital infrastructure globally contribute to growth. Staplers are widely adopted for gastrointestinal, thoracic, and colorectal procedures. Surgeons value consistent performance and reduced procedural risk. Growing awareness of patient safety reinforces their use.

The Surgical Sutures segment is expected to witness the fastest CAGR of 7.8% from 2026 to 2033, fueled by rising demand for absorbable, antimicrobial, and bioengineered sutures. Innovations that improve wound healing, reduce infection, and enable precise cardiovascular and soft tissue surgeries are driving growth. Sutures are essential in laparoscopic, robotic, and open procedures. Emerging markets increasingly adopt advanced sutures due to their cost-effectiveness and clinical benefits. Disposable suture packs support outpatient and ambulatory procedures. Surgeons prefer sutures for delicate tissue handling and minimal trauma. Increasing surgical volumes and aging populations further support expansion. Clinical guidelines and training programs encourage adoption. The segment is also benefiting from rising use in complex gastrointestinal and cardiovascular procedures, where precision and reliability are critical.

- By Application

On the basis of application, the Anastomosis Device market is segmented into Gastrointestinal Surgeries, Cardiovascular & Thoracic Surgeries, and Other Surgeries. The Gastrointestinal Surgeries segment dominated the largest market revenue share of 46.2% in 2025, owing to increasing colorectal cancer prevalence, rising bariatric surgeries, and gastrointestinal disorder treatments. Staplers and sutures are preferred for bowel resections, gastric bypass, and colectomies due to precision and reduced operative time. Minimally invasive and robotic-assisted procedures further accelerate adoption. Hospitals invest in advanced staplers and bioengineered sutures to improve outcomes and reduce complications. Single-use devices minimize infection risk. Technological advancements improve staple line strength and wound healing. Rising surgical volumes and patient awareness encourage adoption. Linear and circular staplers are widely used. Surgeons value consistent performance and improved recovery outcomes. Device availability in high-volume hospitals supports market dominance.

The Cardiovascular & Thoracic Surgeries segment is expected to witness the fastest CAGR of 8.1% from 2026 to 2033, driven by the growing prevalence of cardiac diseases and coronary bypass procedures. Vascular staplers and reinforced sutures are critical for precise tissue approximation. Minimally invasive cardiac and thoracic procedures further increase adoption. Devices reduce anastomotic errors and operative time. Surgeons prefer durable and high-precision products. Aging populations and increasing cardiovascular interventions support growth. Expansion of cardiac care units in emerging markets drives uptake. Outpatient and day-care cardiac procedures also contribute. Clinical guidelines and surgeon training reinforce adoption. High reliability and clinical outcomes boost demand in this segment.

- By End-Users

On the basis of end-users, the Anastomosis Device market is segmented into Hospitals, Ambulatory Surgery Centers (ASCs), and Clinics. The Hospitals segment accounted for the largest market revenue share of 52.4% in 2025, driven by high surgical volumes, availability of trained surgeons, and comprehensive device portfolios. Hospitals adopt staplers, sutures, and sealants for laparoscopic, robotic-assisted, and open surgeries. Single-use disposable devices reduce infection risk and ensure sterility. High-volume gastrointestinal and cardiovascular procedures support demand. Hospitals invest in advanced surgical infrastructure and training, facilitating adoption. Clinical validation and surgeon familiarity reinforce confidence. Hospitals prioritize efficiency, patient safety, and procedural precision. Advanced surgical programs in developed markets favor hospital uptake. Regulatory guidelines for infection prevention drive adoption. Surgeons value devices that reduce complications and improve outcomes.

The Ambulatory Surgery Centers and Clinics segment is expected to witness the fastest CAGR of 7.5% from 2026 to 2033, due to increasing outpatient procedures and day-care surgeries. Disposable staplers and sutures ensure sterility and faster patient turnover. Minimally invasive and laparoscopic procedures are increasingly performed in ASCs and specialty clinics. Cost-effectiveness, operational efficiency, and device reliability favor adoption. Expansion of ASC infrastructure in emerging markets supports growth. Disposable devices minimize infection risk and improve patient convenience. Partnerships with device manufacturers further drive adoption. Training programs and clinical guidelines reinforce safe and effective use. Rising awareness of outpatient surgical care accelerates segment growth.

- By Product Type

On the basis of product type, the Anastomosis Device market is segmented into Disposable and Reusable Devices. The Disposable Devices segment dominated the largest market revenue share of 58.1% in 2025, driven by sterility, ease of use, and reduced infection risk. Hospitals and high-volume surgical centers prefer single-use staplers, sutures, and sealants. Disposable devices support laparoscopic, robotic, and open surgeries. They minimize cross-contamination, enhance workflow efficiency, and reduce postoperative complications. Technological advancements in design and reinforcement improve precision. Single-use products are widely used in gastrointestinal and cardiovascular surgeries. Regulatory emphasis on infection prevention accelerates adoption. Surgeons trust disposable devices for consistent clinical outcomes. Hospital preference is strengthened by improved patient safety and operational efficiency.

The Reusable Devices segment is expected to witness the fastest CAGR of 6.9% from 2026 to 2033, due to cost-effectiveness, durability, and improved sterilization protocols. Hospitals in emerging markets increasingly adopt reusable staplers and sutures to optimize expenditure. Technological improvements enhance performance and longevity. Reusable devices support high-volume procedures and complex surgeries. Training and clinical guidelines support safe usage. Adoption is rising in cardiovascular, gastrointestinal, and thoracic surgeries. Combining reusable instruments with disposable consumables improves efficiency. Growing surgical volumes and sustainability awareness fuel adoption. Reusable devices complement disposable product lines to offer operational flexibility.

Anastomosis Device Market Regional Analysis

- North America dominated the anastomosis device market, accounting for approximately 42.6% of the global revenue share in 2025

- Supported by advanced healthcare infrastructure, high surgical volumes, strong reimbursement policies, and the presence of leading medical device manufacturers, particularly in the U.S.

- The region benefits from widespread adoption of minimally invasive and robotic-assisted surgeries, along with continuous technological advancements in surgical staplers and anastomosis systems

U.S. Anastomosis Device Market Insight

The U.S. anastomosis device market captured the largest revenue share within North America in 2025, driven by a high number of gastrointestinal, cardiovascular, and colorectal surgical procedures. The presence of major device manufacturers, strong surgeon preference for advanced anastomosis solutions, and favorable reimbursement frameworks further contribute to market growth. Increasing adoption of minimally invasive procedures continues to support demand for efficient and reliable anastomosis devices.

Europe Anastomosis Device Market Insight

The Europe anastomosis device market is projected to expand at a steady CAGR throughout the forecast period, driven by rising surgical volumes, increasing prevalence of chronic diseases, and growing adoption of advanced surgical technologies. Well-established healthcare systems in countries such as Germany, France, and the U.K. support the use of technologically advanced anastomosis devices in both open and minimally invasive surgeries.

U.K. Anastomosis Device Market Insight

The U.K. anastomosis device market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing numbers of colorectal and gastrointestinal surgeries and continued investments in surgical infrastructure. Government initiatives to reduce surgical backlogs and improve procedural outcomes further encourage adoption of advanced anastomosis devices across NHS hospitals and private healthcare facilities.

Germany Anastomosis Device Market Insight

The Germany anastomosis device market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong healthcare infrastructure, high surgical standards, and early adoption of innovative surgical devices. Germany’s emphasis on precision surgery and minimally invasive techniques promotes the use of advanced anastomosis systems in hospitals and specialty surgical centers.

Asia-Pacific Anastomosis Device Market Insight

The Asia-Pacific anastomosis device market is expected to be the fastest-growing region, registering an estimated CAGR of 8.8% during the forecast period. Growth is driven by expanding healthcare infrastructure, increasing surgical procedures, rising healthcare expenditure, and growing adoption of advanced surgical technologies across emerging economies such as China, India, and Southeast Asian countries.

Japan Anastomosis Device Market Insight

The Japan anastomosis device market is gaining momentum due to an aging population, rising incidence of gastrointestinal and cardiovascular disorders, and strong adoption of minimally invasive surgical techniques. Advanced hospital infrastructure and surgeon preference for high-quality surgical devices support steady market growth in the country.

China Anastomosis Device Market Insight

The China anastomosis device market accounted for the largest revenue share in the Asia-Pacific region in 2025. Growth is driven by rapid expansion of hospital infrastructure, increasing surgical volumes, rising healthcare expenditure, and growing adoption of advanced surgical technologies. Government initiatives to modernize healthcare facilities and the presence of domestic manufacturers offering cost-effective solutions further support market expansion in China.

Anastomosis Device Market Share

The Anastomosis Device industry is primarily led by well-established companies, including:

• B. Braun SE (Germany)

• Teleflex Incorporated (U.S.)

• Stryker Corporation (U.S.)

• Cook Medical (U.S.)

• ConMed Corporation (U.S.)

• Karl Storz SE & Co. KG (Germany)

• Integra LifeSciences (U.S.)

• Smith & Nephew (U.K.)

• LivaNova PLC (U.K.)

• Zimmer Biomet (U.S.)

• Vascular Innovations Co., Ltd. (Japan)

• KLS Martin Group (Germany)

• Apollo Endosurgery (U.S.)

• Teleflex Medical (Ireland)

• Advanced Medical Solutions Group (U.K.)

• Merit Medical Systems (U.S.)

Latest Developments in Global Anastomosis Device Market

- In June 2021, Intuitive Surgical Inc. introduced the SureForm surgical stapler with SmartFire technology, enhancing staple line consistency and procedural precision—an important innovation in surgical stapling and anastomosis tools

- In March 2021, Johnson & Johnson (Ethicon) launched the ECHELON+ Stapler, a powered surgical stapler designed to improve uniform tissue compression and reduce surgical complications, contributing to safer anastomosis procedures

- In March 2023, Peters Surgical was acquired by Peters Surgical’s European partner, expanding the company’s footprint in cardiovascular and gastrointestinal anastomosis solutions and supporting broader distribution and product integration in Europe

- In September 2024, GT Metabolic Solutions achieved FDA de novo clearance for the MagDI system, a first‑generation magnetic compression anastomosis device that enables incision‑less procedures and reduces retained foreign material risks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.